DISCO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DISCO Bundle

DISCO's competitive landscape is shaped by intense rivalry, the bargaining power of buyers, and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder looking to navigate this dynamic market.

The complete report reveals the real forces shaping DISCO’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DISCO, a cloud-native platform, depends significantly on major cloud infrastructure providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). The bargaining power of these suppliers is typically substantial, given the immense capital investment in their infrastructure and the considerable costs associated with migrating DISCO's entire operational footprint. These providers are indispensable for delivering the scalability and computing power necessary for DISCO's advanced AI solutions.

The bargaining power of suppliers for specialized AI/ML talent and model developers is significant for DISCO. The demand for these professionals is soaring, with the global AI market expected to reach $1.3 trillion by 2030, according to Grand View Research. This scarcity directly impacts DISCO's ability to recruit and retain top-tier AI engineers and data scientists, potentially driving up compensation and project costs.

Furthermore, DISCO's reliance on potentially third-party AI model developers for cutting-edge solutions means these external entities can exert considerable influence. The rapid evolution of AI means that access to the most advanced, proprietary models can be a critical differentiator, giving developers leverage over pricing and licensing terms. The legal tech sector's increasing embrace of AI, with companies investing heavily in AI-driven solutions, further amplifies this demand and supplier power.

Legal data and content providers, such as LexisNexis and Westlaw, wield significant bargaining power over e-discovery platforms like DISCO. Their curated databases of case law, statutes, and regulatory information are essential for DISCO's core offerings. For instance, in 2023, the legal tech market saw substantial investment, highlighting the value placed on such data, with companies like Relativity raising significant funding, indirectly reflecting the cost of accessing premium legal content.

The exclusivity and comprehensiveness of these legal datasets directly influence DISCO's ability to provide accurate and competitive e-discovery solutions. Licensing agreements for these specialized legal materials can represent a considerable portion of DISCO's operating expenses, impacting its profitability and pricing strategies. Failure to secure access to vital legal content could hinder DISCO's innovation and market position.

Cybersecurity and Data Privacy Solution Providers

Cybersecurity and data privacy solution providers wield considerable bargaining power over legal tech companies like DISCO. The critical need to protect sensitive legal data means these specialized suppliers offer essential services that are not easily substituted. Failure to meet high security and privacy standards can result in severe penalties and loss of client trust, making these solutions a non-negotiable cost for DISCO.

The market for cybersecurity solutions is characterized by continuous innovation and increasing complexity. For instance, the global cybersecurity market was projected to reach over $270 billion in 2024, highlighting the significant investment and demand in this sector. Suppliers who can demonstrate advanced threat detection, robust data encryption, and seamless compliance with regulations like GDPR and CCPA can command premium pricing.

- High Switching Costs: Implementing and integrating new cybersecurity systems can be complex and costly, locking DISCO into existing providers.

- Essential Services: Data privacy and security are fundamental requirements for legal technology, not optional add-ons.

- Regulatory Compliance: Suppliers offering solutions that ensure compliance with evolving legal frameworks have a distinct advantage.

Hardware and Software Component Providers for Data Processing

While DISCO operates in the cloud, the providers of critical hardware and specialized software for data processing, storage, and AI acceleration hold significant bargaining power. These components are fundamental to DISCO's ability to manage the vast amounts of electronic data required for e-discovery.

Any disruptions or price hikes from these essential technology suppliers can directly affect DISCO's operational efficiency and overall costs. For instance, the semiconductor industry, crucial for AI acceleration hardware, has seen significant price volatility. In 2024, advanced AI chips, essential for high-performance computing, continued to command premium pricing due to sustained high demand from cloud providers and AI developers.

- Reliance on Specialized Hardware: High-performance computing and AI acceleration rely on specialized hardware, often from a limited number of suppliers.

- Software Integration Complexity: Proprietary software for data processing and AI can be complex to integrate, creating switching costs for DISCO.

- Market Concentration: Key segments of the hardware and software market are concentrated, giving dominant players more leverage.

The bargaining power of suppliers for DISCO is a critical consideration, particularly concerning cloud infrastructure providers like AWS, Azure, and GCP, whose essential services and high switching costs grant them significant leverage. Similarly, the scarcity and high demand for specialized AI/ML talent, coupled with the proprietary nature of advanced AI models, empower these talent and model developers. Legal data providers such as LexisNexis and Westlaw also hold substantial power due to the indispensable nature of their curated databases for DISCO's core e-discovery functions.

