Dick's Sporting Goods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Dick's Sporting Goods faces a dynamic retail landscape, leveraging its strong brand recognition and extensive product selection as key strengths. However, it must navigate the challenges posed by intense competition and evolving consumer preferences.

Want the full story behind Dick's Sporting Goods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dick's Sporting Goods stands out as a leader in omnichannel retail, effectively blending its vast physical store presence with a strong online shopping experience. This dual approach allows customers to engage with the brand in ways that best suit their needs, whether through in-store discovery or the convenience of digital purchasing.

The company's successful integration of these channels has been a significant driver of its financial performance. For instance, in the first quarter of fiscal year 2025, Dick's reported record sales and notable comparable sales growth, underscoring the power of its unified retail strategy in attracting and retaining customers.

Dick's Sporting Goods benefits from a robust brand portfolio, offering a wide array of name-brand products that resonate with a diverse customer base, from casual athletes to serious enthusiasts. This extensive selection solidifies its standing in the market and attracts a broad spectrum of consumers.

The company holds a significant position in the U.S. sporting goods sector, estimated at $140 billion, with Dick's capturing nearly 9% of this market. Over the past year, they've managed to increase their market share by approximately 50 basis points, demonstrating consistent growth and effective strategy.

Strategic alliances with prominent brands, such as Nike, are crucial to Dick's Sporting Goods' strength. These partnerships grant them privileged access to exclusive and high-quality merchandise, further differentiating their offerings and reinforcing their competitive edge.

Dick's Sporting Goods is significantly investing in and expanding its experiential store formats, specifically the 'House of Sport' and 'Field House' concepts. These stores offer unique, interactive experiences like climbing walls and batting cages, designed to draw customers in and enhance engagement.

These immersive, larger-format stores are demonstrating strong financial performance, with new House of Sport locations projected to achieve around $35 million in omnichannel sales within their first year of operation. This success underscores the appeal of experiential retail in the sporting goods sector.

The company has ambitious plans for these formats, aiming to open a substantial number of additional House of Sport and Field House locations through 2025 and beyond. The strategic goal is to have between 75 and 100 House of Sport stores by 2027, signaling a major shift towards this more engaging retail model.

Diversified Specialty Retail Concepts

Dick's Sporting Goods' strength lies in its diversified specialty retail concepts, extending beyond its core brand. This includes banners like Golf Galaxy and Public Lands, which target specific sporting and outdoor niches. These specialized stores allow Dick's to tap into different customer segments and create varied revenue streams, thereby broadening its market presence. For instance, the company is actively investing in Golf Galaxy Performance Centers, aiming to capture growth within specialized golf markets.

The strategic expansion of these specialty banners is a key driver of Dick's Sporting Goods' market penetration. By operating distinct brands, the company can cater to the unique needs and preferences of enthusiasts in areas like golf and outdoor recreation. This approach not only diversifies revenue but also strengthens the overall brand portfolio, allowing for more targeted marketing and product offerings. The continued investment in these concepts underscores their importance to the company's growth strategy.

- Diversified Revenue Streams: Ownership of Golf Galaxy and Public Lands allows Dick's to capture sales from specialized sports and outdoor markets, reducing reliance on the flagship brand.

- Niche Market Penetration: These specialty concepts enable deeper engagement with specific customer bases, such as dedicated golfers and outdoor adventurers.

- Strategic Investment: Ongoing investment in formats like Golf Galaxy Performance Centers signals a commitment to expanding reach and capturing growth in high-potential niche segments.

Solid Financial Performance and Shareholder Returns

Dick's Sporting Goods has showcased impressive financial strength, with fiscal year 2024 ending January 28, 2023, seeing net sales reach $12.33 billion. This performance was bolstered by a 3.5% increase in comparable store sales. The company's commitment to shareholders is evident in its aggressive share repurchase program, having bought back $700 million worth of stock in fiscal 2024, alongside a 10% increase in its quarterly dividend.

