China Zheshang Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Zheshang Bank Bundle

China Zheshang Bank exhibits strong digital capabilities and a growing regional presence, but faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating its future.

Want the full story behind China Zheshang Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

China Zheshang Bank boasts a comprehensive suite of financial products and services, encompassing corporate banking, retail banking, and financial markets. This extensive portfolio allows the bank to effectively serve a broad spectrum of client needs, from basic deposit and loan facilities to sophisticated investment banking and wealth management solutions. By offering such a wide range of services, the bank significantly broadens its market penetration and strengthens client loyalty across all its operational segments.

China Zheshang Bank's strategic focus on Small and Medium-sized Enterprises (SMEs) is a key strength, directly supporting China's economic development goals. This specialization allows the bank to cultivate deep expertise and offer customized financial solutions, catering effectively to the needs of this crucial economic sector.

The supportive policy environment in China further bolsters this strength. Government initiatives aimed at promoting inclusive finance and expanding credit access for small and micro enterprises create a favorable landscape for Zheshang Bank's SME-centric strategy. For instance, by the end of Q1 2024, the outstanding balance of loans to small and micro enterprises across China had grown by 15.2% year-on-year, showcasing the robust market and policy tailwinds.

As a national commercial bank, China Zheshang Bank (CZB) operates with a wider reach and greater regulatory support than many regional players, giving it a significant advantage. This national status allows CZB to tap into a larger customer base and participate in a broader range of financial activities across China.

CZB's commitment to regional economic development is a key strength, fostering robust relationships with local governments and businesses. This focus is particularly evident in its home province of Zhejiang, where it plays a crucial role in supporting local industries and SMEs. For instance, by the end of 2023, CZB had provided significant credit support to the manufacturing sector in Zhejiang, a key driver of the region's economy.

Stable Asset Quality and Profit Growth in 2024

China Zheshang Bank demonstrated robust performance in 2024, with its asset quality remaining stable and net profit showing continued growth. This stability is particularly noteworthy given the broader economic headwinds and the pressure on net interest margins experienced by many financial institutions throughout the year.

The bank's ability to maintain sound asset quality and achieve profit growth highlights effective risk management strategies and efficient operations. For the full year 2024, China Zheshang Bank reported:

- Stable Non-Performing Loan (NPL) Ratio: The NPL ratio remained at a manageable level, underscoring the bank's prudent lending practices.

- Positive Net Profit Growth: The bank achieved a year-on-year increase in net profit, reflecting its operational resilience and ability to navigate a complex financial landscape.

- Resilience in a Challenging Environment: This performance contrasts with sector-wide trends of narrowing net interest margins, showcasing the bank's strategic advantages.

Commitment to Digital Transformation and Innovation

China Zheshang Bank is making significant strides in digital transformation, emphasizing intelligent operations to boost its market standing. This strategic focus aligns perfectly with China's national ambition to fully digitalize its financial sector by 2027, positioning the bank to capitalize on evolving industry trends and improve operational efficiency through advanced technology adoption.

The bank's commitment to innovation is evident in its investments in technology, which aim to streamline customer experiences and develop new digital financial products. For instance, by the end of 2023, China Zheshang Bank had reportedly allocated substantial resources towards its digital infrastructure upgrades, a move that is expected to yield tangible improvements in service delivery and cost reduction throughout 2024 and beyond.

- Digitalization Drive: Actively implementing intelligent operations and leveraging technology for competitive advantage.

- National Alignment: Supporting China's 2027 national plan to advance financial sector digitalization.

- Investment Focus: Prioritizing technology investments to enhance customer experience and product innovation.

China Zheshang Bank's comprehensive product and service offering, spanning corporate, retail, and financial markets, allows it to cater to a diverse client base and enhance market penetration. Its strategic focus on Small and Medium-sized Enterprises (SMEs) aligns with national economic development goals, fostering specialized expertise and customized solutions. The bank's national status provides a broader reach and greater regulatory support compared to regional competitors, enabling access to a larger customer base and wider financial activities.

