Digital China Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Group Bundle

Digital China Group navigates a landscape shaped by evolving customer demands and intense competition, with the threat of new entrants presenting a significant challenge.

Understanding the subtle interplay of supplier power and the availability of substitutes is crucial for any stakeholder looking to grasp Digital China Group's strategic positioning.

The complete report reveals the real forces shaping Digital China Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Digital China Group's reliance on key technology partners such as Oracle, Novell, and CA Technologies highlights the concentrated nature of its supplier base for critical software and hardware. This concentration, particularly for proprietary and specialized components, grants these suppliers considerable leverage in negotiations. For instance, in 2023, the global IT hardware market saw significant price increases for semiconductors, impacting the cost of components for many technology providers.

Switching from established technology partners or IT product suppliers involves substantial costs for Digital China. These costs include re-training staff, re-configuring complex systems, and the potential for significant service disruptions during the transition. For example, a migration from a proprietary enterprise resource planning (ERP) system to a new cloud-based solution could incur millions in direct costs and lost productivity.

These high switching costs effectively reduce Digital China's operational flexibility and consequently increase the bargaining leverage of its existing suppliers. The deep embeddedness of suppliers within Digital China's integrated IT solutions, often involving proprietary interfaces and data formats, further solidifies this supplier power.

While numerous hardware and software components exist, the availability of genuine substitutes for highly specialized or established industry-standard platforms can be quite restricted. This limitation can give suppliers significant leverage, especially if their components are critical and difficult to replace.

China's strategic push for domestic alternatives in crucial Information and Communication Technology (ICT) components, such as advanced semiconductors and network switch gear, is a direct response to this. The goal is to build a robust local component ecosystem, thereby reducing reliance on foreign suppliers and mitigating this specific aspect of supplier bargaining power.

For instance, in 2023, China's investment in its domestic semiconductor industry continued to grow, with significant state-backed funds targeting chip manufacturing and design, aiming to increase self-sufficiency in this vital area.

Supplier Importance to Digital China

Digital China's reliance on key technology suppliers for its cloud computing, big data, and digital transformation services, as well as its IT product distribution, highlights a significant supplier bargaining power. Without access to cutting-edge or widely adopted technologies from these partners, Digital China's competitive edge and capacity for innovation would be substantially weakened.

The dynamic nature of technologies such as artificial intelligence and cloud computing demands robust and ongoing relationships with suppliers to ensure Digital China remains at the forefront of the industry. For instance, in 2024, the global cloud infrastructure market, a key area for Digital China, was projected to grow significantly, underscoring the importance of securing favorable terms with leading cloud providers.

- Critical Technology Dependence: Digital China's core offerings in cloud, big data, and digital transformation hinge on the availability and quality of technologies provided by external suppliers.

- Innovation and Competition: A lack of access to advanced or popular technologies from suppliers directly impedes Digital China's ability to innovate and compete effectively in the rapidly evolving digital landscape.

- Supplier Relationship Management: Maintaining strong ties with technology vendors is essential for Digital China to navigate the continuous technological advancements, particularly in areas like AI, which saw substantial investment globally in 2024.

Threat of Forward Integration by Suppliers

Major technology suppliers to Digital China, such as global cloud and software titans, possess the capability to directly offer IT services to end-users. This potential for forward integration could significantly bolster their bargaining power, especially if they choose to directly challenge Digital China in specific market segments.

For instance, in 2024, several leading cloud providers expanded their direct managed services portfolios, aiming to capture a larger share of enterprise IT spending. This strategic move by suppliers could put pressure on Digital China's service margins.

- Supplier Capability: Global tech giants can leverage their existing platforms and customer relationships to offer competing services.

- Market Impact: Increased direct competition from suppliers could fragment Digital China's customer base.

- Digital China's Advantage: The company's extensive local market knowledge and established integration expertise remain key differentiators.

Digital China Group faces significant supplier bargaining power due to its reliance on a concentrated base of critical technology providers for software and hardware. High switching costs, including system reconfiguration and staff retraining, further empower these suppliers. For example, in 2023, the global semiconductor market experienced price surges, impacting component costs for technology vendors and subsequently Digital China.

