Dalekovod Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dalekovod Bundle

Dalekovod's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of its buyers. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Dalekovod’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dalekovod relies on a select group of suppliers for critical inputs like specialized steel structures and high-voltage electrical components. The uniqueness of these components means there are fewer alternatives, potentially giving suppliers more leverage.

For example, in 2024, the market for advanced engineering software showed consolidation, with a few key players dominating. This concentration, coupled with the highly customized nature of some inputs, grants these suppliers significant bargaining power over Dalekovod.

Dalekovod would likely incur significant costs if it were to switch suppliers for its specialized electrical components and construction materials. These costs could include the expense of retooling manufacturing processes to accommodate new specifications, the time and resources needed to requalify new components to meet stringent industry standards, and the potential penalties or renegotiation fees associated with breaking existing long-term supply contracts. For instance, in the energy infrastructure sector, a single component change could necessitate extensive testing and certification, potentially delaying projects by months.

The threat of forward integration by Dalekovod's suppliers, such as those providing specialized components or raw materials for power transmission lines, is generally considered low. While some suppliers might have the technical expertise, the significant capital investment and complex project management required for Engineering, Procurement, and Construction (EPC) services in this sector present a substantial barrier to entry. For instance, in 2024, the global EPC market for energy infrastructure, while robust, is dominated by established players with decades of experience and extensive supply chains, making it difficult for component manufacturers to transition effectively.

Importance of Supplier's Input to Dalekovod's Cost Structure

The bargaining power of suppliers is a crucial factor for Dalekovod, particularly concerning the cost of raw materials and specialized components. Understanding the proportion of total project costs tied to specific supplier inputs helps gauge their influence. For instance, if steel and specialized electrical equipment constitute a substantial part of Dalekovod's expenditures, suppliers of these items will naturally wield greater pricing power.

In 2024, Dalekovod's reliance on key inputs like steel and electrical components significantly impacts its cost structure. While precise figures for 2024 are still being finalized, historical data suggests that materials and subcontracted specialized work, heavily dependent on supplier pricing, can represent upwards of 60-70% of a project's total cost for companies in the energy infrastructure sector.

- Steel: A primary input for transmission towers and supporting structures, fluctuations in global steel prices directly affect Dalekovod's material costs.

- Specialized Electrical Equipment: Transformers, switchgear, and conductors, often sourced from a limited number of manufacturers, are critical and can be high-cost items.

- Logistics and Transportation: The cost of moving large components to project sites also represents a significant supplier-driven expense.

- Energy Costs: While Dalekovod operates in the energy sector, its own operational energy consumption is also subject to supplier pricing.

Availability of Substitute Inputs

Dalekovod's ability to find alternative materials or technologies for its power transmission projects is crucial. If there are few viable substitutes for specialized components, suppliers gain significant leverage. For instance, in 2024, the global market for high-voltage direct current (HVDC) components saw limited suppliers capable of meeting stringent quality and performance demands.

The scarcity of readily available alternatives for critical inputs, such as specialized conductors or insulators used in high-voltage applications, directly translates to increased bargaining power for Dalekovod's suppliers. This is particularly evident in projects requiring bespoke engineering solutions where customization limits the pool of potential alternative suppliers.

- Limited Substitutes: The market for specialized power transmission components often features a concentrated supplier base, making it difficult for companies like Dalekovod to switch inputs without impacting project timelines or quality.

- Supplier Leverage: When few alternatives exist for essential materials or technologies, suppliers can dictate terms, including pricing and delivery schedules, thereby increasing their bargaining power.

- Technological Dependence: Dalekovod's reliance on specific, advanced manufacturing processes for its transmission towers and equipment means suppliers of these technologies hold considerable sway.

- Innovation Impact: Future innovations in materials science or construction methods could introduce viable substitutes, potentially reducing supplier power over time, though such shifts are often gradual.

