Deutz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutz Bundle

Deutz faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in its market landscape. Understanding these dynamics is key to navigating the engine manufacturing industry.

The complete report reveals the real forces shaping Deutz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Deutz AG's reliance on a global supplier network means that the concentration of suppliers for critical components significantly impacts its bargaining power. If a particular specialized part, essential for Deutz's engine production, comes from only a handful of manufacturers, those suppliers gain considerable leverage. For instance, in 2024, the automotive and machinery sectors continued to grapple with supply chain disruptions, particularly for advanced semiconductors and rare earth metals, where supplier concentration is historically high. This situation can translate into higher input costs or potential production delays for Deutz if these key suppliers exert their power.

Switching suppliers for critical engine components or specialized materials can be a costly endeavor for Deutz. These expenses can encompass re-tooling manufacturing lines, redesigning product specifications, re-certifying new parts, and extensive testing, all of which contribute to higher switching costs.

These substantial switching costs inherently bolster the bargaining power of Deutz's suppliers. When it’s difficult and expensive for Deutz to transition to alternative suppliers, existing suppliers can leverage this inertia to their advantage, potentially demanding more favorable terms.

Deutz actively works to counter this supplier leverage through strategic dual sourcing. By establishing relationships with multiple suppliers for key components, Deutz can reduce its dependence on any single provider, thereby mitigating the risks associated with high switching costs and enhancing its negotiating position.

Suppliers offering highly specialized or proprietary technologies, like advanced emission control systems, can wield considerable power. For instance, Deutz's acquisition of HJS Emission Technology in January 2025 highlights the value of such unique capabilities. These critical components, essential for meeting increasingly strict environmental regulations, limit Deutz's alternative sourcing options, thereby strengthening the suppliers' bargaining leverage.

Threat of Forward Integration by Suppliers

While less common in the industrial engine sector, a powerful supplier could theoretically integrate forward by manufacturing engines themselves, directly competing with Deutz. However, the significant capital investment, extensive research and development needs, and deeply entrenched customer relationships in engine manufacturing present substantial barriers to such forward integration, thereby mitigating this particular threat. The risk is generally low for large, complex components.

- Capital Intensity: Establishing engine manufacturing facilities requires billions in upfront investment, a deterrent for most suppliers.

- R&D Requirements: Continuous innovation in engine technology demands substantial and ongoing R&D expenditure.

- Customer Relationships: Existing loyalty and established supply chains between engine manufacturers and their customers are difficult to disrupt.

- Component Complexity: The intricate nature of industrial engines makes direct competition challenging for component suppliers.

Importance of Deutz to Supplier's Business

The significance of Deutz to its suppliers can vary considerably. For smaller or niche suppliers, Deutz could represent a substantial portion of their annual sales, potentially diminishing their bargaining power due to their reliance on this single large customer. Conversely, a large, diversified supplier for whom Deutz is only a minor client would likely possess greater leverage in negotiations.

Deutz's commitment to cultivating robust and collaborative relationships with its suppliers is a key element of its strategy. This approach, as outlined in its supplier code of conduct, aims to build stable, long-term partnerships rather than purely transactional ones.

- Supplier Dependence: Deutz's revenue contribution is critical for some smaller suppliers, limiting their ability to dictate terms.

- Supplier Diversification: For large, multi-industry suppliers, Deutz's business might be less impactful, granting them more negotiation strength.

- Relationship Focus: Deutz actively promotes cooperative supplier relationships, aiming for mutual benefit and stability.

Suppliers hold significant bargaining power when they provide critical, specialized components like advanced emission control systems, as seen with Deutz's acquisition of HJS Emission Technology in early 2025. High switching costs, including re-tooling and re-certification, further empower suppliers, making it difficult and expensive for Deutz to change providers. While forward integration by suppliers is a theoretical risk, the substantial capital and R&D required for engine manufacturing make it unlikely for component makers.

