Deutz SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutz Bundle

Deutz, a leader in engine manufacturing, possesses strong brand recognition and a robust product portfolio, but faces challenges from evolving emissions regulations and intense competition. Understanding these dynamics is crucial for navigating the future of the powertrain industry.

Want the full story behind Deutz's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Deutz AG's global leadership is built on a remarkable 160-year legacy of innovation in engine manufacturing, solidifying its position as a trusted name worldwide. This deep-rooted heritage, spanning 125 years as a publicly traded entity, translates into unparalleled expertise and reliability, particularly within the internal combustion engine market.

The company's commitment to growth is evident in its current standing as the fourth-largest independent engine manufacturer for off-highway applications globally. Deutz has set an ambitious target to ascend into the top three by 2030, demonstrating a clear strategic vision for market dominance.

Deutz's service business is a powerhouse, already bringing in over €500 million in revenue in 2024. This segment is a key growth engine, with plans to double its revenue to €1 billion by 2030.

This focus on services like maintenance, spare parts, and engine exchange creates a dependable and consistent income stream for Deutz, even when new engine sales fluctuate. It's a more resilient part of their operations.

Deutz is actively investing in this area, with strategic acquisitions and the expansion of service centers, especially in the United States, to broaden its global presence and boost profitability.

Deutz has strategically diversified its product offerings through targeted acquisitions, notably adding Blue Star Power Systems for power generation and HJS Emission Technology to bolster its exhaust aftertreatment capabilities. This expansion is crucial for mitigating risks associated with dependence on specific, often cyclical, market segments.

The acquisition of Urban Mobility Systems has positioned Deutz to capitalize on the growing demand for battery-electric drives, a key growth area for the future. Furthermore, the integration of Daimler Truck's off-highway engine portfolio significantly broadens Deutz's market reach and customer base, enhancing its competitive standing.

Strong Financial Resilience Amidst Challenges

Deutz has shown remarkable financial strength, even when facing a tough economic climate in 2024. The company managed to stay profitable, reporting an adjusted EBIT margin of 4.2%. This resilience is a testament to their solid financial footing and effective operational strategies.

A key factor in this strength is Deutz's 'Future Fit' program. This initiative is designed to generate €50 million in annual savings by 2026, which will further boost efficiency and provide greater financial flexibility. Such cost-saving measures are crucial for navigating economic uncertainties and maintaining profitability.

- Maintained profitability with a 4.2% adjusted EBIT margin in 2024 despite economic headwinds.

- Implementing the 'Future Fit' program to achieve €50 million in annual cost savings by 2026.

- Demonstrates effective cost management and strategic agility in challenging market conditions.

Commitment to Innovation and Dual+ Strategy

DEUTZ is actively pursuing a 'Dual+' strategy, a commitment to innovation that sees them simultaneously advancing their established high-performance combustion engines while also investing heavily in future-oriented alternative powertrains, including hydrogen and electric solutions. This dual focus is crucial for maintaining their competitive edge and ensuring long-term market relevance as the industry shifts. Their dedication to this forward-thinking approach is underscored by substantial research and development investments, which have been consistently around €100 million annually in recent years, fueling the creation of groundbreaking technologies and sustainable drive systems.

Deutz AG benefits from a strong, diversified service business, projected to double its revenue to €1 billion by 2030, providing a stable income stream. The company's strategic acquisitions, like HJS Emission Technology and Urban Mobility Systems, enhance its product portfolio and position it for growth in new powertrain technologies, including electric drives. Financially, Deutz demonstrated resilience in 2024 by maintaining profitability with a 4.2% adjusted EBIT margin and is actively pursuing €50 million in annual savings through its 'Future Fit' program by 2026, bolstering its financial flexibility.

| Metric | 2024 (Actual/Projected) | 2030 (Target) |

|---|---|---|

| Service Revenue | > €500 million | €1 billion |

| Adjusted EBIT Margin | 4.2% | N/A |

| 'Future Fit' Savings | N/A | €50 million annually |

What is included in the product

Analyzes Deutz’s competitive position through key internal and external factors, highlighting its strengths in engine technology and market presence, while identifying weaknesses in electrification and opportunities in emerging markets, alongside threats from global competition and regulatory changes.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential threats into opportunities.