Dalekovod's bargaining power with its suppliers is constrained by the specialized nature of its inputs and the limited number of qualified providers. For instance, in 2024, the market for high-voltage electrical components remained concentrated, with a few manufacturers dominating. This scarcity of alternatives means suppliers can command higher prices and dictate terms, directly impacting Dalekovod's project costs, which can represent a significant portion of overall expenses.

| Supplier Input | 2024 Market Condition | Impact on Dalekovod | Supplier Bargaining Power |

|---|---|---|---|

| Specialized Steel Structures | Concentrated market, few alternatives for high-strength alloys. | Increased material costs, potential for project delays if supply is disrupted. | High |

| High-Voltage Electrical Components | Dominated by a few global manufacturers with proprietary technology. | Significant cost component, limited ability to negotiate pricing. | High |

| Advanced Engineering Software | Consolidation among key software providers in 2024. | Reliance on specific software for design and simulation, potential for increased licensing fees. | Moderate to High |

What is included in the product

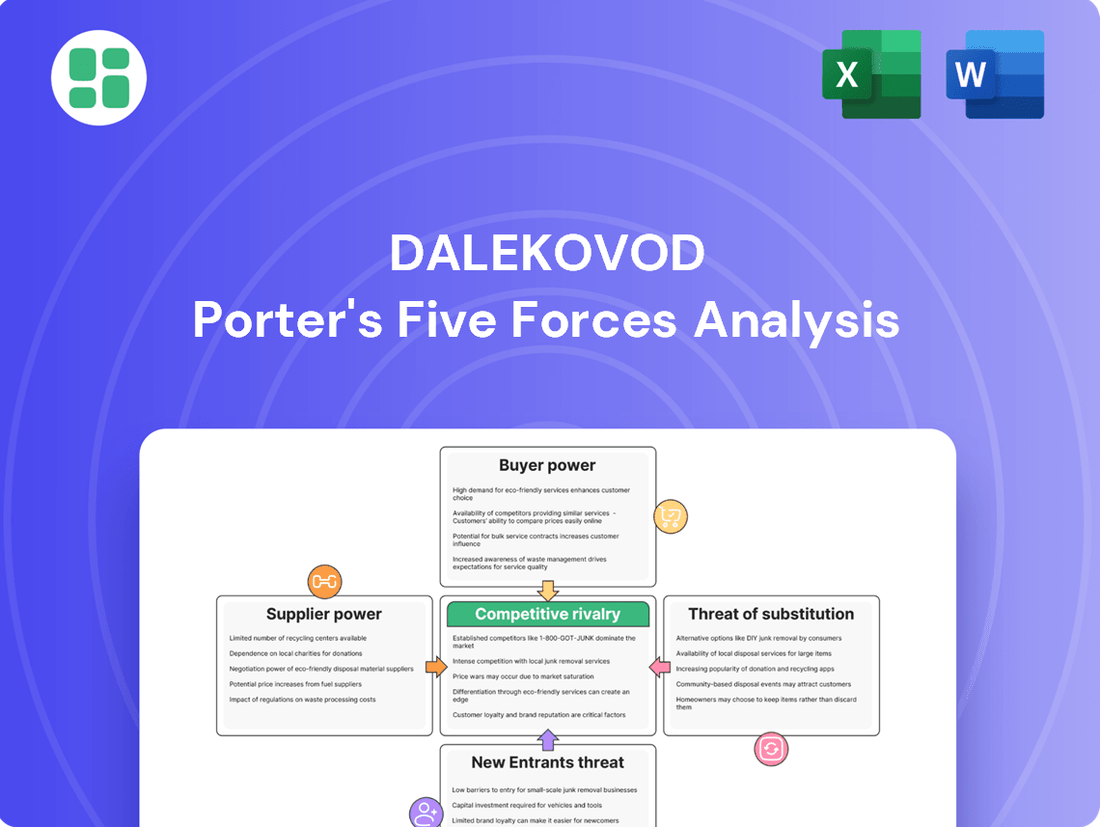

This analysis unpacks Dalekovod's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Effortlessly visualize competitive intensity with a dynamic spider chart, instantly highlighting areas of strategic vulnerability.

