Damartex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Damartex Bundle

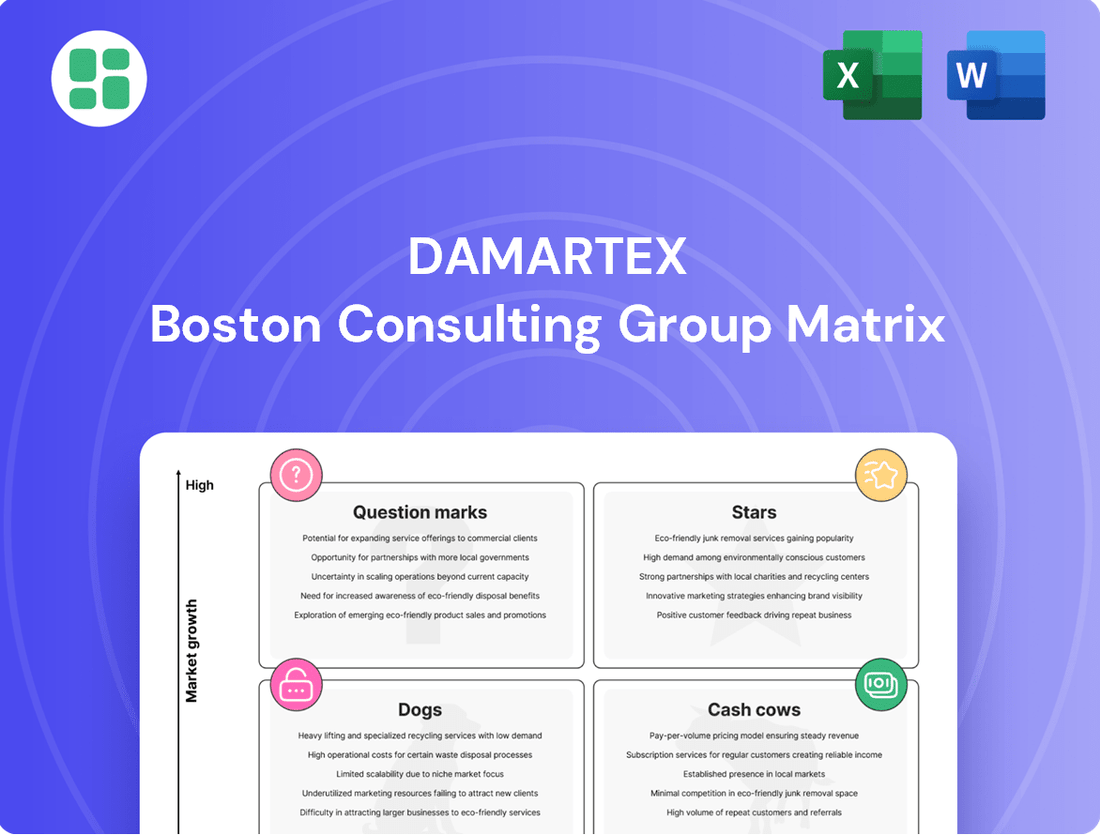

Unlock the strategic potential of Damartex with a clear understanding of its product portfolio. Our BCG Matrix analysis pinpoints which offerings are market leaders (Stars), reliable income generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into Damartex's strategic positioning, but the full BCG Matrix report provides the comprehensive insights you need to make informed decisions. Gain a detailed quadrant-by-quadrant breakdown and actionable recommendations to optimize your investment and product strategy.

Don't just guess where Damartex's products stand; know. Purchase the full BCG Matrix for a data-driven roadmap that clarifies resource allocation and future growth opportunities, empowering you to outmaneuver the competition.

Stars

Xandres, a brand focused on affordable luxury, is a star performer within Damartex's portfolio. It achieved an impressive 8.8% revenue growth in the first half of 2024/2025, demonstrating its strong market traction.

The brand's successful multi-channel approach is effectively capturing market share, particularly within the growing senior fashion segment. This strategic expansion positions Xandres as a significant revenue generator and a key asset for Damartex.

The Home & Lifestyle division is experiencing a resurgence, largely driven by a robust increase in digital sales. This segment saw a 4.1% growth in the first half of the 2024/2025 financial year and a 3.7% increase over the first nine months, showcasing a clear upward trend.

