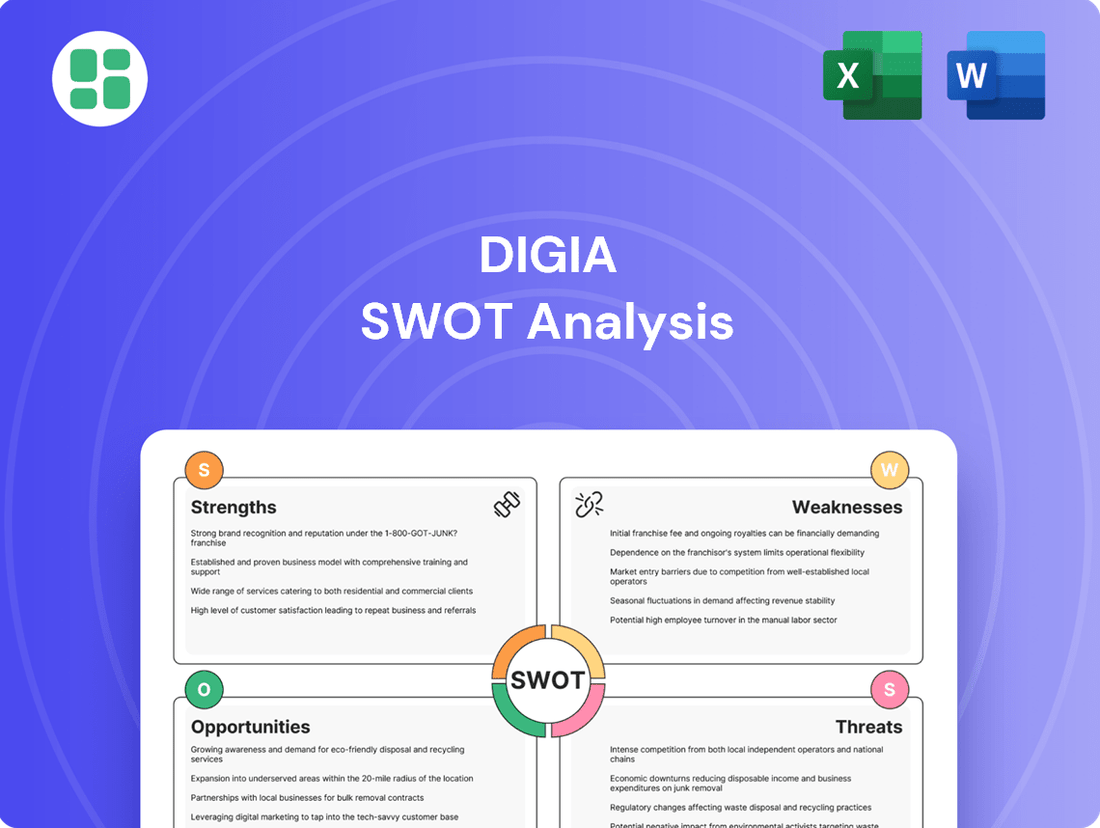

Digia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digia Bundle

Digia's strategic positioning is clear: leveraging strong technological expertise and a focus on digital transformation. However, to truly capitalize on opportunities and mitigate potential threats, a deeper dive is essential.

Want the full story behind Digia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Digia demonstrated exceptional financial strength in 2024, achieving a record year with net sales exceeding EUR 200 million. This impressive performance, coupled with an operating profit (EBITA) of EUR 20 million, marks the company's ninth consecutive year of profitable growth. Such sustained financial success highlights Digia's robust business model and its ability to thrive even in demanding market conditions.

Digia truly excels with its extensive range of digital services, covering everything from initial strategy and design to the ongoing maintenance of business platforms and data analytics. This end-to-end capability means they can support clients throughout their entire digital journey, a significant advantage in today's complex market.

Their deep expertise isn't limited to one area; it spans the full spectrum of digital transformation. This broad knowledge base allows Digia to cater to a diverse clientele across numerous sectors, demonstrating a robust and adaptable service model.

The company's financial performance in 2024 highlights the strength of this offering, with nearly half of its net sales generated from continuous maintenance services. This recurring revenue stream underscores the value and stickiness of Digia's solutions, providing a solid foundation for future growth.

Digia has seen significant improvements in customer and employee satisfaction. By the close of 2024, the company's customer Net Promoter Score (NPS) had increased by 18%, and its employee NPS (eNPS) saw a substantial 60% rise from its 2022 baseline.

Further validating this positive trend, a Nordic Whitelane Research survey conducted in April 2025 recognized Digia as one of Finland's leading application service providers in terms of customer satisfaction. These metrics highlight strong client relationships and a healthy internal company culture.