Customers Bargaining Power

Dalekovod's customer base is notably concentrated, with state-owned utility companies and large industrial clients for major infrastructure projects forming its core. This concentration means that a few significant customers can wield considerable influence.

For instance, in 2023, the company's top five customers accounted for a substantial portion of its revenue, highlighting the power these large entities hold. Their ability to award or withhold large-scale projects gives them significant leverage in negotiations, impacting pricing and contract terms for Dalekovod.

Customer switching costs for Dalekovod are typically substantial. Moving to a different Engineering, Procurement, and Construction (EPC) provider for major power transmission projects involves significant effort and expense. These projects demand highly specialized technical expertise and often require extensive regulatory approvals, making the transition complex and time-consuming.

The long-term nature of infrastructure development means that once a customer has committed to Dalekovod, the costs and complexities associated with switching are generally high. For instance, if a project is halfway complete, the cost of onboarding a new provider, re-certifying designs, and potentially re-negotiating supply chains can easily run into millions of euros, effectively locking in the customer.

Dalekovod's customers, often national grid operators and large industrial entities, exhibit significant price sensitivity. This is amplified by their reliance on public funding, which is subject to stringent budget constraints and intense public scrutiny. For instance, in 2024, many European countries continued to focus on fiscal discipline, impacting the capital expenditure budgets of state-owned utility companies, a key customer segment for Dalekovod.

The critical nature of energy infrastructure means that while cost is a major factor, reliability and long-term value also play a crucial role in purchasing decisions. However, when budgets are tight, as they have been for many public sector clients in 2024 due to macroeconomic pressures, the immediate price of a project can become a dominant consideration, potentially forcing customers to seek the lowest bid even if it means compromising on certain long-term advantages.

Threat of Backward Integration by Customers

The threat of backward integration by Dalekovod's customers, primarily large utility companies, presents a significant challenge. These utilities might possess the internal engineering and construction capabilities to handle power infrastructure projects themselves, diminishing their need for external Engineering, Procurement, and Construction (EPC) providers like Dalekovod. This potential for in-house execution directly impacts Dalekovod's bargaining power.

While Dalekovod operates in a highly specialized field requiring significant technical expertise and equipment, some major utility clients do maintain substantial engineering departments. For instance, large national grid operators often have dedicated teams for project planning and even some aspects of construction and maintenance. This internal capacity allows them to potentially bring certain operations in-house, thereby reducing their reliance on and bargaining power over Dalekovod.

Consider the financial implications: if a utility company can perform a project for 10-15% less by using its own resources, it creates a strong incentive for backward integration. For example, in 2024, several European utilities announced increased investment in their internal project management and execution capabilities to gain greater control over costs and timelines for grid modernization projects, a trend that could directly affect demand for EPC services.

- Potential for In-house Capabilities: Large utility companies may possess the engineering and construction expertise to manage power infrastructure projects internally.

- Reduced Reliance on EPCs: The ability of customers to perform tasks like design, construction, and maintenance in-house directly weakens their dependence on companies like Dalekovod.

- Cost Savings Incentive: Utilities might opt for backward integration if they estimate significant cost reductions compared to outsourcing to external EPC providers.

- Strategic Control: Bringing projects in-house can give utilities greater control over project timelines, quality, and strategic direction.

Customer Information and Project Transparency

Customers in the energy infrastructure sector, particularly large utility companies or government entities, often possess significant leverage due to their deep understanding of project lifecycle costs and available alternatives. This is particularly true when they have well-established internal engineering departments or engage specialized consultants. For instance, in 2024, major infrastructure projects often involve detailed bidding processes where clients can scrutinize every aspect of a contractor's proposal, from material sourcing to labor allocation.

