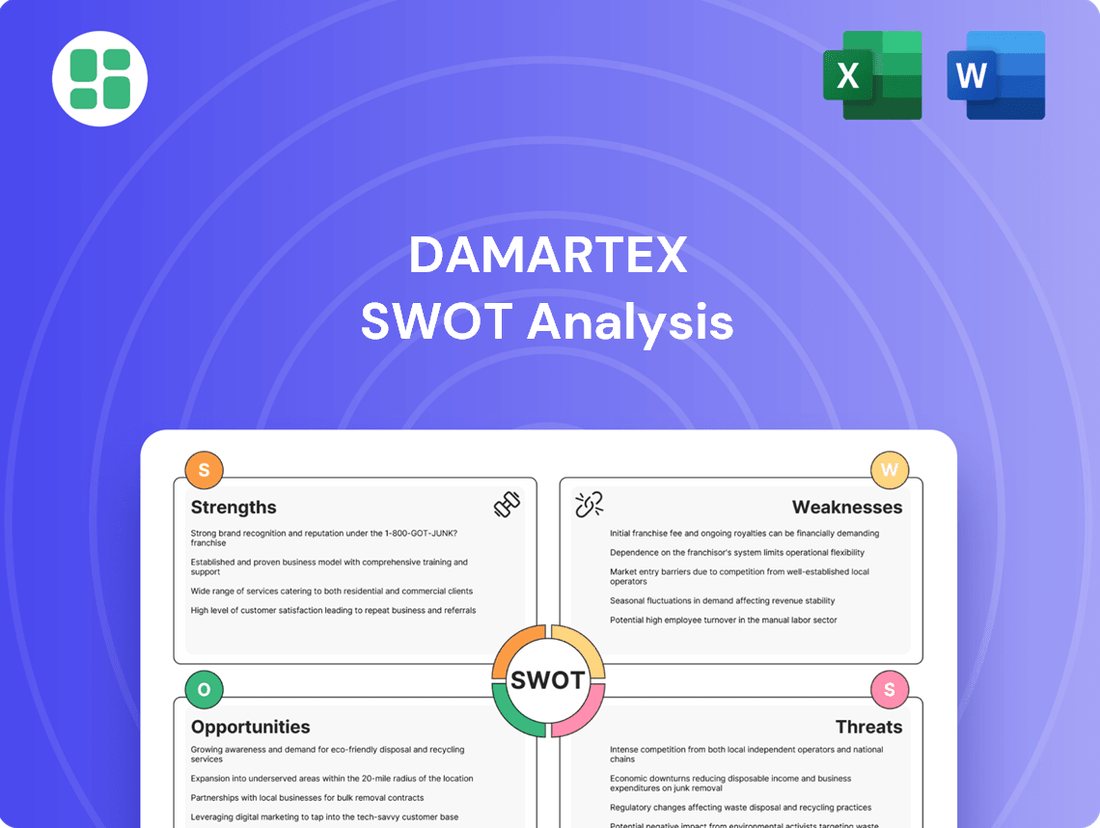

Damartex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Damartex Bundle

Damartex possesses significant strengths in its established brand and loyal customer base, but faces potential threats from evolving market trends. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Damartex's market position, including detailed opportunities and weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and competitive analysis.

Strengths

Damartex's niche market specialization in the senior demographic (over 55) is a significant strength, allowing for a deep understanding of their specific needs. This focus translates into tailored product development, emphasizing comfort, quality, and innovative features that resonate with this age group. With the global population aged 65 and over projected to reach 1.6 billion by 2050, this specialization taps into a consistently expanding and stable consumer base, ensuring long-term market relevance.

Damartex boasts a robust and diversified brand portfolio, strategically spread across three key divisions: Fashion, Home & Lifestyle, and Healthcare. This structure includes eight distinct brands such as Damart and Xandres in fashion, 3 Pagen and Coopers of Stortford in home and lifestyle, and Almadia, Santéol, and MSanté in healthcare.

This broad diversification significantly mitigates risk by lessening the group's dependence on any single product category or market segment. For instance, the strong performance observed in brands like Xandres in recent periods, like its 2023 financial results showing continued growth, directly contributes to the overall stability and resilience of Damartex.

Damartex's strength lies in its robust omni-channel distribution strategy, seamlessly integrating catalogs, e-commerce, and physical stores. This approach effectively serves its senior demographic, who appreciate traditional catalog ordering while increasingly embracing digital channels.

The company has seen significant success with its online sales, which is a testament to the adaptability of its distribution model. For instance, in the first half of fiscal year 2024, Damartex reported a notable increase in its online revenue, demonstrating the growing importance and effectiveness of its digital presence.

