CSG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSG Bundle

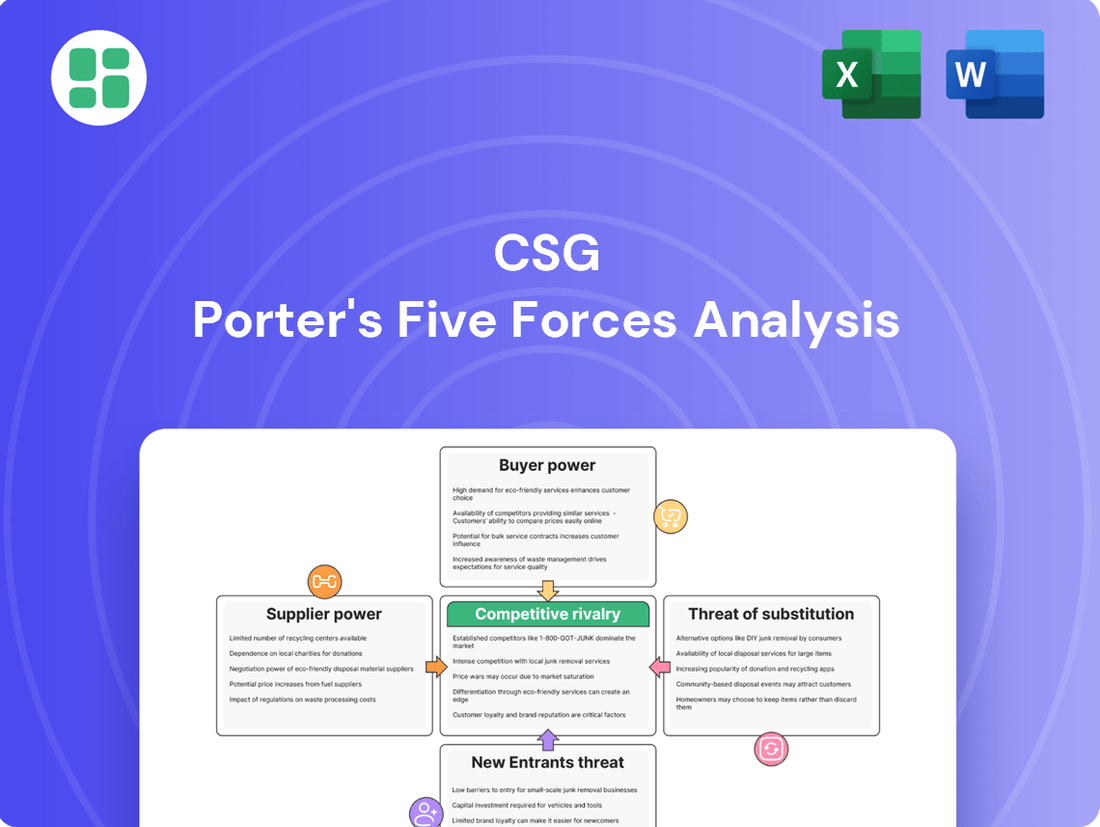

CSG's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic planning and identifying CSG's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CSG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized software components or critical intellectual property for CSG's Business Support Systems (BSS) solutions can wield considerable bargaining power. The proprietary nature of these components, combined with the significant costs CSG would incur to switch to an alternative, allows these suppliers to influence pricing and contract terms. This leverage is magnified when the market lacks readily available substitutes or when these specialized elements are deeply integrated into CSG's foundational product architecture, potentially impacting innovation timelines and operational continuity.

Cloud infrastructure providers like AWS, Azure, and Google Cloud wield significant bargaining power over companies like CSG. This power is amplified by their massive economies of scale, comprehensive service portfolios, and the inherent risk of vendor lock-in, particularly for critical, large-scale operations. CSG's reliance is underscored by its recognition as a top AWS partner in the Telco category for the second year running, indicating a deep integration with these platforms.