The level of information and transparency customers have directly impacts their bargaining power. When clients can easily access data on material prices, labor rates, and comparable project expenditures, they are better positioned to negotiate favorable terms. This transparency is increasingly facilitated by industry-wide data sharing initiatives and the rise of sophisticated project management software. In 2024, many large-scale energy projects saw clients demanding greater visibility into supply chain costs, directly influencing contract negotiations.

- Informed Clients Drive Price Pressure: Customers with robust internal engineering teams or external consultants can effectively benchmark project costs, leading to more aggressive pricing negotiations.

- Transparency in Project Execution: Access to detailed information on design, materials, and execution phases empowers clients to identify potential cost savings and negotiate better terms.

- Market Data Influence: The availability of industry benchmarks and cost data for similar projects in 2024 allows sophisticated buyers to exert considerable influence over contractor pricing.

- Negotiating Power through Alternatives: Well-informed customers understand the competitive landscape and the availability of alternative solutions or contractors, further strengthening their bargaining position.

Dalekovod's bargaining power with customers is moderate, influenced by the specialized nature of its services and the significant switching costs involved in large infrastructure projects. However, customer concentration, price sensitivity, and the potential for backward integration by major clients temper this power.

In 2024, many European state-owned utilities, a key customer segment for Dalekovod, faced budget constraints due to fiscal discipline, increasing their price sensitivity. This meant that while switching costs remained high, the immediate project price became a more critical negotiation point.

The potential for large utility companies to perform certain project phases in-house, if cost-effective, also acts as a check on Dalekovod's pricing power. For example, if a utility could save 10-15% by managing a project internally, it incentivizes them to consider backward integration, impacting Dalekovod's leverage.

Customers' access to market data and their ability to scrutinize project costs in 2024, often through detailed bidding processes, further empowered them to negotiate more favorable terms, directly influencing Dalekovod's pricing strategies.

Preview the Actual Deliverable

Dalekovod Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Dalekovod Porter's Five Forces Analysis provides an in-depth examination of the competitive landscape, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry within the industry.

Rivalry Among Competitors

Dalekovod faces significant competitive rivalry from both large, established international players and more specialized regional firms in the power transmission and electrical infrastructure EPC sector. Domestically in Croatia, key competitors include companies like Končar Elektroindustrija, which also offers a broad range of electrical equipment and infrastructure solutions. Internationally, Dalekovod competes with global giants such as Siemens Energy, General Electric, and ABB, as well as other European EPC contractors like Vinci Energies and Bouygues Construction.

The number of competitors varies by project size and geographical focus, but the industry is characterized by a substantial presence of major multinational corporations with extensive resources and global reach. For instance, the global power transmission and distribution market was valued at approximately USD 260 billion in 2023 and is projected to grow, indicating a large and active competitive landscape. These larger players often have the capacity to undertake massive, complex projects, posing a significant challenge to regional specialists like Dalekovod.

Regional specialists, while often smaller in scale, can be formidable competitors due to their local market knowledge, established relationships, and potentially more agile operational structures. These companies are adept at navigating specific regulatory environments and understanding local demand dynamics. The intensity of competition is further amplified by the cyclical nature of infrastructure spending and the drive for energy transition projects, which attract a wide array of participants seeking to capitalize on new opportunities.

The power infrastructure and Engineering, Procurement, and Construction (EPC) market is experiencing robust global growth, driven by the transition to renewable energy and the need to upgrade aging grids. Projections indicate substantial investment in energy infrastructure, with some estimates suggesting the global power transmission and distribution market could reach over $300 billion by 2028. However, in more developed regions, the growth for new high-voltage transmission lines and substations may be more measured. This can lead to heightened competition among established players like Dalekovod for a finite number of new projects.

