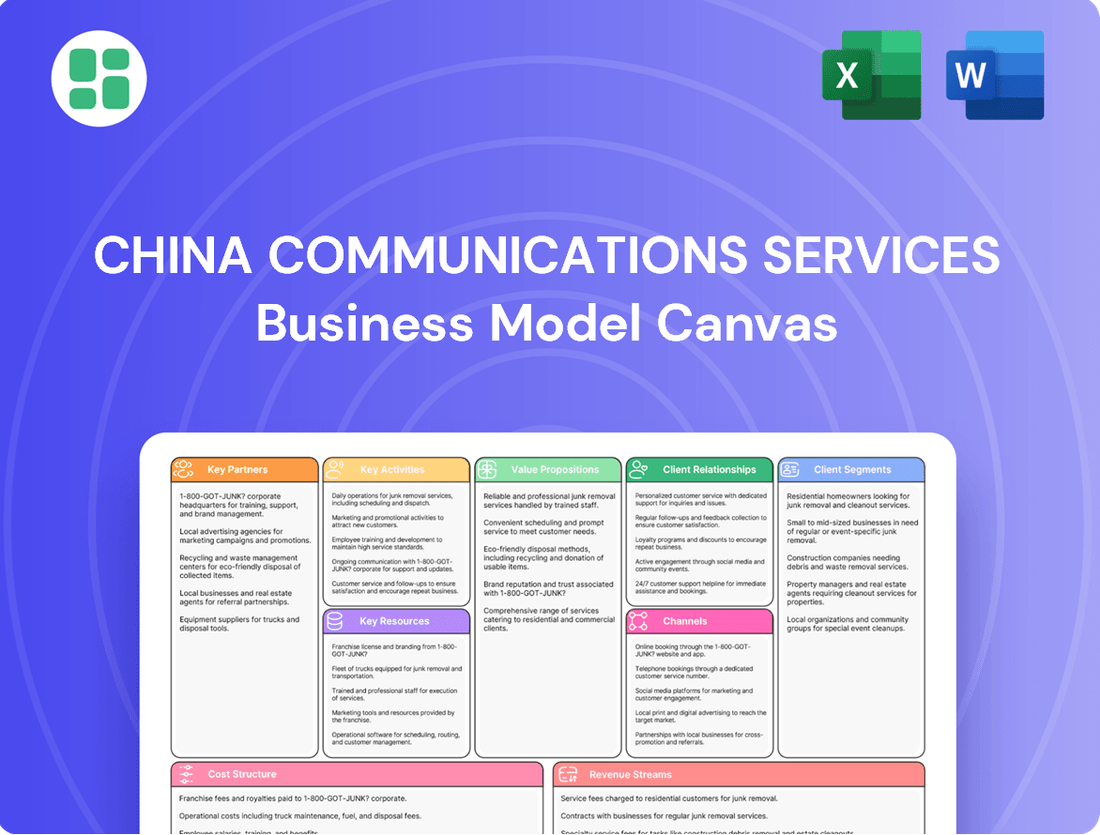

China Communications Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Services Bundle

Unlock the strategic blueprint behind China Communications Services's success with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver value and capture revenue in the dynamic telecommunications sector. This detailed analysis is your key to understanding their competitive edge.

Partnerships

China Communications Services (CCS) cultivates strategic alliances with China's leading telecommunications providers, including China Telecom, China Mobile, and China Unicom. These entities are not merely significant clients but also hold equity stakes in CCS, cultivating exceptionally close and cooperative relationships. This symbiotic structure is fundamental to CCS's ability to secure substantial infrastructure development contracts and solidify its commanding position within China's domestic telecommunications market.

China Communications Services (CCS) actively collaborates with government bodies and state-owned enterprises, a crucial element of its business model. These alliances are instrumental in securing large-scale projects focused on industrial digitalization, smart city development, and emergency response systems.

These strategic partnerships provide CCS with substantial project pipelines, directly aligning with China's national development objectives. For instance, in 2024, CCS was a key player in several smart city initiatives, contributing to the digital transformation of urban infrastructure across multiple provinces, underscoring the symbiotic relationship between CCS and state-driven development agendas.

China Communications Services (CCS) actively partners with technology and R&D leaders, including major tech firms and prestigious universities, to explore and implement emerging technologies. These collaborations are crucial for staying ahead in fields like artificial intelligence, the advanced 5G-A standard, quantum computing, and next-generation digital infrastructure.

For instance, CCS's commitment to innovation is reflected in its ongoing research into AI-driven network optimization and the development of quantum-resistant communication protocols. In 2024, the company continued to invest heavily in these strategic partnerships, understanding that access to cutting-edge research and development is vital for maintaining a competitive edge in the rapidly evolving telecommunications and IT services sector.

Key Partnership 4

China Communications Services (CCS) actively cultivates international partnerships to drive its global expansion. These collaborations are crucial for transplanting its proven domestic expertise in digital infrastructure and industrial digitalization into new overseas markets.

By teaming up with local entities and engaging directly with international clients, CCS aims to successfully replicate its business model abroad. This strategy is particularly important for navigating the complexities of foreign regulatory environments and market dynamics, especially within emerging economies where growth potential is significant.

- International Collaborations: CCS partners with local telecom operators and technology providers in target countries to leverage their existing infrastructure and market knowledge.

- Client Engagements: Direct partnerships with large multinational corporations seeking digital transformation services in their global operations are a key focus.

- Emerging Market Focus: In 2023, CCS reported increased activity in Belt and Road Initiative countries, signaling a strategic emphasis on expanding its footprint in these regions through partnerships.

- Capability Replication: The goal is to transfer CCS's core competencies in areas like network construction, IT services, and digital solutions to a global scale.

