Cyient Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cyient Bundle

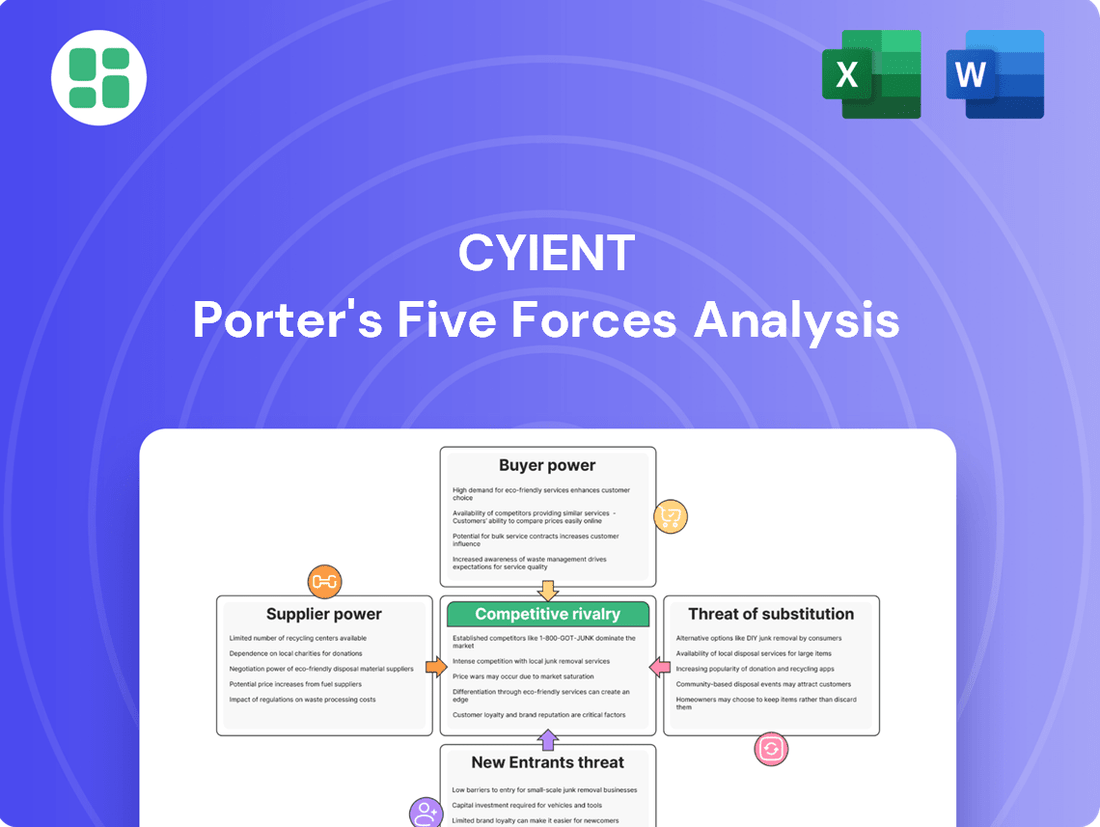

Cyient navigates a complex competitive landscape, shaped by intense rivalry and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Cyient’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cyient's dependence on a highly specialized workforce, including engineers and technology specialists, directly impacts its operational capacity. The scarcity of talent in fields such as aerospace, defense, and semiconductors amplifies the bargaining power of these professionals, potentially leading to increased labor costs. In 2023, Cyient reported that employee-related expenses constituted a substantial portion of its overall costs, highlighting the significance of managing this supplier relationship.

Suppliers of proprietary software and advanced design tools wield significant bargaining power. For companies like Cyient, which rely on these platforms for engineering design and digital solutions, the indispensability of these tools can lead to vendors dictating pricing and terms. This is especially true when viable alternatives are scarce.

Cyient's strategy to counter this involves cultivating strategic partnerships with key software providers and investing in its own internal development of proprietary solutions, such as CyientifIQ. This approach aims to reduce reliance on external vendors and enhance control over essential technological capabilities. For instance, in 2024, the global market for engineering software was valued at over $10 billion, highlighting the critical nature of these tools.

Cyient's Design Led Manufacturing (DLM) segment relies on suppliers for specialized hardware and electronic components, particularly for its aerospace and defense customers. The critical nature of these components, often requiring stringent certifications and high quality, means suppliers of unique or scarce parts hold significant bargaining power. This is amplified when components have extended lead times or are available from only a single source.