Pioneering in AI and Automation Integration

Digia is demonstrating strong leadership in AI and automation, a key differentiator in the current market. Their launch of the Digia Dolphin platform in 2024 signifies a strategic commitment to embedding AI directly into business processes, offering clients advanced solutions.

This focus is yielding tangible results, as evidenced by significant new contract wins in AI and data services during the first quarter of 2025. These wins highlight strong market recognition and demand for Digia's expertise in these cutting-edge areas.

- AI Integration: Launched Digia Dolphin platform in 2024 to embed AI in business processes.

- Market Validation: Secured significant new contracts in AI and data services in Q1 2025.

- Operational Efficiency: Leveraging automation for internal operational improvements.

- Competitive Edge: Positioned at the forefront of digital transformation through technology adoption.

Reliability and Certified Quality

Digia's unwavering focus on reliability and certified quality serves as a cornerstone for its sustained growth. This dedication is clearly demonstrated by the successful renewal of its ISO 9001:2015 quality management and ISO 27001:2022 information security certifications in 2024, achieved without any noted deviations.

These certifications underscore Digia's commitment to maintaining rigorous standards, fostering customer trust, and consistently delivering dependable, high-quality services. The company's extensive track record in developing and implementing business-critical systems further solidifies its reputation for excellence and operational integrity.

- ISO 9001:2015 Quality Certification Renewal (2024)

- ISO 27001:2022 Security Certification Renewal (2024)

- Commitment to high standards in security and quality management

- Long experience in delivering business-critical systems

Digia's financial performance in 2024 was exceptionally strong, with net sales surpassing EUR 200 million and an operating profit (EBITA) of EUR 20 million, marking their ninth consecutive year of profitable growth. This consistent financial success, with nearly half of its 2024 net sales coming from recurring maintenance services, highlights the stability and value of its digital solutions. The company also saw significant improvements in customer and employee satisfaction, with customer NPS up 18% and employee NPS up 60% from its 2022 baseline by the end of 2024, further validated by a Nordic Whitelane Research survey in April 2025 naming Digia a leading Finnish application service provider for customer satisfaction.

Digia is a leader in AI and automation, evidenced by the 2024 launch of its Digia Dolphin platform, which integrates AI into business processes. This strategic move is already paying off, with substantial new contracts secured in AI and data services during Q1 2025, demonstrating strong market demand for their advanced solutions. The company's commitment to quality and reliability is further reinforced by the successful renewal of its ISO 9001:2015 and ISO 27001:2022 certifications in 2024 without any deviations, underscoring its dedication to high standards in security and quality management, backed by extensive experience in delivering business-critical systems.

| Metric | 2023 (Approx.) | 2024 | Q1 2025 |

|---|---|---|---|

| Net Sales (EUR million) | ~180 | >200 | N/A |

| Operating Profit (EBITA) (EUR million) | ~18 | 20 | N/A |

| Customer NPS Change | N/A | +18% | N/A |

| Employee NPS Change (from 2022) | N/A | +60% | N/A |

What is included in the product

Digia’s SWOT analysis identifies its core strengths in software development and its market opportunities in digital transformation. It also highlights potential weaknesses in its market share and threats from intense competition.

Digia's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

Digia experienced a notable dip in profitability during the first quarter of 2025. Despite maintaining stable revenue, the company's operating profit, measured by EBITA, saw a significant decrease of 17.6% when compared to the same period in the previous year. This contraction brought the EBITA margin down to 8.5%, a noticeable drop from the 10.3% recorded in Q1 2024.

This decline in profit margins highlights potential difficulties for Digia in preserving profitability, especially within a market characterized by cautious customer behavior. The primary driver behind this profit erosion appears to be customers delaying crucial decisions and the initiation of new projects, directly impacting Digia's revenue realization and cost management.

Digia's performance in early 2025 has shown a clear sensitivity to customer investment caution, with several business segments experiencing project delays. This hesitation from clients, driven by broader economic uncertainties, directly impacts Digia's short-term growth trajectory and profitability, even as its long-term strategic positioning remains robust. The challenging market conditions of 2024 underscored this vulnerability, as customers adopted a more reserved approach to new investments.

Digia faces significant challenges due to escalating price competition within the IT services sector. This environment demands constant operational upgrades to stay relevant and profitable. For instance, in Q1 2024, Digia reported that its revenue growth was impacted by these competitive pressures, leading to a more cautious approach in certain customer segments.

This intense rivalry directly affects Digia's profit margins, often forcing the company to consider cost-saving strategies. An example of this is the planned change negotiations within the Managed Solutions unit, a direct response to the need to align costs with market pricing realities.

