Dayforce Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dayforce Bundle

Dayforce operates in a dynamic HR technology landscape, facing significant competitive pressures. Understanding the interplay of industry rivals, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes is crucial for strategic success.

This brief overview highlights the core forces at play. Unlock the full Porter's Five Forces Analysis to explore Dayforce’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dayforce’s reliance on cloud infrastructure providers like Microsoft Azure, where it is now available, presents a dynamic where supplier power is somewhat constrained. The sheer scale of these providers is undeniable, but the increasingly commoditized nature of cloud services and the growing adoption of multi-cloud strategies by companies like Dayforce significantly dilute their individual bargaining leverage.

This ability to adopt or integrate with multiple cloud providers acts as a crucial counter-balance, empowering Dayforce to negotiate favorable terms and mitigate the risk of over-dependence on any single supplier. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, indicating intense competition among major players, which further benefits cloud consumers.

Dayforce's reliance on specialized third-party software components or APIs for niche functionalities, such as advanced analytics or specific compliance modules, can introduce a moderate level of supplier bargaining power. The influence of these vendors hinges on how unique and essential their offerings are to Dayforce's overall Human Capital Management (HCM) suite, alongside the ease of finding comparable alternatives. For instance, if a particular integration provides a critical, hard-to-replicate feature, the supplier's leverage increases.

For standard IT hardware, office software, and general operational tools, Dayforce experiences low bargaining power from its suppliers. This is largely due to the widespread availability of these products and services in a highly competitive market. For instance, the global IT hardware market was valued at approximately $1.1 trillion in 2023, offering Dayforce numerous vendor options.

The ease with which Dayforce can switch between vendors for these essential components significantly limits any single supplier's ability to dictate terms or prices. This diverse supplier landscape ensures that Dayforce can secure favorable pricing and terms, maintaining operational efficiency without being overly reliant on any one provider.

Variable Power from Data and Analytics Tool Providers

Dayforce's reliance on data and analytics tools means the bargaining power of its suppliers can fluctuate significantly. If a supplier offers proprietary data or unique AI algorithms that are critical to Dayforce's competitive edge, that supplier gains considerable leverage. For instance, a provider of specialized labor market analytics that Dayforce integrates into its workforce management solutions could command higher prices or more favorable terms if those insights are not readily available from other sources.

Conversely, if the data or analytical capabilities are commoditized and easily replicable, the bargaining power of these suppliers is weakened. Dayforce can then switch to alternative providers with less disruption or cost. This dynamic is crucial, as Dayforce aims to differentiate itself through AI-powered insights and data-driven decision-making. The availability and uniqueness of these external inputs directly impact Dayforce's operational efficiency and its ability to innovate.

- Supplier Dependence: Dayforce's commitment to AI and data analytics necessitates external data and tool providers, creating a degree of dependence.

- Uniqueness as a Lever: The bargaining power of these suppliers is directly proportional to the uniqueness and critical nature of their offerings for Dayforce's AI capabilities.

- Market Availability: If alternative sources for similar data or analytical tools exist, the supplier's power to dictate terms is significantly reduced.

- Impact on Dayforce: The cost and availability of these third-party data and analytics solutions can influence Dayforce's pricing, product development, and overall profitability.

Low Power from Professional Services and Consulting Firms

Dayforce experiences low bargaining power from professional services and consulting firms. The market is populated with numerous firms offering specialized expertise, allowing Dayforce to select from a broad range of providers. This competitive landscape enables Dayforce to negotiate favorable rates and adaptable engagement terms.

For instance, the global management consulting market size was estimated to be around $370 billion in 2023, indicating a highly competitive and fragmented supplier base. This vastness empowers clients like Dayforce to source talent effectively.

- Abundant Supplier Pool: A wide array of professional services and consulting firms exists, reducing reliance on any single provider.

- Competitive Pricing: The competitive nature of the consulting market allows Dayforce to secure services at favorable price points.

- Flexible Engagement Models: Dayforce can choose from various contract structures, from project-based to long-term retainers, matching its specific needs.

