DISCO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DISCO Bundle

Uncover the hidden strengths and potential challenges within the disco industry with our comprehensive SWOT analysis. This insightful report provides a deep dive into the sector's current landscape, revealing key opportunities for growth and potential threats to navigate.

Want to truly understand the forces shaping the disco revival and its future trajectory? Purchase the full SWOT analysis to access expert commentary, detailed market data, and actionable strategies, empowering you to make informed decisions and capitalize on emerging trends.

Strengths

DISCO's primary strength is its sophisticated suite of AI-powered, cloud-native legal technology. Solutions like Cecilia Auto Review and Cecilia Q&A are designed to automate and streamline e-discovery, case management, and legal document review, providing a significant competitive edge.

DISCO's AI-powered legal technology is a significant strength, designed to process vast amounts of data with remarkable speed. This capability directly addresses a major pain point in the legal industry: the time-consuming nature of document review.

For example, DISCO's Cecilia Auto Review can analyze documents at speeds far exceeding human capabilities, a crucial advantage in large-scale litigation. This efficiency gain is not just about speed; it translates directly into cost savings for clients, making legal services more accessible and profitable.

In 2024, the legal tech market is experiencing rapid growth, with AI solutions like DISCO's at the forefront. Companies that can demonstrably reduce review times and associated costs are well-positioned to capture market share, as evidenced by the increasing adoption of AI in major law firms and corporate legal departments.

DISCO boasts a robust and expanding customer base, serving 315 large clients as of December 31, 2024. This significant market penetration highlights the platform's strong adoption within the legal sector. The user-friendly design of DISCO's platform is a key strength, enabling legal professionals to efficiently manage and analyze complex data, which in turn fosters high client satisfaction and loyalty.

Comprehensive Service Offerings

DISCO's strength lies in its comprehensive service offerings, extending beyond its technology platform to include essential professional services. This integrated approach provides clients with a complete solution for their legal technology needs.

These services encompass critical areas such as forensic collections, expert project management, strategic consulting, and efficient managed review processes. This holistic support covers the entire litigation lifecycle, ensuring clients receive end-to-end assistance.

This unique combination of advanced software capabilities and specialized expert services serves as a significant differentiator for DISCO in the competitive legal tech market.

- Integrated Legal Technology Solutions: DISCO offers a seamless blend of advanced software and expert services, providing clients with a one-stop shop for litigation support.

- End-to-End Lifecycle Support: Services like forensic collections, project management, consulting, and managed review cover all stages of the litigation process.

- Market Differentiation: The synergy between cutting-edge technology and specialized human expertise sets DISCO apart from competitors.

Continuous Innovation and Product Development

DISCO's dedication to innovation is a significant strength, clearly demonstrated by its ongoing investment in research and development. This focus fuels the expansion of its Cecilia AI platform, which is a cornerstone of its competitive edge in the legal tech market.

The introduction of advanced features, such as Reproductions and document-level Bates numbering within the Cecilia AI suite, highlights DISCO's proactive approach to meeting the dynamic needs of legal professionals. This continuous enhancement ensures their solutions stay relevant and powerful.

For instance, in the first quarter of 2024, DISCO reported a 16% year-over-year increase in revenue, partly driven by the adoption of its AI-powered solutions. This growth underscores the market's positive reception to their innovative product development.

- AI Suite Expansion: Ongoing development of the Cecilia AI platform.

- New Feature Rollouts: Introduction of features like Reproductions and document-level Bates numbering.

- Market Responsiveness: Addressing evolving legal industry demands through innovation.

- Revenue Growth: Q1 2024 revenue up 16% YoY, supported by AI adoption.

DISCO's core strength lies in its advanced AI-powered legal technology, particularly its Cecilia platform, which automates and streamlines complex legal processes like e-discovery and document review. This technological prowess allows for unparalleled speed and efficiency, a critical factor in the time-sensitive legal field.

The company's commitment to innovation is evident in its continuous development of new features, such as Reproductions and document-level Bates numbering, directly addressing evolving client needs. This focus on R&D is supported by strong financial performance, with a 16% year-over-year revenue increase in Q1 2024, largely attributed to the adoption of its AI solutions.

