DigitalOcean Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigitalOcean Bundle

DigitalOcean navigates a dynamic cloud computing landscape, facing intense rivalry from hyperscalers and niche providers alike. Understanding the bargaining power of its buyers, who demand cost-effectiveness and robust features, is crucial for its market position.

The threat of new entrants, while somewhat mitigated by high infrastructure costs, remains a factor as specialized cloud solutions emerge. Furthermore, the availability of substitutes, like on-premises solutions or alternative managed services, constantly pressures DigitalOcean to innovate and differentiate.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore DigitalOcean’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

DigitalOcean's reliance on specialized hardware, such as servers and networking gear, positions hardware manufacturers as key suppliers. While DigitalOcean's scale provides some negotiation strength, the burgeoning demand for high-performance components, particularly GPUs vital for AI development, has amplified supplier leverage. For instance, the global GPU market saw significant growth in 2024, driven by AI demand, potentially increasing costs for cloud providers.

Data center providers also wield considerable bargaining power, especially those situated in prime locations offering robust connectivity and reliable power infrastructure. The scarcity of such optimal sites means DigitalOcean, like its competitors, may face higher leasing costs or specific contract terms dictated by these facility owners. The ongoing expansion of cloud infrastructure globally in 2024 highlights the critical importance and thus the strong position of data center real estate providers.

Software and technology vendors, particularly those providing proprietary operating systems, virtualization software, or specialized managed databases, can exert considerable bargaining power. This power is amplified when their solutions require unique skill sets for implementation and maintenance. However, DigitalOcean's strategic emphasis on open-source compatibility helps to diffuse this power by offering readily available, community-supported alternatives.

DigitalOcean's approach, which favors open-source technologies, directly counters the potential leverage of proprietary software suppliers. For instance, by supporting a wide range of Linux distributions and open-source databases like PostgreSQL and MySQL, they reduce customer lock-in associated with specific vendors. This strategy allows customers to choose cost-effective and flexible solutions, thereby diminishing the bargaining power of individual software providers.

Recent strategic collaborations, such as DigitalOcean's partnership with Hugging Face to integrate AI models, illustrate a move towards leveraging specialized technology without necessarily succumbing to high supplier dependence. This type of partnership allows DigitalOcean to offer advanced capabilities to its users while maintaining flexibility in its technology stack, rather than being beholden to a single, dominant software vendor.

Energy providers hold significant bargaining power over DigitalOcean due to the immense energy demands of data centers. In 2024, data centers are estimated to consume a substantial portion of global electricity, with projections indicating continued growth. Regions with fewer energy provider options or escalating energy prices amplify this supplier leverage, directly impacting DigitalOcean's operational costs.

Network Bandwidth Providers

Network bandwidth providers hold significant bargaining power over cloud infrastructure companies like DigitalOcean. This is because reliable and high-speed internet connectivity is absolutely essential for cloud services to function effectively. Without robust networks, DigitalOcean cannot deliver its platform to customers.

The high costs involved in building and maintaining global network infrastructure mean that only a few major internet service providers (ISPs) and backbone network operators truly dominate the market. This limited competition allows these providers to exert considerable influence.

DigitalOcean's global expansion strategy, aiming for a broad customer base, inherently requires diverse and strong network partnerships. This reliance on a select group of network providers amplifies their bargaining power.

- Critical Infrastructure Dependence: Cloud providers like DigitalOcean are fundamentally reliant on network bandwidth for service delivery.

- High Barriers to Entry: The substantial capital investment required for global network infrastructure limits the number of competitive suppliers.

- Global Network Requirements: DigitalOcean's need for widespread, high-performance connectivity necessitates strong relationships with major network operators.

Skilled Talent and Specialized Labor

The market for highly skilled engineers, cloud architects, and AI/ML specialists is intensely competitive. A persistent shortage of these specialized professionals directly translates to increased labor costs for companies like DigitalOcean. This scarcity empowers these highly sought-after employees, effectively acting as suppliers of critical human capital, to negotiate for higher compensation and more attractive benefits, impacting DigitalOcean's operational expenses and its capacity for rapid innovation and growth.

