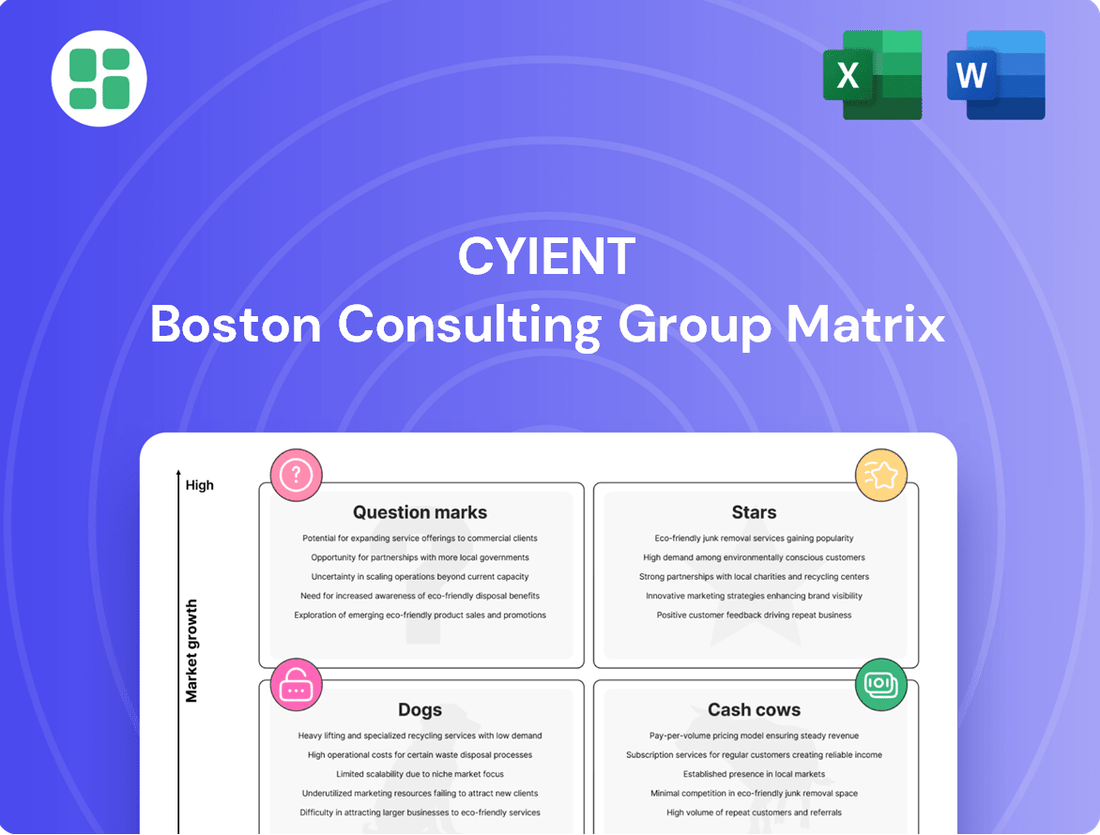

Cyient Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cyient Bundle

Curious about Cyient's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete report for actionable insights and a clear roadmap to optimize Cyient's market performance.

Stars

Cyient holds a dominant position in Aerospace & Defense engineering, recognized as a Tier 1 player in Zinnov Zones 2024 for ER&D services. This leadership is underpinned by crucial long-term partnerships with industry giants such as Airbus and Deutsche Aircraft, guaranteeing a steady revenue stream.

The A&D sector is a significant contributor to Cyient's growth, fueled by continued investment in aerospace supply chains and Maintenance, Repair, and Overhaul (MRO) services. This robust demand, coupled with strategic client relationships, solidifies its strong market standing.

Cyient's Digital Engineering & Transformation segment is a standout performer, demonstrating robust growth. The company is a recognized leader, driving advanced digital transformation initiatives by integrating technologies like Industry 4.0, IoT, and sophisticated analytics for diverse sectors.

This strategic focus on digitalizing engineering processes and accelerating Industry 4.0 adoption places Cyient in a prime position within a rapidly expanding market. For instance, the global digital engineering market was valued at approximately $60 billion in 2023 and is projected to grow significantly, with Cyient capturing a notable share through its specialized offerings.

Semiconductor Solutions represent a high-growth area for Cyient, evidenced by its Tier 1 recognition in Zinnov Zones 2024 and the creation of a specialized semiconductor subsidiary.

