Centre Testing International Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centre Testing International Group Bundle

Centre Testing International Group possesses significant strengths in its established brand and extensive testing capabilities, but faces potential threats from evolving technological landscapes. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Centre Testing International Group's competitive advantages and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Centre Testing International Group (CTI) boasts a comprehensive service portfolio, encompassing testing, inspection, certification, and calibration. This extensive range covers a multitude of industries, positioning CTI as a one-stop solution for clients. For instance, in 2023, CTI reported a revenue of ¥2.4 billion, demonstrating the market's demand for such integrated services.

This all-encompassing approach simplifies complex compliance and quality assurance processes for businesses, enhancing CTI's market appeal. By offering a broad spectrum of services, CTI effectively addresses diverse client needs, from ensuring product safety to meeting stringent national and international standards, contributing to their strong client retention rates.

Centre Testing International (CTI) leverages an extensive global network, operating approximately 160 laboratories and over 260 offices across more than 90 cities. This vast infrastructure, powered by a workforce exceeding 13,000 employees, allows CTI to offer comprehensive testing and inspection services worldwide.

As a recognized market leader within China's Testing, Inspection, and Certification (TIC) industry, CTI's listing on the Shenzhen Stock Exchange underscores its established credibility and significant market presence. This leadership position, coupled with its global reach, provides a strong foundation for continued growth and service expansion.

Centre Testing International Group's (CTI) commitment to quality is underscored by its impressive portfolio of accreditations. Holding certifications like China Compulsory Certification (CCC), China National Accreditation Service for Conformity Assessment (CNAS), and China Metrology Accreditation (CMA) signifies a robust quality management system. Furthermore, its designation as a European Commission Notified Body highlights its capability to facilitate market access for clients in the European Union.

Diversified Sectoral Expertise

Centre Testing International Group (CTI) boasts a significant strength in its diversified sectoral expertise, serving a wide array of industries. This includes established sectors like consumer products, industrial products, food, environmental, and automotive, as well as forward-looking areas such as chips, semiconductors, and green low-carbon environmental services. This broad reach across the economy is a key advantage.

This diversification is crucial as it effectively mitigates the risks associated with over-reliance on any single industry. By operating across multiple economic segments, CTI is well-positioned to benefit from growth opportunities wherever they arise. For example, the automotive Testing, Inspection, and Certification (TIC) market is anticipated to experience substantial expansion, providing a direct avenue for CTI's growth.

- Broad Industry Coverage: CTI's services span consumer, industrial, food, environmental, automotive, semiconductors, and green services.

- Risk Mitigation: Diversification reduces dependence on any single sector's performance.

- Growth Capitalization: The company is positioned to leverage growth across various economic segments.

- Automotive Market Focus: CTI is set to benefit from the projected robust growth in the automotive TIC sector.

Commitment to Innovation and ESG

Centre Testing International Group (CTI) demonstrates a robust commitment to innovation, actively investing in research and development. This focus fuels the enhancement of their services and the adoption of cutting-edge technologies, such as advanced automated testing processes. For instance, in 2024, CTI allocated a significant portion of its budget towards R&D, aiming to streamline testing methodologies and expand its service portfolio.

Furthermore, CTI is proactively integrating Environmental, Social, and Governance (ESG) principles into its core operations. This strategic alignment with sustainable development and climate change mitigation efforts is crucial. By embedding ESG governance systems, CTI not only addresses growing global regulatory pressures but also capitalizes on increasing market demand for environmentally and socially responsible businesses.

- Innovation Investment: CTI's R&D spending in 2024 saw a notable increase, focusing on automated testing solutions.

- ESG Integration: The company is actively embedding ESG governance, responding to market trends and regulatory shifts.

- Sustainable Practices: Commitment to sustainability aligns with increasing global demand for responsible business operations.

CTI's comprehensive service portfolio, including testing, inspection, and certification across diverse industries, positions it as a key player in the global TIC market. This integrated approach simplifies compliance for clients, driving demand and contributing to strong client relationships.

The company's extensive global network, featuring approximately 160 laboratories and over 260 offices, supported by more than 13,000 employees, enables it to provide widespread service delivery. As a recognized leader in China's TIC sector, CTI's public listing on the Shenzhen Stock Exchange further solidifies its credibility and market standing.

