Dayforce Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dayforce Bundle

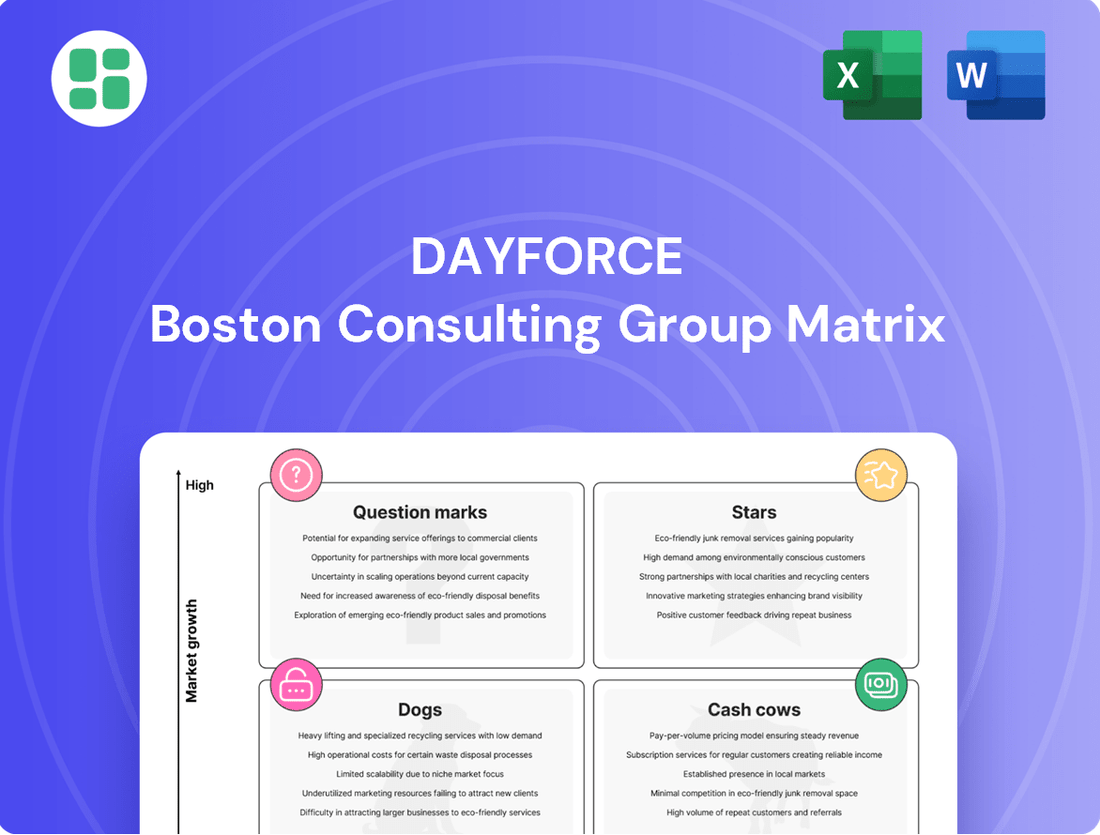

Curious about Dayforce's product portfolio and its market performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. To truly understand their strategic positioning and unlock actionable insights for investment and resource allocation, you need the full picture.

Don't miss out on the detailed quadrant placements and data-backed recommendations that the complete Dayforce BCG Matrix provides. Purchase the full report to gain a clear roadmap for smart product decisions and a competitive edge.

Stars

Dayforce's AI-Powered Human Capital Management (HCM) solutions, including its new AI Agents and Strategic Workforce Planning tools, are positioned as stars in the BCG Matrix. These innovations, slated for select customer access in 2025, are designed to streamline HR operations by automating tasks and offering sophisticated insights for workforce strategy. This move directly targets the burgeoning AI in HR sector, which is projected for significant expansion.

Dayforce is making significant inroads into the enterprise market, a key indicator of its growing strength. The company is actively capturing market share within the larger enterprise segment of the Human Capital Management (HCM) sector.

This strategic focus on upmarket penetration is crucial, as larger enterprises represent a substantial growth avenue for HCM solutions. Dayforce's unified platform is particularly well-suited to meet the complex needs of these organizations.

Evidence of this success is seen in Dayforce's strong bookings growth and the rising recurring revenue it's generating from these larger clients. For instance, in the first quarter of 2024, Dayforce reported a 20% year-over-year increase in total revenue, with a significant portion driven by new enterprise client acquisitions.

Dayforce's advanced Workforce Management (WFM) solutions, bolstered by AI-driven scheduling and predictive analytics, are solidifying its leadership in an expanding market. These capabilities are crucial for organizations aiming to optimize their labor force, minimize scheduling disputes, and boost overall operational efficiency, addressing key demands in today's fluctuating labor landscape.