The increasing reliance on cybersecurity and data privacy solutions, essential for protecting sensitive legal data, further strengthens the bargaining power of these specialized providers. This is underscored by the projected $270 billion global cybersecurity market in 2024. Finally, suppliers of critical hardware and specialized software for data processing and AI acceleration, operating in concentrated markets, also exert considerable influence due to the specialized nature of their offerings and the complexity of integration.

| Supplier Category | Key Providers | Impact on DISCO | Justification |

| Cloud Infrastructure | AWS, Azure, GCP | High influence on pricing and service terms due to essential services and high switching costs. | Immense capital investment, indispensable for scalability and AI solutions. |

| AI/ML Talent & Models | Specialized Developers, Data Scientists | Drives up recruitment and project costs due to scarcity and high demand. | Global AI market projected to reach $1.3 trillion by 2030; access to cutting-edge models is a differentiator. |

| Legal Data & Content | LexisNexis, Westlaw | Significant impact on operating expenses and pricing strategies. | Curated databases are essential; licensing agreements represent a considerable cost. |

| Cybersecurity & Privacy | Specialized Solution Providers | Premium pricing and non-negotiable costs due to critical data protection needs. | Global cybersecurity market projected over $270 billion in 2024; essential for compliance and trust. |

| Hardware & Software | Semiconductor Manufacturers, Software Developers | Potential for price volatility and operational disruptions. | Reliance on specialized hardware (e.g., AI chips) and complex software integration creates switching costs. |

What is included in the product

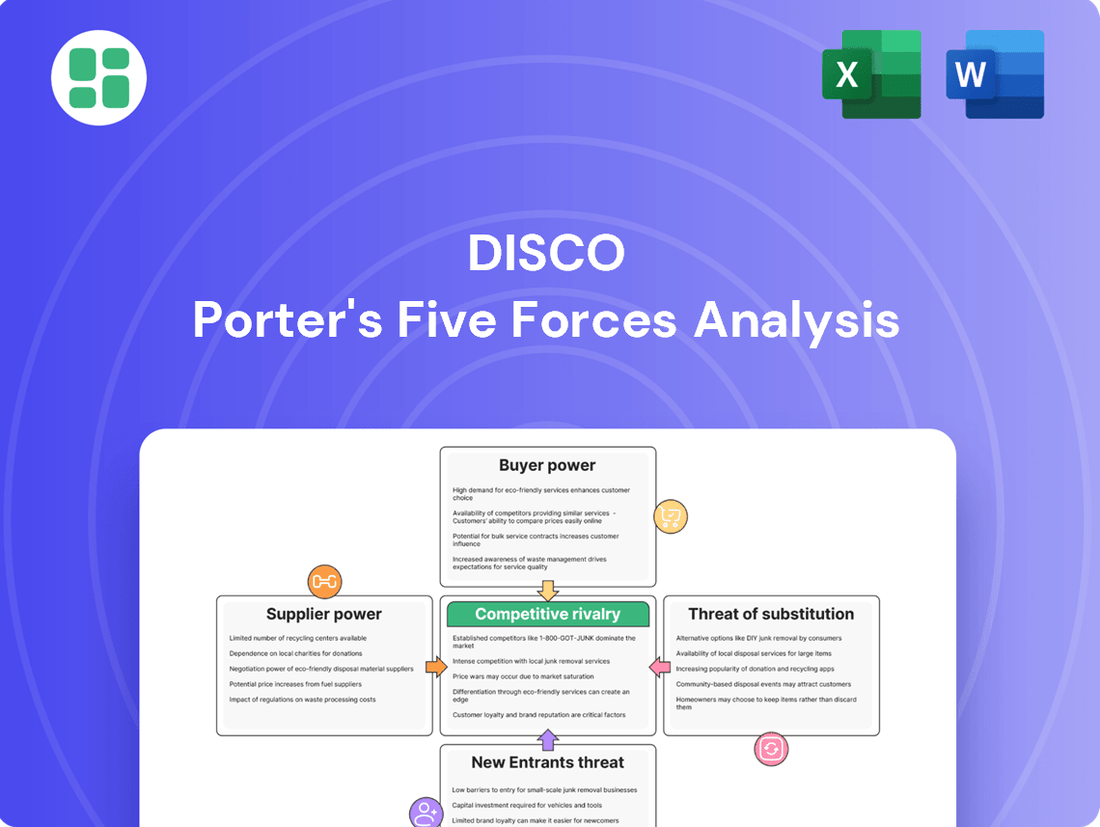

DISCO's Porter's Five Forces analysis examines the competitive intensity and attractiveness of the market DISCO operates within, assessing threats from new entrants, buyers, suppliers, substitutes, and existing rivals.