Infrastructure and Technology Providers

Providers of critical infrastructure like cloud services and secure data centers are vital for Cyient's global operations and digital solutions. As Cyient leans more into AI and digital platforms, the influence of these major tech providers could increase, impacting costs and how services are delivered. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the significant scale of these suppliers.

Cyient's strategic moves, such as recent collaborations in AI and semiconductor manufacturing, suggest a proactive approach to managing and potentially mitigating the bargaining power of these infrastructure and technology suppliers. This can involve securing favorable terms or developing alternative solutions.

- Cloud Computing Dominance: Major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform hold substantial sway due to their extensive infrastructure and service offerings, which are fundamental to Cyient's digital transformation initiatives.

- Network and Data Center Dependencies: Reliable and high-speed network solutions and secure data center facilities are non-negotiable for Cyient's service delivery, giving providers in this space considerable leverage.

- AI and Semiconductor Ecosystems: The increasing reliance on advanced AI technologies and the underlying semiconductor hardware means that key manufacturers and developers in these areas can exert significant influence over Cyient's innovation pipeline and operational capabilities.

Consulting and Subcontracting Services

Cyient's reliance on external consultants and subcontractors for specialized skills or to manage demand surges grants these suppliers a degree of bargaining power. The availability and cost of high-caliber, niche expertise directly influence project execution, potentially impacting Cyient's profitability and delivery schedules. For instance, in 2023, the IT services sector saw increased demand for specialized skills in areas like AI and cloud computing, leading to higher rates for consultants.

The bargaining power of suppliers in consulting and subcontracting is influenced by several factors:

- Availability of Niche Expertise: When specific skills are scarce, suppliers offering them gain leverage.

- Supplier Concentration: A limited number of high-quality subcontractors can consolidate their power.

- Switching Costs: High costs for Cyient to onboard new subcontractors can strengthen existing supplier relationships.

- Cyient's Mitigation Strategies: Cyient actively works to build internal capabilities and manage its supplier base to control this power.

The bargaining power of suppliers for Cyient is a significant factor, particularly concerning specialized talent and critical software. For instance, in 2024, the global market for engineering software was valued at over $10 billion, underscoring the vital role these tools play and the leverage their providers hold. Similarly, the scarcity of highly specialized engineers, especially in fields like aerospace and semiconductors, can lead to increased labor costs for Cyient, as employee-related expenses constituted a substantial portion of its overall costs in 2023.

Cyient actively manages this by fostering strategic partnerships with software vendors and investing in internal solutions like CyientifIQ to reduce external dependencies. The company also faces leverage from providers of essential infrastructure, such as cloud services, given the projected $1.3 trillion market for cloud computing by 2024. Furthermore, suppliers of niche hardware components for segments like Design Led Manufacturing (DLM) can exert considerable influence, especially when dealing with critical, single-source parts.

| Supplier Type | Key Factors Influencing Bargaining Power | Cyient's Mitigation Strategies | 2024 Market Context/Data Point |

| Specialized Workforce | Scarcity of niche engineering talent, high demand for AI/cloud skills | Internal upskilling, strategic partnerships, competitive compensation | Increased salary benchmarks for specialized engineers |

| Proprietary Software & Tools | Indispensability of advanced design platforms, limited viable alternatives | Developing in-house solutions (e.g., CyientifIQ), long-term vendor agreements | Global engineering software market > $10 billion |

| Critical Hardware Components (DLM) | Strict certification requirements, single-source availability, long lead times | Diversifying supplier base, strategic inventory management, long-term contracts | High demand for certified aerospace components |

| Cloud & Data Center Services | Dominance of major providers (AWS, Azure, GCP), critical for digital operations | Negotiating favorable service level agreements (SLAs), exploring hybrid cloud models | Global cloud computing market projected > $1.3 trillion |

What is included in the product

This analysis delves into the competitive forces impacting Cyient, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the engineering and technology solutions sector.

Cyient's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, allowing businesses to proactively address market pressures and secure their strategic position.

Customers Bargaining Power

Cyient's large enterprise clients, particularly in sectors like aerospace, defense, and transportation, wield significant bargaining power. These major customers often enter into substantial, long-term agreements, making them crucial revenue sources.