This strategic focus is backed by significant investment and partnerships, like the one with GlobalFoundries, bolstering its custom silicon and ASIC design expertise.

The sector's robust market growth and Cyient's dedicated efforts position Semiconductor Solutions as a crucial future revenue and innovation engine for the company.

Data & AI Engineering

Data & AI Engineering is a key growth driver for Cyient, reflecting the increasing demand for AI and data analytics solutions across various sectors. The company is strategically investing in and delivering advanced AI/ML capabilities.

Cyient's commitment to innovation is evident in its development of cutting-edge AI platforms. For instance, its Industrial Advisory Co-pilot is a prime example of its foray into generative AI, aiming to enhance operational efficiency and decision-making for its clients.

The market for Data & AI Engineering is experiencing robust expansion, with Cyient well-positioned to capitalize on this trend. The company's focus on this segment is expected to unlock substantial opportunities for future growth and technological advancement.

- Market Growth: The global AI market is projected to reach over $1.5 trillion by 2030, indicating a significant opportunity for companies like Cyient.

- Cyient's Investment: Cyient has been increasing its R&D spending in AI and data analytics, with a notable portion of its recent acquisitions focused on bolstering these capabilities.

- Solution Deployment: Cyient reported a substantial increase in AI-driven project wins in 2023, demonstrating tangible progress in deploying its solutions.

- Generative AI Focus: The company is actively exploring and integrating generative AI into its service offerings, anticipating a surge in demand for these advanced technologies.

Sustainability Solutions

Cyient's focus on sustainability solutions is a significant growth driver, contributing substantially to its order intake in FY24. The company is actively engaged in engineering clean energy projects and developing strategies for carbon and water neutrality, reflecting a strong commitment to environmentally sound practices.

This strategic direction is well-aligned with prevailing global trends and the increasing client demand for sustainable and green technologies. Cyient's expertise in this area positions it favorably in the market.

- Order Intake Boost: Sustainability initiatives significantly bolstered Cyient's order intake in FY24.

- Clean Energy Focus: The company is involved in the design and implementation of clean energy projects.

- Neutrality Goals: Cyient is actively working towards achieving carbon and water neutrality for its clients.

- Market Alignment: This strategic emphasis directly addresses the growing global demand for environmentally sustainable solutions and green technologies.

Cyient's Semiconductor Solutions are a clear Star within its BCG portfolio, showcasing high growth and strong market position. The company's Tier 1 recognition in Zinnov Zones 2024 and the establishment of a dedicated semiconductor subsidiary underscore this strategic emphasis. Investments and key partnerships, such as the one with GlobalFoundries for custom silicon and ASIC design, further solidify its capabilities in this rapidly expanding sector.

What is included in the product

Cyient's BCG Matrix analysis provides strategic insights into its business units, highlighting which to invest in, hold, or divest based on market share and growth.

The Cyient BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex business unit analysis.

Cash Cows

Cyient's traditional Product Lifecycle Management (PLM) services are a prime example of a Cash Cow within its business portfolio. These offerings leverage the company's deep-rooted expertise in foundational engineering, providing a steady and reliable stream of revenue. This stability is a direct result of long-standing client relationships and the predictable nature of recurring contracts in this mature market segment.

While not characterized by explosive growth, these PLM services benefit from Cyient's significant and well-defended market share. The company's established presence ensures consistent demand. For instance, in fiscal year 2024, Cyient reported a robust performance in its Engineering and Digital Solutions segment, which encompasses these core services, demonstrating their enduring value.

Cyient's mature communications network design and maintenance services are a classic cash cow. With a long history in the sector, these operations likely provide a steady stream of revenue, underpinning the company's financial stability. This segment benefits from established infrastructure, even as the industry evolves towards digital solutions.

The company's strong market position in Telecommunications, a sector that saw significant investment in network upgrades and maintenance throughout 2024, further solidifies the cash-generating potential of these mature services. For instance, global telecom infrastructure spending was projected to reach hundreds of billions of dollars in 2024, with a substantial portion allocated to maintaining and optimizing existing networks.

Cyient's Core Geospatial Services, a segment often categorized as a Cash Cow, benefits from a well-established market position. This business area, which includes essential services like mapping, geospatial data management, and foundational analytics, generates consistent and reliable revenue for the company.