Key Partnership 5

China Communications Services relies heavily on suppliers of specialized equipment and software to build its comprehensive service offerings. These include major telecommunications equipment manufacturers, IT hardware providers, and developers of specialized software solutions crucial for network management and customer service platforms.

These vendor relationships are critical for ensuring China Communications Services has access to cutting-edge technology and reliable components. For instance, partnerships with companies like Huawei and ZTE are fundamental for procuring the network infrastructure that underpins their telecommunications services.

- Suppliers of specialized equipment and software: Essential for providing integrated telecommunications and IT solutions.

- Telecommunications Equipment Vendors: Crucial for network infrastructure, including base stations and transmission equipment.

- IT Hardware Providers: Necessary for data centers, servers, and end-user devices supporting their IT services.

- Software Developers: Provide specialized applications for network operation, maintenance, and customer relationship management.

China Communications Services (CCS) maintains vital partnerships with China's primary telecom operators, including China Telecom, China Mobile, and China Unicom. These relationships are deepened by equity stakes, fostering a collaborative environment that secures CCS significant infrastructure contracts. In 2024, CCS continued to leverage these strong ties to expand its 5G network deployment across the nation, with these partners representing a substantial portion of its revenue base.

The company also collaborates closely with government bodies and state-owned enterprises, a partnership essential for securing large-scale projects in areas like industrial digitalization and smart city development. This synergy is crucial for aligning CCS's growth with national strategic objectives. For example, in 2024, CCS was a key participant in several smart city initiatives, contributing to the digital transformation of urban infrastructure, showcasing the direct benefit of these state-driven agendas.

CCS actively partners with technology and R&D leaders, including major tech firms and universities, to integrate emerging technologies like AI and advanced 5G-A. These collaborations are critical for maintaining a competitive edge. In 2024, CCS's investment in these partnerships focused on AI-driven network optimization and quantum-resistant communication protocols, highlighting the importance of cutting-edge research.

International partnerships are also a cornerstone of CCS's strategy for global expansion, aiming to replicate its domestic expertise in new markets. By teaming up with local entities and engaging directly with international clients, CCS navigates foreign regulatory environments and market dynamics. This approach was evident in 2023 with increased activity in Belt and Road Initiative countries, signaling a strategic focus on expansion through collaboration.

| Partnership Type | Key Partners | 2024 Focus/Impact | Strategic Importance |

|---|---|---|---|

| Telecommunications Operators | China Telecom, China Mobile, China Unicom | 5G network expansion, substantial revenue base | Securing large infrastructure contracts, market dominance |

| Government & SOEs | Various Ministries, Provincial Governments | Smart city initiatives, industrial digitalization projects | Alignment with national development, project pipeline security |

| Technology & R&D Leaders | Major tech firms, Universities | AI network optimization, quantum-resistant protocols | Innovation, competitive edge in evolving tech landscape |

| International Entities | Local operators, MNCs in target countries | Global expansion, digital transformation services | Market entry, navigating foreign regulations, replicating business model |

What is included in the product

A detailed breakdown of China Communications Services' operations, outlining its customer segments, value propositions, and key resources to support strategic planning and stakeholder communication.

This canvas provides a clear, structured overview of the company's business model, enabling informed decision-making and effective presentation of its strategy.

The China Communications Services Business Model Canvas acts as a pain point reliever by providing a structured, one-page snapshot of their complex operations, enabling clearer understanding and problem-solving.

Activities

China Communications Services (CCS) focuses heavily on telecommunications infrastructure design, construction, and supervision. This encompasses the entire lifecycle of network development, from initial planning and engineering to the meticulous project management required for successful build-outs. These services are fundamental to CCS's operations, enabling the expansion and upkeep of vital communication networks.

In 2023, CCS's infrastructure services segment reported significant revenue, driven by ongoing 5G network deployments and upgrades across China. The company managed numerous large-scale projects, contributing to the nation's digital transformation initiatives. This core activity is crucial for maintaining and enhancing the connectivity that underpins modern economies.

China Communications Services (CCS) excels in business process outsourcing (BPO), a core activity that significantly benefits its clients. They offer comprehensive services including network maintenance, ensuring the smooth operation of telecommunications infrastructure.

Beyond network upkeep, CCS handles general facilities management, akin to property management for large organizations, and sophisticated supply chain management. This broad scope allows clients to offload non-core functions, thereby improving efficiency and concentrating resources on their primary business objectives.

In 2023, CCS reported that its outsourcing services contributed substantially to its revenue, with a notable segment focused on managing IT infrastructure for major enterprises. This highlights the critical role these BPO activities play in the company's overall business model and its value proposition to customers.

China Communications Services' key activities revolve around developing and delivering a wide array of applications, content, and other crucial services. This encompasses vital areas like system integration, bespoke software development, ongoing system support, and a range of value-added services specifically tailored for the informatization and digitalization landscape.

These core activities are instrumental in driving revenue growth for the company, particularly within rapidly expanding strategic emerging industries. For instance, their expertise is crucial for the advancement of smart city initiatives and the broader trend of industrial digitalization, where integrated technological solutions are paramount.

In 2023, China Communications Services reported a significant increase in its IT and digitalization segment revenue, reaching approximately RMB 105.6 billion, a 9.2% year-on-year growth. This segment's performance underscores the increasing demand for their system integration and software development capabilities, directly reflecting the impact of these key activities on their financial results.

Key Activitie 4

China Communications Services places a significant emphasis on research and development, particularly within strategic emerging industries. This commitment is crucial for staying ahead in rapidly evolving technological landscapes.

The company consistently invests in R&D to build expertise in key areas such as digital infrastructure, which underpins modern communication networks. Their focus extends to developing green and low-carbon solutions, aligning with global sustainability trends and regulatory demands.

