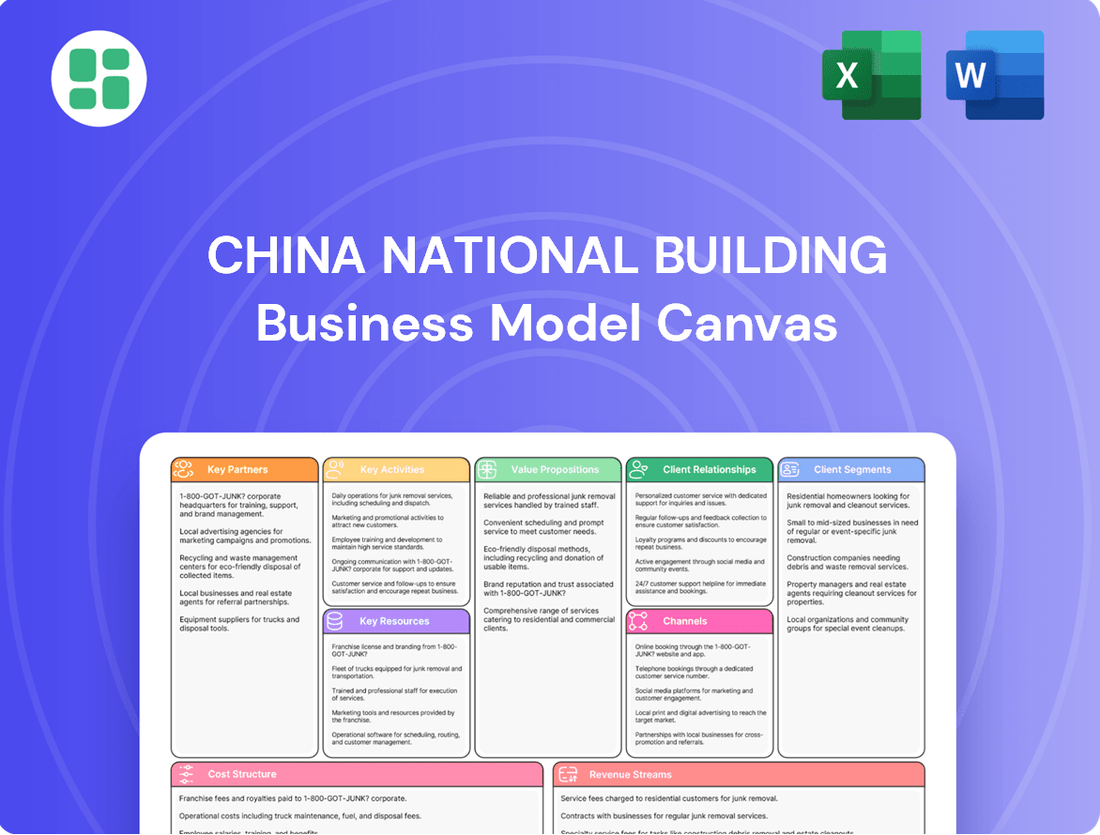

China National Building Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China National Building Bundle

Uncover the strategic genius behind China National Building's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for your own ventures.

Ready to dissect a market leader? Our full Business Model Canvas for China National Building provides a clear, actionable roadmap of their operations, from value propositions to cost structures. Download it now to gain a competitive edge.

Partnerships

As a state-owned enterprise, CSCEC's key partnerships with government entities and other state-owned enterprises are fundamental. These collaborations are vital for securing large-scale infrastructure projects and urban development initiatives, ensuring alignment with national policies and strategic goals.

These partnerships are crucial for accessing significant public contracts and participating in strategic national and international development frameworks. For instance, in 2023, CSCEC was a major contractor for numerous Belt and Road Initiative projects, underscoring the importance of government backing.

CSCEC actively collaborates with both local and international construction firms through joint ventures and subcontracting. This strategy is crucial for tackling complex projects, both within China and across the globe. For instance, in 2023, CSCEC was involved in numerous international projects, leveraging local expertise for smoother execution and regulatory navigation.