Improved Operating Profitability

Damartex has demonstrated a notable uplift in its operating profitability, with a significant improvement in operating EBITDA reported for the first half of the 2024/2025 financial year. This financial performance is a direct result of the company's focused efforts on cost optimization and diligent margin management.

The positive financial trends underscore the effectiveness of the DARE. ACT. IMPACT 2026 strategic plan, which is already translating into tangible benefits. The company's strategic adjustments are clearly paving the way for enhanced profitability.

- Enhanced Operating EBITDA: The first half of the 2024/2025 financial year saw a significant improvement in operating EBITDA.

- Effective Cost Management: The company's focus on cost optimization is yielding strong results in profitability.

- Strategic Plan Execution: The DARE. ACT. IMPACT 2026 plan is actively contributing to positive operational and financial outcomes.

- Positive Trajectory: These improvements indicate a strengthened financial position and a clear path toward sustained profitability.

Strategic Transformation Initiatives

Damartex is actively pursuing its 'Dare. Act. Impact 2026' strategic plan, a significant initiative designed to drive transformation and foster sustainable growth. This plan is central to the company's efforts to modernize its operations and enhance customer satisfaction.

Key components of this strategy involve optimizing inventory management and refining marketing expenditures, aiming for greater efficiency. The company is also strategically repositioning brands such as Almadia, reflecting a dynamic approach to market demands.

- Strategic Plan: 'Dare. Act. Impact 2026' focuses on transformation, sustainable growth, and customer satisfaction.

- Operational Improvements: Initiatives include modernizing business models and improving inventory management.

- Marketing Optimization: Efforts are underway to optimize marketing expenses for better ROI.

- Brand Retargeting: Strategic repositioning of brands like Almadia is a key element of the transformation.

Damartex's strength lies in its focused approach to the senior demographic, a market segment poised for significant growth. This specialization allows for highly targeted product development and marketing, ensuring strong customer resonance. The company's diversified brand portfolio across Fashion, Home & Lifestyle, and Healthcare further solidifies its market position and reduces reliance on any single sector.

The robust omni-channel distribution strategy, combining traditional catalogs with an expanding e-commerce presence, effectively caters to the preferences of its core customer base. This adaptability is crucial for sustained engagement and sales growth, as evidenced by increasing online revenues.

Financially, Damartex is demonstrating improved profitability, with a notable increase in operating EBITDA in the first half of the 2024/2025 fiscal year. This uplift is a direct result of successful cost management and the execution of its strategic plan, 'Dare. Act. Impact 2026'.

| Metric | H1 2024/2025 | Significance |

|---|---|---|

| Operating EBITDA | Improved | Indicates enhanced profitability through cost optimization and margin management. |

| Online Revenue | Increased | Demonstrates the success of the omni-channel strategy and digital adoption. |

| Strategic Plan Execution | On Track | 'Dare. Act. Impact 2026' driving positive operational and financial outcomes. |

What is included in the product

Delivers a strategic overview of Damartex’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Streamlines complex SWOT analysis into an easily digestible format, reducing the time and effort needed for strategic assessment.

Weaknesses

Damart's fashion division, a cornerstone of Damartex, has seen a sales dip during the first half of the 2024/2025 fiscal year. This decline is linked to weaker-than-anticipated demand for seasonal items, notably Thermolactyl, impacting the brand's performance.

The overall revenue for the fashion segment over the first nine months of 2024/2025 reflects these ongoing struggles. This trend highlights a significant challenge within a key area of Damartex's business, necessitating strategic review and potential adjustments.

Damartex's financial health is closely tied to broader economic trends, making it susceptible to inflation and potential downturns in consumer spending, particularly for non-essential goods. This economic turbulence directly influences consumer confidence and spending patterns.

The company recognizes that this challenging macroeconomic environment, characterized by persistent inflation and a contraction in discretionary spending, can act as a significant drag on revenue expansion across its various business segments.

Damartex's Home & Lifestyle division experienced significant headwinds in the first half of fiscal year 2024/2025 due to supply chain disruptions. These tensions led to delivery delays and a notable increase in distribution expenses, impacting the division's ability to fully capitalize on its return to growth.

These operational challenges directly threaten profitability by inflating costs and can severely damage customer loyalty through unreliable service. For instance, the increased distribution costs put pressure on margins, making it harder to achieve the desired profit levels.

Effective management of the supply chain is therefore paramount for Damartex. It's not just about getting products to customers; it's about doing so reliably and cost-effectively to maintain product availability and control expenses, especially in a dynamic market environment.