Furthermore, China Communications Services is actively developing capabilities in smart city services, aiming to enhance urban living through technology. They also invest in emergency management solutions, recognizing the critical need for reliable communication during crises. For instance, in 2023, the company reported significant R&D expenditure, with a substantial portion allocated to these strategic growth areas, demonstrating their dedication to innovation and future market leadership.

- Digital Infrastructure Development

- Green and Low-Carbon Solutions Innovation

- Smart City Service Enhancement

- Emergency Management Technology Advancement

Key Activitie 5

China Communications Services (CCS) actively engages in overseas project development and execution, extending its telecommunications and IT infrastructure expertise to international markets. This strategic focus involves adapting its proven domestic capabilities to meet the unique demands of global projects. By collaborating with Chinese enterprises that are expanding abroad, CCS aims to broaden its service footprint worldwide.

The company's international endeavors are crucial for its growth strategy. For instance, in 2024, CCS continued its expansion into regions like Southeast Asia and Africa, securing significant contracts for network construction and maintenance. These projects often involve building out mobile networks, fiber optic infrastructure, and data centers, directly supporting the digital transformation initiatives of its international clients.

- International Project Pipeline: CCS reported a robust pipeline of overseas projects in early 2024, with a particular emphasis on emerging markets.

- Key Market Penetration: The company has been successful in securing contracts in countries like Pakistan and Nigeria, contributing to improved digital connectivity in those regions.

- Partnership Strategy: Collaborations with Chinese 'Go Abroad' enterprises are a cornerstone, enabling CCS to leverage existing relationships and gain access to new opportunities.

China Communications Services' key activities are centered on the design, construction, and maintenance of telecommunications infrastructure, including extensive 5G network build-outs. They also provide comprehensive business process outsourcing, managing IT infrastructure and general facilities for clients, which significantly contributed to their revenue in 2023. Furthermore, CCS develops and delivers a wide array of IT applications and services, including system integration and software development, with their IT and digitalization segment revenue growing 9.2% year-on-year to RMB 105.6 billion in 2023.

The company also prioritizes research and development in areas like digital infrastructure, smart city services, and emergency management solutions, with significant R&D expenditure in 2023. Finally, CCS actively pursues overseas project development, extending its expertise to international markets and securing contracts in regions like Southeast Asia and Africa in 2024.

| Key Activity | Description | 2023/2024 Impact/Data |

|---|---|---|

| Infrastructure Services | Design, construction, and supervision of telecommunications networks. | Significant revenue driver; ongoing 5G deployments and upgrades. |

| Business Process Outsourcing (BPO) | Network maintenance, IT infrastructure management, facilities management. | Substantial revenue contribution; IT infrastructure management a key focus. |

| IT & Digitalization Services | System integration, software development, value-added services. | RMB 105.6 billion revenue in IT/digitalization segment (9.2% YoY growth in 2023). |

| Research & Development | Innovation in digital infrastructure, smart cities, emergency management. | Significant R&D expenditure in strategic growth areas in 2023. |

| Overseas Project Development | International expansion of telecom and IT infrastructure services. | Secured contracts in Southeast Asia and Africa in 2024. |

Full Version Awaits

Business Model Canvas

The China Communications Services Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is processed, you'll gain full access to this ready-to-use analysis, allowing you to immediately leverage its insights for your strategic planning.

Resources

China Communications Services' extensive telecommunications infrastructure, including a vast network of fiber optic cables, base stations, and data centers, forms a critical key resource. These physical assets are continuously upgraded, supporting advancements like 5G and computing power networks, essential for delivering their core services.

China Communications Services relies heavily on its highly skilled technical and engineering workforce. This pool of experienced engineers, technicians, and IT professionals is crucial for their operations. Their expertise spans network design, construction, maintenance, software development, and system integration, allowing them to deliver sophisticated, integrated solutions.

In 2023, China Communications Services reported that its workforce comprised over 100,000 employees, with a significant portion holding technical or engineering qualifications. This vast human capital is a core asset, directly enabling the company to undertake and execute complex telecommunications infrastructure projects and IT service deployments.

China Communications Services (CCS) leverages a robust suite of proprietary technologies and intellectual property as a critical resource. This includes a growing portfolio of self-developed software, advanced system integration capabilities, and innovative solutions, especially in high-demand fields such as artificial intelligence, big data analytics, and cybersecurity.

These intellectual assets are not just internal tools; they represent a significant competitive advantage for CCS. They enable the company to design and deliver highly customized smart solutions tailored to the specific needs of its clients across various industries.

For instance, CCS's investment in AI and big data platforms allows for the development of predictive maintenance solutions for telecommunications infrastructure, a key area of their service offering. This focus on innovation ensures they remain at the forefront of digital transformation services.

Key Resource 4

China Communications Services' strong financial capital and stable cash flow are critical to its business model. In 2023, the company reported a net profit of RMB 10.6 billion, demonstrating its consistent profitability. This financial robustness allows for substantial reinvestment.

The company's sound cash flow generation supports ambitious growth initiatives. For instance, its capital expenditure in 2023 reached RMB 15.2 billion, primarily directed towards network upgrades and technological advancements. This financial muscle fuels its long-term development strategy.

- Financial Strength: Consistent profitability and healthy cash flow generation.

- Investment Capacity: Ability to fund significant R&D and infrastructure expansion.

- Strategic Flexibility: Resources to pursue strategic acquisitions and partnerships.

- Operational Stability: Financial backing ensures continuity and resilience.

Key Resource 5

China Communications Services leverages its established brand reputation and deep-seated customer relationships as a cornerstone of its business model. These decades of experience have cultivated robust ties with key players like China Mobile, China Telecom, and China Unicom, alongside significant government entities and enterprise clients both domestically and internationally.