Dayforce's bargaining power with suppliers is generally strong, particularly for commoditized inputs like standard hardware and software. The vastness of the global IT hardware market, valued at approximately $1.1 trillion in 2023, and the competitive cloud computing sector, projected to exceed $600 billion in 2024, offer Dayforce numerous options and leverage for negotiation. This allows Dayforce to secure favorable terms and pricing, minimizing dependence on any single vendor.

However, dependence on specialized third-party data and analytics providers, especially those offering unique AI algorithms or critical labor market insights, can shift power towards these suppliers. The uniqueness and essential nature of these offerings directly influence their leverage. Conversely, the abundance of professional services firms, with the global management consulting market around $370 billion in 2023, ensures Dayforce can negotiate competitive rates and flexible engagement models.

| Supplier Category | Bargaining Power Level | Key Factors Influencing Power | Supporting Data/Examples (2023-2024) |

| Cloud Infrastructure | Moderate to Low | Commoditization of services, multi-cloud adoption | Global cloud market > $600 billion (2024 projection) |

| Specialized Software/APIs | Moderate to High | Uniqueness, criticality of offering, availability of alternatives | N/A (depends on specific integration) |

| Standard IT Hardware/Software | Low | High availability, competitive market | Global IT hardware market ~ $1.1 trillion (2023) |

| Data & Analytics Tools | Variable (Low to High) | Proprietary nature of data/algorithms, differentiation | N/A (depends on specific data source) |

| Professional Services | Low | Fragmented market, numerous providers | Global management consulting market ~ $370 billion (2023) |