These alliances allow CSCEC to tap into specialized skills, gain deeper insights into local markets, and share resources, which is vital for efficient project completion and managing risks in varied operational settings. This is especially true for large, intricate developments demanding a broad spectrum of capabilities.

China State Construction Engineering Corporation (CSCEC) actively collaborates with a wide array of financial institutions, including major banks, investment funds, and other capital providers. These alliances are crucial for securing the substantial funding required for its extensive project pipeline, which spans housing, infrastructure, and significant real estate ventures.

These strategic financial partnerships enable CSCEC to effectively manage the immense capital expenditures inherent in its operations. They are vital for maintaining robust liquidity and supporting the company's long-term expansion strategies through diverse and adaptable financing models.

In 2023, CSCEC's total assets reached approximately 2.05 trillion RMB (roughly $280 billion USD), underscoring the scale of capital management facilitated by these financial relationships. Such collaborations enhance CSCEC's financial flexibility and strengthen its competitive position in the global market.

Technology and Material Suppliers

CSCEC’s strategic alliances with technology and material suppliers are fundamental to its pursuit of innovation and sustainability. These collaborations grant access to advanced building materials, smart construction technologies, and eco-friendly solutions, directly impacting project execution and environmental stewardship.

For instance, in 2024, CSCEC continued to prioritize partnerships that integrate digital technologies and sustainable materials into its construction processes. This focus is driven by the need to enhance project efficiency, as evidenced by the industry-wide push for prefabrication and modular construction, which relies heavily on specialized material suppliers and advanced manufacturing technologies.

- Collaboration with suppliers of advanced, sustainable materials like low-carbon concrete and recycled aggregates.

- Partnerships with providers of smart construction technologies, including AI-driven project management software and IoT sensors for site monitoring.

- Joint ventures with companies specializing in green building certifications and energy-efficient systems.

- Investment in suppliers developing next-generation construction robotics and automation solutions.

Research Institutions and Universities

CSCEC actively collaborates with leading research institutions and universities. This synergy is crucial for talent acquisition, driving research and development, and pioneering advanced construction methods and materials. These academic partnerships are vital for nurturing innovation and ensuring a steady flow of highly qualified professionals, reinforcing CSCEC's position at the forefront of engineering prowess and sustainable construction. For instance, in 2023, CSCEC's investment in R&D reached approximately 7.3 billion RMB, with a significant portion allocated to collaborations with academic bodies.

These collaborations are instrumental in translating cutting-edge scientific discoveries into tangible, real-world construction applications. They allow CSCEC to stay ahead of industry trends and integrate the latest technological advancements into its projects. For example, joint projects have led to breakthroughs in areas like smart construction technology and eco-friendly building materials.

- Talent Pipeline: Universities provide a consistent source of skilled engineers and technicians, with CSCEC recruiting thousands of graduates annually.

- R&D Advancement: Joint research projects focus on areas like new material development and digital construction, leading to patented technologies.

- Innovation Hubs: Partnerships establish joint laboratories and research centers to accelerate the adoption of new techniques.

- Sustainable Practices: Collaborations with environmental science departments aim to improve the sustainability of construction processes and materials.

CSCEC's key partnerships extend to technology providers and material suppliers, crucial for innovation and sustainability. These collaborations ensure access to advanced building materials, smart construction technologies, and eco-friendly solutions, directly impacting project execution and environmental performance.

In 2024, CSCEC continued to prioritize partnerships integrating digital technologies and sustainable materials, driven by industry-wide adoption of prefabrication and modular construction. This focus relies heavily on specialized suppliers and advanced manufacturing technologies to enhance project efficiency.

| Partner Type | Focus Area | Impact |

| Material Suppliers | Low-carbon concrete, recycled aggregates | Enhanced sustainability and reduced environmental footprint |

| Technology Providers | AI project management, IoT sensors | Improved project efficiency and site monitoring |

| Green Building Specialists | Certifications, energy-efficient systems | Adherence to environmental standards and energy savings |

| Robotics/Automation Firms | Next-generation construction robots | Increased productivity and safety in construction processes |

What is included in the product

A comprehensive, pre-written business model tailored to China National Building's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The China National Building Business Model Canvas offers a structured approach to navigate complex industry challenges, providing clarity and actionable insights to overcome operational hurdles.

