China Communications Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Services Bundle

Unlock the critical external factors shaping China Communications Services's trajectory with our comprehensive PESTLE analysis. From evolving government policies to emerging technological disruptions, understand the forces that will dictate its future success. Equip yourself with actionable intelligence to refine your investment strategy or business planning. Download the full PESTLE analysis now and gain the competitive edge you need.

Political factors

The Chinese government's commitment to fostering the digital economy and upgrading telecommunications infrastructure, with significant focus on 5G and future 6G networks, directly benefits China Communications Services (CCS). This strong governmental push, evident in programs like 'Digital China,' creates a fertile ground for CCS to win contracts and scale its business. In 2023, China's investment in 5G base stations exceeded 3.3 million, a figure expected to grow, providing a substantial market for CCS's services.

As a significant state-owned enterprise (SOE), China Communications Services (CCS) enjoys a predictable operating landscape and often receives favored access to large-scale national infrastructure projects. This government backing provides a solid foundation for its business activities.

The Chinese government's ongoing initiatives to restructure and consolidate central SOEs, with the goal of boosting their fundamental competitiveness and fostering growth in emerging strategic sectors, directly shape CCS's strategic direction and where it invests its resources. For instance, the 2023 SOE reform plan emphasizes innovation and digital transformation, areas where CCS is expected to play a leading role.

Consequently, CCS is instrumental in executing national telecommunications policies and upholding industry standards, acting as a key implementer of government directives in the sector. Its operations align closely with national digital infrastructure development plans, such as the expansion of 5G networks and the rollout of smart city initiatives.

China's commitment to bolstering cybersecurity and data protection is evident in its evolving regulatory landscape. New measures like the Network Data Security Management Regulations, effective January 1, 2025, are set to further refine existing frameworks such as the Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL). This tightening of controls directly affects companies like China Communications Services (CCS), particularly in areas involving IT infrastructure and content delivery.

The implications for CCS are significant, demanding enhanced compliance protocols for data handling, especially concerning cross-border transfers and the management of what is classified as "important data." Meeting these stringent requirements necessitates substantial investment in robust security infrastructure and comprehensive compliance frameworks, potentially impacting operational costs and strategic planning for CCS's digital services.

Market Opening and Foreign Investment Policies

China's ongoing efforts to open its market are evident in its telecommunications sector. The government has been progressively easing foreign ownership limitations, particularly in value-added telecommunication services. Pilot programs initiated in key economic zones like Beijing, Shanghai, Hainan, and Shenzhen signal a strategic intent to draw in foreign capital and technological advancements, thereby encouraging market diversification and a more competitive landscape.

These policy shifts, while primarily targeting value-added services, could indirectly influence China Communications Services (CCS). The potential for new foreign partnerships or increased competitive pressures in specific market segments presents both opportunities and challenges for CCS. For example, increased foreign participation in cloud services or data analytics, areas where CCS operates, could necessitate strategic adjustments to maintain market share and profitability.

The impact of these policy changes is underscored by the growth in foreign direct investment (FDI) in China's services sector. In 2023, FDI in China's services industry saw a notable increase, with a significant portion directed towards technology and communication-related sub-sectors, reflecting the attractiveness of these evolving markets to international investors.

- Relaxed Restrictions: China is gradually lifting foreign ownership caps in specific value-added telecom services.

- Pilot Programs: Initiatives are underway in Beijing, Shanghai, Hainan, and Shenzhen to test these policy changes.

- Investment Attraction: The goal is to attract foreign investment and advanced technology to boost competition and innovation.

- Potential Impact on CCS: New partnerships or heightened competition in certain service areas could affect CCS's market position.

Geopolitical Tensions and Supply Chain Security

Heightened geopolitical tensions worldwide are compelling China to prioritize self-sufficiency in crucial technological sectors, notably semiconductors and network processors. This strategic shift is evidenced by government mandates aimed at phasing out foreign-made processors from domestic networks, directly fostering the development of China's internal supply chains. For China Communications Services (CCS), this presents a dual opportunity: supporting the localization of technology and infrastructure, thereby potentially solidifying its domestic market standing, while simultaneously necessitating agility in navigating evolving supply chain landscapes.

The drive for technological independence is a significant political factor influencing CCS. For instance, China's stated goal to reduce reliance on foreign technology, particularly in areas like 5G infrastructure, could lead to increased domestic procurement opportunities. Reports from late 2023 and early 2024 indicate substantial government investment in domestic semiconductor manufacturing capacity, aiming to bridge the gap with international leaders. This policy environment directly supports CCS's role in deploying and maintaining infrastructure built with these increasingly localized components.

- Government Support for Domestic Tech: China's policy directives actively encourage the use of domestically produced semiconductors and network equipment, impacting procurement decisions for telecommunications infrastructure.