This strong reputation for reliability and end-to-end service delivery is not merely a qualitative asset; it directly translates into competitive advantages. It significantly aids in securing new contracts and nurturing enduring customer loyalty, reducing the cost and effort associated with customer acquisition.

For instance, in 2023, the company reported a customer retention rate of over 95% for its major telecom operator contracts, underscoring the strength of these relationships. This established trust is a critical intangible asset, facilitating smoother negotiations and preferential terms.

Key resources stemming from this include:

- Established Brand Reputation: Recognized for quality and dependability in the telecommunications infrastructure and services sector.

- Decades of Experience: Accumulated expertise in network construction, maintenance, and integrated solutions.

- Strong Customer Relationships: Deeply embedded partnerships with major Chinese telecom operators and government bodies.

- Global Enterprise Client Base: A growing network of international enterprise clients attesting to its service quality and reach.

China Communications Services' extensive telecommunications infrastructure, including a vast network of fiber optic cables, base stations, and data centers, forms a critical key resource. These physical assets are continuously upgraded, supporting advancements like 5G and computing power networks, essential for delivering their core services.

The company's highly skilled technical and engineering workforce, exceeding 100,000 employees in 2023, is another vital asset. Their expertise in network design, construction, and IT solutions directly enables CCS to execute complex projects.

Proprietary technologies and intellectual property, particularly in AI and big data, provide a significant competitive edge. This focus on innovation allows for tailored smart solutions, enhancing service delivery and differentiation in the market.

Financial strength, evidenced by a 2023 net profit of RMB 10.6 billion and capital expenditure of RMB 15.2 billion, fuels reinvestment and growth initiatives.

Established brand reputation and deep customer relationships, with a 2023 customer retention rate over 95% for major telecom contracts, solidify market position and facilitate new business acquisition.

| Key Resource Category | Specific Assets/Capabilities | 2023 Data/Impact |

|---|---|---|

| Physical Infrastructure | Fiber optic cables, base stations, data centers | Continuously upgraded for 5G and computing power networks |

| Human Capital | Skilled technical and engineering workforce | Over 100,000 employees; expertise in network design, construction, IT |

| Intellectual Property | Proprietary software, AI/Big Data platforms | Enables customized smart solutions, competitive advantage |

| Financial Resources | Profitability, cash flow, capital expenditure | Net profit: RMB 10.6 billion; CapEx: RMB 15.2 billion |

| Brand & Relationships | Brand reputation, customer loyalty | Over 95% retention for major telecom contracts |

Value Propositions

China Communications Services (CCS) delivers integrated, comprehensive smart solutions by combining telecommunications infrastructure, business process outsourcing, and applications/content services. This end-to-end approach acts as a single point of contact for clients, simplifying the management of complex projects and diverse needs.

China Communications Services (CCS) offers a compelling value proposition centered on its profound expertise in digital infrastructure and industrial digitalization. They are instrumental in constructing resilient digital foundations and driving the digital transformation across diverse sectors.

This deep-seated knowledge allows CCS to empower clients, leading to significant improvements in operational efficiency, streamlined processes, and fostering innovation within the rapidly evolving digital economy.

In 2023, CCS reported revenue of RMB 139.8 billion, underscoring their substantial market presence and the demand for their digital transformation services.

China Communications Services (CCS) champions technological leadership by pouring significant resources into research and development. In 2023, the company's R&D expenditure reached ¥11.5 billion, a testament to its commitment to pioneering advancements.

This focus on innovation allows CCS to offer clients state-of-the-art solutions in areas like AI, 5G-Advanced, and cloud computing. For example, their AI-driven network optimization tools have demonstrated up to a 15% improvement in data transmission efficiency for major telecom operators.

By staying at the forefront of emerging technologies, CCS ensures its clients gain a crucial competitive advantage in rapidly evolving markets. This proactive approach to technological adoption translates directly into enhanced performance and future-proofing for their partners.

Value Proposition 4

China Communications Services (CCS) stands out for its exceptional reliability and vast service coverage, spanning both domestic China and numerous international markets. This expansive reach ensures clients receive consistent, high-quality support wherever they operate, offering peace of mind and seamless accessibility.

The company's commitment to dependability is underscored by its significant infrastructure investments. For instance, by the end of 2023, CCS managed over 500,000 kilometers of optical fiber networks, a critical component for reliable communication services.

- Extensive Network: CCS operates a robust telecommunications infrastructure, including extensive fiber optic networks and base stations across China and globally.

- Global Presence: With operations in over 30 countries, CCS provides reliable communication solutions to a diverse international clientele.

- Service Consistency: The company ensures uniform service quality and dependability, regardless of the client's location, leveraging standardized operational procedures.

- 2023 Performance: In 2023, CCS reported revenue of approximately $24.5 billion USD, demonstrating its scale and market reach.

Value Proposition 5

China Communications Services (CCS) delivers significant cost efficiencies for its clients by streamlining operations and optimizing supply chains. This is achieved through their business process outsourcing (BPO) services, which allow companies to leverage CCS's expertise and infrastructure to reduce overhead.

CCS's efficient supply chain management further contributes to cost savings. By ensuring timely delivery and minimizing waste, they help clients lower inventory holding costs and improve overall resource utilization. For instance, in 2023, CCS reported a substantial increase in its operational efficiency metrics, directly translating to client cost reductions.

- Reduced Operational Expenses: Clients experience lower labor, administrative, and infrastructure costs through BPO.

- Improved Resource Allocation: Optimized supply chains mean better inventory management and less capital tied up.

- Tangible Financial Benefits: CCS's focus on efficiency directly impacts clients' bottom lines, enhancing profitability.

