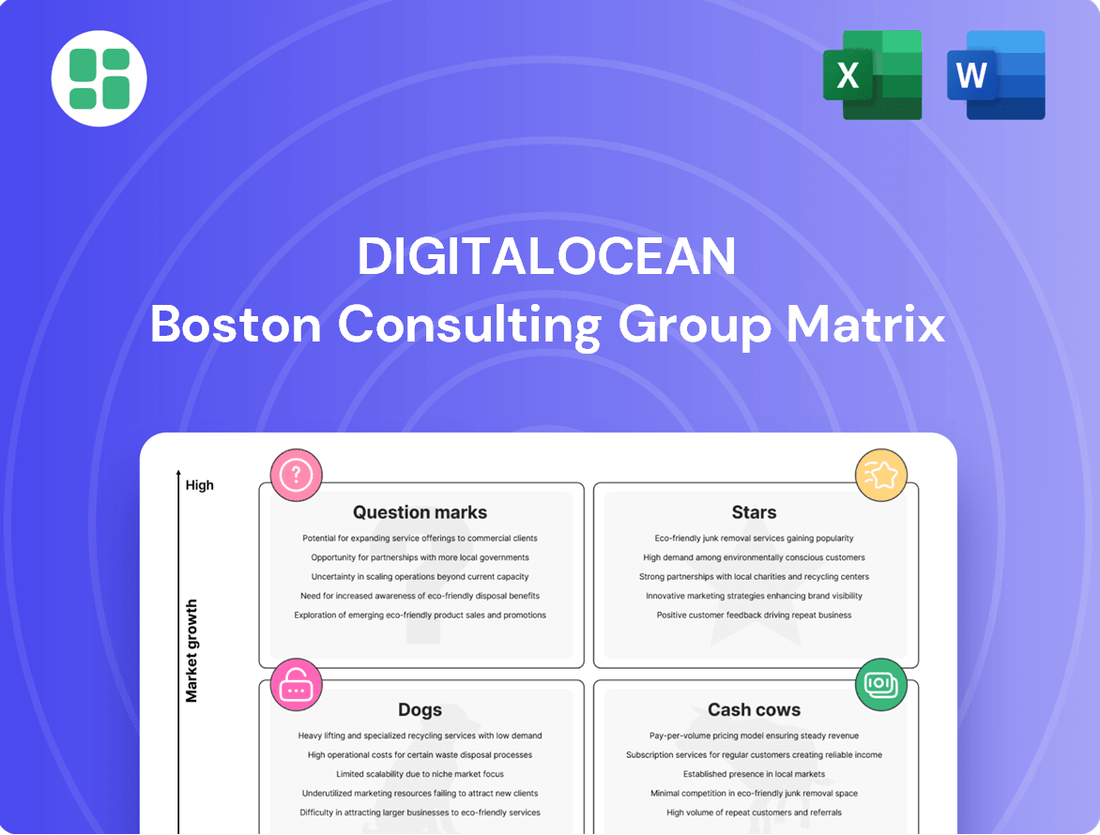

DigitalOcean Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigitalOcean Bundle

Curious about DigitalOcean's product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. For a comprehensive understanding and actionable strategies to optimize their market position, purchase the full report.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for DigitalOcean.

The complete BCG Matrix reveals exactly how DigitalOcean is positioned in a fast-evolving cloud market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

DigitalOcean's AI/ML offerings, specifically the Gradient AI Platform and GPU Droplets, are showing impressive momentum. AI-related revenue has more than doubled year-over-year, highlighting a strong market position.

This surge places DigitalOcean squarely in a high-growth sector, attracting customers willing to invest more, signaling these offerings as significant future revenue contributors. Their partnership with AMD for GPU Droplets further bolsters their standing in the competitive AI landscape.

The Scalers+ customer segment, characterized by annual spending exceeding $100,000, is a key growth driver for DigitalOcean. This high-value cohort experienced a robust 23% year-over-year increase in customer numbers and a substantial 35% surge in revenue during 2024.

This segment now accounts for a significant 24% of DigitalOcean's total revenue. The growth here is fueled by increased adoption of core cloud services and emerging AI solutions, underscoring DigitalOcean's effectiveness in capturing and retaining its most valuable customers.