Their ability to negotiate favorable terms, pricing, and service level agreements is amplified by the sheer volume of business they represent. For instance, Cyient's Digital, Engineering, and Technology (DET) business had a total contract potential of US$ 370.8 million for FY25, highlighting the scale of these client relationships.

While large clients possess significant bargaining power, Cyient's deep integration into their operations often creates substantial switching costs. For instance, migrating complex engineering designs or critical digital transformation platforms from Cyient to a competitor can involve considerable time, financial investment, and potential operational disruptions. This complexity inherently limits a customer's ability to easily switch providers, thereby reducing their immediate bargaining leverage.

Industry consolidation among Cyient's clients can significantly amplify their bargaining power. As fewer, larger entities emerge, they gain greater leverage in negotiating terms with service providers. For instance, a major aerospace manufacturer acquiring a smaller competitor might consolidate its engineering outsourcing needs, potentially demanding lower rates from Cyient.

Furthermore, clients developing in-house engineering and technology capabilities reduce their dependence on external partners. If a large automotive OEM successfully builds out its internal AI development team, its need for Cyient's specialized AI engineering services diminishes, increasing its negotiating leverage for remaining projects.

However, the highly specialized nature of Cyient's intelligent engineering solutions often presents a barrier to full in-housing for many clients. The deep expertise and advanced tools required for areas like digital twin development or IoT integration are difficult and costly for most customers to replicate internally, thus limiting their bargaining power in these specific domains.

Price Sensitivity in Commoditized Services

For commoditized or less specialized services within Cyient's portfolio, customers often exhibit significant price sensitivity. This can put pressure on profit margins, especially when clients are looking to cut costs. For instance, in 2023, many companies across various sectors tightened their belts due to ongoing macroeconomic uncertainties, leading to more rigorous negotiation on service pricing.

While Cyient strategically positions itself in high-value intelligent engineering and digital solutions, certain aspects of its service delivery might still encounter this price-driven competition. This is particularly true in areas where the differentiation is less pronounced or where clients have readily available alternatives. The global economic outlook for 2024 continues to suggest a cautious spending environment for many businesses, amplifying the need for cost-effective solutions.

- Price Sensitivity Impact: Customers in commoditized segments may prioritize cost over unique features, potentially squeezing Cyient's margins.

- Macroeconomic Influence: Economic headwinds in 2023 and anticipated in 2024 encourage clients to scrutinize all expenditures, including engineering and IT services.

- Competitive Landscape: The availability of alternative providers for less specialized services intensifies customer bargaining power.

Diverse Customer Base Across Industries

Cyient effectively manages customer bargaining power by maintaining a broad customer base across numerous sectors. These include aerospace, defense, communications, transportation, healthcare, and energy. This wide reach prevents any single customer or industry from wielding excessive influence.

This strategic diversification is evident in Cyient's recent performance. For instance, in the first quarter of fiscal year 2026 (Q1 FY26), the company successfully onboarded 14 new clients across its various industry verticals. This ongoing expansion further dilutes individual customer impact and strengthens Cyient's overall market position.

- Diverse Industry Presence: Cyient's operations span aerospace, defense, communications, transportation, healthcare, and energy sectors.

- Reduced Client Dependence: This broad industry focus minimizes reliance on any single customer or sector, thereby diffusing customer power.

- New Client Acquisition: In Q1 FY26, Cyient added 14 new logos, underscoring its continued success in diversifying its client portfolio.

Cyient's large clients, especially in aerospace and defense, hold significant sway due to the volume of business they represent, often leading to substantial, long-term contracts. Their ability to negotiate favorable pricing and terms is directly linked to the scale of their engagement, as evidenced by the US$ 370.8 million total contract potential for Cyient's DET business in FY25.

However, the complexity and integration of Cyient's services create high switching costs for these clients, mitigating their immediate bargaining power. The specialized nature of solutions like digital twin development also limits clients' ability to replicate these capabilities in-house, further strengthening Cyient's position.