What is included in the product

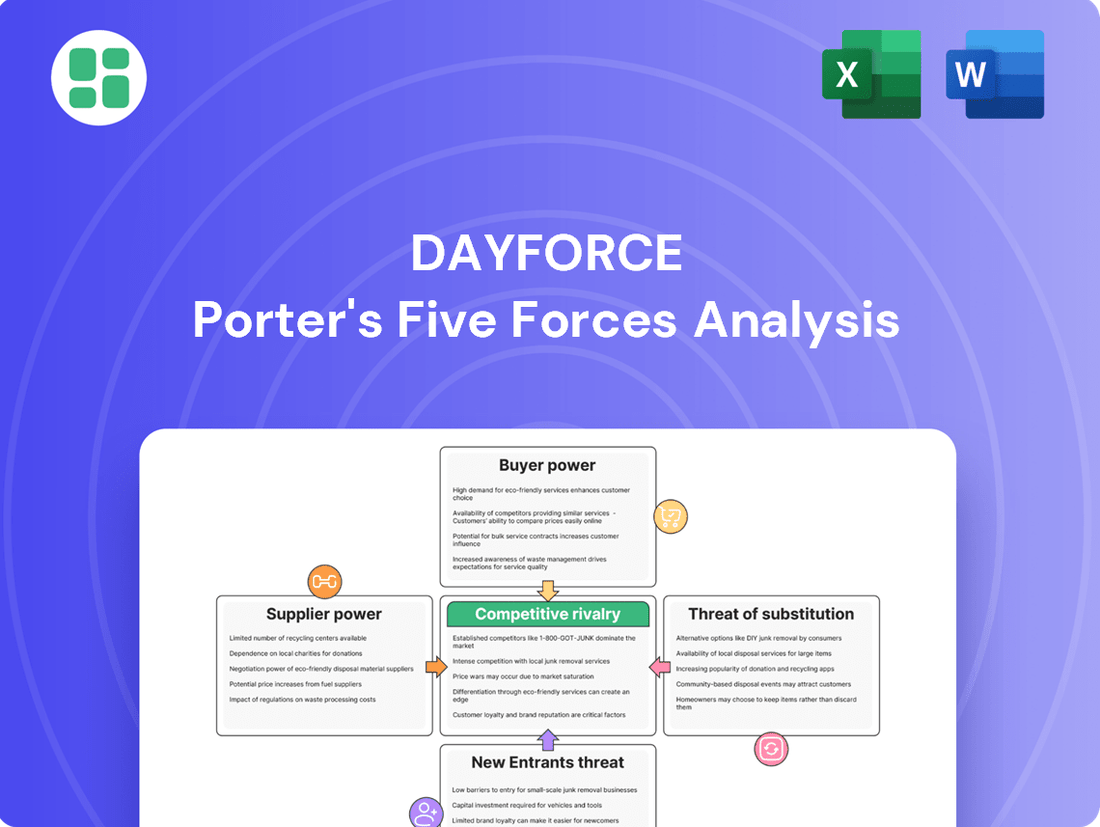

Analyzes the competitive forces impacting Dayforce, including supplier and buyer power, threat of new entrants and substitutes, and existing rivalry, to inform strategic decision-making.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, enabling swift identification of strategic threats and opportunities.

Customers Bargaining Power

Large enterprise clients, particularly those with over 1,000 employees, wield considerable bargaining power. This stems from the significant contract values involved and the intricate implementation processes required for their extensive workforces. These clients often seek tailored functionalities, robust support, and preferential pricing, using their scale as leverage in negotiations.

Dayforce's success in securing large new clients and maintaining a strong gross revenue retention rate of 98% in 2024 highlights its strategic approach to managing these high-value customer relationships. This high retention indicates a strong ability to meet the demanding needs of these powerful customers, thereby mitigating some of their bargaining leverage through superior service and product fit.

Mid-market customers generally hold moderate bargaining power with Dayforce. While they might not have the leverage of massive enterprise clients to demand highly bespoke solutions, their collective revenue is substantial, and they have a decent selection of Human Capital Management (HCM) alternatives available.

Dayforce's success in attracting a wide array of clients, from various sectors and of differing scales, suggests that while individual mid-market players have some sway, their power is tempered by the platform's broad appeal and the availability of other solutions. This balance means Dayforce can maintain pricing and service terms without excessive pressure from this segment.

For smaller businesses, especially those utilizing platforms like Dayforce's Powerpay, which caters to companies with fewer than 100 employees, customer bargaining power is notably weaker. These businesses often opt for standardized solutions, making the perceived cost and effort of switching to a competitor a significant deterrent, thus reducing their ability to negotiate favorable terms.

Power Influenced by Switching Costs

The bargaining power of customers for Human Capital Management (HCM) solutions like Dayforce is influenced by switching costs. These costs are significant because moving complex HR, payroll, talent, and workforce management data and processes to a new system is a substantial undertaking. This complexity makes customers hesitant to switch unless they face extreme dissatisfaction or find a demonstrably better offering, thereby somewhat reducing their leverage.

Dayforce's integrated platform is designed to enhance customer stickiness. By providing a unified solution for various HR functions, the effort and cost associated with migrating away increase. This integration strategy aims to make it less appealing for clients to seek out and implement alternative, potentially fragmented, solutions.

For instance, in 2024, the average cost for businesses to switch HR software can range from thousands to tens of thousands of dollars, depending on the size and complexity of the organization. This includes data migration, employee training, and potential downtime. The integrated nature of platforms like Dayforce directly addresses and raises these switching costs.

- High Data Migration Complexity: Moving years of employee records, payroll history, and performance data is a significant technical and logistical hurdle.

- Integration Challenges: Ensuring seamless integration with other business systems (e.g., ERP, finance) adds another layer of difficulty and cost to switching.

- Employee Training Investment: New systems require training for HR staff and potentially all employees, representing a considerable time and resource commitment.

- Process Re-engineering: A new HCM platform often necessitates adapting or redesigning existing HR workflows, adding to the overall implementation burden.

Power Influenced by Customer Retention and Value Proposition

Dayforce's strong customer retention significantly curtails customer bargaining power. In 2024, the company reported an impressive annual gross revenue retention rate of 98%. This high figure suggests that clients find substantial value in Dayforce's offerings, making them less likely to switch providers. Consequently, customers have less leverage to demand lower prices or more favorable terms.

