Dick's Sporting Goods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

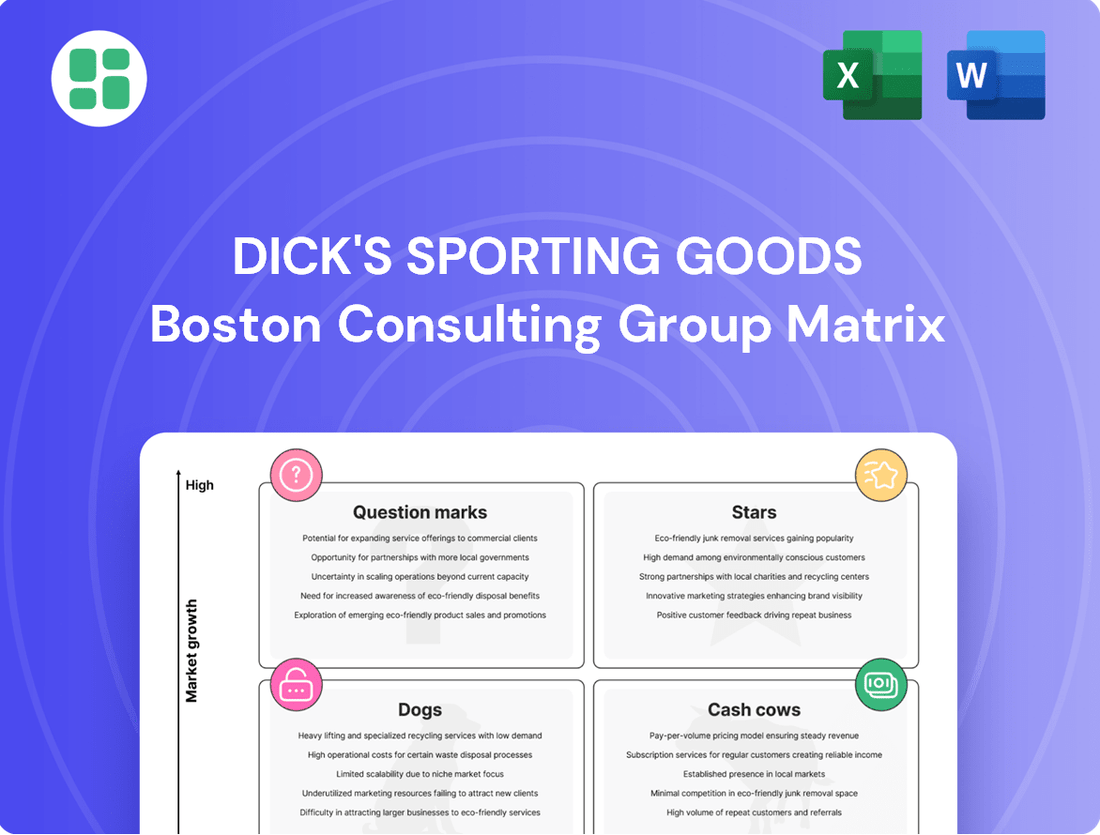

Curious about Dick's Sporting Goods' product portfolio? Our BCG Matrix analysis offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks, helping you understand their current market standing.

Ready to unlock the full strategic potential? Purchase the complete BCG Matrix for a detailed quadrant breakdown, actionable insights, and a clear roadmap to optimizing Dick's Sporting Goods' product investments and future growth.

Stars

The House of Sport store concept is a key growth driver for Dick's Sporting Goods, holding a strong position in the premium sporting goods market. These stores offer engaging, interactive experiences that attract more customers and generate higher sales compared to their traditional outlets.

Dick's Sporting Goods is heavily investing in this format, with plans to open around 100 House of Sport locations by the end of fiscal year 2027. This expansion strategy underscores the success and potential of this experiential retail model.

Dick's Sporting Goods' commitment to its e-commerce and omnichannel approach is clearly paying off. In the first quarter of 2025, digital sales saw a significant jump, growing faster than the company's overall revenue. This highlights the effectiveness of their strategy in meeting modern consumer demands.

The company is actively investing in its online infrastructure, aiming to improve everything from website speed to checkout convenience. A particular focus is being placed on their mobile app, recognizing its potential to drive further market share gains in the digital space.

This digital-first mindset, coupled with a seamless integration of online and in-store experiences, positions Dick's Sporting Goods to continue leading the market in serving athletes wherever and however they choose to shop.

The performance footwear category is a cornerstone of Dick's Sporting Goods' strategy, representing a substantial 28% of the company's overall business. This segment has experienced remarkable growth, with half of its expansion over the past decade concentrated in the last three years alone, underscoring its increasing importance.