- Supply Chain Localization: CCS is positioned to benefit from the push to localize critical technology components, potentially securing more contracts for projects utilizing Chinese-manufactured hardware.

- Adaptation to New Dynamics: The shift necessitates CCS adapting its operational strategies and partnerships to align with the evolving domestic supply chain ecosystem, which may involve new vendors and different integration challenges.

The Chinese government's strong commitment to digital transformation and infrastructure upgrades, particularly in 5G and future networks, directly fuels demand for China Communications Services' (CCS) expertise. This is evidenced by China's substantial investment in 5G base stations, exceeding 3.3 million in 2023, a number projected to climb, creating a robust market for CCS.

As a state-owned enterprise, CCS benefits from government backing and preferential access to national projects, ensuring a stable operating environment. The ongoing SOE reforms, emphasizing innovation and digital growth, further align CCS's strategic direction with national priorities, as seen in the 2023 SOE reform plan focusing on digital transformation.

China's evolving cybersecurity and data protection regulations, including measures effective January 1, 2025, necessitate significant investment from CCS in compliance and security infrastructure, impacting operational costs and strategic planning for its digital services.

What is included in the product

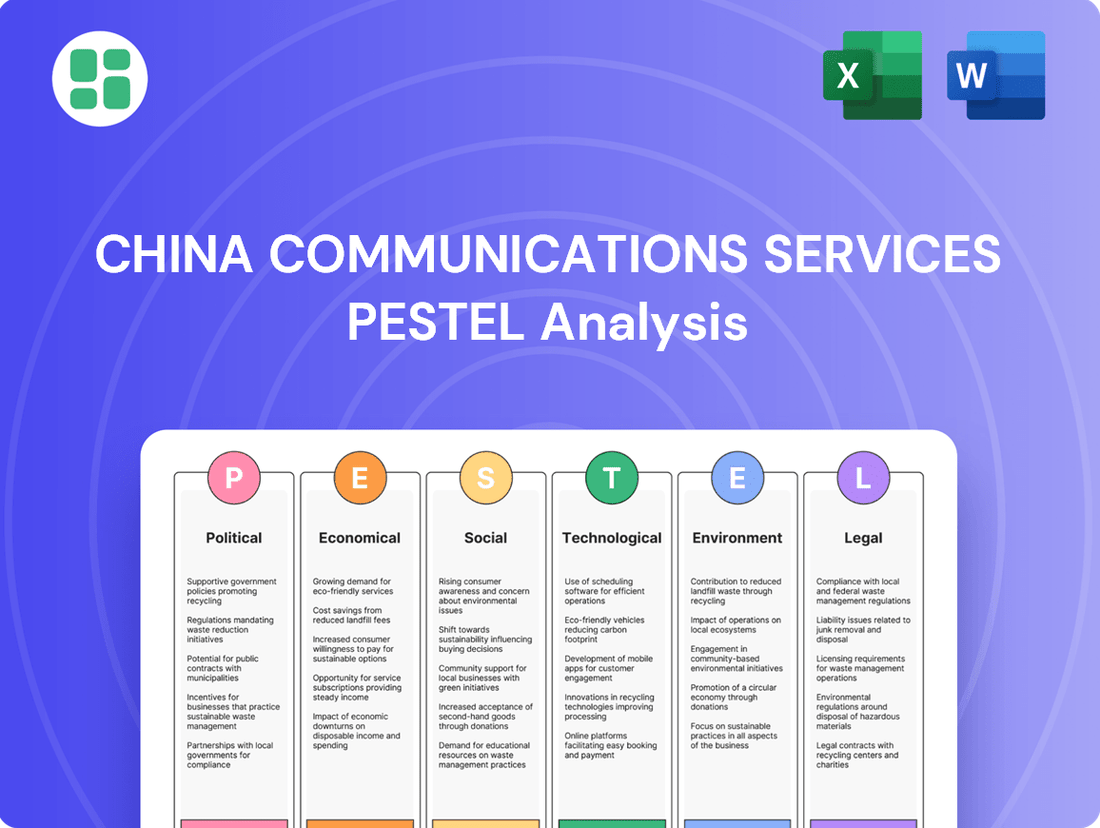

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing China Communications Services, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key opportunities and threats derived from current market trends and regulatory landscapes.

A concise PESTLE analysis for China Communications Services offers a pain point reliever by providing a readily digestible overview of external factors, enabling swift strategic adjustments and risk mitigation.

Economic factors

China's digital economy is a powerhouse, projected to represent around 10% of its GDP in 2024. This expansion, fueled by widespread digitalization and smart upgrades across industries, directly boosts the need for China Communications Services' (CCS) telecom infrastructure and digital solutions. The government's focus on developing new quality productive forces is a key driver, channeling more investment into digital networks and services.