Dalekovod's competitive rivalry is influenced by its product and service differentiation. The company offers a range of services including design, construction, maintenance, and manufacturing of power transmission and distribution infrastructure. The degree to which these offerings are unique compared to competitors plays a significant role in mitigating direct price competition.

In 2024, Dalekovod's ability to showcase strong technical expertise, particularly in complex project management and adherence to stringent safety standards, serves as a key differentiator. For instance, their specialized manufacturing capabilities for high-voltage equipment, if distinct from rivals, can command premium pricing and foster customer loyalty, thereby reducing pressure for price-based rivalry.

Exit Barriers for Competitors

Competitors in the power infrastructure Engineering, Procurement, and Construction (EPC) market, like Dalekovod, face significant hurdles when trying to exit. These barriers often keep companies engaged even when market conditions are unfavorable, intensifying rivalry.

High fixed assets are a major factor. Companies have invested heavily in specialized equipment, manufacturing facilities, and testing infrastructure. For instance, a significant portion of an EPC firm's capital is tied up in heavy machinery and dedicated production lines for components like transmission towers or substations. The resale value of such specialized assets is often substantially lower than their book value, making a complete exit financially punitive.

Furthermore, the need for specialized labor creates another layer of difficulty. The power infrastructure sector requires highly skilled engineers, project managers, and technicians with specific expertise in areas like high-voltage systems or grid integration. Retaining this talent is crucial for ongoing projects, but the specialized nature of their skills can make it challenging to redeploy them to other industries, increasing the cost and complexity of downsizing or closure.

Long-term project commitments also act as substantial exit barriers. EPC contracts often span several years, involving multi-stage deliverables and ongoing maintenance obligations. Companies are legally and financially bound to complete these projects, even if profitability declines. For example, a major transmission line project might have a five-year construction timeline with penalties for early termination. This commitment means that even in a downturn, firms must continue operations to fulfill existing contracts, leading to sustained competitive pressure as they fight to retain market share and cover fixed costs.

- High Capital Investment: Significant expenditure on specialized plant, machinery, and technology for power infrastructure projects.

- Specialized Workforce Requirements: Dependence on highly skilled engineers and technicians with niche expertise.

- Long-Term Contractual Obligations: Multi-year project commitments that cannot be easily terminated without penalty.

- Asset Specificity and Low Resale Value: Specialized equipment often has limited use outside the power infrastructure sector, leading to substantial write-downs upon sale.

Switching Costs for Customers Among Competitors

The ease with which clients can switch from Dalekovod to its competitors for new infrastructure projects is a key factor in competitive rivalry. While the initial bidding process for major contracts is inherently competitive, the real impact on rivalry comes from the costs associated with switching for ongoing maintenance or mid-project changes. These switching costs can significantly deter clients from moving to a competitor, thus influencing the intensity of competition.

For Dalekovod, the switching costs are not insignificant. Once a project is underway, changing contractors can lead to substantial delays, renegotiation expenses, and potential penalties. For instance, in large-scale energy transmission projects, which often involve specialized equipment and integrated systems, the cost of switching could easily run into millions of euros, making it an unattractive option for clients. This inertia benefits established players like Dalekovod.

- High initial investment in project setup: Clients often invest heavily in site preparation and preliminary work with a chosen contractor, making a switch costly.

- Specialized equipment and integration: Many projects, especially in the energy sector, require highly specialized equipment that is integrated into existing infrastructure, raising the cost and complexity of switching.

- Project completion timelines: Delays caused by switching contractors can incur significant financial penalties and reputational damage for the client, serving as a strong deterrent.

- Contractual obligations and penalties: Existing contracts typically include clauses with penalties for early termination, further increasing the financial burden of switching.

Dalekovod operates in a highly competitive environment, facing pressure from both global powerhouses and agile regional specialists. The intense rivalry stems from the industry's significant growth potential, particularly in renewable energy infrastructure, attracting a broad range of players. For example, the global power transmission and distribution market was valued at approximately USD 260 billion in 2023.