The company continued its positive trajectory into the first quarter of fiscal 2025, reporting net sales of $2.75 billion, up 5.5% year-over-year, with comparable store sales increasing by 4.0%. This sustained growth highlights the effectiveness of their strategic initiatives and operational execution. These solid financial results provide a strong base for continued investment in the business and shareholder value enhancement.

- Record Sales: Fiscal year 2024 net sales reached $12.33 billion.

- Comparable Store Sales Growth: Achieved 3.5% growth in fiscal year 2024 and 4.0% in Q1 2025.

- Shareholder Returns: Executed $700 million in share repurchases in fiscal 2024 and increased dividends by 10%.

Dick's Sporting Goods leverages its strong omnichannel presence and strategic brand partnerships to drive significant financial performance. The company's ability to blend physical and digital retail experiences has led to consistent comparable sales growth, as seen in the 4.0% increase in Q1 fiscal 2025. This, coupled with a diversified portfolio including specialty banners like Golf Galaxy and Public Lands, allows Dick's to capture niche markets and generate varied revenue streams.

The company's commitment to shareholder value is demonstrated through substantial share repurchases and dividend increases. For instance, $700 million in stock was bought back in fiscal 2024, alongside a 10% dividend hike. These financial strengths provide a solid foundation for ongoing strategic investments and growth initiatives.

| Metric | Fiscal Year 2024 (Ending Jan 28, 2023) | Q1 Fiscal Year 2025 (Ending Apr 29, 2023) |