The limited availability of genuine substitutes for specialized IT components also strengthens supplier leverage. China's strategic investment in domestic ICT alternatives, such as semiconductors, aims to mitigate this dependence. In 2023, China's semiconductor industry saw substantial state-backed funding to boost self-sufficiency.

Major suppliers, particularly global cloud and software leaders, possess the capability for forward integration, potentially offering direct IT services and challenging Digital China in certain market segments. In 2024, leading cloud providers expanded their direct managed services, increasing pressure on Digital China's service margins.

| Supplier Characteristic | Impact on Digital China | Supporting Data/Trend |

|---|---|---|

| Supplier Concentration | Increased leverage for key technology partners. | Reliance on a few major software/hardware providers. |

| Switching Costs | Reduced operational flexibility, higher supplier power. | Costs associated with system migration and retraining. |

| Availability of Substitutes | Limited substitutes for specialized components enhance supplier power. | China's drive for domestic ICT alternatives. |

| Supplier Forward Integration | Potential for direct competition from major tech giants. | Expansion of direct managed services by cloud providers in 2024. |

What is included in the product

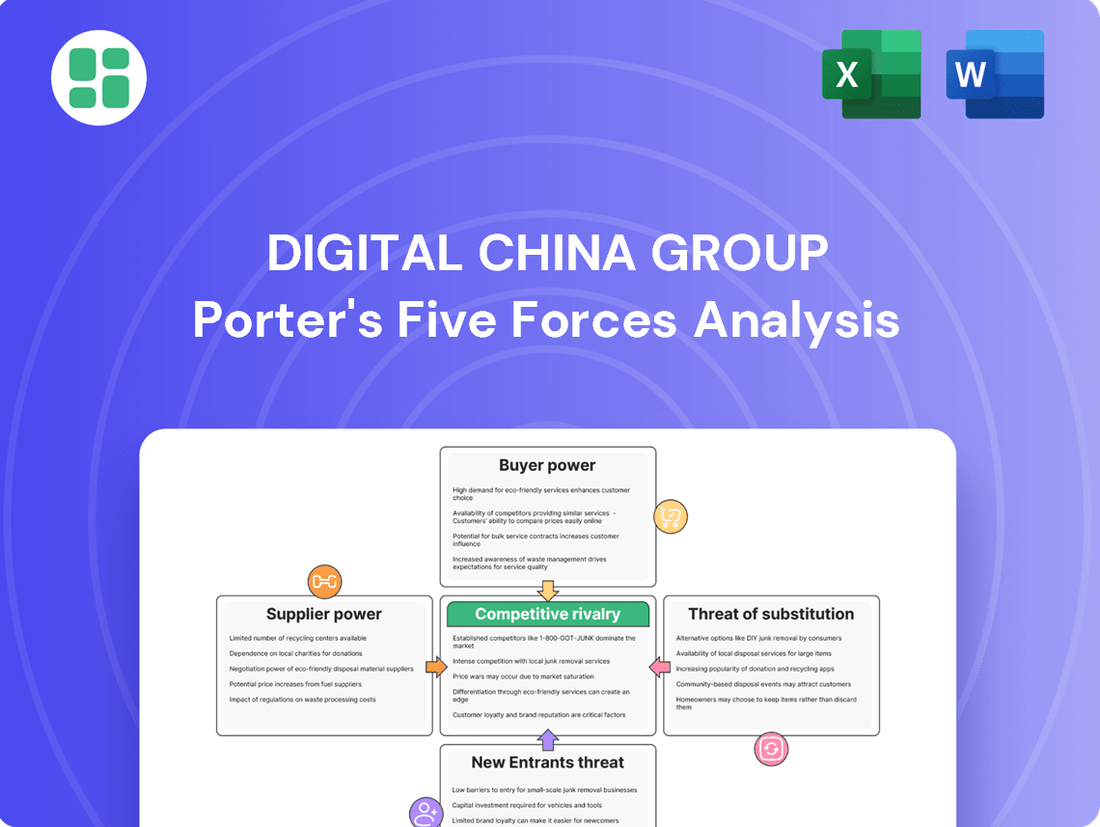

This analysis unpacks the competitive forces impacting Digital China Group, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly visualize the competitive landscape of Digital China Group's market with a dynamic, interactive model that highlights key threats and opportunities.