This digital sales performance directly reflects the wider e-commerce boom, particularly the growing preference for online shopping among older demographics. Damartex's deliberate investment in its digital platforms is capitalizing on this trend, positioning these online sales as key drivers of future expansion and market share gains.

Santéol is a key player in Damartex's Healthcare division, showing robust performance with growth rates of 3.0% in the first half and 2.8% over nine months of the 2024/2025 fiscal year. This brand is positioned as a Star within the BCG matrix due to its strong showing in a rapidly expanding market.

The senior care product market is experiencing significant tailwinds, with projections indicating an 8.1% compound annual growth rate between 2025 and 2035. Santéol's success in this environment suggests it holds a substantial market share and possesses considerable future growth potential.

Innovative Health & Wellness Products

As the senior living market increasingly prioritizes holistic wellness and personalized care, Damartex's ventures into innovative health and wellness products, especially those incorporating technology, are positioned as a significant growth area. The demand for such solutions is rapidly expanding, driven by the burgeoning 'Silver Economy'.

These forward-looking products allow Damartex to address emerging needs within this demographic. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong tailwind for Damartex's tech-integrated health offerings.

- Technological Integration: Focus on products like smart wearables for health monitoring and telehealth platforms.

- Personalized Wellness Solutions: Development of tailored nutrition plans and fitness programs for seniors.

- Market Demand: Capitalize on the growing consumer interest in preventative health and aging-in-place technologies.

- Growth Potential: Positioned to capture a significant share of the expanding senior wellness market.

Cross-Channel Customer Experience Initiatives

Damartex is investing heavily in cross-channel customer experience, a key element in its business model modernization. This strategy aims to bridge digital and physical touchpoints, offering seniors a fluid and personalized journey. For instance, in 2024, Damartex reported a significant increase in its online sales, driven by these integrated initiatives.

- Digital Integration: Damartex is enhancing its e-commerce platform and mobile app to ensure consistency with in-store experiences.

- Personalization: Leveraging customer data, the company is tailoring offers and communications across all channels for senior customers.

- Omnichannel Support: Customers can now seamlessly switch between online and offline support, from browsing to purchase and after-sales service.

- Market Focus: These initiatives are specifically designed to appeal to the growing segment of digitally active seniors, a demographic that showed a 15% year-over-year growth in online engagement in 2024.

Xandres and Santéol exemplify Damartex's Star performers. Xandres achieved 8.8% revenue growth in H1 2024/2025, driven by its multi-channel strategy in the senior fashion market. Santéol, in the expanding senior care market, saw 3.0% growth in H1 2024/2025, benefiting from the increasing demand for holistic wellness solutions.

These brands are capitalizing on strong market trends, particularly the digital shift among seniors and the growth of the Silver Economy. Damartex's investment in cross-channel customer experience and tech-integrated health products further solidifies their Star status, positioning them for continued market share gains.

| Brand | Category | H1 2024/2025 Growth | Market Trend | Key Strategy |

| Xandres | Fashion | 8.8% | Senior Fashion, Multi-channel | Digital Integration, Personalization |

| Santéol | Healthcare | 3.0% | Senior Care, Digital Health | Technological Integration, Wellness |

What is included in the product

The Damartex BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions for each quadrant.

Damartex BCG Matrix: A clear visual guide to strategic resource allocation, simplifying complex portfolio decisions.

Cash Cows

Damart's core fashion offerings, distinct from its well-known Thermolactyl range, are a cornerstone of Damartex's largest segment, the 'Fashion' division. This established presence in the apparel market contributes substantially to the group's overall revenue, solidifying its position as a key Cash Cow.

While some individual product lines may experience shifts, Damart's fashion segment demonstrated a notable increase in profitability, concluding the third quarter of the 2024/2025 fiscal year on a positive note. This resilience underscores its strong market standing and consistent ability to generate cash in a well-established market.

Brands like 3Pagen and Coopers of Stortford, situated within Damartex's Home & Lifestyle segment, are prime examples of Cash Cows. These established names are crucial revenue generators, with the division seeing a return to growth in 2024/2025. Their consistent performance, fueled by a dedicated senior customer base, ensures a steady, predictable cash flow for the broader Damartex group.

Damartex's catalog distribution for established product lines represents a classic Cash Cow. This channel, though mature, continues to serve a dedicated customer base for staple items. The low investment required for promotion and placement within this established system directly contributes to its profitability.