| Factor | Impact on Deutz | Example/Data Point |

|---|---|---|

| Supplier Concentration | High for specialized parts | Semiconductors and rare earth metals in 2024 |

| Switching Costs | Significant for critical components | Re-tooling, re-certification, product redesign |

| Supplier Differentiation | High for proprietary tech | Advanced emission control systems |

| Deutz's Importance to Supplier | Varies; critical for small suppliers | Minor client for large, diversified suppliers |

What is included in the product

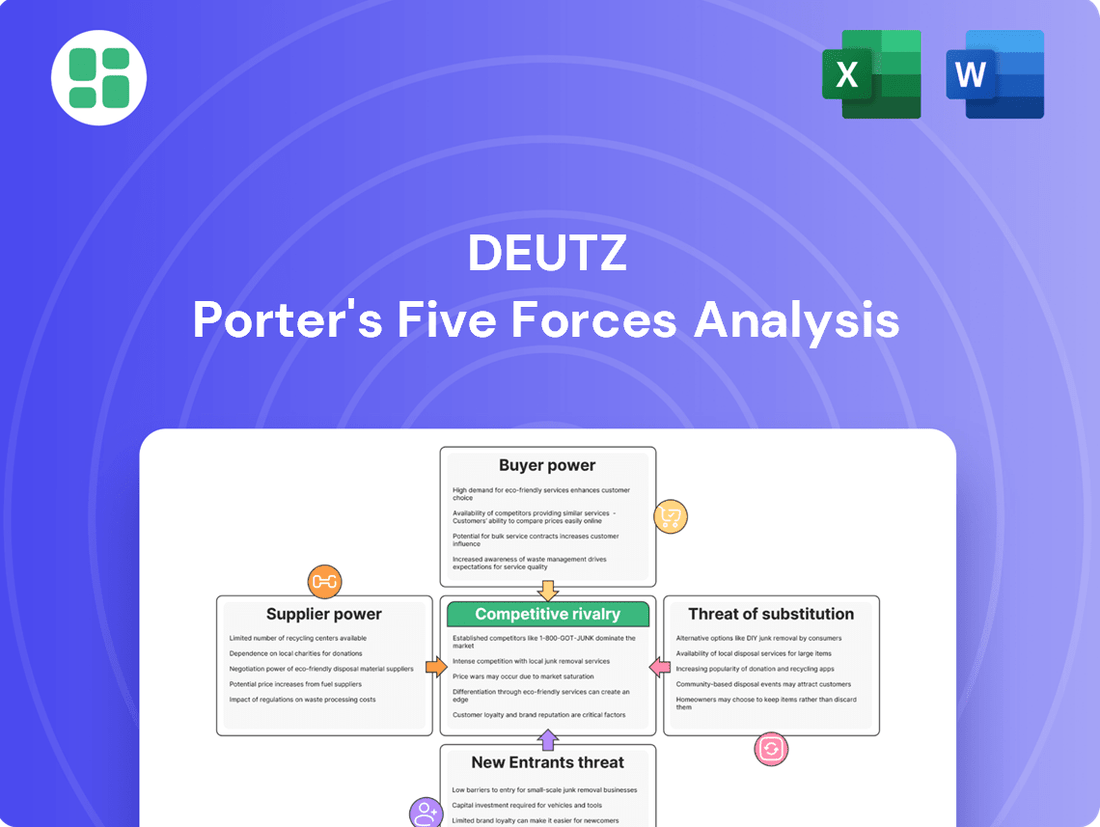

Deutz's Porter's Five Forces analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the engine manufacturing industry.

Instantly identify and address competitive threats with a structured framework that highlights key industry pressures.

Customers Bargaining Power

Deutz's customer concentration is a key factor in its bargaining power. The company primarily supplies engines to original equipment manufacturers (OEMs) in sectors like construction and agriculture. For instance, in 2024, Deutz reported that its top ten customers accounted for a significant portion of its revenue, highlighting the potential leverage these large buyers hold.

While Deutz serves a broad customer base, the sheer volume purchased by some major OEMs grants them considerable bargaining power. This means large customers can negotiate more favorable terms, potentially impacting Deutz's profit margins. For example, a single large order could represent a substantial percentage of a particular engine model's production for a given year.