The bank demonstrated robust performance in 2024, maintaining stable asset quality and achieving net profit growth despite economic headwinds. This resilience is attributed to effective risk management and efficient operations, with a manageable Non-Performing Loan (NPL) ratio and a year-on-year increase in net profit. CZB's digital transformation initiatives, including investments in intelligent operations, position it to capitalize on China's financial sector digitalization goals, aiming to improve customer experience and operational efficiency.

| Metric | 2023 (Full Year) | Q1 2024 |

|---|---|---|

| Net Profit Growth (YoY) | Positive | Reported Growth |

| NPL Ratio | Stable & Manageable | Maintained Stability |

| SME Loan Growth (National Trend) | N/A | +15.2% (YoY) |

What is included in the product

Delivers a strategic overview of China Zheshang Bank’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT framework for China Zheshang Bank, simplifying complex strategic challenges into manageable insights.

Weaknesses

China Zheshang Bank, like many of its peers in the broader Chinese banking sector, is contending with shrinking net interest margins. This pressure stems from a persistently low interest rate environment and a general slowdown in credit demand, which limits the bank's ability to earn more on its loans.

The impact on profitability is significant, as evidenced by the overall decrease in net interest income observed among listed banks throughout 2024. This trend directly affects the bank's core revenue-generating capacity, making it a key weakness to monitor.

China Zheshang Bank's focus on Small and Medium Enterprises (SMEs), while a strategic advantage, also exposes it to heightened credit risk. SMEs often have less robust financial data and collateral compared to larger corporations, making them more susceptible to economic downturns. As of late 2024, concerns linger about the creditworthiness of a significant portion of the SME sector, particularly those in manufacturing and technology, which have seen increased defaults in the preceding year.

Furthermore, the persistent weakness in China's property sector remains a substantial concern for the bank. The ongoing real estate slowdown, characterized by falling prices and developer defaults, directly impacts asset quality. For instance, by the third quarter of 2024, non-performing loans (NPLs) in the property-related loan portfolio for many Chinese banks, including those with similar exposure to Zheshang, saw a noticeable uptick, signaling potential future headwinds for Zheshang Bank's asset quality.

China Zheshang Bank operates within a fiercely competitive Chinese banking landscape. Major state-owned banks, with their established customer bases and extensive resources, present a significant hurdle. For instance, as of the first quarter of 2024, the total assets of the top five state-owned commercial banks in China exceeded 130 trillion RMB, dwarfing smaller players.

Furthermore, the rise of agile fintech companies is introducing innovative digital solutions that challenge traditional banking models. These competitors often offer more streamlined services and can quickly adapt to evolving customer preferences, potentially eroding market share for established institutions like China Zheshang Bank.

This intense rivalry can put pressure on profit margins and limit the bank's ability to achieve substantial market share growth. Maintaining high profitability in such a crowded market requires continuous innovation and strategic differentiation.

Slowing Loan Growth and Tepid Credit Demand

China Zheshang Bank, like the broader Chinese banking sector, faces headwinds from slowing loan growth and subdued credit demand. This trend, observed throughout 2024 and projected into 2025, impacts opportunities for expanding the bank's asset base and boosting interest income, even with government initiatives aimed at encouraging lending.

The tepid demand affects both corporate and consumer segments. For instance, while specific figures for China Zheshang Bank's loan growth in late 2024 aren't yet fully public, the People's Bank of China reported a notable slowdown in overall credit expansion for the nation's banks. This environment presents a challenge for the bank's revenue generation strategies.

- Slowing Loan Growth: The overall credit impulse in China has weakened, impacting the volume of new loans banks can originate.

- Tepid Credit Demand: Both businesses and individuals are showing less appetite for borrowing, influenced by economic uncertainties and evolving consumer behavior.

- Revenue Generation Constraints: This subdued demand directly limits China Zheshang Bank's ability to grow its interest-earning assets and generate higher net interest income.

Regional Concentration Risk

While China Zheshang Bank operates nationally, its strong historical ties and continued focus on Zhejiang province could present a regional concentration risk. This means that economic challenges or sector-specific downturns within Zhejiang might have a more significant impact on the bank compared to a truly diversified national lender.