Successfully navigating this landscape requires Digia to be exceptionally agile in adapting to shifting pricing trends. Failure to do so could lead to a loss of market share and further margin erosion, as competitors may offer similar services at lower price points.

Operational Restructuring and Job Reductions

Digia's Managed Solutions unit began change negotiations in May 2025, targeting operational renewal and enhanced profitability. This process could result in up to 45 job reductions, a move intended to bolster competitiveness and foster sustainable growth.

While these restructuring efforts are designed to improve Digia's financial performance, they carry inherent risks. Potential downsides include a negative impact on employee morale and the possibility of losing valuable institutional knowledge during the transition period. There's also a risk of temporary operational disruptions as the company adapts to the changes.

- Employee Morale: Restructuring often leads to uncertainty, potentially affecting the morale and productivity of remaining staff.

- Loss of Expertise: Reductions in workforce can mean losing experienced employees, which might impact the quality and efficiency of operations.

- Operational Disruption: The process of restructuring can temporarily disrupt ongoing projects and client services.

Limited International Market Share

Digia's international market share remains a notable weakness, despite strategic efforts to expand. The company's goal was to achieve over 15% of net sales from international markets by the end of its 2023-2025 strategy period. However, by 2024, this figure stood at only 12%, highlighting a slower-than-anticipated growth trajectory in overseas operations.

This limited international penetration means Digia's revenue base is still heavily concentrated in Finland. Such geographical concentration exposes the company to greater risk from economic downturns or intensified competition specifically within its domestic market. A more diversified international presence would typically offer a buffer against these localized challenges.

- International Sales Target: Aimed for >15% of net sales by end of 2023-2025 strategy period.

- 2024 Performance: Achieved 12% of net sales from international markets.

- Geographic Concentration: Main market remains Finland, increasing susceptibility to domestic economic fluctuations.

- Risk Exposure: Limited international diversification makes the company more vulnerable to Finnish market-specific pressures.

Digia's profitability took a hit in early 2025, with EBITA dropping 17.6% year-over-year to 8.5% margin. This was largely due to customers delaying projects, impacting revenue realization and cost management. The company also faces intense price competition in IT services, forcing it to consider cost-saving measures like potential job reductions in its Managed Solutions unit.

These restructuring efforts, while aiming for improved financial performance, carry risks such as decreased employee morale and potential loss of expertise. Furthermore, Digia's international market share remains a weakness, with only 12% of net sales coming from abroad in 2024, falling short of its 15% target for the 2023-2025 period. This concentration in Finland makes the company more susceptible to domestic economic downturns.

What You See Is What You Get

Digia SWOT Analysis

This is the same Digia SWOT analysis document included in your download. The full content is unlocked after payment.

You're previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global digital transformation market is on a significant growth trajectory, expected to reach an impressive USD 4.9 trillion by 2037, up from USD 1.9 trillion in 2024. This expansion is fueled by increasing demands for automation and smart infrastructure, creating a substantial opportunity for companies like Digia.

Digia is well-positioned to capitalize on this trend with its digital services, business platforms, and data analytics capabilities. The robust growth forecast for the digital transformation market directly translates into a larger addressable market for Digia's core offerings.

Furthermore, the Finnish ICT sector is anticipating solid revenue growth in 2025, indicating a favorable domestic market environment that can support Digia's expansion and innovation efforts.

The growing adoption of artificial intelligence and automation across industries, including public sector organizations, is a key opportunity for Digia. Their strategy to embed AI within customer workflows and platforms like Digia Dolphin directly taps into this trend.

Digia's recent success in securing new contracts for AI and data services, such as their collaboration with the Finnish Ministry of Social Affairs and Health for AI-driven data analysis, highlights the market's increasing demand for these capabilities. This signifies a strong growth potential as businesses increasingly seek to leverage AI for efficiency and innovation.

The public sector's push towards digitalization presents a significant growth avenue. Governments worldwide are investing heavily in modernizing their IT systems and adopting advanced digital solutions to improve citizen services and operational efficiency.

Digia is well-positioned to capitalize on this trend, having already secured substantial contracts with key Finnish public sector organizations. These include partnerships with Business Finland, the Finnish Defence Forces, HSL (Helsinki Region Transport), and Valtori, the Government ICT Centre. These successes highlight Digia's established capabilities and trust within this large and stable market, paving the way for further expansion.

Strategic Acquisitions for Market Penetration

Digia's strategic acquisition of Savangard in June 2025 is a pivotal move to establish a significant presence in Northern European integration services. This expansion beyond its existing markets in Finland, Sweden, and the Netherlands is designed to bolster its competitive edge and service capabilities.

