China Zheshang Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Zheshang Bank Bundle

China Zheshang Bank operates within a dynamic financial landscape, facing intense rivalry from established players and nimble fintech disruptors. Understanding the bargaining power of its customers and the constant threat of new entrants is crucial for navigating this competitive terrain.

The complete report reveals the real forces shaping China Zheshang Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors, especially large corporate and institutional clients, wield moderate to high bargaining power in China's banking sector. This is because these clients have numerous banking alternatives and can easily shift their deposits. For instance, in 2023, China's total deposits reached approximately 258 trillion yuan, highlighting the sheer volume of funds available and the competition among banks to attract them.

While individual retail depositors have less individual sway, their collective actions, driven by factors like interest rate changes and perceptions of bank stability, can significantly influence a bank's funding costs and liquidity. The People's Bank of China's monetary policies, including adjustments to benchmark interest rates and reserve requirement ratios, directly impact the cost of these funds for banks like China Zheshang Bank.

The bargaining power of technology providers is on the rise for banks like China Zheshang Bank. As digital transformation accelerates, banks are pouring significant resources into areas like artificial intelligence, big data analytics, and cloud infrastructure to improve operations and customer engagement. This heightened reliance means that specialized fintech firms offering advanced or proprietary solutions can increasingly dictate terms and pricing.

Skilled human capital, particularly in rapidly evolving fields like fintech, robust risk management, and sophisticated wealth management, wields considerable bargaining power within China Zheshang Bank. The intense competition for this specialized talent across China's dynamic financial sector compels the bank to offer attractive compensation packages and clear pathways for career advancement to secure and retain its most valuable employees.

Interbank Market and Capital Market Access

China Zheshang Bank's access to interbank markets and its ability to raise capital through avenues like bond issuances significantly shape its bargaining power relative to suppliers, particularly depositors. By tapping into these broader funding sources, the bank can lessen its dependence on traditional deposit bases, thereby mitigating the power individual depositors might wield.

In 2024, China Zheshang Bank continued to leverage capital markets for funding. For instance, its successful issuance of Tier 2 capital bonds in prior years demonstrated its capacity to attract institutional investors, providing a substantial alternative to retail deposits. This strategic move enhances its financial flexibility.

- Interbank Market Access: China Zheshang Bank actively participates in the interbank market, securing short-term and long-term funding. This allows for efficient management of liquidity and reduces reliance on more costly deposit-gathering strategies.

- Capital Raising: The bank has a proven track record of accessing capital markets. For example, its A+H rights issue in past years boosted its equity base, and ongoing issuances of Tier 2 capital bonds in 2023 and 2024 provided significant capital injections.

- Reduced Depositor Power: By diversifying funding sources through capital market instruments, the bank can negotiate more effectively with depositors, as it is less vulnerable to deposit outflows or demands for higher interest rates from a concentrated depositor base.

- Financial Stability: Successful capital raising efforts contribute to the bank's overall financial stability and regulatory compliance, further strengthening its position against potential supplier pressures.

Regulatory Influence on Funding Costs

Regulatory actions by China's People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA) directly shape China Zheshang Bank's funding costs. For instance, changes to the Required Reserve Ratio (RRR) influence the amount of capital banks must hold, impacting their available funds for lending and thus their reliance on more expensive external funding. Similarly, adjustments to the Loan Prime Rate (LPR) signal broader shifts in monetary policy that can affect the cost of borrowing for banks.

These top-down policies can significantly alter the bargaining power of suppliers to China Zheshang Bank, such as depositors and interbank lenders. When the PBOC tightens monetary policy by raising rates or RRR, it generally increases funding costs for banks, potentially giving their funding sources more leverage. Conversely, easing measures can reduce these costs and shift the balance.

- PBOC Policy Tools: Adjustments to the RRR and LPR are key mechanisms influencing banks' funding expenses.

- NFRA Oversight: The NFRA's prudential regulations also indirectly affect funding costs by dictating capital requirements and risk management practices.

- Impact on Bargaining Power: Monetary policy shifts can strengthen or weaken the negotiating position of banks' funding providers.

- Objective of Policies: Regulatory measures often aim to bolster the real economy or maintain financial system stability, with funding costs being a critical transmission channel.