Effortlessly identify and neutralize competitive threats by visualizing the intensity of each force on a dynamic spider chart.

Customers Bargaining Power

For legal firms and corporations that have invested in DISCO's platform, the process of migrating vast amounts of sensitive legal data creates significant switching costs. These costs, encompassing data transfer expenses and the need for staff retraining, effectively anchor customers to the platform, diminishing their immediate bargaining power.

While DISCO benefits from this data lock-in, customer retention hinges on consistently delivering value. For instance, in 2024, the legal tech market saw continued growth, with companies like DISCO focusing on enhancing user experience and data security to maintain client loyalty amidst evolving competitive pressures.

Customers in the legal sector, like law firms and in-house legal teams, are feeling the heat to cut expenses and work smarter, particularly with tasks such as e-discovery. This pressure fuels their desire for AI tools that actually deliver results, giving them leverage to ask for clear returns on investment and fair pricing.

They are actively looking for technology that demonstrably saves them both time and money. For instance, a 2024 report indicated that legal departments aim to reduce operational costs by an average of 15% year-over-year, making efficiency-driving solutions a top priority.

The e-discovery market is quite competitive, with many players like Everlaw, Relativity, Logikcull, and Exterro offering similar services. This abundance of choice means clients can easily switch if they find a better deal or service elsewhere.

For instance, the legal tech sector saw significant investment in 2024, indicating robust competition. Customers can therefore shop around, comparing features, pricing structures, and support quality across these platforms. This ability to compare and switch directly enhances their bargaining power.

DISCO, like its rivals, needs to stay ahead by constantly improving its offerings and pricing to keep clients loyal. The pressure to innovate is high because customers have many alternatives readily available.

Customer Size and Volume of Data

DISCO's bargaining power of customers is significantly influenced by customer size and the volume of data processed. Large entities like major law firms, extensive corporations, and government bodies are crucial as they represent substantial revenue through their extensive data needs.

These high-volume clients wield considerable influence. Their ability to negotiate better terms, request bespoke functionalities, or leverage their scale to impact pricing is a direct consequence of the significant business they bring to DISCO. DISCO strategically targets these high-value accounts, acknowledging their market sway.

- Customer Concentration: DISCO's reliance on a few large clients means these customers have substantial bargaining power.

- Data Volume as Leverage: The sheer volume of data these clients entrust to DISCO allows them to negotiate pricing and service level agreements more effectively.

- Customization Demands: Large clients often require tailored solutions, giving them leverage to influence product development and feature sets.

- Revenue Impact: The significant revenue generated by these large accounts makes DISCO more amenable to their demands to maintain these relationships.

Expectation for Advanced AI and User Experience

The increasing sophistication of AI and legal tech has significantly amplified customer expectations. Clients now anticipate advanced features, such as generative AI for streamlined document review and intelligent case management systems. This heightened demand for intuitive and powerful tools necessitates continuous innovation from companies like DISCO to meet evolving user needs and maintain a competitive advantage.

In 2024, the legal tech market saw substantial growth, with AI-powered solutions becoming a key differentiator. Customers are actively seeking platforms that offer not just efficiency but also enhanced accuracy and predictive capabilities, directly influenced by the rapid progress in artificial intelligence. This trend places considerable pressure on providers to integrate cutting-edge AI, like natural language processing and machine learning, into their core offerings to satisfy a more discerning user base.

- AI-Driven Efficiency: Customers expect AI to automate routine tasks, freeing up legal professionals for higher-value work.

- Enhanced Accuracy: Demand for AI that minimizes errors in document analysis and legal research is paramount.

- Intuitive User Interface: A seamless and user-friendly experience is no longer a bonus but a core requirement.

- Predictive Analytics: Clients are increasingly looking for AI that can offer insights into case outcomes and legal strategy.