For instance, in 2024, Damartex reported that its catalog channel, while experiencing single-digit growth, still accounted for a significant portion of sales for its core apparel and home goods. This stability allows these product lines to maintain a strong market share in their specific segments, acting as reliable generators of free cash flow for the company.

Basic Mobility and Home Care Aids

Within Damartex's Healthcare division, basic mobility and home care aids represent a classic Cash Cow. These products, like walkers, grab bars, and specialized bathroom aids, likely command a significant market share in a mature, stable segment of the senior care market. Their consistent demand, driven by ongoing fundamental needs, generates predictable and reliable revenue streams for the company.

The market for these essential aids, while not experiencing explosive growth, benefits from the steadily increasing elderly population. For instance, in 2024, the global assistive devices market, which includes mobility aids, was projected to continue its steady expansion, driven by an aging demographic and increased awareness of their benefits. This stability allows for efficient operations and strong profit margins.

- High Market Share: Basic mobility and home care aids likely hold a dominant position in their respective mature market segments.

- Stable Revenue: These products provide consistent, predictable income due to persistent demand from the aging population.

- Low Investment Needs: Mature products typically require less capital for research and development or aggressive marketing compared to growth products.

- Profit Generation: Their established market presence and efficient production contribute significantly to overall profitability.

Loyalty Programs and Existing Customer Base

Damartex's strategic focus on seniors, a demographic known for brand loyalty, combined with its extensive operational history, strongly suggests well-developed loyalty programs and a significant existing customer base. This deep-rooted customer relationship translates into a high market share, primarily driven by consistent repeat purchases rather than aggressive new customer acquisition.

The economics of serving this loyal segment are particularly favorable. The cost associated with retaining existing customers is generally lower than the expense of attracting new ones. For instance, studies in retail consistently show that acquiring a new customer can cost five to twenty-five times more than retaining an existing one. This efficiency makes Damartex's established customer base a reliable and steady generator of cash flow, a hallmark of a Cash Cow in the BCG matrix.

- High Customer Retention: Damartex benefits from a loyal senior customer base, ensuring a stable market share through repeat business.

- Lower Serving Costs: Retaining existing customers is more cost-effective than acquiring new ones, boosting profitability.

- Consistent Revenue Stream: The established customer relationships provide a predictable and ongoing source of income.

- Brand Loyalty: Damartex's long history and targeted approach foster strong brand affinity among its core demographic.

Damartex's established brands, such as 3Pagen and Coopers of Stortford within its Home & Lifestyle segment, exemplify Cash Cows. These brands have a strong market presence and cater to a loyal senior customer base, ensuring consistent revenue generation.

The company’s core fashion division also operates as a Cash Cow, demonstrating resilience and profitability, even seeing growth in the 2024/2025 fiscal year. This segment benefits from high customer retention due to Damart's targeted approach towards its senior demographic.

Furthermore, essential healthcare products like mobility aids represent another Cash Cow. The increasing elderly population fuels steady demand for these mature products, which require minimal investment while yielding predictable profits.

| Brand/Product Category | Segment | BCG Category | Key Characteristics | 2024/2025 Performance Indicator |

| Damart Fashion | Fashion | Cash Cow | High market share, stable demand, loyal customer base | Increased profitability in Q3 |

| 3Pagen, Coopers of Stortford | Home & Lifestyle | Cash Cow | Established brands, strong senior customer loyalty | Return to growth |

| Basic Mobility & Home Care Aids | Healthcare | Cash Cow | Mature market, consistent demand, low investment needs | Steady expansion driven by aging demographic |

Preview = Final Product

Damartex BCG Matrix

The Damartex BCG Matrix preview you're examining is the definitive document you'll receive upon purchase, offering a clear and actionable strategic framework. This isn't a sample or a demo; it's the complete, professionally formatted analysis ready for immediate integration into your business planning. You'll gain access to the full BCG Matrix, meticulously detailing Damartex's product portfolio across its market share and growth rate quadrants. This comprehensive report is designed for strategic decision-making, enabling you to identify opportunities and allocate resources effectively.

Dogs

Almadia's mail-order channel for home care accessories has been discontinued as of the end of the current half-year. This move signals its classification as a "dog" within the Damartex BCG Matrix, characterized by low market share and low growth. The decision to cease operations highlights the channel's declining profitability and strategic irrelevance, freeing up resources that can be redirected to more promising ventures.