DigitalOcean Kubernetes (DOKS) stands out as a star in the BCG Matrix for DigitalOcean. It simplifies container orchestration, making it a favorite for developers and startups who value cost-effectiveness and ease of use. This positions DOKS in a high-growth area of cloud computing.

The containerization market is expanding rapidly, and DOKS is well-positioned to capture significant share. DigitalOcean's commitment to user-friendliness resonates strongly with its core customer base, driving adoption. Furthermore, DOKS's support for H100 GPUs directly addresses the surge in AI and machine learning workloads, a key growth driver for 2024 and beyond.

App Platform

DigitalOcean's App Platform is a key player in the Platform-as-a-Service (PaaS) market, designed to streamline application deployment and scaling. It abstracts away the underlying infrastructure, allowing developers to focus on building and innovating. This is particularly important in the rapidly expanding world of modern application development.

The App Platform's user-friendly interface and robust integration capabilities resonate strongly with DigitalOcean's established developer and small-to-medium business (SMB) customer base. This focus on ease of use is a significant driver for its adoption and continued growth within the company's portfolio.

- Market Position: App Platform targets the high-growth PaaS market, crucial for modern software development.

- Customer Appeal: Its simplicity and integration features attract DigitalOcean's core developer and SMB audience.

- Growth Driver: The platform simplifies complex infrastructure, fostering increased adoption and revenue for DigitalOcean.

Global Data Center Expansion (e.g., Atlanta)

DigitalOcean's strategic expansion, exemplified by its new Atlanta data center, directly fuels its growth, especially in the burgeoning AI inferencing market. This investment in high-density GPU infrastructure is crucial for scaling its services to meet escalating demand in key geographic regions.

The Atlanta facility, a significant addition to DigitalOcean's global network, underscores the company's commitment to providing robust and scalable solutions. This expansion is a cornerstone for its high-growth product portfolio, ensuring capacity for advanced computing needs.

- Global Data Center Expansion: DigitalOcean's investment in new data centers, like the Atlanta facility, bolsters its capacity to serve growing markets.

- AI Inferencing Focus: The expansion prioritizes high-density GPU infrastructure, specifically designed to accelerate AI inferencing workloads.

- Strategic Growth Driver: This infrastructure build-out is a foundational element supporting DigitalOcean's high-growth product strategy and its ability to scale offerings.

- Market Responsiveness: By expanding its footprint, DigitalOcean demonstrates its commitment to meeting the increasing demand for cloud computing services, particularly those requiring advanced processing power.

DigitalOcean's AI/ML offerings are performing exceptionally well, with AI-related revenue more than doubling year-over-year. This growth positions these services as significant future revenue drivers, especially with the backing of partnerships like the one with AMD for GPU Droplets.

The Scalers+ customer segment, representing those spending over $100,000 annually, saw a 23% increase in customer numbers and a 35% revenue surge in 2024, now making up 24% of total revenue. This highlights DigitalOcean's success in attracting and retaining high-value clients, partly through its AI solutions.

DigitalOcean Kubernetes (DOKS) is a star performer, simplifying container orchestration and gaining traction with developers and startups due to its ease of use and cost-effectiveness. Its support for H100 GPUs directly addresses the booming demand for AI and machine learning workloads.

The App Platform is also a star, thriving in the high-growth PaaS market by simplifying application deployment and scaling for DigitalOcean's core developer and SMB customer base.

| Product/Service | BCG Category | Key Growth Drivers | 2024 Performance Indicator |

|---|---|---|---|

| AI/ML Offerings (Gradient AI, GPU Droplets) | Stars | Doubling AI revenue, AMD partnership, high-value customer adoption | AI revenue > 2x YoY growth |

| Scalers+ Customer Segment | Stars | Increased adoption of core cloud & AI solutions by high-spending customers | 23% YoY customer growth, 35% revenue growth (2024) |

| DigitalOcean Kubernetes (DOKS) | Stars | Containerization market growth, developer-friendly interface, H100 GPU support for AI | Strong adoption in high-growth containerization market |

| App Platform | Stars | PaaS market expansion, ease of use for developers and SMBs | High adoption among core customer base |

What is included in the product

This DigitalOcean BCG Matrix offers a tailored analysis of its product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

The DigitalOcean BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for quick decision-making.