Customers Bargaining Power

Digital China Group's customer base spans multiple industries like government, finance, manufacturing, and retail, indicating a diversified rather than concentrated customer pool. This breadth generally dilutes the bargaining power of any single customer.

However, the digital transformation market is significantly influenced by large enterprise and government clients. These major clients often procure substantial volumes of services and products, granting them considerable individual bargaining power. For instance, a large government digital infrastructure project could represent a significant portion of Digital China's annual revenue, making the client’s negotiation leverage quite high.

These large-scale engagements frequently involve intricate negotiations and the development of highly customized solutions. This complexity further amplifies the customer's ability to influence pricing and terms due to the sheer scale and tailored nature of the business.

For integrated IT services, system integration, and digital transformation solutions, customer switching costs are generally high. Migrating complex IT systems, data, and processes from one provider to another can be costly, time-consuming, and disruptive. This significantly reduces a customer's ability to easily switch providers, thereby lowering their bargaining power.

Customers in the IT services market, particularly large enterprises and government entities, are increasingly knowledgeable about prevailing prices, alternative solutions, and their precise requirements. This heightened awareness, combined with a strong emphasis on cost-effectiveness in digital transformation projects, often translates into significant price sensitivity among these buyers.

For instance, in 2024, many large enterprises actively negotiated for discounts on cloud migration services, with some securing savings of up to 15% by leveraging competitive bids from multiple IT service providers. This price sensitivity directly empowers customers to demand more competitive pricing from Digital China Group and its peers.

Potential for Backward Integration by Customers

Large enterprises and government bodies often have substantial resources and technical know-how, enabling them to build or enhance their internal IT departments. This capability can lessen their dependence on third-party IT service providers such as Digital China Group. For instance, many large Chinese state-owned enterprises have been investing heavily in their digital transformation initiatives, building out internal cloud and data analytics capabilities, which could reduce their outsourcing needs.

While complete backward integration into IT services is a significant undertaking, the mere possibility serves as a potent bargaining chip for customers during price and service negotiations. This leverage can pressure Digital China to offer more competitive terms to retain their business.

- Customer Leverage: The threat of customers developing in-house IT capabilities, particularly among large enterprises and government entities, directly impacts Digital China's pricing power.

- Resource Availability: Many major clients possess the financial and human capital to pursue internal IT solutions, a trend observed in China's ongoing digital transformation push.

- Negotiation Power: The potential for backward integration, even if not fully realized, empowers customers to demand better service level agreements and pricing from Digital China.

- Market Dynamics: This dynamic highlights the competitive pressure Digital China faces, necessitating a focus on value-added services and innovation to maintain customer loyalty.

Availability of Substitute Providers

The Chinese digital transformation and IT services market is highly fragmented, featuring a mix of large domestic tech players and agile, specialized startups. This intense competition among service providers directly benefits customers, as they have a wide array of choices. For instance, in 2023, the China IT services market was estimated to be worth over $200 billion, with a significant number of vendors vying for market share.

This abundance of options empowers customers to negotiate favorable terms, prioritize cost-effectiveness, and select providers that best match their specific technical requirements and quality expectations. The sheer volume of available providers means that no single firm can dictate terms, significantly reducing the switching costs for clients.

- Market Fragmentation: The Chinese digital transformation market includes numerous domestic tech giants and specialized IT service firms.

- Customer Choice: High competition grants customers multiple options for IT services.

- Negotiating Power: Customers can leverage provider competition to secure better pricing and service terms.

- 2023 Market Size: The China IT services market exceeded $200 billion in 2023, indicating a competitive landscape.