CTI's commitment to quality is evidenced by its numerous accreditations, including CNAS and CMA, and its role as a European Commission Notified Body, facilitating market access for clients. This dedication to high standards underpins its reputation and operational capabilities.

The company's diversified sectoral expertise, spanning consumer products, industrial goods, food, environmental, automotive, and emerging areas like semiconductors and green services, is a significant strength. This broad coverage, as highlighted by its presence in the growing automotive TIC market, effectively mitigates sector-specific risks and allows CTI to capitalize on varied growth opportunities.

CTI's strategic investment in research and development, particularly in automated testing solutions, and its proactive integration of ESG principles into its operations demonstrate a forward-looking approach. These initiatives are crucial for staying competitive and meeting evolving market demands for sustainability and technological advancement.

| Strength Area | Key Feature | Impact |

|---|---|---|

| Service Portfolio | Testing, Inspection, Certification, Calibration | One-stop solution, simplifies compliance |

| Global Network | 160+ Labs, 260+ Offices, 13,000+ Employees | Extensive service reach, global market penetration |

| Market Leadership | Recognized leader in China's TIC sector, Shenzhen Stock Exchange listed | Credibility, market presence, growth foundation |

| Accreditations | CNAS, CMA, EU Notified Body | Quality assurance, market access facilitation |

| Sectoral Diversification | Consumer, Industrial, Food, Environmental, Automotive, Semiconductors, Green Services | Risk mitigation, growth capitalization |

| Innovation & ESG | R&D investment, ESG integration | Competitive edge, sustainable operations |

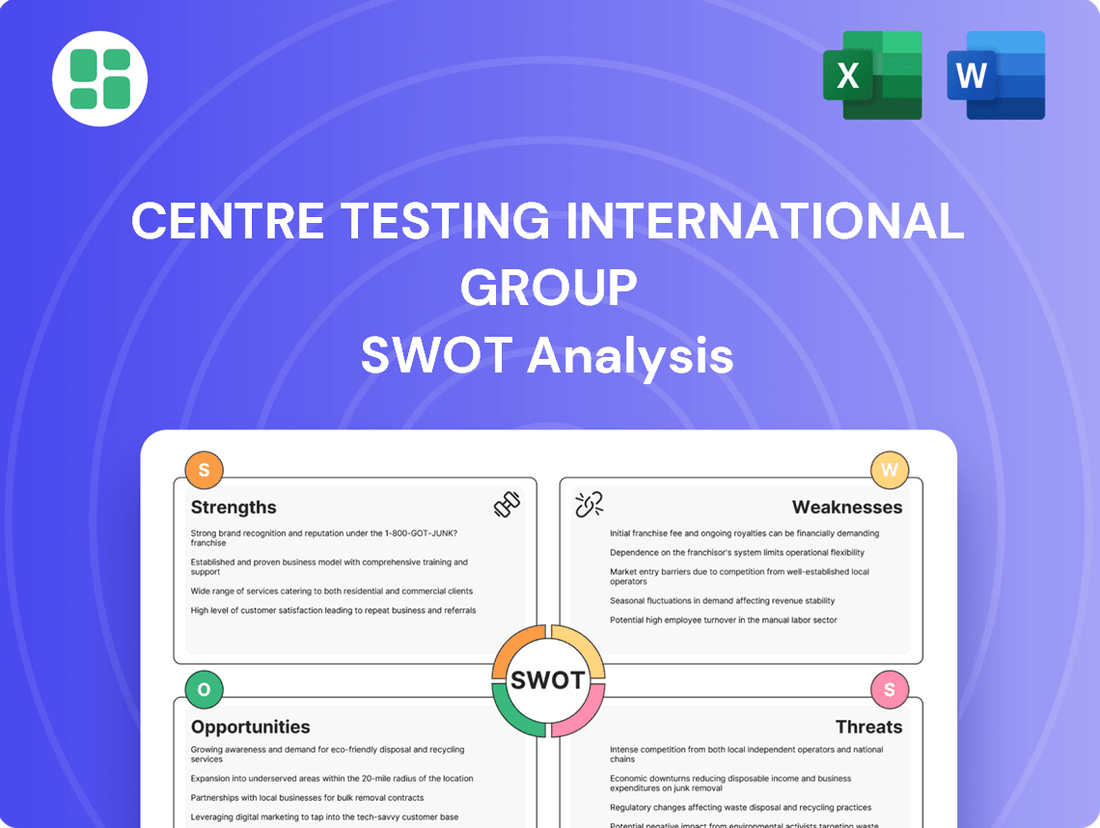

What is included in the product

This analysis identifies Centre Testing International Group's core competencies and market vulnerabilities, alongside potential avenues for expansion and external challenges. It provides a comprehensive view of the company's strategic landscape.