Dick's Sporting Goods has strategically amplified its marketing efforts and cultivated robust relationships with leading footwear brands. These initiatives are directly contributing to sustained market share increases within this vital segment of the athletic apparel and footwear market.

DICK'S Private Label Brands

Dick's Sporting Goods' private label brands, including DSG, VRST, and Calia, are key drivers of its competitive edge. These brands are not just about offering unique products; they are strategically positioned to capture market share and boost profit margins. By developing exclusive lines, DKS strengthens its customer loyalty and gains greater control over its product offerings, reducing dependence on third-party brands.

The performance of these in-house brands is robust, contributing to Dick's Sporting Goods' overall financial health. For instance, private label penetration is a critical metric for retailers, and DKS has seen positive trends in this area. In the first quarter of 2024, Dick's Sporting Goods reported net sales of $2.67 billion, and the strength of its private label portfolio plays a vital role in maintaining healthy gross margins amidst a competitive retail landscape.

- DSG (Dick's Sporting Goods): This brand offers a broad range of athletic apparel and footwear, appealing to a wide demographic.

- VRST: Positioned as a premium performance wear brand, VRST targets athletes seeking high-quality, innovative gear.

- Calia: Focused on women's activewear and lifestyle apparel, Calia emphasizes comfort, style, and versatility.

- Contribution to Profitability: Private label brands typically offer higher profit margins compared to national brands due to direct sourcing and reduced marketing costs.

GameChanger Digital Platform

The GameChanger app represents a significant digital asset for Dick's Sporting Goods, categorized as a Star in the BCG Matrix due to its high growth and market leadership in the youth sports mobile platform space.

This platform is a powerful growth engine, boasting over 6.5 million unique active users and demonstrating robust year-over-year growth, indicating strong market penetration and user commitment.

GameChanger effectively expands the Dick's Sporting Goods ecosystem by connecting with athletes beyond traditional retail channels, fostering deeper engagement and creating high-margin digital revenue streams.

- High Growth: GameChanger exhibits substantial user acquisition and engagement, positioning it as a key growth driver.

- Market Leadership: As a leading youth sports mobile platform, it commands a strong position in its niche.

- Ecosystem Expansion: It extends Dick's reach into the digital sports community, creating new avenues for revenue and brand loyalty.

- Digital Revenue Stream: The platform contributes significantly to the company's long-term digital revenue objectives.

The GameChanger app is a prime example of a Star within Dick's Sporting Goods' BCG Matrix. It operates in a high-growth market for youth sports technology and has established itself as a leader in this niche.

With over 6.5 million unique active users and consistent year-over-year growth, GameChanger demonstrates strong market penetration and user loyalty, solidifying its position as a key growth driver.

This digital platform effectively expands Dick's Sporting Goods' ecosystem by engaging athletes beyond traditional retail, fostering deeper brand connections and generating valuable, high-margin digital revenue.

| BCG Category | Product/Service | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Star | GameChanger App | High | High (Leader in youth sports tech) | Invest for continued growth and market dominance. |

| Cash Cow | Performance Footwear | Moderate to High | High (28% of business) | Maintain market share and generate cash flow. |

| Question Mark | Private Label Brands (e.g., DSG, VRST, Calia) | Varies (Potential for high growth) | Varies (Growing penetration) | Evaluate and invest selectively to build market share. |

| Dog | (Hypothetical) Declining Store Formats | Low | Low | Divest or reposition to minimize losses. |

What is included in the product

This BCG Matrix analysis highlights Dick's Sporting Goods' product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights on investment, holding, or divestment for each category.

A clear BCG Matrix visualizes Dick's Sporting Goods' portfolio, relieving the pain of strategic uncertainty by highlighting Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

The vast network of traditional Dick's Sporting Goods stores forms the backbone of the company's operations, generating substantial and consistent revenue with a significant market share in the sporting goods retail sector.

While the company explores newer formats, these established stores continue to be profitable and provide a strong, recognizable physical presence for customers.

As of the first quarter of 2024, Dick's Sporting Goods reported net sales of $2.37 billion, a testament to the ongoing strength of its traditional store fleet.

These stores represent a mature market segment that reliably delivers cash flow, enabling strategic investments in growth areas and innovative retail experiences.

Dick's Sporting Goods' core athletic apparel and equipment, encompassing team sports gear and basic fitness wear, stands as a Cash Cow. This segment commands a high market share due to its broad assortment and consistent demand.

These mature product lines, unlike high-growth areas, necessitate less promotional spending. They are significant cash generators for the company, thanks to their established market presence and extensive customer reach.