Deutz actively works to mitigate this by fostering strategic partnerships, such as its ongoing collaboration with AGCO, a major agricultural machinery manufacturer. These long-term relationships aim to secure consistent demand and build loyalty, thereby reducing the immediate impact of individual customer's bargaining strength on overall business operations.

Customers integrating Deutz engines into their machinery often face significant switching costs. These can include the expense and time involved in re-designing equipment, re-certifying products to meet regulatory standards, and adapting complex manufacturing processes. These hurdles create a substantial lock-in effect for Original Equipment Manufacturers (OEMs).

Consequently, the ability of customers to easily switch to alternative engine suppliers is considerably diminished. This complexity and cost associated with changing providers effectively reduces the bargaining power of Deutz's customers, at least in the short to medium term, as the investment in integration is already made.

Customer price sensitivity is a significant factor for Deutz, particularly in competitive sectors like construction and agriculture. Original Equipment Manufacturers (OEMs) in these industries often operate on tight margins, making them highly attuned to pricing. This directly impacts Deutz, as OEMs will push for more competitive pricing on engines to maintain their own profitability.

Economic downturns can amplify this price sensitivity. For instance, during periods of economic headwinds, such as those observed impacting the construction and agricultural markets in 2024, customers become even more cautious with their spending. This increased price sensitivity from OEMs can translate into downward pressure on Deutz's pricing strategies, potentially affecting its revenue and profit margins.

Importance of Deutz Engines to Customer's Product

Deutz AG's engines are not just components; they are foundational to the performance and reputation of their customers' end products. This high degree of integration means that a Deutz engine's quality and reliability directly impact the customer's own brand image and market success. For instance, in the construction equipment sector, where Deutz engines are prevalent, equipment downtime due to engine failure can lead to significant financial losses and reputational damage for the equipment manufacturer. This critical dependency grants Deutz a degree of pricing power, as customers are often willing to pay a premium for dependable power units that ensure their own product's integrity and marketability.

- Engine as a Core Competency: For many Deutz customers, the engine is a critical, high-value element that defines their product's capabilities and reliability.

- Quality Over Price: The emphasis on performance and dependability means customers often prioritize engine quality, which can mitigate aggressive price negotiations.

- Reputational Linkage: A failure in a Deutz engine can directly harm the customer's brand reputation, making them more sensitive to quality assurance.

- Market Data Insight: In 2024, the global market for industrial engines, a key segment for Deutz, continued to show demand for robust and efficient solutions, underscoring the value placed on reliable engine suppliers.

Threat of Backward Integration by Customers

Large, integrated Original Equipment Manufacturers (OEMs) possess the capability to produce their own engines, a move known as backward integration. This would lessen their dependence on external suppliers like Deutz. For instance, in 2024, major construction equipment manufacturers often have significant capital reserves and extensive engineering departments, making this a plausible, albeit costly, strategic option for them.

However, the substantial capital outlay, the need for advanced research and development (R&D) expertise, and the operational know-how required for engine manufacturing present significant barriers. This threat is primarily concentrated among Deutz's largest clientele, who have the scale and resources to contemplate such a significant undertaking.

Deutz actively mitigates this threat by continually broadening its engine product range and enhancing its service and support network. This strategy aims to foster stronger customer loyalty by offering comprehensive solutions that go beyond mere engine supply, making it less attractive for customers to consider in-house production.

- Significant capital investment is required for OEMs to establish engine manufacturing capabilities.

- R&D and technical expertise are critical for successful engine development and production.

- Deutz's strategy of portfolio expansion and service enhancement aims to increase customer stickiness.

- The threat of backward integration is most pronounced for Deutz's largest and most resource-rich customers.

Deutz's customers, particularly large Original Equipment Manufacturers (OEMs), wield significant bargaining power due to their substantial order volumes and the potential for backward integration. In 2024, Deutz's revenue structure indicated that a few key clients represented a considerable portion of sales, allowing them to negotiate favorable terms. This concentrated customer base means that any shift in demand or pricing pressure from these major players can directly impact Deutz's profitability.

