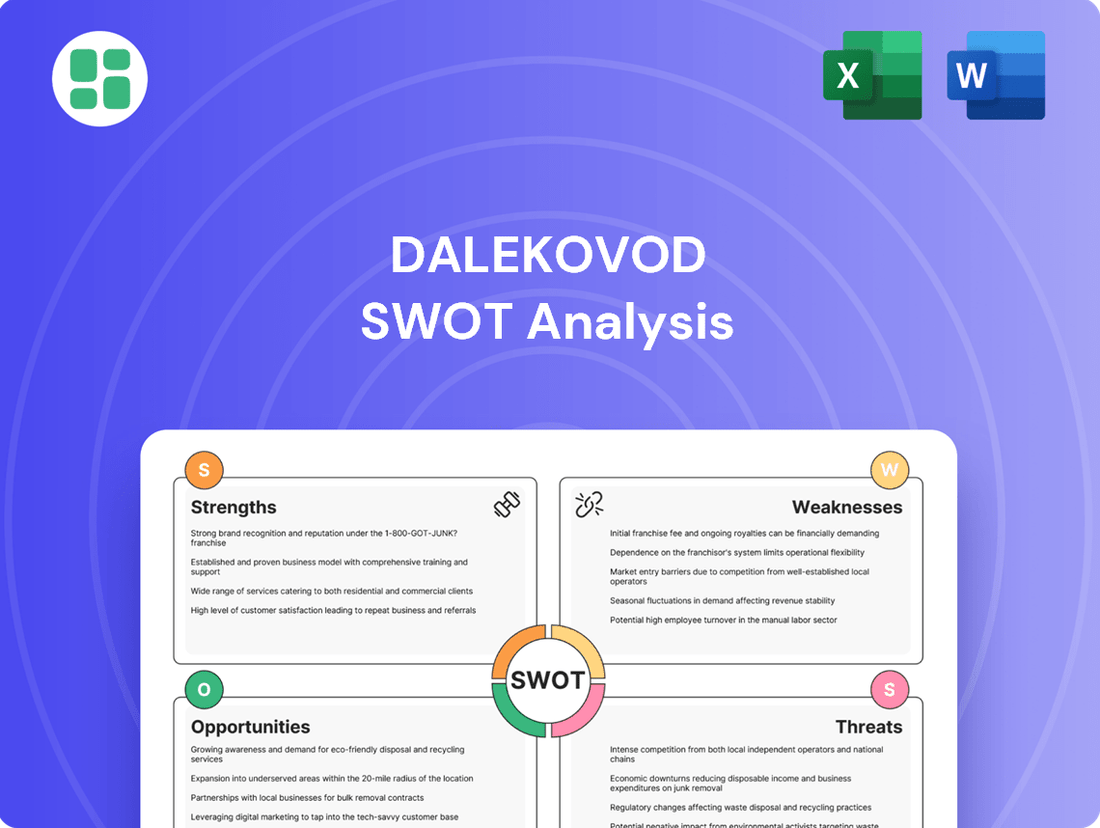

Dalekovod SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dalekovod Bundle

Dalekovod's strong engineering expertise and established market presence are significant strengths, but potential weaknesses in adapting to new technologies could hinder growth. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Dalekovod's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dalekovod Group showcased impressive financial strength in 2024, reporting a 17% surge in operating revenues to EUR 195.8 million. This upward trend was further underscored by an EBITDA of EUR 12.5 million, marking an EUR 11.3 million improvement from the prior year.

The company's momentum carried strongly into the first quarter of 2025. Sales reached EUR 54.65 million, a notable increase from EUR 36.09 million in the same period of 2024, demonstrating sustained operational success and effective market engagement.

Dalekovod's substantial contract book at the close of 2024, valued at EUR 415 million, highlights a significant increase of EUR 134 million compared to the previous year. This robust backlog provides a secure revenue stream and indicates strong demand for its services, underpinning future business activity.

The company's ability to secure such a large volume of work demonstrates effective tender participation and strategic foresight in identifying and winning key projects. This growing order book is a clear indicator of Dalekovod's competitive strength and its positive trajectory in the market.

