CSG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSG Bundle

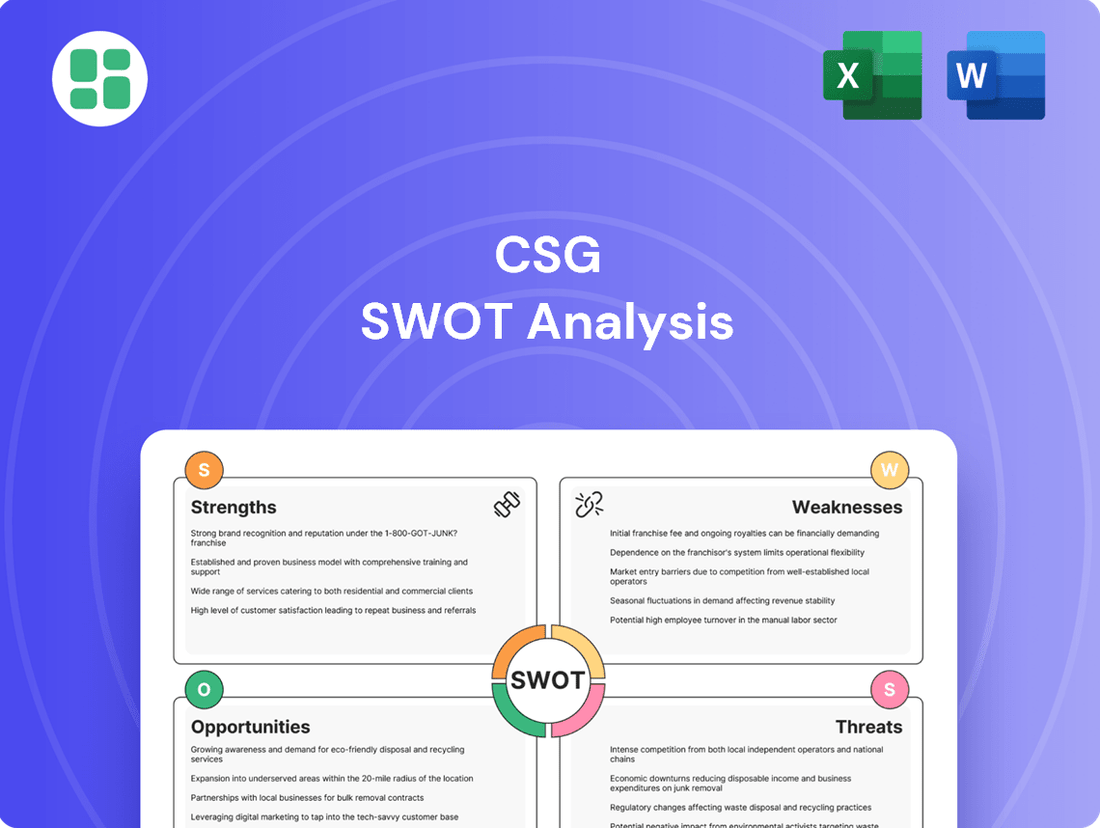

Discover the critical strengths, potential weaknesses, promising opportunities, and significant threats facing CSG. This preview offers a glimpse into their competitive landscape, but the full SWOT analysis unlocks actionable strategies and deeper market context. Ready to gain a comprehensive understanding and make informed decisions?

Strengths

CSG boasts an established market position, especially in the business support systems (BSS) sector, serving key players in telecommunications, cable, and media. This strong foothold translates into a significant competitive advantage.

The company's financial stability is further bolstered by its highly recurring revenue model. This model, driven by long-term contracts with major clients, ensures predictable cash flows, a crucial element for sustained growth and investment.

For instance, in the first quarter of 2024, CSG reported approximately 84% of its revenue as recurring, highlighting the dependability of its income streams and the stickiness of its customer base.

CSG boasts a robust and expanding portfolio, encompassing critical areas like billing, revenue management, customer experience, and payments. This wide array of solutions enables CSG to serve a broad spectrum of client requirements, establishing them as a comprehensive service provider.