Digital China Group's bargaining power with customers is influenced by their size, knowledge, and the availability of alternatives. Large clients, especially government entities, wield significant power due to the volume of their purchases and the complexity of customized solutions required, often leading to intense price negotiations. For example, in 2024, many large enterprises secured discounts of up to 15% on cloud migration services by leveraging competitive bids.

While high switching costs generally limit customer power, the increasing technical expertise of clients and the fragmented nature of the IT services market, valued at over $200 billion in China in 2023, provide customers with ample choices and negotiating leverage.

| Factor | Impact on Digital China Group | Customer Action/Leverage | Supporting Data/Example |

|---|---|---|---|

| Customer Size & Volume | High for large clients | Negotiate pricing, demand tailored solutions | Large government digital infrastructure projects represent significant revenue portions. |

| Customer Knowledge & Price Sensitivity | Increases pressure on pricing | Demand competitive pricing, seek cost-effectiveness | 2024: Up to 15% discounts secured on cloud migration services. |

| Availability of Alternatives | Reduces Digital China's pricing power | Switch providers, leverage competitive bids | China IT services market exceeded $200 billion in 2023, with numerous vendors. |

| Potential for Backward Integration | Threatens revenue streams | Develop in-house capabilities, reduce outsourcing | Large state-owned enterprises investing in internal cloud and data analytics. |

Same Document Delivered

Digital China Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Digital China Group, detailing the competitive landscape and strategic implications within the industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. This provides a clear understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all crucial for strategic decision-making regarding Digital China Group.

Rivalry Among Competitors

Digital China Group operates within a fiercely competitive Chinese IT services and digital transformation landscape. The market is notably fragmented, presenting Digital China Group with a substantial number of rivals, from major domestic technology conglomerates like Alibaba and Tencent to a multitude of smaller, niche players and international firms. This broad spectrum of competitors, each with varying strengths and market focuses, significantly escalates the intensity of rivalry.

The digital transformation and Information and Communication Technology (ICT) markets in China are on a significant upward trajectory. Government support and the rapid embrace of emerging technologies are fueling this expansion. For instance, China's digital economy reached an estimated 50.2 trillion yuan in 2023, a substantial increase from previous years, indicating a strong growth rate.

This vigorous market growth creates a more favorable environment for companies like Digital China Group. As the overall pie gets bigger, there's more room for everyone to expand their share without necessarily engaging in cutthroat price wars. Companies can instead prioritize innovation and market penetration to capture this burgeoning demand, which can somewhat alleviate the pressure of direct competitive rivalry.

Digital China Group competes in a crowded market where differentiating its extensive portfolio, which includes cloud computing, big data, digital transformation, IT distribution, and system integration, is paramount. While the company highlights its AI-driven cloud integration and comprehensive service approach, the intensity of competition means that truly unique value propositions are essential for standing out. For instance, in 2023, the Chinese cloud market saw significant growth, with major players like Alibaba Cloud, Tencent Cloud, and Huawei Cloud vying for market share, underscoring the need for Digital China to carve out distinct competitive advantages.

Switching Costs for Customers

Customer switching costs in the IT services sector are typically substantial, creating a degree of customer loyalty and somewhat dampening direct rivalry by retaining existing clients. For instance, in 2023, the average IT project implementation time for enterprise resource planning (ERP) systems, a common IT service, ranged from 6 to 18 months, underscoring the investment in time and resources for clients.

Despite these high switching costs, aggressive new entrants and established competitors can still lure clients away by offering significantly better value propositions, innovative technologies, or more competitive pricing structures. This dynamic means that even 'locked-in' customers remain potential targets for disruptive players aiming to gain market share.

- High Switching Costs: IT services often involve deep integration and specialized knowledge, making it costly and time-consuming for clients to switch providers.

- Barriers to Entry: The established relationships and proprietary systems create a protective moat for incumbent IT service providers.

- Competitive Pressure: Nevertheless, aggressive pricing, technological advancements, and tailored solutions can still persuade customers to switch, especially if the perceived benefits outweigh the costs.