For less specialized services, customers are more price-sensitive, a trend amplified by the cautious economic climate of 2023 and 2024, which encourages cost scrutiny across industries. This price pressure is particularly relevant where Cyient's offerings are more commoditized or face readily available alternatives.

| Factor | Impact on Cyient | Mitigation Strategy |

|---|---|---|

| Client Size & Volume | High bargaining power for large clients | Diversified client base across multiple sectors |

| Switching Costs | Low bargaining power due to integration complexity | Deep client integration and specialized solutions |

| Price Sensitivity | Increased pressure on commoditized services | Focus on high-value, differentiated intelligent engineering |

Full Version Awaits

Cyient Porter's Five Forces Analysis

This preview showcases the complete Cyient Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within its industry. The document you see is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain access to a fully formatted and professionally analyzed report, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The global engineering and technology solutions market is characterized by its fragmentation, with a vast number of companies vying for market share. This includes large multinational IT service providers, specialized engineering firms, and smaller, niche players, all contributing to an intensely competitive landscape.

Cyient contends with a broad spectrum of competitors. Prominent among these are companies such as TRC Companies, Quest Global, and Belcan, each offering a range of services that overlap with Cyient's core offerings, intensifying the rivalry for clients and projects.

Competitive rivalry in the engineering and technology solutions sector is fierce, with companies like Cyient constantly vying for market share. This competition plays out across several key fronts: pricing, where cost-effectiveness is crucial; quality of service, ensuring client satisfaction and reliability; and innovation, developing cutting-edge solutions to stay ahead. Delivery capabilities are also paramount, with timely and efficient project execution being a major differentiator.

Cyient distinguishes itself by championing an 'Intelligent Engineering' strategy. This approach emphasizes digital transformation, the development of autonomous systems, and the integration of sustainable practices into engineering solutions. For instance, in 2024, Cyient reported a significant increase in its digital and platform engineering services revenue, reflecting the growing demand for these specialized capabilities and its success in competing on innovation.

Cyient faces intense competition from both large, established global engineering and technology firms and agile, specialized regional players. This dual competitive landscape demands a sophisticated global delivery network coupled with deep, localized market insights to effectively serve diverse client needs.

The company's strategic moves, including recent partnerships and acquisitions, underscore its commitment to bolstering its worldwide presence and enhancing its service offerings. For instance, in 2024, Cyient continued its expansion by integrating capabilities that directly address the needs of key regional markets, aiming to solidify its competitive edge.

Rapid Technological Advancements

The rapid pace of technological change, particularly in fields like Artificial Intelligence (AI), the Internet of Things (IoT), and digital twins, intensifies competitive rivalry. Companies are constantly pushing to deliver the most advanced solutions, creating a dynamic environment where innovation is paramount.

This relentless innovation cycle forces competitors, including Cyient, to continuously invest heavily in research and development (R&D) and cultivate top talent to stay ahead. Staying competitive means not just keeping up but actively shaping the future of technology offerings.

Cyient demonstrates its commitment to this innovation through initiatives like its CyientifIQ Experience Centre. Furthermore, its strategic focus on Generative AI (Gen AI) underscores its dedication to leveraging emerging technologies to maintain a competitive edge and offer differentiated solutions to its clients.

- Technological Pace: AI, IoT, and digital twins are key drivers of rapid advancement.

- Rivalry Driver: Companies innovate to capture market share, necessitating R&D and talent investment.

- Cyient's Response: CyientifIQ Experience Centre and Gen AI focus highlight its innovation strategy.

Talent Acquisition and Retention

The intense competition for skilled engineering and technology professionals significantly shapes the competitive rivalry within Cyient's industry. Companies vie for top talent, which directly influences their operational capacity and the quality of services they can deliver.

This struggle for human capital is a critical battleground. For instance, in early 2024, the demand for specialized engineering skills, particularly in areas like AI, cloud computing, and cybersecurity, remained exceptionally high. Companies that can effectively attract and retain these individuals gain a distinct advantage.

Key metrics that highlight this dynamic include employee count and revenue per headcount. A growing employee base, coupled with increasing revenue generated per employee, often signals a company's success in securing and leveraging valuable talent amidst fierce competition. As of the fiscal year ending March 31, 2024, Cyient reported a headcount of approximately 16,000 employees, underscoring the scale of human capital management in this sector.

- Talent as a Differentiator: The ability to attract and retain top engineering and technology talent is a primary driver of competitive advantage in this knowledge-intensive sector.

- Impact on Operations: Fierce competition for skilled professionals directly affects a company's ability to scale operations and maintain high service quality.