China Zheshang Bank's bargaining power with suppliers, particularly depositors, is influenced by its access to alternative funding channels. By actively participating in interbank markets and successfully raising capital through bond issuances, such as Tier 2 capital bonds in 2023 and 2024, the bank reduces its dependence on traditional deposits. This strategic diversification strengthens its negotiating position, allowing it to manage funding costs more effectively.

The bank's ability to tap into capital markets, evidenced by its past A+H rights issue and ongoing bond programs, provides a significant buffer against the power of individual depositors. This financial flexibility is crucial in a market where large corporate and institutional clients, holding substantial portions of the 258 trillion yuan in total deposits as of 2023, can exert considerable influence. By diversifying its funding base, China Zheshang Bank can mitigate the risk of deposit outflows and demands for higher interest rates.

Regulatory policies from bodies like the People's Bank of China (PBOC) also play a critical role. For instance, adjustments to the Reserve Requirement Ratio (RRR) and Loan Prime Rate (LPR) directly impact funding costs. When the PBOC tightens monetary policy, it can increase these costs, potentially shifting leverage towards funding providers. Conversely, easing measures can reduce reliance on more expensive funding, thereby enhancing the bank's bargaining power.

| Funding Source | Estimated Bargaining Power (2024) | Key Influencing Factors | China Zheshang Bank's Mitigating Strategies |

|---|---|---|---|

| Depositors (Retail) | Low to Moderate | Collective action, interest rate sensitivity, bank stability perception | Diversified funding, strong digital services, customer loyalty programs |

| Depositors (Corporate/Institutional) | Moderate to High | Large deposit volumes, numerous banking alternatives, liquidity needs | Capital market access, competitive deposit rates, relationship management |

| Interbank Lenders | Moderate | Market liquidity, prevailing interest rates, bank's creditworthiness | Active interbank participation, strong liquidity management, diversified capital structure |

| Capital Markets (Bondholders) | Moderate | Investor sentiment, credit ratings, economic outlook, regulatory environment | Consistent capital raising, transparent financial reporting, adherence to regulations |

What is included in the product

This analysis provides a comprehensive examination of the competitive forces impacting China Zheshang Bank, detailing the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and mitigate competitive threats with a visually intuitive breakdown of China Zheshang Bank's Porter's Five Forces, simplifying complex strategic analysis.

Customers Bargaining Power

Retail customers, though numerous, typically possess limited individual bargaining power with China Zheshang Bank. This is largely due to the standardized nature of many banking products and relatively low costs associated with switching between institutions. For instance, in 2023, the average household deposit balance in China remained modest, meaning individual deposit amounts offered little leverage.

However, the collective power of retail customers can be significant. As digital banking platforms proliferate, customers find it increasingly easy to compare interest rates and service fees across various banks. This ease of comparison, coupled with a growing appetite for higher returns in wealth management products, means that a large segment of customers can influence market dynamics by shifting their deposits or seeking more favorable financial solutions from competitors.

Corporate and SME customers, especially those with substantial financial health or larger transaction volumes, hold considerable sway over China Zheshang Bank. This influence is particularly evident when negotiating loan conditions, interest rates, and bespoke financial products.

Given China Zheshang Bank's strategic emphasis on the Small and Medium-sized Enterprise (SME) sector, it navigates a competitive landscape where securing desirable borrowers is paramount. For instance, in 2023, SMEs accounted for a significant portion of China's GDP, highlighting their economic importance and, by extension, their bargaining leverage with financial institutions.

Furthermore, government policies aimed at enhancing SME access to financing and improving loan terms indirectly bolster the bargaining power of these business clients. This environment necessitates that China Zheshang Bank offers competitive terms to attract and retain these valuable customers.

Wealth management clients, particularly high-net-worth individuals and institutional investors, wield significant bargaining power. These clients expect a broad array of sophisticated, tailored investment products and consistently seek superior returns, often venturing into alternative asset classes. This demand compels institutions like China Zheshang Bank to continually innovate and enhance their service offerings to retain and attract this valuable customer base.

Availability of Alternatives and Switching Costs

The bargaining power of customers for China Zheshang Bank is significantly influenced by the increasing availability of alternatives. Fintech companies and other financial institutions are constantly introducing new products and services, making it easier for customers to switch providers. This heightened competition directly impacts the bank's ability to dictate terms.