|---|---|---|

| Net Sales | $12.33 billion | $2.75 billion |

| Comparable Store Sales Growth | 3.5% | 4.0% |

| Share Repurchases | $700 million | N/A |

What is included in the product

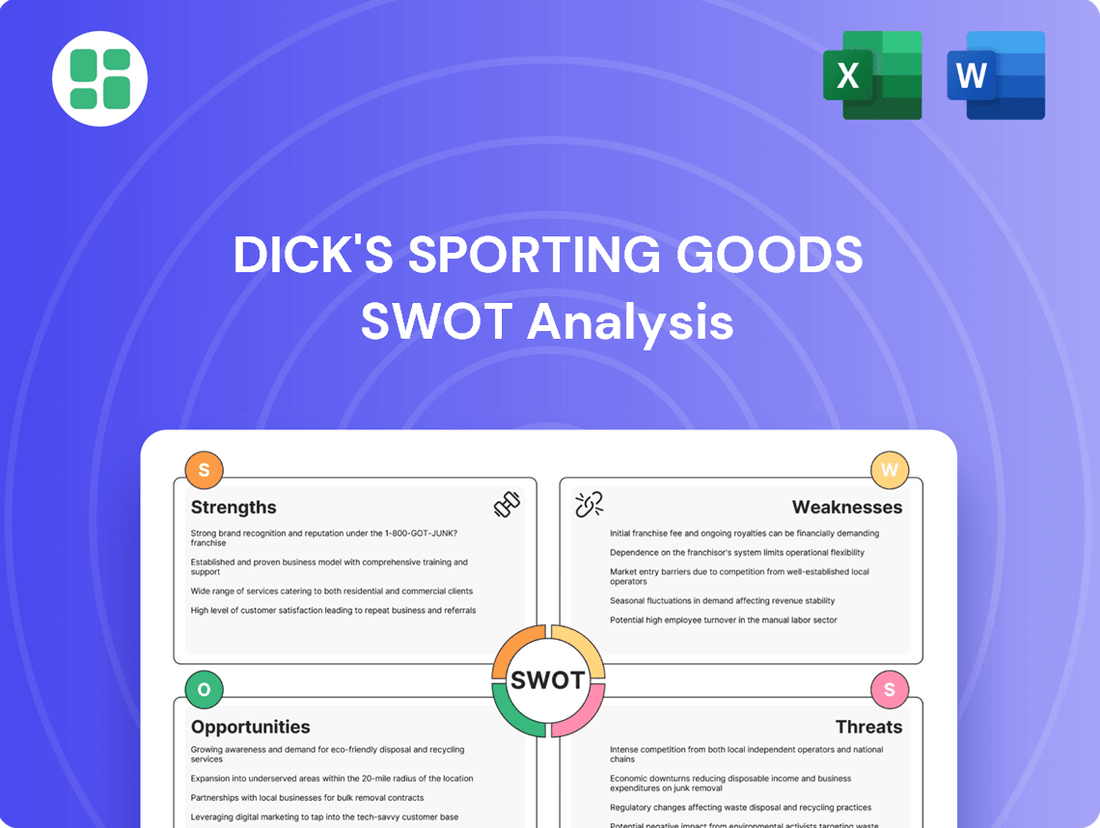

Analyzes Dick's Sporting Goods’s competitive position through key internal and external factors, examining its strengths in brand loyalty and omnichannel strategy against weaknesses like inventory management and opportunities in private label expansion, while considering threats from online retailers and changing consumer preferences.

Uncovers critical threats and weaknesses to proactively address competitive pressures.

Weaknesses

Dick's Sporting Goods' reliance on discretionary consumer spending is a key weakness. As a seller of sporting goods and apparel, its sales are highly sensitive to economic conditions. When consumers face inflation or economic uncertainty, they tend to cut back on non-essential purchases, which directly affects Dick's revenue and profits.

For instance, in the first quarter of 2024, while net sales saw a slight increase, the company's outlook for the full year indicated potential headwinds, reflecting ongoing consumer caution. This vulnerability means that a prolonged period of economic strain could significantly challenge the company's financial performance.

Dick's Sporting Goods faces significant pressure from a crowded retail environment. This includes established big-box retailers, nimble online-only players, and the growing direct-to-consumer (DTC) efforts of major athletic brands like Nike and Adidas, which can bypass traditional retail channels.

This intense competition directly impacts pricing strategies and can compress profit margins. For instance, in 2023, the sporting goods sector saw promotional activity increase as retailers vied for market share, a trend expected to continue into 2024.

Furthermore, the need to constantly refresh product offerings and enhance the in-store and online customer experience requires substantial ongoing investment. This is crucial for staying relevant against competitors who are often quicker to adopt new technologies or offer unique product collaborations.

Managing the extensive and varied inventory across Dick's Sporting Goods' numerous product categories and store formats, including their newer experiential locations, presents a significant operational challenge. The company's strategy of offering a curated assortment means that misjudgments in anticipating consumer demand or navigating supply chain disruptions could easily result in either excess stock requiring costly markdowns or insufficient inventory leading to missed sales.

Indeed, Dick's Sporting Goods reported an increase in inventory levels year-over-year for the first quarter of fiscal year 2025, a trend that, if not effectively managed, could heighten the risk of financial strain due to holding costs and potential obsolescence.

High Operating Costs of Physical Footprint

Maintaining a substantial physical retail presence, including the larger House of Sport formats, comes with considerable operating expenses. These include ongoing costs for rent, utilities, and employee wages across numerous locations. For instance, while DICK'S Sporting Goods reported total operating expenses of $9.0 billion for fiscal year 2023, a significant portion is tied to its brick-and-mortar infrastructure.

These high overheads can put pressure on profit margins, particularly if the company experiences a slowdown in sales growth at its existing stores. Should comparable store sales growth falter, these fixed costs could disproportionately impact the bottom line.

- Significant Overhead: Rent, utilities, and staffing for a large physical footprint represent substantial, ongoing costs.

- Profitability Strain: High operating costs can negatively affect profitability, especially if sales growth slows.

- Impact of Deceleration: A slowdown in comparable store sales growth would make these fixed costs a larger burden.

Vulnerability to Supply Chain Disruptions and Tariffs

Dick's Sporting Goods' reliance on global sourcing makes it susceptible to supply chain disruptions. Issues like manufacturing delays or shipping problems can affect product availability and increase costs. For instance, the company's 2025 outlook mentioned minimal direct exposure to tariff changes, but the broader risk of geopolitical factors impacting logistics and product pricing remains a concern.

These vulnerabilities can lead to fluctuating inventory levels and potentially higher operational expenses. The company needs to continuously monitor global trade dynamics and logistics networks to mitigate these risks effectively.

- Global Sourcing Risks: Exposure to manufacturing, shipping, and transportation cost volatility.