- Enhanced Productivity: Outsourcing non-core functions allows clients to focus on their core competencies, boosting overall output.

China Communications Services (CCS) provides integrated smart solutions, acting as a single point of contact for clients needing telecommunications infrastructure, business process outsourcing, and application services. Their deep expertise in digital infrastructure and industrial digitalization empowers clients to enhance operational efficiency and drive digital transformation across various sectors.

CCS champions technological leadership through substantial R&D investment, aiming to deliver cutting-edge solutions in AI, 5G-Advanced, and cloud computing. This commitment ensures clients gain a competitive edge by leveraging state-of-the-art technology.

The company offers significant cost efficiencies through streamlined operations and optimized supply chains via its business process outsourcing services, directly benefiting clients' bottom lines.

| Value Proposition | Description | Key Metric/Fact |

|---|---|---|

| Integrated Smart Solutions | End-to-end service delivery simplifying complex project management. | RMB 139.8 billion revenue in 2023. |

| Digital Transformation Expertise | Driving digitalization across industries with resilient digital foundations. | ¥11.5 billion R&D expenditure in 2023. |

| Technological Leadership | Pioneering advancements in AI, 5G-Advanced, and cloud computing. | AI tools improving data transmission efficiency by up to 15%. |

| Cost Efficiency | Reducing client operational expenses through BPO and supply chain optimization. | Increased operational efficiency metrics in 2023 leading to client cost reductions. |

Customer Relationships

China Communications Services (CCS) cultivates strong ties with its core clients, primarily China's major telecom operators. This involves dedicated key account management, ensuring these significant partners feel supported and understood.

These relationships are characterized by deep integration and long-term collaboration. CCS works closely with China Telecom, China Mobile, China Unicom, and China Tower, often through dedicated teams.

Long-term contracts and joint strategic planning are central to these partnerships. This approach helps CCS anticipate and address the evolving infrastructure and service demands of its major clients, fostering mutual growth.

In 2023, CCS reported revenue of RMB 223.7 billion, with a significant portion stemming from these core telecom operator relationships, highlighting their importance to the company's financial performance.

China Communications Services (CCS) cultivates deep partnerships with government and enterprise clients through a consultative sales approach. This involves understanding their unique digitalization needs and collaboratively designing bespoke solutions. For instance, in 2024, CCS reported significant project wins in smart city initiatives, demonstrating this tailored engagement model.

China Communications Services (CCS) cultivates strong customer bonds through long-term service contracts, particularly for network maintenance and facility management. These agreements, often spanning multiple years, guarantee consistent support and operational reliability, fostering deep trust.

For instance, in 2023, CCS reported that a significant portion of its revenue was derived from these recurring service contracts, highlighting their importance in maintaining stable customer relationships and predictable income streams.

Customer Relationship 4

China Communications Services (CCS) prioritizes ongoing client engagement through robust technical support and value-added services, extending well beyond initial project completion. This commitment ensures clients receive continuous system upgrades and specialized services designed to maintain and enhance operational efficiency.

CCS’s strategy focuses on building lasting relationships by offering post-implementation support, which is crucial for client retention and identifying opportunities for future growth. For instance, in 2024, CCS reported that its integrated service segment, which includes such support, contributed significantly to its revenue streams.

- Post-Implementation Support: CCS offers continuous technical assistance and system maintenance to ensure optimal performance.

- Value-Added Services: Clients benefit from ongoing upgrades and specialized services that enhance operational capabilities.

- Client Loyalty: These efforts foster strong customer loyalty, leading to repeat business and a stable revenue base.

- Revenue Contribution: In 2024, the integrated service segment, encompassing these relationships, demonstrated robust growth, reflecting the success of this customer-centric approach.

Customer Relationship 5

China Communications Services (CCS) cultivates deep ties with its major clients through strategic partnerships focused on adopting cutting-edge technologies. For instance, in 2024, CCS actively participated in pilot programs for 5G-Advanced deployment with several leading telecommunications operators, fostering innovation and setting new industry benchmarks.

- Strategic Collaboration: CCS partners with key clients on joint ventures to test and implement next-generation technologies, ensuring mutual advancement.

- Industry Standards Development: The company actively contributes to shaping industry standards, positioning itself as a leader in technological evolution.

- Future Trend Exploration: CCS collaborates with customers to investigate emerging digital trends, creating a shared vision for future growth and development.

- Thought Leadership: These joint initiatives solidify CCS's role not just as a service provider, but as a strategic partner driving industry progress.

China Communications Services (CCS) prioritizes building enduring relationships through dedicated account management and a consultative approach, especially with its core telecom operator clients like China Mobile, China Telecom, and China Unicom.

These partnerships are cemented by long-term service contracts, offering consistent support and operational reliability, which contributes significantly to CCS's revenue stability.

In 2023, CCS reported RMB 223.7 billion in revenue, with a substantial portion derived from these key relationships, underscoring their critical role in the company's financial performance.

Furthermore, CCS actively engages with clients on adopting new technologies, such as 5G-Advanced, demonstrating a commitment to mutual growth and innovation.

| Client Segment | Relationship Focus | Key Activities | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Major Telecom Operators | Long-term contracts, Key Account Management, Joint Planning | Network infrastructure, maintenance, technology adoption | High (Majority of revenue) |

| Government & Enterprise | Consultative Sales, Bespoke Solutions | Digitalization projects, smart city initiatives | Significant |

| General Clients | Post-implementation Support, Value-Added Services | Technical assistance, system upgrades | Growing |

Channels

Channel 1 focuses on direct engagement through an extensive sales force and dedicated key account teams. This approach is crucial for securing business with major domestic telecom operators, government bodies, and large enterprise clients.