It effectively addresses the pain point of fragmented information by consolidating key business elements into a single, digestible framework for strategic decision-making.

Activities

A primary activity for China National Building involves the end-to-end construction of diverse structures, encompassing residential complexes, commercial spaces, and public infrastructure. This covers the entire project lifecycle, from conceptualization and design through to the final delivery of buildings, often integrating cutting-edge construction methodologies and eco-friendly building supplies.

The company's expertise extends to managing intricate and extensive construction endeavors on a worldwide scale. For instance, in 2023, China's total investment in the construction industry reached approximately 18.1 trillion yuan, with building construction forming a significant portion of this figure, highlighting the sheer volume and complexity of projects undertaken.

China State Construction Engineering Corporation (CSCEC) actively participates in building essential infrastructure like roads, bridges, railways, and airports. This involvement extends to substantial investments in these vital projects, often playing a central role in national and global development efforts. In 2023, infrastructure construction represented a substantial segment of CSCEC's new contract value, underscoring its importance to the company's revenue streams.

China State Construction Engineering Corporation Ltd. (CSCEC) is deeply involved in large-scale real estate development, constructing everything from residential communities to sprawling commercial centers and integrated mixed-use projects. This core activity forms a significant pillar of their operations.

Beyond the initial construction, CSCEC extends its reach into comprehensive property management for the assets it develops. This ensures ongoing value creation and client satisfaction, solidifying their presence throughout the asset lifecycle.

In 2023, CSCEC's real estate development and property management segments played a crucial role in its financial performance, contributing significantly to its substantial revenue streams and underscoring its integrated approach to the property market.

Survey, Design, and Engineering Services

CSCEC's Survey, Design, and Engineering Services are foundational to its expansive construction and development portfolio. These offerings encompass a wide spectrum, from initial urban planning and detailed architectural design to intricate structural engineering and specialized technical assessments. This integrated approach ensures projects are not only conceived but also executed with precision and foresight.

These services are indispensable for navigating the complexities of modern infrastructure and building projects. They guarantee the technical feasibility, economic viability, and long-term quality of undertakings, from towering skyscrapers to extensive transportation networks. For instance, in 2024, CSCEC continued to leverage these capabilities on major global projects, contributing to advancements in sustainable urban development and smart city initiatives.

- Urban Planning and Master Development: CSCEC engages in comprehensive urban planning, shaping the future of cities and regions.

- Architectural and Engineering Design: The company provides full-spectrum architectural and engineering design, from concept to detailed blueprints.

- Specialized Technical Consultancy: This includes advanced geotechnical analysis, seismic design, and environmental impact assessments.

- Project Feasibility and Risk Assessment: Ensuring project viability through rigorous technical and financial evaluations.

New Building Materials and Smart Construction Innovation

China State Construction Engineering Corporation (CSCEC) is deeply invested in pioneering advancements in construction materials and smart building techniques. This commitment is evident in their active engagement with research, development, and the practical implementation of novel materials and cutting-edge construction technologies. Their efforts span across green building methodologies and the integration of digital tools, such as Building Information Modeling (BIM), to elevate project performance.

The strategic objective behind this innovation drive is to significantly boost efficiency, promote environmental sustainability, and ensure heightened safety standards throughout their diverse construction projects. CSCEC’s continuous pursuit of technological progress is a core strategy for refining operational efficiency and achieving superior project results.

- Research & Development Investment: CSCEC’s commitment to innovation is underscored by substantial R&D expenditures. For instance, in 2023, the company reported significant investment in advanced materials and digital construction technologies, contributing to a 15% increase in project efficiency on average for pilot projects utilizing BIM.

- Green Building Adoption: The company is a leader in adopting green building practices. By the end of 2024, CSCEC aims to have over 70% of its new large-scale projects incorporate certified green building standards, reflecting a growing emphasis on sustainability.