Lower switching costs mean customers can readily move their deposits or seek financing elsewhere. For instance, the proliferation of digital banking platforms and peer-to-peer lending services provides readily accessible alternatives. This flexibility empowers customers, compelling China Zheshang Bank to maintain competitive interest rates and deliver exceptional service to retain its client base.

- Increased Competition: The rise of fintechs and digital banks in China has expanded customer choices, with many offering competitive rates and user-friendly interfaces.

- Reduced Switching Costs: Online account opening and seamless fund transfers significantly lower the effort and expense for customers to change banks.

- Customer Empowerment: In 2023, China's digital payment transaction volume reached trillions of yuan, indicating a high degree of customer comfort and engagement with alternative financial channels, thereby increasing their bargaining power.

Regulatory Protection for Consumers

The establishment of China's National Financial Regulatory Administration (NFRA) in 2023 significantly bolsters consumer power. This new body centralizes financial regulation and places a strong emphasis on protecting financial consumers. By setting clearer rules and enforcing stricter oversight, the NFRA ensures banks like China Zheshang Bank engage in fairer practices and provide greater transparency, directly increasing customer leverage.

This enhanced regulatory environment empowers customers by safeguarding them against potentially exploitative practices. The NFRA's focus encourages financial institutions to prioritize consumer rights and interests, leading to more competitive offerings and better service. For instance, regulations concerning fee transparency and complaint resolution mechanisms give consumers more recourse and confidence.

- NFRA's Mandate: Centralized financial regulation with a primary focus on consumer protection.

- Impact on Banks: Increased pressure for transparent practices and fair treatment of customers.

- Consumer Benefits: Greater power through enhanced rights, recourse, and improved service quality.

The bargaining power of customers for China Zheshang Bank is a nuanced factor, with retail clients generally possessing limited individual leverage due to standardized products and low switching costs. However, the collective power of these customers, amplified by digital platforms, allows them to easily compare offerings and influence market dynamics through deposit shifts.

Corporate and SME clients, especially those with substantial financial needs or transaction volumes, hold significant sway, particularly when negotiating loan terms and bespoke financial products. This leverage is underscored by the economic importance of SMEs in China, a sector China Zheshang Bank actively targets.

Wealth management clients, including high-net-worth individuals and institutional investors, exert considerable bargaining power. Their demand for sophisticated, tailored investment products and superior returns compels banks like China Zheshang Bank to continuously innovate their service portfolios to attract and retain them.

| Customer Segment | Bargaining Power Influence | Key Drivers |

| Retail Customers | Low (individual), Moderate (collective) | Standardized products, low switching costs, but amplified by digital comparison and ease of access to alternatives. |

| SMEs & Corporate Clients | High | Substantial transaction volumes, financial health, and strategic importance to the bank. |

| Wealth Management Clients | Very High | Demand for tailored products, expectation of high returns, and significant asset management. |