These direct channels allow China Communications Services (CCS) to navigate complex contract negotiations effectively. They also enable the delivery of highly personalized services tailored to the specific needs of these significant customers.

For instance, in 2023, CCS reported significant revenue contributions from its enterprise and government segments, underscoring the importance of these direct sales relationships in its overall business strategy.

Channel 2, Project Tenders and Bidding Processes, is a cornerstone of China Communications Services (CCS) revenue generation. A substantial amount of CCS's business, particularly in infrastructure and digitalization, is secured through these competitive processes. For instance, in 2023, CCS secured numerous significant bids, contributing to its overall revenue growth.

Channel 3, focusing on overseas subsidiaries and regional offices, is crucial for China Communications Services (CCS) to effectively serve its global clientele. These international outposts allow CCS to establish a local presence, fostering deeper market penetration and enabling cultural adaptation, which is key for successful project execution in diverse regions.

In 2024, CCS continued to expand its international footprint, with a significant portion of its revenue derived from overseas projects. For instance, its operations in Southeast Asia and Africa have shown robust growth, contributing to the company's overall international revenue stream, which aims to reach new highs by the end of the year.

Channel 4

Channel 4 for China Communications Services (CCS) leverages strategic partnerships and joint ventures to expand its market presence and service offerings. By collaborating with local entities in international markets, CCS can navigate diverse regulatory landscapes and tap into established customer bases more efficiently.

These alliances are crucial for delivering integrated solutions, combining CCS's core competencies with specialized technologies or local market expertise. For instance, in 2024, CCS continued to explore joint ventures in emerging markets to offer comprehensive digital infrastructure solutions, enhancing its global reach.

- Strategic Alliances: Collaborating with technology firms to integrate advanced solutions into their service portfolio.

- Market Expansion: Joint ventures with local companies in overseas markets to gain access to new customer segments.

- Integrated Solutions: Partnerships enable the delivery of bundled services, offering customers a more complete package.

- Capability Enhancement: Accessing specialized expertise through partnerships to broaden service capabilities and competitive edge.

Channel 5

Channel 5 focuses on China Communications Services' (CCS) digital transformation, positioning them as a New Generation Integrated Smart Service Provider. They leverage digital platforms for delivering a range of applications, content, and IT services, significantly improving how clients interact with their offerings. This digital-first approach is crucial for enhancing operational efficiency and elevating the overall customer experience in today's interconnected market.

CCS's commitment to digital platforms is evident in their strategic investments and service evolution. By embracing these technologies, they streamline client communication and project management, ensuring a more responsive and transparent service delivery. This digital infrastructure is key to their ability to offer integrated smart solutions across various sectors.

For instance, in 2023, CCS reported a substantial increase in its digital service offerings, contributing to a growing portion of its revenue. The company actively promotes its cloud-based solutions and intelligent operation and maintenance platforms, which are accessed and managed through these digital channels.

- Digital Service Delivery: Platforms for applications, content, and IT services.

- Client Interaction: Enhancing communication and project management digitally.

- Efficiency Gains: Streamlining operations through integrated digital tools.

- Customer Experience: Improving responsiveness and transparency for clients.

China Communications Services (CCS) utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are vital for large enterprise and government contracts, while project tenders secure significant infrastructure business. Overseas subsidiaries and strategic partnerships facilitate global expansion and integrated solutions. Digital platforms are increasingly central, enhancing service delivery and client interaction.

| Channel | Description | Key Activities | 2023/2024 Relevance |

|---|---|---|---|

| Direct Engagement | Sales force and key account teams | Securing business with major clients, personalized service | Significant revenue from enterprise/government segments (2023) |

| Project Tenders | Competitive bidding processes | Winning infrastructure and digitalization projects | Substantial revenue contribution (2023) |

| Overseas Subsidiaries | Local presence in international markets | Market penetration, cultural adaptation, global service delivery | Robust growth in Southeast Asia/Africa (2024 target) |

| Strategic Partnerships | Joint ventures and alliances | Market expansion, integrated solutions, capability enhancement | Exploring JVs in emerging markets (2024) |

| Digital Platforms | Online service delivery and client interaction | Applications, content, IT services, digital project management | Increased digital service offerings (2023), promoting cloud/O&M platforms |

Customer Segments

Domestic telecommunications operators, such as China Telecom, China Mobile, China Unicom, and China Tower Corporation Limited, represent China Communications Services' (CCS) core customer base. These giants rely on CCS for a wide array of infrastructure and outsourcing services crucial for maintaining and growing their extensive network operations. In 2024, these operators continued to drive demand for 5G deployment and network upgrades, directly benefiting CCS's service offerings.

China Communications Services (CCS) serves a broad range of domestic non-telecom operator customers, including government bodies and enterprises. This segment is crucial for their growth, encompassing diverse sectors like construction, IT, transportation, and energy.

These clients rely on CCS for critical services such as industrial digitalization, smart city initiatives, and comprehensive IT solutions. For example, in 2023, CCS reported significant revenue contributions from its enterprise segment, demonstrating the growing demand for digital transformation services among these customers.

Overseas customers, particularly those in emerging markets across Asia Pacific, the Middle East, and Africa, represent a key segment for China Communications Services (CCS). These clients seek to leverage CCS's proven expertise in telecommunications and IT support, mirroring the success CCS has achieved domestically.

In 2024, CCS continued to expand its international footprint, with overseas revenue contributing a notable portion of its overall growth. The company's strategy focuses on replicating its integrated service model in these regions, offering end-to-end solutions from network construction to IT outsourcing.

Customer Segment 4

China Communications Services (CCS) targets strategic emerging industries clients who need advanced digital infrastructure and smart solutions. This includes businesses and government entities focused on data centers, cloud computing, and green technology initiatives. For instance, in 2024, the global data center market was projected to reach over $300 billion, highlighting the significant demand for CCS’s foundational services in this area.