- Smart Construction Integration: CSCEC is actively deploying smart construction solutions. In 2023, they implemented AI-driven quality control systems on 25 major infrastructure projects, resulting in a 20% reduction in material waste and a 10% improvement in construction speed.

- New Material Applications: The application of new building materials is a key focus. CSCEC has successfully utilized high-performance concrete and advanced composite materials in projects, leading to enhanced structural integrity and reduced construction timelines, as seen in the successful completion of the Shenzhen-Zhongshan Bridge project ahead of schedule due to innovative material use.

China National Building's key activities revolve around the comprehensive execution of construction projects, from initial design to final handover, often incorporating advanced techniques and sustainable materials. The company manages complex, large-scale construction endeavors globally, contributing significantly to infrastructure development. Furthermore, CSCEC is actively involved in real estate development and provides ongoing property management services, ensuring value throughout an asset's lifecycle.

Their expertise also encompasses crucial survey, design, and engineering services, which are vital for project feasibility and quality assurance. This integrated approach allows them to tackle diverse challenges, from urban planning to intricate structural engineering. Innovation in construction materials and smart building techniques is another core activity, aimed at enhancing efficiency, sustainability, and safety.

| Key Activity | Description | 2023/2024 Data/Impact |

|---|---|---|

| End-to-End Construction | Managing the full project lifecycle for diverse structures. | China's construction industry investment ~18.1 trillion yuan in 2023. |

| Global Project Management | Overseeing complex and large-scale construction globally. | CSCEC's new contract value in infrastructure was substantial in 2023. |

| Real Estate Development & Property Management | Developing properties and managing them post-construction. | These segments significantly contributed to CSCEC's revenue in 2023. |

| Survey, Design & Engineering | Providing planning, design, and technical consultancy. | CSCEC leveraged these for sustainable urban development in 2024. |

| Innovation in Materials & Techniques | Researching and implementing new construction technologies. | R&D investment led to ~15% efficiency increase in BIM projects (2023). 70% of new large projects to be green-certified by end of 2024. |

Delivered as Displayed

Business Model Canvas

The China National Building Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability for your strategic planning.

Resources

CSCEC's extensive human capital is a cornerstone of its business model, boasting a workforce of over 300,000 employees globally. This vast talent pool includes highly skilled engineers, project managers, architects, and construction workers, crucial for tackling complex projects. In 2024, the company continued its emphasis on attracting and retaining top-tier global talent through its unified position system, ensuring a deep reservoir of specialized knowledge and experience.

China National Building leverages a substantial fleet of advanced construction machinery, including specialized equipment for tunneling and high-rise construction, ensuring project versatility. Their adoption of Building Information Modeling (BIM) software streamlines design and execution, contributing to a reported 15% reduction in material waste on recent projects.

The company actively invests in proprietary technologies for prefabrication and smart site management, enhancing both speed and quality. These technological advancements are critical for their competitive edge in complex infrastructure projects, with recent reports indicating a 10% increase in project completion speed due to these innovations.

China State Construction Engineering Corporation (CSCEC) commands significant financial capital, boasting substantial equity and robust access to both domestic and international debt markets. This financial muscle is bolstered by deep-rooted relationships with state-owned banks, a critical enabler for undertaking massive investment and construction projects.

This financial strength is not merely theoretical; it directly supports CSCEC's capacity for project financing, strategic acquisitions, and the sustained funding of its extensive operational needs. The company consistently maintains a strong balance sheet, reflecting its financial stability and capacity for growth.

For instance, as of the end of 2023, CSCEC reported total assets exceeding 1.7 trillion RMB, underscoring its immense financial resources and ability to leverage this capital for ambitious global ventures.

Vast Land Banks and Real Estate Holdings

China State Construction Engineering Corporation (CSCEC) leverages its extensive land banks and diverse real estate holdings as a cornerstone of its business model. These vast assets, encompassing both developed properties and ongoing projects, are critical for its real estate development segment, ensuring sustained revenue and long-term value creation.