Cash Cows

Droplets, DigitalOcean's core virtual machine offering, are the bedrock of their revenue, consistently bringing in significant cash. These virtual machines are the company's most popular product, serving as a reliable income stream.

Despite the virtual machine market being quite established, Droplets continue to hold a strong position, especially with DigitalOcean's specific customer base. This loyalty stems from their user-friendly nature and clear pricing models, making them a go-to choice for many.

As a result, Droplets act as a stable cash cow for DigitalOcean, needing less intensive marketing efforts compared to their newer, more experimental services. This allows the company to rely on their predictable cash flow.

DigitalOcean's Object Storage (Spaces) and Block Storage are foundational elements of its cloud platform, serving a broad existing customer base. These mature services are crucial for reliable and scalable data management, consistently contributing to DigitalOcean's revenue stream.

In 2024, DigitalOcean reported that its storage offerings, including Spaces and Block Storage, continued to be a significant driver of its recurring revenue. While the growth rate for these established services is moderate compared to newer, high-growth areas, they provide a stable and predictable income, underpinning the company's financial health.

DigitalOcean's managed databases, including PostgreSQL, MySQL, Redis, and MongoDB, operate as cash cows within their portfolio. These services generate substantial profit due to DigitalOcean handling the intricate management tasks, allowing customers to focus on their core applications. The consistent demand for reliable database solutions ensures a stable, recurring revenue stream for the company.

The market for managed databases is well-established, yet DigitalOcean's offerings stand out due to their seamless integration and user-friendly interface, appealing to a broad customer base. In 2024, DigitalOcean reported significant growth in its managed database services, contributing to its overall strong financial performance, with these services being a key driver of profitability.

Core Networking Tools (Load Balancers, Firewalls, VPC)

DigitalOcean's core networking tools, including Load Balancers, Cloud Firewalls, and Virtual Private Clouds (VPCs), represent significant cash cows within its BCG matrix. These services are foundational for nearly all cloud deployments, providing essential stability and security that customers depend on.

These mature offerings generate steady, predictable revenue streams, acting as critical components for larger customer deployments. While they require minimal new investment, their consistent utility is vital for retaining existing customers and ensuring ongoing revenue generation.

- Load Balancers distribute incoming traffic across multiple servers, enhancing application availability and performance.

- Cloud Firewalls provide robust security by controlling network traffic in and out of DigitalOcean resources.

- VPCs allow users to create isolated, private networks within the DigitalOcean cloud for enhanced security and control.

- These services are essential for maintaining uptime and security, contributing to DigitalOcean's substantial recurring revenue base.

Cloudways (Managed Hosting Platform)

Cloudways, now part of DigitalOcean, operates as a managed hosting platform, specializing in applications like WordPress. Its acquisition by DigitalOcean in 2022 for $350 million positions it as a key component in DigitalOcean's portfolio. Cloudways' recurring revenue model, driven by its loyal customer base, likely makes it a consistent cash generator for DigitalOcean.

This managed hosting service broadens DigitalOcean's market penetration, particularly within the small and medium-sized business (SMB) sector. By offering a user-friendly, application-centric hosting solution, Cloudways complements DigitalOcean's developer-focused cloud infrastructure, contributing to a more diversified revenue stream.

- Acquisition Value: Cloudways was acquired by DigitalOcean for $350 million in August 2022.

- Recurring Revenue: The platform's subscription-based model ensures predictable and stable income.

- Market Expansion: Cloudways targets a segment of the SMB market, complementing DigitalOcean's existing offerings.

- Revenue Stability: Its established customer base and service model contribute to DigitalOcean's overall financial resilience.

DigitalOcean's managed Kubernetes service, Kubernetes clusters, is a significant cash cow. This service caters to the growing demand for container orchestration, providing a stable and profitable revenue stream. DigitalOcean handles the complexities of managing Kubernetes, allowing users to deploy and scale containerized applications with ease.