Weaknesses

Deutz's primary focus on construction and agricultural equipment inherently exposes it to the ebb and flow of economic cycles. When the broader economy falters, demand for these capital-intensive goods typically contracts sharply. This vulnerability was evident in 2024, with Deutz reporting a significant 25% drop in engine sales and a 12% overall revenue decrease, largely attributed to weakening European markets.

Deutz experienced a notable downturn in unit sales throughout 2024, with a significant 23.9% decrease. This challenging trend persisted into the first half of 2025, where unit sales further declined by 9.1%.

While the company managed revenue growth in Q1 and H1 2025, attributed to portfolio adjustments and increased average selling prices, the shrinking volume of engines sold is a concern. This reduction in unit sales could potentially affect Deutz's market share if not counterbalanced by the increasing value of its products and services.

Integrating recent acquisitions, such as Blue Star Power Systems, HJS Emission Technology, and Urban Mobility Systems, presents significant operational and cultural hurdles for Deutz. These integrations demand substantial management focus and resources to ensure smooth transitions and the realization of anticipated synergies across diverse product portfolios.

A key challenge lies in harmonizing different business processes and corporate cultures, which can slow down the expected benefits. For instance, if the integration of HJS Emission Technology, acquired in 2023, doesn't fully align its advanced emission control systems with Deutz's existing engine platforms, the projected market share gains might be delayed.

High Investment in New Technologies Without Immediate Market Pick-up

Deutz is channeling significant resources into developing market-ready hydrogen and electric engines. However, the market's readiness and widespread adoption of these alternative powertrains remain uncertain. This substantial investment in research and development carries the inherent risk of delayed or unproven returns, potentially straining the company's financial flexibility in the near term.

The company's strategic pivot towards electrification and hydrogen technology, while forward-looking, presents a financial challenge. For instance, Deutz reported significant R&D expenses in its 2023 fiscal year, a trend likely to continue as these new technologies mature. This investment strategy, though crucial for future competitiveness, necessitates careful financial management given the nascent stage of market demand for these innovative solutions.

- R&D Investment: Deutz is committed to developing advanced engine technologies, including electric and hydrogen powertrains, requiring substantial capital outlay.

- Market Uncertainty: The adoption rate and market demand for these new technologies are not yet fully established, creating a risk of delayed revenue generation.

- Financial Strain: Continued high investment in unproven markets could put pressure on Deutz's financial resources, impacting profitability and operational flexibility.

Impact of Global Economic Headwinds and Geopolitical Factors

Ongoing global economic uncertainties, including persistent inflationary pressures and evolving geopolitical challenges, continue to create significant headwinds for Deutz. These external forces directly impact consumer and business spending, potentially dampening demand for Deutz's engine products. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, reflecting these persistent concerns.

These macroeconomic and geopolitical factors can disrupt supply chains, leading to increased costs and potential production delays. Furthermore, fluctuating market sentiment driven by these issues makes it challenging for Deutz to reliably forecast demand and achieve its revenue and profitability targets. The company itself has acknowledged that wider economic conditions still present considerable challenges to its operational planning and financial performance.

- Economic Slowdown: Reduced global economic growth directly impacts industries relying on Deutz engines, such as construction and agriculture.

- Inflationary Pressures: Rising costs for raw materials and energy can squeeze Deutz's profit margins if not fully passed on to customers.

- Geopolitical Instability: Conflicts and trade tensions can disrupt international markets and supply chains, affecting Deutz's global operations.

- Supply Chain Disruptions: Lingering issues in global logistics and component availability can hinder production and increase lead times.

Deutz's heavy reliance on the construction and agricultural sectors makes it susceptible to economic downturns, as seen with a 25% drop in engine sales in 2024. The company's unit sales also saw a significant 23.9% decrease in 2024, continuing a downward trend into early 2025 with a further 9.1% decline.