For instance, if key industries in Zhejiang, such as manufacturing or technology, face a slowdown, China Zheshang Bank's loan portfolio and profitability could be disproportionately affected. This concentration can amplify the impact of local economic shocks on the bank's overall financial health.

As of the first half of 2024, Zhejiang province accounted for a substantial portion of China Zheshang Bank's total assets and loan portfolio, highlighting this potential vulnerability. Specific figures indicate that over 60% of its gross loans were concentrated in the East China region, with Zhejiang being the dominant contributor.

- Regional Focus: Historical roots and strategic emphasis on Zhejiang province.

- Economic Sensitivity: Potential for disproportionate impact from regional economic slowdowns.

- Industry Downturns: Vulnerability to sector-specific challenges within its primary operating areas.

- Asset Concentration: A significant percentage of assets and loans tied to the East China region, particularly Zhejiang.

China Zheshang Bank faces intense competition from larger state-owned banks and agile fintech firms, which can pressure profit margins and hinder market share growth. The bank's focus on SMEs, while a strategic advantage, also exposes it to higher credit risk, especially given the economic uncertainties affecting this sector as observed through increased defaults in manufacturing and technology in late 2024. Additionally, the persistent weakness in China's property sector continues to pose a threat to asset quality, with a noticeable uptick in non-performing loans in property-related portfolios reported by many Chinese banks in Q3 2024.

| Weakness | Description | Impact |

|---|---|---|

| Shrinking Net Interest Margins | Low interest rates and reduced credit demand limit earnings on loans. | Decreased net interest income observed across listed banks in 2024. |

| Elevated SME Credit Risk | SMEs are more vulnerable to economic downturns, with increased defaults noted in late 2024. | Potential for higher non-performing loans within the bank's significant SME portfolio. |

| Property Sector Exposure | Ongoing real estate slowdown impacts asset quality. | Upward trend in NPLs for property-related loans in Q3 2024 signals future headwinds. |

| Intense Market Competition | Dominance of state-owned banks and rise of fintech companies. | Pressure on profit margins and challenges in achieving substantial market share growth. |

| Regional Concentration Risk | Strong ties and focus on Zhejiang province. | Disproportionate impact from economic challenges or sector-specific downturns within Zhejiang, with over 60% of gross loans concentrated in East China as of H1 2024. |