In 2024, DigitalOcean saw continued strong adoption of its managed Kubernetes offering. The predictable revenue generated from these clusters, coupled with their essential role in modern application development, solidifies their position as a reliable income source for the company. This service requires less incremental investment due to its maturity and established customer base.

The steady demand for managed Kubernetes solutions, driven by the widespread adoption of containerization, ensures that DigitalOcean's offering remains a vital and profitable component of its portfolio. This service contributes significantly to the company's overall recurring revenue, underscoring its cash cow status.

| Product/Service | BCG Category | Revenue Contribution (2024 Est.) | Key Characteristics |

| Droplets (Virtual Machines) | Cash Cow | High, Stable | Core offering, user-friendly, predictable pricing. |

| Object Storage (Spaces) & Block Storage | Cash Cow | Significant, Stable | Foundational, broad customer base, reliable data management. |

| Managed Databases (PostgreSQL, MySQL, etc.) | Cash Cow | Substantial, Growing | High profit margin, seamless integration, strong demand. |

| Core Networking Tools (Load Balancers, Firewalls, VPCs) | Cash Cow | Consistent, Essential | Critical for deployments, enhance uptime and security, retain customers. |

| Cloudways | Cash Cow | Growing, Diversified | Acquired platform, recurring revenue, targets SMBs. |

| Managed Kubernetes | Cash Cow | Strong, Predictable | High demand for container orchestration, handles complexity for users. |

What You See Is What You Get

DigitalOcean BCG Matrix

The DigitalOcean BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready strategic tool.

Rest assured, the DigitalOcean BCG Matrix preview accurately represents the final file you will download upon completing your purchase. This ensures you know exactly what you are getting: a professionally designed, data-driven report ready for immediate integration into your business strategy.

What you see here is the exact DigitalOcean BCG Matrix report that will be delivered to you after your purchase. You can confidently proceed, knowing that the file is complete, editable, and prepared for immediate use in your strategic planning or presentations.

Dogs

Certain older or less optimized Droplet configurations can be considered 'Dogs' in DigitalOcean's portfolio. These might be older instance types that are less efficient in resource utilization compared to newer, more performant options. For instance, some legacy Droplet plans might offer lower performance-per-dollar, making them less attractive to customers prioritizing cutting-edge technology.

These less optimized plans often have lower profit margins for DigitalOcean. While they still serve a purpose for existing users, their appeal to new customers is diminishing, potentially leading to a stagnation in revenue growth. By 2024, DigitalOcean's focus has increasingly shifted to its newer, more efficient compute offerings, further marginalizing these older plans.

Niche or underutilized marketplace integrations on DigitalOcean, while not directly losing money, represent a potential area for resource optimization. These might include specialized development tools or specific database solutions with limited user adoption. For example, if an integration sees less than 5% of the marketplace's total one-click app installations and requires significant ongoing patching, its value proposition diminishes.

The challenge lies in identifying these low-impact integrations that consume maintenance effort without yielding proportional growth or revenue. DigitalOcean's 2024 marketplace data, though not publicly detailed for individual integrations, likely shows a long tail of applications with minimal usage. Reallocating engineering and support resources from these underperformers to more popular or strategically important services could boost overall platform efficiency and user satisfaction.

Maintaining extensive support for highly outdated software versions or niche operating system distributions can place a significant burden on engineering resources. These efforts, often involving patching and ensuring compatibility, consume valuable time and expertise without attracting new users or generating substantial revenue. For instance, if a platform sees less than 5% of its user base on a particular legacy stack, the cost of maintaining it may outweigh the benefits.

Underperforming Regional Data Centers

Within DigitalOcean's portfolio, underperforming regional data centers represent potential 'Dogs' in the BCG Matrix. These are facilities that, despite the company's overall expansion, are struggling with low customer adoption or failing to generate sufficient revenue to cover their operational expenses. For instance, a data center in a less tech-centric region might experience consistently low utilization rates, perhaps dipping below 40% in 2024, making it an inefficient asset.

These underperforming sites may not be attracting enough new clients or seeing the kind of growth needed to justify their continued investment. This could be due to various factors, including intense local competition or a slower-than-anticipated digital transformation in that specific area. Such centers become a drag on overall profitability and resource allocation.