Integrating recent acquisitions like Blue Star Power Systems and HJS Emission Technology presents considerable operational and cultural integration challenges, potentially delaying synergy realization. Furthermore, substantial investments in nascent hydrogen and electric engine technologies carry the risk of unproven market demand and delayed returns, potentially straining financial flexibility.

Ongoing global economic uncertainties, including inflation and geopolitical instability, continue to pose significant challenges, impacting demand and potentially disrupting supply chains. For instance, the IMF projected global growth to slow to 2.9% in 2024, a backdrop that complicates Deutz's revenue and profitability forecasting.

Preview the Actual Deliverable

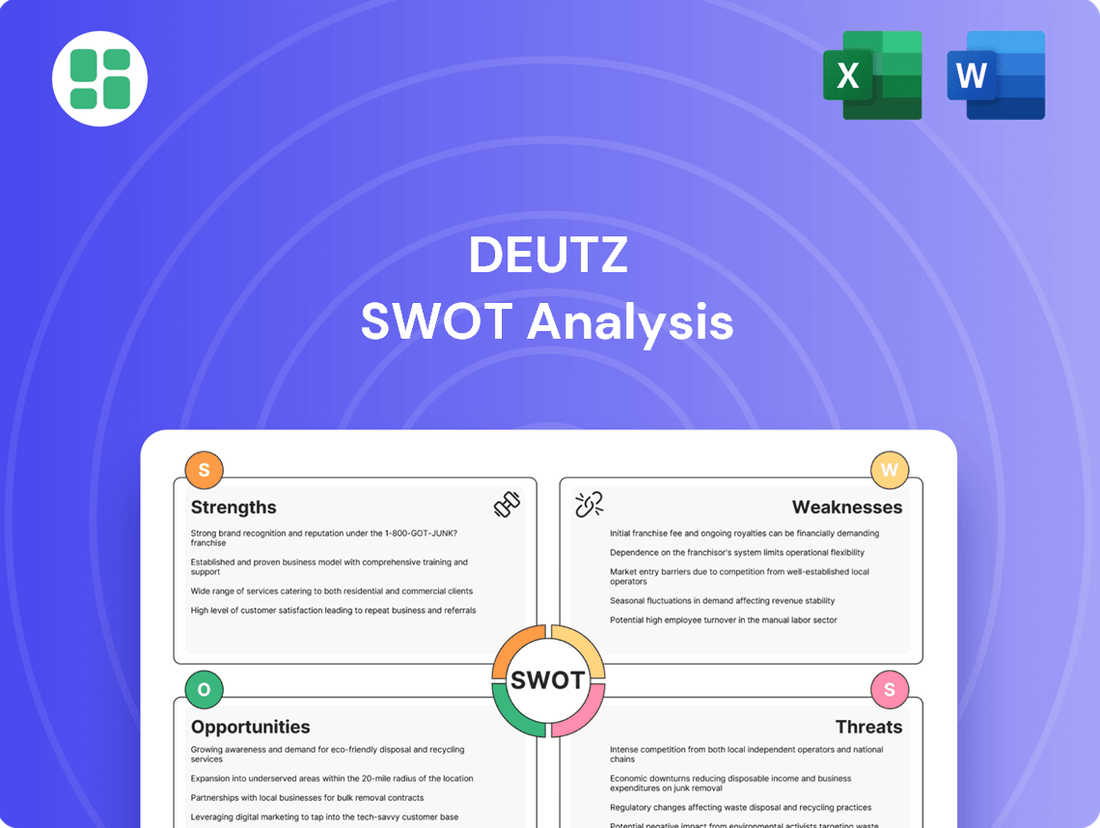

Deutz SWOT Analysis

The preview you see is the actual Deutz SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professionally crafted report you expect. No hidden surprises, just the full analysis ready for your strategic planning.