The company's commitment to innovation is evident in its continuous integration of cloud-native technologies and artificial intelligence. For instance, CSG's investment in AI is geared towards enhancing customer engagement and operational efficiency, directly addressing the evolving needs of the digital economy. This proactive approach ensures their offerings remain competitive and relevant in a rapidly changing market landscape.

CSG's strategic shift to high-margin Software-as-a-Service (SaaS) and cloud offerings is a significant strength. By 2023, these solutions already represented a substantial 88% of their total revenue, highlighting the successful execution of this pivot. This focus is directly contributing to their growth and improved profitability.

The company's financial performance in early 2025 underscores this strength, with record Q1 revenue and expanding non-GAAP operating margins. This demonstrates that the move towards cloud-based services is not just a strategy but a tangible driver of financial success.

Furthermore, CSG's partnerships with major cloud providers like Amazon Web Services (AWS) are crucial. These collaborations are accelerating their transformation and ensuring they remain at the forefront of cloud technology adoption, which is key for future revenue streams.

Strong Financial Performance and Shareholder Returns

CSG has shown impressive financial strength, with record quarterly revenue in Q4 2024 and outperforming its profitability and cash flow goals. The company anticipates further revenue increases and robust free cash flow generation throughout 2025, underscoring its solid financial footing.

This financial stability directly benefits shareholders through consistent dividend payouts and ongoing share repurchase programs. CSG's commitment to returning value to its investors is evident in these actions, reinforcing its position as a financially sound entity.

- Record Q4 2024 Revenue: CSG achieved its highest quarterly revenue in the final quarter of 2024.

- Exceeded Financial Targets: The company surpassed its projections for both profitability and cash flow in 2024.

- Projected 2025 Growth: CSG forecasts continued revenue expansion and strong free cash flow for the upcoming year.

- Shareholder Returns: Financial health supports consistent dividends and share buybacks, demonstrating a focus on investor value.

Deep Industry Expertise and Customer Loyalty

CSG's deep industry expertise, honed over decades, is a significant strength. This specialized knowledge in the communication service provider sector allows them to craft solutions that truly resonate with clients, fostering strong, lasting partnerships. For instance, their long-standing relationships with major players in the telecommunications and media industries are a testament to this. This expertise directly translates into high customer retention, with CSG often reporting retention rates exceeding 90% for its core software solutions in recent fiscal years, a clear indicator of their value proposition.

This profound understanding of the communications landscape fuels exceptional customer loyalty. CSG's ability to anticipate and address the evolving needs of service providers, from billing and revenue management to customer experience, cultivates a sticky customer base. This loyalty not only ensures recurring revenue streams but also opens doors for significant upselling opportunities as clients look to expand their use of CSG's integrated platforms. In 2024, CSG highlighted that a substantial portion of its revenue growth came from existing customers expanding their service agreements, underscoring the power of this loyalty.

- Decades of specialized experience in the communications, media, and entertainment industries.

- Strong relationships with a significant portion of the world's leading communication service providers.

- High customer retention rates, often reported above 90% for key software offerings, demonstrating deep client satisfaction and value realization.

- Opportunities for upselling and cross-selling within an established and loyal customer base, driving organic growth.

CSG possesses a strong market presence, particularly in the business support systems (BSS) sector, serving major telecommunications, cable, and media companies, which provides a significant competitive edge. Their recurring revenue model, driven by long-term contracts, ensures predictable cash flows, with approximately 84% of revenue being recurring as of Q1 2024. This stability is further enhanced by a diverse and growing product portfolio covering billing, revenue management, customer experience, and payments, making them a comprehensive solution provider.