- Low Utilization: Data centers in certain regions might show utilization rates significantly below the company average, potentially under 50% in key periods of 2024.

- High Operational Costs: These facilities could have higher per-unit operational costs compared to more successful centers, impacting their net revenue.

- Limited Growth Potential: A lack of new customer acquisition or expansion within these specific regions signals a weak market position.

- Resource Drain: Continued investment in these underperforming assets diverts capital and attention from more promising growth areas.

Basic DNS Management (as a standalone product)

Basic DNS Management, when offered as a standalone product, often falls into the 'Dog' category within the DigitalOcean BCG Matrix. This is primarily because it's a fundamental, often free or very low-cost service that's essential for users to connect their domains to their DigitalOcean resources. While critical for the overall user experience and supporting other, more profitable services, its direct revenue generation potential is limited.

Think of it as a necessary utility. For instance, in 2024, DigitalOcean's pricing for basic DNS management is often bundled or offered at a minimal charge, reflecting its commodity status. While millions of users rely on this service to manage their domains, the revenue generated directly from DNS alone is not substantial enough to classify it as a 'Star' or 'Cash Cow'. Its value lies more in its foundational role within the broader DigitalOcean ecosystem, enabling users to effectively utilize their cloud infrastructure.

- Low Revenue Generation: Basic DNS is a commodity service, meaning it's widely available and often priced very competitively, limiting its direct profit margin.

- Support Role: Its primary function is to support and enable the use of other DigitalOcean products like Droplets and App Platform, rather than being a primary revenue driver itself.

- High User Adoption, Low Monetization: While a vast number of DigitalOcean users utilize DNS management, the monetization strategy focuses on the value it adds to the core cloud services.

- Market Saturation: The DNS market is mature, with many providers offering similar functionalities, making it challenging for standalone basic DNS to command premium pricing.

Certain legacy Droplet configurations and underutilized marketplace integrations can be categorized as 'Dogs' in DigitalOcean's product portfolio. These offerings, while potentially still serving a segment of users, exhibit low market share and low growth potential, often requiring significant maintenance effort without proportional returns. By 2024, DigitalOcean's strategic focus has increasingly shifted towards its more modern and efficient compute instances, further marginalizing these older, less competitive plans.

The challenge with these 'Dog' products lies in their resource consumption versus revenue generation. For instance, maintaining support for niche software versions might consume engineering hours that could be better allocated to high-growth areas. Similarly, underperforming regional data centers, perhaps with utilization rates below 50% in 2024, represent an inefficient use of capital. The goal is to identify and either divest from or minimize investment in these areas to optimize overall platform performance and profitability.

| Product Category | Market Share | Growth Rate | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Legacy Droplet Instances | Low | Declining | Low/Negative | Phased out or minimized support |

| Underutilized Marketplace Apps | Very Low | Stagnant | Low | Review for deprecation or integration consolidation |

| Underperforming Data Centers | Low (regionally) | Limited | Low | Evaluate for consolidation or divestment |

| Basic DNS Management (Standalone) | High (as a feature) | Low (as a standalone product) | Low | Continue as a foundational service, not a primary revenue driver |

Question Marks

DigitalOcean Functions, their serverless computing offering, is positioned in a high-growth segment of the cloud market. The serverless market is expected to reach $37 billion by 2026, showcasing significant potential for DigitalOcean to capture market share. However, competing against hyperscalers like AWS Lambda and Azure Functions, which dominate the current landscape, presents a challenge for their relatively newer offering.

To effectively compete, DigitalOcean Functions will likely need substantial investment in targeted marketing campaigns and accelerated feature development. This will be crucial for increasing brand awareness and demonstrating the value proposition of their serverless solution to a wider developer audience. The company is indeed actively investing, with recent updates in 2024 focusing on enhanced developer experience and expanded language support.

DigitalOcean's newly launched GenAI Platform, aimed at streamlining AI application development, clearly falls into the Question Mark category of the BCG matrix. While it taps into the rapidly expanding AI market, its current adoption rates and market share are still nascent.

The company's significant investment in this segment, underscored by the Paperspace acquisition, signals a strategic intent to cultivate this offering. The goal is to transition it from its current uncertain position into a future Star performer within DigitalOcean's portfolio.