Customers in the legal sector, driven by a need for cost reduction and enhanced efficiency in tasks like e-discovery, possess significant bargaining power. They actively seek AI-driven solutions that offer tangible returns on investment and competitive pricing, especially given the competitive landscape of legal tech providers.

The sheer volume of data processed by large clients, such as major law firms and corporations, grants them considerable leverage. This allows them to negotiate favorable terms, request customized features, and influence pricing structures, making them key stakeholders whose demands DISCO must address to maintain strong relationships.

The legal tech market's rapid advancement, particularly in AI, has elevated customer expectations for sophisticated features and intuitive interfaces. This necessitates continuous innovation from DISCO to meet the demand for efficiency, accuracy, and predictive capabilities, thereby mitigating customer churn.

| Factor | Impact on DISCO | 2024 Data Point |

|---|---|---|

| Switching Costs | High due to data migration and retraining | Legal departments aimed for 15% cost reduction in 2024 |

| Competition | Intense with numerous alternatives | Legal tech sector saw significant investment in 2024 |

| Customer Size & Data Volume | Large clients wield significant negotiation power | Major law firms and corporations represent substantial revenue |

| AI Expectations | Clients demand advanced AI for efficiency and accuracy | AI-powered solutions became key differentiators in 2024 |

Preview Before You Purchase

DISCO Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive DISCO Porter's Five Forces Analysis breaks down competitive intensity and industry attractiveness, providing actionable insights for strategic decision-making. What you're previewing is precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The legal technology and e-discovery sectors are booming, fueled by a surge in electronic data, more intricate regulations, and a strong push for automated solutions. This robust expansion naturally draws in a multitude of companies, consequently heightening the competitive landscape.

This dynamic environment is clearly demonstrated by the e-discovery market's projected growth. Forecasts indicate it will reach an impressive $22.57 billion by 2029, a significant increase that attracts new entrants and intensifies rivalry among existing players.

Competitive rivalry within the legal tech sector, particularly concerning eDiscovery solutions, is undeniably fierce. This intensity is largely fueled by a relentless pace of technological innovation, with artificial intelligence (AI) and machine learning at the forefront of this evolution.

Companies like DISCO are actively pushing boundaries with platforms such as Cecilia AI and Auto Review, showcasing a commitment to developing advanced features. This creates a dynamic environment where staying competitive necessitates continuous investment in research and development, as firms strive to differentiate themselves and capture market share through superior technological offerings.

DISCO operates in a highly competitive landscape, facing strong rivalry from established e-discovery giants like Everlaw, Relativity, and Exterro. These players have significant market share and deep customer relationships, posing a considerable challenge to DISCO's growth.

Adding to the competitive pressure is a burgeoning field of niche legal tech startups, each targeting specific segments of the market with specialized solutions. While DISCO champions its cloud-native, AI-first strategy, the sheer variety of offerings from these competitors means customers have a broad spectrum of choices to address their unique e-discovery requirements.

Product Differentiation and Service Quality

Competitive rivalry in the legal technology space, particularly for eDiscovery solutions like those offered by DISCO, is intense. Companies actively differentiate themselves through a combination of product features, ease of use, scalability, robust data security, and the quality of their professional services. DISCO, for instance, promotes its user-friendly platform and the expertise of its professional services team as key differentiators. However, competitors are not standing still; they consistently emphasize their own unique strengths, fostering an ongoing drive for brand loyalty and a compelling value proposition.

The battle for market share means that continuous innovation and customer-centric approaches are paramount. For example, in 2024, the eDiscovery market saw significant investment in AI-powered analytics and predictive coding, areas where companies like Relativity and Everlaw also made substantial advancements. DISCO's reported revenue growth, while not directly tied to competitive rivalry alone, indicates its ability to capture market share amidst this competitive landscape. The emphasis remains on providing a superior user experience and demonstrable value, whether through advanced technology or specialized support.

- Product Features: Companies compete on the sophistication and breadth of their eDiscovery tools, including AI capabilities, data processing speeds, and review functionalities.

- Service Quality: The caliber of professional services, such as project management, legal expertise, and technical support, is a critical differentiator in complex legal matters.

- Brand Loyalty: Building trust and demonstrating consistent performance are key to retaining clients and fostering long-term relationships in a market with high switching costs.

- Value Proposition: Companies must clearly articulate the cost-effectiveness and efficiency gains their solutions provide to stand out against a crowded field of competitors.