SSubstitutes Threaten

While direct substitutes for large-scale, high-voltage power transmission infrastructure are scarce, emerging technologies present potential disruptions. Advancements in decentralized energy generation, such as widespread rooftop solar and microgrids, could lessen the reliance on extensive transmission networks for certain communities. For instance, by 2024, the U.S. saw significant growth in distributed solar, with installations contributing to a more localized power supply.

Furthermore, the development of sophisticated smart grids and advanced energy storage solutions, like utility-scale batteries, can improve grid efficiency and flexibility. This might reduce the immediate need for new, traditional transmission line construction in some areas by better managing existing capacity and demand. The global energy storage market, projected to reach hundreds of billions of dollars by the late 2020s, underscores this trend.

The rise of decentralized energy solutions presents a growing threat of substitutes for traditional large-scale transmission projects. As more consumers adopt rooftop solar panels and participate in microgrids, their reliance on the centralized grid diminishes. This trend is particularly evident in Croatia, where renewable energy, especially solar power, has experienced significant growth in recent years, with installed solar capacity increasing substantially by the end of 2023.

Advancements in energy efficiency and demand-side management pose a significant threat by potentially curbing the need for new power infrastructure. As consumers and industries adopt more efficient technologies, overall energy consumption can decrease, directly impacting the demand for expanded transmission and distribution networks. For instance, smart grid technologies and advanced building management systems are actively reducing peak load demands, which are often the primary drivers for new infrastructure investments.

The International Energy Agency (IEA) reported in 2024 that energy efficiency measures are increasingly vital in meeting climate goals. They highlighted that improved efficiency in buildings and industry could reduce global energy demand growth by over 40% by 2030. This directly translates to a reduced requirement for new power generation and transmission capacity, thereby weakening the bargaining power of infrastructure providers like Dalekovod.

Undergrounding of Transmission Lines

The increasing preference for undergrounding transmission lines, driven by aesthetic concerns and a desire for greater resilience against weather events, presents a significant threat of substitution for traditional overhead line construction. While still a capital-intensive infrastructure project, the shift to undergrounding requires different specialized skills, advanced trenching technologies, and unique cable insulation materials, potentially diverting demand from established overhead line providers.

For instance, in the United States, the cost of undergrounding transmission lines can range from $1.5 million to $5 million per mile, significantly higher than overhead lines which typically cost $300,000 to $1 million per mile, according to various industry reports. This cost differential, however, is often weighed against the reduced maintenance and outage costs associated with underground systems. By 2024, several states have implemented or are considering mandates for undergrounding critical infrastructure, signaling a growing market shift.

This trend impacts companies like Dalekovod by creating a substitute technology that fulfills a similar function but with different operational and material requirements. Companies that cannot adapt their expertise or invest in new technologies for undergrounding may find their market share eroded by competitors specializing in this alternative method.

- Shift in Technology: Undergrounding requires specialized trenching, cable laying, and insulation techniques, differing from overhead line construction.

- Cost Implications: While upfront costs for undergrounding are higher (e.g., $1.5M-$5M per mile vs. $0.3M-$1M for overhead), long-term resilience and maintenance savings are key drivers.

- Regulatory Influence: Growing regulatory pushes and aesthetic preferences are accelerating the adoption of underground transmission lines.

- Market Adaptation: Companies unable to adapt to undergrounding technologies risk losing market share to specialized competitors.

Non-Traditional Grid Solutions

The development of non-traditional grid solutions presents a growing threat of substitution for Dalekovod's conventional AC transmission lines. Advanced technologies like superconducting transmission and enhanced High-Voltage Direct Current (HVDC) systems offer alternative methods for power transfer. These innovations, while still within the realm of transmission, represent a distinct technological paradigm that could displace traditional AC infrastructure in certain use cases, potentially impacting Dalekovod's market share and the demand for its core products and services.