The availability of highly skilled labor, especially in cutting-edge fields like AI/ML, data analytics, and cybersecurity, significantly bolsters supplier power within the BSS sector. A scarcity of professionals with deep expertise in these areas, and in specific BSS domains, directly translates to increased labor costs and can impede CSG's capacity for innovation and project execution. This intense competition for a finite talent pool grants individual experts considerable leverage.

The increasing integration of AI and ML into Business Support Systems (BSS) solutions is a critical trend that further amplifies the bargaining power of suppliers possessing these specialized skills. For instance, in 2024, the demand for AI/ML engineers outstripped supply by a considerable margin, with some reports indicating a 20-30% salary increase for these roles compared to the previous year, directly impacting companies like CSG.

Hardware and Network Equipment Vendors

Hardware and network equipment suppliers hold significant bargaining power for CSG, particularly when clients opt for on-premise or hybrid deployments. The performance and reliability of these components directly impact CSG's Business Support Systems (BSS) offerings. For instance, in 2024, the global server market saw continued demand for high-performance computing, with companies like Dell Technologies and HPE playing a crucial role. If CSG relies on specialized, proprietary hardware that is difficult to source elsewhere, these vendors can leverage their position.

The ability of these suppliers to exert power is amplified if there are few alternatives that meet CSG's stringent technical specifications for networking gear and data storage. A concentrated market for critical infrastructure components, such as in the specialized telecommunications equipment sector, can lead to higher input costs for CSG. For example, the global network infrastructure market, valued at approximately $100 billion in 2024, is dominated by a few key players, giving them considerable leverage.

- Limited Substitutability: Proprietary hardware or network solutions with unique functionalities can reduce CSG's options, increasing supplier leverage.

- Supplier Concentration: A market with few vendors for essential components, like high-end servers or specialized network switches, empowers those suppliers.

- Criticality of Components: The performance and uptime of CSG's BSS solutions are directly tied to the quality and reliability of the underlying hardware, making these suppliers indispensable.

Data Providers and Analytics Tools

CSG's reliance on external data providers and advanced analytics tools means these suppliers can wield significant bargaining power. Companies offering unique, comprehensive, or real-time data feeds, particularly those crucial for AI-driven customer experience analytics, are in a strong position. For instance, the increasing demand for sophisticated AI capabilities in customer service, a key area for CSG, amplifies the leverage of data and analytics tool providers who can deliver these specialized insights.

The proprietary nature of these data sets and analytical engines, coupled with the difficulty for CSG to replicate such specialized capabilities independently, further strengthens supplier leverage. This is especially true as the market continues to prioritize data-driven decision-making and personalized customer interactions.

- Data Dependence: CSG's platforms often integrate data from third-party sources, making them dependent on the availability and quality of this information.

- Proprietary Technology: Suppliers of unique analytical algorithms or AI models possess a competitive advantage that is difficult for CSG to replicate.

- Market Trends: The growing emphasis on AI and real-time analytics in customer experience management enhances the bargaining power of suppliers in these specialized areas.

- Switching Costs: High costs associated with switching data providers or analytics platforms can lock CSG into existing supplier relationships.

Suppliers of specialized components, particularly those with proprietary technology or deep integration into CSG's BSS solutions, possess significant bargaining power. This is amplified by limited substitutability and high switching costs for CSG, especially concerning critical infrastructure like cloud services and specialized hardware. The scarcity of highly skilled labor in areas like AI/ML further empowers these suppliers, driving up costs and potentially impacting innovation timelines.

| Supplier Type | Key Factors Influencing Power | Impact on CSG |

|---|---|---|

| Specialized Software/IP Providers | Proprietary nature, high switching costs, integration depth | Pricing leverage, contract terms, potential delays |

| Cloud Infrastructure Providers | Economies of scale, vendor lock-in, comprehensive services | Service costs, dependency, potential for price increases |

| Skilled Labor Providers (AI/ML, Data) | Scarcity of expertise, high demand | Increased labor costs, talent acquisition challenges |

| Hardware & Network Equipment Suppliers | Limited alternatives, criticality of components, market concentration | Input costs, reliance on specific vendors, performance impact |

| Data & Analytics Tool Providers | Unique data sets, proprietary algorithms, market trends (AI focus) | Data access costs, integration complexity, reliance on insights |

What is included in the product

This analysis unpacks the competitive forces impacting CSG, examining industry rivalry, buyer and supplier power, new entrant threats, and the risk of substitutes.