- Key Performance Indicators: Employee count and revenue per headcount serve as crucial indicators of a company's success in navigating the talent acquisition landscape.

- Industry Trend: The demand for specialized skills in areas like AI and cloud computing remains robust, intensifying the competition for qualified engineers.

The competitive rivalry within the engineering and technology solutions sector is intense, driven by a fragmented market with numerous players. Companies differentiate themselves through pricing, service quality, innovation, and delivery capabilities, with rapid technological advancements like AI and IoT further fueling this competition.

Cyient competes with firms like TRC Companies and Quest Global, facing pressure to continuously invest in R&D and talent. The battle for skilled professionals, particularly in emerging tech areas, is a critical differentiator, impacting operational capacity and service quality.

Cyient's focus on 'Intelligent Engineering' and its investment in areas like Generative AI demonstrate its strategy to stay ahead. The company's headcount of approximately 16,000 as of March 31, 2024, highlights the significant human capital component in this competitive landscape.

| Key Competitor Examples | Cyient's Strategic Focus | Talent Market Dynamics | Innovation Drivers |

| TRC Companies, Quest Global, Belcan | Intelligent Engineering, Digital Transformation, Generative AI | High demand for AI, Cloud, Cybersecurity skills | AI, IoT, Digital Twins |

| CyientifIQ Experience Centre | Competition for specialized engineers | Continuous R&D investment | |

| Expansion through partnerships and acquisitions | Revenue per headcount as a key metric | Need for top talent |

SSubstitutes Threaten

Clients building in-house engineering and technology capabilities represent a significant substitute for Cyient's offerings. Major corporations increasingly opt to develop their own product development, digital transformation, or manufacturing design teams, thereby diminishing their dependence on outside service providers.

This trend is especially pronounced for routine tasks or ongoing maintenance, where the cost and control benefits of internal management outweigh the specialized expertise Cyient might offer. For instance, in 2024, many large IT outsourcing contracts saw clients retain more core functions internally, driven by a desire for greater agility and data security.

The availability of off-the-shelf software and platform-as-a-service (PaaS) presents a significant threat of substitution for Cyient. Clients may choose readily available, standardized solutions for certain functions instead of bespoke, engineered services. For instance, the global PaaS market was estimated to reach over $100 billion in 2023, indicating a robust and growing alternative.

As enterprise software becomes more sophisticated and user-friendly, the demand for highly customized solutions in some areas could diminish. This trend is particularly relevant in sectors where standard business processes can be effectively managed by generic software. Cyient's strategy to counter this involves concentrating on intricate, integrated, and domain-specific digital solutions that are not easily replicated by off-the-shelf products.

The increasing maturity and accessibility of open-source software and platforms represent a significant threat of substitutes for certain Cyient services. For instance, companies with strong in-house IT capabilities might leverage open-source solutions for generic IT infrastructure or development tasks, bypassing the need for external providers. This trend is particularly noticeable in less specialized areas of IT services.

While open-source can substitute for some IT functions, Cyient's core strength lies in its deep, specialized engineering and design expertise, particularly within sectors like aerospace, automotive, and telecommunications. These highly technical domains require bespoke solutions and specialized knowledge that are not easily replicated by off-the-shelf open-source alternatives. Cyient's value proposition is built on delivering end-to-end, domain-specific solutions, not just generic software implementation.

Consulting Firms with Different Service Models

While Cyient provides consulting, the threat from substitute services is moderate. Traditional management consulting firms or specialized technology consultancies can offer strategic advice, potentially fulfilling a client's need for high-level guidance without requiring Cyient's end-to-end engineering and implementation. These firms often focus on strategy development, leaving execution to clients or other service providers.

These substitute firms may present a challenge by offering strategic planning services that clients can then manage internally or outsource to different vendors. This approach allows clients to potentially unbundle services, seeking specialized expertise for strategy alone.

Cyient's integrated model, encompassing design, build, operate, and maintain, acts as a key differentiator against these substitutes. This comprehensive offering provides a distinct advantage by offering a single point of accountability for a project's lifecycle, which pure strategy consultants cannot match.

- Substitute Threat: Traditional management consulting firms and niche technology consultancies offer strategic advisory services.