The mature nature of the core geospatial market means Cyient can rely on steady income from these offerings, requiring minimal reinvestment to maintain its competitive edge. In 2023, Cyient's Engineering and Digital Services (EDS) segment, which houses many of these core offerings, saw robust growth, indicating the continued strength of these foundational services.

Long-Term Engineering Partnerships

Cyient's long-term engineering partnerships, especially within established sectors like aerospace and industrial, function as significant cash cows. These mature client relationships provide a consistent revenue stream through predictable design and support services, demonstrating high client retention.

These stable, ongoing engagements are crucial for Cyient's financial health, acting as reliable profit generators. For instance, in the fiscal year ending March 2024, Cyient reported a robust performance, with its engineering and digital solutions segment contributing substantially to overall revenue, reflecting the strength of these long-standing partnerships.

- Stable Revenue: Predictable demand for engineering services from legacy clients ensures consistent income.

- High Retention: Long-term contracts in mature industries typically exhibit low churn rates.

- Profitability: These established relationships often operate with optimized cost structures, leading to healthy profit margins.

- Cash Generation: The consistent cash flow from these partnerships supports investment in growth areas.

Legacy IT Application Modernization Services

Cyient's Legacy IT Application Modernization Services function as a Cash Cow within its business portfolio. While the market for modernization is robust, Cyient's established expertise in migrating and supporting these older systems for its existing clientele generates a stable, predictable revenue stream, even if growth is more moderate compared to other segments.

These services are crucial for a significant installed base of clients who require ongoing maintenance, essential upgrades, and continued support for their critical legacy applications. This consistent demand ensures a reliable income source for Cyient.

- Stable Revenue: Legacy modernization provides a consistent, albeit lower-growth, revenue stream due to ongoing client needs for maintenance and support.

- Large Installed Base: Cyient leverages its existing client relationships to offer these essential services, tapping into a large installed base.

- Established Demand: The need for migration and support of legacy applications remains high across many industries, ensuring continued demand for Cyient's offerings.

- Lower Growth, High Stability: While not a high-growth area, the predictability and stability of these services make them a valuable Cash Cow for the company.

Cyient's established Product Lifecycle Management (PLM) services are a prime example of a Cash Cow. These offerings, built on deep engineering expertise, deliver a steady and reliable revenue stream, a testament to long-standing client relationships and predictable recurring contracts in a mature market. For instance, Cyient's Engineering and Digital Solutions segment, which includes these core services, demonstrated robust performance in fiscal year 2024, underscoring their enduring value and consistent demand due to Cyient's significant market share.

| Business Segment | BCG Category | Key Characteristics | Financial Year 2024 Data Insight |

|---|---|---|---|

| Product Lifecycle Management (PLM) | Cash Cow | Steady revenue, high client retention, mature market | Engineering & Digital Solutions segment showed strong performance |

| Communications Network Design & Maintenance | Cash Cow | Stable income from established infrastructure, predictable demand | Global telecom infrastructure spending in 2024 supported network maintenance |

| Core Geospatial Services | Cash Cow | Consistent revenue from mapping and data management, low reinvestment needs | EDS segment's robust growth in 2023 indicates continued strength |

| Long-term Engineering Partnerships (Aerospace, Industrial) | Cash Cow | Predictable design and support services, high client retention | Engineering & Digital Solutions contributed substantially in FY24 |

| Legacy IT Application Modernization | Cash Cow | Stable revenue from migrating and supporting older systems, large installed base | Ongoing client needs for maintenance and support ensure consistent income |

What You See Is What You Get

Cyient BCG Matrix

The Cyient BCG Matrix preview you are currently viewing is the complete, unwatermarked document you will receive immediately after your purchase. This means you're seeing the final, professionally formatted report, ready for immediate integration into your strategic planning processes without any additional editing or modifications required.

Dogs

Cyient's traditional IT services, those not deeply connected to its intelligent engineering or advanced digital offerings, are likely experiencing significant commoditization. This segment faces fierce competition, leading to price pressures and limited differentiation.

These offerings may show sluggish growth and struggle to capture substantial market share. In 2024, the global IT services market, while growing, saw traditional segments like infrastructure management facing slower expansion compared to cloud and digital transformation services.

Consequently, these traditional services could become a drag on resources, demanding investment without yielding proportionate returns. Cyient's focus on integrating these with higher-growth, higher-margin digital solutions is crucial for improving overall portfolio performance.