Pinpoint the exact sources of competitive pressure with a visual breakdown, alleviating the anxiety of unknown market threats.

Customers Bargaining Power

CSG's core clientele consists of major telecommunications, cable, and media firms. These large entities often represent substantial portions of CSG's revenue, giving them considerable leverage.

The bargaining power of these customers is amplified by their significant purchasing volume, their capacity to negotiate for tailored solutions, and their option to seek alternative vendors if they are not satisfied with CSG's offerings.

In the first quarter of 2025, CSG's two largest clients, Charter and Comcast, together accounted for 37% of the company's total revenue, underscoring the concentrated nature of its customer base and the inherent power these major players wield.

While large customers can exert significant influence, the substantial switching costs associated with complex Business Support Systems (BSS) can temper their immediate bargaining power. These costs include the intricate integration of new systems, the complex process of data migration, the need for extensive personnel retraining, and the potential for significant operational disruption during a vendor change.

Customer concentration is a key factor influencing bargaining power. If CSG relies heavily on a few major clients, these customers can leverage their importance to negotiate more favorable terms. This dependence means that the loss of even one significant client could severely impact CSG's financial stability.

For CSG, this dynamic is quite pronounced. In 2023, the company reported that its two largest customers accounted for approximately forty percent of its total revenue. This high concentration highlights the substantial bargaining power these major clients possess.

Availability of In-house Solutions

Large telecommunications and media companies possess significant resources and technical capabilities, enabling them to develop and manage their Business Support Systems (BSS) internally. This internal capability serves as a potent bargaining chip for these customers.

The mere possibility of customers opting for self-provisioning, despite its inherent costs and complexity, pressures companies like CSG to offer more attractive pricing and improved functionalities to retain their business.

- In-house BSS Development Costs: While specific figures vary, major telecom operators can invest hundreds of millions of dollars in developing and maintaining their own BSS infrastructure.

- Customer Leverage: The threat of developing in-house solutions can reduce the perceived switching costs for large clients, enhancing their bargaining power.

- CSG's Competitive Response: To counter this, CSG must continuously innovate and demonstrate superior value in its offerings, potentially through flexible pricing models or specialized feature sets.

Demand for Tailored Solutions and Flexibility

Customers in telecom and media are demanding more customized and adaptable BSS solutions. This is driven by the need to support evolving technologies like 5G and new services such as streaming. For instance, in 2024, the global BSS market was projected to reach over $35 billion, with a significant portion of that growth fueled by these customization demands.

Their ability to seek out solutions that fit specific business models and enable new revenue streams directly increases their bargaining power. This forces companies like CSG to allocate substantial resources to research and development, often in response to competitive pressures and the need for unique feature sets.

- Increased demand for modular BSS solutions.

- Need for flexibility to adapt to new technologies like 5G.

- Customers seek solutions supporting new revenue streams.

- This drives R&D investment and customization efforts.

CSG's significant customer concentration, with major clients like Charter and Comcast representing a substantial portion of revenue, grants them considerable bargaining power. This leverage is further amplified by their ability to negotiate tailored solutions and the potential to switch vendors, although high switching costs for complex BSS can mitigate this immediate power.