The continuous enhancement of Dayforce's WFM features, with significant updates planned for 2025, underscores a deep commitment to this high-demand sector. For instance, the global WFM market was valued at an estimated $4.5 billion in 2023 and is projected to grow significantly, with some reports suggesting a compound annual growth rate of over 10% through 2030, highlighting the substantial opportunity Dayforce is capitalizing on.

Global Payroll Expansion

Dayforce's strategic expansion into new international markets, exemplified by the 2024 launch of its payroll services in Singapore, highlights a significant growth opportunity. This move is designed to establish Dayforce as a dominant global player by providing a unified, compliant payroll system that spans multiple countries.

The company's aggressive global payroll expansion is a direct response to the growing need among multinational corporations for integrated payroll solutions. This strategy aims to simplify complex international payroll operations for businesses operating across diverse regulatory landscapes.

- Global Payroll Market Growth: The global payroll market was valued at approximately $35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, indicating strong demand for integrated solutions.

- Singapore as a Hub: Singapore's strategic location and robust business environment make it a key market for expanding payroll services in the Asia-Pacific region.

- Unified System Benefits: Companies adopting unified global payroll systems report an average reduction of 15% in administrative costs and a 20% improvement in payroll accuracy.

- Dayforce's Market Position: Dayforce aims to capture a larger share of this expanding market by offering a single, cloud-based platform that ensures compliance and efficiency for its clients worldwide.

Integrated Talent Management and Learning

Dayforce is significantly bolstering its position in the high-growth talent management sector. The 2024 integration of Eloomi and the introduction of new Dayforce Learning experiences underscore this commitment. These advancements are specifically designed to address the critical need for upskilling, fostering career progression, and delivering personalized learning journeys, aligning perfectly with the dynamic demands of today's workforce.

This strategic expansion into integrated talent management and learning is vital for organizations aiming to attract and retain top talent, a key driver of market interest and competitive advantage. The focus on continuous development and tailored educational pathways directly impacts employee engagement and organizational agility.

- Talent Management Market Growth: The global talent management software market was valued at approximately $11.7 billion in 2023 and is projected to reach over $23 billion by 2028, growing at a CAGR of around 14.5%.

- Upskilling Demand: A 2024 survey indicated that 75% of employees believe their company should provide more opportunities for upskilling and reskilling.

- Learning Experience Platforms (LXPs): The LXP market is expected to grow substantially, with estimates suggesting a compound annual growth rate of over 18% through 2027, driven by the demand for personalized and engaging learning.

- Employee Retention Impact: Companies with strong learning and development programs report a 30-50% higher employee retention rate compared to those without.

Dayforce's AI-powered HCM solutions, including new AI Agents and Strategic Workforce Planning, are positioned as Stars. These innovations, with select customer access in 2025, streamline HR through automation and strategic insights, targeting the rapidly expanding AI in HR sector.

Dayforce's advanced Workforce Management (WFM) solutions, enhanced by AI for scheduling and predictive analytics, solidify its leadership in a growing market. The global WFM market was valued at $4.5 billion in 2023 and is projected for significant growth, with a CAGR exceeding 10% through 2030.

The company's strategic international expansion, including its 2024 Singapore payroll launch, targets the global payroll market, valued at $35 billion in 2023 and expected to grow at over 8% CAGR through 2030. Dayforce aims to capture market share with its unified, cloud-based platform.

Dayforce is strengthening its talent management offerings with the 2024 integration of Eloomi and new Dayforce Learning experiences. The talent management software market was valued at $11.7 billion in 2023 and is projected to exceed $23 billion by 2028, with a CAGR of around 14.5%.

| Product Area | Market Growth Indicator | Dayforce's Strategic Action | 2024/2025 Relevance |

|---|---|---|---|

| AI-Powered HCM | AI in HR Sector Expansion | AI Agents, Strategic Workforce Planning | Select customer access in 2025 |

| Workforce Management (WFM) | Global WFM Market: $4.5B (2023), >10% CAGR | AI-driven scheduling, predictive analytics | Continuous feature enhancement |

| Global Payroll | Global Payroll Market: $35B (2023), >8% CAGR | Singapore launch, unified platform | 2024 international expansion |

| Talent Management & Learning | Talent Mgmt Market: $11.7B (2023), ~14.5% CAGR | Eloomi integration, Dayforce Learning | 2024 integration and introduction |

What is included in the product

Strategic assessment of Dayforce's offerings, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Dayforce's BCG Matrix offers a clear, actionable view of your portfolio, eliminating the pain of unclear strategic direction.