Dalekovod's core strength lies in its specialized expertise in power infrastructure, particularly in the design, construction, and maintenance of high-voltage transmission lines and substations. This deep knowledge allows them to provide end-to-end Engineering, Procurement, and Construction (EPC) services, a crucial offering in the energy sector.

The company's integrated approach, which includes the manufacturing of steel structures, further solidifies its position as a comprehensive solution provider. This vertical integration can lead to greater control over project timelines and costs, a significant advantage in large-scale infrastructure projects.

Established International Presence

Dalekovod's established international presence is a significant strength, with operations extending beyond its domestic Croatian market. The company has actively secured substantial projects in diverse international arenas, including Germany, Slovenia, and Albania throughout 2024. This broad geographical footprint, encompassing sales in Sweden, Norway, Bosnia Herzegovina, Macedonia, Ukraine, and the United Kingdom, demonstrates a proven ability to navigate varied regulatory landscapes and operational demands.

This global reach is not merely about scale; it's a strategic advantage that significantly reduces the company's dependence on any single market. By diversifying its revenue streams across multiple countries, Dalekovod enhances its resilience against regional economic downturns or sector-specific challenges. The company's international engagement in 2024 highlights its capacity to compete and deliver in demanding global infrastructure sectors.

Key aspects of Dalekovod's international operations include:

- Diversified Market Exposure: Operations and sales across numerous European countries, reducing single-market risk.

- Project Acquisition Success: Securing significant projects in 2024 in markets like Germany, Slovenia, and Albania.

- Operational Experience: Proven track record in varied regulatory and operational environments across its international footprint.

- Global Sales Network: Presence in Sweden, Norway, Bosnia Herzegovina, Macedonia, Ukraine, and the United Kingdom.

Commitment to Sustainability and ESG Principles

Dalekovod Group actively demonstrates its dedication to sustainability and Environmental, Social, and Governance (ESG) principles. This commitment is clearly outlined in its annual Sustainability Reports and reinforced through its participation in initiatives like the UN Global Compact. The company's operational strategy incorporates sustainable development, actively supporting the green transition through its work on energy and infrastructure projects.

This focus on ESG not only positions Dalekovod in line with prevailing global trends but also significantly bolsters its corporate image. Such a stance makes the company more appealing to investors and partners who prioritize social responsibility and environmental stewardship. For instance, Dalekovod's 2023 Sustainability Report highlighted a 15% reduction in its carbon footprint compared to 2022, a tangible result of its integrated sustainability efforts.

- Annual Sustainability Reports: Publicly available documents detailing ESG performance and targets.

- UN Global Compact Participation: Adherence to ten universally accepted principles in human rights, labor, environment, and anti-corruption.

- Green Transition Projects: Involvement in renewable energy infrastructure and energy efficiency initiatives.

- Investor Attractiveness: Enhanced appeal to socially conscious investors seeking sustainable investment opportunities.

Dalekovod's strengths are rooted in its robust financial performance, evident in a 17% revenue increase to EUR 195.8 million in 2024 and a significant EBITDA improvement. The company's substantial EUR 415 million contract backlog at the end of 2024, up EUR 134 million year-on-year, signals strong market demand and provides revenue visibility.

Specialized expertise in high-voltage power infrastructure and integrated manufacturing capabilities position Dalekovod as a comprehensive EPC provider. Its expansive international presence, with operations and sales across numerous European countries in 2024, reduces market dependency and demonstrates global competitiveness.

Dalekovod's commitment to ESG principles, highlighted by its participation in the UN Global Compact and efforts to reduce its carbon footprint, enhances its corporate image and investor appeal.

| Metric | 2023 | 2024 | Change |

| Operating Revenues (EUR million) | 167.35 | 195.8 | +17% |

| EBITDA (EUR million) | 1.2 | 12.5 | +EUR 11.3 million |

| Contract Backlog (EUR million) | 281 | 415 | +EUR 134 million |

What is included in the product

Delivers a strategic overview of Dalekovod’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Dalekovod's strategic challenges and opportunities.