For instance, superconducting cables boast significantly lower energy losses compared to traditional conductors, making them increasingly attractive for high-capacity, long-distance transmission. While the initial investment remains a hurdle, ongoing research and development, coupled with pilot projects demonstrating their viability, signal a future where these advanced solutions could become more cost-competitive. The global market for HVDC transmission, a key competitor to AC in certain scenarios, saw significant growth, with projects like the North Sea Link (connecting Norway and the UK) highlighting the increasing adoption of these advanced technologies.

- Superconducting Transmission: Offers near-zero resistance, drastically reducing energy loss.

- Advanced HVDC Systems: More efficient for long-distance and bulk power transfer than traditional AC.

- Potential Impact: These technologies could reduce demand for conventional AC transmission lines, affecting Dalekovod's core business.

- Market Trends: Investment in grid modernization and renewable energy integration favors solutions that overcome the limitations of traditional AC infrastructure.

The threat of substitutes for traditional power transmission infrastructure is evolving, driven by technological advancements and changing energy consumption patterns. While direct replacements for large-scale transmission are limited, alternative approaches to delivering and managing electricity are gaining traction.

Decentralized energy generation, such as widespread rooftop solar, and the development of microgrids are reducing reliance on extensive transmission networks for certain areas. By 2024, the U.S. witnessed a notable increase in distributed solar installations, contributing to more localized power supply. Similarly, advancements in energy efficiency and demand-side management, supported by smart grid technologies, are curbing the need for new infrastructure by lowering overall energy consumption and peak load demands. The International Energy Agency (IEA) reported in 2024 that energy efficiency measures are crucial for climate goals, potentially reducing global energy demand growth by over 40% by 2030.

Furthermore, the growing preference for undergrounding transmission lines, driven by resilience and aesthetic factors, presents a substitute for conventional overhead construction. While more expensive upfront, estimated at $1.5 million to $5 million per mile compared to $300,000 to $1 million for overhead lines in the U.S. by 2024, the long-term benefits are driving adoption. Companies unable to adapt to these specialized techniques risk market share erosion.

Finally, emerging technologies like superconducting transmission and advanced High-Voltage Direct Current (HVDC) systems offer alternative, more efficient power transfer methods. The global HVDC market, for example, has seen significant growth, indicating a shift towards these advanced solutions that could impact demand for traditional AC transmission lines.

Entrants Threaten

The power transmission and electrical infrastructure sector demands immense capital. Companies need to invest heavily in specialized heavy machinery, extensive manufacturing facilities for steel structures, and sophisticated engineering tools. For instance, a new high-voltage transmission line project can easily run into hundreds of millions of dollars, encompassing everything from substation equipment to conductor stringing.

The energy infrastructure sector is heavily regulated, with new entrants facing significant challenges due to complex permitting processes. These bureaucratic hurdles, often involving multiple government agencies and lengthy approval timelines, act as a substantial barrier to entry. For instance, projects in Croatia, a key market for companies like Dalekovod, can experience delays in grid connection and obtaining necessary permits, discouraging new competition.

Economies of scale play a crucial role in industries like power infrastructure, significantly deterring new entrants. Dalekovod benefits from substantial cost advantages in design, procurement, and construction due to its established scale. For instance, bulk purchasing of materials can lead to lower per-unit costs, a benefit smaller, newer firms struggle to match.

Dalekovod's extensive experience and proven track record in delivering large, complex power projects are invaluable assets. This accumulated knowledge and successful project history build trust and credibility, making it easier for Dalekovod to secure new contracts. Newcomers face a steep uphill battle in demonstrating similar capabilities and reliability to potential clients.

In 2023, Dalekovod's revenue reached approximately €240 million, showcasing its significant operational scale. This financial strength allows for greater investment in technology, personnel, and project management, further solidifying its competitive position against less established players who may lack the capital and experience to compete effectively on large-scale projects.