Cash Cows

Dayforce's core HR and Payroll platform is undeniably its cash cow. This foundational offering, a significant driver of its business, has cultivated a vast and loyal customer base, consistently generating substantial recurring revenue. In 2024, Dayforce reported strong performance in its Human Capital Management (HCM) segment, which includes these core services, with revenue growth reflecting the platform's deep market penetration and high customer retention.

Dayforce's benefits administration is a cornerstone of its comprehensive human capital management system, acting as a reliable cash cow. This mature offering is fundamental to employee well-being and retention, making it a consistently in-demand service for businesses of all sizes.

The stability of benefits administration directly contributes to Dayforce's recurring revenue streams, reinforcing its position as a dependable asset within the company's portfolio. For instance, in 2024, the global benefits administration market was valued at approximately $30 billion, highlighting the significant and enduring demand for such services.

Dayforce's Compliance Management Suite stands out as a strong Cash Cow within its offerings. The company provided over 900 compliance updates in 2024, highlighting its commitment to keeping clients ahead in a complex regulatory landscape. This extensive focus on compliance is a critical need for businesses, solidifying Dayforce's market presence and ensuring consistent revenue streams.

The suite's ability to mitigate risk for its users makes it a stable and highly sought-after component of Dayforce's product ecosystem. Businesses rely on this dependable feature to navigate regulatory requirements, making it a predictable source of income and a cornerstone of their value proposition.

Existing Customer Base and Retention

Dayforce's existing customer base is a powerful cash cow, evidenced by a remarkable 98% annual gross revenue retention rate in 2024. This high retention signifies the loyalty and satisfaction of its current clients, translating into stable and predictable revenue streams. The increasing recurring revenue per customer further solidifies this segment as a primary source of consistent cash flow.

These entrenched customer relationships are highly valuable because they require comparatively less investment for maintenance and growth compared to the acquisition of new clients. This efficiency allows Dayforce to generate substantial profits from its established user base, fueling further investment and expansion.

- 98% Gross Revenue Retention in 2024

- Increasing Recurring Revenue Per Customer

- Predictable Revenue Streams from Long-Term Relationships

- Lower Investment Needs for Maintenance vs. Acquisition

Powerpay for Small Businesses (Canada)

Powerpay, a key component of Dayforce's strategy for the Canadian market, targets small businesses with under 100 employees. This segment, while not experiencing explosive growth, offers a stable and predictable revenue stream for Dayforce. In 2024, Dayforce continued to serve a significant portion of this niche, demonstrating its established foothold.

The platform’s consistent performance within this mature segment solidifies its role as a Cash Cow. This steady income generation supports Dayforce's broader investments and growth initiatives in other market areas.

- Target Market: Small businesses in Canada (under 100 employees).

- Revenue Generation: Provides a consistent, reliable income stream.

- Market Maturity: Operates in a well-established, less volatile segment.

- Strategic Role: Supports overall Dayforce financial stability and growth.

Dayforce's core HR and Payroll platform, along with its benefits administration and compliance management suites, consistently generate substantial recurring revenue due to high customer retention, as evidenced by a 98% gross revenue retention rate in 2024. These mature offerings, serving critical business needs, represent stable assets that require less investment for maintenance compared to new client acquisition, thereby acting as reliable cash cows for the company.

| Product/Service | BCG Category | 2024 Data/Insight |

|---|---|---|

| Core HR & Payroll | Cash Cow | Strong recurring revenue, high customer retention |

| Benefits Administration | Cash Cow | Mature offering, consistent demand, global market valued ~$30 billion |

| Compliance Management | Cash Cow | Over 900 compliance updates in 2024, mitigates client risk |

| Existing Customer Base | Cash Cow | 98% gross revenue retention, increasing recurring revenue per customer |

| Powerpay (Canada) | Cash Cow | Stable revenue from small businesses, established market presence |

Preview = Final Product

Dayforce BCG Matrix

The Dayforce BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally crafted strategic tool ready for your immediate use. You can confidently assess the quality and comprehensiveness of our analysis, knowing the final product will be exactly as presented. This accurate representation ensures you're investing in a tangible, actionable report designed to enhance your strategic decision-making for Dayforce.

Dogs

Less-integrated legacy modules within Dayforce's ecosystem, particularly those not fully aligned with its single data model, can be categorized as Dogs in a BCG-like analysis. These might be older features or modules from acquired companies that haven't been fully assimilated, leading to lower growth potential and higher maintenance costs. For instance, if a module still relies on separate databases or complex data synchronization, its ability to contribute to the platform's overall efficiency and market appeal is limited.