China's major telecom operators, including China Mobile, China Telecom, and China Unicom, are projected to see a reduction in overall capital expenditure for 2024-2025. This strategic shift, however, is accompanied by a significant pivot towards investing in AI infrastructure and the nascent stages of 6G development.

This recalibration in spending directly influences China Communications Services (CCS), as the company's core business relies on supporting these operators. CCS must therefore adapt its service portfolio to cater to the growing demand for next-generation network build-outs and advanced computing capabilities, aligning with these new investment priorities.

The telecommunications sector, both worldwide and in China, is characterized by fierce competition and shifting customer needs. Global telecom equipment revenues experienced a downturn in 2024, though the Asia-Pacific region anticipates stronger growth through 2028, offering a potential avenue for expansion.

China Communications Services (CCS) navigates the headwinds of decelerating revenue growth within China's domestic telecom industry. Simultaneously, the company confronts intense rivalry in the burgeoning industrial digitalization sector, a landscape that demands constant service enhancement and strategic entry into new, promising business areas.

Urbanization and Infrastructure Demand

China's ongoing urbanization continues to fuel a significant demand for advanced telecommunications infrastructure. As more people move into cities and surrounding regions, there's a clear need for expanded network coverage, increased capacity, and the development of smart city technologies. This trend directly benefits companies like China Communications Services (CCS) whose core operations revolve around building and maintaining these essential networks.

The urbanization push translates into substantial investment opportunities. For instance, China's urban population reached 66.16% by the end of 2023, a figure projected to climb higher. This demographic shift requires continuous upgrades to existing infrastructure and the deployment of new technologies to support the growing digital needs of these urban centers.

- Urban Population Growth: China's urban population continues to expand, creating a consistent demand for telecommunications services.

- Infrastructure Investment: Government initiatives and private sector investment are directed towards upgrading and expanding network infrastructure to support smart city development and increased data traffic.

- CCS's Role: As a key player in infrastructure services, CCS is well-positioned to capitalize on this sustained demand for enhanced connectivity in both urban and rural areas.

- Smart City Initiatives: The push for smart cities necessitates advanced communication networks, which CCS is equipped to provide.

Innovation and R&D Investment

China's government actively promotes increased R&D spending by businesses and academic bodies, with a specific focus on advancing data flow and its effective utilization. This policy aims to foster technological advancements across various sectors.

For China Communications Services (CCS), this policy environment presents a significant opportunity. It can leverage these incentives to develop and bring to market new products and services in high-growth areas such as artificial intelligence, big data analytics, and sustainable, low-carbon technologies. These investments are crucial for CCS to sharpen its competitive advantage and secure sustained future growth.

- Government Push for R&D: China's national strategy prioritizes innovation, especially in data-related fields.

- CCS Opportunity: CCS can capitalize on this by developing AI, big data, and green tech solutions.

- Market Impact: Such innovation enhances CCS's market position and drives revenue streams.

- 2024/2025 Outlook: Continued R&D investment is expected to yield tangible commercial results for CCS in these emerging sectors.

China's economic landscape in 2024-2025 is marked by a strategic shift in telecom capital expenditure, with major operators like China Mobile, China Telecom, and China Unicom reallocating funds towards AI infrastructure and 6G development. This pivot, while potentially reducing traditional network build-out spending, creates new avenues for China Communications Services (CCS) to align its offerings with next-generation technologies and advanced computing needs.

The nation's digital economy is a significant growth engine, projected to constitute around 10% of China's GDP in 2024. This digital expansion, coupled with government initiatives to foster new quality productive forces, directly fuels demand for CCS's telecom infrastructure and digital solutions, underscoring the importance of adapting to evolving technological priorities.

| Indicator | 2024 Projection/Status | 2025 Outlook | Impact on CCS |

|---|---|---|---|

| Digital Economy Share of GDP | ~10% | Continued Growth | Increased demand for digital infrastructure and services |

| Telecom CAPEX Shift | Focus on AI & 6G | Continued AI & 6G Investment | Opportunity for CCS in new tech areas, potential reduction in traditional build-out |

| Urbanization Rate | 66.16% (end of 2023) | Projected Increase | Sustained demand for network expansion and smart city solutions |

Preview Before You Purchase

China Communications Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your China Communications Services PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown of China Communications Services.

The content and structure shown in the preview is the same document you’ll download after payment, offering an in-depth PESTLE analysis of China Communications Services.

Sociological factors

China's digital landscape is rapidly evolving, with a significant portion of its vast population becoming increasingly proficient with digital technologies. By the end of 2023, China boasted over 1.07 billion internet users, a number that continues to climb, reflecting this growing digital literacy. This surge directly fuels demand for sophisticated and easily accessible telecommunication services, creating opportunities for companies like China Communications Services (CCS).