Access to Distribution Channels and Customer Relationships

New companies entering the power infrastructure sector face significant hurdles in securing access to crucial distribution channels and building lasting customer relationships. Established firms like Dalekovod have cultivated deep ties with major clients, including national utility providers and government bodies. These relationships are often built on years of demonstrated reliability and trust, making it difficult for newcomers to penetrate the market.

For instance, securing contracts with entities like Hrvatska elektroprivreda (HEP) in Croatia, a key customer for many in the sector, typically requires a proven track record of successful project completion and adherence to stringent quality standards. New entrants may find it challenging to gain the initial trust needed to even bid on these high-value projects. This established network and reputation act as a powerful barrier, limiting the threat of new entrants.

- Difficulty in establishing relationships with key customers

- Long-term trust and proven reliability are essential for utility and government contracts

- Existing players benefit from established networks and reputations

- New entrants struggle to gain initial trust and access to high-value projects

Proprietary Technology and Expertise

Dalekovod's significant investment in proprietary technology and specialized engineering methodologies creates a substantial barrier to entry. New competitors would find it incredibly difficult and costly to replicate Dalekovod's advanced high-voltage infrastructure and complex steel structure fabrication capabilities, which have been honed over decades of operation.

This technological moat is a key factor in deterring potential new entrants. For instance, Dalekovod's unique expertise in designing and manufacturing large-scale transmission towers requires specialized knowledge and equipment that are not readily available on the open market.

- Proprietary Technology: Dalekovod possesses unique, patented technologies for welding and structural analysis crucial for high-voltage power line construction.

- Specialized Engineering Methodologies: The company employs highly specialized engineering processes for seismic resistance and wind load calculations in its steel structures, developed through extensive R&D.

- Unique Manufacturing Capabilities: Dalekovod operates state-of-the-art manufacturing facilities with custom-built machinery for producing large-diameter steel tubes and complex lattice structures.

- Expertise in High-Voltage Infrastructure: Decades of experience in designing, manufacturing, and erecting high-voltage transmission lines and substations represent a significant knowledge and skill barrier.

The threat of new entrants for Dalekovod is relatively low due to the substantial capital requirements for infrastructure projects and the extensive regulatory landscape. Significant investments in specialized machinery and navigating complex permitting processes create formidable barriers. Furthermore, established economies of scale and deep customer relationships with entities like Hrvatska elektroprivreda (HEP) make it difficult for newcomers to gain traction.

Dalekovod's competitive advantage is further bolstered by its proprietary technology and specialized engineering expertise, which are costly and time-consuming to replicate. These factors, combined with a proven track record and strong financial standing, effectively deter new companies from entering the power transmission and electrical infrastructure sector.

| Barrier Type | Description | Impact on New Entrants | Dalekovod's Advantage |

|---|---|---|---|

| Capital Requirements | High cost of specialized machinery, manufacturing facilities, and project financing. | Prohibitive for most new firms. | €240 million revenue in 2023 demonstrates significant financial capacity. |

| Regulatory Hurdles | Complex permitting, lengthy approval timelines, and grid connection challenges. | Causes significant delays and discourages entry. | Experience navigating Croatian energy regulations. |

| Economies of Scale | Cost advantages in procurement, design, and construction due to large operational volume. | New entrants lack cost competitiveness. | Bulk purchasing power and optimized processes. |

| Customer Relationships | Established trust and long-term contracts with key utility providers. | Difficult for new firms to secure initial projects. | Strong ties with major clients like HEP. |

| Proprietary Technology & Expertise | Unique engineering methodologies and specialized manufacturing capabilities. | High replication costs and knowledge gap. | Decades of R&D in high-voltage infrastructure and structural analysis. |

Porter's Five Forces Analysis Data Sources

Our Dalekovod Porter's Five Forces analysis is built on a foundation of publicly available company filings, industry-specific market research reports, and broad economic indicators. This comprehensive approach ensures a robust understanding of the competitive landscape.