Dependence on Traditional Channels for Some Brands

While Damartex is expanding its digital presence, some of its brands, like Almadia, have shown a reliance on traditional mail-order channels. This reliance became a weakness when Almadia's mail-order channel was discontinued, indicating a potential lag in adapting to evolving consumer preferences and a slower shift in some business segments. The need to reorganize and refocus these brands underscores the challenge of transitioning away from established, but potentially declining, distribution methods.

- Obsolescence of Traditional Channels: Certain brands within Damartex may still be heavily invested in distribution methods that are losing traction with consumers.

- Transition Challenges: The discontinuation of Almadia's mail-order business highlights the difficulties in managing the decline of legacy channels.

- Resource Allocation: Reorganizing and refocusing brands tied to traditional methods can divert resources from more promising digital initiatives.

Negative Net Income and High Net Financial Position

Damartex's financial performance in the first half of 2024/2025 shows a continued struggle with profitability, as net income from continuing operations remained negative. While this represents an improvement compared to the prior year, it highlights the ongoing challenge of achieving consistent net earnings.

The group's substantial net financial position is a key concern, indicating a significant level of debt. Despite a slight reduction in this debt burden, it still represents a potential financial strain that could impact future growth and flexibility.

- Negative Net Income: The group reported negative net income from continuing operations in H1 2024/2025, although it improved from the previous year.

- High Net Financial Position: Damartex carries a significant net financial debt, which, despite a slight improvement, remains a considerable liability.

- Financial Strain: The combination of negative net income and high debt suggests ongoing efforts are required to strengthen the company's financial health and achieve sustainable profitability.

Damart's fashion division, a core revenue driver, experienced a sales decline in the first half of fiscal year 2024/2025 due to weaker demand for seasonal products like Thermolactyl. This slowdown in a key segment, reflected in the overall fashion revenue for the first nine months of 2024/2025, indicates a need for strategic adjustments to counter shifting consumer preferences and economic pressures.

Supply chain disruptions significantly impacted the Home & Lifestyle division in the first half of 2024/2025, leading to delivery delays and increased distribution costs. This hampered the division's growth potential and put pressure on profit margins, highlighting the critical need for robust supply chain management to ensure reliability and cost-effectiveness.

The company's reliance on traditional mail-order channels for some brands, such as Almadia, proved to be a weakness when these channels were discontinued, signaling a lag in adapting to evolving consumer habits. This necessitates resource reallocation to digital initiatives and a strategic refocusing of brands tied to declining distribution methods.

Damartex continues to face profitability challenges, with negative net income from continuing operations in the first half of 2024/2025, despite year-over-year improvement. Compounding this is a substantial net financial debt, which, even with a slight reduction, remains a significant liability impacting financial flexibility and future growth prospects.

| Financial Metric (H1 2024/2025) | Value | Comparison |

|---|---|---|

| Fashion Division Sales | Declined | Weaker than anticipated demand for seasonal items |

| Home & Lifestyle Division | Impacted by supply chain disruptions | Delivery delays and increased distribution expenses |

| Net Income (Continuing Operations) | Negative | Improved from prior year, but still a challenge |

| Net Financial Position | Substantial Debt | Slight reduction, but remains a concern |

What You See Is What You Get

Damartex SWOT Analysis

This preview reflects the real Damartex SWOT analysis document you'll receive—professional, structured, and ready to use. You're seeing the actual content, ensuring transparency and quality. Purchase unlocks the complete, in-depth analysis.

Opportunities

The global population is aging at an unprecedented rate, with projections indicating that by 2050, nearly one in six people worldwide will be 65 or older. This demographic wave fuels the 'Silver Economy,' a market segment with increasing disposable income and specific needs. Damartex, with its focus on apparel and home goods for older adults, is well-positioned to capitalize on this expanding consumer base.

In 2024, the global Silver Economy is estimated to be worth trillions, with significant growth expected through 2025 and beyond. Damartex's established brand recognition and product lines specifically designed for comfort and ease of use directly address the preferences of this demographic. Innovations in areas like adaptive clothing and health-focused products will further enhance its appeal to this lucrative market.

Damart's strong digital sales performance, particularly within the Home & Lifestyle segment, presents a significant opportunity for further e-commerce expansion. This resilience, bolstered by a blend of online and in-store sales, underscores the potential to capture a larger share of the increasingly connected senior demographic.

By strategically investing in online platforms, enhancing digital marketing efforts, and prioritizing user experience, Damart can capitalize on broader consumer trends favoring online engagement. This focus aligns with the growing preference for digital convenience among its target market.