In 2024, Dick's reported strong performance in its apparel and footwear categories, which are central to its core offerings. This segment continues to be a reliable source of revenue and profit, underpinning the company's overall financial health.

Golf Galaxy specialty stores represent a significant cash cow for Dick's Sporting Goods. These stores operate within the mature golf market, a segment where Dick's has established a robust market share. This strong position allows Golf Galaxy to generate consistent revenue from a loyal customer base that values specialized equipment and apparel.

The steady revenue stream from Golf Galaxy is crucial for funding other areas of Dick's Sporting Goods' business. While the company is investing in new Performance Centers, the existing Golf Galaxy locations continue to function as reliable, cash-generating assets. This stability is a hallmark of a cash cow within the BCG matrix framework.

Established National Brand Partnerships

Dick's Sporting Goods' established national brand partnerships, particularly with giants like Nike, Adidas, and Under Armour, signify a dominant market share within the branded athletic wear sector. These collaborations are crucial, guaranteeing the company access to sought-after merchandise that consistently fuels substantial sales volumes.

This mature segment of Dick's Sporting Goods' business thrives on the bedrock of established brand loyalty and predictable consumer purchasing habits. For instance, in fiscal year 2023, Nike alone accounted for approximately 21% of Dick's net sales, highlighting the immense contribution of these key partnerships.

- High Market Share: Dominant position in branded athletic apparel and footwear.

- Strong Demand: Consistent consumer pull for products from Nike, Adidas, and Under Armour.

- Mature Revenue Stream: Benefits from established brand equity and repeat customer purchases.

- Significant Sales Driver: These partnerships are instrumental in driving overall revenue and profitability.

ScoreCard Loyalty Program

The ScoreCard loyalty program is a cornerstone of Dick's Sporting Goods' success, acting as a significant cash cow. This program boasts over 25 million active members, a substantial base that drives a remarkable 75% of the company's total sales. This high level of participation underscores the program's effectiveness in cultivating customer loyalty and encouraging frequent purchases, thereby securing a steady and substantial revenue stream for the company.

The extensive reach and engagement of the ScoreCard program provide Dick's Sporting Goods with invaluable customer data. This data is instrumental in refining marketing campaigns and product assortment strategies, particularly within the competitive and mature retail landscape. By understanding member behavior and preferences, the company can make more targeted and efficient decisions, further solidifying the program's role as a reliable revenue generator.

- Customer Loyalty Driver: The ScoreCard program has over 25 million active members.

- Revenue Generation: Approximately 75% of Dick's Sporting Goods' total sales are attributed to ScoreCard members.

- Data Advantage: The program yields rich customer data for strategic marketing and product planning.

The core athletic apparel and footwear segment, bolstered by strong national brand partnerships, represents a significant Cash Cow for Dick's Sporting Goods. These categories benefit from consistent consumer demand and established brand loyalty, driving substantial and predictable revenue.

In fiscal year 2023, key partnerships like Nike contributed approximately 21% of Dick's net sales, underscoring the mature yet robust nature of this segment. The company reported strong performance in these areas throughout early 2024, reinforcing their status as reliable profit generators.

The ScoreCard loyalty program, with over 25 million active members contributing around 75% of total sales, is another prime example of a Cash Cow. Its ability to foster repeat business and provide valuable customer data ensures a steady cash flow, enabling strategic investments elsewhere.

| Segment | Market Share | Revenue Contribution (Est.) | Growth Potential |

|---|---|---|---|

| Core Athletic Apparel & Footwear | High | Significant | Low to Moderate |

| Golf Galaxy Stores | Strong | Consistent | Low |

| ScoreCard Loyalty Program | Dominant (within customer base) | Very High (75% of sales) | Moderate (through data utilization) |

Preview = Final Product

Dick's Sporting Goods BCG Matrix

The BCG Matrix analysis of Dick's Sporting Goods you are previewing is the identical, fully formatted report you will receive upon purchase. This comprehensive document, devoid of any watermarks or demo content, offers a strategic breakdown of Dick's product portfolio, ready for immediate application in your business planning.

What you see here is the actual, professionally designed BCG Matrix report for Dick's Sporting Goods that will be delivered to you after your purchase. This preview accurately represents the final, analysis-ready file, ensuring you receive exactly what you need to understand their market positioning and make informed strategic decisions.

This preview showcases the exact Dick's Sporting Goods BCG Matrix report you will download post-purchase, offering a complete and polished strategic assessment. You can be confident that no watermarks or sample data will be present in the final version, providing you with an immediately usable tool for competitive analysis.