Price Competition and Value Proposition

While legal tech solutions promise substantial long-term cost reductions, the initial capital outlay and ongoing subscription fees create a competitive battleground. Companies are intensely focused on proving a compelling return on investment (ROI) and a superior overall value proposition to secure and keep clients.

This competition often translates into significant pricing pressures, particularly for legal tech products that lack strong differentiation. For instance, in 2024, the average annual cost for a comprehensive legal practice management software subscription could range from $500 to $2,000 per user, depending on features and firm size, making value demonstration crucial.

- Cost Savings vs. Initial Investment: Legal tech aims for long-term efficiency gains, but upfront costs are a key competitive factor.

- ROI and Value Proposition: Demonstrating clear financial benefits and overall client value is paramount for market share.

- Pricing Pressure on Undifferentiated Offerings: Legal tech providers with similar features face intense pressure to offer competitive pricing.

The competitive rivalry in the legal technology sector, particularly for eDiscovery solutions, is intense. Companies differentiate on features, service, brand, and value proposition. For example, in 2024, significant investment in AI analytics and predictive coding by major players like Relativity and Everlaw highlights the drive for technological advancement to capture market share. DISCO's own revenue growth suggests it's navigating this competitive landscape effectively by emphasizing its AI-first, cloud-native strategy and user experience.

| Key Differentiators | Examples of Focus | Market Impact |

|---|---|---|

| Product Features | AI capabilities, processing speed, review tools | Drives innovation and user adoption |

| Service Quality | Project management, legal expertise, technical support | Builds trust and client retention |

| Brand Loyalty | Consistent performance, established reputation | Reduces customer churn, lowers acquisition costs |

| Value Proposition | Cost savings, efficiency gains, ROI demonstration | Secures market share against competitors |

SSubstitutes Threaten

Historically, legal document review was a labor-intensive process relying on manual examination. While DISCO offers advanced AI, smaller firms or niche legal areas might still opt for traditional methods, viewing them as a substitute, particularly if initial technology investment is a concern. However, the sheer volume of data in modern legal cases makes purely manual review increasingly inefficient.

The rise of general-purpose AI tools, like advanced large language models, poses a threat of substitution for specialized legal tech. If legal professionals begin adapting these widely available AI tools for tasks such as document review or preliminary legal research, it could divert demand from dedicated platforms.

While these general AI tools may not possess the deep legal domain expertise or the robust security protocols that DISCO offers, their perceived lower cost and ease of access could entice a segment of the market. For instance, by mid-2024, many general AI tools saw significant user adoption, with some reports indicating a substantial increase in their use for professional tasks outside their original scope.

Large law firms and corporate legal departments with substantial financial backing may choose to build their own e-discovery and legal document review platforms. This approach offers unparalleled customization and direct oversight, serving as a direct alternative to external service providers.

While this internal development provides complete control, the significant upfront investment, need for specialized technical talent, and continuous upkeep present considerable barriers. For many organizations, these factors make in-house solutions a less practical substitute compared to leveraging third-party offerings.

Alternative Legal Service Providers (ALSPs)

Alternative Legal Service Providers (ALSPs) pose a significant threat by offering comprehensive outsourced legal solutions. These providers often bundle services like e-discovery, utilizing their own technology and human resources, which can substitute for standalone software like DISCO.

Many ALSPs develop or adopt proprietary technologies, creating a complete e-discovery offering that competes directly with specialized software providers. This bundling strategy can be particularly attractive to clients seeking end-to-end solutions, potentially reducing the need for individual software purchases.

The ALSP market is experiencing substantial growth. For instance, the global legal services market, which includes ALSP offerings, was projected to reach over $1 trillion by 2024, with ALSPs capturing an increasing share by providing cost-effective and efficient alternatives.

- ALSPs offer bundled legal services, including e-discovery, as a substitute for standalone software.

- They leverage their own technology and human expertise, potentially using proprietary tools instead of third-party platforms.

- The ALSP market is growing, with significant market share gains in the broader legal services sector.

Other Specialized Legal Software Not Directly E-discovery

The threat of substitutes for comprehensive e-discovery solutions is amplified by other specialized legal software. For instance, contract lifecycle management (CLM) tools streamline agreement processes, potentially reducing the volume of documents requiring e-discovery. In 2024, the CLM market was projected to reach over $5 billion, indicating significant adoption.