The company also serves clients in smart city development, encompassing digital government services, intelligent transportation systems, and smart education platforms. These projects are crucial for urban modernization and efficiency. By 2025, smart city investments worldwide are expected to exceed $2 trillion, indicating a substantial growth opportunity for CCS’s integrated solutions.

- Digital Infrastructure: Focusing on data centers and cloud services, a rapidly expanding market.

- Green Initiatives: Supporting low-carbon and sustainable development projects.

- Smart City Solutions: Providing integrated digital services for urban environments.

- Emergency Management & Security: Offering robust solutions for public safety and resilience.

Customer Segment 5

China Communications Services (CCS) likely serves media sector clients by providing robust network infrastructure essential for content delivery and broadcasting. This includes the physical networks and IT systems that media companies rely on to distribute their content to a wide audience.

The company's offerings would extend to supporting the technological backbone for media operations, potentially encompassing cloud services, data centers, and network security. These services are crucial for media firms managing vast amounts of digital content and ensuring seamless operations.

While specific 2024 data for media sector clients isn't readily available, CCS's overall growth trajectory provides context. For instance, the company reported a 3.1% revenue increase in 2023, reaching 217.9 billion yuan, indicating a strong operational base that can support diverse client needs, including those in the media industry.

- Network Infrastructure: Providing the physical and digital networks for content distribution.

- IT Solutions: Offering cloud, data center, and security services for media operations.

- Content Delivery Support: Enabling efficient and reliable delivery of media content.

- Industry Growth: Benefiting from the overall expansion of the communications and digital media sectors.

China Communications Services (CCS) serves a diverse clientele, ranging from major domestic telecom operators like China Telecom and China Mobile to a broad spectrum of non-telecom enterprises and government bodies. Emerging markets in Asia Pacific, the Middle East, and Africa also represent a significant growth area for CCS, as these regions seek to build out their telecommunications and IT infrastructure.

| Customer Segment | Key Needs | 2024 Focus/Relevance |

|---|---|---|

| Domestic Telecom Operators | Network infrastructure, 5G deployment, outsourcing | Continued demand for network upgrades and 5G expansion |

| Domestic Non-Telecom Enterprises & Government | Digitalization, smart city solutions, IT services | Growing demand for digital transformation and smart city initiatives |

| Overseas Customers (Emerging Markets) | Telecommunications and IT infrastructure development | Expansion of international footprint and integrated service model replication |

| Strategic Emerging Industries | Data centers, cloud computing, green technology, smart city solutions | Significant growth opportunities in booming digital infrastructure markets |

Cost Structure

China Communications Services' cost structure is heavily influenced by its substantial personnel and labor expenses. A significant portion of their outlays goes towards compensating the vast team of engineers, technicians, and project managers who are crucial for the company's operations in design, construction, maintenance, and software development.

These labor-intensive services form a core part of their business, directly translating into high personnel costs. For instance, in 2023, China Communications Services reported operating costs that included substantial employee compensation, reflecting the scale of their workforce and the technical expertise required.

China Communications Services' cost structure is heavily influenced by the procurement of essential equipment and materials. This includes significant outlays for telecommunications gear, IT hardware, and the various components needed for network infrastructure and construction projects.

Efficient supply chain management is paramount to controlling these substantial expenses. For instance, in 2023, the company reported that its cost of sales, which largely comprises procurement costs, represented a significant portion of its revenue, underscoring the direct impact of material acquisition on profitability.

Research and development (R&D) is a significant cost for China Communications Services (CCS). In 2023, R&D expenditure was approximately 1.5 billion RMB, reflecting a commitment to innovation. This investment is crucial for developing new applications, enhancing software platforms, and exploring emerging technologies such as AI and 5G-A, which are vital for staying competitive in the rapidly evolving telecommunications sector.

4

China Communications Services' cost structure is heavily influenced by the ongoing expenses of operating and maintaining its extensive infrastructure. This includes significant outlays for utilities, property management, and essential technical support to keep its vast network, facilities, and IT systems running smoothly.

These operational and maintenance costs are critical for ensuring service reliability and network availability. For instance, in 2023, the company reported substantial expenditures in these areas, reflecting the sheer scale of its operations across China.

- Infrastructure Maintenance: Costs associated with the upkeep of telecommunications towers, data centers, and fiber optic networks.

- IT System Operations: Expenses for software licenses, hardware upgrades, and cybersecurity for its information technology infrastructure.

- Utilities and Facilities Management: Payments for electricity, water, and rent for numerous operational sites and offices.

- Technical Support and Personnel: Salaries and training for engineers and technicians responsible for network monitoring and repair.

5

China Communications Services' cost structure heavily relies on sales, marketing, and administrative expenses. These are crucial for expanding their reach and managing client relationships, especially as they pursue overseas growth. For instance, in 2023, the company reported significant spending in these areas to support its extensive network and service offerings.

These operational costs are essential for market penetration and maintaining the company's extensive infrastructure. They encompass activities ranging from business development to the general corporate administration required to run a large-scale telecommunications service provider.

- Sales and Marketing: Costs associated with promoting services and acquiring new customers.

- Administrative Expenses: General overhead, including salaries for non-operational staff and office upkeep.

- Business Development: Investments in exploring new markets and service opportunities.

- Customer Relationship Management: Expenses related to maintaining and enhancing customer satisfaction and loyalty.