Preview Before You Purchase

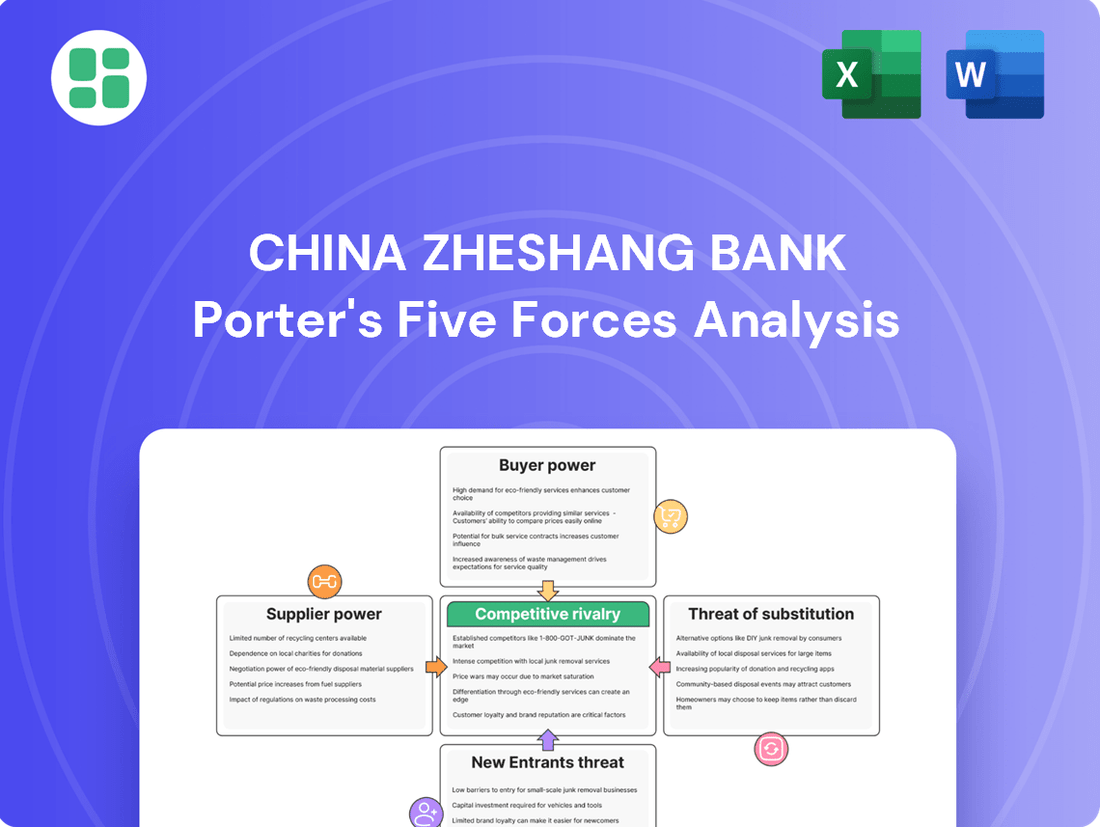

China Zheshang Bank Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for China Zheshang Bank, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, providing immediate access to valuable market insights.

Rivalry Among Competitors

China Zheshang Bank operates in a highly competitive landscape, particularly against the four largest state-owned commercial banks: Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Bank of China (BOC), and Agricultural Bank of China (ABC). These giants command substantial market share, boasting extensive branch networks and massive customer bases, which were further bolstered by their significant asset growth in recent years; for instance, by the end of 2023, these major banks collectively held trillions in assets, dwarfing smaller institutions.

These state-owned behemoths benefit from implicit government backing, which translates into lower funding costs and greater access to capital, allowing them to offer more competitive pricing on loans and other financial products. This inherent advantage makes it challenging for joint-stock banks like China Zheshang Bank to compete on price and scale, as they often lack the same level of market influence and perceived stability.

China Zheshang Bank faces intense rivalry from both joint-stock commercial banks and city commercial banks. These competitors frequently vie for the same customer bases, particularly small and medium-sized enterprises (SMEs), and operate within similar geographic areas. This competitive landscape is particularly challenging as many of these banks are known for their agility and strong regional focus.

The bank's strategic emphasis on serving SMEs and fostering regional economic growth directly pits it against numerous nimble, locally-oriented institutions. For instance, by the end of 2023, China's banking sector comprised over 4,000 financial institutions, with a significant portion being city commercial banks and rural commercial banks, many of which are deeply entrenched in specific local markets and possess a strong understanding of regional business needs.

The Chinese banking sector faces intense competition, partly due to narrowing net interest margins. In 2023, the average net interest margin for major Chinese banks hovered around 1.7%, a notable decline from previous years. This compression is fueled by a low interest rate environment and government policies encouraging banks to support the real economy through lending concessions.

This profitability pressure compels banks like China Zheshang Bank to aggressively vie for both deposits and loans. The struggle for market share in a less profitable environment naturally escalates the competitive rivalry among financial institutions.

Homogenization of Basic Banking Products

The competitive rivalry among banks, particularly concerning basic deposit and loan products, is intense due to a high degree of homogenization. This uniformity forces many institutions into price-based competition, where the lowest rates often win customers. For instance, as of late 2024, the average interest rate on savings accounts across major Chinese banks hovered around 0.25%, with minimal differentiation.

While core products are highly contested, banks like China Zheshang Bank strive to differentiate through enhanced service quality, robust digital capabilities, and the development of specialized offerings. These might include sophisticated wealth management services or tailored investment banking solutions. However, the fundamental nature of basic banking products means that competition remains fierce, impacting profit margins on these foundational services.