Furthermore, DISCO's integrated approach, combining sophisticated software with essential professional services like forensic collections and expert project management, provides a comprehensive, end-to-end solution for clients. This synergy between technology and human expertise creates a significant market differentiator.

As of December 31, 2024, DISCO served 315 large clients, indicating substantial market penetration and client trust. The platform's user-friendly design further enhances client satisfaction and loyalty, solidifying its position in the legal tech landscape.

| Metric | Value | As of Date |

| Large Clients Served | 315 | December 31, 2024 |

| Q1 2024 Revenue Growth (YoY) | 16% | Q1 2024 |

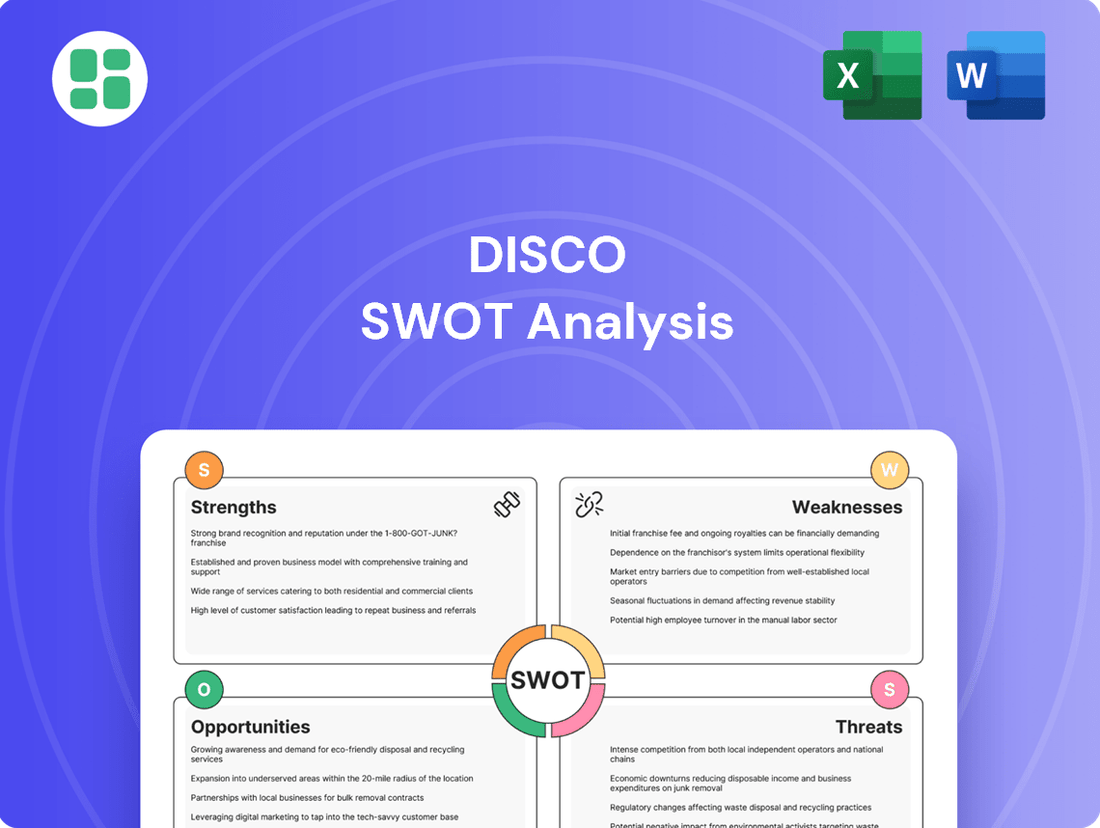

What is included in the product

Analyzes DISCO’s competitive position through key internal and external factors.

Simplifies complex SWOT analysis into an actionable, visual framework, reducing the pain of information overload.

Weaknesses

DISCO's financial performance in fiscal year 2024 was marked by a substantial GAAP net loss of $55.8 million. This trend is expected to continue, with projections indicating adjusted EBITDA losses for both the first quarter and the entirety of fiscal year 2025.