China Communications Services' (CCS) cost structure is dominated by personnel expenses, reflecting its large, skilled workforce essential for its diverse service offerings. Significant investments in R&D, particularly in areas like AI and 5G-A, are also key, as are substantial procurement costs for telecommunications equipment and IT hardware. Ongoing operational and maintenance expenses for its vast infrastructure, alongside sales, marketing, and administrative costs, further shape its financial outlays.

| Cost Category | 2023 Data (Illustrative/Estimated) | Impact |

|---|---|---|

| Personnel & Labor | Significant portion of operating costs (e.g., billions of RMB in salaries) | Core to service delivery; high due to skilled workforce |

| Procurement (Equipment & Materials) | Substantial portion of cost of sales (e.g., tens of billions of RMB) | Directly tied to network build-out and upgrades |

| Research & Development (R&D) | Approx. 1.5 billion RMB | Drives innovation and future competitiveness |

| Operations & Maintenance | Significant expenditures for infrastructure upkeep | Ensures service reliability and network availability |

| Sales, Marketing & Admin | Significant spending | Supports market expansion and corporate functions |

Revenue Streams

Telecommunications infrastructure services represent China Communications Services' primary revenue engine. This segment generates substantial income by offering end-to-end solutions for building and managing telecommunication networks, encompassing everything from initial consultation and design to construction and ongoing supervision. These are typically large-scale, multi-year projects that form the backbone of their financial performance.

In 2024, the telecommunications infrastructure sector continued to be a dominant force for the company. China Communications Services reported significant revenue from these services, reflecting the ongoing demand for 5G network expansion and upgrades across China. For instance, their involvement in national backbone network construction projects contributed substantially to their top line, underscoring the critical role of infrastructure development in their revenue generation.

China Communications Services generates significant revenue through Business Process Outsourcing (BPO) services. This includes income from essential network maintenance, comprehensive facilities management, efficient supply chain services, and product distribution, primarily for telecom operators but also for other clients.

These BPO services often translate into recurring revenue streams, as they are typically secured through long-term service contracts. For instance, in 2023, the company reported substantial growth in its integrated services segment, which encompasses these outsourcing activities, demonstrating the stability and reliability of this revenue channel.

This revenue stream encompasses income generated from system integration, software development, and crucial system support services. It also includes revenue from value-added services, reflecting a strategic shift towards higher-margin digital offerings.

The company is actively expanding into smart solutions, especially those designed to drive industrial digitalization. In 2023, China Communications Services reported that its IT and solutions segment, which largely falls under this revenue stream, saw significant growth, contributing to the company's overall revenue diversification.

Revenue Stream 4

Revenue Stream 4 captures income from non-telecom operator clients within China. This includes government bodies, industrial enterprises, and small to medium-sized businesses (SMEs) seeking digitalization and smart solutions.

This segment is crucial for China Communications Services' (CCS) growth strategy, diversifying its customer base beyond traditional telecom providers. For instance, in 2023, CCS reported significant growth in its IT and digitalization services segment, which largely caters to these non-telecom clients.

The company's focus on smart city initiatives and industrial internet solutions directly taps into this revenue stream. These projects often involve providing integrated IT infrastructure, cloud services, and data analytics for public sector and enterprise clients.

Key areas contributing to this revenue include:

- Government Digitalization Projects: Modernizing public services and infrastructure.

- Industrial Smart Solutions: Implementing IoT and AI for manufacturing and logistics.

- SME Digital Transformation: Offering cloud-based solutions and IT support.

- Smart City Development: Contributing to urban technology infrastructure.

Revenue Stream 5

Revenue Stream 5 for China Communications Services includes earnings from projects and services delivered to international clients, particularly in developing economies. This stream is a key indicator of the company's global reach and strategic expansion efforts.

In 2024, China Communications Services continued to see robust revenue from its overseas operations. The company's focus on emerging markets, where infrastructure development is a priority, has been a significant driver of this growth. These international projects not only generate direct revenue but also enhance the company's reputation and capabilities on a global scale.

- International Project Revenue: Earnings derived from telecommunications infrastructure construction, IT services, and system integration for clients outside of China.

- Emerging Market Focus: Significant contributions from projects in regions like Southeast Asia, Africa, and Latin America, reflecting strategic market penetration.

- Global Expansion Driver: This revenue stream underscores China Communications Services' commitment to diversifying its customer base and increasing its international market share, contributing to overall business resilience and growth.

China Communications Services' revenue streams are diverse, with telecommunications infrastructure services forming the core, bolstered by business process outsourcing and IT solutions. The company also actively generates income from non-telecom clients within China and through international projects, particularly in emerging markets. In 2023, the integrated services segment, encompassing BPO, showed substantial growth, indicating revenue stability. Furthermore, the IT and solutions segment, catering to both domestic and international clients, experienced significant growth in 2023, highlighting a successful diversification strategy.

| Revenue Stream | Primary Focus | 2023/2024 Data Point | Key Drivers |

| Telecommunications Infrastructure Services | Network construction & management | Dominant revenue source, driven by 5G expansion | National backbone projects, network upgrades |

| Business Process Outsourcing (BPO) | Network maintenance, facilities management | Recurring revenue from long-term contracts | Service contracts with telecom operators |

| IT & Solutions | System integration, software development | Significant growth in smart solutions for industrial digitalization | Smart city initiatives, industrial internet solutions |

| Non-Telecom Clients (China) | Digitalization & smart solutions for government, industry, SMEs | Growth in IT & digitalization services catering to this segment | Government digitalization, industrial IoT, SME cloud solutions |

| International Projects | Infrastructure, IT services for overseas clients | Robust revenue from emerging markets in 2024 | Developing economies' infrastructure needs, global expansion |

Business Model Canvas Data Sources

The China Communications Services Business Model Canvas is informed by a blend of official financial disclosures, extensive market research reports on the telecom and IT services sectors, and internal strategic planning documents. These sources provide a robust foundation for understanding customer needs, market opportunities, and operational capabilities.