- Client Approach: Clients may opt for these substitutes to obtain high-level strategy and manage execution independently or with other vendors.

- Cyient's Advantage: Cyient's integrated service model (design, build, operate, maintain) differentiates it from these substitutes.

Automation and AI Tools

The rise of automation and AI presents a significant threat of substitution for Cyient's traditional engineering and digital services. As these technologies advance, they can perform tasks previously requiring human expertise, potentially offering a more cost-effective alternative for clients. For instance, AI-driven design tools could reduce the need for manual CAD work, a core area for many engineering firms.

However, Cyient is strategically positioned to mitigate this threat by integrating AI and automation into its own service portfolio. By developing AI-powered solutions for network configuration and leveraging Generative AI for service tools, Cyient is transforming this potential disruption into a competitive advantage. This proactive approach ensures Cyient remains at the forefront of intelligent engineering rather than being displaced by it.

- Automation Threat: AI and automation can perform tasks like data analysis and software testing, substituting for human-led services.

- Cyient's Response: Cyient is embedding AI into its offerings, such as AI-driven predictive maintenance solutions.

- Opportunity Realization: By offering intelligent automation services, Cyient can capture new market segments and enhance existing client relationships.

Clients increasingly build in-house engineering and technology capabilities, especially for routine tasks, reducing reliance on external providers like Cyient. This trend was evident in 2024, with many large IT outsourcing contracts seeing clients retain more core functions internally for agility and data security.

Off-the-shelf software and platform-as-a-service (PaaS) also pose a threat, as clients may opt for standardized solutions over bespoke engineering services. The global PaaS market's estimated over $100 billion valuation in 2023 highlights this growing alternative.

Open-source software offers a substitute for generic IT infrastructure and development tasks, particularly for companies with strong in-house IT teams. However, Cyient's deep, specialized engineering expertise in sectors like aerospace and automotive remains a key differentiator against these less specialized alternatives.

The rise of automation and AI can substitute for traditional engineering services, but Cyient is integrating these technologies into its portfolio, such as AI-driven predictive maintenance, to create a competitive advantage.

| Substitute Type | Description | Cyient's Mitigation Strategy |

|---|---|---|

| In-house Capabilities | Clients developing their own engineering and digital teams. | Focus on complex, integrated, domain-specific solutions. |

| Off-the-Shelf Software/PaaS | Standardized software solutions replacing bespoke services. | Highlighting value in intricate, end-to-end, domain-specific solutions. |

| Open-Source Software | Leveraging open-source for generic IT tasks. | Emphasizing deep, specialized engineering expertise not easily replicated. |

| Automation & AI | AI and automation performing tasks previously done by humans. | Integrating AI into offerings, e.g., AI-driven predictive maintenance. |

Entrants Threaten

The engineering and technology solutions sector, particularly in specialized areas like aerospace and defense, demands substantial capital for advanced infrastructure, cutting-edge technology, and a workforce possessing deep expertise. For instance, setting up a state-of-the-art R&D facility for semiconductor design can easily run into tens of millions of dollars. This high barrier effectively deters many potential new entrants.

Cyient’s strategic investments, such as its acquisition of Citec in 2021 for approximately $90 million, underscore the significant financial commitment required to scale and compete. These investments are crucial for acquiring specialized capabilities and expanding market reach, reinforcing the high capital and expertise requirements as a formidable entry barrier.

The need for established client relationships and trust acts as a significant barrier to new entrants in the engineering and digital solutions sector. Building this trust, especially with large enterprise clients in high-stakes industries like defense and healthcare, is a time-consuming endeavor. New players simply don't possess the decades-long track record and deep-seated relationships that established firms, such as Cyient, have painstakingly built.

Cyient's advantage is underscored by its extensive customer base, which includes a substantial 30% of the top 100 global innovators. This existing network and proven reliability make it exceptionally difficult for newcomers to penetrate the market and secure the long-term contracts that are crucial for sustained growth and profitability.

Cyient's deep expertise across various sectors, including aerospace, defense, and healthcare, necessitates specialized knowledge and adherence to stringent regulatory frameworks. For instance, its ITAR certification, crucial for handling defense-related projects, represents a substantial hurdle for newcomers.

The significant investment in time and resources required to attain such domain-specific knowledge and certifications acts as a powerful deterrent. New entrants would face considerable challenges in replicating Cyient's established proficiency and compliance, thereby limiting the immediate threat of new competition in these specialized areas.