Before the recent surge in advanced analytics and AI, basic reporting tools within HR platforms, if not significantly upgraded, could be seen as a 'Dog' in the BCG matrix. These tools offered standard data extraction but lacked predictive power or deep insights.

In today's competitive landscape, where businesses demand actionable intelligence, undifferentiated reporting provides a weak value proposition. Compared to platforms offering AI-driven forecasting and personalized analytics, these basic tools can lead to lower user adoption and a diminished perception of value.

Dayforce is actively working to overcome this by integrating new AI capabilities, aiming to transform its reporting functionalities from basic to advanced. This strategic shift is crucial for staying relevant and competitive in the evolving HR technology market.

Niche or outdated industry-specific solutions within Dayforce's offerings could be considered 'Dogs' in the BCG matrix. These are likely specialized features that haven't evolved with broader HCM technology, leading to a shrinking market and low growth potential. For example, if Dayforce offers a highly tailored payroll module for a declining manufacturing sub-sector that hasn't been updated in years, it would fit this category.

Underperforming Regional Offerings (Non-Strategic)

Underperforming regional offerings, often termed 'Dogs' in the BCG Matrix, represent Dayforce's smaller, less focused ventures that haven't achieved significant market traction or aligned with its core global expansion strategy. These initiatives might be consuming valuable resources without contributing substantially to market share or revenue growth.

For instance, if Dayforce had a minor partnership in a specific European region that saw less than 5% year-over-year growth in new customer acquisition in 2024, and its contribution to overall revenue remained below 1%, it would likely be classified as a Dog. Such ventures, lacking strategic alignment and robust performance, typically warrant a review for potential divestiture or de-prioritization to reallocate capital towards more promising growth areas.

- Low Market Share: These regional offerings typically hold a very small percentage of their respective local markets, often in the single digits.

- Slow Growth: In 2024, these ventures likely experienced growth rates significantly below the industry average or Dayforce's overall growth targets.

- Resource Drain: They consume management attention and financial resources without generating a commensurate return, impacting overall profitability.

- Strategic Misalignment: Their focus or scale may no longer fit with Dayforce's overarching strategy for global market penetration and product development.

Non-Cloud or On-Premise Solutions

While Dayforce's core strength lies in its cloud-based Human Capital Management (HCM) platform, any remaining non-cloud or on-premise solutions would likely be categorized as Dogs in a BCG Matrix analysis. This is because these legacy offerings cater to a shrinking market segment as the industry overwhelmingly favors cloud-native solutions.

These on-premise or hybrid components face low growth prospects and declining market share. For instance, as of early 2024, the global HCM market is heavily skewed towards cloud deployment, with estimates suggesting over 80% of new HCM implementations are cloud-based. This trend indicates a diminishing demand for on-premise alternatives.

The strategic implication for Dayforce is a clear focus on its cloud platform, which represents its Stars and Cash Cows.

- Declining Market Share: On-premise HCM solutions are losing ground to cloud alternatives.

- Low Growth Potential: The shift to cloud limits the expansion opportunities for non-cloud offerings.

- Industry Trend: The overwhelming majority of new HCM deployments are cloud-based, leaving on-premise solutions in a niche.

- Strategic Focus: Dayforce prioritizes its cloud-native platform, signaling a divestment or minimal investment in legacy on-premise components.

Modules or features within Dayforce that exhibit low market share and minimal growth potential are classified as Dogs. These are often legacy components or niche offerings that haven't kept pace with technological advancements or market demand. For example, an older, less integrated reporting tool that lacks AI-driven insights would fall into this category, as businesses increasingly seek predictive analytics.

These 'Dog' segments typically consume resources without contributing significantly to revenue or strategic advantage. By 2024, the market's strong preference for cloud-native, AI-enhanced HCM solutions means that on-premise or outdated modules within Dayforce face declining relevance and growth prospects. This strategic positioning necessitates a careful evaluation for potential divestment or reduced investment.

Dayforce's focus on its integrated, cloud-based platform means that underperforming or outdated components are often candidates for de-prioritization. For instance, a regional offering in a market with less than 5% year-over-year growth in 2024, contributing minimally to overall revenue, would be a prime example of a 'Dog' requiring strategic review.

These elements are characterized by low market share, slow growth rates significantly below industry averages, and a potential drain on resources. Their strategic misalignment with Dayforce's core cloud-first, AI-driven HCM strategy further solidifies their classification as Dogs.

Question Marks

Dayforce AI Agents, designed to streamline operations and boost efficiency, are set to launch for a select group of clients in 2025. This innovative solution taps into a burgeoning market driven by AI adoption, indicating substantial growth prospects.