- Competitive Talent Market: Demand for cloud and AI expertise outstrips supply, driving up wages.

- Increased Labor Costs: Shortages force companies to offer higher salaries and better benefits to attract and retain talent.

- Impact on Innovation: Difficulty in hiring specialized staff can slow down product development and expansion efforts.

- Employee Bargaining Power: Skilled professionals have significant leverage in negotiating terms of employment.

Suppliers of specialized hardware, like high-performance GPUs essential for AI, hold significant leverage, especially given the booming demand in 2024. Data center providers in prime locations also dictate terms due to the scarcity of optimal sites. Furthermore, essential network bandwidth providers, a limited group due to high infrastructure costs, wield considerable power over DigitalOcean's global operations.

| Supplier Type | Leverage Factor | 2024 Impact/Trend |

|---|---|---|

| Hardware Manufacturers (e.g., GPUs) | High demand for AI components | Increased costs for cloud providers due to AI boom |

| Data Center Providers | Scarcity of prime locations | Higher leasing costs and specific contract terms |

| Network Bandwidth Providers | Limited competition, high infrastructure costs | Essential for service delivery, amplifying their influence |

What is included in the product

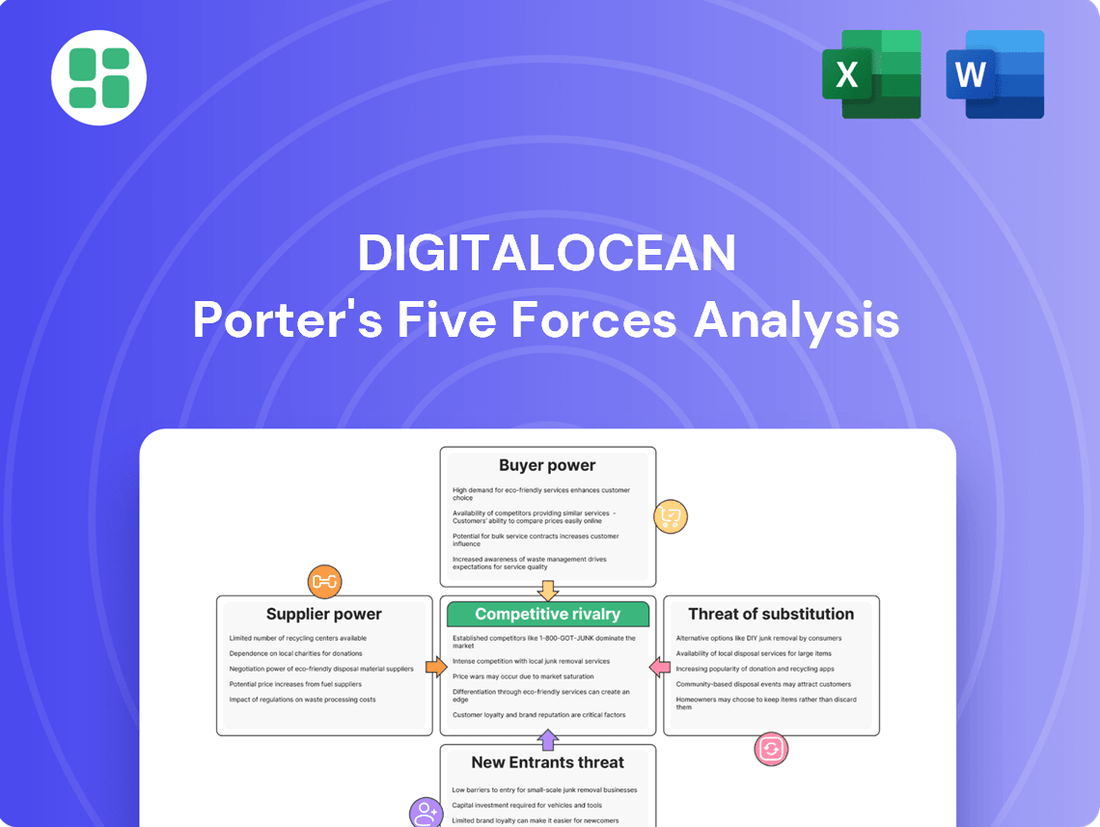

This DigitalOcean Porter's Five Forces analysis dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the cloud infrastructure market.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces on a single, intuitive dashboard.

