Digital China Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Group Bundle

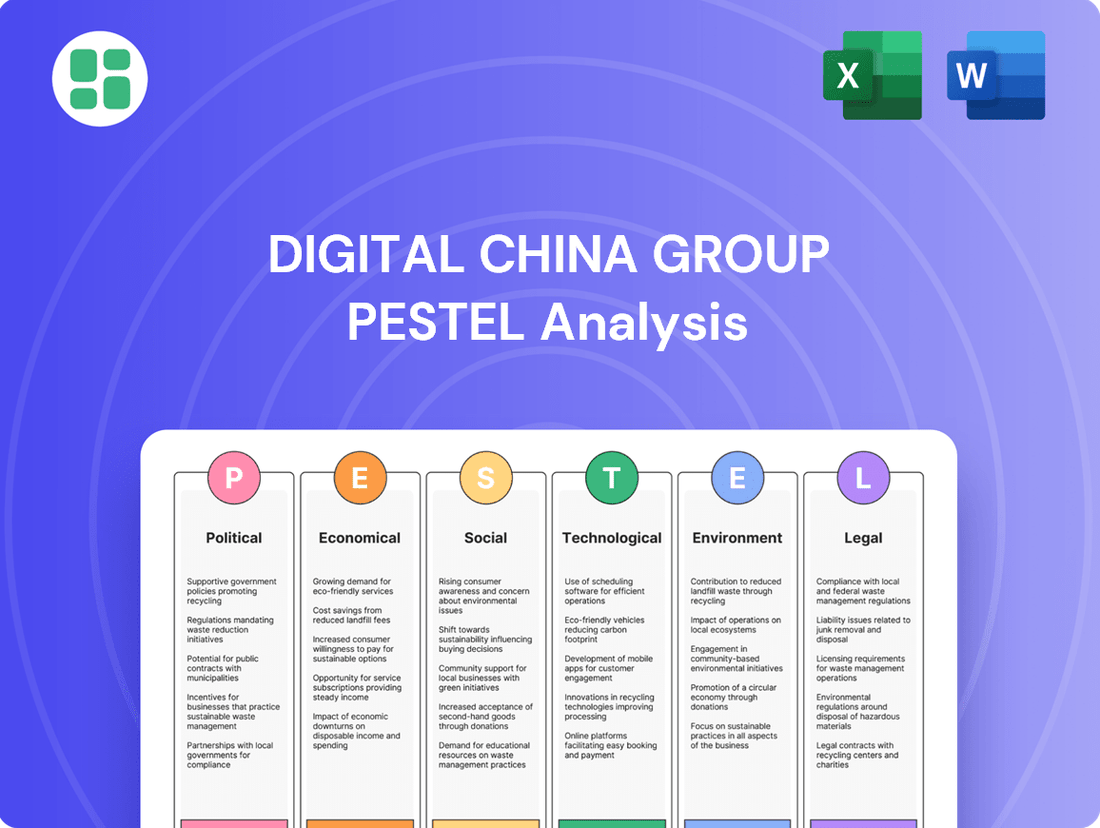

Navigate the complex external forces impacting Digital China Group with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping its trajectory. Equip yourself with the strategic foresight needed to capitalize on opportunities and mitigate risks. Download the full PESTLE analysis today and gain a decisive market advantage.

Political factors

The Chinese government's commitment to its 'Digital China' initiative remains a significant political driver, fostering a supportive ecosystem for digital transformation. This strategy, actively promoted and funded, aims to modernize the nation's economy, society, and governance through extensive digital integration.

This national push creates substantial opportunities for companies like Digital China Group, particularly in crucial areas such as building digital infrastructure and developing data elements. For instance, in 2023, China's digital economy reached an estimated 50.2 trillion yuan, accounting for 41.5% of its GDP, underscoring the government's successful efforts and the vast market potential.

Recent government procurement policies, including a draft in late 2024, strongly favor domestically produced IT products and services, often offering a 20% price advantage. This directly benefits local players like Digital China Group by significantly enhancing their competitiveness in securing government contracts.