Legal research databases, such as Westlaw and LexisNexis, also offer functionalities that can overlap with certain aspects of e-discovery, particularly in identifying relevant case law or statutes. This can divert resources and attention away from dedicated e-discovery platforms. The legal tech market as a whole saw substantial investment in 2024, with e-discovery tools competing for a share of this expanding pie.

Compliance software, designed to manage regulatory adherence, can also address specific data handling needs that might otherwise fall under e-discovery. This creates a competitive landscape where firms might opt for integrated compliance solutions rather than standalone e-discovery services. The global compliance software market was estimated to be worth nearly $60 billion in 2024, highlighting its broad appeal.

- Contract Lifecycle Management (CLM) adoption: CLM market projected to exceed $5 billion in 2024, offering an alternative for document management.

- Legal Research Databases: Tools like Westlaw and LexisNexis provide overlapping functionalities, potentially reducing reliance on dedicated e-discovery.

- Compliance Software Market Growth: The global compliance software market reached nearly $60 billion in 2024, indicating strong competition for legal tech budgets.

- Diversion of Budget and Attention: These specialized tools address related pain points, potentially diverting financial resources and strategic focus from comprehensive e-discovery solutions.

The threat of substitutes for specialized legal technology like DISCO comes from various sources. General-purpose AI tools, while lacking deep legal expertise, offer a lower-cost entry point for tasks like document review, with significant user adoption seen by mid-2024. Large firms might also develop proprietary in-house solutions, though this demands substantial investment and technical talent. Alternative Legal Service Providers (ALSPs) are a significant threat, offering bundled services that encompass e-discovery, and this market segment is growing rapidly within the broader legal services industry.

Furthermore, specialized legal software in adjacent areas can act as substitutes. Contract Lifecycle Management (CLM) tools, with a market projected to exceed $5 billion in 2024, can reduce the need for extensive e-discovery. Legal research platforms also offer overlapping functionalities, and the booming compliance software market, valued at nearly $60 billion in 2024, can address specific data handling needs, diverting budgets and attention from dedicated e-discovery solutions.

| Substitute Category | Example | 2024 Market Relevance | Impact on E-discovery Demand |

|---|---|---|---|

| General AI Tools | Advanced Large Language Models | High adoption for professional tasks | Potential diversion due to lower cost and accessibility |

| In-house Development | Custom-built e-discovery platforms | Feasible for large, well-funded legal departments | Reduces reliance on third-party providers, but high barrier to entry |

| Alternative Legal Service Providers (ALSPs) | Outsourced legal solutions bundles | Growing market share in legal services | Offers end-to-end solutions, potentially replacing standalone software |

| Specialized Legal Software | Contract Lifecycle Management (CLM) | Projected >$5 billion market | Reduces document volume requiring e-discovery |

| Specialized Legal Software | Legal Research Databases (e.g., Westlaw) | Significant market presence | Overlapping functionalities can reduce reliance on dedicated e-discovery |

| Specialized Legal Software | Compliance Software | Nearly $60 billion global market | Addresses specific data handling needs, competing for budget |

Entrants Threaten

Developing and maintaining a sophisticated legal technology platform, especially one leveraging advanced AI, demands substantial upfront capital. DISCO, for instance, needs significant investment in research and development to refine its AI-powered e-discovery and legal case management tools. This R&D spend, coupled with the cost of building and scaling robust cloud infrastructure, creates a considerable financial hurdle for any new player looking to enter the market.

The threat of new entrants in the legal tech space is significantly shaped by the substantial need for deep legal domain expertise and access to high-quality data. Simply having advanced technology isn't enough; success hinges on a nuanced understanding of intricate legal processes, ever-evolving regulations, and the specific nature of legal data. This knowledge barrier is substantial.

New players must contend with the challenge of acquiring this specialized legal acumen, often requiring years of experience or significant investment in legal professionals. Furthermore, building or accessing comprehensive, accurate legal datasets is crucial for developing effective AI and automation tools. For instance, training a legal AI model for contract review might require millions of annotated legal documents, a resource that established firms or specialized data providers already possess.

The legal industry's stringent regulatory environment presents a significant threat of new entrants. Navigating complex compliance landscapes, including data privacy laws like GDPR and CCPA, requires substantial investment in legal expertise and technology, making it a costly and time-consuming endeavor for newcomers. For instance, in 2024, the average cost for a new fintech company to achieve full regulatory compliance across multiple jurisdictions could easily reach millions of dollars, deterring many potential entrants.