While the potential is high, Dayforce AI Agents currently hold a minimal market share, reflecting their nascent stage of development and early adoption. Achieving market leadership will necessitate substantial ongoing investment to capitalize on this promising opportunity.

Dayforce Strategic Workforce Planning, slated for a 2025 release to select clients, represents a significant move into the high-growth analytical Human Capital Management (HCM) space. This AI-enhanced solution aims to tackle intricate workforce planning challenges by leveraging real-time data and predictive analytics. The market for such advanced planning tools is expanding rapidly, with some analysts projecting the global workforce analytics market to reach over $2.5 billion by 2025, indicating substantial opportunity.

While Dayforce Strategic Workforce Planning is positioned to capitalize on this trend, its current market share is minimal. This means significant investment will be necessary to establish its value proposition and gain traction against more established players. The company's strategy will likely involve demonstrating clear ROI and differentiating its AI capabilities to capture a meaningful segment of this burgeoning market.

Dayforce Co-Pilot, an AI-powered tool designed to streamline HR functions, is showing promising early adoption. In the first quarter of 2025, approximately half of all new customer agreements incorporated this feature, signaling significant market interest.

Despite this strong initial uptake, Dayforce Co-Pilot remains a relatively nascent component within Dayforce's comprehensive suite of offerings. Its long-term market penetration is therefore classified as a Question Mark, contingent on ongoing development and successful integration into user workflows.

Emerging Global Market Entry Points

Beyond its established global presence and recent Singapore launch, Dayforce's exploration into other new, less-penetrated international markets represents a strategic move into potential high-growth territories. These emerging markets offer significant upside for Human Capital Management (HCM) solutions, as businesses increasingly seek to digitize their workforce management.

These markets present a compelling opportunity for Dayforce to capture market share in regions with lower HCM adoption rates. However, success hinges on substantial upfront investment in tailoring solutions to local needs, building robust sales channels, and establishing comprehensive support networks to compete effectively with established players.

- High Growth Potential: Emerging markets often exhibit faster GDP growth and increasing business investment in technology, driving demand for advanced HCM solutions. For instance, the global HCM market was projected to reach $32.7 billion by 2024, with emerging economies expected to contribute a significant portion of this growth.

- Localization Investment: Entering these markets requires adapting products to local languages, regulations, and business practices. This investment is crucial for building trust and ensuring seamless adoption by new customers.

- Competitive Landscape: Dayforce will face competition from both global HCM providers and local players who may have a deeper understanding of regional nuances. Strategic partnerships and targeted marketing will be key to gaining traction.

- Market Penetration Strategy: A phased approach, potentially starting with key economic hubs within these emerging regions, can help manage risk and optimize resource allocation for market entry.

Dayforce Talent Exchange

Dayforce Talent Exchange, slated for an early 2024 launch, is designed to assist businesses in pinpointing and utilizing both internal and external talent. This initiative directly confronts the rapidly expanding demand for enhanced talent mobility and optimization within organizations.

The market adoption and competitive positioning of Dayforce Talent Exchange are still in nascent stages, reflecting its status as a newer product. To fully capitalize on its potential and prevent it from being categorized as a 'Dog' in the BCG matrix, strategic investments are crucial.

- Market Need: The global talent acquisition market is projected to reach $47.6 billion by 2027, highlighting the significant demand for solutions like Talent Exchange.

- Strategic Focus: Dayforce's investment in this area indicates a move towards addressing the growing need for agile workforce management.

- Competitive Landscape: Early adoption and feature development will be key differentiators against established HR tech platforms.

Dayforce AI Agents, though promising for streamlining operations, are in their early stages with minimal market share, necessitating significant investment to achieve leadership in the growing AI adoption market.

Dayforce Strategic Workforce Planning, a new AI-enhanced solution for the expanding HCM market, also faces a minimal market share, requiring substantial investment to prove its value and capture market segments.

Dayforce Co-Pilot shows strong early customer adoption, with about half of new agreements in Q1 2025 including it, but its long-term success as a Question Mark depends on continued development and workflow integration.

Dayforce's expansion into new, less-penetrated international markets presents high growth potential for HCM solutions but demands significant upfront investment in localization and channel development to compete effectively.

Dayforce Talent Exchange, launched in early 2024 to address talent mobility needs, is in its nascent stages and requires strategic investment to prevent it from becoming a 'Dog' in the BCG matrix, especially given the large global talent acquisition market.

BCG Matrix Data Sources

Our Dayforce BCG Matrix leverages comprehensive data from Dayforce's financial reports, market share analysis, and industry growth trends to provide strategic insights.