The core of Dayforce's value proposition lies in its ability to streamline complex Human Capital Management (HCM) processes and assist businesses in navigating intricate compliance requirements. This focus on simplifying operations and mitigating risk creates a sticky platform that customers are reluctant to abandon. The effectiveness of this value proposition directly weakens the bargaining power of individual customers, as the cost and effort associated with switching are substantial.

- High Retention: Dayforce's 98% gross revenue retention in 2024 demonstrates strong customer loyalty.

- Value Proposition: Simplifying HCM and compliance makes the platform indispensable for many clients.

- Reduced Bargaining Power: Customers are less inclined to exert pressure when they receive significant value and face switching costs.

Dayforce's customers, particularly larger enterprises, possess considerable bargaining power due to the substantial contract values and complex implementation needs. Their ability to negotiate is further amplified by the availability of alternative Human Capital Management (HCM) solutions. However, Dayforce's high customer retention, reaching 98% in 2024, indicates its success in mitigating this power through strong value delivery and product fit.

Switching costs represent a significant barrier for customers looking to move away from Dayforce, thereby reducing their leverage. These costs encompass data migration, integration with other systems, and employee training, making it a substantial undertaking. For instance, in 2024, the average cost for businesses to switch HR software could range from thousands to tens of thousands of dollars, depending on organizational complexity.

The bargaining power of Dayforce's customers is generally moderate. While large clients can exert significant influence, the company's integrated platform and proven value proposition, evidenced by its 98% gross revenue retention in 2024, help to balance this power dynamic. This allows Dayforce to maintain favorable terms while addressing the complex needs of its diverse client base.

Preview Before You Purchase

Dayforce Porter's Five Forces Analysis

This preview showcases the complete Dayforce Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no surprises or missing information. You can confidently proceed with your purchase knowing you'll gain immediate access to this ready-to-use strategic tool.

Rivalry Among Competitors

The Human Capital Management (HCM) market is a battleground with formidable players. Established giants like Workday, SAP SuccessFactors, Oracle Fusion Cloud HCM, UKG Pro, and ADP offer robust, cloud-based solutions that directly challenge Dayforce for enterprise and mid-market clients.

Dayforce itself is recognized for its strength, being named a leader in the 2024 Gartner Magic Quadrant for Cloud HCM Suites for enterprises with over 1,000 employees for the fifth consecutive year. This consistent recognition highlights its competitive position against these well-entrenched rivals.

Beyond the large, all-encompassing Human Capital Management (HCM) providers, Dayforce also contends with specialized players. Companies like Paycor, for instance, focus intensely on payroll functions, while others excel in specific areas like workforce management. These niche providers can be very attractive to customers who need exceptionally deep functionality in one particular area, even if it means not having a fully integrated suite.

Competitive rivalry in the HCM sector is fierce, driven by the rapid integration of AI and machine learning into platforms. Companies are constantly innovating to offer more sophisticated solutions.

Dayforce is a prime example, actively embedding AI features like Dayforce AI Agents and Strategic Workforce Planning. This push for AI integration is crucial for Dayforce to stay ahead and meet the dynamic demands of its clientele.

Global Market Expansion and Regional Competition

Dayforce operates on a global scale, facing intense competition not just in its home market of North America but also across EMEA, LATAM, and APJ. This broad reach means navigating a diverse array of regional competitors, each with their own strengths and market understanding.

The competitive landscape is further complicated by varying regulatory environments in each region. These differences require Dayforce to adapt its offerings and strategies, adding significant complexity to its operations. For instance, North America dominated the HCM market in 2024, but the Asia-Pacific region is projected to experience the most rapid growth, presenting both opportunities and intensified competition.

- Global Reach, Local Rivals: Dayforce's presence in North America, EMEA, LATAM, and APJ exposes it to a wide spectrum of competitors, from global giants to specialized regional players.

- Regulatory Hurdles: Diverse regional regulations in areas like data privacy and labor laws create unique challenges and require tailored compliance strategies.