Established Customer Relationships and Brand Loyalty

Established players like DISCO have cultivated deep relationships with their clientele, including law firms, corporations, and government agencies. This long-standing trust and brand loyalty present a significant hurdle for newcomers. For instance, in the legal tech sector, where DISCO operates, client retention rates are often very high, with many firms reluctant to switch providers due to the perceived risks and integration complexities. This loyalty means new entrants must not only offer a superior product but also invest heavily in building credibility and demonstrating reliability to even get a foot in the door.

New entrants must overcome the inertia of existing customer commitments and the aversion to risk inherent in many industries DISCO serves. Building brand recognition and trust takes time and substantial investment. For example, a new eDiscovery platform entering the market would need to demonstrate robust data security, proven efficiency, and seamless integration with existing legal workflows, all while competing against established reputations. This challenge is amplified in sectors where regulatory compliance and data integrity are paramount, making clients hesitant to adopt unproven solutions.

- Customer Retention: High retention rates among existing DISCO clients mean fewer readily available opportunities for new entrants.

- Brand Trust: Years of reliable service have solidified DISCO's brand reputation, a difficult asset for competitors to replicate quickly.

- Switching Costs: The effort and potential disruption involved in migrating data and retraining staff create barriers for clients considering a change.

- Risk Aversion: Industries that rely on DISCO's services often prioritize stability and proven performance over the potential benefits of unproven technologies.

Talent Acquisition and Retention Challenges

New entrants in the legal tech space face significant hurdles in attracting and retaining top-tier talent, particularly in specialized fields like AI development and legal expertise. This intense competition for skilled professionals can dramatically increase operational costs for new players. For instance, in 2024, the demand for AI specialists outstripped supply, leading to salary increases of up to 20% for experienced professionals in the field, according to industry reports.

The financial burden of competing for this talent is substantial. New companies must offer competitive salaries, comprehensive benefits, and attractive equity packages to lure experienced professionals away from established firms or other tech sectors. This investment in human capital represents a considerable barrier to entry, potentially diverting crucial resources away from product development and market penetration strategies.

- High Demand for AI Talent: In 2024, the global demand for AI specialists saw a significant surge, with companies reporting an average of 15% longer hiring times for these roles compared to other tech positions.

- Competitive Compensation: To attract top AI engineers and legal tech experts, new entrants often need to offer salaries that are 10-15% above the market average for comparable roles in other industries.

- Retention Challenges: Established legal tech firms often have stronger brand recognition and more robust career development programs, making it harder for new entrants to retain the talent they manage to acquire.

The legal technology sector demands substantial capital investment, particularly for developing sophisticated AI-driven platforms. DISCO's need for ongoing research and development, coupled with the costs of scaling cloud infrastructure, creates a significant financial barrier for potential new entrants. For instance, in 2024, the average cost for a startup to develop a comparable legal tech solution with AI capabilities was estimated to be upwards of $10 million.

New entrants must also overcome the high switching costs and ingrained customer loyalty that established players like DISCO benefit from. Clients often hesitate to migrate due to the perceived risks, integration complexities, and the need for retraining staff. This inertia, combined with the time and investment required to build brand trust and demonstrate reliability, makes market penetration challenging for newcomers.

The threat of new entrants is further mitigated by the need for deep legal domain expertise and access to vast, high-quality datasets for training AI models. Newcomers must acquire specialized legal knowledge and build or acquire substantial data resources, which are often already possessed by incumbents. This knowledge and data barrier, alongside stringent regulatory compliance requirements, significantly deters many potential competitors.

| Factor | Impact on New Entrants | Example/Data (2024) |

| Capital Requirements | High | Estimated $10M+ for AI-driven legal tech platform development. |

| Customer Loyalty & Switching Costs | Significant Barrier | High retention rates in legal tech, reluctance to change providers. |

| Domain Expertise & Data Access | Critical Hurdle | Need for millions of annotated legal documents for AI training. |

| Regulatory Compliance | Costly & Time-Consuming | Millions of dollars for startups to achieve compliance across jurisdictions. |

Porter's Five Forces Analysis Data Sources

Our DISCO Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and government economic indicators. This comprehensive approach ensures a thorough understanding of the competitive landscape.