Within Cyient's transportation vertical, traditional engineering sub-segments like design and maintenance for mature automotive and railway components are experiencing a downturn. These areas, not capitalizing on digital or electrification advancements, present a challenge.

For instance, reports from 2024 indicate a slowdown in capital expenditure for legacy rail infrastructure in several key markets, directly impacting demand for traditional engineering services in this segment. This translates to low growth and potentially shrinking market share for Cyient in these specific niches, necessitating a strategic review.

Underperforming niche geographic markets represent areas where Cyient has a limited footprint and faces significant challenges in expanding its market share. These regions, often smaller or highly localized, may drain resources without delivering proportionate returns or growth. For instance, if Cyient’s presence in a specific South American country remains negligible, with revenue from that region contributing less than 0.5% to the company's overall global revenue in 2024, it would likely be classified as a dog.

Outdated Software Maintenance & Support

Maintaining and supporting highly specialized, legacy software applications that are fading from the market can be a low-growth, low-profit area. These services often consume resources on technologies with diminishing relevance and limited prospects for future growth or innovation.

For instance, consider the market for mainframe support. While essential for some organizations, the overall demand for new development on these platforms has significantly declined. In 2024, it's estimated that only a small percentage of new application development occurs on mainframes, making continued investment in supporting older versions a strategic challenge.

- Low Market Growth: The demand for services related to obsolete software is naturally contracting as newer, more efficient technologies emerge.

- Resource Drain: Allocating skilled personnel and capital to maintain outdated systems diverts resources from potentially higher-return investments in modern technologies.

- Limited Future Potential: These segments offer little opportunity for expansion or the development of new service lines, hindering overall business development.

Highly Commoditized Basic CAD/CAE Services

Highly commoditized basic CAD/CAE services often face significant price competition in the engineering services sector. Without advanced digital integration or specialized domain knowledge, these offerings can lead to thin profit margins for companies like Cyient.

This category of services, characterized by a lack of differentiation, can struggle to achieve substantial market share growth. For instance, while the global CAD/CAE market was valued at approximately $12.6 billion in 2023, the basic service segment within it often sees intense bidding wars, potentially impacting revenue realization.

- Intense Price Pressure: Basic CAD/CAE work is often awarded based on cost, squeezing profitability.

- Limited Differentiation: Services lacking advanced digital tools or niche expertise are easily replicated.

- Low Margin Business: Companies in this segment typically operate with lower profit margins compared to specialized offerings.

- Stagnant Growth Potential: Without innovation or specialization, market share expansion becomes challenging.

Cyient's "Dogs" likely represent segments with low market growth and weak competitive positions. These could include highly commoditized IT services or traditional engineering services lacking digital integration, facing intense price pressure and limited differentiation.

For example, basic CAD/CAE services, which saw intense bidding wars in 2023, represent a low-margin business with stagnant growth potential. Similarly, supporting obsolete software with diminishing market relevance, like legacy mainframe applications where new development was minimal in 2024, consumes resources without offering future prospects.

These areas, such as underperforming niche geographic markets where Cyient’s 2024 revenue contribution was negligible, often drain resources without delivering proportionate returns, necessitating a strategic review to reallocate capital to more promising ventures.

Question Marks

Cyient Semiconductors Private Limited, a recent venture by Cyient, targets the high-growth custom silicon and ASIC design market. This strategic move positions Cyient within a capital-intensive and rapidly evolving sector, aiming to capture a share of the burgeoning semiconductor demand.

While Cyient Semiconductors has initiated strategic partnerships, its market share is still nascent. The company is in the early phases of establishing its presence, a common characteristic for 'Question Marks' in the BCG matrix, requiring significant investment to achieve substantial growth and market penetration.

Cyient is strategically investing in advanced Generative AI (GenAI) platforms, like its Industrial Advisory Co-pilot. This positions them within a market experiencing significant growth and rapid evolution, indicating strong potential. For instance, the global GenAI market was projected to reach $110.8 billion in 2024, highlighting the lucrative nature of this sector.

Despite this promising market, Cyient is still working to solidify its position. The inherent newness of these GenAI technologies and the presence of fierce competition mean that establishing a dominant market share is an ongoing process. By 2024, while adoption is accelerating, market leadership is still being defined across the industry.