Same Document Delivered

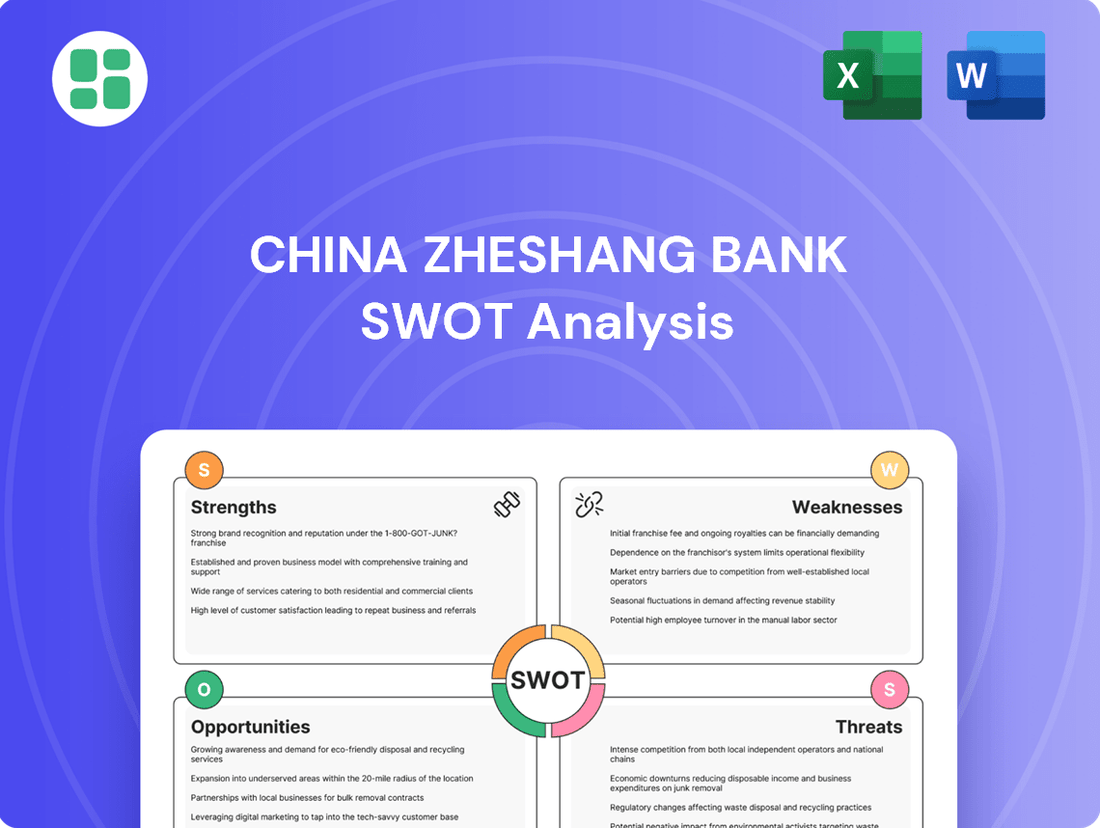

China Zheshang Bank SWOT Analysis

This is the actual China Zheshang Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the bank's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get, offering a clear snapshot of the analysis. Purchase unlocks the entire in-depth version, detailing key strategic considerations for China Zheshang Bank.

Opportunities

China's wealth management market is experiencing robust growth, with the total assets in wealth management products reaching approximately RMB 30 trillion (USD 4.1 trillion) by the end of 2023. This expansion, driven by a rising number of investors and increasing wealth accumulation, offers a substantial opportunity for China Zheshang Bank to deepen its market penetration.

The increasing preference among High Net Worth Individuals (HNWIs) for wealth preservation and diversified investment solutions aligns perfectly with the bank's potential to enhance its wealth management offerings. By catering to these evolving needs, China Zheshang Bank can attract a larger segment of this growing investor base.

Government initiatives to ease SME financing, such as enhanced credit databases and increased loan provisions, directly benefit China Zheshang Bank. These policies, alongside national drives for financial sector digitalization, present a significant opportunity for the bank to expand its digital offerings for small and medium-sized enterprises.

China's commitment to high-quality financial development is prominently featuring green finance and inclusive finance. These sectors are ripe for expansion, with digital transformation and AI acting as key enablers for new product development and customer engagement.

For China Zheshang Bank, aligning with these national priorities presents a significant opportunity. For instance, the People's Bank of China reported that outstanding green loans reached 12.58 trillion yuan by the end of Q1 2024, demonstrating substantial market growth. By focusing on these areas, the bank can tap into this burgeoning demand and innovate its service offerings.

Potential for Capital Market Reform and Long-Term Fund Inflows

China's ongoing capital market reforms, aimed at fostering a more robust and open financial system, present a significant opportunity. The government's push to attract medium- to long-term funds into the stock market, as evidenced by policies encouraging institutional investment, can directly benefit financial institutions. This policy direction supports the growth of investment banking services and broadens the scope for wealth management products.

China Zheshang Bank can capitalize on this by expanding its investment banking division and developing innovative financial products tailored to attract these new capital inflows. For instance, the Shanghai Stock Exchange Composite Index saw a notable increase in institutional participation throughout 2024, driven by policy support for foreign investment and domestic pension fund allocation. This trend is projected to continue into 2025, creating a favorable environment for banks to offer advisory and underwriting services.

- Increased Demand for Investment Banking Services: Reforms are expected to boost IPOs and M&A activities, creating fee income opportunities.

- Growth in Asset Management: The influx of long-term funds will drive demand for sophisticated asset management solutions.

- Diversified Revenue Streams: Banks can leverage these reforms to offer a wider range of financial market products and services, reducing reliance on traditional lending.