Customers' capacity to develop BSS solutions in-house, despite significant investment, acts as a potent bargaining chip, pressuring CSG to offer competitive pricing and enhanced functionalities. The demand for customized, adaptable BSS to support evolving technologies like 5G and new revenue streams also increases customer leverage, driving CSG's R&D and customization efforts.

| Customer Concentration | Impact on Bargaining Power | Mitigating Factors |

|---|---|---|

| Two largest clients accounted for 37% of revenue in Q1 2025. | High dependence gives clients significant negotiation leverage. | High switching costs for complex BSS integration. |

| In 2023, two largest clients represented 40% of total revenue. | Clients can demand favorable terms due to their importance. | CSG's continuous innovation and value demonstration. |

| Major telecom operators can invest hundreds of millions in BSS. | Threat of in-house development reduces perceived switching costs. | CSG's flexible pricing and specialized features. |

Full Version Awaits

CSG Porter's Five Forces Analysis

This preview showcases the complete CSG Porter's Five Forces Analysis, offering a detailed examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholders. You can confidently download and utilize this comprehensive tool to understand your competitive landscape and inform strategic decisions.

Rivalry Among Competitors

The Business Support Systems (BSS) market is a mature arena, characterized by the presence of robust, established global competitors. These include major IT service providers and specialized BSS vendors, all vying for dominance.

Key players such as Amdocs, Ericsson, Huawei, and Netcracker are significant forces in the OSS BSS landscape. In 2024, these companies, among others, collectively command a substantial share of the global revenue, indicating a highly concentrated and competitive market.

This intense rivalry means companies must constantly innovate and offer competitive pricing to capture and retain market share, making it challenging for new entrants to gain a foothold.

The Business Support Systems (BSS) sector demands substantial initial outlays in research and development, product creation, and sales networks, resulting in elevated fixed costs. For instance, major BSS providers often invest hundreds of millions of dollars in developing and maintaining their software platforms.

Furthermore, the highly specialized technology and the commitment of customers through lengthy service agreements create significant hurdles for companies looking to exit the market. These high exit barriers mean that even in less favorable economic conditions, firms are incentivized to remain active and compete fiercely.

Competitive rivalry in the Business Support Systems (BSS) market is intense, largely fueled by the rapid pace of innovation and the critical need for product differentiation. While many BSS solutions share fundamental capabilities, companies are actively distinguishing themselves through advanced features such as AI-powered analytics, cloud-native architectures, and tools designed to significantly improve customer experience.

Success in this arena hinges on offering superior technology, enabling quicker deployment cycles, and providing agile solutions that can adapt to evolving industry demands. This competitive pressure necessitates continuous and substantial investment in research and development, with leading players like Amdocs and Oracle consistently showcasing new functionalities and platform upgrades to maintain their market edge.

For instance, the global BSS market was valued at approximately $25 billion in 2023 and is projected to grow, underscoring the ongoing investment and innovation within the sector. Companies are investing heavily in R&D to stay ahead, with many reporting significant portions of their revenue dedicated to developing next-generation capabilities.

Market Growth and Consolidation Trends

The overall OSS BSS market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) that fuels intense competition. For instance, the global OSS BSS market was valued at approximately USD 30 billion in 2023 and is expected to reach over USD 60 billion by 2030, demonstrating significant expansion opportunities.

This growth inherently attracts more players, intensifying rivalry among existing and new entrants. Companies like CSG are navigating this landscape, where market expansion can also lead to increased pressure on pricing and innovation.

Consolidation within the BSS sector or among its customer base is a notable trend that reshapes competitive dynamics. Mergers and acquisitions, such as ongoing speculation around CSG's strategic positioning, can lead to fewer, larger entities with greater market power. This consolidation can either dampen rivalry by creating dominant players or intensify it as these larger entities vie for market share.

- Market Growth: Global OSS BSS market projected to grow from ~USD 30 billion (2023) to over USD 60 billion by 2030, indicating strong expansion.

- Intensifying Rivalry: Significant market growth attracts more competitors, leading to increased competition on price and innovation.

- Consolidation Impact: M&A activity, including speculation around CSG, can reduce the number of players, creating larger, more powerful competitors.

- Strategic Implications: Consolidation reshapes the competitive landscape, influencing market share and strategic maneuvering for all participants.

Customer Stickiness and Contract Lengths

While high switching costs can foster customer loyalty, the Business Support Systems (BSS) market sees intense rivalry. Competitors aggressively pursue new contracts and renewals, recognizing that even sticky customers require ongoing attention. This competition centers on delivering exceptional service, consistent innovation, and attractive pricing to secure and maintain business.