- Market Dynamics: While North America led the HCM market in 2024, the Asia-Pacific region's anticipated rapid growth signals an intensifying competitive battleground.

Focus on Customer Experience and Retention

In the Human Capital Management (HCM) sector, a significant driver of competitive rivalry is the unwavering focus on customer experience and retention. Dayforce's commitment to enhancing the work life for both its clients and their employees is a cornerstone of its strategy. This dedication is directly reflected in its impressive gross revenue retention rate, a critical metric in a market where fostering long-term client relationships and ensuring high levels of customer satisfaction are paramount for sustained growth and market leadership.

Dayforce’s approach directly combats churn by providing a seamless and integrated experience that addresses the core needs of businesses. This focus on customer satisfaction is not just a qualitative measure; it translates into tangible financial benefits. For instance, a strong retention rate means predictable revenue streams, which is highly valued by investors and analysts alike. Companies that excel in customer experience often see lower customer acquisition costs over time, as satisfied customers become advocates.

- Customer Experience as a Differentiator: In the competitive HCM landscape, superior customer experience is a key differentiator, moving beyond just feature sets.

- Retention Metrics: Dayforce’s high gross revenue retention rate, a vital indicator of customer loyalty and satisfaction, underscores its success in this area.

- Impact on Growth: Strong customer retention directly fuels sustained growth by ensuring recurring revenue and reducing the need for constant new customer acquisition.

- Market Dynamics: The HCM market increasingly rewards providers who can demonstrate a genuine commitment to improving the employee and employer experience, making retention a central competitive battleground.

The Human Capital Management (HCM) market is intensely competitive, with Dayforce facing off against major players like Workday, SAP SuccessFactors, and Oracle. These established giants offer comprehensive cloud-based solutions, directly vying for the same enterprise and mid-market clients. Dayforce's consistent recognition as a leader in the 2024 Gartner Magic Quadrant for Cloud HCM Suites, for the fifth consecutive year, underscores its strong standing amidst this fierce rivalry.

SSubstitutes Threaten

Organizations, particularly larger ones, may stick with or develop their own in-house HR management systems instead of adopting cloud-based solutions like Dayforce. These internal systems, though often less efficient and more costly to maintain, act as a legacy substitute that can slow down the move to external platforms. For instance, a 2024 survey indicated that about 30% of large enterprises still rely on some form of custom-built HR software, highlighting the persistence of this threat.

Manual processes and spreadsheets represent a low-cost substitute, particularly for smaller businesses or specific HR tasks. This threat is most pronounced for Dayforce's penetration into the micro-business segment or for companies hesitant to adopt digital HR solutions. For instance, a 2024 survey indicated that up to 30% of businesses with fewer than 50 employees still rely heavily on spreadsheets for payroll and HR functions.

Companies can opt for specialized point solutions from niche vendors instead of a comprehensive HCM suite like Dayforce. These specialized tools offer deep functionality for specific HR needs, such as payroll, talent acquisition, or time and attendance. This fragmentation of HR technology creates a significant threat of substitutes for integrated providers.

Professional Employer Organizations (PEOs)

Professional Employer Organizations (PEOs) present a significant threat of substitutes for businesses considering in-house Human Capital Management (HCM) solutions. PEOs bundle essential HR functions like payroll, benefits administration, and compliance management, offering a comprehensive outsourced HR department.

For small and medium-sized businesses (SMBs), engaging a PEO can be a more cost-effective and less complex alternative to investing in and maintaining their own HCM technology platform. This is particularly true as PEOs often leverage sophisticated technology themselves, providing access to advanced features without direct capital expenditure.

- PEOs offer a complete HR outsourcing solution, covering payroll, benefits, and compliance.

- SMBs can substitute PEO services for in-house HCM platforms, reducing technology investment and management overhead.

- The PEO market is substantial, with the National Association of Professional Employer Organizations (NAPEO) reporting that PEOs co-employ more than 3.7 million workers in the U.S. as of 2024.

- PEOs provide access to robust HR technology and expertise, making them an attractive alternative to building internal capabilities.