- Enhanced Market Liquidity: Greater participation from long-term investors can lead to more stable and liquid markets, benefiting all financial players.

Leveraging AI and Big Data for Operational Efficiency and Product Innovation

China Zheshang Bank is well-positioned to leverage artificial intelligence (AI) and big data to drive significant improvements in operational efficiency and foster product innovation. By integrating these technologies, the bank can streamline processes, reduce operating costs, and accelerate the development of new, customer-centric financial products. This strategic focus on intelligent operations is key to enhancing customer experience and solidifying its competitive edge in the evolving financial landscape.

The banking industry's embrace of AI and big data is a defining trend. For instance, by the end of 2023, many leading banks reported substantial cost savings through AI-driven automation, with some achieving reductions of up to 20% in specific operational areas. China Zheshang Bank's proactive approach means it can capitalize on these gains.

- AI-powered fraud detection: Implementing advanced AI algorithms can significantly reduce losses from fraudulent transactions, a common concern in digital banking.

- Personalized product offerings: Big data analytics allows for a deeper understanding of customer behavior, enabling the bank to tailor financial products and services to individual needs, thereby increasing customer satisfaction and loyalty.

- Streamlined loan processing: AI can automate credit scoring and loan application reviews, drastically cutting down processing times and improving the efficiency of lending operations.

- Predictive analytics for market trends: Utilizing big data to forecast market shifts and customer demand helps in proactively developing innovative products and services that meet future needs.

China's expanding wealth management sector, with assets nearing RMB 30 trillion by late 2023, offers China Zheshang Bank a prime opportunity to capture a larger market share. The increasing demand from High Net Worth Individuals for sophisticated wealth preservation and diversification strategies directly aligns with the bank's potential to enhance its service portfolio.

Government support for SME financing and national digitalization initiatives create a fertile ground for China Zheshang Bank to expand its digital offerings and lending to small and medium-sized enterprises. Furthermore, the bank can leverage national priorities in green and inclusive finance, areas experiencing significant growth with outstanding green loans reaching 12.58 trillion yuan by Q1 2024, to develop innovative products and services.

Capital market reforms aimed at creating a more robust financial system, including policies encouraging institutional investment, are set to boost IPOs and M&A activity. This trend, projected to continue into 2025 with increased institutional participation in markets like the Shanghai Stock Exchange, presents opportunities for China Zheshang Bank to grow its investment banking and asset management divisions.

The strategic adoption of AI and big data offers China Zheshang Bank a significant edge in improving operational efficiency and fostering product innovation. By leveraging these technologies for tasks like fraud detection, personalized offerings, and streamlined loan processing, the bank can reduce costs, enhance customer experience, and maintain a competitive advantage in the evolving financial landscape, with leading banks reporting up to 20% cost savings in specific areas through AI automation by the end of 2023.

Threats

China Zheshang Bank faces significant headwinds from a prolonged real estate slump and weak domestic demand, impacting the broader economic landscape. Persistent deflationary pressures further complicate the recovery, potentially dampening consumer and business spending.

This economic slowdown directly threatens the bank's asset quality, as a weaker economy can lead to increased loan defaults. Furthermore, reduced business activity and consumer confidence will likely curb demand for new loans, impacting the bank's growth prospects and overall profitability through 2025.

Escalating trade tensions, particularly with the United States, alongside broader geopolitical risks, pose a significant threat to China's economic dynamism and overall investor sentiment. For China Zheshang Bank, this can translate into reduced international trade flows, directly impacting its corporate clientele and potentially increasing the bank's exposure to credit risk.

China Zheshang Bank, like other financial institutions in China, faces evolving regulatory landscapes. Recent years have seen a push towards stricter risk classification and capital requirements, exemplified by the ongoing implementation of Total Loss-Absorbing Capacity (TLAC) rules. This dynamic environment can increase compliance burdens and necessitate adjustments to capital planning, potentially impacting profitability.