Customers Bargaining Power

DigitalOcean's focus on developers and small to medium-sized businesses (SMBs) means its customers often face low technical hurdles when shifting basic cloud infrastructure services to a competitor. This ease of migration empowers customers.

The simplicity of DigitalOcean's platform, a key selling point, can also be a double-edged sword. If rivals offer more appealing pricing or enhanced features, customers can readily switch, highlighting the bargaining power of these users.

For instance, in 2024, the cloud computing market saw intense competition, with providers like AWS, Azure, and Google Cloud frequently adjusting pricing and introducing new services. This competitive landscape directly impacts DigitalOcean, as developers can leverage these options to negotiate better terms or simply move their workloads if DigitalOcean's offerings become less attractive.

Small to medium-sized businesses (SMBs) and startups, a significant portion of DigitalOcean's clientele, exhibit a pronounced sensitivity to pricing. This cost-consciousness drives them to meticulously evaluate and compare cloud service offerings from various providers, thereby amplifying their bargaining power. DigitalOcean's deliberately simplified pricing structure is designed to resonate with this inherent price sensitivity, aiming to attract and retain these budget-conscious customers.

The sheer volume of cloud alternatives available significantly empowers customers. They can readily switch between major hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, or opt for more specialized providers such as DigitalOcean itself, Linode, Vultr, or Hetzner. This broad selection means customers aren't tied to a single vendor, allowing them to leverage competitive pricing and feature sets.

Fragmented Customer Base with Aggregated Demand

DigitalOcean's customer base, while vast, is largely fragmented. This means that typically, no single customer represents a substantial chunk of their revenue, which inherently limits the bargaining power of any individual client. For instance, in 2023, the company's revenue was approximately $770 million, spread across millions of users.

However, the collective demand from the Small and Medium-sized Business (SMB) and developer segments wields significant influence. This aggregated demand means DigitalOcean must remain highly attuned to the needs and feedback of this broad user base. Their ability to switch providers, while individually minor, becomes a considerable factor when considered collectively.

- Fragmented Individual Customer Base: No single customer typically accounts for a significant percentage of DigitalOcean's revenue, reducing individual customer leverage.

- Aggregated SMB and Developer Demand: The collective purchasing power of the SMB and developer segments is substantial, giving them considerable influence over DigitalOcean's offerings and pricing.

- Responsiveness to Collective Needs: DigitalOcean's business model necessitates a high degree of responsiveness to the aggregated feedback and evolving requirements of its core user demographics.

- Market Share Dynamics: While specific market share data for 2024 is still emerging, DigitalOcean consistently competes in a cloud infrastructure market valued in the hundreds of billions, highlighting the importance of retaining this broad customer base.

Demand for Specialized Solutions and AI Capabilities

As small and medium-sized businesses (SMBs) increasingly embrace artificial intelligence and cutting-edge technologies, their requirements are shifting. They are actively seeking cloud providers that offer integrated AI and machine learning platforms, alongside robust GPU infrastructure. This trend directly impacts the bargaining power of customers.

DigitalOcean's strategic move to invest in AI offerings and GPU droplets is a direct response to this evolving market demand. By providing these specialized capabilities, they aim to cater to the growing needs of their customer base. However, customers with very specific, high-end AI requirements might find themselves with greater leverage, potentially exploring niche providers who can offer more tailored solutions.

- Demand for AI/ML Platforms: As AI adoption accelerates, businesses are prioritizing cloud solutions that simplify the integration and deployment of AI models.

- GPU Infrastructure Importance: The computational demands of AI workloads mean that access to powerful and scalable GPU resources is a critical factor for many customers.

- DigitalOcean's Response: DigitalOcean's expansion into AI and GPU services aims to capture this growing market segment and retain customers with advanced needs.

- Customer Leverage: Businesses with highly specialized AI requirements may possess increased bargaining power, as they can choose from a wider array of specialized vendors if their needs aren't fully met by generalist providers.