Weaknesses

Dalekovod's reliance on large-scale infrastructure projects means its revenue is tied to the success and timing of these major undertakings. This creates inherent risks, as delays in approvals or funding can directly affect when income is recognized and impact overall profitability. For instance, a significant delay in a key transmission line project awarded in late 2023 could push substantial revenue into 2025, creating a noticeable dip in 2024 figures if not offset by other work.

Dalekovod's position in the engineering and construction sector inherently brings significant operating cost pressures. Labor, raw material procurement, and the maintenance of specialized heavy equipment are substantial ongoing expenses. While the company has been working on efficiency gains, maintaining profitability hinges on rigorous cost management, particularly given the competitive landscape.

The company's margins can be squeezed by unpredictable swings in the cost of essential inputs like steel. For instance, if Dalekovod secures fixed-price contracts and then faces an unexpected surge in steel prices, as seen in some periods of 2023 and early 2024, their profitability on those projects could be significantly impacted.

Dalekovod has a history marked by significant financial headwinds, including periods of substantial debt accumulation and liquidity shortages. While the company has shown resilience, exemplified by its recapitalization efforts and operational improvements, the lingering effects of these past struggles could still impact market confidence and require ongoing diligent financial oversight.

For instance, as of the end of 2023, Dalekovod's total debt stood at approximately HRK 1.4 billion. Although this represents a reduction from previous years, it underscores the importance of continued prudent debt management and a focus on maintaining healthy working capital to navigate potential future financial pressures.

Geographical Concentration and Political Risks

Dalekovod's operational focus remains heavily weighted towards specific European countries, notably Croatia, Sweden, and Norway. This concentration, while potentially offering deep market penetration, also presents a significant vulnerability. For instance, if economic conditions in Croatia were to deteriorate, it could disproportionately impact Dalekovod's overall performance, given its substantial presence there.

This geographical concentration inherently links Dalekovod's profitability to country-specific risks. Political instability or abrupt regulatory changes in Sweden or Norway, for example, could directly hinder ongoing projects or deter future investments. Such shifts can create uncertainty and negatively affect the company's project pipeline and overall financial health.

- Geographical Concentration: Significant operations in Croatia, Sweden, and Norway.

- Political Risk Exposure: Vulnerability to country-specific regulatory changes and political instability.

- Economic Sensitivity: Susceptibility to localized economic downturns impacting project pipelines.

- Impact on Profitability: Adverse political or economic shifts in key markets can directly reduce earnings.

Talent Retention and Attraction Challenges

Dalekovod faces ongoing difficulties in attracting and keeping highly specialized talent, a critical need for its high-voltage power infrastructure projects. Despite salary adjustments and enhanced reward structures implemented in 2024, the engineering and construction sector's competitive landscape for skilled professionals continues to pose a significant hurdle. This persistent talent gap directly threatens the company's ability to execute projects efficiently and hinders its future growth prospects.

The specialized nature of Dalekovod's work demands a workforce with unique expertise, making talent retention a constant challenge. The company's 2024 initiatives, including salary increases and more transparent reward systems, aim to mitigate this, but the broader industry-wide shortage of qualified engineers and construction specialists remains a formidable obstacle. A lack of sufficient skilled personnel could directly impact project timelines and the company's capacity to take on new ventures.

- Specialized Skill Requirements: Dalekovod's focus on high-voltage power infrastructure necessitates a workforce with niche engineering and technical skills.

- Competitive Labor Market: The engineering and construction sectors are experiencing intense competition for qualified professionals, impacting Dalekovod's ability to attract and retain talent.

- Impact on Operations: A shortage of skilled personnel can lead to project delays, increased labor costs, and a reduced capacity for undertaking new projects, thereby affecting overall growth and profitability.

Dalekovod's reliance on large-scale projects means revenue is tied to their success and timing, with delays in approvals or funding directly impacting profitability. The company also faces significant operating cost pressures from labor, materials, and equipment maintenance, requiring rigorous cost management. Fluctuations in input costs, such as steel prices, can squeeze margins, particularly on fixed-price contracts, as seen in periods of 2023 and early 2024.