The company's strategic pivot to high-margin, cloud-native SaaS offerings is a key strength, with these solutions comprising 88% of revenue by 2023, leading to improved profitability and record revenue in early 2025. Strategic partnerships with cloud giants like AWS accelerate this transformation. CSG's financial performance in early 2025, marked by record Q1 revenue and expanding margins, confirms the success of this strategy, supported by strong free cash flow generation and shareholder returns through dividends and buybacks.

| Financial Metric | Q1 2024 | Q4 2024 | Projected 2025 |

|---|---|---|---|

| Recurring Revenue % | ~84% | N/A | N/A |

| SaaS/Cloud Revenue % | N/A | ~88% (as of 2023) | N/A |

| Revenue Growth | Positive | Record Quarterly | Continued Expansion |

| Profitability | Expanding Margins | Exceeded Targets | Strong |

| Free Cash Flow | N/A | Exceeded Targets | Robust Generation |

What is included in the product

Analyzes CSG’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges and opportunities.

Weaknesses

A significant weakness for CSG lies in its customer concentration. In 2023, around 70% of its revenue stemmed from the telecommunications industry. This heavy reliance on a single sector, and specifically on major clients like Comcast and Charter, creates a substantial risk.

Any downturn in the financial standing or a strategic change by these key customers could have a material negative effect on CSG's overall financial results. This concentration limits CSG's diversification and makes it vulnerable to the specific challenges faced by its largest clients.

CSG operates within the Business Support Systems (BSS) sector, a space characterized by fierce rivalry. Major global competitors like Amdocs, Oracle, Netcracker, Huawei, and Ericsson are deeply entrenched, creating significant pressure on pricing and lengthening sales cycles.

This intense competition necessitates continuous and substantial investment in research and development to simply keep pace, let alone gain an edge. For instance, the BSS market is projected to grow at a CAGR of around 5-7% through 2025, but this growth is shared among many players, demanding innovation to capture market share.

Macroeconomic uncertainties, such as persistent inflation and shifting interest rate environments, have notably slowed down project decision-making among CSG's client base. This cautious approach means customers are less inclined to commit to the large, long-term strategic projects that are crucial for CSG's growth.

Clients are now heavily favoring solutions with a rapid, demonstrable return on investment, often within a 12-18 month timeframe. This pivot can lead to the deferral or scaling down of more ambitious, transformative initiatives that CSG is well-positioned to deliver, impacting pipeline value.

For instance, analysis of industry trends in the telecommunications and media sectors, CSG's primary markets, indicates a potential 10-15% reduction in average contract size for new strategic engagements in 2024 compared to 2023, directly attributable to this heightened economic caution.

Operational Costs and Integration Challenges from Acquisitions

Acquisitions, while a cornerstone of CSG's expansion, bring inherent integration hurdles and elevated operational expenses. These integration complexities can strain resources and impact profitability in the short term. For example, acquisition-related costs notably affected CSG's GAAP operating income in the third quarter of 2024.

Successfully merging acquired businesses, such as iCG Pay, requires meticulous attention to integrating new technologies, personnel, and customer portfolios. Failure to achieve seamless integration can hinder the realization of anticipated synergies and profitability targets. This process demands significant investment and strategic planning to overcome potential operational friction.

- Integration Complexity: Merging disparate systems, cultures, and processes from acquired companies presents significant operational challenges.

- Increased Operational Costs: Acquisition-related expenses, including due diligence, legal fees, and system harmonization, can temporarily inflate operating expenditures.

- Synergy Realization: The success of acquisitions hinges on effectively integrating new entities to achieve projected cost savings and revenue enhancements.

- Impact on Profitability: In Q3 2024, acquisition-related expenses directly impacted CSG's GAAP operating income, highlighting the financial implications of growth through M&A.

Vulnerability to Technological Obsolescence

CSG faces a constant challenge from the swift evolution of technology, even with ongoing innovation investments. The rapid advancements in fields like artificial intelligence and cloud-native designs mean that staying ahead requires significant and continuous effort. For instance, while CSG reported a 6% increase in R&D spending in 2023, reaching $320 million, the competitive landscape is also intensifying with specialized fintechs emerging rapidly.

A key weakness lies in the potential for technological obsolescence if CSG cannot match the agility of its competitors. If its legacy systems become less appealing to clients who are actively seeking the latest, most advanced solutions, CSG could lose market share. This is particularly relevant as the demand for AI-driven customer engagement platforms continues to surge, with market analysts projecting the AI in customer service sector to grow at a CAGR of over 25% through 2027.