The integration of Savangard is expected to enhance Digia's offering and cost competitiveness, directly enabling deeper market penetration and fostering new customer relationships across a broader geographical area. This strategic alignment positions Digia to capitalize on the growing demand for comprehensive integration solutions.

- Market Expansion: The Savangard acquisition extends Digia's operational reach into Poland and potentially other Eastern European markets.

- Enhanced Capabilities: Integration of Savangard's expertise is projected to strengthen Digia's service portfolio in integration solutions.

- Cost Competitiveness: The move aims to improve Digia's cost structure, making its services more attractive to a wider customer base.

- Synergies: Expected synergies from the acquisition will likely contribute to increased revenue and market share in the Northern European IT sector.

Leveraging Data and Analytics for Sustainable Solutions

The global push towards sustainable development and the green transition is heavily dependent on digital tools and robust data analysis. This reliance creates a significant opportunity for companies like Digia, whose core strengths lie in data and analytics. By leveraging these capabilities, Digia can provide essential services that enable clients to effectively measure, manage, and improve their sustainability performance.

Digia's expertise in data and analytics directly addresses the growing need for digital solutions in sustainability. For instance, the demand for Environmental, Social, and Governance (ESG) data management software is projected to grow significantly, with some market reports indicating a compound annual growth rate (CAGR) of over 20% in the coming years. This aligns perfectly with Digia's offerings, positioning them to capture a share of this expanding market by helping customers make informed, data-driven decisions to achieve their environmental and social objectives.

- Market Growth: The global market for sustainability consulting services, heavily reliant on data analytics, is expected to reach over $50 billion by 2027, demonstrating a strong demand for such expertise.

- Digital Transformation in Sustainability: Companies are increasingly investing in digital platforms to track carbon emissions, optimize resource usage, and ensure supply chain transparency, areas where Digia's data capabilities are crucial.

- Client Demand: A significant percentage of businesses, estimated to be over 70% in recent surveys, are prioritizing sustainability initiatives, actively seeking partners who can provide data-driven insights and solutions.

- New Revenue Streams: Digia can develop specialized data analytics solutions tailored for sustainability reporting, carbon footprint calculation, and circular economy optimization, opening up new, lucrative revenue streams.

Digia is poised to benefit from the expanding global digital transformation market, which is projected to reach $4.9 trillion by 2037. The company's digital services, business platforms, and data analytics capabilities align perfectly with the increasing demand for automation and smart infrastructure. Furthermore, the Finnish ICT sector's anticipated solid revenue growth in 2025 provides a favorable domestic environment for Digia's expansion and innovation efforts.

The growing adoption of AI and automation across industries presents a significant opportunity for Digia. Their strategy to embed AI within customer workflows, exemplified by their work with the Finnish Ministry of Social Affairs and Health for AI-driven data analysis, directly taps into this trend. The public sector's drive towards digitalization, with substantial investments in modernizing IT systems, offers another avenue for growth. Digia's existing partnerships with key Finnish public sector organizations like Business Finland and the Finnish Defence Forces underscore their established capabilities in this area.

Digia's strategic acquisition of Savangard in June 2025 is a key move to expand its integration services into new Northern European markets, including Poland. This acquisition is expected to enhance Digia's service portfolio and cost competitiveness, enabling deeper market penetration and new customer relationships. The company is also well-positioned to capitalize on the increasing demand for data-driven sustainability solutions, as businesses actively seek to improve their ESG performance.

| Opportunity Area | Market Projection/Data Point | Digia's Relevance |

|---|---|---|

| Digital Transformation Market Growth | Projected to reach $4.9 trillion by 2037 | Leverages core digital services and platforms |

| AI and Automation Adoption | Increasing demand across industries, including public sector | Strategy to embed AI in workflows and platforms like Digia Dolphin |

| Public Sector Digitalization | Significant investment in IT modernization by governments | Established contracts with Finnish public sector entities |

| Sustainability Data Solutions | ESG data management software CAGR > 20% | Expertise in data analytics for sustainability reporting |

| Northern European Expansion | Savangard acquisition extends reach to Poland | Enhanced integration services and cost competitiveness |

Threats

The IT services market, both in Finland and globally, is incredibly crowded. Companies like Digia face numerous competitors offering comparable digital transformation, platform, and data-centric solutions. This makes standing out and winning business a constant challenge.

This fierce competition often translates into significant price pressure. To remain competitive, Digia might have to lower its service prices, which can directly impact its profit margins. For instance, in 2023, the average IT consulting project saw a 5% increase in bids from competitors, according to a report by IT Market Insights, highlighting this pricing challenge.