General Business Software with HR Modules

General business software suites, such as Enterprise Resource Planning (ERP) systems, often incorporate basic human resources (HR) modules. These can act as substitutes for dedicated Human Capital Management (HCM) solutions, particularly for businesses looking for an integrated, all-in-one management platform. While these modules might not offer the specialized depth of a standalone HCM, their appeal lies in seamless integration within the broader business software ecosystem.

Dayforce's core strategy is to consolidate fragmented systems into a single, unified platform. This integrated approach inherently diminishes the attractiveness of less specialized, modular solutions that require separate management and integration efforts. For instance, companies might opt for an ERP with a basic HR component to avoid managing multiple vendors, even if it means sacrificing advanced HCM features.

- ERP systems with HR modules: Offer a single point of integration for core business functions, potentially reducing complexity for some organizations.

- Specialization vs. Integration: While Dayforce excels in specialized HCM functionality, some businesses prioritize the convenience of integrated, albeit less specialized, HR features within their existing ERP.

- Cost-Benefit Analysis: The decision often hinges on whether the cost and complexity of managing separate HR software outweigh the benefits of advanced features compared to a bundled solution.

The threat of substitutes for Dayforce is multifaceted, encompassing legacy in-house systems, manual processes, specialized point solutions, Professional Employer Organizations (PEOs), and integrated ERP systems with HR modules. These alternatives can slow adoption by offering lower upfront costs or perceived simplicity, especially for smaller businesses or those hesitant to fully embrace cloud-based HCM. For example, a 2024 survey revealed that approximately 30% of large enterprises still utilize custom-built HR software, illustrating the persistence of legacy systems as a substitute.

Manual processes and spreadsheets remain a viable, low-cost substitute, particularly for micro-businesses or specific HR tasks, with up to 30% of companies under 50 employees still relying on spreadsheets for payroll in 2024. Furthermore, niche vendors offering specialized HR tools for payroll or talent acquisition present a threat by fragmenting the market and appealing to companies seeking deep functionality in specific areas rather than a comprehensive suite.

PEOs offer a compelling substitute, especially for SMBs, by bundling HR functions like payroll and benefits administration into an outsourced service. The PEO market is substantial, with PEOs co-employing over 3.7 million workers in the U.S. as of 2024, according to NAPEO. Similarly, ERP systems with integrated HR modules can serve as substitutes by offering a single point of integration, appealing to businesses that prioritize consolidated management over specialized HCM features.

| Substitute Type | Description | Key Appeal | 2024 Data Point |

|---|---|---|---|

| Legacy In-House HR Systems | Custom-built or older HR software | Familiarity, perceived control | ~30% of large enterprises still use custom HR software |

| Manual Processes & Spreadsheets | Basic, non-integrated HR management | Low cost, simplicity for small tasks | Up to 30% of businesses <50 employees use spreadsheets for payroll |

| Specialized Point Solutions | Niche software for specific HR functions (e.g., payroll, ATS) | Deep functionality in a specific area | N/A (Market fragmentation is the threat) |

| Professional Employer Organizations (PEOs) | Outsourced HR services bundling multiple functions | Cost-effectiveness, reduced complexity for SMBs | PEOs co-employ >3.7 million workers in the U.S. |

| ERP Systems with HR Modules | Integrated business software with basic HR capabilities | All-in-one integration, reduced vendor management | N/A (Strategic integration is the appeal) |

Entrants Threaten

The threat of new companies entering the Human Capital Management (HCM) software market, particularly for a platform like Dayforce, is significantly reduced by the sheer scale of investment needed. Building a robust, cloud-based system that seamlessly integrates HR, payroll, talent management, workforce scheduling, and benefits administration requires substantial upfront capital. For instance, major cloud infrastructure, advanced security measures, and ongoing development are not trivial expenses.

Furthermore, the competitive landscape demands continuous innovation. New entrants would need to pour considerable resources into research and development, especially in cutting-edge areas like artificial intelligence for predictive analytics in HR and sophisticated data security protocols. Without this deep R&D commitment, any newcomer would struggle to match the feature sets and capabilities of established players like Dayforce, which consistently invests in enhancing its offerings.