CSG's success in this arena is evident in its significant contract wins and extensions. For instance, their agreement with Comcast, extending through the end of 2030, highlights the long-term value and trust placed in CSG's solutions. This demonstrates a strategic focus on retaining key clients through sustained performance and value delivery.

- Aggressive Competition: Despite high customer switching costs, BSS providers actively compete for new deals and contract renewals.

- Retention Strategies: Rivalry involves not only acquiring new clients but also retaining existing ones through superior service, innovation, and pricing.

- CSG's Success: CSG has secured substantial contract extensions, including a notable deal with Comcast extending to year-end 2030, showcasing strong customer retention.

Competitive rivalry in the BSS market is fierce due to the presence of established global players and the sector's rapid innovation cycle. Companies like Amdocs, Ericsson, and Huawei are constantly pushing boundaries with AI, cloud-native solutions, and enhanced customer experience tools, necessitating substantial R&D investment. This intense competition, fueled by a projected market growth from approximately USD 30 billion in 2023 to over USD 60 billion by 2030, means providers must offer superior technology and agile solutions to stay ahead.

| Key BSS Competitors | 2024 Market Focus | Competitive Strategy Example |

|---|---|---|

| Amdocs | AI-driven analytics, cloud solutions | Continuous platform upgrades and new functionalities |

| Ericsson | Digital BSS, cloud-native architecture | Faster deployment cycles and agile solutions |

| Huawei | End-to-end BSS, digital transformation | Competitive pricing and extensive service networks |

| CSG | Customer experience, revenue management | Securing long-term contracts (e.g., Comcast extension to 2030) |

SSubstitutes Threaten

Large telecommunication and media companies have a history of developing their own in-house BSS systems. While this approach is expensive and complex, it remains a potent substitute threat for vendors. This internal development is especially viable for companies with highly specific operational needs that off-the-shelf solutions cannot fully accommodate, allowing them to maintain greater control and customization.

The rise of open-source software presents a growing threat of substitutes for traditional Business Support System (BSS) solutions. While fully integrated open-source BSS suites for large telecom operators are still developing, modular open-source components for specific functions like customer management or billing could be adopted. This allows companies to reduce their dependence on proprietary BSS vendors for certain operational needs.

For non-core Business Support System (BSS) functions, particularly for smaller telecom operators, generic Enterprise Resource Planning (ERP) or Customer Relationship Management (CRM) systems can act as potential substitutes. These systems, while not specifically designed for telecom billing and revenue management, can often handle certain aspects like customer data management or basic invoicing.

This substitution threat is particularly relevant as many businesses increasingly adopt integrated ERP/CRM solutions for overall operational efficiency. For example, a 2024 market report indicated that the global ERP market alone was projected to reach over $50 billion, highlighting the widespread availability and adoption of these broader business tools.

While these generic systems might not offer the deep, specialized functionality of dedicated BSS solutions, they can still fulfill basic needs, thereby reducing the perceived necessity for highly specialized telecom-specific software for certain operational areas.

Managed Services and Outsourcing Providers

Managed services and outsourcing providers present a significant threat of substitution for traditional BSS software providers like CSG. Instead of investing in and maintaining their own BSS platforms, companies can delegate these functions to specialized third-party providers. These outsourcers often leverage their own robust BSS infrastructure, effectively eliminating the need for clients to license or operate CSG's software directly.

This shift fundamentally alters the value proposition, moving the focus from software acquisition to the seamless delivery of managed services, such as billing, customer care, and revenue assurance. For instance, a telecommunications company might choose to outsource its entire customer lifecycle management to a provider that handles everything from onboarding to billing and support, bypassing the need for CSG's core BSS capabilities.

The global managed services market is substantial and growing. In 2024, the IT outsourcing market alone was projected to reach over $400 billion, with a significant portion dedicated to business process outsourcing (BPO) which includes customer management and billing operations. This indicates a strong market appetite for offloading these complex functions.