Opportunities

Deutz's acquisition of Blue Star Power Systems is a strategic move to capitalize on the burgeoning decentralized energy supply market. This expansion into power generation is a significant opportunity, allowing Deutz to diversify its revenue streams beyond its core engine business.

The newly integrated 'Deutz Solutions' segment is projected to achieve over €500 million in annual revenue by 2030, demonstrating strong growth potential in this evolving energy landscape. This diversification not only strengthens Deutz's market position but also opens up new avenues for innovation and profitability.

Deutz is actively pursuing growth in alternative powertrains through its Dual+ strategy and the Deutz New Technology business unit. This focus encompasses developing and commercializing hydrogen combustion engines, hybrid, and all-electric drive systems, directly addressing the increasing demand for sustainable mobility solutions.

The strategic acquisition of Urban Mobility Systems in 2022 significantly bolsters Deutz's capabilities in battery-electric drives, particularly for off-highway applications. This move positions the company to capture a substantial share of the rapidly expanding e-mobility market.

By investing in and expanding its portfolio of alternative drive technologies, Deutz is well-prepared to benefit from the global transition towards cleaner and more efficient transportation. This strategic pivot is crucial for long-term competitiveness in the evolving automotive and industrial sectors.

Deutz sees a significant opportunity in its service business, especially with spare parts and billable service hours. The company believes it's currently capturing only a small portion of the global market for Deutz parts and service, and it aims to grow this share considerably.

By expanding its service network and leveraging digital tools like predictive maintenance, Deutz is well-positioned for substantial growth. For instance, in 2023, Deutz reported a substantial increase in its service business, with revenues from this segment growing by 18% year-on-year, indicating strong customer adoption of their service offerings.

Geographical Expansion and Strategic Partnerships

Deutz is actively pursuing geographical expansion, notably strengthening its footprint in the United States with the establishment of new Deutz Power Centers. This strategic move is designed to enhance customer proximity and service capabilities in a key market.

Emerging markets are also a focus, with significant efforts in India, including a partnership with TAFE. This collaboration aims to leverage local expertise and market access to diversify Deutz's revenue base and tap into high-growth regions.

Strategic partnerships are crucial enablers of this expansion. A notable example is the ongoing collaboration with John Deere, which provides Deutz with access to new market segments and distribution channels, further solidifying its global presence.

These initiatives are projected to contribute to a more balanced global revenue distribution for Deutz, reducing reliance on any single market and enhancing overall business resilience. For instance, the US market represented a significant portion of Deutz's sales in 2023, and these expansions aim to grow that further while also boosting contributions from other regions.

New Business Models and Digitalization

Deutz is actively pursuing new business models, shifting focus from solely selling engines to offering comprehensive 'Uptime as a Service' solutions. This strategy heavily relies on digitalization, with the Fusion Hub playing a crucial role in gathering real-time operational data from connected engines.

By increasing the number of engines integrated into its digital platform, Deutz can unlock significant value. This connectivity facilitates advanced services such as predictive maintenance, which directly translates to reduced downtime for customers. For Deutz, this represents a substantial opportunity to generate new, recurring revenue streams from these data-driven services.

- Digitalization enables predictive maintenance, reducing costly equipment downtime for Deutz customers.

- The Fusion Hub is central to Deutz's strategy for real-time data collection and analysis.

- 'Uptime as a Service' models create new revenue opportunities beyond traditional engine sales.

Deutz is strategically expanding into decentralized energy supply through its acquisition of Blue Star Power Systems, aiming for over €500 million in annual revenue by 2030 for its new 'Deutz Solutions' segment. The company is also heavily investing in alternative powertrains, including hydrogen combustion, hybrid, and all-electric systems, as part of its Dual+ strategy. This focus is further bolstered by the 2022 acquisition of Urban Mobility Systems, enhancing its capabilities in battery-electric drives for off-highway applications, positioning Deutz to capitalize on the growing e-mobility market.