- Rapid Technological Advancements: Constant need to adapt to AI, cloud-native, and other emerging technologies.

- Competitor Agility: Risk of falling behind nimble competitors who innovate faster.

- Legacy System Appeal: Potential for older systems to become less attractive to clients seeking cutting-edge solutions.

- R&D Investment Pace: Ensuring R&D spending ($320 million in 2023) adequately addresses the speed of technological change.

CSG's significant customer concentration, with approximately 70% of its 2023 revenue derived from the telecommunications sector, particularly major clients like Comcast and Charter, poses a considerable risk. This reliance makes the company vulnerable to any financial instability or strategic shifts among these key customers, limiting its diversification and exposing it to sector-specific challenges.

The Business Support Systems (BSS) market is highly competitive, featuring established global players such as Amdocs, Oracle, and Netcracker. This intense rivalry pressures CSG on pricing and extends sales cycles, demanding continuous, substantial investment in research and development to maintain market position. The projected 5-7% CAGR for the BSS market through 2025 highlights the need for innovation to capture share amidst this crowded field.

Macroeconomic headwinds, including inflation and interest rate volatility, have slowed client decision-making for large, long-term projects. Customers are prioritizing solutions with rapid returns on investment (12-18 months), potentially deferring or scaling back more ambitious initiatives that CSG is equipped to deliver. This caution could lead to a 10-15% reduction in average contract sizes for new strategic engagements in 2024 compared to 2023.

Acquisitions, while a growth strategy, introduce integration complexities and increased operational costs. Successfully merging new entities requires careful management of technology, personnel, and customer portfolios to achieve anticipated synergies and profitability. For example, acquisition-related expenses impacted CSG's GAAP operating income in Q3 2024, underscoring the financial implications of M&A activities.

The rapid pace of technological advancement, especially in AI and cloud-native solutions, presents a challenge for CSG. Despite a 6% increase in R&D spending to $320 million in 2023, the company must remain agile to avoid technological obsolescence. The AI in customer service sector is expected to grow at over 25% CAGR through 2027, indicating a strong market demand for cutting-edge solutions.

| Weakness | Description | Impact | Supporting Data |

|---|---|---|---|

| Customer Concentration | Heavy reliance on the telecommunications industry and a few major clients. | Vulnerability to client-specific downturns or strategic changes. | ~70% of 2023 revenue from telecom; key clients include Comcast and Charter. |

| Intense Competition | Presence of strong global BSS competitors. | Pricing pressure and extended sales cycles, demanding high R&D investment. | Market growth of 5-7% CAGR (through 2025) shared among many players. |

| Macroeconomic Sensitivity | Client caution due to inflation and interest rates impacting project decisions. | Slower adoption of long-term strategic projects, preference for rapid ROI solutions. | Potential 10-15% reduction in average contract size for new engagements in 2024. |

| Acquisition Integration | Challenges in merging acquired businesses, systems, and cultures. | Increased operational costs and potential delays in realizing synergies. | Acquisition-related costs impacted Q3 2024 GAAP operating income. |

| Technological Obsolescence Risk | Need to keep pace with rapid technological evolution (AI, cloud-native). | Potential loss of market share if legacy systems become less attractive. | AI in customer service sector CAGR projected over 25% (through 2027); 2023 R&D spend $320M. |

Preview the Actual Deliverable

CSG SWOT Analysis

This is the same CSG SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual CSG SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real CSG SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global digital transformation market is booming, expected to grow at a compound annual growth rate of 24.1% between 2024 and 2030. This presents a prime opportunity for CSG to enhance its cloud-based solutions and customer experience management services, tapping into a rapidly expanding market across its existing and new industry verticals.

As businesses worldwide prioritize modernizing their operations, the need for CSG's established expertise in areas like customer engagement and digital billing solutions is set to rise significantly. This accelerated shift towards digital processes directly fuels demand for the very services CSG provides, positioning the company for substantial growth.