- Market Shift: Companies are increasingly prioritizing operational efficiency and cost reduction, making managed services an attractive alternative to in-house BSS management.

- Cost Advantage: Outsourcing providers can often achieve economies of scale, offering services at a lower cost than what individual companies might incur managing their own BSS infrastructure.

- Focus on Core Competencies: By outsourcing BSS operations, businesses can redirect resources and attention to their core business activities, such as service innovation and customer acquisition.

- Technological Advancement: Leading outsourcing providers continuously invest in cutting-edge BSS technology, offering clients access to advanced capabilities without direct capital expenditure.

Hybrid and Modular Cloud Solutions

The increasing adoption of hybrid and modular cloud solutions presents a significant threat of substitutes for integrated Business Support System (BSS) providers like CSG. Companies are increasingly building their technology stacks by selecting best-of-breed components from various vendors, rather than opting for a single, comprehensive BSS suite. This trend is fueled by the rise of cloud-native and microservices-based architectures, allowing for greater flexibility and customization.

This modular approach enables businesses to procure specific functionalities, such as a standalone rating engine or a specialized analytics module, from different providers. For instance, a telecommunications company might leverage a cloud-native OSS/BSS platform and integrate specialized microservices for billing or customer management from niche providers. This can reduce the reliance on a single, monolithic BSS solution.

- Modular Cloud Adoption: Gartner predicted that by 2025, 70% of new enterprise IT applications would be developed using cloud-native practices, a trend that supports the modular substitution threat.

- Best-of-Breed Focus: Companies are prioritizing best-of-breed solutions for specific functions, potentially bypassing integrated BSS suites for specialized, cloud-native alternatives.

- Cost and Agility: This modularity can offer cost savings and greater agility compared to large, integrated systems, making it an attractive substitute for businesses seeking to optimize their operations.

- Vendor Landscape: The growing number of specialized cloud service providers and open-source BSS components further strengthens the threat of substitutes by offering viable alternatives to traditional, integrated offerings.

The threat of substitutes for traditional Business Support System (BSS) providers like CSG stems from companies developing their own in-house solutions or adopting modular, cloud-native components. Open-source software and generic ERP/CRM systems also offer alternatives for specific functions. Furthermore, managed services and outsourcing providers present a significant substitution threat by handling BSS operations entirely, bypassing the need for direct software acquisition.

| Substitute Type | Description | 2024 Market Context |

|---|---|---|

| In-house Development | Companies build custom BSS systems for specific needs. | High initial cost, but offers maximum control. |

| Open-Source Software | Modular components for specific BSS functions. | Growing adoption for cost-efficiency and flexibility. |

| Generic ERP/CRM | Broader business systems handling basic BSS functions. | Global ERP market projected over $50 billion in 2024. |

| Managed Services/Outsourcing | Third-party providers manage entire BSS operations. | IT outsourcing market over $400 billion in 2024. |

| Modular Cloud Solutions | Best-of-breed cloud-native components integrated. | Supports agility and cost optimization. |

Entrants Threaten

Entering the Business Support Systems (BSS) market, which is crucial for telecommunications companies, demands a significant upfront financial commitment. This includes the substantial costs associated with developing sophisticated software, building robust IT infrastructure, and establishing a worldwide sales and customer support presence.

Furthermore, new players must allocate considerable funds to research and development. This ongoing investment is essential to stay competitive, as the BSS landscape is constantly reshaped by rapid technological advancements and evolving customer expectations. For instance, the global BSS market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating the scale of investment required to capture even a small share.

These considerable capital and R&D expenditures act as formidable barriers, effectively discouraging many potential new entrants from challenging established players in the BSS arena.

The telecommunications, cable, and media sectors demand extensive, specialized knowledge in areas like billing, revenue assurance, customer service, and regulatory compliance. Newcomers must navigate a steep learning curve to develop solutions that address these intricate industry requirements. This substantial intellectual barrier significantly discourages potential new entrants.