This policy shift not only bolsters domestic enterprises but also incentivizes foreign companies to establish local production facilities within China to remain competitive. For instance, the 2023 government IT procurement budget reached an estimated $40 billion, highlighting the substantial market opportunity for domestic suppliers.

Rising geopolitical tensions, especially between China and Western nations, are accelerating China's drive for technological independence and control over its own data. This political environment compels IT service providers to favor domestic solutions and rigorously follow national data security regulations, a trend that positively impacts Digital China Group's strategic emphasis on homegrown technologies and services.

'AI+' Initiative and Strategic Plans

The Chinese government's 'AI+' initiative, a key component of its digital transformation strategy, was prominently featured in the 2025 Government Work Report. This initiative underscores a national commitment to embedding artificial intelligence across critical industries, with a particular emphasis on manufacturing. This focus directly supports Digital China Group's strategic direction, as the company is heavily invested in AI-powered cloud services and intelligent solutions.

This national push for AI integration presents a significant opportunity for Digital China Group. The company is well-positioned to leverage this government priority, as its core business aligns with the objectives of the 'AI+' initiative. By capitalizing on these national development priorities, Digital China Group can expect to see increased demand for its AI-driven cloud and smart manufacturing solutions.

- Government Support: The 'AI+' initiative signals strong state backing for AI adoption, creating a favorable policy environment.

- Market Expansion: This national strategy is expected to drive significant growth in the AI-powered cloud services market in China.

- Strategic Alignment: Digital China Group's existing business model directly benefits from these government-led AI integration efforts.

Regulatory Stability and Policy Evolution

China's regulatory environment, especially concerning data security and cybersecurity, remains a key political factor for Digital China Group. While dynamic, the government's push towards a more unified and transparent market system provides a framework for adaptation. This evolving structure aims to offer greater clarity, enabling Digital China Group to refine its compliance strategies and operate within defined legal parameters.

The government's commitment to regulatory stability, despite the pace of evolution, is crucial. For instance, the Cybersecurity Review Measures, implemented in 2023, aim to standardize security assessments for critical information infrastructure operators. This provides Digital China Group with clearer guidelines for data handling and operational security, fostering confidence in long-term planning.

- Regulatory Evolution: China is moving towards a more structured and transparent market system, impacting data security and cybersecurity regulations.

- Policy Clarity: The government's efforts to unify regulations provide businesses like Digital China Group with clearer operational boundaries.

- Compliance Adaptation: Digital China Group can strategically adapt its compliance measures to align with evolving legal frameworks.

- Market Stability: The aim for regulatory stability supports predictable business operations and investment within China's digital sector.

The Chinese government's strategic focus on technological self-reliance, particularly in areas like semiconductors and AI, directly influences the market landscape for companies like Digital China Group. This drive is evident in significant state investment and preferential policies aimed at fostering domestic innovation and reducing reliance on foreign technology. For instance, the national semiconductor industry investment fund received substantial capital injections in 2024, signaling a long-term commitment to this sector.

Government procurement policies continue to favor domestic IT solutions, with draft revisions in late 2024 suggesting an even stronger preference for local providers, potentially offering a 20% price advantage. This trend, coupled with the nation's push for technological independence driven by geopolitical considerations, creates a more favorable environment for companies like Digital China Group that emphasize homegrown technologies and robust data security compliance.

The ongoing implementation of the 'AI+' initiative, highlighted in the 2025 Government Work Report, further solidifies government support for AI integration across industries, especially manufacturing. This national priority aligns perfectly with Digital China Group's expertise in AI-powered cloud services and intelligent solutions, positioning the company to capitalize on increased demand for its offerings.

| Policy/Initiative | Year | Impact on Digital China Group | Supporting Data/Context |

|---|---|---|---|

| Digital China Initiative | Ongoing | Fosters ecosystem for digital transformation, creating market opportunities. | China's digital economy reached 50.2 trillion yuan in 2023 (41.5% of GDP). |

| Domestic IT Procurement Preference | Late 2024 (Draft) | Enhances competitiveness for government contracts. | Potential 20% price advantage for domestic products; 2023 IT procurement budget estimated at $40 billion. |

| 'AI+' Initiative | 2025 (Govt. Work Report) | Drives demand for AI-driven cloud and smart manufacturing solutions. | National commitment to embedding AI across critical industries. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Digital China Group, covering political, economic, social, technological, environmental, and legal dimensions.