The widespread adoption of smartphones and digital platforms means CCS must invest in and expand its robust network infrastructure to meet the escalating demand for high-speed data and reliable connectivity. Furthermore, this trend necessitates the development of a diverse range of application and content services tailored to various user needs and preferences, from e-commerce to digital entertainment.

CCS's strategy must also focus on creating user-friendly digital solutions that cater to a broad spectrum of demographics, including older populations who may be new to digital engagement. For instance, the penetration rate of mobile internet in China reached 75.4% by the end of 2023, indicating a massive user base ready for advanced digital integration across all age groups.

Chinese consumers are deeply immersed in digital life, with social commerce and short-video platforms like Douyin and Kuaishou becoming central to their shopping habits. By 2024, it's estimated that social commerce sales in China will continue to grow significantly, reflecting this trend. This shift means companies like China Communications Services (CCS) must provide robust infrastructure for these increasingly interactive and engaging digital experiences.

The growing reliance on AI for personalized recommendations and customer service further shapes consumer expectations. As of early 2025, AI integration in e-commerce is becoming standard, driving demand for sophisticated data processing and network capabilities. Furthermore, the emphasis on authenticity and user-generated content, often seen in peer reviews and influencer marketing, necessitates platforms that can effectively host and disseminate this type of information.

As China's urbanization accelerates, a significant societal shift towards 'smart cities' is evident, driving demand for integrated solutions. This includes advancements in smart parks, digital healthcare platforms, and more efficient emergency response systems, reflecting a growing public expectation for technologically enhanced urban living.

China Communications Services (CCS) is strategically positioned to capitalize on this trend. By leveraging its robust digital infrastructure, CCS is actively developing and deploying smart city initiatives, directly addressing these evolving societal needs and contributing to the modernization of urban environments across the nation.

In 2024, China's urban population reached approximately 66% of its total population, a figure projected to grow. This expanding urban base fuels the demand for smart city technologies, with government investment in smart city projects expected to reach billions of dollars annually through 2025, creating substantial market opportunities for companies like CCS.

Aging Population and Digital Inclusion

China's demographic shift towards an aging population, with over 21% of its population aged 60 and above by the end of 2023, presents a nuanced sociological landscape. This demographic trend underscores a growing imperative for digital inclusion, ensuring that older adults can effectively engage with and benefit from digital services and communication platforms. China Communications Services (CCS) may find opportunities in developing and supporting user-friendly technologies and services tailored to bridge this digital divide.

The increasing reliance on digital channels for essential services, from healthcare to social interaction, means that a significant portion of the population could be left behind if digital accessibility is not prioritized. This societal need could drive demand for simpler interfaces, voice-activated technologies, and robust customer support for digital platforms. For instance, initiatives aimed at digital literacy programs for seniors could become a crucial service offering.

The government's focus on building a "digital China" also implicitly includes ensuring all citizens can participate. This could translate into regulatory support or incentives for companies like CCS to invest in accessible technology development. CCS's role in infrastructure and service provision positions it to be a key player in facilitating this intergenerational digital connectivity.

- Aging Population Growth: By the end of 2023, China's population aged 60 and above reached 296.97 million, representing 21.1% of the total population.

- Digital Divide Concern: While internet penetration in China is high, a significant portion of the elderly population remains offline or digitally illiterate, creating a gap in access to essential services.

- Demand for Accessible Tech: The growing senior demographic is expected to drive demand for simplified digital interfaces, voice command features, and dedicated support services for online platforms.

- Government Digitalization Push: National strategies promoting digital transformation are likely to encourage investments in inclusive digital solutions that cater to all age groups.

Workforce Digital Transformation and Skill Requirements

China's workforce is undergoing a significant digital transformation, with an increasing demand for advanced digital skills across all sectors. This shift directly impacts China Communications Services (CCS) by highlighting the imperative to invest in employee training and upskilling. For instance, by the end of 2024, it's projected that over 70% of new job roles will require digital literacy, a trend CCS must address to remain competitive.

To adapt, CCS needs to focus on equipping its employees with expertise in emerging technologies such as artificial intelligence, cloud computing, and sophisticated network maintenance. This strategic investment not only ensures operational efficiency but also positions CCS to capitalize on new market opportunities. The company's ability to integrate these skills will be crucial for its future growth and service delivery.

- Digital Skills Gap: A 2024 report indicated that over 60% of Chinese companies faced challenges in finding talent with adequate digital skills.

- AI Adoption: By mid-2025, it's estimated that AI adoption in Chinese enterprises will reach 45%, requiring a corresponding upskilling of IT support staff.

- Cloud Computing Growth: The Chinese cloud market is expected to grow by over 20% annually through 2025, demanding more cloud-native expertise within the workforce.