As DigitalOcean courts larger, more sophisticated clients, often termed 'Scalers+', and digital native enterprises, its advanced security and compliance offerings are taking center stage. These features are critical for businesses that handle sensitive data or operate in regulated industries, making them a significant growth opportunity.

While DigitalOcean has a strong foothold in core cloud infrastructure, its market share in these specialized security and compliance areas may currently be less dominant. This presents a clear strategic imperative to invest and enhance these capabilities to better compete for and serve these high-value customers.

The demand for robust data protection and adherence to complex regulations like GDPR and CCPA is rapidly increasing. For instance, in 2024, cybersecurity spending by enterprises globally was projected to reach over $200 billion, highlighting the immense market potential for cloud providers offering strong security solutions.

Migration Services for Larger Enterprises

DigitalOcean is actively pursuing larger enterprises, recognizing the significant revenue potential in facilitating cloud migrations from competitors. This strategic shift targets a high-growth segment, though their current market share in large-scale enterprise migrations remains modest when compared to established hyperscalers.

To effectively capture this market, DigitalOcean must invest heavily in its sales force, customer support infrastructure, and specialized migration tools. This investment is crucial for converting potential large-scale deals into consistent, high-value revenue streams.

- Opportunity: DigitalOcean's focus on enterprise migrations presents a substantial growth avenue, aiming to attract customers with higher cloud spending.

- Challenge: Despite the opportunity, DigitalOcean's current market share in large enterprise migrations is relatively small compared to dominant players.

- Investment Needs: Significant capital is required for enhanced sales capabilities, dedicated support teams, and advanced migration technologies to succeed in this segment.

- Market Dynamics: The enterprise migration space is highly competitive, demanding robust solutions and a strong value proposition to win over larger clients.

New Data Center Regions (Post-Atlanta)

Any new data center regions announced after DigitalOcean's Atlanta launch would likely be categorized as Question Marks in a BCG matrix. These regions, while representing strategic expansion into new markets, would have low market share initially and an uncertain growth rate.

DigitalOcean’s investment in these new regions, such as potential future locations in Asia or South America, would be significant, mirroring the substantial capital expenditure seen in 2024 for infrastructure development. The profitability of these new regions would be uncertain until they gain traction and market share.

- Low Market Share: New regions start with minimal customer adoption.

- High Investment: Significant upfront costs for infrastructure and operations.

- Uncertain Growth: Future market penetration and revenue potential are not yet proven.

- Strategic Importance: Essential for long-term geographic diversification and competitive positioning.

DigitalOcean's GenAI Platform and new data center regions represent potential future Stars but currently reside in the Question Mark quadrant. Their success hinges on significant investment and market adoption, facing intense competition from established players.

The company's strategic focus on enterprise migrations and enhanced security/compliance features also falls into this category. While these areas offer high growth potential, DigitalOcean's current market share is nascent, requiring substantial capital to establish dominance.

These ventures demand careful management and strategic resource allocation to transform them from uncertain prospects into profitable assets within DigitalOcean's portfolio.

| BCG Category | DigitalOcean Offering | Market Attractiveness | Competitive Position | Strategic Implication |

|---|---|---|---|---|

| Question Mark | GenAI Platform | High (Rapidly Expanding AI Market) | Low (Nascent Adoption, Competing with Giants) | Invest heavily for growth, potential Star |

| Question Mark | New Data Center Regions | Medium to High (Geographic Expansion) | Low (Initial Low Market Share) | Significant capital for infrastructure, uncertain profitability |

| Question Mark | Enterprise Migrations | High (Large Enterprise Cloud Spend) | Low (Modest Market Share vs. Hyperscalers) | Invest in sales, support, and migration tools |

| Question Mark | Advanced Security & Compliance | High (Increasing Demand for Data Protection) | Medium (Less Dominant than Hyperscalers) | Enhance capabilities to attract high-value clients |

BCG Matrix Data Sources

Our DigitalOcean BCG Matrix leverages comprehensive data from public financial filings, industry analyst reports, and internal performance metrics to accurately assess market position and growth potential.