It offers strategic insights into how these forces shape opportunities and threats for the company's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, easing the burden of synthesizing complex external factors for Digital China Group.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear framework to navigate the dynamic Digital China landscape.

Economic factors

China's digital economy is on a strong upward trajectory. Projections indicate that by the close of 2025, the value added by core digital industries will surpass 10% of the nation's Gross Domestic Product. This impressive growth is fueled by substantial investments poured into digital infrastructure development, creating a fertile ground for technological advancement.

This expanding digital landscape offers a significant and increasingly lucrative market for Digital China Group. Their offerings in cloud computing, big data analytics, and comprehensive digital transformation services are in high demand across a wide array of industries. The group is well-positioned to capitalize on this trend, providing essential tools and expertise to businesses navigating this digital shift.

China's national strategy to build a Digital China is a major driver for increased computing power demand. The ambitious goal is to exceed 300 EFLOPS of total computing power by the close of 2025. This surge in need for robust computing infrastructure directly plays into the strengths of Digital China Group.

Digital China Group is well-positioned to capitalize on this trend, offering essential IT infrastructure services. Their 'AI-driven cloud integration' strategy is specifically designed to meet this escalating demand for advanced computing solutions, making them a key player in the nation's digital transformation.

China's digital transformation market is experiencing robust growth, with projections indicating it will reach USD 410.67 billion by 2029. This expansion, driven by a compound annual growth rate of 13.10% starting in 2024, is significantly bolstered by supportive government policies and the increasing integration of cutting-edge technologies across the economy.

Digital China Group, as a prominent integrated IT service provider, is strategically positioned to capitalize on this burgeoning market. Its comprehensive service offerings across diverse industries allow it to effectively serve the evolving digital needs of businesses undergoing transformation, capturing a substantial portion of this expanding opportunity.

Investment in Data Elements and Marketization

The Chinese government's strategic push for market-oriented data allocation, as outlined in initiatives like the 'Three-Year Action Plan for Data Elements (2024-2026),' is fundamentally reshaping the economic landscape. This policy shift recognizes data as a core production factor, directly impacting how businesses operate and generate value.

Digital China Group is well-positioned to capitalize on this trend. The emphasis on data governance and application within this new framework presents significant opportunities for the company to develop innovative business models. For instance, by facilitating secure data sharing and enabling data-driven insights, Digital China Group can unlock new revenue streams.

The marketization of data elements is expected to drive substantial economic growth. China's digital economy, valued at over 50 trillion yuan in 2023, is projected to continue its rapid expansion, with data playing an increasingly pivotal role. This creates a fertile ground for companies like Digital China Group that can effectively manage and leverage data assets.

- Data as a Production Factor: Government policies are formalizing data's role in economic output, akin to labor or capital.

- National Data Market Cultivation: Efforts are underway to create a unified platform for data trading and utilization.

- Digital China Group's Opportunity: The company can leverage its expertise in data governance, cloud services, and IT solutions to support this market.

- Economic Impact: The data element market is anticipated to be a significant driver of GDP growth in the coming years.

Economic Headwinds and Opportunities

Despite China's continued economic expansion, sectors like real estate are experiencing a downturn, and global trade tensions could pose external challenges. For instance, China's GDP growth moderated to 5.2% in 2023, a slight decrease from 5.5% in 2022, reflecting these complexities.

However, significant opportunities arise from the government's strategic focus on high-tech sectors and digital transformation. Initiatives promoting domestic consumption and an accelerated green transition are reshaping the economic landscape. This rebalancing presents a fertile ground for IT firms like Digital China Group to play a crucial role.

- Government investment in AI and cloud computing is projected to reach $150 billion by 2025, directly benefiting IT infrastructure providers.

- China's retail sales grew by 7.2% year-on-year in the first quarter of 2024, indicating a rebound in domestic demand that IT solutions can support.

- The nation aims to increase the share of non-fossil fuels in its primary energy consumption to around 20% by 2025, driving demand for digital solutions in energy management.