- Geopolitical Sensitivity: Potential impact of trade policies and tariffs on product costs and availability.

- Inventory Management Challenges: Disruptions can lead to stockouts or excess inventory, impacting sales.

Dick's Sporting Goods faces intense competition from both established retailers and emerging online brands, which can pressure pricing and profit margins. The company's significant investment in its physical store footprint, including larger experiential formats, results in substantial overhead costs like rent and staffing. Managing a diverse inventory across numerous categories is operationally complex, with risks of overstock or stockouts impacting sales and profitability. Furthermore, reliance on global sourcing exposes the company to supply chain disruptions and potential cost volatility.

What You See Is What You Get

Dick's Sporting Goods SWOT Analysis

This preview reflects the real Dick's Sporting Goods SWOT analysis document you'll receive—professional, structured, and ready to use. You're seeing the actual content, ensuring transparency and quality. The full, detailed report becomes available immediately after purchase.

Opportunities

Dick's Sporting Goods is capitalizing on the trend of experiential retail with its 'House of Sport' and 'Field House' concepts. These stores are designed to offer more than just products; they provide interactive experiences that resonate with consumers looking for engagement. This approach is a key opportunity for growth.

The company's commitment to expanding these immersive formats is a strategic move. Dick's plans to open approximately 100 new 'House of Sport' and 'Field House' locations by the end of fiscal year 2027. This aggressive expansion signals strong confidence in the model's ability to attract customers and drive sales.

These experiential formats are showing promising results, with higher sales per square foot compared to traditional stores. By offering unique in-store experiences, Dick's is fostering deeper customer loyalty and creating a destination that encourages repeat visits and increased spending.

Dick's Sporting Goods is capitalizing on the accelerating e-commerce growth by enhancing its digital capabilities, focusing on personalized customer experiences, and developing its mobile app. This strategic push aims to capture a larger share of the online market.

The company plans significant investments in technology and marketing to bolster its digital presence, including leveraging platforms like GameChanger and a new retail media network. For the fiscal year 2023, Dick's reported e-commerce sales represented approximately 18% of total net sales, a testament to the ongoing shift towards online purchasing.

Dick's Sporting Goods' potential acquisition of Foot Locker, reportedly valued around $2.4 billion, presents a significant opportunity to bolster its global presence and unlock substantial shareholder value. This move aligns with a broader trend of market consolidation, allowing Dick's to capture a larger market share and potentially diminish competitive pressures.

By integrating Foot Locker's established brand and customer base, Dick's can diversify its product assortment and tap into new demographics, particularly within the athletic footwear and apparel segments. Such consolidation is a strategic lever for achieving economies of scale and enhancing operational efficiencies across the combined entity.

Capitalizing on Growing Interest in Sports and Wellness

The increasing fusion of sports with everyday culture, alongside a heightened consumer focus on health, fitness, and outdoor activities, creates a robust market opportunity. This trend is amplified by significant sporting events planned in the United States through 2030, including the 2026 FIFA World Cup and the 2028 Los Angeles Olympics, which are expected to drive consumer engagement and spending on athletic apparel and equipment.

Dick's Sporting Goods is well-positioned to leverage this growing interest. The company's extensive product assortment and brand partnerships align directly with these consumer preferences. For instance, in the first quarter of 2024, Dick's reported a 5.6% increase in net sales compared to the prior year, indicating strong consumer demand for sporting goods.

- Growing Health Consciousness: A significant portion of the U.S. population is actively participating in fitness activities, boosting demand for related gear.

- Major Sporting Events: Upcoming global and national sporting events will likely spur increased consumer spending on sports-related merchandise.

- Outdoor Recreation Boom: Continued interest in hiking, camping, and other outdoor pursuits provides a consistent revenue stream for relevant product categories.

- Brand Partnerships: Strategic alliances with popular athletic brands allow Dick's to offer sought-after products that cater to current trends.

Further Development of Private Label and Exclusive Products

Dick's Sporting Goods has a significant opportunity to expand its private label and exclusive product offerings. Brands like CALIA, DSG, and VRST already contribute substantially to sales and provide a pathway to higher profit margins. By continuing to develop and promote these vertical brands, Dick's can solidify its competitive edge and foster deeper customer loyalty.