The switching costs for customers integrating Deutz engines are substantial, involving redesigns, recertification, and manufacturing process adjustments, which inherently limits their immediate ability to change suppliers. However, this is counterbalanced by customer price sensitivity, especially in sectors like construction and agriculture where margins are tight. Economic conditions in 2024, which saw some volatility in these markets, further amplified this sensitivity, pushing OEMs to seek cost efficiencies.

Deutz's engines are critical to customer product performance and brand reputation, creating a dependency that can grant Deutz some pricing leverage. Despite this, the threat of major customers pursuing backward integration, while capital-intensive, remains a consideration. Deutz counters this by expanding its product range and enhancing services to build stronger customer relationships and mitigate the impact of customer bargaining power.

| Factor | Impact on Deutz | Mitigation Strategies |

|---|---|---|

| Customer Concentration | High leverage for major OEMs, potential for price pressure. | Strategic partnerships, fostering long-term relationships. |

| Switching Costs | Lowers immediate customer bargaining power due to integration complexity. | Focus on product reliability and integrated solutions. |

| Price Sensitivity | Increases pressure for competitive pricing, especially during economic downturns. | Cost optimization, value-added services. |

| Backward Integration Threat | Potential for large customers to produce engines in-house. | Portfolio expansion, enhanced service and support network. |

Preview Before You Purchase

Deutz Porter's Five Forces Analysis

This preview showcases the comprehensive Deutz Porter's Five Forces Analysis you will receive immediately upon purchase. You are viewing the exact, professionally formatted document, ensuring no discrepancies or missing information after your transaction. This detailed analysis, covering all five forces, is ready for your immediate use and strategic application.

Rivalry Among Competitors

The industrial engine market is a crowded space with many global competitors. Major players like Cummins, Caterpillar, Yanmar, and Volvo Penta are all vying for market share. Deutz, currently the fourth-largest non-captive engine manufacturer, is actively working to climb into the top three by 2030, highlighting the fierce competition it faces.

The industrial engine market is expected to see a moderate compound annual growth rate (CAGR) of 3.9% to 6.4% between 2025 and 2030. This growth is primarily fueled by ongoing infrastructure projects and a rising demand within the construction and agricultural sectors.

While this growth is a positive indicator, it's not substantial enough to significantly dampen the intense competition among players. Companies continue to vie aggressively for market share, making competitive rivalry a key factor in the industry.

Engine manufacturers, including Deutz, actively differentiate their offerings through technological advancements. This includes developing engines with superior fuel efficiency, meeting stringent emissions standards, and pioneering alternative fuel solutions such as hydrogen and electric powertrains. Durability and robust service networks also play a crucial role in setting manufacturers apart.

Deutz's strategic approach, known as Dual+, exemplifies this differentiation by simultaneously investing in and refining traditional internal combustion engines while aggressively pursuing innovation in electric and hydrogen-based drive systems. This dual focus allows Deutz to cater to diverse market needs and maintain a competitive edge across different technological landscapes.

Exit Barriers

High capital investment in manufacturing facilities, specialized machinery, and research and development creates significant exit barriers for companies in the industrial engine sector. For instance, Deutz AG's substantial investments in its global production network, including its main plant in Cologne, Germany, represent a considerable sunk cost. These large, fixed assets make it economically difficult for firms to leave the market, even when facing profitability challenges.

This stickiness intensifies competitive rivalry. When it's costly to exit, companies are more inclined to remain and fight for market share, even during economic downturns. This can lead to aggressive pricing strategies and increased marketing efforts as competitors strive to maintain their positions. Deutz, for example, would likely continue to operate and compete fiercely rather than abandon its established infrastructure.

- High Capital Intensity: Significant investments in specialized manufacturing equipment and R&D facilities create substantial sunk costs.

- Asset Specificity: Industrial engine production often requires highly specialized machinery that has limited alternative uses, increasing the cost of exiting.

- Operational Scale: Achieving economies of scale necessitates large production volumes, making it difficult to downsize or divest operations without incurring significant losses.

- Brand and Reputation: Established brands and reputations built over years require sustained market presence, discouraging abrupt exits.