DigitalOcean's customers, particularly developers and SMBs, benefit from a highly competitive cloud market where switching providers is relatively easy. This ease of migration, coupled with the availability of numerous alternatives from hyperscalers and specialized vendors, significantly amplifies customer bargaining power.

While individual customers are generally small, their collective demand for cost-effective and user-friendly cloud solutions, especially with the increasing need for AI/ML capabilities and GPU infrastructure, grants them substantial influence. This necessitates DigitalOcean's continuous responsiveness to market trends and customer feedback to maintain competitiveness.

| Factor | Impact on Bargaining Power | DigitalOcean Context |

|---|---|---|

| Ease of Switching | High | Low technical hurdles for basic cloud services; competitors offer similar simplicity. |

| Availability of Alternatives | High | Numerous hyperscalers (AWS, Azure, GCP) and specialized providers (Linode, Vultr) exist. |

| Customer Price Sensitivity | High (especially for SMBs) | DigitalOcean's simplified pricing targets this segment; intense market competition drives price comparisons. |

| Demand for Specialized Services (AI/GPU) | Increasingly High | Customers seek integrated AI/ML platforms and robust GPU infrastructure, potentially leading to niche provider exploration. |

| Individual Customer Size | Low | Fragmented customer base means no single client holds significant individual leverage. |

| Collective Demand Power | High | Aggregated demand from SMBs and developers influences DigitalOcean's strategy and offerings. |

Full Version Awaits

DigitalOcean Porter's Five Forces Analysis

This preview shows the exact DigitalOcean Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document details the competitive landscape for DigitalOcean, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic decision-making and identifying DigitalOcean's competitive advantages and potential vulnerabilities.

Rivalry Among Competitors

The cloud computing landscape is fiercely contested, with hyperscale providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) holding significant sway. These giants command immense resources, broad service offerings, and substantial economies of scale, creating a challenging environment for smaller players like DigitalOcean.

In 2024, AWS, Azure, and GCP continue to dominate the cloud market. AWS, for instance, consistently holds the largest market share, often exceeding 30%, while Azure and GCP follow closely. This dominance means they can invest heavily in R&D and infrastructure, offering competitive pricing and a vast array of services that are difficult for DigitalOcean to match across the board.

DigitalOcean’s competitive landscape includes strong niche and regional players who often mirror its developer-centric approach. Companies like Linode, now part of Akamai, and Vultr are direct rivals, frequently competing on price and ease of use. OVHcloud also presents a significant challenge, particularly in European markets, offering a broad range of cloud services that appeal to similar customer segments.

Despite fierce competition, the cloud computing market is experiencing robust growth, fueled significantly by the accelerating adoption of Artificial Intelligence. This expanding market size, projected to reach over $1.3 trillion by 2025 according to some estimates, offers a larger pie for all participants, including DigitalOcean, to capture new customers and increase revenue. The sheer volume of this growth can, to some extent, temper the intensity of rivalry by widening the total addressable market.

Differentiation Strategy and Developer Focus

DigitalOcean carves out its niche by prioritizing a simple, intuitive user experience and transparent pricing, a strategy that resonates deeply with its developer-centric customer base. This focus on ease of use and predictable costs is a key differentiator in a market often characterized by complexity. For instance, in 2023, DigitalOcean reported a customer base exceeding 600,000, many of whom are individual developers and small to medium-sized businesses that value this straightforward approach.

However, the competitive landscape is dynamic. Major cloud providers like AWS, Azure, and Google Cloud are increasingly investing in simplifying their own interfaces and offering specialized solutions tailored to specific developer workflows. This means DigitalOcean must continuously innovate to maintain its edge. For example, AWS's recent expansions in managed services and developer tools aim to capture some of the same market segments DigitalOcean serves, highlighting the need for ongoing product development and community engagement to retain its competitive advantage.

- User-Friendly Interface: DigitalOcean's platform is designed for ease of use, appealing to developers who want to deploy and manage applications quickly.

- Transparent Pricing: Predictable and straightforward pricing models are a significant draw, reducing cost uncertainty for users.