Damartex's physical retail stores, particularly those in less advantageous locations or those not adapting to changing consumer habits, can be categorized as Dogs. These outlets often face declining foot traffic and sales as the broader retail landscape shifts decisively towards online channels. For instance, in 2024, the overall growth of e-commerce in the apparel sector continued to outpace brick-and-mortar sales, putting pressure on underperforming physical locations.

These underperforming stores typically exhibit low market share and minimal growth prospects within their respective segments. They struggle to attract and retain customers, leading to a drain on resources without generating proportionate returns. This situation ties up valuable capital that could otherwise be reinvested in more promising areas, such as digital expansion or more profitable store formats.

The Thermolactyl range, a key offering from Damart, experienced a downturn in the first half of the 2024/2025 financial year. This decline was primarily attributed to weaker-than-anticipated seasonal demand for its products.

Within the Damartex portfolio, Thermolactyl exhibits traits of a Dog in the BCG Matrix. Its low market growth prospects, coupled with a potential for shrinking market share, are concerning indicators.

If this underperformance persists without substantial strategic adjustments or product innovation, Thermolactyl risks becoming a cash drain for Damartex, consuming resources without generating adequate returns.

Vitrine Magique

Vitrine Magique, a brand within Damartex's Home & Lifestyle segment, saw a slight dip of -1.6% in its performance during the first quarter of 2024/2025. This indicates a potential challenge for the brand, especially as the broader division experiences growth.

This performance suggests Vitrine Magique might be operating in a niche market that is either not expanding or is actually shrinking. Its negative growth, contrasted with the division's positive trend, points to a possible low market share within its specific segment.

- Brand Performance: Vitrine Magique's Q1 2024/2025 saw a -1.6% decline.

- Market Position: Likely holds a low market share in a stagnant or declining niche.

- Strategic Outlook: Risks becoming a persistent underperformer without intervention.

Outdated Catalog-Exclusive Product Lines

Certain product lines within Damartex, particularly those heavily reliant on the traditional catalog sales channel, are likely facing challenges. These offerings may not have effectively adapted to the growing trend of online shopping, a shift that is particularly pronounced among their core demographic of senior consumers. As e-commerce adoption continues to rise, these catalog-exclusive items could see diminishing demand and a shrinking market presence.

These products represent a potential "Dog" category in the BCG Matrix due to their low growth prospects and potentially declining market share. Damartex might consider a phased withdrawal or a significant strategic re-evaluation for these lines. For instance, in 2023, the overall UK e-commerce market grew by approximately 8%, while traditional retail sales saw much slower growth, highlighting the digital divide.

- Declining Demand: Products sold primarily via catalog may experience reduced sales as consumers shift to online purchasing.

- Digital Transition Failure: A lack of successful migration to digital platforms can exacerbate the decline.

- Market Share Erosion: With increasing e-commerce adoption by the senior demographic, these products risk losing market share.

- Strategic Re-evaluation: Damartex may need to divest or significantly revamp these underperforming product lines.

Dogs represent business units or products with low market share in a low-growth industry. These entities typically consume more resources than they generate, often requiring significant investment to maintain their position or a strategic decision for divestment. Damartex's discontinued mail-order channel and underperforming physical stores exemplify this category, as they struggle with declining sales and relevance in a rapidly evolving retail landscape.

The Thermolactyl range, due to weaker seasonal demand in early 2024/2025, and Vitrine Magique, with its Q1 2024/2025 performance dip of -1.6%, also show Dog characteristics. Products heavily reliant on traditional catalog sales, failing to adapt to the digital shift, are further examples of potential Dogs. These segments require careful evaluation to prevent them from becoming persistent cash drains.

Question Marks

Damartex's potential expansion into advanced telemedicine and remote monitoring for seniors positions these services as Question Marks within its BCG Matrix. The senior care product market is experiencing significant technological growth, with telemedicine and smart wearables becoming increasingly important. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a high-growth area for these solutions.

Currently, Damartex likely holds a minimal market share in this specialized segment, necessitating considerable investment to establish a foothold and gain customer adoption. These initiatives are cash-intensive, as they require development, marketing, and infrastructure, but they hold the promise of evolving into Stars if Damartex successfully captures a significant portion of this expanding market.

Damartex's expansion into new European markets, focusing on seniors and employing a digital-first approach, presents a significant growth avenue. Currently, the company's presence is concentrated in France, the UK, Belgium, and Germany. This strategic move targets less penetrated markets where Damartex holds a low market share, indicating substantial untapped potential.