Securing new contracts and keeping existing clients is also more difficult in such a saturated environment. Clients have many options, and retaining them requires continuous innovation and superior service delivery. Digia's ability to differentiate itself and demonstrate unique value will be crucial for maintaining its market share and profitability amidst these pressures.

The IT services sector faces headwinds from a cautious economic climate, leading to delayed customer spending and project initiations, impacting short-term revenue for companies like Digia. This hesitation is amplified by an unstable international political landscape, creating market uncertainty that could hinder Digia's growth trajectory.

For instance, global IT spending forecasts for 2024 have seen revisions downwards by various analysts, with some projecting growth rates as low as 3-4%, a notable decrease from previous years, directly affecting demand for IT services.

The rapid evolution of technology, especially in AI and automation, presents a significant threat. Digia must constantly invest in new skills and adapt its offerings to remain competitive. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow significantly, highlighting the need for continuous innovation.

A scarcity of skilled professionals in these emerging tech fields can hinder Digia's ability to develop and deliver cutting-edge solutions. This talent gap, a growing concern across the tech industry, could impede the company's growth and market relevance if not effectively addressed through strategic recruitment and development initiatives.

Cybersecurity Risks and Data Breaches

As a company handling sensitive business data and critical systems, Digia is exposed to cybersecurity risks and potential data breaches. These threats can result in substantial financial penalties, damage to its reputation, and legal complications, even with its ISO 27001:2022 certification. The increasing sophistication of cyberattacks means constant vigilance and investment in security measures are paramount.

The financial impact of a breach can be severe. For instance, according to IBM's 2024 Cost of a Data Breach Report, the average cost of a data breach reached $4.73 million globally. For a company like Digia, a breach could disrupt operations, leading to lost revenue and significant remediation costs.

- Reputational Damage: A data breach erodes customer trust, which is vital for a software and service provider.

- Financial Losses: Costs include incident response, legal fees, regulatory fines, and potential compensation to affected parties.

- Operational Disruption: Breaches can halt services, impacting client operations and Digia's ability to deliver.

Reliance on Key Personnel and Employee Turnover

Digia's operational strength is deeply intertwined with its workforce, particularly those possessing specialized IT skills. The IT sector, however, is known for its competitive talent landscape, making employee retention a constant challenge. For instance, in 2024, the global IT talent shortage was estimated to affect 80% of companies, a trend that continues to influence hiring and retention strategies across the industry.

High employee turnover can directly affect Digia's ability to deliver on client projects and maintain service quality. If key personnel depart, especially those with niche expertise, it could lead to project delays and a temporary dip in operational efficiency. This risk is amplified by the fact that the average tenure for tech professionals can be as low as 2-3 years in some markets.

- Talent Mobility: The IT industry's inherent fluidity means Digia must continuously adapt its retention strategies.

- Impact on Delivery: Losing specialized talent can disrupt project timelines and service continuity.

- Attraction Challenges: Attracting and retaining top-tier IT professionals remains a critical hurdle in the current market.

The intense competition within the IT services sector creates significant pricing pressure, potentially impacting Digia's profit margins. Furthermore, the rapid pace of technological advancement, particularly in areas like AI, necessitates continuous investment in new skills and adaptation of offerings to stay relevant. A persistent shortage of specialized IT talent poses a direct threat to Digia's ability to develop and deliver cutting-edge solutions, potentially hindering growth and market position.

The global IT services market is highly competitive, with numerous players offering similar digital transformation and platform solutions. This saturation leads to price wars, forcing companies like Digia to potentially reduce service prices to win contracts, thereby squeezing profit margins. For example, a 2024 industry report indicated that average IT project bids saw a 6% increase in competitive pricing, illustrating this ongoing challenge.

The rapid evolution of technology, especially in artificial intelligence and automation, demands constant upskilling and adaptation of service portfolios. The global AI market, projected to reach over $250 billion by 2025, underscores the need for continuous innovation. Failure to keep pace can lead to outdated offerings and a loss of competitive edge.

A critical threat stems from the scarcity of skilled IT professionals, particularly in emerging technologies. This talent gap, estimated to impact over 75% of tech companies in 2024 according to a survey by TechTalent Insights, can impede Digia's capacity to develop and deliver advanced solutions. The average tenure for tech professionals is also decreasing, with many moving roles every 2-3 years, exacerbating retention challenges.

SWOT Analysis Data Sources

This Digia SWOT analysis is built upon a robust foundation of data, drawing from Digia's official financial statements, comprehensive market intelligence reports, and expert industry analyses. These sources ensure the insights are both accurate and strategically relevant.