New entrants face significant hurdles in mastering the intricate domain of HR, payroll, and global compliance. The sheer volume of evolving labor laws, tax codes, and data privacy regulations across regions like North America, EMEA, LATAM, and APJ requires substantial investment in specialized knowledge and legal counsel.

For instance, navigating GDPR in Europe or CCPA in California demands a deep understanding of data handling and consent, a complex undertaking for any newcomer. This regulatory labyrinth acts as a powerful deterrent, making it difficult for new players to quickly establish a credible and compliant service offering that can compete with established providers.

Dayforce benefits from deeply entrenched customer relationships and a strong brand reputation, consistently recognized as a leader in the Human Capital Management (HCM) sector. This loyalty is a significant barrier for newcomers.

New entrants face considerable challenges in replicating Dayforce's established trust and customer base. Potential clients often hesitate to switch from reliable, proven providers, especially given the high switching costs and the critical nature of HR and payroll functions, which demand stability and proven performance.

Data Security and Scalability Requirements

The threat of new entrants in the Human Capital Management (HCM) software space, particularly for platforms like Dayforce, is significantly mitigated by the substantial data security and scalability requirements. Building a platform that can reliably protect sensitive employee data and efficiently manage operations for millions of users is a formidable undertaking. As of December 31, 2024, Dayforce proudly supports 7.6 million global employees, demonstrating its robust infrastructure.

New competitors must prove they can meet these high standards from the outset to even be considered by potential customers. This involves substantial investment in advanced security protocols and infrastructure capable of massive scaling.

- High Development Costs: Creating secure, scalable HCM solutions requires significant upfront investment in technology and expertise.

- Regulatory Compliance: Adhering to global data privacy regulations like GDPR and CCPA adds complexity and cost for new entrants.

- Demonstrated Reliability: Companies need to see a proven track record of uptime and data integrity, which is difficult for newcomers to establish quickly.

- Customer Trust: Gaining the trust of businesses entrusting them with vast amounts of sensitive employee data is a lengthy process.

Network Effects and Ecosystem Development

The Human Capital Management (HCM) market, where Dayforce operates, does show some network effects. This means the platform becomes more valuable as more users join and more services integrate with it. For instance, in 2024, the widespread adoption of cloud-based HCM solutions meant that companies with larger user bases often benefited from richer data insights and more robust community support.

Dayforce has cultivated a comprehensive ecosystem, which includes a wide array of partnerships and integrations with other business software. This extensive network acts as a significant barrier to entry for potential new competitors. A new entrant would need to invest heavily to replicate the breadth of Dayforce's existing offerings and establish a similar network of connections to even begin competing effectively.

- Network Effects: The value of HCM platforms increases with user adoption and integration depth.

- Ecosystem Value: Dayforce's established partnerships and integrations create a competitive moat.

- Barrier to Entry: New entrants must build comparable ecosystems to challenge Dayforce's market position.

The threat of new entrants in the HCM software market is considerably low for Dayforce due to high capital requirements for development and infrastructure, alongside the need for deep expertise in regulatory compliance across various global markets. Established players like Dayforce have already made these substantial investments, creating a significant barrier for newcomers who must also contend with the challenge of building customer trust and demonstrating proven reliability in handling sensitive employee data.

New entrants must overcome substantial hurdles in replicating Dayforce's established ecosystem of partnerships and integrations, which enhances its value through network effects. As of 2024, the trend towards cloud-based HCM solutions has amplified these network effects, making platforms with larger user bases and richer data insights more attractive. A new competitor would need to invest heavily to build a comparable network of connections to effectively challenge Dayforce's market position.

Porter's Five Forces Analysis Data Sources

Our Dayforce Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Dayforce's own financial statements, investor relations materials, and public filings. We supplement this with industry-specific market research reports and competitive intelligence gathered from reputable business news outlets and analyst reports.