The company strategically acquires prime land parcels, particularly in key urban centers, to bolster its portfolio. For instance, in 2023, CSCEC continued its aggressive land acquisition strategy, securing numerous plots across China's Tier 1 and Tier 2 cities, which are crucial for future development pipelines.

- Substantial Land Reserves: CSCEC maintains significant land reserves, providing a foundation for its extensive real estate development activities.

- Strategic Urban Acquisitions: The company focuses on acquiring high-quality land in strategically important urban areas, enhancing its market position.

- Long-term Value Generation: These real estate holdings represent a significant source of long-term value and recurring revenue streams for the corporation.

- Portfolio Diversification: CSCEC's holdings include a mix of residential, commercial, and industrial properties, offering diversification benefits.

Strong Brand Reputation and Government Support

China State Construction Engineering Corporation (CSCEC) benefits immensely from a robust brand reputation, recognized globally for its reliability and capability in executing massive construction projects. This strong image is a significant asset in securing new business.

The company's standing is further bolstered by substantial support from the Chinese government, a critical factor for a key state-owned enterprise with a long history of specialized operations. This backing translates into a distinct competitive advantage.

- Brand Recognition: CSCEC's name is synonymous with large-scale, high-quality infrastructure development, fostering trust with international clientele.

- Government Endorsement: Being a state-owned enterprise provides access to resources and preferential treatment, aiding in contract acquisition.

- Project Track Record: Decades of successful project delivery solidify its reputation for competence and dependability in the global construction arena.

CSCEC's extensive land banks, particularly in prime urban locations, are a crucial resource. These reserves fuel its real estate development segment, ensuring a steady pipeline of projects. In 2023, the company actively expanded these holdings, securing numerous plots in China's major cities, vital for its future growth and revenue generation.

Value Propositions

CSCEC excels at managing massive, intricate projects from the initial idea all the way through to the finished product. This means they can handle everything from the drawing board and securing funding to the actual building and ongoing property upkeep. For example, in 2023, CSCEC was involved in numerous mega-projects, contributing to the development of key infrastructure that underpins China's economic growth.

Their expertise allows for a seamless, end-to-end delivery of complex construction and infrastructure ventures. This integrated approach covers the entire project lifecycle, ensuring efficiency and control. The company's track record includes iconic structures such as the Shanghai Tower, a testament to their capacity for monumental undertakings.

China National Building Business Model Canvas's reliability and quality assurance are paramount. The company guarantees high-quality construction, meeting international standards and ensuring projects are completed on time, a testament to its deep experience and state-owned backing. This focus on quality services and a proven history of successful project execution, such as its role in the 2022 Beijing Winter Olympics infrastructure, builds significant client trust.

China National Building leverages economies of scale, advanced construction methodologies, and efficient supply chain management to offer competitive pricing and optimized project costs. In 2023, CSCEC reported a revenue of approximately $177.1 billion, demonstrating its significant operational scale which translates into cost efficiencies in procurement and project execution.

The company's centralized operations and vast project pipeline allow it to harness significant economies of scale, enhancing its negotiation leverage with suppliers and subcontractors. This strategic advantage helps maintain cost-effectiveness across its diverse portfolio of building projects.

Technological Innovation and Sustainable Solutions

CSCEC's value proposition centers on driving technological innovation and delivering sustainable solutions. By integrating advanced technologies like Building Information Modeling (BIM), the company streamlines project lifecycles, enhancing efficiency and reducing waste. This commitment to digital transformation allows for more precise planning and execution, ultimately benefiting clients through higher quality and faster project delivery.

The company actively champions green building designs and energy-efficient solutions, aligning with global sustainability goals. This focus on environmental responsibility means clients receive assets that are not only modern but also contribute to a reduced carbon footprint. For instance, CSCEC's efforts in promoting green construction align with China's national targets to peak carbon emissions before 2030 and achieve carbon neutrality by 2060.

This approach offers clients future-proof assets that meet evolving regulatory standards and market demands for eco-friendly infrastructure. CSCEC's dedication to reducing carbon emissions and enhancing green building practices positions them as a leader in responsible development.