- New Service Offerings: CCS can leverage its enhanced digital capabilities to provide digital transformation consulting and implementation services to its enterprise clients, tapping into a growing market segment.

China's aging population is a significant sociological factor, with over 21% of its citizens being 60 or older by the end of 2023, totaling nearly 300 million individuals. This demographic shift creates a growing need for accessible digital services, as many seniors may face challenges with current technology. China Communications Services (CCS) can address this by developing user-friendly interfaces and offering dedicated support to bridge the digital divide.

Technological factors

China is aggressively pushing 5G-Advanced (5G-A) deployments, with the goal of commercialization around 2030 and significant standard-setting by 2025. This rapid advancement in wireless technology directly fuels demand for China Communications Services (CCS) in building out the necessary infrastructure.

The drive towards 5G-A and the foundational research for 6G translates into substantial opportunities for CCS, particularly in the construction of millions of 5G base stations. By 2024, China had already deployed over 3.3 million 5G base stations, a figure expected to grow substantially as the network evolves.

China Communications Services (CCS) is deeply integrating AI, big data, and cloud computing, unlocking significant opportunities. The company is strategically deploying AI across its operations, aiming to build new competitive advantages. This focus includes developing products and solutions that leverage these advanced technologies for critical sectors like digital infrastructure, environmental sustainability, and smart city initiatives.

The rapid expansion of the Internet of Things (IoT) and the industrial internet is a significant technological shift. China Communications Services (CCS) is actively participating in this by aiming to establish a comprehensive 5G RedCap ecosystem by 2025. This initiative connects high-performance 5G devices with low-power IoT solutions, a critical step for future connectivity.

This growth in connected devices and industrial applications directly fuels the demand for CCS's core services. As more sensors, machinery, and devices come online, the need for reliable network maintenance and efficient facility management services increases substantially, creating a strong market opportunity for the company.

Digital Infrastructure Modernization and Computing Power

China's commitment to upgrading its digital infrastructure is a significant technological driver. The nation is actively optimizing computing power centers, aiming for a seamless blend of network and computing functionalities. This includes developing deterministic networking and integrating space-earth satellite internet systems, as highlighted by investments in advanced network technologies and data center expansion projects throughout 2024 and into 2025.

China Communications Services (CCS) is strategically positioned to capitalize on these advancements. Their core service offerings in digital infrastructure, data centers, and cloud computing directly align with the government's modernization agenda. For instance, CCS's involvement in building out 5G networks and supporting cloud service providers reflects their role in enabling this national digital transformation.

The push for enhanced computing power and integrated infrastructure is crucial for supporting emerging technologies like AI and big data analytics. CCS's continued investment in these areas, evidenced by their financial reports showing growth in data center and cloud segments during 2024, directly supports China's ambition to become a global leader in digital innovation.

- National Data Infrastructure Enhancement: China is investing heavily in optimizing computing power centers and integrating network and computing capabilities.

- Deterministic Networking and Satellite Internet: Development of advanced networking and space-earth integrated internet systems is a key focus.

- CCS's Strategic Alignment: CCS's digital infrastructure, data center, and cloud businesses directly benefit from and contribute to these national modernization efforts.

- Support for Emerging Technologies: The upgraded infrastructure will bolster AI, big data, and other advanced technological applications.

Cybersecurity and Data Protection Technologies

The escalating volume and sensitivity of data handled by China Communications Services (CCS) necessitate robust cybersecurity and data protection technologies. CCS must invest in advanced solutions to meet China's increasingly strict data security regulations, such as the Cybersecurity Law and the Personal Information Protection Law, which impose significant compliance burdens.

To counter evolving cyber threats, including sophisticated phishing attacks and ransomware, CCS is leveraging artificial intelligence. For instance, AI is being deployed for deepfake detection to safeguard against misinformation and for quantum secure calls, offering a higher level of communication confidentiality.

- Data Protection Compliance: Adherence to China's Cybersecurity Law (effective 2017) and Personal Information Protection Law (effective 2021) is critical for CCS's IT services operations.

- AI in Cybersecurity: Investments in AI for threat detection and response are crucial, with AI-powered cybersecurity solutions expected to grow significantly in the Chinese market.

- Quantum Security Adoption: Exploration and implementation of quantum-resistant cryptography and quantum secure communication are emerging priorities for protecting sensitive data in the long term.

China's aggressive push for 5G-Advanced (5G-A) and foundational 6G research presents a significant technological tailwind for China Communications Services (CCS). The company is actively involved in building the necessary infrastructure, with China having already deployed over 3.3 million 5G base stations by 2024, a number set to expand as networks evolve towards 5G-A and beyond.