The accelerating global deployment of 5G networks presents a significant opportunity for CSG. As operators invest heavily in these advanced networks, the need for robust revenue management and monetization solutions becomes paramount. CSG's expertise in handling the massive data volumes and enabling new service models associated with 5G positions it to assist clients in unlocking these new revenue streams.

For instance, the 5G market is projected to reach $1.3 trillion by 2030, according to Statista, highlighting the immense potential. CSG's ability to support complex billing, charging, and customer management for 5G services, including IoT and edge computing, directly addresses a critical need for communication service providers seeking to monetize their 5G investments effectively.

CSG has a significant opportunity to tap into new markets beyond its core telecom and media focus. Expanding into sectors like financial services, insurance, utilities, and government can unlock substantial revenue diversification. The strategic acquisition of iCG Pay in 2023, a company already serving these adjacent verticals, directly supports this expansion, enabling CSG to apply its proven billing and payment solutions to a broader customer base.

Leveraging AI and Advanced Analytics for Enhanced Offerings

The increasing integration of AI and advanced analytics presents a significant opportunity for CSG to refine its current offerings and pioneer novel solutions. By embedding AI within customer interaction, billing systems, and operational intelligence, CSG can unlock richer data insights, streamline workflows, and craft more tailored, efficient customer journeys.

This strategic focus can lead to tangible improvements in customer satisfaction and operational efficiency. For instance, AI-powered predictive analytics can help anticipate customer churn, allowing for proactive retention strategies. In 2024, the global AI market was projected to reach over $200 billion, with a significant portion dedicated to business applications like those CSG provides.

- Enhanced Customer Experience: AI can personalize interactions, predict needs, and resolve issues faster, boosting loyalty.

- Operational Efficiency: Automation of tasks in billing, service delivery, and support reduces costs and errors.

- New Revenue Streams: Development of AI-driven analytics services for clients can create new market opportunities.

- Data-Driven Decision Making: Advanced analytics provide deeper insights into customer behavior and market trends, informing strategy.

Strategic Mergers and Acquisitions (M&A)

CSG's history of successful acquisitions, like the integration of iCG Pay in 2024, demonstrates its capability to broaden revenue sources and enhance its technology stack. This strategic approach allows CSG to effectively enter new markets and strengthen its competitive standing.

Leveraging its robust financial health and ample liquidity, CSG is primed for additional value-adding M&A ventures. These opportunities could involve consolidating its market presence or tapping into specialized market segments, further solidifying its growth trajectory.

- Acquisition of iCG Pay in 2024: Diversified revenue streams and expanded technological capabilities.

- Strong Financial Position: Enables pursuit of further accretive M&A activities.

- Market Consolidation Potential: Opportunities to increase market share through strategic buyouts.

- Niche Segment Expansion: Entry into new, specialized areas of the market.

CSG can capitalize on the expanding digital transformation market, projected to grow at a 24.1% CAGR through 2030, by enhancing its cloud and customer experience solutions. The increasing global adoption of 5G networks, with the market expected to reach $1.3 trillion by 2030, offers a significant avenue for CSG to provide crucial revenue management and monetization services to telecom operators. Furthermore, CSG can diversify its revenue streams by expanding into adjacent verticals like financial services and utilities, a strategy bolstered by its 2023 acquisition of iCG Pay.

| Opportunity Area | Market Growth/Projection | CSG Relevance |

|---|---|---|

| Digital Transformation | 24.1% CAGR (2024-2030) | Enhance cloud & CX solutions |

| 5G Network Deployment | $1.3 Trillion Market (by 2030) | Revenue management & monetization |

| Vertical Expansion | Targeting Financial Services, Utilities | Leverage iCG Pay acquisition |

Threats

The Business Support Systems (BSS) market is a battleground, with major players and nimble newcomers constantly pushing for dominance. This intense rivalry puts pressure on pricing, can lengthen the time it takes to close deals, and risks chipping away at CSG's market share if rivals offer more attractive or budget-friendly options. For instance, in 2024, the BSS market is projected to grow, but this growth will be fiercely contested, with analysts noting increased M&A activity as companies seek scale to compete more effectively.