Strategic Alliances and Acquisitions

The engine manufacturing sector is characterized by significant consolidation and the formation of strategic alliances, directly impacting competitive rivalry. Deutz AG, for instance, has actively pursued acquisitions to bolster its market presence and technological capabilities. In 2023, Deutz acquired Blue Star Power Systems and Urban Mobility Systems, signaling a strategic push into new market segments and technologies.

Furthermore, Deutz's integration of Daimler Truck Off-Highway engines into its portfolio underscores the trend of industry players seeking to expand their product offerings and operational scale. These strategic moves are not isolated events; they reflect a broader industry dynamic where companies aim to achieve greater economies of scale, enhance their technological expertise, and secure more robust supply chains. This ongoing reshaping of the competitive landscape intensifies rivalry as firms strive to capture market share through expanded capabilities and integrated solutions.

- Strategic Acquisitions: Deutz AG's 2023 acquisitions of Blue Star Power Systems and Urban Mobility Systems demonstrate a clear strategy of inorganic growth to enhance its market position and diversify its product portfolio.

- Technological Integration: The integration of Daimler Truck Off-Highway engines into Deutz's operations signifies a move towards offering a more comprehensive range of engine solutions, catering to a wider array of customer needs and applications.

- Industry Consolidation: These actions are part of a larger trend of consolidation within the industrial engine sector, where companies are merging or forming alliances to gain competitive advantages, improve efficiency, and navigate evolving market demands.

- Reshaping Competitive Landscape: Such strategic maneuvers fundamentally alter the competitive dynamics, forcing other players to re-evaluate their own strategies concerning product development, market access, and technological innovation to remain competitive.

Competitive rivalry in the industrial engine market is intense, driven by a limited number of large, established global players and the high barriers to entry. Companies like Cummins, Caterpillar, and Volvo Penta are significant competitors to Deutz. The market's moderate growth, projected between 3.9% and 6.4% CAGR from 2025-2030, means firms must aggressively compete for market share rather than relying solely on market expansion.

Differentiation through technology, such as fuel efficiency, emissions control, and alternative powertrains (electric, hydrogen), is a key battleground. Deutz's Dual+ strategy, balancing internal combustion engine refinement with new powertrain innovation, exemplifies this. The high capital intensity and asset specificity in manufacturing create substantial exit barriers, compelling companies to remain and compete fiercely, often through aggressive pricing and marketing, to maintain their positions.

Industry consolidation and strategic alliances further intensify rivalry. Deutz's 2023 acquisitions of Blue Star Power Systems and Urban Mobility Systems, along with the integration of Daimler Truck Off-Highway engines, highlight a trend of expanding capabilities and market reach. These moves force competitors to adapt and innovate to stay relevant in an evolving landscape.

| Competitor | Market Position (Approximate) | Key Strengths |

|---|---|---|

| Cummins | Leading global non-captive manufacturer | Broad product portfolio, strong aftermarket service, technological innovation |

| Caterpillar | Major player, particularly in heavy equipment | Integrated solutions, extensive dealer network, robust brand reputation |

| Yanmar | Significant presence, especially in compact and marine engines | Compact engine technology, reliability, growing global footprint |

| Volvo Penta | Strong in marine and industrial applications | Engine efficiency, advanced technology integration, premium brand image |

SSubstitutes Threaten

The primary substitutes for Deutz's internal combustion engines are increasingly sophisticated electric motors, advanced hybrid systems, and emerging hydrogen-based power solutions, including fuel cells and hydrogen internal combustion engines. The market is actively shifting, with a notable rise in hybrid engine adoption and a strong industry emphasis on developing and integrating electric and hydrogen compatibility into power systems.

For instance, the global electric vehicle market, a significant competitor to traditional internal combustion engines, saw substantial growth. In 2024, projections indicated that electric vehicles would represent a significant portion of new car sales, demonstrating the growing viability and consumer acceptance of electric powertrains. This trend directly impacts the demand for conventional engines like those produced by Deutz.

While electric and hybrid engines offer benefits like lower emissions and reduced operating costs, they often come with higher upfront costs compared to traditional diesel engines. For instance, the initial purchase price of an electric truck can be significantly higher, impacting total cost of ownership calculations for fleet operators.