Offers a clear, actionable framework to identify and leverage CTI's competitive advantages, mitigating risks and capitalizing on opportunities for strategic growth.

Weaknesses

Centre Testing International Group's (CTI) deep roots and established reputation in China present a potential vulnerability. While CTI is recognized as a pioneer and leader, this strength is largely confined to the Chinese market. This significant reliance means CTI could be disproportionately affected by economic slowdowns or regulatory changes specific to China.

For instance, if China's economic growth falters, or if new domestic regulations emerge that favor local competitors, CTI's performance could be significantly impacted. In 2023, China's GDP growth was reported at 5.2%, a figure that, while robust, is subject to various domestic and global pressures. Any significant downturn in this key market could therefore pose a considerable risk to CTI's overall financial health and expansion plans.

Centre Testing International (CTI) operates within the global Testing, Inspection, and Certification (TIC) sector, a landscape characterized by intense competition and fragmentation. This means CTI contends with a multitude of global giants and niche specialists vying for market share.

Key rivals such as SGS, Bureau Veritas, TÜV NORD Group, and TÜV SÜD possess significant established market presence and broad service portfolios. This competitive pressure could constrain CTI's ability to grow its market share and dictate pricing, particularly in established or highly specialized segments of the TIC market.

Centre Testing International Group's (CTI) extensive global network of laboratories and offices, coupled with ongoing investment in cutting-edge testing equipment and research into emerging technologies like AI and IoT within the Testing, Inspection, and Certification (TIC) sector, necessitates substantial capital expenditure. For instance, in 2023, CTI reported capital expenditures of approximately RMB 210 million, highlighting the significant financial commitment required to maintain and expand its operational capabilities.

This inherent capital intensity can place a strain on financial resources, particularly during periods of economic downturn or rapid technological evolution where the pace of investment needs to be sustained to remain competitive. Such high upfront costs can impact CTI's flexibility in allocating capital to other strategic initiatives or returning value to shareholders.

Workforce Shortages and Talent Retention

The testing, inspection, and certification (TIC) sector, including companies like Centre Testing International Group (CTI), frequently grapples with shortages of skilled workers. This is particularly true for roles requiring specialized technical expertise and deep knowledge of evolving regulatory landscapes. Finding and keeping these highly qualified individuals presents an ongoing hurdle, impacting operational efficiency and increasing recruitment costs.

For CTI, attracting and retaining top-tier talent, especially those adept in cutting-edge technologies and intricate compliance requirements, represents a persistent operational and financial challenge. The competitive nature of the labor market for these specialized skills means that CTI must continually invest in competitive compensation and development programs to secure and keep its expert workforce.

- Talent Scarcity: The TIC industry faces a significant deficit in professionals with advanced technical skills and up-to-date knowledge of global standards.

- Retention Costs: High turnover rates in specialized roles can lead to increased recruitment expenses and a loss of institutional knowledge for CTI.

- Emerging Tech Gap: A particular challenge lies in finding experts proficient in new technologies and complex international regulatory frameworks, impacting CTI's ability to offer services in these growing areas.

Vulnerability to Supply Chain Disruptions

Centre Testing International Group (CTI) faces significant vulnerability to global supply chain disruptions. Events like the COVID-19 pandemic or ongoing geopolitical tensions have demonstrated how quickly international logistics can falter, directly impacting CTI's ability to perform timely inspections and certifications worldwide. These disruptions can lead to increased operational costs and delays, potentially affecting client satisfaction and CTI's overall efficiency.

The reliance on a global network for sample collection, testing equipment, and personnel means that even localized disruptions can have a cascading effect. For instance, a major port closure in Asia in late 2023, reported by supply chain analytics firms, caused significant delays for various industries, a risk CTI must actively manage. Such events can strain resources and necessitate the use of more expensive, alternative shipping methods, impacting profit margins.