These in-house brands are crucial for differentiation in a crowded retail landscape. They allow Dick's to control the product lifecycle and offer unique items not available elsewhere. This strategy is particularly potent as consumers increasingly seek value and distinctiveness.

- Private Label Growth: Continued investment in developing and marketing brands like CALIA, DSG, and VRST offers a clear avenue for increased market share and profitability.

- Margin Enhancement: Exclusive products typically carry higher gross margins compared to third-party brands, directly boosting the company's bottom line.

- Customer Loyalty: Differentiated product lines encourage repeat purchases and build a stronger connection with the customer base, reducing reliance on external brands.

- Competitive Advantage: A robust private label portfolio acts as a barrier to entry for competitors and provides unique selling propositions that attract and retain shoppers.

Dick's Sporting Goods can leverage the growing consumer focus on health and wellness, further amplified by major upcoming sporting events like the 2026 FIFA World Cup and 2028 Los Angeles Olympics, to drive sales of athletic apparel and equipment. The company's strong performance, evidenced by a 5.6% increase in net sales in Q1 2024, highlights its ability to capitalize on these trends.

Expanding its exclusive private label brands, such as CALIA, DSG, and VRST, presents a significant opportunity for margin enhancement and differentiation. These brands already contribute substantially to sales and offer higher profit margins compared to third-party offerings, fostering customer loyalty and creating a competitive advantage.

The company's strategic expansion of experiential retail concepts, like 'House of Sport' and 'Field House,' with plans for approximately 100 new locations by fiscal year 2027, is a key growth driver. These immersive formats are already demonstrating success with higher sales per square foot, attracting customers and encouraging repeat visits.

Furthermore, the potential acquisition of Foot Locker, reportedly valued around $2.4 billion, could significantly bolster Dick's global presence and market share. This strategic move aligns with industry consolidation trends and offers diversification benefits.

| Opportunity Area | Description | Key Data/Metric |

|---|---|---|

| Experiential Retail | Expansion of 'House of Sport' and 'Field House' concepts | ~100 new locations by FY2027; higher sales per square foot |

| Private Label Brands | Growth of CALIA, DSG, VRST | Contribute substantially to sales; higher profit margins |

| Market Trends | Health & wellness, major sporting events | 5.6% net sales increase in Q1 2024 |

| Strategic Acquisition | Potential Foot Locker acquisition | Reported valuation ~$2.4 billion |

Threats

Economic instability, including potential recessions and persistent inflation, poses a significant threat by curbing consumer discretionary spending. This directly affects sales of non-essential items like sporting goods and apparel, impacting retailers such as Dick's Sporting Goods.

For fiscal year 2025, Dick's Sporting Goods anticipates a challenging retail environment, with net sales projected to be between $9.70 billion and $10.08 billion. This forecast acknowledges the ongoing macroeconomic uncertainties and their potential impact on consumer purchasing behavior.

Major athletic brands are increasingly prioritizing their direct-to-consumer (DTC) channels, a trend that could lessen their dependence on multi-brand retailers like Dick's Sporting Goods. For instance, Nike's stated goal to significantly expand its DTC sales, aiming for over 60% of its revenue from DTC by 2025, directly impacts partners. This strategic shift by key suppliers poses a threat by potentially limiting Dick's access to sought-after exclusive products and intensifying direct competition for the same customer base, thereby challenging product differentiation and overall sales volume.

Ongoing global supply chain disruptions, marked by labor shortages and transportation delays, continue to pose a significant threat to Dick's Sporting Goods. These external factors can directly translate into higher operational expenses and difficulties in managing inventory effectively. For instance, the cost of shipping containers saw substantial increases throughout 2023 and into early 2024, impacting the landed cost of goods for many retailers.

Rising raw material costs, from synthetic fabrics to metals used in sporting equipment, further exacerbate these challenges. While Dick's is investing in its distribution network to build resilience, these persistent external pressures remain a key vulnerability that could affect profitability and product availability in 2024 and beyond.