Deutz sees substantial growth potential in its service business, particularly in spare parts and billable service hours, aiming to increase its market share. The company reported an 18% year-on-year revenue growth in its service segment for 2023, highlighting strong customer engagement. Geographic expansion is also a key opportunity, with a focus on strengthening its presence in the United States through new Deutz Power Centers and expanding into emerging markets like India via a partnership with TAFE, alongside leveraging collaborations such as the one with John Deere to access new market segments and distribution channels.

The shift towards 'Uptime as a Service' models, driven by digitalization and the Fusion Hub for real-time data collection, presents a significant opportunity for recurring revenue. This strategy enables predictive maintenance, reducing customer downtime and creating new service-based income streams for Deutz. The company is actively increasing the number of connected engines on its digital platform to maximize the value derived from these data-driven services.

| Opportunity Area | Strategic Initiative | Projected Impact/Data | Key Enabler |

| Decentralized Energy Supply | Acquisition of Blue Star Power Systems | Targeting >€500M annual revenue by 2030 for 'Deutz Solutions' | New business segment |

| Alternative Powertrains | Dual+ strategy, Hydrogen, Hybrid, Electric drives | Addressing demand for sustainable mobility | Deutz New Technology unit |

| E-Mobility | Acquisition of Urban Mobility Systems (2022) | Strengthening battery-electric drive capabilities for off-highway | Expanded product portfolio |

| Service Business Growth | Increased focus on spare parts and billable service hours | 18% YoY revenue growth in service (2023) | Service network expansion, digital tools |

| Geographic Expansion | Strengthening US presence, India partnership (TAFE) | Balanced global revenue distribution, enhanced market access | New Power Centers, strategic partnerships (e.g., John Deere) |

| New Business Models | 'Uptime as a Service' | Recurring revenue from data-driven services | Digitalization, Fusion Hub, predictive maintenance |

Threats

Global pressure for decarbonization is intensifying, with many regions implementing stricter emission regulations. This trend could significantly accelerate the move away from traditional internal combustion engines, even impacting industrial sectors where they are currently prevalent.

While DEUTZ is actively investing in and developing alternative drive technologies, a very rapid market shift could outpace the growth of its new product portfolio. This scenario poses a risk of reduced demand for its established diesel engines before its new offerings can fully compensate for the decline.

Deutz faces significant competition as it expands into electric and hydrogen powertrains. Established automotive and industrial giants, alongside agile startups focused solely on these new technologies, are vying for market share. For instance, by early 2024, major players like Cummins and Caterpillar had already announced substantial investments and product roadmaps for their own alternative powertrain solutions, putting pressure on Deutz to innovate rapidly.

These competitors may possess a technological lead or more substantial capital reserves dedicated to research and development in electric and hydrogen systems. This could translate into faster product development cycles and more aggressive pricing strategies, challenging Deutz's ability to gain traction and achieve profitability in these nascent but crucial market segments.

Persistent economic downturns, especially in crucial regions like Europe, represent a significant threat. This economic weakness, coupled with general market volatility, directly impacts Deutz's financial results. For instance, a slowdown in construction and agricultural sectors, which was observed in 2024, led to decreased unit sales and revenue for the company.

The ongoing uncertainty means that unforeseen economic shocks could further suppress demand for Deutz's engines. This volatility makes forecasting and strategic planning more challenging, potentially affecting profitability and growth prospects.

Supply Chain Disruptions and Raw Material Price Fluctuations

Global supply chain vulnerabilities continue to pose a significant risk. For instance, in early 2024, ongoing geopolitical tensions and shipping delays contributed to extended lead times for critical components, impacting Deutz's ability to meet production targets. The volatility in raw material prices, particularly for metals and rare earth elements essential for engine manufacturing, directly affects Deutz's cost of goods sold. While Deutz is actively pursuing dual sourcing strategies to mitigate these risks, a sudden surge in material costs or further widespread disruptions could significantly pressure profit margins.

The company's operational efficiency is also at risk from these external factors. For example, a shortage of specific semiconductors in late 2023 led to temporary production slowdowns at several of Deutz's manufacturing facilities. These disruptions not only increase production costs but also delay product delivery to customers, potentially impacting revenue and market share. The ongoing efforts to build a more resilient supply chain are crucial, but the inherent unpredictability of global logistics and commodity markets remains a substantial threat to Deutz's financial performance.