- Impact on Service Delivery: Delays in receiving samples or essential testing materials can postpone critical certification processes, affecting client timelines and potentially leading to contractual penalties.

- Increased Operational Costs: Sourcing alternative suppliers or expedited shipping due to disruptions can significantly raise the cost of delivering services.

- Reputational Risk: Consistent service failures or delays stemming from supply chain issues could damage CTI's reputation for reliability and promptness in the market.

CTI's concentrated reliance on the Chinese market, despite its leadership position there, exposes it to significant risks from economic downturns or regulatory shifts within China. For example, while China's GDP grew 5.2% in 2023, any slowdown could disproportionately impact CTI's performance and expansion plans.

What You See Is What You Get

Centre Testing International Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Centre Testing International Group's strategic landscape. You can trust that the insights presented are authentic and representative of the complete analysis.

Opportunities

The global testing, inspection, and certification (TIC) market is experiencing robust expansion, with projections indicating continued steady growth. This surge is fueled by escalating regulatory mandates worldwide, the increasing complexity of global supply chains, and a heightened consumer emphasis on product safety and quality. For instance, the TIC market was valued at approximately $240 billion in 2023 and is expected to reach over $300 billion by 2028, demonstrating a compound annual growth rate of around 5% to 6%.

This expanding demand creates a significant growth avenue for Centre Testing International Group (CTI). Industries such as automotive, healthcare, food and beverage, and general manufacturing are all increasingly reliant on rigorous compliance and quality assurance. As these sectors navigate evolving standards and global trade dynamics, the need for trusted third-party verification services like those offered by CTI becomes paramount, presenting a clear opportunity for market penetration and service expansion.

Centre Testing International Group (CTI) can seize significant opportunities by embracing emerging technologies and expanding into high-growth sectors. The integration of AI-powered inspection systems, IoT for real-time monitoring, blockchain for enhanced data security, and digital twins are revolutionizing the Testing, Inspection, and Certification (TIC) landscape.

CTI is well-positioned to leverage these advancements by increasing its investment in and service offerings for rapidly expanding areas. This includes crucial sectors like electric vehicles (EVs), where demand for battery testing and component certification is surging, and renewable energy, requiring rigorous quality assurance for solar panels and wind turbines.

Further opportunities lie in sustainability certifications, a market driven by increasing environmental regulations and corporate social responsibility initiatives. Additionally, the growing need for cybersecurity testing across all industries and the critical demand for semiconductor testing services present substantial avenues for CTI’s growth and market diversification.

The testing, inspection, and certification (TIC) sector is seeing significant consolidation, with established companies acquiring smaller, specialized businesses. This strategy allows them to broaden their service portfolios, enter new markets, and enhance their technological expertise. Centre Testing International Group (CTI) has actively pursued this growth avenue, notably acquiring ALS Chemex Guangzhou and Safety SA Holdco Ltd in July 2025.

These strategic acquisitions bolster CTI's competitive standing and contribute to a more diversified business model. By integrating these entities, CTI can leverage new capabilities and expand its geographical footprint, reinforcing its market position in an increasingly competitive landscape.

Increasing Outsourcing of TIC Services

The Testing, Inspection, and Certification (TIC) market is seeing significant expansion in its outsourced segment. This growth is fueled by increasingly intricate global supply chains and a strategic push by major corporations to reduce operational expenses and concentrate on their primary business functions. This shift creates a clear pathway for Centre Testing International Group (CTI) to broaden its reach and acquire new clients by delivering streamlined and economically viable third-party testing and certification services worldwide.

The global TIC market was valued at approximately $220 billion in 2023 and is projected to reach over $300 billion by 2028, with outsourcing forming a substantial growth driver. CTI is well-positioned to capitalize on this by offering specialized expertise and scalable solutions.

- Growing Demand for Specialized Expertise: Businesses increasingly rely on external providers for niche testing and certification requirements, a trend CTI can leverage.

- Cost Optimization Strategies: Corporations are actively seeking to outsource non-core functions to manage costs, presenting an opportunity for CTI's efficient service model.

- Global Supply Chain Complexity: The intricate nature of modern supply chains necessitates robust and reliable third-party verification, a service CTI excels in providing.