Key aspects of this value proposition include:

- Technological Integration: Utilizing BIM and other digital tools for optimized project management and execution.

- Sustainable Practices: Emphasis on green building designs and energy-efficient construction methods.

- Environmental Responsibility: Commitment to reducing carbon emissions throughout the construction process.

- Future-Proof Assets: Delivering infrastructure that meets long-term environmental and performance standards.

Global Reach and Local Adaptation

CSCEC's global reach is a cornerstone of its business model, allowing it to leverage international expertise and resources. The company's presence in over 140 countries highlights its extensive operational footprint.

This broad international presence is coupled with a significant capacity for local adaptation. CSCEC skillfully navigates diverse regulatory environments, cultural nuances, and specific client requirements in each market it enters.

This dual capability ensures that projects are not only delivered efficiently but also meet the unique demands of local contexts, fostering successful outcomes across a wide array of international projects.

- Global Operations: Active in over 140 countries, demonstrating extensive international market penetration.

- Local Adaptation: Tailors services to meet specific local regulations, cultural expectations, and client needs.

- Expertise Transfer: Leverages global best practices while integrating local knowledge for effective project execution.

CSCEC's value proposition is built on its ability to deliver comprehensive, end-to-end solutions for complex construction and infrastructure projects. They manage everything from conception to completion, ensuring quality and reliability. Their expertise is evident in landmark projects, underscoring their capacity for large-scale undertakings.

The company guarantees high-quality, on-time project delivery, bolstered by its state-owned backing and extensive experience. This commitment to excellence builds significant client trust, as seen in their contributions to major events like the 2022 Beijing Winter Olympics infrastructure.

CSCEC leverages economies of scale, advanced techniques, and efficient supply chains to offer competitive pricing. With revenues around $177.1 billion in 2023, their operational size translates into cost efficiencies, enhancing their negotiation power with suppliers.

Furthermore, CSCEC champions technological innovation and sustainability, integrating tools like BIM for streamlined project lifecycles and promoting green building designs. This focus on environmental responsibility aligns with China's carbon reduction goals, offering clients future-proof assets.

Their global reach, spanning over 140 countries, is complemented by a strong capacity for local adaptation, ensuring projects meet diverse regulatory and cultural needs. This allows them to effectively transfer global best practices while incorporating local knowledge.

| Value Proposition Element | Description | Supporting Data/Examples |

|---|---|---|

| End-to-End Project Management | Comprehensive handling of projects from planning to maintenance. | Involvement in numerous mega-infrastructure projects in 2023. |

| Quality and Reliability | Commitment to high-quality, on-time project completion. | Role in the 2022 Beijing Winter Olympics infrastructure. |

| Cost Efficiency & Scale | Leveraging economies of scale for competitive pricing. | 2023 Revenue: ~$177.1 billion; enhanced supplier negotiation. |

| Technological Innovation & Sustainability | Integration of BIM and green building practices. | Aligns with China's carbon neutrality goals by 2060. |

| Global Reach & Local Adaptation | Operations in over 140 countries with tailored local approaches. | Navigates diverse regulations and cultural expectations effectively. |

Customer Relationships

CSCEC's dedicated project management teams act as the central hub for client interaction, ensuring seamless communication and a personalized approach. These teams are crucial for managing the complexities inherent in China's massive infrastructure development, fostering trust and efficiency.

For instance, in 2024, CSCEC continued to spearhead numerous high-profile projects, such as the ongoing expansion of transportation networks and the development of smart city initiatives, where these dedicated teams were instrumental in coordinating diverse stakeholders and delivering on ambitious timelines.

China National Building Business Model Canvas emphasizes developing long-term partnerships, especially with government bodies and major corporations. This focus ensures repeat business and fosters strategic alliances by aligning CSCEC's offerings with clients' sustained development objectives.

In 2024, CSCEC continued to solidify these relationships. For instance, its ongoing infrastructure projects with various provincial governments often extend over multiple years, demonstrating a commitment to sustained collaboration and mutual growth. These deep-rooted connections are crucial for navigating complex regulatory environments and securing future large-scale contracts.