- Homogenization: Basic deposit and loan products exhibit significant similarity across the banking sector.

- Price Competition: This uniformity drives competition primarily on price, impacting profitability.

- Differentiation Strategies: Banks focus on service, digital platforms, and specialized products to stand out.

- Contested Core: Despite differentiation efforts, core banking products remain a highly competitive battleground.

Digital Transformation and Innovation Race

China Zheshang Bank, like its peers, is deeply involved in a digital transformation race. This involves significant investment in technologies like artificial intelligence, big data analytics, and cloud computing. The aim is to streamline operations, personalize customer interactions, and bolster risk assessment capabilities.

This technological arms race intensifies competition. Banks that successfully leverage digital tools can offer superior customer experiences and more efficient services, thereby gaining a competitive advantage. For instance, by Q1 2024, many Chinese banks reported increased digital transaction volumes, indicating a shift in customer preference towards online channels.

- AI Integration: Banks are using AI for fraud detection, personalized product recommendations, and automated customer service.

- Big Data Analytics: Leveraging vast datasets allows for better understanding of customer behavior and more precise risk modeling.

- Cloud Computing Adoption: This enables scalability, cost efficiency, and faster deployment of new digital services.

- Customer Experience Enhancement: Digital channels are crucial for attracting and retaining tech-savvy demographics.

China Zheshang Bank faces formidable competition from the four largest state-owned banks, which dominate the market with vast networks and customer bases, further solidified by substantial asset growth. These giants benefit from implicit government backing, enabling lower funding costs and greater capital access, making it difficult for joint-stock banks to compete on price.

The intense rivalry is also fueled by numerous agile city and joint-stock commercial banks, especially in serving SMEs, often with strong regional focuses. With over 4,000 financial institutions in China by late 2023, including many deeply entrenched local banks, competition for market share is fierce, particularly as net interest margins narrowed to around 1.7% for major banks in 2023.

This pressure drives a strong emphasis on price competition for basic products, with savings account rates around 0.25% in late 2024. Banks like China Zheshang Bank are investing heavily in digital transformation, including AI and big data, to enhance customer experience and operational efficiency, as seen in the increased digital transaction volumes reported by many Chinese banks by Q1 2024.

| Competitor Type | Key Characteristics | Impact on China Zheshang Bank |

|---|---|---|

| Large State-Owned Banks | Vast networks, large customer bases, implicit government backing, lower funding costs | Dominant market share, price advantage, challenges for smaller players |

| Joint-Stock & City Commercial Banks | Agility, regional focus, strong SME relationships | Intense local competition, direct rivalry for core customer segments |

| Digital Challengers | Advanced technology adoption (AI, Big Data), superior digital customer experience | Need for continuous investment in digital capabilities to remain competitive |

SSubstitutes Threaten

The rapid growth of fintech and digital payment platforms like Alipay and WeChat Pay presents a substantial threat to China Zheshang Bank. These platforms offer seamless, often cheaper alternatives for transactions, lending, and even wealth management, directly competing with traditional banking services and potentially reducing customer reliance on established institutions.

By 2024, China's digital payment market continued its explosive growth, with mobile payments accounting for a vast majority of transactions. For instance, Alipay and WeChat Pay processed trillions of yuan in transactions annually, demonstrating their deep penetration into the daily financial lives of Chinese consumers and businesses, thereby increasing the pressure on banks like Zheshang to innovate and maintain competitive pricing and service quality.

For corporate clients, direct financing through bond issuance, equity markets, or private equity investments can serve as a viable alternative to traditional bank loans. This trend is particularly pronounced as capital markets in China continue to mature and expand.

Larger corporations, in particular, are increasingly able to bypass traditional banking channels for their financing needs. For instance, in 2023, the total value of corporate bonds issued in China reached approximately 15.9 trillion yuan, demonstrating the significant scale and accessibility of this alternative financing route.

While China's P2P lending sector has seen substantial regulatory tightening, other non-bank lending avenues and alternative credit providers remain a viable threat. These entities, including microfinance institutions and fintech companies focusing on supply chain finance, can offer faster, more flexible credit solutions, particularly for small and medium-sized enterprises (SMEs) and individuals who might find traditional bank processes cumbersome. For instance, by the end of 2023, the outstanding balance of non-bank financial institution loans in China was reported to be in the trillions of yuan, indicating their significant market presence.