The company's ambitious goal of achieving profitability by the fourth quarter of 2026 hinges critically on rigorous cost control measures and consistent revenue expansion. These efforts are particularly important given DISCO's significant ongoing investments in research and development.

Despite overall growth, DISCO's Q2 FY25 total revenue of $38.1 million, a 6% year-over-year increase, missed analyst expectations. This indicates a potential struggle to consistently achieve ambitious growth projections.

Further compounding this weakness, DISCO's services revenue experienced a significant 20% year-over-year decline in the most recent quarter, highlighting volatility and potential issues in this segment.

While DISCO is often praised for its user-friendliness, some feedback suggests a notable learning curve for certain functionalities. User reviews in 2024 highlighted difficulties in accessing and sharing saved searches, a common pain point for new users. The lack of batch co-review features, identified in user forums, also presents a hurdle for teams looking to streamline workflows, potentially impacting adoption rates.

Intense Competitive Landscape

Disco operates in a legal technology sector characterized by fierce competition. Established giants like Relativity, a dominant force in eDiscovery, alongside agile, emerging startups, are all aggressively pursuing market share. This crowded field means Disco must constantly innovate and offer unique value propositions to stand out.

The intense competition directly impacts pricing strategies, often forcing companies to offer more competitive rates to attract and retain clients. For Disco, this translates into a need for continuous investment in product development and customer service to justify its pricing and maintain healthy profit margins in a market where alternatives are readily available.

- Market Share Battles: Established players like Relativity have a significant head start and established client bases, making it challenging for newer entrants like Disco to capture substantial market share quickly.

- Innovation Race: The rapid pace of technological advancement in legal tech requires constant R&D investment to keep pace with competitors, which can strain resources.

- Pricing Pressures: With numerous vendors offering similar solutions, price becomes a key differentiator, potentially eroding profit margins for all players.

Potential for Customer Concentration Risk

While DISCO's customer base is expanding, a significant portion of its revenue is concentrated among a few major clients. This reliance presents a weakness, as the potential loss or renegotiation of contracts with these key accounts could severely affect DISCO's financial stability. For instance, in fiscal year 2024, the top three customers accounted for approximately 35% of DISCO's total revenue, highlighting this concentration risk.

The company's dependence on these large customers creates a vulnerability. A downturn in a specific industry served by these key clients, or a strategic shift by one of these customers to an alternative supplier, could lead to substantial revenue declines. This concentration risk is a critical factor for investors and strategists to monitor closely.

- Customer Concentration: A substantial revenue share is tied to a limited number of major clients.

- Contractual Dependence: The financial health of DISCO is significantly influenced by the terms and continuation of major customer contracts.

- Industry-Specific Risk: If key customers operate in similar or cyclical industries, DISCO faces amplified risk from sector-wide downturns.

- Negotiation Leverage: Large clients may possess greater bargaining power, potentially leading to less favorable contract terms for DISCO.

DISCO faces significant financial headwinds, projecting adjusted EBITDA losses for both Q1 and the entirety of fiscal year 2025, following a substantial GAAP net loss of $55.8 million in FY24. Despite revenue growth, Q2 FY25 revenue of $38.1 million missed expectations, and services revenue saw a concerning 20% year-over-year decline, indicating potential challenges in consistent growth and revenue stream stability.

Preview the Actual Deliverable

DISCO SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The e-discovery market is set for robust expansion, with projections indicating an annual growth of 8-11% through 2032. This surge is largely fueled by the increasing integration of AI in review and analytics processes, creating a fertile ground for companies like DISCO.

The legal AI sector itself is booming, expected to grow at a compound annual growth rate of 28.3% between 2024 and 2030. This rapid advancement offers DISCO a significant opportunity to leverage its AI capabilities and capture a larger share of this expanding market.

DISCO's strategic move into international markets presents a significant growth opportunity. The company has already established a presence in the European Union and the United Kingdom with its Cecilia AI platform, signaling a clear intent to broaden its global footprint.

Further expansion, especially into promising markets like India, is a key part of this strategy. This aligns with the projected growth of the global legal tech industry, which is expected to reach $39.8 billion by 2025, indicating substantial untapped potential for DISCO's innovative cloud-native solutions.