- Focus on Core Competencies: By outsourcing TIC services, companies can redirect internal resources towards innovation and strategic development, benefiting CTI's service offerings.

Leveraging Digital Transformation for Efficiency

Centre Testing International Group (CTI) can significantly boost its operations by embracing the ongoing digital transformation within the certification industry. The adoption of e-certification platforms and remote auditing technologies presents a clear path to greater efficiency and reduced operational expenses. For instance, by digitizing certificate issuance, CTI could potentially cut down on administrative overhead associated with physical document handling and mailing, which often represent a notable portion of operational costs. This move not only streamlines compliance but also positions CTI as a forward-thinking provider, appealing to clients who prioritize speed and transparency in their certification processes.

The strategic implementation of digital tools offers CTI a distinct competitive advantage. By enhancing service delivery speed and transparency through digital means, CTI can attract a broader client base, particularly those seeking agile and modern compliance solutions. For example, in 2024, the global market for digital certification solutions was projected to reach over $1.5 billion, indicating a strong demand for such services. CTI’s ability to leverage these technologies can translate into increased market share and improved client satisfaction.

- Enhanced Efficiency: Digital platforms can automate many manual processes, leading to faster turnaround times for certifications.

- Cost Reduction: Implementing e-certification and remote auditing can significantly lower administrative and logistical expenses.

- Improved Transparency: Digital tracking and online portals offer clients real-time visibility into their certification status.

- Competitive Edge: Early adoption of digital transformation attracts clients seeking modern, streamlined compliance solutions.

Centre Testing International Group (CTI) is poised to capitalize on the burgeoning demand for specialized testing and certification services across various high-growth sectors. The increasing complexity of global supply chains and a heightened focus on product safety and sustainability are driving a significant outsourcing trend within the Testing, Inspection, and Certification (TIC) market. By offering efficient, cost-effective third-party verification, CTI can expand its client base and market reach.

CTI's strategic acquisitions, such as the July 2025 integration of ALS Chemex Guangzhou and Safety SA Holdco Ltd, are instrumental in broadening its service portfolio and geographical presence. These moves enhance CTI's competitive edge in a consolidating market, allowing it to offer a more diversified range of capabilities and strengthen its overall market position.

Embracing digital transformation presents a substantial opportunity for CTI to improve operational efficiency and client service. The adoption of e-certification and remote auditing technologies can streamline compliance processes, reduce administrative costs, and provide clients with greater transparency. For instance, the global digital certification solutions market was projected to exceed $1.5 billion in 2024, highlighting a strong market appetite for these advancements.

| Opportunity Area | Market Driver | CTI Advantage | Potential Impact |

|---|---|---|---|

| Specialized Sector Growth | EVs, Renewable Energy, Cybersecurity | Leveraging expertise in emerging technologies | Increased market share in high-demand niches |

| Market Consolidation | Acquisitions for service expansion | Strategic integration of acquired entities | Enhanced competitive standing and diversified model |

| Digital Transformation | E-certification, Remote Auditing | Improving efficiency and client transparency | Reduced operational costs and improved client satisfaction |

| Outsourcing Trend | Supply chain complexity, cost reduction | Streamlined and economical third-party services | Broadened reach and acquisition of new clients |

Threats

Centre Testing International Group (CTI) operates in a sector highly sensitive to governmental oversight. Changes in regulations, such as stricter environmental standards or new product safety requirements, can force significant capital expenditures for CTI to adapt its testing and certification capabilities. For instance, the European Union's ongoing review of its Ecodesign for Sustainable Products Regulation, expected to expand significantly in 2024-2025, could introduce new testing protocols impacting various product categories CTI serves.

These regulatory shifts can also increase the complexity of compliance, demanding more specialized expertise and potentially leading to higher operational costs. A substantial portion of CTI's revenue is tied to ensuring products meet existing standards; therefore, a rapid evolution of these standards presents a direct challenge to maintaining profitability and market share without commensurate investment.

Global economic uncertainties, including persistent inflation and elevated interest rates, pose a significant threat by potentially reducing demand for testing and certification services as businesses tighten their budgets. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, reflecting these headwinds.

Growing geopolitical tensions can further disrupt supply chains and dampen international trade, indirectly impacting CTI's revenue streams. The ongoing conflicts in Eastern Europe and the Middle East, for example, have already led to increased energy costs and supply chain volatility, impacting manufacturing output and thus the need for related testing services.