Wealth Management Alternatives

Beyond traditional bank wealth management products, customers have a growing array of substitute investment vehicles available. These include mutual funds, private equity, hedge funds, and direct investments in assets like stocks and real estate, offering diverse avenues for wealth growth and preservation. The increasing preference among high-net-worth individuals for portfolio diversification and capital preservation further amplifies the competitive pressure from these alternatives.

The threat of substitutes in wealth management is significant for China Zheshang Bank. For instance, by the end of 2023, China's mutual fund market saw substantial growth, with assets under management reaching approximately RMB 29 trillion, indicating a strong customer preference for these diversified products. This trend suggests that customers are actively seeking alternatives to bank-offered wealth management solutions.

- Growing Mutual Fund Market: China's mutual fund industry's AUM surpassed RMB 29 trillion by the end of 2023, highlighting a key substitute.

- Demand for Diversification: High-net-worth individuals increasingly favor diversified portfolios, drawing capital away from single-institution offerings.

- Direct Investment Appeal: Direct investments in stocks and real estate offer perceived higher returns and control, presenting a competitive challenge.

- Fintech Innovations: Digital platforms and robo-advisors provide accessible and often lower-cost wealth management alternatives, further fragmenting the market.

Government-Backed Financing Platforms

Government-backed credit information sharing platforms and initiatives aimed at improving Small and Medium-sized Enterprise (SME) financing directly provide credit access. These platforms can reduce the reliance on traditional bank channels for certain financing needs, acting as a partial substitute for services offered by institutions like China Zheshang Bank. For instance, China's central bank has been actively promoting the development of credit reporting systems for SMEs, with significant data available on their usage in facilitating loan applications.

- Government initiatives to bolster SME financing through digital platforms can divert demand from traditional banking services.

- Improved access to alternative credit information may lower the perceived risk for non-bank lenders, increasing their competitiveness.

- In 2023, China's financial regulators continued to emphasize digital credit solutions to support economic growth, potentially impacting traditional lending volumes.

The threat of substitutes for China Zheshang Bank is multifaceted, encompassing fintech alternatives, direct capital markets access, and diverse wealth management options. Fintech platforms like Alipay and WeChat Pay, processing trillions of yuan in mobile payments by 2024, offer seamless competition for everyday transactions and lending. Furthermore, the burgeoning Chinese bond market, with approximately 15.9 trillion yuan in corporate bonds issued in 2023, provides a significant alternative for corporate financing, particularly for larger entities. These substitutes challenge traditional banking models by offering convenience, potentially lower costs, and greater accessibility, forcing banks to adapt and innovate.

| Substitute Category | Key Players/Mechanisms | 2023/2024 Impact Data |

|---|---|---|

| Fintech & Digital Payments | Alipay, WeChat Pay | Trillions of yuan in mobile payment transactions annually; deep consumer penetration. |

| Direct Capital Markets | Bond Issuance, Equity Markets | Approx. 15.9 trillion yuan in corporate bonds issued in China in 2023. |

| Alternative Lending | Microfinance, Fintech Lenders | Trillions of yuan in outstanding non-bank financial institution loans by end of 2023. |

| Wealth Management Alternatives | Mutual Funds, Private Equity, Direct Investments | Mutual fund AUM surpassed RMB 29 trillion by end of 2023; increasing demand for diversification. |

Entrants Threaten

The threat of new entrants for China Zheshang Bank is significantly mitigated by high regulatory barriers within China's banking sector. The People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA) enforce rigorous capital adequacy ratios, complex licensing processes, and continuous compliance mandates.

These stringent requirements effectively deter potential new commercial banks from entering the market. For instance, as of early 2024, the minimum registered capital for a commercial bank in China remains substantial, coupled with extensive operational and risk management prerequisites that new players must satisfy, making market entry exceptionally challenging.

The capital intensity for establishing a new commercial bank in China is immense. For instance, in 2024, the minimum registered capital requirements for commercial banks are substantial, often running into billions of Renminbi. This high financial hurdle, coupled with the need for extensive branch networks, advanced IT systems, and compliance with stringent regulatory capital adequacy ratios, makes it incredibly difficult for new players to enter the market and compete effectively with incumbents like China Zheshang Bank.