Cyient's new digital Field Service Management (FSM) deployments, powered by its strategic partnership with Zinier for AI-driven tools, are positioned in a high-growth segment targeting asset-intensive industries. This initiative reflects Cyient's ambition to lead digital transformation in this space. For instance, the global FSM market was valued at approximately $3.5 billion in 2023 and is projected to reach over $7.5 billion by 2028, indicating substantial growth potential.

While Cyient is actively expanding its presence in these new FSM deployments, its market share is still in its nascent stages. Significant investment is being channeled into developing this capability and gaining a stronger foothold. This strategic focus aligns with the company's objective to capitalize on the increasing demand for efficient field operations, particularly as businesses across sectors like utilities, telecommunications, and manufacturing increasingly adopt advanced digital solutions.

Electric Vertical Take-off and Landing (eVTOL) Aircraft Development

Cyient's engagement in Electric Vertical Take-off and Landing (eVTOL) aircraft development, exemplified by its collaboration with SkyDrive Inc., positions it within a rapidly evolving and potentially transformative aerospace sector. This market, while holding significant long-term promise, is characterized by intense innovation and competition, meaning Cyient's current market share in this nascent field is likely modest.

To establish a leading position in the eVTOL space, Cyient will need to commit considerable resources towards research, development, and scaling its capabilities. The global eVTOL market is projected to reach substantial figures, with some estimates suggesting it could be worth over $100 billion by 2030, underscoring the strategic importance of this segment.

- High Growth Potential: The eVTOL market is a nascent but rapidly expanding segment of aerospace, driven by demand for sustainable urban air mobility solutions.

- Disruptive Technology: eVTOLs represent a significant technological shift, promising cleaner, quieter, and potentially more efficient air transportation.

- Strategic Collaborations: Partnerships, such as Cyient's with SkyDrive, are crucial for navigating the complexities and accelerating development in this specialized area.

- Investment Requirement: Achieving market leadership in eVTOL development necessitates substantial ongoing investment in R&D, manufacturing, and regulatory compliance.

Power-to-X (P2X) Solutions

Cyient's involvement in Power-to-X (P2X) technologies, which are designed to convert and store renewable energy, places the company in a dynamic and rapidly expanding area within the sustainability market. This strategic engagement taps into a significant growth opportunity as the world transitions towards cleaner energy sources.

While P2X represents a high-growth segment, the market for these advanced solutions is still in its early stages of development. Cyient's current market share within this nascent sector is in the development phase, indicating a need for ongoing strategic investment and focus to capture a substantial position.

- Market Maturity: The global Power-to-X market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by decarbonization targets and advancements in electrolyzer technology.

- Cyient's Position: Cyient is actively developing its capabilities in P2X, focusing on engineering and digital solutions that support the infrastructure and operationalization of these technologies.

- Investment Needs: Continued investment in research and development, strategic partnerships, and talent acquisition will be crucial for Cyient to solidify its market presence and capitalize on the P2X opportunity.

- Growth Potential: As P2X solutions become more mainstream, Cyient is well-positioned to benefit from the increasing demand for specialized engineering services and digital transformation in this sector.

Cyient's ventures into custom silicon and ASIC design, Generative AI (GenAI), digital Field Service Management (FSM), Electric Vertical Take-off and Landing (eVTOL) aircraft development, and Power-to-X (P2X) technologies all represent significant growth opportunities.

These areas are characterized by high potential but are also in their early stages of market development, with Cyient still working to establish substantial market share.

Significant investment is required across these segments to drive innovation, scale operations, and gain a competitive edge, aligning with the characteristics of 'Question Marks' in the BCG matrix.

| Business Area | Market Growth Potential | Cyient's Current Market Share | Investment Needs (General) |

|---|---|---|---|

| Custom Silicon & ASIC Design | High | Nascent | Significant |

| Generative AI (GenAI) | Very High (Global market projected to reach $110.8 billion in 2024) | Early Stage | Substantial |

| Digital Field Service Management (FSM) | High (Global FSM market projected to reach over $7.5 billion by 2028 from $3.5 billion in 2023) | Nascent | Ongoing |

| eVTOL Aircraft Development | Very High (Potential to exceed $100 billion by 2030) | Modest | Considerable |

| Power-to-X (P2X) Technologies | High (Projected to reach hundreds of billions by 2030) | Development Phase | Strategic |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, industry growth rates, and competitive landscape analysis to provide strategic insights.