These macroeconomic challenges could directly affect CTI's revenue growth and profitability, particularly given its operations across diverse global regions where economic slowdowns might manifest differently. A slowdown in key markets like Europe, which saw inflation remain elevated in early 2024, could particularly weigh on CTI's performance.

The relentless march of technological advancement poses a significant threat, as Centre Testing International Group's (CTI) current testing equipment and methods risk rapid obsolescence. This necessitates ongoing, substantial investment in emerging technologies like artificial intelligence, the Internet of Things, and sophisticated data analytics to maintain a competitive edge.

This continuous investment represents a considerable financial outlay and carries inherent risks. Should these capital expenditures fail to deliver the anticipated returns, or if even newer technologies emerge unexpectedly, CTI could face a competitive disadvantage and financial strain. For example, the global testing, inspection, and certification (TIC) market, which CTI operates within, is projected to grow, but this growth is heavily influenced by technological adoption. Reports suggest that companies failing to integrate AI into their testing processes by 2025 could see a significant drop in efficiency and market share.

Aggressive Competition and Pricing Pressure

The Testing, Inspection, and Certification (TIC) sector is highly competitive, with established global players and specialized regional firms vying for market share. This intense rivalry frequently translates into significant pricing pressure, as companies may undercut each other to secure contracts. For Centre Testing International Group (CTI), this means a constant need to balance competitive pricing with maintaining healthy profit margins.

Competitors, particularly those with leaner operational structures or focusing on specific niches, can often present more attractive price points. This forces CTI to either match these lower prices, potentially impacting profitability, or to further invest in differentiating its service offerings. Such differentiation might involve enhanced technological capabilities, broader service portfolios, or superior customer service, all of which require strategic investment.

For instance, in the broader TIC market, major players like SGS and Bureau Veritas have historically demonstrated pricing strategies that can influence market dynamics. While specific pricing data for CTI's direct competitors isn't publicly detailed in a comparative manner, industry reports from 2024 indicate that price sensitivity remains a key factor for clients across various sectors, from automotive to electronics testing.

- Intense TIC Market Rivalry: Global leaders and niche providers create a highly competitive landscape.

- Pricing Pressure: Competitors' aggressive pricing can force margin reductions or increased investment in differentiation.

- Strategic Response: CTI must balance competitive pricing with service enhancement to maintain market position.

- Client Sensitivity: 2024 industry observations highlight that clients often prioritize cost-effectiveness in TIC services.

Cybersecurity Risks and Data Integrity Concerns

As Centre Testing International Group (CTI) continues to digitize its testing, inspection, and certification (TIC) processes, cybersecurity risks are a significant concern. The increasing reliance on interconnected systems makes CTI vulnerable to breaches that could compromise sensitive client data and testing results. In 2024, global cybersecurity spending is projected to reach $232 billion, highlighting the escalating threat landscape that CTI must navigate.

A successful cyberattack could have severe repercussions for CTI. Imagine a scenario where client proprietary information or critical testing outcomes are leaked or altered. This would not only cause irreparable damage to CTI's reputation but also expose the company to substantial legal liabilities and a profound loss of client trust. In the TIC sector, where accuracy and confidentiality are paramount, such a breach could be existential.

- Data Breach Impact: A 2024 IBM report indicated the average cost of a data breach in the technology sector reached $5.61 million, a figure CTI would aim to avoid.

- Reputational Damage: Trust is the currency of the certification industry; a cybersecurity incident could erode this trust rapidly.

- Operational Disruption: System compromise could halt testing operations, leading to significant financial losses and client dissatisfaction.

- Regulatory Fines: Non-compliance with data protection regulations, such as GDPR or similar frameworks, can result in hefty penalties.

The highly competitive nature of the Testing, Inspection, and Certification (TIC) market presents a significant threat due to intense rivalry from both global leaders and specialized regional firms. This competition often leads to considerable pricing pressure, forcing CTI to either reduce its margins or invest more in differentiating its services. Industry observations from 2024 indicate that clients across various sectors remain highly sensitive to cost-effectiveness in TIC services, making it challenging for CTI to maintain healthy profit margins without compromising on service quality or value.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Centre Testing International Group's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded and actionable assessment.