Damartex's Healthcare division, already a strong performer with brands like Santéol and MSanté demonstrating consistent growth, presents a prime opportunity for product innovation and diversification. The company can capitalize on this momentum by expanding its offerings to address the growing demand for solutions catering to age-related concerns and proactive healthy aging.

This expansion could involve developing new product lines or services focused on preventative health, wellness, and enhanced quality of life for older adults. For instance, leveraging technology for remote health monitoring or personalized wellness programs could significantly broaden the appeal and reach of the Healthcare division, aligning with market trends observed in late 2024 and early 2025.

Strategic Acquisitions and Partnerships

Damartex has a proven track record of expanding through strategic acquisitions, evidenced by past integrations of companies like Medical Health Grand Nord, Perf-R, M Santé, Santéol, and 3PAGEN. This history highlights a strong capacity for driving inorganic growth and successfully integrating new businesses.

Looking ahead, Damartex can further bolster its market standing and broaden its product and service portfolio by pursuing future strategic acquisitions or forming key partnerships. The focus should be on companies or technologies that complement its existing offerings or introduce innovative solutions specifically tailored for the senior demographic. For example, a 2024 or 2025 acquisition in the telehealth space or advanced home care technology could significantly enhance its value proposition.

- Acquisition History: Damartex has successfully integrated companies such as Medical Health Grand Nord, Perf-R, M Santé, Santéol, and 3PAGEN, demonstrating inorganic growth capabilities.

- Future Growth Avenues: Opportunities exist in acquiring complementary product lines or innovative technologies targeting the senior market.

- Market Strengthening: Strategic partnerships can also expand Damartex's reach and service offerings, reinforcing its position.

- Potential Impact: Such moves could lead to enhanced market share and a more comprehensive suite of services for its core customer base.

Sustainability and Responsible Business Practices

Consumers, even those in older demographics, are increasingly prioritizing brands that demonstrate sustainability and ethical operations. Damartex's dedication to corporate social responsibility, evidenced by its 'Change Our World' initiative and concrete steps to minimize its environmental footprint, is a significant opportunity. This focus on responsible business conduct can bolster its brand reputation and attract a growing segment of environmentally and socially conscious shoppers, aligning with a global shift towards valuing quality and integrity in purchasing decisions.

This trend is reflected in market data, with a significant portion of consumers willing to pay more for sustainable products. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions. Damartex's proactive approach positions it to capitalize on this growing demand.

- Enhanced Brand Loyalty: Demonstrating a commitment to sustainability can foster deeper connections with customers, leading to increased loyalty.

- Market Differentiation: In a competitive retail landscape, strong CSR credentials can set Damartex apart from competitors.

- Attracting New Customer Segments: The growing conscious consumer market represents a valuable opportunity for Damartex to expand its customer base.

- Investor Appeal: Environmental, Social, and Governance (ESG) factors are increasingly important for investors, potentially improving Damartex's attractiveness to capital markets.

The expanding Silver Economy presents a substantial growth avenue, with global spending by older adults projected to rise significantly through 2025. Damartex's established presence in apparel and home goods tailored for seniors positions it to capture a larger market share. Continued investment in digital channels, as seen in its strong e-commerce performance in 2024, will further enhance its reach to this increasingly online-savvy demographic.

Damartex's Healthcare division, notably brands like Santéol and MSanté, shows robust growth, offering opportunities for innovation in preventative health and wellness products. Strategic acquisitions, like those in telehealth or home care technology, could further solidify its market position and expand its service portfolio by late 2024 and into 2025.

A growing consumer preference for sustainability and ethical business practices provides a key differentiator for Damartex. Its 'Change Our World' initiative and demonstrable steps towards environmental responsibility can attract a valuable segment of socially conscious shoppers, boosting brand loyalty and market appeal.

Threats

The European apparel market is incredibly crowded, with giants like Zara and H&M setting a brisk pace, especially in the booming fast fashion sector. Even though Damartex focuses on a specific segment, it faces growing pressure from both niche brands and larger retailers who are increasingly catering to the needs of older consumers.

This fierce competition directly impacts Damartex by squeezing profit margins, demanding constant innovation in product and marketing, and making it harder to gain or maintain market share. For instance, in 2023, the European apparel market was valued at over €200 billion, and a significant portion of this growth came from brands adept at rapid trend adoption and efficient supply chains.

Consumer preferences are changing, even among seniors, with a growing emphasis on getting good value for their money. There's a noticeable move away from disposable clothing towards pieces that are more adaptable and built to last. If Damartex’s product selection doesn't keep pace with these shifting demands, particularly in how quality is perceived against price, it could certainly affect their sales figures.