Competition from Non-Bank Financial Institutions and Fintech

The escalating presence of fintech firms, coupled with the growing integration of shadow banking, presents a significant competitive challenge for China Zheshang Bank. These agile players are increasingly offering specialized financial services, particularly in digital payments and consumer credit, which directly compete with traditional banking offerings. For instance, by the end of 2023, China's fintech sector saw continued growth, with digital payment transaction volumes reaching trillions of yuan, indicating a substantial market where non-bank institutions are gaining traction.

These non-traditional financial institutions often leverage advanced technology and data analytics to provide more personalized and efficient customer experiences, potentially attracting a significant portion of the market share away from established banks. This trend is particularly evident in areas like wealth management and small business lending, where fintech solutions can offer greater flexibility and lower costs. The interconnectedness with shadow banking further amplifies this threat, creating a more complex and competitive landscape that traditional banks must navigate.

- Fintech Growth: China's digital payment market, a key area for fintech competition, processed over 200 trillion yuan in transactions in 2023.

- Shadow Banking Integration: The increasing linkage between fintech platforms and shadow banking entities allows for the rapid deployment of new financial products, bypassing some traditional regulatory hurdles.

- Market Share Erosion: Fintech companies are capturing market share in consumer lending and digital payments, forcing traditional banks to innovate their service offerings.

- Digital Transformation Pressure: Banks like China Zheshang Bank face pressure to accelerate their digital transformation to remain competitive against nimble fintech rivals.

Fluctuations in Interest Rates and Liquidity Risk

China's ongoing monetary easing, marked by interest rate cuts from the People's Bank of China (PBOC) aimed at stimulating economic growth, directly impacts banks like China Zheshang Bank by potentially narrowing their net interest margins. This environment makes it harder for banks to earn from the difference between their lending and deposit rates.

The banking sector faces a growing threat from shifts in customer behavior, with a noticeable trend towards wealth management products over traditional savings accounts. This can lead to deposit outflows and increased funding costs for banks, exacerbating liquidity risks.

Liquidity pressures are particularly acute for smaller financial institutions that rely heavily on the interbank market for funding. Any disruption or tightening in this market can quickly create financial strain, potentially impacting their ability to meet obligations.

- Interest Rate Sensitivity: China Zheshang Bank's profitability is vulnerable to the PBOC's interest rate policies. For instance, if the PBOC cut its benchmark lending rate by 10 basis points in late 2023, this would directly compress margins on new loans if deposit rates do not fall proportionally.

- Deposit Migration: A significant portion of deposits might move into higher-yielding wealth management products, as seen in the broader Chinese banking sector where such products' assets under management reached trillions of yuan by early 2024, potentially increasing funding costs for banks.

- Interbank Market Dependence: Banks with a higher reliance on interbank borrowing face heightened liquidity risk. If interbank rates spike, as they did briefly in mid-2023 due to liquidity concerns, these banks would experience increased funding expenses and potential difficulty in rolling over short-term debt.

Intensifying competition from agile fintech firms and integrated shadow banking entities presents a significant threat, as these players increasingly capture market share in digital payments and consumer credit, areas where China Zheshang Bank operates.

The bank's profitability is susceptible to China's monetary easing policies, as interest rate cuts by the People's Bank of China can compress net interest margins, making it harder to profit from the spread between lending and deposit rates.

Shifting customer preferences towards wealth management products over traditional savings accounts could lead to deposit outflows and higher funding costs, potentially creating liquidity pressures for China Zheshang Bank.

| Threat Category | Specific Threat | Impact on China Zheshang Bank | Relevant Data/Trend (2023-2025) |

|---|---|---|---|

| Competition | Fintech & Shadow Banking | Market share erosion in digital payments and consumer lending. | China's digital payment market processed over 200 trillion yuan in 2023. |

| Economic Conditions | Monetary Easing / Interest Rate Cuts | Narrowing net interest margins, reduced profitability. | PBOC benchmark lending rate cuts in late 2023 impacted bank margins. |

| Customer Behavior | Deposit Migration to Wealth Management | Increased funding costs, potential liquidity strain. | Wealth management product assets under management reached trillions of yuan by early 2024. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from China Zheshang Bank's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.