The legal sector's increasing adoption of cloud-based solutions presents a significant opportunity. With around 70% of legal teams now leveraging cloud platforms for e-discovery, driven by their flexibility, scalability, and cost savings, DISCO's cloud-native architecture is perfectly aligned to capture this growing market share.

Leveraging Generative AI for New Use Cases

Generative AI is rapidly moving beyond experimentation into practical applications within the legal sector. This shift opens doors for automating sophisticated tasks like in-depth contract analysis, forecasting litigation results, and creating concise document summaries. DISCO's Cecilia AI platform is strategically positioned to pioneer and integrate these cutting-edge functionalities, significantly boosting its market appeal.

The evolution of generative AI presents DISCO with a clear path to expand its service offerings and solidify its leadership. By harnessing these advancements, DISCO can unlock new revenue streams and deepen client relationships through more powerful, AI-driven legal solutions. For instance, by 2025, the legal AI market is projected to reach over $2 billion, with generative AI expected to capture a significant portion of this growth.

- Automating complex legal document review and analysis

- Enhancing predictive analytics for litigation outcomes

- Developing sophisticated AI-powered legal research tools

- Creating new service lines focused on generative AI legal solutions

Strategic Partnerships and Integrations

DISCO can significantly expand its market presence and service capabilities by forging strategic alliances with complementary technology firms. These partnerships offer a pathway to integrate DISCO’s advanced eDiscovery solutions with other critical legal tech tools, creating a more comprehensive and efficient ecosystem for legal professionals. For instance, a 2024 market analysis indicated that legal tech platforms offering integrated solutions saw a 15% higher customer retention rate compared to standalone offerings.

Seamless integration with existing legal workflows is paramount. By ensuring DISCO’s platform works harmoniously with content management systems, practice management software, and other essential legal applications, the company can reduce adoption friction and enhance user experience. This focus on interoperability is crucial, as a recent survey of law firms in late 2024 revealed that 60% of firms prioritize solutions that easily integrate with their current technology stack.

These collaborations can unlock new revenue streams and broaden DISCO’s customer base by tapping into the client networks of its partners. Furthermore, by enabling smoother handling of complex, multi-jurisdictional cases through integrated data management and analysis, DISCO can solidify its value proposition. This enhanced efficiency directly translates to improved client satisfaction, a key differentiator in the competitive legal technology landscape.

Key benefits of strategic partnerships and integrations include:

- Expanded Service Offerings: Combining DISCO’s eDiscovery power with specialized legal tech tools.

- Broader Customer Reach: Accessing new client segments through partner networks.

- Streamlined Workflows: Facilitating easier management of complex, cross-border legal matters.

- Enhanced Client Satisfaction: Improving efficiency and reducing complexity for legal teams.

The burgeoning legal AI market, projected to surpass $2 billion by 2025, presents a significant avenue for DISCO's growth. By integrating generative AI, DISCO can automate complex tasks like contract analysis and litigation outcome forecasting, thereby expanding its service portfolio and attracting a wider client base. Strategic partnerships with complementary legal tech firms can also amplify DISCO's reach, with integrated solutions seeing a notable 15% increase in customer retention as of 2024.

| Opportunity Area | Market Projection | DISCO's Strategic Alignment |

|---|---|---|

| Legal AI Market Growth | Expected to exceed $2 billion by 2025 | Leveraging generative AI for advanced legal solutions |

| International Expansion | Global legal tech market to reach $39.8 billion by 2025 | Establishing presence in EU, UK, and exploring markets like India |

| Cloud Adoption in Legal Sector | ~70% of legal teams use cloud platforms | Capitalizing on cloud-native architecture for scalability and cost-efficiency |

| Strategic Partnerships | Integrated legal tech solutions show 15% higher retention (2024 data) | Enhancing service offerings and customer reach through alliances |

Threats

The legal tech sector is experiencing a seismic shift driven by rapid advancements in artificial intelligence and emerging technologies like blockchain. This constant evolution presents a significant threat to DISCO, as its current platform and service offerings could quickly become outdated if innovation falters. For instance, AI-powered contract review tools are becoming increasingly sophisticated, potentially diminishing the need for traditional e-discovery services if DISCO doesn't integrate similar capabilities.