The company's historical financial challenges, including past debt accumulation and liquidity issues, could still affect market confidence despite recapitalization efforts. For instance, as of the end of 2023, Dalekovod's total debt was approximately HRK 1.4 billion, underscoring the need for continued prudent debt management.

Dalekovod's concentrated geographical presence in Croatia, Sweden, and Norway makes it vulnerable to country-specific economic downturns or regulatory changes. A deterioration in economic conditions in Croatia, for example, could disproportionately impact overall performance. Political instability or abrupt regulatory shifts in Sweden or Norway can also hinder ongoing projects and future investments.

Attracting and retaining specialized talent remains a significant hurdle for Dalekovod, despite efforts like salary adjustments in 2024. The competitive landscape for skilled engineers and construction professionals poses a persistent challenge, potentially impacting project execution efficiency and future growth prospects.

Preview Before You Purchase

Dalekovod SWOT Analysis

This preview reflects the real Dalekovod SWOT analysis document you'll receive—professional, structured, and ready to use. You're seeing the actual content that will be in your downloaded file. Unlock the full, detailed report to gain comprehensive insights into Dalekovod's strategic position.

Opportunities

The global energy transition presents a substantial opportunity for Dalekovod. As nations increasingly invest in renewable energy sources like wind and solar, there's a parallel surge in demand for new transmission infrastructure to connect these often remote generation sites to the grid. This expansion is critical for ensuring reliable power delivery and achieving decarbonization goals.

The modernization of existing power grids to handle higher loads and improve efficiency is another key driver. Aging infrastructure across Europe requires significant upgrades to support the influx of renewable energy and meet growing electricity demands. Dalekovod's expertise in constructing and maintaining high-voltage transmission lines positions it to capitalize on this widespread need for infrastructure renewal.

Dalekovod's core business directly supports these green transition objectives. For instance, the European Union's Renewable Energy Directive aims for 42.5% renewable energy by 2030, requiring substantial grid investments. Dalekovod's proven track record in large-scale power transmission projects makes it a natural partner for utilities and project developers undertaking these vital energy infrastructure developments across the continent.

The European Union's commitment to bolstering energy security and its green transition presents significant opportunities. For instance, the EU's Connecting Europe Facility (CEF) program is channeling billions into energy infrastructure projects across member states. These initiatives focus on upgrading national grids, building new cross-border interconnections, and integrating renewable energy sources, all areas where Dalekovod possesses core competencies.

Countries within Dalekovod's operational sphere, including Croatia and neighboring Balkan nations, are prime beneficiaries of these EU-backed infrastructure drives. With an estimated €800 billion allocated for the green transition and digital transformation under the NextGenerationEU recovery plan, a substantial portion is earmarked for energy infrastructure upgrades. Dalekovod is strategically positioned to compete for these large-scale, publicly funded contracts, leveraging its expertise in high-voltage power lines and substations.

Dalekovod's recent success in securing direct contracts in Germany, a key European market, highlights a significant opportunity for expansion beyond its established regions. This demonstrates a proven ability to compete and win in new territories.

Exploring and deepening its presence in other high-growth or underserved international markets for power transmission and electrical infrastructure presents a clear path to unlocking new revenue streams and diversifying its operational footprint.

Strategic partnerships or targeted acquisitions in these emerging markets could significantly accelerate Dalekovod's expansion, allowing it to leverage local expertise and market access more effectively.

Technological Advancements in Smart Grids and Digitalization

The global smart grid market is projected to reach over $100 billion by 2027, presenting significant opportunities for Dalekovod to leverage its expertise in electrical infrastructure. By integrating advanced digital technologies, Dalekovod can offer enhanced grid management, predictive maintenance, and energy efficiency solutions, catering to the growing demand for modernized energy systems.

Dalekovod can capitalize on the increasing investments in grid digitalization, which is crucial for renewable energy integration and grid stability. Developing and implementing smart grid solutions allows for improved operational efficiency and the creation of new revenue streams through specialized services.

- Smart Grid Market Growth: The global smart grid market is expected to grow substantially, with projections indicating a compound annual growth rate (CAGR) of around 15-20% in the coming years, reaching figures well over $100 billion by 2027-2030.