China's digital economy is a significant growth engine, with core digital industries' value added projected to exceed 10% of GDP by 2025. This expansion is supported by substantial infrastructure investments and a national strategy to boost computing power, aiming for over 300 EFLOPS by 2025. The digital transformation market is set to reach USD 410.67 billion by 2029, growing at a 13.10% CAGR from 2024.

| Key Economic Indicators | Value/Projection | Year |

| Digital Economy Value Added (% of GDP) | > 10% | 2025 |

| Total Computing Power | > 300 EFLOPS | 2025 |

| Digital Transformation Market Size | USD 410.67 billion | 2029 |

| Digital Transformation Market CAGR | 13.10% | 2024-2029 |

Same Document Delivered

Digital China Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Digital China Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors shaping its operations and future. Understand the critical external forces impacting this key player in China's digital landscape.

Sociological factors

China's commitment to boosting digital literacy, as outlined in its 2025 plan, is creating a more skilled workforce. This initiative aims to cultivate a comprehensive system for digital talent, directly benefiting companies like Digital China Group by expanding their potential talent pool and increasing the tech-savviness of their client base.

China's government is actively pushing for a more digitized society, emphasizing smart lifestyles and enhanced digital public services. This initiative directly fuels demand for the kinds of intelligent solutions and digital platforms that Digital China Group specializes in, particularly within the smart city and digital transformation sectors.

By 2023, over 90% of provincial-level government services were accessible online, showcasing a significant societal shift towards digital engagement. This trend is expected to continue, creating a robust market for companies like Digital China Group that can deliver seamless digital experiences and integrated smart city infrastructure.

China's demographic landscape is shifting, with an aging population and a declining workforce becoming prominent features. By 2023, over 21% of China's population was aged 60 and above, a figure projected to grow significantly. This presents a dual challenge and opportunity for companies like Digital China Group.

Despite the aging trend, there's a strong societal push towards digital inclusion, aiming to ensure older citizens can benefit from technological advancements. This includes initiatives focused on elder care technology and digital literacy programs for seniors. For Digital China Group, this translates into a market ripe for solutions that cater to the unique needs of an aging demographic, from smart healthcare devices to user-friendly digital platforms.

Evolving Workplace Preferences and Talent Shortages

China's labor market is experiencing a significant shift, with a growing demand for digital skills clashing with evolving employee expectations. This dynamic creates a challenging environment for companies like Digital China Group, particularly in securing and retaining talent in crucial tech fields. For instance, by the end of 2024, reports indicated a shortage of over 1 million AI professionals in China, highlighting the intensity of this demand.

To navigate these talent shortages, Digital China Group must prioritize robust upskilling and reskilling initiatives. This ensures their existing workforce can adapt to new technological demands. Simultaneously, innovative strategies for attracting and retaining top talent are essential, especially as younger generations increasingly value flexible work arrangements and opportunities for professional development.

Key considerations for Digital China Group include:

- Investing in continuous learning and development programs to bridge the digital skills gap.

- Developing competitive compensation and benefits packages that align with current market expectations.

- Fostering a positive and inclusive work culture that emphasizes employee well-being and growth.

- Exploring flexible work models, such as hybrid or remote options where feasible, to attract a wider talent pool.

Increased Data Consumption and Digital Habits

The post-pandemic landscape has cemented digital habits, driving a significant surge in online consumption, remote work adoption, and digital interactions across China. This deep integration of technology into daily life and business operations translates into a robust and ongoing demand for the services Digital China Group offers.

For instance, in 2024, China's e-commerce sales were projected to reach over $3.7 trillion, highlighting the sustained consumer shift online. This trend directly benefits companies like Digital China Group, which provide the underlying IT infrastructure and digital solutions powering these transactions.

- Sustained Demand: The permanence of digital habits post-pandemic ensures continued growth in online services.

- Infrastructure Needs: Increased digital activity necessitates reliable IT infrastructure, cloud services, and data security solutions.

- Market Opportunity: Digital China Group is well-positioned to capitalize on this persistent demand for digital transformation.

- Economic Impact: The digital economy's expansion, fueled by these habits, directly supports Digital China Group's service offerings.