Strategic Commitments and Exit Barriers

Companies within China's dynamic IT sector, including Digital China Group, frequently make substantial strategic commitments. These investments are often channeled into burgeoning fields like artificial intelligence (AI), robust cloud infrastructure, and specialized industry verticals, frequently bolstered by supportive government policies and initiatives. For instance, China's stated goal to become a global leader in AI by 2030 underscores the strategic importance of these investments.

The sheer scale of capital expenditure required for cutting-edge technology and infrastructure development, coupled with the fundamental role of digital transformation in China's national economic agenda, erects formidable exit barriers. This means that firms are largely compelled to remain engaged and compete vigorously within the market, rather than seeking to divest or withdraw.

- Strategic Commitments: Digital China Group, like its peers, invests heavily in AI and cloud, aligning with national digital transformation goals.

- Government Support: Policies favoring digital infrastructure and AI development create an environment of long-term commitment.

- High Capital Investment: Significant outlays in technology and infrastructure make exiting the market financially prohibitive.

- National Agenda Integration: Digital transformation's centrality to China's economic strategy locks companies into continued competition.

Digital China Group faces intense competition from a wide array of domestic and international players in China's rapidly expanding IT services market. The digital economy's growth, reaching an estimated 50.2 trillion yuan in 2023, fuels this rivalry, encouraging innovation and market penetration over price wars. Despite high customer switching costs, estimated at 6-18 months for major IT projects in 2023, aggressive competitors continually vie for market share by offering superior value and technology.

| Competitor Type | Key Strengths | Market Focus |

| Domestic Tech Giants (e.g., Alibaba, Tencent) | Vast ecosystems, strong brand recognition, significant R&D budgets | Cloud, AI, e-commerce integration, broad digital services |

| International IT Firms | Global expertise, established methodologies, advanced technology solutions | Enterprise software, cloud migration, cybersecurity |

| Niche Domestic Players | Specialized expertise, agility, localized solutions | Industry-specific software, data analytics, IoT solutions |

| Digital China Group | Comprehensive IT distribution, system integration, cloud & AI services | Digital transformation, IT infrastructure, hybrid cloud solutions |

SSubstitutes Threaten

Many large Chinese enterprises and government entities are building substantial in-house IT capabilities. This allows them to manage core digital transformation projects and sensitive data internally, acting as a significant substitute for external IT service providers.

For instance, by 2024, it's estimated that over 60% of large state-owned enterprises in China have dedicated digital transformation units, reducing their reliance on third-party vendors for foundational IT infrastructure and software development.

This trend directly impacts Digital China Group by potentially limiting the market for its outsourced IT solutions, especially for routine maintenance and standard digital upgrades where in-house expertise suffices.

The rise of generic software and open-source solutions presents a significant threat to Digital China Group's proprietary IT offerings. As these alternatives mature and become more accessible, they provide cost-effective substitutes for businesses seeking to fulfill specific IT needs without the premium associated with custom or specialized platforms. For instance, the global open-source software market was valued at approximately $23.5 billion in 2023 and is projected to grow substantially, indicating a strong demand for these flexible and often free or low-cost options.

Major cloud providers such as Alibaba Cloud, Huawei Cloud, and Tencent Cloud are expanding their direct offerings. These platforms provide businesses with the tools to build and manage their digital infrastructure, potentially reducing reliance on third-party IT service providers for certain solutions.

For instance, in 2023, Alibaba Cloud reported a 4% year-over-year revenue growth, reaching RMB 60.27 billion, indicating its continued investment and expansion in direct service capabilities. This trend presents a direct substitute threat as businesses can increasingly leverage these hyperscalers for core cloud services.

Low-Code/No-Code Development Platforms

The increasing accessibility of low-code/no-code (LCNC) platforms, often enhanced by artificial intelligence, presents a significant threat of substitutes for traditional custom software development and system integration services. These platforms empower businesses to build applications and automate processes with significantly reduced reliance on specialized IT skills.