Hydrogen engines, though promising for zero CO2 emissions, also face challenges related to infrastructure and cost. The development of hydrogen refueling stations is still in its nascent stages, and the cost of hydrogen fuel itself can be volatile, making it a less predictable substitute for many applications in 2024.

Original Equipment Manufacturers (OEMs) face substantial switching costs when considering alternative power sources. These costs include the significant investment in re-designing entire equipment platforms, the expense of setting up entirely new manufacturing lines, and the considerable outlay required to develop necessary charging or refueling infrastructure. These financial and operational hurdles naturally slow down the widespread adoption of substitute technologies.

Despite these high switching costs, there's a growing trend driven by increasing regulatory pressure worldwide. For instance, in 2024, many regions intensified emissions standards for heavy-duty vehicles and industrial equipment, directly incentivizing the transition away from traditional internal combustion engines. This regulatory push is a key factor compelling OEMs to evaluate and invest in alternatives, even with the initial cost barriers.

Technological Advancements in Substitutes

Technological advancements are rapidly making substitutes more competitive. For instance, breakthroughs in battery technology and electric drivetrains are creating viable alternatives to traditional internal combustion engines. Companies like Volvo Penta have already introduced fully electric industrial engines, signaling a shift in the market.

The development of hydrogen internal combustion engines further intensifies this threat. These engines offer a cleaner alternative, appealing to environmentally conscious industries and potentially capturing market share from established players. This push towards electrification and alternative fuels means Deutz faces increasing pressure from innovative substitute solutions.

- Battery Technology Advancements: Continued improvements in energy density and charging times make electric powertrains more practical for a wider range of applications.

- Electric Drivetrain Viability: The increasing availability and performance of electric motors and power management systems are lowering the barrier to entry for electric substitutes.

- Hydrogen Engine Traction: Growing investment and research into hydrogen combustion technology present a significant long-term threat, offering zero tailpipe emissions.

Regulatory Pressure and Environmental Concerns

Increasingly stringent global emission regulations, such as the upcoming Euro 7 standards and ambitious CO2 reduction targets, are a significant factor driving the adoption of cleaner alternative power sources. This heightened regulatory pressure directly amplifies the threat of substitutes for traditional internal combustion engines.

Manufacturers like Deutz are compelled to allocate substantial resources towards research and development of new technologies, including electric and hydrogen-powered systems, to meet these evolving environmental mandates. For instance, the European Union's CO2 emission performance standards for new passenger cars and vans have set targets for fleet-wide average emissions, pushing the entire automotive sector towards electrification.

- Euro 7 standards aim to further reduce pollutants from vehicles, impacting engine design and aftertreatment systems.

- EU CO2 reduction targets are pushing for significant cuts in greenhouse gas emissions across the transport sector.

- Global climate agreements like the Paris Agreement indirectly influence national regulations on emissions.

- Increasing consumer demand for environmentally friendly products also fuels the shift towards alternative powertrains.

The threat of substitutes for Deutz's internal combustion engines is significant and growing, driven by advancements in electric, hybrid, and hydrogen technologies. These alternatives offer environmental benefits and are increasingly supported by regulatory mandates and evolving consumer preferences. While switching costs for Original Equipment Manufacturers (OEMs) remain high, the continuous improvement in substitute technologies and the global push for decarbonization are making them more competitive.

| Substitute Technology | Key Advantages | Challenges | Market Trend (2024 Focus) |

|---|---|---|---|

| Electric Powertrains | Zero tailpipe emissions, lower operating costs, quieter operation | Higher upfront cost, charging infrastructure, battery range/lifespan | Rapid growth in EV sales, increasing battery density |

| Hybrid Systems | Improved fuel efficiency, reduced emissions compared to ICE | Increased complexity, still reliant on fossil fuels (partially) | Growing adoption in commercial vehicles and off-highway equipment |

| Hydrogen Fuel Cells/Engines | Zero tailpipe emissions (water vapor), fast refueling | High cost of fuel cells, limited hydrogen infrastructure, production costs | Significant R&D investment, pilot projects expanding |

Entrants Threaten

Entering the industrial engine manufacturing sector, a key area for Deutz, demands substantial financial backing. Companies need significant capital for research and development, establishing advanced manufacturing plants, acquiring specialized machinery, and building robust global distribution and service networks. For instance, the development of a new engine platform can easily cost hundreds of millions of dollars.