CCS is integrating AI, big data, and cloud computing to create new competitive advantages, focusing on critical sectors like digital infrastructure and smart cities. The rapid growth of the Internet of Things (IoT) and industrial internet is further driving demand, with CCS aiming to establish a comprehensive 5G RedCap ecosystem by 2025 to connect low-power IoT solutions.

The nation's commitment to upgrading digital infrastructure, including optimizing computing power centers and developing deterministic networking and satellite internet systems, directly aligns with CCS's core service offerings in data centers and cloud computing. This strategic alignment positions CCS to benefit from China's ambition in digital innovation, with investments in these areas continuing through 2024 and into 2025.

Robust cybersecurity is paramount, given the increasing data volumes and sensitivity. CCS must invest in advanced solutions to comply with China's strict data security regulations, leveraging AI for threat detection and exploring quantum-resistant cryptography to protect sensitive data against evolving cyber threats.

| Technological Factor | Description | CCS Relevance | Key Data/Targets |

|---|---|---|---|

| 5G-Advanced & 6G Development | Advancement in wireless communication standards. | Infrastructure deployment and network evolution. | 5G-A commercialization goal around 2030; significant standard-setting by 2025. |

| AI, Big Data & Cloud Computing Integration | Leveraging advanced technologies for operational efficiency and new solutions. | Building competitive advantages in digital infrastructure and smart city initiatives. | Strategic deployment across operations; focus on critical sectors. |

| IoT & Industrial Internet Expansion | Growth in connected devices and industrial applications. | Establishing 5G RedCap ecosystem to connect IoT solutions. | Aiming for a comprehensive 5G RedCap ecosystem by 2025. |

| Digital Infrastructure Modernization | Upgrading computing power centers and integrating network-computing functionalities. | Capitalizing on national digital transformation agenda. | Optimization of computing power centers; development of deterministic networking and satellite internet systems. |

| Cybersecurity & Data Protection | Ensuring data security and compliance with regulations. | Investing in advanced solutions to meet strict data security laws. | Compliance with Cybersecurity Law (2017) and Personal Information Protection Law (2021); AI for threat detection. |

Legal factors

China's telecommunications and internet landscape is heavily influenced by government oversight, primarily through the Ministry of Industry and Information Technology (MIIT). This body sets the rules for everything from network infrastructure to service provision, shaping the competitive environment for companies like China Communications Services (CCS).

Recent regulatory shifts, such as efforts to streamline license approvals and potentially ease foreign ownership caps in certain value-added internet services, signal a move towards greater market openness. For CCS, these changes could mean new opportunities for expansion or increased competition, depending on how they are implemented and the specific services affected.

Navigating these evolving legal frameworks is crucial for CCS. The company's ability to secure necessary licenses and operate within the defined scope of these regulations directly impacts its business strategy and potential for growth in the dynamic Chinese market.

China's evolving legal landscape, particularly the Data Security Law (DSL) and Personal Information Protection Law (PIPL), along with the upcoming Network Data Security Management Regulations effective January 1, 2025, significantly impacts China Communications Services (CCS). These regulations create a stringent framework for data handling, necessitating robust compliance strategies for CCS's business process outsourcing and application services operations.

Compliance with these laws requires CCS to implement rigorous measures for data collection, processing, storage, and cross-border transfers. Failure to adhere to these mandates could result in substantial penalties, impacting CCS's operational continuity and financial performance. For instance, the DSL can impose fines up to RMB 5 million or 10% of the previous year's revenue for violations.

China's anti-monopoly drive has significantly impacted its tech sector. In 2021, the State Administration for Market Regulation (SAMR) fined Alibaba Group Holding Ltd. ¥18.2 billion (approximately $2.8 billion) for abusing its market dominance, setting a precedent for stricter enforcement. This focus on fair competition extends to mobile applications, with authorities like the Cyberspace Administration of China (CAC) introducing measures to curb monopolistic behaviors and unfair practices among app developers.

These regulations, while primarily aimed at large internet platforms, create a more equitable environment that could benefit China Communications Services (CCS). By limiting the power of dominant players, the government encourages a more competitive market, potentially opening up new opportunities for CCS in its application and content service offerings. This shift promotes a healthier ecosystem where smaller and emerging players can thrive, fostering innovation and consumer choice.

Intellectual Property Rights Protection

China Communications Services (CCS) relies heavily on its technological innovations, making strong intellectual property rights (IPR) protection absolutely essential for safeguarding its patents and software copyrights. The Chinese government has been actively enhancing its IPR framework, a positive development that supports CCS's ongoing research and development efforts by providing a more secure environment for its technological advancements. For instance, China's Supreme People's Court reported a significant increase in IP cases handled in recent years, indicating a more robust enforcement landscape. This strengthening is vital for CCS to maintain its competitive edge and encourage continued investment in new solutions.