China's societal embrace of digital technologies is accelerating, with a growing emphasis on digital literacy and smart living. This trend, underscored by over 90% of provincial government services going online by 2023, creates a fertile ground for Digital China Group's intelligent solutions and digital platforms.

The nation's demographic shifts, including an aging population (over 21% aged 60+ in 2023), present both challenges and opportunities, particularly for elder care technology and digital inclusion initiatives. Simultaneously, the demand for digital skills in the labor market, with a reported shortage of over 1 million AI professionals by late 2024, necessitates strategic talent development and retention by companies like Digital China Group.

| Sociological Factor | Description | Implication for Digital China Group | Supporting Data (2023-2024) |

|---|---|---|---|

| Digital Literacy & Adoption | Government push for digitized society and smart lifestyles. | Increased demand for digital platforms and intelligent solutions. | Over 90% of provincial government services online (2023). |

| Demographic Shifts | Aging population and evolving workforce expectations. | Market for elder care tech; talent acquisition challenges. | Over 21% of population aged 60+ (2023); >1 million AI professional shortage (late 2024). |

| Post-Pandemic Habits | Entrenched digital consumption and remote work. | Sustained demand for IT infrastructure and digital services. | Projected e-commerce sales >$3.7 trillion (2024). |

Technological factors

China's commitment to Artificial Intelligence, especially generative AI and Large Language Models (LLMs), is substantial, driving significant investment and widespread adoption across various sectors. This technological push is central to its national strategy.

Digital China Group is strategically aligning with this trend by developing comprehensive AI offerings. Their approach spans from foundational computing power infrastructure to specialized AI applications tailored for specific industries, aiming to capture a leading position in this evolving landscape.

By mid-2024, China's AI market was projected to reach approximately $20 billion, with LLMs expected to be a significant growth driver, indicating the immense commercial potential Digital China Group is targeting.

Cloud computing and big data are central to China's digital economy, with widespread adoption across key sectors. In 2024, China's cloud computing market was projected to reach $300 billion, demonstrating robust growth.

Digital China Group's business model is directly aligned with this trend, as its expertise in cloud services and big data solutions positions it to capitalize on this expanding market. The company's revenue from cloud services saw a significant increase in the first half of 2024, reflecting this demand.

China's commitment to building a national computing network and data circulation infrastructure is a significant technological push towards self-reliance. This initiative aims to create a robust foundation for domestic technological advancement.

Digital China Group's investment in its Shenzhou Kuntai AI computing servers directly aligns with and benefits from this national strategy. By developing its own-brand servers, the company is contributing to and capitalizing on the growth of China's indigenous computing power.

The government has allocated substantial resources to this endeavor, with reports indicating significant investment in high-performance computing centers across the country. For instance, by the end of 2023, China had established over 30 national computing hubs and 10 national data centers, underscoring the scale of this infrastructure development.

Emphasis on Cybersecurity Technologies

As digital adoption accelerates across China, the emphasis on robust cybersecurity and data protection technologies is paramount. This trend directly impacts IT service providers like Digital China Group, necessitating continuous investment in cutting-edge security solutions.

Digital China Group, by its nature as a handler of sensitive data and critical infrastructure for its clients, must prioritize advanced cybersecurity offerings. This commitment is not just about compliance with evolving regulations but also about fostering trust with a diverse clientele, from government entities to large enterprises.

The global cybersecurity market is projected for significant growth. For instance, the worldwide cybersecurity market was valued at approximately $214.9 billion in 2023 and is expected to reach $366 billion by 2028, growing at a compound annual growth rate of 11.2%. This indicates a strong demand for the very services Digital China Group provides.

- Increased Demand for Cloud Security: As more businesses migrate to cloud environments, the need for specialized cloud security solutions, including identity and access management and data encryption, is surging.

- AI-Powered Threat Detection: The integration of artificial intelligence and machine learning into cybersecurity platforms is becoming standard for proactive threat identification and response.

- Data Privacy Regulations: Stricter data privacy laws, such as China's Personal Information Protection Law (PIPL), mandate sophisticated data protection technologies and practices.

- Endpoint Security Evolution: With the rise of remote work and an expanding attack surface, advanced endpoint detection and response (EDR) solutions are crucial for safeguarding individual devices.