Established manufacturers like Deutz leverage substantial economies of scale, particularly in production and R&D. This allows them to spread fixed costs over a larger output, resulting in lower per-unit costs for their engines. For instance, Deutz's significant investment in advanced manufacturing processes and global supply chains in 2024 enables them to achieve cost efficiencies that are difficult for newcomers to replicate.

New entrants face a considerable hurdle in matching these cost advantages. Without the established volume and infrastructure, their initial production runs would inherently carry higher per-unit expenses, placing them at a distinct competitive disadvantage from the outset.

Deutz AG benefits significantly from its deep-rooted brand loyalty and established relationships with major original equipment manufacturers (OEMs). This trust, built over decades, makes it challenging for newcomers to penetrate the market. For instance, Deutz's long-standing partnerships with leading construction and agricultural machinery producers are a testament to this entrenched position.

Access to Distribution Channels

Deutz AG's extensive global network, comprising almost 900 sales and service partners across more than 130 countries, presents a formidable barrier to new entrants. Establishing a comparable distribution and service infrastructure, essential for supporting industrial engines on a worldwide scale, would incur substantial costs and time, making it exceedingly difficult for newcomers to compete effectively.

The sheer scale and established nature of Deutz's distribution channels mean that any new competitor would struggle to gain access to key markets and provide the necessary after-sales support. This lack of established reach significantly hampers the ability of potential new players to offer a compelling value proposition to customers who rely on consistent and widespread service for their engine needs.

- Global Reach: Deutz operates through nearly 900 sales and service partners in over 130 countries.

- Infrastructure Costs: Building a similar distribution and service network requires massive investment.

- Customer Reliance: Customers depend on widespread service availability for industrial engines.

Regulatory Hurdles and Intellectual Property

The industrial engine sector faces significant regulatory hurdles. For instance, in 2024, the European Union continued to implement stricter emissions standards like Euro VII, demanding substantial research and development investments from all manufacturers, including Deutz.

Existing companies possess vast portfolios of intellectual property, encompassing proprietary engine designs and advanced technological innovations. This creates substantial legal and technical barriers, making it challenging for new entrants to develop competitive products without infringing on established patents.

- Stricter Emission Standards: Regulations like Euro VII (expected to be fully implemented in the coming years) require significant R&D for compliance.

- Intellectual Property Barriers: Deutz and competitors hold extensive patents on engine technology, making it difficult for newcomers to innovate without infringement.

- Capital Investment: Meeting these regulatory and IP challenges requires massive upfront capital, a significant deterrent for potential new entrants.

The threat of new entrants into the industrial engine market, particularly for a company like Deutz, is generally considered moderate to low. Significant capital investment is a primary deterrent, with R&D, manufacturing, and global distribution networks requiring hundreds of millions of dollars to establish. Economies of scale enjoyed by incumbents, coupled with strong brand loyalty and extensive established distribution and service networks, further elevate barriers to entry. Moreover, stringent regulatory requirements and substantial intellectual property held by existing players create additional formidable challenges for newcomers.

| Factor | Impact on New Entrants | Deutz's Advantage |

|---|---|---|

| Capital Requirements | Very High (R&D, manufacturing, distribution) | Established infrastructure, economies of scale |

| Brand Loyalty & Relationships | Low (difficult to build trust) | Decades of established OEM partnerships |

| Distribution & Service Network | High Cost & Time (global reach needed) | Nearly 900 partners in 130+ countries |

| Regulatory & IP Barriers | High (compliance, patent infringement risk) | Extensive IP portfolio, compliance expertise |

Porter's Five Forces Analysis Data Sources

Our Deutz Porter's Five Forces analysis leverages data from Deutz AG's annual reports, investor presentations, and SEC filings, supplemented by industry-specific market research reports and competitor financial statements.