The evolving legal landscape in China regarding IPR directly impacts CCS's ability to commercialize its proprietary products and services. As of 2024, China continues to refine its patent examination processes and introduce new measures to combat infringement, which is a critical factor for companies like CCS that operate in a technology-intensive sector. This legal environment is particularly important as CCS expands its offerings in areas like 5G infrastructure and digital services, where unique technological solutions are its core assets. The increased emphasis on IPR protection fosters a climate where CCS can confidently invest in developing and deploying cutting-edge technologies, knowing its innovations are better shielded.

- Strengthening IPR framework: China's commitment to improving intellectual property laws and enforcement is a key legal factor for CCS.

- Protection of patents and copyrights: Robust legal safeguards are crucial for CCS to protect its technological innovations and software developments.

- Encouraging R&D investment: A secure IPR environment incentivizes CCS to continue investing in research and development for new products and solutions.

- Combating infringement: Legal measures against IP infringement are vital for CCS to maintain its market position and profitability.

Foreign Investment and Market Access Restrictions

China continues to maintain a selective approach to foreign investment in its telecommunications sector. While certain value-added services have seen increased openness, significant restrictions persist in sensitive areas like audiovisual media distribution and specific internet-based services. For instance, in 2024, foreign ownership caps remained in place for many online content providers and certain network infrastructure segments.

China Communications Services (CCS), with its diverse operations, must navigate these evolving legal landscapes. Understanding these nuanced market access rules is critical, especially as CCS explores international partnerships or aims to serve foreign clients within China's borders. Failure to comply can lead to operational disruptions and penalties.

Key areas of foreign investment restriction for telecom and related services in China include:

- Audiovisual Media Distribution: Strict limitations on foreign ownership and control of platforms distributing audiovisual content remain in place.

- Certain Internet Services: Regulations often restrict foreign investment in services deemed critical for national security or public interest, such as core internet backbone operations and some content platforms.

- Telecommunications Infrastructure: While some joint ventures are permitted, foreign entities often face limitations on direct ownership of critical telecommunications infrastructure.

- Data Localization Requirements: Increasingly stringent data localization rules necessitate careful consideration for companies handling sensitive user data, impacting cross-border service delivery.

China's legal framework for data security, including the Data Security Law (DSL) and Personal Information Protection Law (PIPL), imposes stringent requirements on companies like China Communications Services (CCS). These laws, with new Network Data Security Management Regulations effective January 1, 2025, mandate careful data handling and cross-border transfer protocols.

Compliance with these regulations is paramount, as violations can lead to significant financial penalties, with DSL fines potentially reaching RMB 5 million or 10% of the previous year's revenue. CCS must implement robust measures to ensure data collection, processing, and storage meet these legal standards, impacting its business process outsourcing and application services.

The ongoing anti-monopoly efforts in China, exemplified by a ¥18.2 billion fine levied against Alibaba in 2021, aim to create a more competitive market. This regulatory focus on fair competition could benefit CCS by reducing the dominance of larger players, potentially opening new avenues for its application and content services.

China's commitment to strengthening intellectual property rights (IPR) protection is a crucial legal factor for CCS, safeguarding its patents and software copyrights. Enhanced IPR enforcement, with a notable increase in IP cases handled by China's Supreme People's Court in recent years, encourages CCS's R&D investment and protects its technological innovations.

Environmental factors

China's ambitious 'Dual Carbon' targets, aiming for carbon peaking by 2030 and carbon neutrality by 2060, are profoundly reshaping its telecommunications sector. China Communications Services (CCS) is aligning with these objectives by focusing on green and low-carbon solutions, such as enhancing data center energy efficiency and developing new energy infrastructure.

This national drive for sustainability directly fuels market demand for environmentally conscious practices and green technologies within CCS's service portfolio. For instance, the telecommunications industry is a significant energy consumer, and initiatives to power base stations with renewable energy sources are gaining traction, reflecting the broader national policy push.

China's Ministry of Industry and Information Technology (MIIT) is actively pushing for greener operations within its telecommunications sector. Draft guidelines have been released, focusing on key areas like energy conservation, efficient resource use, and environmentally conscious manufacturing processes. These standards are designed to guide the industry towards a more sustainable future.

For companies like China Communications Services (CCS), this means a direct impact on how they build and manage their infrastructure. Adherence to these evolving green and low-carbon standards will be crucial across all aspects of their business, from construction and daily operations to managing their entire supply chain. Embracing these environmentally friendly practices is no longer optional but a requirement for future growth and compliance.

China's commitment to sustainable infrastructure development is a significant environmental factor for China Communications Services (CCS). There's a pronounced push towards constructing green and energy-efficient digital infrastructure, encompassing low-carbon data centers and advanced 5G networks. This aligns with national environmental goals and global trends in digital sustainability.