Changing Consumer Preferences and Retail Landscape Shifts

Dick's Sporting Goods faces the threat of rapidly changing consumer preferences. For instance, a notable shift towards athleisure wear over traditional athletic apparel could impact sales of core sporting goods. Furthermore, the rise of digitally native brands and a growing consumer demand for sustainable products present significant challenges to Dick's established retail model and supply chains.

The retail landscape itself is in constant flux, requiring ongoing adaptation. Dick's must continually innovate its in-store and online experiences to stay relevant. In 2023, online sales continued to be a dominant force, with e-commerce penetration in the retail sector reaching approximately 21.4% in the US, a figure that necessitates a robust digital strategy for survival and growth.

- Shifting Demand: A move away from participation in certain traditional sports towards new fitness trends or outdoor activities could reduce demand for specific product categories.

- Sustainability Focus: Increasing consumer emphasis on eco-friendly products and ethical sourcing may pressure Dick's to overhaul its product offerings and supplier relationships.

- Digital Competition: Pure-play online retailers and digitally native brands continue to capture market share, forcing Dick's to enhance its e-commerce capabilities and customer engagement strategies.

Organized Retail Crime and Shrinkage

Organized retail crime and general shrinkage remain a persistent threat to Dick's Sporting Goods, impacting its bottom line. In 2023, the National Retail Federation reported that retail shrink, which includes losses from theft, administrative errors, and damage, cost the industry an estimated $112 billion. This ongoing issue necessitates substantial and continuous investment in loss prevention strategies and technologies to mitigate inventory losses.

The impact of these losses can be substantial, directly affecting profitability. While specific 2024 figures for Dick's Sporting Goods are still emerging, the trend from previous years highlights the need for vigilance. Effective loss prevention measures are crucial for maintaining healthy margins and ensuring operational efficiency in the face of these persistent challenges.

- Shrinkage directly erodes profit margins by reducing available inventory.

- Organized retail crime is a significant driver of this shrinkage, impacting the entire retail sector.

- Continuous investment in loss prevention is essential to combat these threats effectively.

The increasing focus of major athletic brands on their direct-to-consumer (DTC) channels poses a significant threat, potentially reducing their reliance on multi-brand retailers like Dick's. For example, Nike aims for over 60% of its revenue from DTC by 2025, which could limit Dick's access to exclusive products and intensify competition.

Economic headwinds, including potential recessions and ongoing inflation, threaten discretionary spending on items like sporting goods. Dick's Sporting Goods projects net sales between $9.70 billion and $10.08 billion for fiscal year 2025, acknowledging these macroeconomic uncertainties.

Supply chain disruptions and rising raw material costs continue to challenge retailers. The cost of shipping containers saw substantial increases through 2023 into early 2024, impacting inventory management and operational expenses.

Rapidly shifting consumer preferences, such as a move towards athleisure or demand for sustainable products, challenge Dick's existing retail models. The continued dominance of online sales, representing approximately 21.4% of US retail in 2023, necessitates a strong digital strategy.

Organized retail crime and shrinkage remain a persistent threat, costing the industry an estimated $112 billion in 2023, according to the National Retail Federation. This necessitates continuous investment in loss prevention measures.

| Threat Category | Specific Example/Impact | Relevant Data/Projection |

| Brand DTC Focus | Reduced access to exclusive products, increased competition | Nike aiming for >60% DTC revenue by 2025 |

| Economic Instability | Decreased consumer discretionary spending | FY2025 Net Sales Projection: $9.70B - $10.08B |

| Supply Chain & Costs | Higher operational expenses, inventory challenges | Significant shipping container cost increases (2023-early 2024) |

| Consumer Preferences | Shift to athleisure, demand for sustainability | US E-commerce Penetration: ~21.4% (2023) |

| Shrinkage & Crime | Erosion of profit margins, inventory loss | Industry Shrinkage Cost: ~$112 Billion (2023) |

SWOT Analysis Data Sources

This Dick's Sporting Goods SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and insightful industry expert commentary, ensuring a robust and data-driven assessment.