Integration of Digital Twins and IoT

The integration of digital twins and the Internet of Things (IoT) is a cornerstone of China's smart city initiatives and industrial modernization. Digital China Group is actively incorporating these advanced technologies into its smart city projects and industrial solutions, demonstrating a keen awareness of and alignment with prevailing technological advancements. For instance, by 2023, China's IoT market size reached an estimated 1.1 trillion yuan, showcasing the significant investment and growth in this sector.

Digital China Group's strategic emphasis on digital twins and IoT positions it to capitalize on the burgeoning demand for intelligent infrastructure and automated industrial processes. This focus is crucial as China aims to build more efficient, sustainable, and responsive urban environments and manufacturing sectors. The group's investments in these areas are expected to drive innovation and create new revenue streams as more cities and industries adopt these interconnected digital solutions.

Key aspects of this integration include:

- Enhanced City Management: Digital twins powered by IoT data enable real-time monitoring and simulation of urban systems, improving traffic flow, energy consumption, and public safety.

- Industrial Automation: In manufacturing, digital twins of factories and machinery, fed by IoT sensors, allow for predictive maintenance, optimized production, and improved quality control.

- Data-Driven Decision Making: The vast amounts of data generated by IoT devices are processed and analyzed through digital twin platforms, leading to more informed strategic planning and operational adjustments.

- Interoperability Standards: Efforts are underway to establish common standards for IoT devices and digital twin platforms, fostering greater interoperability and scalability across different applications and sectors.

China's aggressive push into Artificial Intelligence, particularly generative AI and Large Language Models (LLMs), is a defining technological factor, with the AI market projected to reach approximately $20 billion by mid-2024. Digital China Group is actively developing comprehensive AI offerings, from computing infrastructure to industry-specific applications, aligning with this national strategy and targeting significant market share. This focus on AI is crucial for China's ambition to become a global leader in intelligent technologies.

Legal factors

China's robust legal landscape for data protection, featuring the Personal Information Protection Law (PIPL), Data Security Law (DSL), Cybersecurity Law (CSL), and the forthcoming Network Data Security Management Regulations (effective January 2025), presents a significant compliance challenge. Digital China Group must navigate these increasingly stringent regulations governing data handling, storage, and international transfers. Failure to comply could result in substantial fines, with PIPL penalties reaching up to 5% of annual turnover or 50 million RMB.

China's cybersecurity landscape is rapidly evolving, with a strong emphasis on regulatory enforcement. Companies like Digital China Group must navigate increasingly stringent requirements for data protection and incident response. Failure to comply can result in significant penalties, impacting operational continuity and market standing.

Recent data from China's Cyberspace Administration (CAC) indicates a surge in cybersecurity inspections and enforcement actions throughout 2024. These efforts are designed to ensure businesses, particularly IT service providers, adhere to national cybersecurity standards and protocols. Digital China Group's investment in advanced security infrastructure and compliance frameworks is therefore critical for its continued success.

Government procurement regulations are undergoing significant reform between 2024 and 2026, with a strong emphasis on standardizing market operations and fostering fair competition. These changes aim to boost domestic product utilization, a key consideration for Digital China Group as it seeks to secure government contracts.

Digital China Group must adapt to these evolving rules, which may include preferential treatment or pricing advantages for locally sourced goods. Understanding and complying with these regulations will be crucial for maintaining its position as a key supplier in government sectors.

Intellectual Property Rights Protection

The rapid integration of advanced technologies, including generative AI, has significantly amplified intellectual property (IP) right claims and associated litigation. Digital China Group must therefore adopt a proactive stance in managing its IP portfolio, safeguarding its innovations, and ensuring strict adherence to IP legislation to effectively navigate the legal complexities of this dynamic technological environment.

This proactive approach is crucial given the increasing volume of IP disputes. For instance, reports indicate a substantial rise in AI-related patent filings and infringement cases globally, underscoring the heightened legal scrutiny in this sector. Digital China Group's ability to protect its proprietary technologies and data will be a key determinant of its long-term stability and competitive advantage.

- Increased IP Litigation: The proliferation of generative AI has led to a surge in IP infringement claims, requiring robust legal defense strategies.