Initiating these ventures demands considerable investment in marketing and logistics to establish brand awareness and secure a market position. While the inherent uncertainty of new market entry remains, the projected growth trajectory for senior-focused digital services in Europe, estimated to reach €150 billion by 2025 according to Statista, underscores the promising nature of this strategy.

Damartex's exploration of AI-driven personalized product recommendations for seniors positions this initiative as a potential Question Mark within its BCG Matrix. The company is investing in sophisticated AI to tailor offerings, aiming to boost customer engagement and sales in a market segment that values personalized service.

However, the significant upfront costs associated with developing and deploying advanced AI systems present a considerable financial hurdle. Furthermore, the actual market reception and the quantifiable impact on Damartex's revenue streams remain uncertain, making this a strategic area requiring close monitoring and further validation.

Sustainable and Eco-Designed Collections

Damartex's dedication to corporate social responsibility is evident in its sustainable and eco-designed collections. In 2024, 33% of their offerings met these criteria, a figure they aim to expand, tapping into a significant and expanding consumer demand for environmentally conscious products.

These sustainable lines, particularly those tailored for seniors, represent a strategic entry into a high-growth market segment. However, within Damartex's broad product range, these collections likely hold a low initial market share, necessitating dedicated investment in consumer education and brand building to establish a stronger presence.

- Market Share: Sustainable collections currently represent a small fraction of Damartex's overall portfolio, but this is expected to grow.

- Consumer Trend: A significant portion of consumers, especially seniors, are increasingly prioritizing eco-friendly and sustainably produced goods.

- Investment Needs: Developing and marketing these collections requires upfront investment in R&D, material sourcing, and consumer awareness campaigns.

- Growth Potential: Damartex's focus on this area positions them to capture a larger share of the expanding sustainable fashion and homeware market for older demographics.

Community-Based and Social Engagement Platforms for Seniors

The senior living market is seeing a significant shift towards community-based models and enhanced social engagement. Damartex's development of digital platforms focused on fostering these connections, potentially integrating with their existing product lines, would position them in a high-growth segment.

These digital initiatives represent a strategic move to deepen customer loyalty and broaden Damartex's market reach beyond conventional retail. While requiring substantial initial investment, the potential for high returns is considerable, aligning with a Stars category in the BCG Matrix.

- Market Growth: The global senior living market was valued at approximately $773.7 billion in 2023 and is projected to grow, with digital engagement platforms being a key driver.

- Customer Retention: Platforms that facilitate social interaction can significantly improve customer retention rates, as seen in other subscription-based digital services.

- Investment vs. Return: Initial development costs for robust digital platforms are high, but the long-term benefits of increased engagement and potential new revenue streams can offer substantial returns.

- Competitive Landscape: Competitors are increasingly investing in digital solutions to enhance the senior living experience, making this a crucial area for Damartex to capture market share.

Damartex's ventures into new digital services and international markets for seniors represent classic Question Marks. These initiatives require substantial investment to build market share in areas where Damartex currently has limited presence, but they tap into high-growth potential, particularly in the expanding digital health and senior living sectors. For instance, the senior living market is projected for significant growth, with digital engagement platforms playing a crucial role.

The company's focus on AI-driven personalization and sustainable product lines also falls into this category. While these areas show promise, they demand considerable upfront capital for development and market penetration. The success of these ventures hinges on Damartex's ability to capture significant market share in these nascent or evolving segments, transforming them from Question Marks into potential Stars.

| Initiative | Market Growth Potential | Current Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Advanced Telemedicine/Remote Monitoring | High (Global digital health market valued at ~$200 billion in 2023) | Low | High | Question Mark |

| New European Market Expansion (Digital-First Seniors) | High (European senior digital services projected to reach €150 billion by 2025) | Low | High | Question Mark |

| AI-Driven Personalized Recommendations | Medium to High (Growing demand for personalized retail experiences) | Low | High | Question Mark |

| Sustainable Collections for Seniors | High (Increasing consumer demand for eco-friendly products) | Low | Medium | Question Mark |

| Digital Platforms for Senior Social Engagement | High (Global senior living market ~$773.7 billion in 2023, with digital engagement as a key driver) | Low | High | Question Mark |

BCG Matrix Data Sources

Our Damartex BCG Matrix leverages comprehensive market data, including sales figures, customer segmentation, and competitor analysis, to accurately position each business unit.