- Developer Community: A strong focus on building and supporting a vibrant developer community fosters loyalty and provides valuable feedback.

- Competitive Pressure: Major cloud providers are enhancing their offerings to attract developers, requiring DigitalOcean to stay agile and innovative.

High Fixed Costs and Exit Barriers

The cloud infrastructure sector, where DigitalOcean operates, is characterized by immense capital requirements. Building and maintaining data centers, along with the necessary hardware, demands significant upfront investment. This capital intensity creates high fixed costs for all players, including DigitalOcean.

These substantial fixed costs, coupled with significant barriers to exiting the market, compel existing companies to actively pursue and defend market share. To achieve economies of scale and maximize the utilization of their expensive assets, companies are incentivized to engage in aggressive competition. For instance, in 2023, major cloud providers continued to invest billions in expanding their infrastructure, with Amazon Web Services (AWS) alone reporting capital expenditures of over $40 billion for the year, underscoring the ongoing need for high asset utilization.

- High Capital Investment: Cloud infrastructure requires massive upfront spending on data centers and hardware.

- Significant Exit Barriers: Once invested, it's difficult and costly for companies to leave the market.

- Incentive for Competition: High fixed costs drive companies to fight for market share to ensure asset profitability.

- Asset Utilization Focus: Companies strive to keep their expensive infrastructure running at optimal capacity.

Competitive rivalry in the cloud computing sector is intense, dominated by hyperscale providers like AWS, Azure, and Google Cloud, which collectively held over 60% of the global cloud infrastructure market in 2023. These giants leverage vast resources and economies of scale, making it challenging for smaller players like DigitalOcean. DigitalOcean differentiates itself through a developer-centric approach, emphasizing ease of use and transparent pricing, which appeals to its core customer base of individual developers and SMBs.

While DigitalOcean competes directly with similar niche players such as Linode (now Akamai) and Vultr, the overarching threat comes from the sheer market power and continuous innovation of the hyperscalers. These larger providers are increasingly simplifying their offerings and developing specialized tools, directly encroaching on DigitalOcean's established user base. The market's rapid growth, particularly driven by AI, does provide opportunities, but maintaining a competitive edge requires ongoing agility and product development.

| Competitor | 2023 Market Share (Approx.) | Key Differentiators |

|---|---|---|

| AWS | 31% | Broadest service portfolio, extensive global reach |

| Microsoft Azure | 24% | Strong enterprise integration, hybrid cloud solutions |

| Google Cloud Platform | 11% | Data analytics, AI/ML capabilities, open-source contributions |

| DigitalOcean | Niche focus | Developer-friendly interface, predictable pricing, community support |

| Linode (Akamai) | Niche focus | Simplicity, performance, competitive pricing |

SSubstitutes Threaten

While startups and small to medium-sized businesses (SMBs) are DigitalOcean's sweet spot, some larger SMBs or those with unique needs might consider on-premise or hybrid cloud solutions. These alternatives can emerge as substitutes, particularly when data sovereignty, stringent security protocols, or highly specialized performance demands are paramount. For instance, a growing number of enterprises are exploring hybrid models to balance the agility of cloud with the control of on-premise infrastructure, with the global hybrid cloud market projected to reach $1,149.44 billion by 2028, growing at a CAGR of 23.1% from 2021 according to a 2024 report by Grand View Research.

For specific needs demanding greater hardware control or guaranteed performance, traditional managed hosting and dedicated server providers present a viable substitute for DigitalOcean's virtual machines. These alternatives cater to users prioritizing an exclusive environment or those running older applications that might not perform optimally on virtualized infrastructure.

Platform-as-a-Service (PaaS) offerings like Heroku and Google App Engine, along with serverless computing options such as AWS Lambda and Google Cloud Functions, present a significant threat by abstracting infrastructure management. This allows developers to concentrate solely on their code, bypassing the need for server provisioning and maintenance, which is a core aspect of DigitalOcean's IaaS model.

While DigitalOcean's App Platform provides some PaaS capabilities, specialized PaaS or serverless solutions can be more appealing substitutes for specific application needs, potentially diverting customers seeking fully managed environments. The growing adoption of serverless, for instance, is reshaping cloud infrastructure preferences, with companies increasingly looking for ways to reduce operational overhead.