The software and services sector, where CSG operates, is experiencing an unprecedented acceleration in technological advancement. The rise of cloud-native architectures, sophisticated AI applications, and novel digital service delivery methods means that what is cutting-edge today can be outdated tomorrow. This rapid innovation cycle poses a significant threat, demanding continuous and substantial investment in research and development for CSG to maintain its competitive edge and avoid becoming technologically irrelevant.

For instance, the global IT services market saw significant growth in AI-driven solutions in 2024, with companies heavily investing in automation and data analytics, areas that directly impact CSG's offerings. Competitors are also rapidly adopting these technologies, meaning CSG must not only keep pace but also innovate to differentiate itself. Failure to do so could lead to a loss of market share to more agile or technologically advanced rivals.

Customer churn, particularly from large enterprise clients, presents a significant threat to CSG's revenue stability. Even with strong relationships, the possibility of losing key accounts or facing unfavorable terms during contract renewals can impact future growth. For instance, a crucial contract renewal in 2024 with a top-tier client stipulated no price increases for 2025, directly limiting potential revenue expansion and impacting profitability margins.

Evolving Regulatory Landscape and Data Security Risks

CSG's global operations and its handling of sensitive customer and billing data mean it must navigate a complex web of evolving data privacy regulations like GDPR and CCPA. Failure to comply or a major data breach could lead to severe financial penalties, legal issues, and significant damage to its reputation and customer trust. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a 15% increase from 2022, highlighting the financial stakes involved.

The increasing sophistication of cybersecurity threats presents a constant challenge. A successful cyberattack could disrupt CSG's services, compromise customer information, and lead to substantial recovery costs. The threat landscape is dynamic, with new vulnerabilities and attack vectors emerging regularly, requiring continuous investment in robust security measures.

- Regulatory Complexity: CSG must stay abreast of diverse and changing data privacy laws across its operating regions.

- Data Breach Impact: The financial and reputational consequences of a data breach can be severe, impacting customer retention and market standing.

- Cybersecurity Investment: Ongoing and significant investment in advanced cybersecurity infrastructure and protocols is essential to mitigate evolving threats.

- Compliance Costs: Maintaining compliance with a multitude of regulations adds operational overhead and requires dedicated resources.

Economic Downturn and Reduced Client IT Spending

A general economic downturn, or even sector-specific slowdowns within telecommunications and media, poses a significant threat to CSG. Clients facing financial pressures are likely to scale back their IT investments. This could directly impact CSG's revenue streams from new software sales and the professional services that accompany them.

For instance, if clients delay or cancel large IT transformation projects due to budget constraints, CSG's backlog and future bookings could shrink. Historically, periods of economic contraction have seen discretionary IT spending decrease by as much as 10-15% across various industries, a trend that could affect CSG's growth trajectory.

- Reduced client IT budgets can directly impact CSG's revenue from new solutions.

- Economic uncertainty often leads to delays or cancellations of large-scale projects.

- Professional services revenue, tied to project implementation, is also vulnerable.

- Industry-specific slowdowns in telecom and media amplify this risk for CSG.

The intense competition within the Business Support Systems (BSS) market pressures pricing and can lead to market share erosion if rivals offer more compelling solutions. Rapid technological advancements, particularly in AI and cloud-native architectures, necessitate continuous R&D investment to avoid obsolescence. Customer churn, especially from large enterprise clients, poses a direct threat to revenue stability, as seen with a 2024 contract renewal that capped price increases for 2025.

Navigating complex and evolving data privacy regulations like GDPR and CCPA is a significant challenge, with the global average cost of a data breach reaching $4.45 million in 2023. The increasing sophistication of cybersecurity threats requires ongoing investment in robust security measures to prevent service disruptions and data compromises. Furthermore, economic downturns or sector-specific slowdowns in telecommunications and media can lead clients to reduce IT spending, impacting CSG's new sales and professional services revenue, with historical data showing discretionary IT spending can drop by 10-15% during contractions.

SWOT Analysis Data Sources

This CSG SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry analysis to provide a well-rounded and actionable strategic overview.