Talent Scarcity and Development Costs

The threat of new entrants is significantly influenced by talent scarcity and the associated development costs. New companies face substantial hurdles in recruiting, training, and retaining the specialized engineers and technology professionals necessary to compete. For instance, the intense global demand for skilled IT and engineering talent, particularly in areas like AI and cloud computing, means new players must invest heavily to attract and keep top performers. This can be a major barrier to entry, as established firms like Cyient often have robust, long-standing talent development programs and a reputation that aids retention.

The difficulty in rapidly scaling operations due to this talent competition is a critical factor. Companies entering the market must contend with the high cost and time involved in building a skilled workforce from scratch. This is particularly true in 2024, where reports indicate a widening gap between the demand for cybersecurity professionals and available talent, with estimates suggesting millions of unfilled positions globally. Cyient's established infrastructure and proven track record in nurturing talent give it a distinct advantage in navigating these challenges, thereby mitigating the threat posed by new entrants seeking to replicate its capabilities.

- Talent Acquisition Costs: New entrants must budget significant funds for competitive salaries, signing bonuses, and recruitment fees to attract specialized engineering talent in a tight labor market.

- Training and Development Investment: Significant resources are needed for onboarding, upskilling, and continuous training programs to ensure new hires meet industry standards and company-specific needs.

- Retention Challenges: High turnover rates can plague new companies, increasing costs and disrupting project timelines as they struggle to retain key personnel against more established competitors.

- Global Talent Competition: In 2024, the competition for skilled engineers is global, driving up wages and making it harder for smaller, newer firms to secure the necessary workforce to scale effectively.

Intellectual Property and Proprietary Solutions

The threat of new entrants into the engineering and digital solutions space is significantly mitigated by the substantial intellectual property and proprietary solutions established players like Cyient possess. Developing comparable capabilities requires considerable investment in research and development, as well as time to build a unique knowledge base and toolset. For instance, Cyient's focus on advanced analytics and AI, bolstered by acquisitions like Azimuth AI in 2023, creates a high barrier to entry.

Newcomers would face the daunting task of either replicating these complex, often patented, solutions or acquiring them, both of which are resource-intensive. This intellectual capital represents a critical competitive advantage, making it difficult for new firms to quickly match the depth and breadth of services offered by incumbents.

- Proprietary Methodologies: Cyient leverages unique frameworks for digital transformation and product lifecycle management, developed over years of client engagement.

- Acquisition of IP: Strategic acquisitions, such as Azimuth AI in 2023 for an undisclosed sum, directly integrate advanced AI and data analytics IP, strengthening Cyient's offerings.

- R&D Investment: Significant ongoing investment in research and development allows Cyient to continuously innovate and maintain a technological lead.

- Talent and Expertise: The accumulated knowledge and specialized skills of Cyient's workforce represent a form of intellectual capital that is difficult for new entrants to replicate quickly.

The threat of new entrants in Cyient's sector is generally low due to high capital requirements for advanced technology and specialized talent, as well as the significant time and resources needed to build client trust and regulatory compliance. Intellectual property and proprietary solutions further solidify this barrier, making it challenging for newcomers to compete effectively.

In 2024, the demand for specialized engineering talent remains exceptionally high, with companies like Cyient leveraging established talent acquisition and development programs. This scarcity, coupled with significant R&D investments, creates a formidable barrier for new entrants aiming to replicate existing capabilities and market presence.

Cyient's strategic acquisitions, such as Azimuth AI in 2023, bolster its intellectual property and technological advantage. This continuous innovation and integration of advanced solutions make it difficult for new players to quickly establish a comparable offering, thereby limiting the immediate threat of new competition.

The barriers to entry for new companies in Cyient's market are substantial, encompassing high initial investments in infrastructure, the need for deep domain expertise, and the cultivation of long-term client relationships. These factors, combined with stringent regulatory requirements and the difficulty in acquiring specialized talent, significantly deter new market participants.

Porter's Five Forces Analysis Data Sources

Our Cyient Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Cyient's own investor relations disclosures, annual reports, and publicly available financial statements. We supplement this with insights from reputable industry research firms and market intelligence platforms to provide a comprehensive view of the competitive landscape.