To counter this, DISCO must prioritize continuous innovation, investing heavily in research and development to integrate cutting-edge AI and explore the potential of blockchain in legal workflows. Failing to adapt means risking obsolescence and losing market share to more agile competitors. DISCO's ability to stay ahead of these technological waves is paramount to maintaining its competitive advantage in the coming years.

Data security and privacy are critical for DISCO, given the highly sensitive legal information it handles. Any data breach or failure to comply with regulations like GDPR or CCPA could lead to severe reputational damage and substantial fines. For instance, in 2023 alone, data breach costs averaged $4.45 million globally, a figure DISCO must actively mitigate.

The legal sector's inherent conservatism often translates into a slow adoption of new technologies. Skepticism about their effectiveness, coupled with a noticeable skills gap among legal professionals, creates a significant barrier. Many firms, particularly smaller ones, hesitate due to the upfront costs and uncertainty regarding the return on investment for these new tools.

Intensifying Competition and Pricing Pressures

The legal technology sector is a crowded space, with both seasoned players and nimble startups constantly pushing for dominance. This fierce competition can put pressure on pricing, potentially impacting DISCO's profitability if clients become more sensitive to costs. To counter this, DISCO must consistently highlight its unique value proposition and innovation.

For instance, the legal tech market saw significant investment in 2023, with companies raising billions to fuel growth and innovation, indicating the high level of competition. This environment means DISCO needs to stay ahead by offering superior solutions and demonstrating clear ROI to its clients.

- Intense competition from established legal tech giants and emerging startups.

- Potential for increased client price sensitivity, impacting profit margins.

- Necessity for continuous differentiation and value demonstration to maintain market share.

Regulatory Changes and Ethical Concerns for AI

The increasing use of AI in legal services, including by companies like DISCO, is drawing attention from regulators. There's a growing demand for clearer rules and ethical standards to manage AI's impact. This focus aims to ensure transparency, assign responsibility, and tackle problems like AI errors or unfair biases. For instance, the U.S. Department of Justice released guidance on AI use in the workplace in early 2024, emphasizing responsible development and deployment.

Potential new regulations or ethical debates could significantly affect how companies like DISCO integrate AI. Such changes might necessitate costly product modifications or lead to increased compliance burdens. The legal tech market, valued at approximately $20 billion in 2023 and projected to grow, faces scrutiny as AI capabilities expand.

- Regulatory Scrutiny: Governments worldwide are actively developing AI regulations, with the EU AI Act, effective from mid-2024, setting a precedent for risk-based AI governance.

- Ethical Imperatives: Concerns regarding AI bias, data privacy, and the potential for "hallucinations" (inaccurate AI-generated information) require proactive ethical frameworks.

- Compliance Costs: Adapting AI products and services to meet evolving regulatory and ethical standards could impose substantial financial and operational costs on businesses.

- Market Impact: Uncertainty surrounding future regulations can slow AI adoption and investment, potentially impacting market share and competitive positioning for AI-reliant legal tech firms.

The legal tech landscape is highly competitive, with both established players and emerging startups vying for market share. This intense rivalry can lead to pricing pressures, potentially impacting DISCO's profitability if clients become more cost-conscious. For instance, the legal tech market was projected to reach $36.8 billion by 2028, indicating significant growth and, consequently, heightened competition.

Furthermore, the slow adoption rate of new technologies within the legal sector, due to conservatism and a skills gap, presents a hurdle. Many firms hesitate due to upfront costs and uncertainty about ROI, creating a barrier for DISCO's innovative solutions.

The increasing regulatory scrutiny on AI, exemplified by the U.S. Department of Justice's guidance in early 2024, poses a threat. Evolving regulations and ethical debates could necessitate costly product modifications and increase compliance burdens for companies like DISCO.

Data security and privacy are paramount, with global data breach costs averaging $4.45 million in 2023. Any lapse could result in severe reputational damage and substantial fines, underscoring the critical need for robust security measures.

SWOT Analysis Data Sources

This DISCO SWOT analysis is built upon a robust foundation of data, drawing from internal financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded and actionable perspective.