The Dick's Sporting Goods BCG Matrix you are currently viewing is the final, unedited document you will receive after completing your purchase. This preview guarantees that the report is professionally formatted and packed with the strategic insights you expect, ready for direct integration into your business strategy.

Dogs

Public Lands, Dick's Sporting Goods' dedicated outdoor concept, is currently positioned as a Dog in the BCG matrix. This classification stems from the company's strategic decision to close five of its eight existing Public Lands stores.

This move suggests that the Public Lands concept has not met its growth and market share objectives within its specialized niche. The company plans to repurpose these underperforming locations, converting them into more successful formats such as House of Sport or Field House, which have demonstrated stronger performance.

Certain legacy product categories within Dick's Sporting Goods, such as outdated team sports equipment or specific types of apparel that have fallen out of favor, could be classified as Dogs. These segments likely represent a small portion of overall sales, with minimal growth potential. For instance, if sales in a particular niche equipment category saw a 5% year-over-year decline in 2024, it would reinforce its Dog status.

Dick's Sporting Goods' Going Going Gone! and temporary Warehouse Sale stores are designed to liquidate excess inventory. These outlets typically function in a low-growth, low-margin segment of the market. Their main goal is to clear out stock, not to build long-term market share or profitability.

Outdated or Low-Traffic Traditional Store Locations

Certain traditional Dick's Sporting Goods store locations may be experiencing reduced customer visits and sales, particularly those situated in less frequented retail areas. These underperforming stores, while part of a larger, profitable traditional fleet, necessitate careful review. The company's strategy includes assessing these specific locations for potential closure or repurposing into more efficient formats, reflecting an ongoing effort to optimize its physical store footprint.

Dick's Sporting Goods has been actively managing its store portfolio. For instance, in 2023, the company continued its strategy of optimizing its store base, which can involve closing underperforming locations. While specific numbers for individual store closures due to low traffic aren't always publicly detailed, the company's overall approach indicates a focus on high-performing, strategically located stores. The emphasis remains on ensuring the traditional store fleet, which generates significant cash flow, is composed of locations that meet current market demands and consumer shopping habits.

- Store Portfolio Optimization: Dick's Sporting Goods is actively evaluating its traditional store locations to ensure they align with current market dynamics and consumer behavior.

- Underperforming Location Assessment: Stores with consistently low foot traffic or declining sales are subject to review for potential closure or format conversion.

- Focus on Profitability: The company aims to maintain a strong, cash-generating traditional store fleet by addressing individual underperforming sites.

- Strategic Repositioning: Dick's is repositioning its store fleet to enhance overall performance and adapt to evolving retail landscapes.

Discontinued or De-emphasized Niche Brands

Discontinued or de-emphasized niche brands at Dick's Sporting Goods represent investments that didn't capture significant market share. These are products or lines that, despite initial introduction or acquisition, failed to gain traction. For instance, if Dick's had a specific line of specialized fishing gear that saw minimal sales, it would likely be moved to this category. This strategic shift allows the company to reallocate resources to more promising areas.

These brands are essentially the "Dogs" in the BCG matrix, indicating low market share and low market growth. Their performance means they are not contributing significantly to revenue or profit. Dick's Sporting Goods, like many retailers, periodically reviews its product portfolio to identify underperforming segments. In 2023, the company continued its strategy of optimizing its brand assortment, which often involves phasing out less successful niche offerings.

- Low Market Share: These brands typically hold a minimal percentage of their respective market segments.

- Limited Growth Potential: The overall market for these niche products is often stagnant or declining.

- Resource Reallocation: Discontinuation frees up capital and management focus for more profitable ventures.

- Past Investments: They represent prior strategic bets that did not yield expected returns.

Certain legacy product categories within Dick's Sporting Goods, such as outdated team sports equipment or specific types of apparel that have fallen out of favor, could be classified as Dogs. These segments likely represent a small portion of overall sales, with minimal growth potential. For instance, if sales in a particular niche equipment category saw a 5% year-over-year decline in 2024, it would reinforce its Dog status.

Discontinued or de-emphasized niche brands at Dick's Sporting Goods represent investments that didn't capture significant market share. These are products or lines that, despite initial introduction or acquisition, failed to gain traction. Dick's Sporting Goods, like many retailers, periodically reviews its product portfolio to identify underperforming segments. In 2023, the company continued its strategy of optimizing its brand assortment, which often involves phasing out less successful niche offerings.

The Public Lands concept, Dick's Sporting Goods' outdoor-focused venture, is also categorized as a Dog. This is evidenced by the company's decision to close five of its eight Public Lands stores, indicating underperformance against its growth and market share goals. These underperforming locations are slated for repurposing into more successful formats like House of Sport or Field House.