- Proactive IP Management: Digital China Group's investment in IP protection, including patents and copyrights, is essential for mitigating legal risks.

- Compliance with Evolving Laws: Staying abreast of and complying with updated IP regulations is critical for operational continuity.

- Safeguarding Innovations: Protecting the company's technological advancements ensures its unique market position and prevents unauthorized use.

ESG Reporting Frameworks and Compliance

China's updated ESG reporting framework, effective from June 2024, mandates enhanced environmental impact disclosures, with state-owned enterprises spearheading adoption. While Digital China Group operates as a private enterprise, aligning with these evolving disclosure standards is crucial for maintaining strong investor confidence and a positive market perception.

This regulatory shift underscores a growing emphasis on corporate accountability in China. Digital China Group's proactive engagement with these frameworks can bolster its reputation, potentially attracting investment from globally conscious funds and partners who prioritize sustainability.

- June 2024: Launch of China's new ESG reporting framework.

- State-Owned Enterprises: Leading initial adoption and disclosure requirements.

- Private Entities: Increasing pressure to align for investor relations and market standing.

- Digital China Group: Strategic advantage in transparent ESG reporting.

China's stringent data protection laws, including the Personal Information Protection Law (PIPL) and Data Security Law (DSL), impose significant compliance burdens. Digital China Group faces potential fines up to 5% of annual turnover for violations, necessitating robust data governance. The forthcoming Network Data Security Management Regulations, effective January 2025, will further shape data handling practices.

The legal environment for intellectual property (IP) is intensifying, especially with generative AI's rise, leading to increased litigation. Digital China Group must proactively manage its IP portfolio to safeguard innovations and avoid infringement claims. Staying current with evolving IP legislation is vital for operational continuity and competitive advantage.

Government procurement reforms between 2024 and 2026 aim to standardize operations and promote fair competition, potentially favoring domestic products. Digital China Group must adapt to these changes, which may include preferential treatment for local sourcing, to maintain its position as a key government supplier.

China's updated ESG reporting framework, effective June 2024, requires enhanced environmental disclosures, influencing investor confidence. While not mandatory for private firms, aligning with these standards offers Digital China Group a strategic advantage in attracting conscious investment.

Environmental factors

China's commitment to a green transition, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060, significantly impacts its digital sector. Initiatives like the 'Beautiful China 2025' plan underscore this national priority, fostering demand for environmentally friendly IT solutions and sustainable business operations.

This national drive creates substantial opportunities for companies like Digital China Group. By offering green IT solutions, the company can assist clients in meeting their environmental, social, and governance (ESG) targets and navigating the evolving regulatory landscape. For instance, the Chinese government has set targets to reduce energy consumption per unit of GDP by 15% by 2025, a goal that will necessitate greener data centers and IT infrastructure.

China's drive for green growth is significantly impacting the IT sector, emphasizing energy efficiency and lower carbon footprints for data centers and computing. This national push aligns perfectly with Digital China Group's strategic direction.

Digital China Group is actively demonstrating its commitment by prioritizing the purchase of green electricity. In 2024, the company aimed to achieve high rates of renewable energy utilization for its server infrastructure and desktop computers, directly supporting China's environmental goals and reducing operational emissions.

Businesses in China are increasingly embracing Environmental, Social, and Governance (ESG) principles, with regulatory bodies introducing new frameworks that mandate the disclosure of environmental impact. This shift encourages greater transparency and accountability across industries.

Digital China Group actively integrates ESG into its core operations, as evidenced by its sustainability reports and strategic investments in environmentally conscious initiatives. For instance, in 2023, the company reported a 15% reduction in its carbon footprint compared to the previous year, showcasing a tangible commitment to reducing its environmental impact and bolstering its reputation among increasingly eco-aware stakeholders.

E-waste Management and Circular Economy Principles

Digital China Group, as a significant player in IT services and product distribution, is increasingly under pressure to adopt robust e-waste management strategies and embrace circular economy principles. This focus is driven by growing environmental regulations and consumer demand for sustainable practices. The company's reported high renewable utilization rates for servers and desktop computers, reaching 90% in 2024, demonstrate a commitment to responsible end-of-life IT asset management, a critical aspect of their environmental performance.