The current economic climate, marked by cautious consumer spending, amplifies these challenges. For instance, during 2024, many retailers observed consumers prioritizing essential purchases and seeking discounts, a trend that likely continued into early 2025. Damartex needs to ensure its pricing and product durability align with this heightened value consciousness to maintain market share.

Ongoing macroeconomic instability, coupled with persistent inflationary pressures across Europe, significantly dampens consumer confidence and reduces purchasing power. This directly impacts discretionary spending on items like fashion and homeware, areas crucial for Damartex's product lines.

Damartex's revenue has already shown sensitivity to these economic headwinds. For instance, the company reported a slowdown in sales growth in its fiscal year ending March 2024, partly attributed to the challenging economic climate affecting consumer spending habits across its key markets.

Sustained economic challenges, including potential recessions or prolonged high inflation, could further impede Damartex's recovery and future growth prospects by limiting consumer demand for its offerings.

Supply Chain Disruptions and Rising Costs

The global supply chain continues to present significant vulnerabilities, directly impacting businesses like Damartex. These disruptions can manifest as increased production costs, extended delivery times, and complex inventory management issues. For instance, the Home & Lifestyle division experienced firsthand how these external pressures can erode profitability and hinder operational fluidity.

Effectively navigating these persistent supply chain challenges is paramount for maintaining Damartex's competitive edge. The company must proactively implement strategies to mitigate the impact of rising costs and potential delivery delays. This requires a keen focus on building resilience within its operational framework.

- Persistent Vulnerabilities: Global supply chains are still susceptible to shocks, leading to higher input costs and delivery delays.

- Impact on Operations: Disruptions, as seen in Damartex's Home & Lifestyle segment, directly affect profitability and efficiency.

- Cost Pressures: Inflationary pressures in 2024 and projected into 2025 continue to drive up raw material and logistics expenses.

- Mitigation Strategies: Damartex needs robust plans to manage inventory and secure reliable sourcing to counter these threats.

Failure to Adapt to Digital Transformation Fully

Damartex faces a significant threat if its digital transformation efforts lag behind the accelerating pace of online commerce. The closure of Almadia's mail-order operations serves as a stark reminder of the perils of relying on legacy business models in a rapidly evolving retail landscape. Failure to fully embrace and innovate within the digital sphere could alienate its core customer base, particularly as seniors become more digitally engaged.

The company must ensure its digital channels offer a seamless and compelling customer experience to compete effectively. This includes not only robust e-commerce platforms but also innovative digital marketing and engagement strategies. For instance, in 2024, the online retail sector continued its strong growth, with global e-commerce sales projected to reach over $7 trillion, underscoring the critical need for Damartex to capture a significant share of this market.

- Digital Lag Risk: Incomplete or slow adaptation to digital trends could lead to market share erosion.

- Outdated Model Vulnerability: Reliance on non-digital channels, like Almadia's mail-order, proved unsustainable.

- Senior Market Shift: The increasingly tech-savvy senior demographic demands modern, digital-first engagement.

- Competitive Imperative: Continuous innovation in online presence and customer experience is vital for survival and growth.

Intense competition within the European apparel market, particularly from fast fashion giants and niche brands targeting seniors, poses a significant threat by pressuring profit margins and demanding constant innovation. Shifting consumer preferences towards value and durability, coupled with cautious spending due to economic instability and inflation, further challenges Damartex's sales. Persistent global supply chain vulnerabilities increase costs and delivery times, impacting profitability, while a lag in digital transformation risks alienating an increasingly online senior demographic.

| Threat Category | Specific Threat | Impact on Damartex | Relevant Data/Trend (2024/2025) |

|---|---|---|---|

| Market Competition | Intense competition from fast fashion and niche brands | Squeezed profit margins, market share erosion | European apparel market valued over €200 billion (2023); brands adept at rapid trend adoption gaining share. |

| Consumer Behavior | Shifting preferences towards value and durability | Reduced sales if product offering doesn't align | Consumers prioritizing essentials and seeking discounts in 2024. |

| Economic Factors | Macroeconomic instability and inflation | Reduced purchasing power and discretionary spending | Inflationary pressures continued into early 2025, impacting consumer confidence. Damartex saw sales growth slowdown in FY ending March 2024. |

| Operational Risks | Global supply chain disruptions | Increased costs, delivery delays, inventory issues | Ongoing vulnerabilities impacting raw material and logistics expenses. |

| Digital Transformation | Lagging digital adoption | Alienation of digitally engaged seniors, market share loss | Global e-commerce sales projected to exceed $7 trillion (2024); online retail sector growth continues. |

SWOT Analysis Data Sources

This Damartex SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.