Brand reputation and customer trust are significant barriers to entry in banking. China Zheshang Bank, like other established institutions, has cultivated years of customer loyalty and a perception of stability, assets that new entrants find exceedingly difficult to quickly match. For instance, in 2023, China Zheshang Bank reported a net profit of 35.75 billion yuan, reflecting its established market position and customer base.

Fintech Challengers and Digital Banks

While establishing a full-fledged traditional bank in China faces significant hurdles, the threat of new entrants comes primarily from agile fintech challengers and digital banks. These entities, often unburdened by legacy systems, can leverage technology to offer specialized or streamlined financial services, creating an indirect competitive pressure. For instance, the growth of digital payment platforms and online lending services demonstrates the potential for these new players to capture market share.

The regulatory landscape is a critical factor. Should China's regulatory framework further evolve to accommodate or even encourage digital-only banking licenses, fintech firms could transition from indirect disruptors to direct competitors. This shift would allow them to offer a broader range of banking products, potentially eroding the customer base of established institutions like China Zheshang Bank. By 2024, the digital transformation in China's financial sector has already seen significant investment, with companies like Ant Group and Tencent's WeChat Pay demonstrating the power of technology-driven financial ecosystems.

- Fintech firms are leveraging digital channels to offer services like payments, lending, and wealth management, indirectly competing with traditional banks.

- The potential for new digital-only banking licenses could lower entry barriers for tech-savvy companies.

- In 2024, China's digital finance market continues to expand, with fintech innovations directly impacting customer expectations and banking models.

- Agile new entrants can quickly adapt to changing consumer preferences and technological advancements, posing a dynamic threat.

Government Policy and Market Liberalization

Government policy plays a significant role in shaping the threat of new entrants in China's banking sector, including for institutions like China Zheshang Bank. Market liberalization efforts, particularly in areas like digital finance and financial inclusion, can create opportunities for new players. For instance, the People's Bank of China (PBOC) has been actively promoting the development of digital yuan, which could pave the way for new fintech entrants to offer innovative payment and financial services, potentially altering the competitive landscape.

While the broader banking industry remains subject to stringent regulations, targeted policy shifts can lower entry barriers. In 2024, the Chinese government continued to emphasize financial technology (fintech) development, encouraging innovation in areas such as artificial intelligence (AI) and big data applications within financial services. This focus might see specialized fintech firms or even large tech companies entering specific segments of the banking market, offering services that directly compete with traditional banks.

- Digital Finance Initiatives: Government support for digital yuan and other fintech innovations can reduce entry barriers for specialized financial service providers.

- Financial Inclusion Policies: Mandates or incentives for financial inclusion may encourage new, agile players to enter by focusing on underserved customer segments.

- Regulatory Adjustments: While overall control remains, specific regulatory changes can create pathways for new business models, impacting established banks like China Zheshang Bank.

- Fintech Integration: The ongoing integration of AI and big data in finance suggests that tech-focused entities could emerge as significant new entrants in niche banking services.

The threat of new entrants for China Zheshang Bank is generally low due to substantial regulatory hurdles and high capital requirements, exemplified by the billions of Renminbi in minimum registered capital needed for a commercial bank in 2024. However, agile fintech firms pose an indirect threat by leveraging digital channels for payments, lending, and wealth management, as seen with the significant growth of platforms like Ant Group and WeChat Pay. These tech-savvy entities could become direct competitors if regulatory frameworks evolve to allow for digital-only banking licenses.

| Factor | Assessment for China Zheshang Bank | Supporting Data/Context |

| Regulatory Barriers | High | Stringent licensing, capital adequacy ratios (PBOC, NFRA). Minimum registered capital substantial in 2024. |

| Capital Intensity | Very High | Billions of RMB required for setup, plus IT systems and branch networks. |

| Brand Loyalty/Trust | High | China Zheshang Bank's 2023 net profit of 35.75 billion yuan reflects established market position. |

| Fintech Disruption | Moderate to High (Indirect) | Growth in digital payments and online lending. Continued fintech investment in 2024. |

| Government Policy | Influential | Support for digital yuan and fintech innovation can create opportunities for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Zheshang Bank is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the bank itself and its competitors. We supplement this with data from reputable financial news outlets, industry-specific research reports, and macroeconomic indicators relevant to the Chinese banking sector.