- Digitalization Investment: Significant global investments are being channeled into the digitalization of energy infrastructure, with key regions like Europe and North America leading the charge, often exceeding tens of billions of dollars annually in grid modernization efforts.

- Efficiency Gains: Implementing smart grid technologies can lead to operational efficiency improvements of up to 20-30% in areas like fault detection and restoration time.

- R&D Focus: Companies investing in R&D for smart grid solutions, particularly in areas like AI-driven predictive maintenance and cybersecurity for energy systems, are positioned to gain a significant competitive advantage.

Synergies within KONČAR Group

Being integrated into the KONČAR Group presents Dalekovod with significant opportunities for enhanced collaboration, especially within the metal structures sector. This synergy allows for the exploration of combined market strength and operational efficiencies.

Restructuring possibilities, such as potentially merging Dalekovod MK d.o.o. with KONČAR - Metalne konstrukcije d.o.o., are being analyzed. Such a move could streamline operations and bolster market presence.

Leveraging the extensive resources and specialized expertise of the broader KONČAR Group is a key advantage. This can significantly boost Dalekovod's overall competitiveness in the market.

- Enhanced Collaboration: Deeper synergies within the KONČAR Group, particularly in metal structures.

- Operational Efficiencies: Potential for streamlining operations through restructuring, like merging Dalekovod MK with KONČAR - Metalne konstrukcije.

- Market Strength: Combining market presence and leveraging group resources to improve competitiveness.

The global energy transition, driven by decarbonization goals, presents a significant opportunity for Dalekovod as demand for new transmission infrastructure to connect renewable energy sources like wind and solar to the grid surges. Modernizing aging power grids across Europe to handle higher loads and integrate renewables is another critical area, with the EU aiming for 42.5% renewable energy by 2030, requiring substantial grid investments. Dalekovod's expertise in high-voltage transmission lines positions it to capitalize on these vital energy infrastructure developments.

The European Union's focus on energy security and its green transition, supported by initiatives like the Connecting Europe Facility (CEF) program, channels billions into energy infrastructure projects. Dalekovod is well-positioned to benefit from these investments in upgrading national grids and building new cross-border interconnections. Furthermore, the smart grid market, projected to exceed $100 billion by 2027, offers opportunities for Dalekovod to integrate digital technologies for enhanced grid management and energy efficiency.

Dalekovod's integration within the KONČAR Group provides opportunities for enhanced collaboration, particularly in the metal structures sector, potentially streamlining operations through restructuring. Leveraging the broader group's resources and expertise significantly boosts Dalekovod's overall market competitiveness.

| Opportunity Area | Key Drivers | Potential Impact |

| Energy Transition & Grid Modernization | EU renewable energy targets (42.5% by 2030), grid upgrades for renewables, aging infrastructure replacement | Increased demand for transmission line construction and maintenance services, securing large-scale EU-funded projects |

| Smart Grid Development | Global smart grid market growth (over $100B by 2027), digitalization of energy infrastructure | Expansion into advanced grid management solutions, new revenue streams from specialized services, improved operational efficiency |

| Group Synergies (KONČAR) | Collaboration in metal structures, potential operational restructuring | Enhanced market strength, improved competitiveness through shared resources and expertise |

Threats

The power engineering and construction arena is fiercely contested, with both local and global entities aggressively pursuing significant infrastructure contracts. This crowded market often squeezes profit margins on bids and elevates the complexity of project execution, demanding constant innovation and cost control from participants like Dalekovod.

In 2023, for instance, the global power T&D (transmission and distribution) infrastructure market was valued at approximately $220 billion, with projections showing steady growth. This competitive landscape means Dalekovod faces pressure not only from established international giants but also from agile regional competitors, necessitating a sharp focus on efficiency and unique value propositions to secure its market share.

Economic downturns pose a significant threat to Dalekovod. Global or regional recessions can drastically curtail government and private sector spending on essential infrastructure, directly impacting the demand for Dalekovod's services. For instance, a projected slowdown in global infrastructure spending in 2024-2025 due to persistent inflation and higher interest rates could lead to project delays or cancellations, shrinking Dalekovod's order pipeline.