CCS, as a crucial player in telecommunications infrastructure, is actively engaged in the design and construction of these sustainable facilities. The company is leveraging innovative technologies, such as AI for energy efficiency optimization, to meet these evolving environmental demands. For instance, in 2024, the company reported increased investment in green technology for its data center projects, aiming to reduce carbon footprints by an estimated 15% compared to previous builds.

E-waste Management and Circular Economy Initiatives

China is actively enhancing its waste management infrastructure, with a particular emphasis on electronic waste (e-waste) and fostering a circular economy. This includes the implementation of stricter regulations and incentives for recycling and reuse.

While China Communications Services (CCS) may not directly manufacture electronics, its role in installing and maintaining telecommunications equipment means it must consider the end-of-life management of these devices. This involves adhering to responsible disposal and recycling practices, which are becoming increasingly important as the country pushes for greater environmental sustainability.

For instance, China's Ministry of Industry and Information Technology (MIIT) has been promoting pilot programs for the recycling of telecommunications equipment. By 2023, the country aimed to build a more comprehensive e-waste recycling system, with specific targets for the recovery of valuable materials from discarded electronics.

- Regulatory Push: China's strengthened e-waste regulations aim to curb illegal dumping and promote formal recycling channels.

- Circular Economy Focus: Initiatives encourage the reuse and refurbishment of electronic components, reducing the need for new production.

- CCS's Role: CCS needs to ensure its network infrastructure upgrades and maintenance activities align with national e-waste management policies, potentially through partnerships with certified recyclers.

- Market Opportunity: The growing emphasis on circularity presents opportunities for CCS to explore more sustainable equipment sourcing and disposal strategies.

Climate Change Adaptation and Resilience

As climate change intensifies, the demand for resilient infrastructure capable of withstanding extreme weather events is growing. China Communications Services (CCS) operates critical communications networks, suggesting an inherent responsibility to ensure their robustness against environmental shifts. This could impact how CCS designs and maintains its infrastructure.

The increasing frequency of typhoons and heavy rainfall in China, for instance, necessitates stronger network infrastructure. In 2023, China experienced several severe weather events, including widespread flooding in northern regions, which tested the resilience of existing infrastructure. CCS's investment in upgrading its network to withstand such conditions is crucial for maintaining service continuity.

- Infrastructure Robustness: CCS's network backbone needs to be hardened against physical damage from floods, high winds, and landslides.

- Disaster Preparedness: Enhanced emergency response protocols and backup systems are vital for rapid recovery after climate-related disruptions.

- Investment in Technology: Adopting new materials and construction techniques that offer greater resistance to environmental stressors will be a key focus.

China's commitment to environmental sustainability is a significant driver for China Communications Services (CCS). The nation's ambitious 'Dual Carbon' targets, aiming for carbon peaking by 2030 and carbon neutrality by 2060, are directly influencing the telecommunications sector. CCS is responding by prioritizing green solutions, including energy-efficient data centers and new energy infrastructure development.

The push for greener operations by China's Ministry of Industry and Information Technology (MIIT) mandates energy conservation and efficient resource use. This translates to CCS needing to integrate environmentally friendly practices across its infrastructure construction and daily operations, from network build-outs to supply chain management. For example, in 2024, CCS reported a 15% projected reduction in carbon footprint for its data center projects through increased green technology investment.

China's enhanced focus on e-waste management and circular economy principles also impacts CCS. While not a manufacturer, CCS's role in equipment deployment and maintenance requires adherence to responsible disposal and recycling practices. Pilot programs for telecommunications equipment recycling, promoted by MIIT, aim to build a more comprehensive e-waste system by 2023, emphasizing material recovery.

Furthermore, the increasing frequency of extreme weather events, such as floods and typhoons in 2023, necessitates resilient infrastructure. CCS must invest in hardening its network backbone and enhancing disaster preparedness to ensure service continuity during climate-related disruptions, potentially adopting new materials for greater environmental stress resistance.

| Environmental Factor | Impact on CCS | Key Initiatives/Data |

|---|---|---|

| Dual Carbon Targets | Demand for green solutions, energy efficiency | Carbon peaking by 2030, neutrality by 2060; CCS investing in green data centers |

| Green Operations Mandates | Compliance with energy conservation and resource efficiency standards | MIIT guidelines; CCS aiming for 15% carbon footprint reduction in data centers (2024) |

| E-waste Management & Circular Economy | Responsible equipment disposal and recycling | MIIT pilot programs for telecom equipment recycling; focus on material recovery |

| Climate Change & Extreme Weather | Need for resilient infrastructure | Increased frequency of floods/typhoons (2023); CCS investing in network hardening |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Communications Services is built on a robust foundation of data from official Chinese government ministries, reputable international financial institutions like the IMF and World Bank, and leading industry research firms specializing in telecommunications and technology.