Software-as-a-Service (SaaS) Applications

The rise of Software-as-a-Service (SaaS) applications presents a significant threat to cloud infrastructure providers like DigitalOcean. Many core business functions, which previously necessitated custom application development and hosting on infrastructure-as-a-service (IaaS) platforms, can now be readily addressed by readily available SaaS solutions. This trend diminishes the need for businesses to manage their own application stacks.

The increasing sophistication and widespread adoption of SaaS platforms mean that companies can often find pre-built, scalable solutions for needs like customer relationship management (CRM), enterprise resource planning (ERP), and e-commerce. For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a substantial shift towards these ready-made solutions.

- Increased SaaS Adoption: Businesses are increasingly opting for SaaS for CRM, ERP, and e-commerce, reducing reliance on IaaS for custom builds.

- Market Growth: The global SaaS market's projected growth to over $200 billion in 2024 highlights the expanding availability and appeal of these solutions.

- Reduced IaaS Need: As SaaS offerings mature, they directly substitute the need for businesses to develop and host their own applications on IaaS.

- Cost and Complexity: SaaS often offers a more cost-effective and less complex alternative to managing custom infrastructure.

Local Development Environments and Containers

For development and testing, developers can leverage local machines, virtualized environments, or containerization tools like Docker Desktop, bypassing the immediate need for cloud infrastructure. These solutions often precede cloud adoption but can function as substitutes for initial development phases.

The widespread availability and increasing sophistication of local development tools present a tangible threat. For instance, Docker Desktop, a popular containerization platform, saw significant adoption, with millions of developers utilizing it for local application development and testing. This allows for robust testing and iteration without incurring cloud costs.

- Local Development Environments: Tools like VS Code with integrated debugging and extensions allow for complex application development directly on a developer's machine.

- Containerization (Docker, Kubernetes locally): Technologies such as Docker enable developers to package applications and their dependencies into portable containers, facilitating consistent testing across different local setups before cloud deployment.

- Virtual Machines (VMware, VirtualBox): These allow for the creation of isolated operating system environments on local hardware, mimicking server conditions for testing purposes.

- Cost Savings: Utilizing local resources for development and testing can significantly reduce initial expenditure compared to provisioning cloud resources, making it an attractive substitute for startups and early-stage projects.

The threat of substitutes for DigitalOcean is significant, stemming from various alternatives that can fulfill similar needs. These range from on-premise solutions and managed hosting to more abstract Platform-as-a-Service (PaaS) and Serverless offerings, as well as the pervasive Software-as-a-Service (SaaS) model. Even robust local development environments can act as substitutes for initial stages of projects.

The growing maturity of SaaS applications directly challenges DigitalOcean's Infrastructure-as-a-Service (IaaS) model by providing ready-made solutions for common business functions, thereby reducing the need for custom development and hosting. This trend is underscored by the substantial growth in the SaaS market, which was projected to exceed $200 billion in 2024.

Specialized PaaS and serverless options offer developers a way to bypass infrastructure management entirely, focusing solely on code. This abstraction is a direct substitute for DigitalOcean's core IaaS offerings, especially for those prioritizing reduced operational overhead.

Furthermore, traditional managed hosting and dedicated servers remain viable substitutes for users who require greater hardware control or are running legacy applications. The hybrid cloud market's projected growth to $1,149.44 billion by 2028, with a 23.1% CAGR from 2021, also indicates a strong trend towards alternatives that blend cloud agility with on-premise control.

Entrants Threaten

The cloud infrastructure market demands substantial upfront capital. Companies need billions of dollars to establish data centers, acquire cutting-edge hardware, and build robust global networks. For instance, major cloud providers like Amazon Web Services (AWS) and Microsoft Azure have invested tens of billions of dollars in their infrastructure. This immense financial commitment acts as a significant deterrent for aspiring competitors, effectively limiting the threat of new entrants.