This shift means that companies can achieve digital transformation goals more rapidly and cost-effectively, bypassing the need for extensive custom coding. For instance, a report from Gartner in 2024 projected that LCNC development would account for a substantial portion of application development by 2025, highlighting its growing impact.

- Reduced Demand for Custom Development: LCNC platforms directly substitute the need for bespoke software solutions, lowering the barrier to entry for application creation.

- Cost Efficiency: Businesses can often achieve desired functionalities at a lower cost compared to traditional development, making LCNC an attractive alternative.

- Faster Time-to-Market: The accelerated development cycles offered by LCNC platforms allow companies to deploy solutions much quicker than traditional methods.

- Empowerment of Citizen Developers: LCNC fosters a new wave of 'citizen developers' within organizations, further diminishing the reliance on professional IT departments for certain tasks.

Simplified Digital Tools and Off-the-Shelf Solutions

The availability of simplified digital tools and off-the-shelf solutions presents a significant threat of substitutes for Digital China Group, particularly for businesses with less complex requirements. These readily available options offer comparable functionality at a lower cost and with faster implementation times, bypassing the need for extensive customization or integration services that Digital China Group might typically provide.

The market for these user-friendly, pre-packaged solutions is expanding rapidly, especially within the small and medium-sized enterprise (SME) sector. For instance, by the end of 2023, the global market for cloud-based business management software, which often includes off-the-shelf components, was valued at over $60 billion, with projected annual growth rates exceeding 15% in many segments. This indicates a strong demand for accessible and affordable digital tools that can meet core business needs without requiring significant IT investment or specialized vendor support.

- Growing SME adoption: Many SMEs are prioritizing cost-effectiveness and ease of use, making them more receptive to readily available digital tools.

- Reduced implementation complexity: Off-the-shelf solutions require less planning and integration, lowering the barrier to adoption compared to custom enterprise systems.

- Cost advantage: These substitute solutions often come with subscription-based pricing or one-time purchase options that are more budget-friendly for smaller organizations.

- Increased vendor competition: The proliferation of SaaS providers offering specialized or general business applications intensifies competition by providing accessible alternatives.

The threat of substitutes for Digital China Group is significant, driven by the rise of in-house IT capabilities within large enterprises and government entities. These organizations are increasingly building their own digital transformation units, reducing their reliance on external IT service providers for core projects and data management. By 2024, over 60% of large state-owned enterprises in China have established such units, directly impacting the market for outsourced IT solutions.

Major cloud providers like Alibaba Cloud, Huawei Cloud, and Tencent Cloud are expanding their direct service offerings, acting as direct substitutes. For instance, Alibaba Cloud's revenue reached RMB 60.27 billion in 2023, a 4% year-over-year increase, showcasing their growing capabilities. Additionally, the proliferation of low-code/no-code (LCNC) platforms, often AI-enhanced, allows businesses to develop applications with minimal specialized IT skills, further substituting traditional custom development services.

| Substitute Type | Description | Impact on Digital China Group | Market Data/Trend (2023-2024) |

|---|---|---|---|

| In-house IT Capabilities | Large enterprises and government entities building internal IT teams and infrastructure. | Reduces demand for external IT services, especially for routine tasks. | Over 60% of large Chinese SOEs had dedicated digital transformation units by 2024. |

| Major Cloud Providers | Hyperscalers offering direct cloud services and development tools. | Offers alternative platforms for building and managing digital infrastructure. | Alibaba Cloud revenue grew 4% YoY to RMB 60.27 billion in 2023. |

| Low-Code/No-Code (LCNC) Platforms | User-friendly tools enabling faster, less technical application development. | Substitutes traditional custom software development and integration. | Gartner projected LCNC development to account for a substantial portion of app development by 2025. |

| Off-the-Shelf Solutions | Pre-packaged software and digital tools for common business needs. | Provides cost-effective and faster alternatives for businesses with less complex requirements. | Global cloud business management software market exceeded $60 billion in 2023, with >15% annual growth in many segments. |

Entrants Threaten

The integrated IT services, cloud computing, and digital transformation sectors in China demand significant upfront capital. New players must invest heavily in building robust data centers, acquiring cutting-edge technology, and funding extensive research and development, particularly in rapidly evolving areas like artificial intelligence. For instance, major cloud providers often spend billions annually on infrastructure expansion and R&D, a figure that presents a formidable barrier for smaller, emerging companies aiming to compete.