Dick's Sporting Goods' Going Going Gone! and temporary Warehouse Sale stores are designed to liquidate excess inventory, operating in low-growth, low-margin segments. Their primary function is stock clearance rather than building long-term market share or profitability.

Question Marks

DICK'S Field House concept is a promising new, smaller, experiential store format with significant growth potential. While it's still establishing its market share compared to the larger, established DICK'S Sporting Goods stores, its flexible design aims for strong performance.

As a relatively new initiative, the Field House concept requires substantial investment to achieve scalability and solidify its long-term market leadership. The company's strategic expansion plans include opening around 18 new Field House locations in 2025, underscoring its commitment to this growth avenue.

Dick's Media Network represents a potential 'Question Mark' in Dick's Sporting Goods' BCG Matrix. This retail media platform leverages their ScoreCard loyalty program and extensive customer data, tapping into the booming retail media sector which is projected to reach $125.7 billion globally by 2024.

While the growth potential is significant, the network's current market share and profitability as a dedicated advertising platform are likely still nascent. Substantial investment is required to fully capitalize on its data assets and solidify its position against established players, making its future market position uncertain.

Dick's Sporting Goods' potential acquisition of Foot Locker, if it were to occur, would likely position it as a Stars or Question Marks within a BCG Matrix, depending on the specific market conditions and Foot Locker's performance leading up to such a hypothetical event. The stated goal of creating a global leader in sports retail and achieving significant cost synergies, potentially in the range of $100-$125 million, points towards a high-growth, high-investment strategy.

Emerging Niche Sports Equipment

Emerging niche sports equipment, like pickleball gear, falls into the question mark category for Dick's Sporting Goods within the BCG matrix. These markets exhibit high growth potential, but Dick's may currently hold a smaller market share as these trends are still developing. Significant investments in marketing and inventory are crucial to capture leadership in these nascent segments.

For instance, the pickleball market experienced explosive growth, with participation numbers soaring. In 2023, USA Pickleball reported over 13.2 million players, a substantial increase from previous years. This rapid expansion presents an opportunity for Dick's to invest in a wider range of pickleball equipment, from paddles and balls to court accessories, to capitalize on this burgeoning trend.

- High Market Growth: The pickleball market, for example, saw a significant surge in player numbers, indicating a rapidly expanding market.

- Low Market Share: Despite growth, Dick's may have a smaller slice of this emerging pie, requiring strategic efforts to gain a stronger foothold.

- Investment Needs: Substantial capital is needed for marketing campaigns and stocking a diverse inventory of niche sports equipment to drive sales and market presence.

- Potential for Growth: Successfully converting these question marks into stars requires focused investment to establish market leadership in these evolving athletic trends.

Advanced Digital Personalization Tools

Dick's Sporting Goods is heavily investing in technology, particularly advanced digital personalization tools. These tools leverage AI to offer tailored recommendations, aiming to boost customer engagement and sales across their omnichannel operations. For instance, in early 2024, the company highlighted ongoing enhancements to its e-commerce platform, including more sophisticated personalization algorithms.

While these digital advancements show strong potential for improving the customer experience and driving incremental sales, their impact on significantly expanding market share is still in its early stages. The effectiveness hinges on continued customer adoption and the ongoing refinement of these AI-driven strategies, making their long-term position in the BCG matrix uncertain but promising.

- Investment in AI-driven recommendations

- Focus on omnichannel customer engagement

- Potential for sales improvement

- Market share impact still developing

Dick's Sporting Goods' foray into the retail media network space, particularly through its ScoreCard loyalty program, represents a classic Question Mark. While the retail media sector is booming, with global projections reaching $125.7 billion by 2024, Dick's Media Network is likely in its early stages regarding market share and profitability as a dedicated advertising platform.

Significant investment is required to fully leverage its customer data and compete with established players. The company's strategy involves utilizing its extensive customer data to create a valuable advertising channel, but its long-term success and market position remain uncertain, necessitating careful monitoring and strategic capital allocation.

Emerging niche sports, such as pickleball, also fall under the Question Mark category. The pickleball market's rapid expansion, evidenced by over 13.2 million players in 2023 according to USA Pickleball, presents a high-growth opportunity. However, Dick's market share in this specific segment may still be developing, requiring substantial investment in marketing and inventory to establish leadership.

BCG Matrix Data Sources

Our Dick's Sporting Goods BCG Matrix leverages financial disclosures, market trend analysis, and competitor benchmarks to accurately position each business unit.