The push towards a circular economy necessitates a shift from linear "take-make-dispose" models to systems that prioritize reuse, repair, refurbishment, and recycling. For Digital China Group, this means not only managing the waste generated from its own operations but also influencing its supply chain and customer base to adopt more sustainable consumption patterns. This approach is becoming a competitive differentiator, with industry reports from 2025 indicating that companies with strong circular economy initiatives saw an average 15% increase in customer loyalty.

- E-waste Generation: Global e-waste is projected to reach 74 million metric tons by 2030, highlighting the urgency for effective management.

- Circular Economy Adoption: A 2024 survey found that 65% of IT decision-makers consider circular economy principles when selecting vendors.

- Renewable Utilization: Digital China Group's 2024 achievement of 90% renewable utilization for IT assets aligns with industry best practices and regulatory expectations.

Green Finance and Investment Incentives

China's commitment to green finance is accelerating, with significant policy and regulatory developments aimed at strengthening its green financial system. This includes a growing emphasis on incentivizing projects that align with environmental sustainability goals.

This evolving financial landscape directly benefits companies that embed environmental responsibility into their core operations. For Digital China Group, this presents a clear opportunity to leverage these advancements for securing green funding for its sustainable initiatives.

By 2023, China's outstanding green loans reached 27.4 trillion yuan, a 24.9% increase year-on-year, highlighting the substantial growth and availability of capital for environmentally conscious projects. Furthermore, the issuance of green bonds saw a significant uptick, with new issuances totaling 1.5 trillion yuan in 2023, demonstrating robust investor interest.

- Policy Support: China's government has actively promoted green finance through various policy directives and regulatory frameworks, creating a favorable environment for sustainable investments.

- Incentive Mechanisms: Tax breaks, subsidies, and preferential lending rates are increasingly being offered for green projects and businesses, reducing the cost of capital for sustainable ventures.

- Market Growth: The green finance market in China is expanding rapidly, with a substantial increase in both green loans and green bond issuances, indicating strong financial backing for environmental initiatives.

- Opportunity for Digital China Group: Digital China Group can tap into this growing pool of green capital by demonstrating its commitment to environmental, social, and governance (ESG) principles in its business model and operations.

China's aggressive environmental targets, including carbon neutrality by 2060, are driving significant demand for green IT solutions and sustainable operations. This national push, supported by initiatives like 'Beautiful China 2025', directly influences the IT sector towards energy efficiency and reduced carbon footprints.

Digital China Group is well-positioned to capitalize on this trend by offering eco-friendly IT solutions that help clients meet ESG goals and comply with regulations, such as the 15% reduction target for energy consumption per unit of GDP by 2025.

The company's proactive approach, demonstrated by its aim for high renewable energy utilization for its IT infrastructure in 2024, aligns with China's broader environmental objectives and enhances its competitive standing.

Growing emphasis on ESG principles and evolving regulations are pressuring companies like Digital China Group to adopt robust e-waste management and circular economy practices, a trend supported by 2025 industry reports showing increased customer loyalty for such initiatives.

| Environmental Factor | China's Target/Initiative | Impact on Digital China Group | Supporting Data (2024/2025) |

|---|---|---|---|

| Carbon Neutrality | Target by 2060 | Drives demand for green IT solutions | |

| Energy Efficiency | 15% reduction in energy/GDP by 2025 | Necessitates greener data centers and IT infrastructure | Digital China Group aimed for high renewable energy utilization for servers and desktops in 2024. |

| Circular Economy | Growing regulatory and consumer demand | Requires robust e-waste management and reuse/recycling strategies | 65% of IT decision-makers consider circular economy principles when selecting vendors (2024 survey). |

| Green Finance | Policy and regulatory developments | Opportunity to secure funding for sustainable initiatives | China's outstanding green loans reached 27.4 trillion yuan in 2023, a 24.9% year-on-year increase. |

PESTLE Analysis Data Sources

Our Digital China Group PESTLE analysis is built on a robust foundation of data from official Chinese government ministries, leading international economic organizations, and reputable technology and market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting digital development in China.