China's government is a significant force, actively championing digital transformation through initiatives like the 'Digital China 2025' plan. This provides a fertile ground for growth but also means a complex web of regulations that new entrants must navigate. For instance, the Cybersecurity Law of 2017, and subsequent data privacy regulations, impose strict compliance burdens, especially on foreign companies.

Meeting these stringent requirements, including data localization and security protocols, can be a substantial barrier. Newcomers often need to invest heavily in legal and compliance expertise, and building relationships with government bodies is frequently essential for smooth operation. This regulatory environment, while fostering domestic champions, can significantly deter or slow down the entry of new, particularly international, competitors.

Digital China Group's long-standing presence as an integrated IT service provider has cultivated significant brand loyalty. This is a formidable barrier for any new entrant aiming to disrupt the market.

Decades of operation have allowed Digital China Group to forge deep, established relationships with key clients in vital sectors like government, finance, manufacturing, and retail. These networks are not easily replicated by newcomers.

In 2024, the IT services market, particularly in China, continues to see intense competition, yet the trust and established client ties that Digital China Group possesses remain a critical differentiator, making it challenging for new players to gain immediate traction.

Access to Distribution Channels and Supply Chains

Digital China Group's formidable IT product distribution network and deeply entrenched supply chain relationships present a significant barrier for potential new entrants. Replicating this extensive infrastructure, built over years of operation, is a daunting and costly undertaking.

For new IT service providers, securing consistent and reliable access to essential hardware and software components from key global and domestic vendors is paramount. Without these established relationships, new players struggle to offer competitive solutions.

- Established Network: Digital China's IT distribution network covers a vast geographical area, reaching numerous cities and provinces across China.

- Vendor Relationships: The company has long-standing partnerships with major technology manufacturers, ensuring preferential access and pricing.

- Supply Chain Efficiency: Digital China's optimized logistics and warehousing capabilities contribute to timely delivery and cost-effectiveness, a difficult benchmark for newcomers to meet.

Talent Acquisition and Expertise

The intense competition for specialized talent in areas like cloud computing, big data, artificial intelligence, and cybersecurity presents a significant barrier for new entrants in China's digital sector. Established companies, including Digital China Group, have already cultivated strong employer brands and robust talent pipelines, making it difficult for newcomers to attract and retain the highly skilled professionals needed to compete effectively. For instance, in 2024, the demand for AI engineers in China reportedly outstripped supply by a considerable margin, with many roles remaining unfilled for extended periods.

New companies would need to invest heavily in recruitment and retention strategies to secure individuals with the requisite expertise. This includes offering competitive compensation packages, attractive career development opportunities, and a compelling company culture. The ability to attract and retain top-tier talent directly impacts a new entrant's capacity to innovate and deliver cutting-edge solutions, a crucial factor in a rapidly evolving market.

- High Demand for Specialized Skills: China's digital economy, particularly in cloud, AI, and cybersecurity, faces a persistent talent shortage.

- Talent Retention Challenges: Established firms like Digital China have existing advantages in attracting and keeping top professionals.

- Cost of Acquisition: New entrants must incur significant costs to compete for scarce, specialized talent.

The threat of new entrants into China's integrated IT services and digital transformation market, where Digital China Group operates, is moderate. Significant capital investment is required for infrastructure and R&D, with major cloud providers spending billions annually. Navigating China's complex regulatory landscape, including data privacy laws, also presents a substantial hurdle for newcomers, demanding considerable investment in compliance and government relations.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Digital China Group leverages data from annual reports, industry-specific market research, and government economic statistics to provide a comprehensive view of the competitive landscape.