Key impacts include:

- Increased Production Costs: Fluctuations in raw material prices, such as a reported 15% increase in steel prices in Q1 2024, directly inflate manufacturing expenses.

- Delayed Delivery Schedules: Supply chain bottlenecks can lead to extended lead times for essential engine components, impacting Deutz's ability to fulfill customer orders promptly.

- Erosion of Profit Margins: The inability to fully pass on increased costs due to competitive pressures can shrink Deutz's profit margins.

- Operational Inefficiency: Production stoppages or slowdowns caused by component shortages reduce overall output and efficiency.

Impact of Trade Disputes and Tariffs

Increased import tariffs, particularly those considered in major markets like the United States, present a significant threat to Deutz's financial performance and ability to reach key customer bases. These trade disputes inject considerable uncertainty into the market, potentially raising the cost of essential imported components and impacting the competitiveness of Deutz's exported engines.

The disruption of established supply chains and business models is a direct consequence of escalating trade tensions. For instance, in 2023, the ongoing discussions around potential tariffs on manufactured goods could directly affect Deutz's cost structure for engines sold in North America if key parts are sourced from regions subject to new duties.

Deutz is proactively addressing these challenges by closely monitoring global trade developments and implementing strategies to soften any negative repercussions. This includes diversifying sourcing options and exploring localized production where feasible to maintain market access and profitability.

- Trade uncertainty: Fluctuations in trade policies can make long-term business planning more challenging.

- Increased costs: Tariffs on components or finished goods directly impact Deutz's cost of sales and pricing strategies.

- Market access limitations: Protectionist measures can hinder Deutz's ability to compete effectively in certain international markets.

- Supply chain disruption: Tariffs and trade disputes can interrupt the flow of necessary parts and finished products.

Intensifying global decarbonization efforts and stricter emission regulations pose a significant threat, potentially accelerating the decline of traditional internal combustion engines before Deutz's alternative powertrain offerings mature. This rapid market shift, coupled with robust competition from established players and specialized startups in electric and hydrogen technologies, pressures Deutz to innovate quickly and effectively. For example, by early 2024, competitors like Cummins had announced substantial investments in these new sectors, highlighting the competitive landscape Deutz must navigate.

Persistent economic downturns, particularly in key markets like Europe, directly impact Deutz's sales and revenue, as seen with a slowdown in construction and agriculture in 2024. Furthermore, ongoing supply chain vulnerabilities, exacerbated by geopolitical tensions and shipping delays in early 2024, lead to increased production costs and delayed deliveries, impacting profitability. Escalating trade tensions and potential import tariffs also introduce market uncertainty and could hinder market access and competitiveness.

| Threat Category | Specific Risk | Impact on Deutz | Example/Data (2024/2025 Focus) |

|---|---|---|---|

| Decarbonization & Regulation | Rapid shift away from ICE | Reduced demand for core products | Stricter emission standards implemented in EU and North America in 2024. |

| Competition | New entrants and established rivals in EV/H2 | Market share erosion, pricing pressure | Major competitors like Caterpillar investing billions in alternative powertrains by early 2024. |

| Economic Conditions | Recessions and market volatility | Decreased unit sales, lower revenue | European economic slowdown in 2024 impacting construction and agricultural equipment demand. |

| Supply Chain | Disruptions, material cost volatility | Increased production costs, delayed deliveries | Semiconductor shortages impacting production in late 2023; steel price increases of ~15% in Q1 2024. |

| Trade Policy | Tariffs and trade disputes | Higher costs, reduced market access | Ongoing discussions on US tariffs impacting component sourcing and export competitiveness. |

SWOT Analysis Data Sources

The Deutz SWOT analysis is built upon a robust foundation of data, including official financial reports, comprehensive market research, and insightful expert commentary. This ensures a thorough and accurate assessment of the company's strategic position.