Existing Business Support System (BSS) providers, such as CSG, have cultivated deep-rooted relationships with major telecommunications companies. These established connections are built on years of reliable service and trust, making it difficult for newcomers to penetrate the market. For instance, in 2024, the average tenure of a BSS vendor with a large Tier-1 operator often exceeds a decade.

The mission-critical nature of BSS platforms means that telecom operators are inherently risk-averse when considering new vendors. The potential disruption to billing, customer management, and order fulfillment is substantial. Consequently, the high switching costs and the perceived risk of unproven solutions act as formidable barriers, reinforcing the loyalty to established players like CSG.

Regulatory Hurdles and Compliance Requirements

The telecom and media sectors are heavily regulated, with strict rules on data privacy, consumer protection, and billing practices. For instance, in 2024, the Federal Communications Commission (FCC) continued its enforcement of the Telephone Consumer Protection Act (TCPA), imposing significant fines for violations. New companies entering these markets must invest heavily in legal expertise and compliance systems to navigate this intricate web of regulations.

These compliance demands create a substantial barrier to entry, especially for smaller or less established players. The cost and time associated with meeting these requirements can be prohibitive, effectively limiting the number of new entrants capable of competing. By 2024, many startups found that the sheer volume of regulatory paperwork and ongoing adherence costs diverted crucial resources from innovation and market penetration.

The complexity of these regulatory landscapes can be a significant deterrent.

- Data Privacy Laws: Compliance with regulations like GDPR and CCPA requires robust data handling protocols.

- Consumer Protection: Adherence to fair advertising and billing practices is mandatory.

- Telecommunication Specifics: Regulations concerning network access and spectrum usage add further complexity.

- Ongoing Audits: Companies must be prepared for regular audits to ensure continued compliance.

Network Effects and Integration Complexity

The threat of new entrants in the Business Support Systems (BSS) market is significantly mitigated by the profound network effects and integration complexity inherent in existing solutions. New players face a steep uphill battle, as BSS platforms are deeply embedded within a client's operational and business support systems.

Replicating the extensive integration capabilities that incumbent providers have cultivated is a resource-intensive and time-consuming endeavor. These established networks of integrations act as a formidable barrier, making it exceptionally difficult for newcomers to achieve seamless interoperability and offer a comparable value proposition.

- Integration Complexity: BSS systems must connect with a multitude of other systems, such as billing, CRM, and order management.

- Network Effects: The more clients an incumbent has, the more valuable their BSS ecosystem becomes due to shared data and standardized processes.

- High Switching Costs: For clients, migrating from an established BSS provider with deep integrations can incur significant costs and operational disruption.

- Incumbent Advantage: Companies like Amdocs, with decades of experience and established integration frameworks, possess a significant competitive moat. For instance, Amdocs reported revenues of $4.4 billion in fiscal year 2023, underscoring their market presence and the scale of their integrated solutions.

The threat of new entrants into the Business Support Systems (BSS) market is considerably low due to substantial capital requirements and the need for specialized knowledge. Developing and deploying complex BSS software, alongside establishing a global support network, demands massive upfront investment. For example, the global BSS market was valued at around $30 billion in 2023, highlighting the scale of investment needed to compete.

Furthermore, the intricate nature of telecommunications, cable, and media operations, covering billing, revenue assurance, and regulatory compliance, presents a steep learning curve. New entrants must also navigate a complex web of regulations, including data privacy laws like GDPR and CCPA, and consumer protection mandates. By 2024, startups often found regulatory compliance costs diverting significant resources from innovation.

Established players benefit from deep client relationships, often exceeding a decade of service with major operators in 2024. The high switching costs and perceived risks associated with unproven BSS solutions further solidify customer loyalty to incumbents. The extensive integration of existing BSS platforms with a multitude of other systems, like CRM and order management, creates significant barriers for newcomers seeking seamless interoperability.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including publicly available company financial statements, industry-specific market research reports, and government economic data. This comprehensive approach ensures a robust understanding of competitive intensity and industry attractiveness.