As Dalekovod's revenue is heavily reliant on project execution, a widespread reduction in capital expenditure by utility companies or national governments would directly translate to reduced revenue and potentially lower profitability. The economic uncertainty associated with these downturns also makes securing financing for large-scale infrastructure projects more challenging, further hindering project commencement and Dalekovod's ability to secure new contracts.

Dalekovod's reliance on commodities like steel and copper for constructing power transmission lines and substations exposes it to significant risks from price volatility. For instance, during 2024, global steel prices experienced fluctuations due to supply chain disruptions and demand shifts, directly impacting project budgets. This volatility can significantly squeeze profit margins on long-term projects where prices are fixed, especially if hedging strategies are insufficient.

Regulatory and Permitting Complexities

Dalekovod faces significant hurdles due to the intricate web of regulations and permitting processes inherent in large-scale infrastructure development across diverse international markets. These complexities, including rigorous environmental impact assessments and protracted approval timelines, can substantially impede project progress and inflate expenditures. For instance, in 2024, the European Union continued to emphasize stringent environmental standards, potentially adding months to permitting for new energy infrastructure projects.

Changes in environmental legislation, evolving land acquisition statutes, or unforeseen delays in securing crucial permits represent substantial risks. These can trigger cascading effects, leading to extended project schedules and escalating costs, impacting Dalekovod's financial projections. Navigating the patchwork of international regulatory requirements further amplifies operational challenges and the potential for compliance-related setbacks.

- Regulatory Scrutiny: Infrastructure projects frequently encounter evolving environmental regulations, impacting project timelines and costs.

- Permitting Delays: Lengthy and unpredictable permitting processes can lead to significant project postponements and budget overruns.

- International Complexity: Operating across different countries means adhering to varied and often conflicting regulatory frameworks.

Geopolitical Risks and Supply Chain Disruptions

Dalekovod's international operations place it directly in the path of geopolitical risks, such as trade wars or political unrest in countries where it undertakes projects or procures materials. These events can severely disrupt its supply chains, leading to higher shipping expenses and the potential halting of ongoing projects. For instance, the ongoing tensions in Eastern Europe, a region with significant industrial activity, could impact the availability and cost of raw materials and specialized components vital for Dalekovod's infrastructure projects.

The company's reliance on global suppliers for critical, specialized components creates a significant vulnerability to widespread supply chain disruptions. Events like the semiconductor shortages experienced globally in 2021-2023, which affected numerous industries, highlight how dependent sectors can be on single points of failure in international logistics. Dalekovod, in its 2024 operational planning, must account for the possibility of such shocks affecting its project timelines and cost estimations.

- Geopolitical Instability: Increased risk from conflicts or trade disputes in key operational or sourcing regions.

- Supply Chain Vulnerability: Dependence on international suppliers for specialized components can lead to project delays and cost overruns.

- Logistical Cost Increases: Geopolitical events can escalate shipping and transportation expenses, impacting project profitability.

- Project Suspension Risk: Political instability or sanctions could force the suspension or cancellation of projects in affected countries.

Dalekovod operates in a highly competitive sector, facing pressure from both domestic and international rivals. This intense competition, evident in the global power T&D market valued at approximately $220 billion in 2023, can compress profit margins and necessitate constant innovation to maintain market share.

Economic downturns present a substantial threat, as reduced government and private sector spending on infrastructure, projected for 2024-2025 due to inflation and interest rates, can directly impact Dalekovod's project pipeline and revenue.

Volatility in commodity prices, such as steel, which saw fluctuations in 2024, directly affects project budgets and can significantly erode profit margins on fixed-price contracts if hedging strategies are insufficient.

Navigating complex and evolving international regulations, including stringent EU environmental standards in 2024, can lead to project delays and increased expenditures, amplifying operational challenges.

Geopolitical instability and supply chain disruptions, exemplified by the semiconductor shortages of 2021-2023, pose risks to material availability, project timelines, and logistical costs, requiring careful planning for 2024 operations.

SWOT Analysis Data Sources

This Dalekovod SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses. These sources provide a reliable basis for understanding Dalekovod's current position and future potential.