The threat of new entrants in the cloud computing market, particularly for a player like DigitalOcean, is significantly mitigated by the substantial economies of scale enjoyed by established providers. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have massive data center footprints and purchasing power, allowing them to secure hardware and energy at much lower costs per unit. This cost advantage is difficult for newcomers to replicate.

For instance, in 2024, the sheer volume of infrastructure managed by these hyperscalers translates into per-gigabyte storage and per-CPU hour pricing that is often substantially lower than what a new entrant could offer without operating at a similar scale. This creates a formidable barrier, as new cloud providers would struggle to achieve comparable cost efficiencies, making it challenging to compete on price and attract customers away from the incumbents.

The cloud computing market demands significant upfront investment to establish a reputation for reliability, security, and performance. DigitalOcean has cultivated strong trust within its developer community, fostering a brand loyalty that new entrants find challenging to quickly match.

Technical Complexity and Talent Acquisition

The technical complexity of operating a cloud infrastructure presents a significant barrier to new entrants. Mastering areas like virtualization, advanced networking, robust security protocols, and distributed systems demands substantial upfront investment in both technology and specialized knowledge. For instance, a new cloud provider would need to build out or acquire sophisticated data center capabilities, which can run into hundreds of millions of dollars.

Attracting and retaining top-tier talent in these highly specialized fields is another formidable challenge. The demand for cloud architects, security engineers, and site reliability engineers far outstrips supply. In 2024, average salaries for senior cloud engineers in major tech hubs often exceeded $150,000 annually, not including benefits or stock options, making talent acquisition a major operational cost that new entrants must absorb.

- High Capital Expenditure: Building out hyperscale data centers requires billions in investment.

- Specialized Skill Shortage: Demand for cloud engineers outpaces supply, driving up labor costs.

- Rapid Technological Evolution: Continuous investment is needed to keep pace with advancements in virtualization and AI-driven infrastructure management.

Regulatory and Compliance Hurdles

The cloud computing sector faces substantial regulatory and compliance challenges that act as a significant barrier to entry. New companies must invest heavily in understanding and adhering to a complex web of data privacy regulations like GDPR and CCPA, alongside industry-specific mandates such as HIPAA for healthcare data. For instance, DigitalOcean's commitment to compliance with standards like SOC 2 Type II and ISO 27001 demonstrates the depth of effort required, which can be prohibitively expensive for startups.

These evolving legal frameworks demand continuous adaptation and robust technical infrastructure to ensure data protection and security. Failure to comply can result in severe penalties, deterring potential new entrants who may lack the resources or expertise to navigate these intricate requirements. The ongoing global push for stricter data governance, with many regions implementing or updating their data protection laws, further intensifies this threat.

- Data Privacy Laws: Regulations such as GDPR (effective May 2018) and CCPA (effective January 2020) impose strict rules on data handling and privacy, requiring significant compliance investments.

- Industry-Specific Compliance: Sectors like healthcare (HIPAA) and finance have unique, stringent compliance needs that new entrants must meet, adding complexity and cost.

- Security Standards: Adherence to international security certifications like ISO 27001 and SOC 2 is often expected, demanding substantial resources for audits and ongoing maintenance.

- Evolving Landscape: The constant updates and new implementations of data protection and cybersecurity laws globally create an ongoing challenge for new market participants.

The threat of new entrants for DigitalOcean is relatively low due to the immense capital required to build comparable cloud infrastructure. Establishing data centers, acquiring hardware, and developing global networks necessitate billions of dollars, a barrier that most newcomers cannot overcome. For instance, hyperscale cloud providers like AWS and Microsoft Azure continue to invest tens of billions annually in their infrastructure, setting a high bar for any potential competitor.

Furthermore, established players benefit from significant economies of scale, allowing them to offer services at lower price points. In 2024, the sheer volume of operations for these giants translates into cost efficiencies that are difficult for new entrants to match, making it challenging to compete on price. This cost advantage, coupled with the high upfront investment, effectively limits the influx of new competitors into the cloud infrastructure market.

Porter's Five Forces Analysis Data Sources

Our DigitalOcean Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry analyst reports, and market research from reputable firms like Gartner and Forrester. We also integrate insights from competitor press releases and technology trend publications to capture the dynamic nature of the cloud computing market.