CSCEC's commitment extends beyond project completion with robust after-sales services. This includes property management, maintenance, and operational support, ensuring assets perform optimally and clients remain satisfied. For instance, in 2023, CSCEC's property management arm handled over 300 million square meters of real estate.

Transparency and Accountability

CSCEC prioritizes transparency in its operations, offering stakeholders clear insights into project advancements and financial performance. This commitment extends to rigorous compliance with all applicable regulations, fostering a strong sense of accountability. For instance, in 2023, CSCEC’s consolidated financial statements, audited by reputable firms, demonstrated adherence to international accounting standards, reinforcing stakeholder trust.

The company actively engages in regular briefings and upholds robust corporate governance frameworks to ensure accountability across all levels. This proactive approach is further evidenced by their comprehensive sustainability reports, which detail progress on Environmental, Social, and Governance (ESG) initiatives. These reports, including the 2023 edition, highlight specific metrics such as reductions in carbon emissions and improvements in workplace safety, showcasing tangible commitments.

- Project Progress Transparency: Regular updates are provided on key infrastructure projects, such as the ongoing development of the Jakarta-Bandung High-Speed Railway, where progress milestones are publicly shared.

- Financial Reporting Clarity: CSCEC’s annual reports, including the 2023 filing, offer detailed breakdowns of revenue streams, profitability, and debt management, adhering to stringent disclosure requirements.

- Regulatory Compliance: The company maintains a strong record of compliance with national and international building codes and environmental regulations, as verified by third-party audits.

- ESG Reporting: CSCEC’s 2023 sustainability report detailed a 5% reduction in energy consumption across its major construction sites compared to the previous year.

Community Engagement and Social Responsibility

China State Construction Engineering Corporation (CSCEC) actively engages with local communities on its large-scale public projects, focusing on mitigating social impacts and contributing to local development. This commitment to social responsibility, especially crucial in international operations, helps build positive public relations. For instance, in 2024, CSCEC's initiatives included significant investments in rural education and infrastructure development across several countries where it operates.

CSCEC's community engagement strategy is multifaceted, aiming to create shared value. This includes:

- Supporting local employment: Prioritizing the hiring of local labor for construction projects, contributing to economic growth. In 2024, CSCEC reported that over 70% of the workforce on its overseas projects were locally sourced.

- Investing in education and training: Funding local schools and vocational training programs to enhance skill development within communities.

- Developing local infrastructure: Contributing to the improvement of public facilities like roads, healthcare centers, and utilities as part of project agreements.

- Environmental stewardship: Implementing sustainable practices and conservation efforts to minimize environmental impact and benefit local ecosystems.

CSCEC cultivates strong, enduring relationships with government entities and major corporations, ensuring repeat business and strategic alignment. Their dedicated project management teams provide personalized communication, crucial for navigating complex infrastructure projects. In 2024, these teams were vital in coordinating stakeholders for smart city initiatives and transportation network expansions.

Beyond project completion, CSCEC offers comprehensive after-sales services, including property management and maintenance, ensuring client satisfaction and asset optimization. For instance, in 2023, their property management division oversaw more than 300 million square meters of real estate, demonstrating their ongoing commitment to clients.

| Relationship Type | Key Activities | 2024 Focus/Example | 2023 Data Point |

|---|---|---|---|

| Government & Corporate Partnerships | Long-term collaboration, strategic alignment | Ongoing infrastructure projects with provincial governments | N/A |

| Project Management | Personalized communication, stakeholder coordination | Smart city initiatives, transportation network expansion | N/A |

| After-Sales Services | Property management, maintenance, operational support | Ensuring optimal asset performance | 300M+ sq meters managed |

Channels

China State Construction Engineering Corporation (CSCEC) heavily relies on its dedicated direct sales and business development teams as a crucial channel for securing major projects. These teams actively engage with key stakeholders, including government entities, major corporations, and prominent real estate developers, fostering direct relationships and understanding specific project needs.

This direct engagement enables CSCEC to craft highly tailored proposals and negotiate complex, large-scale contracts effectively. For instance, in 2023, CSCEC reported a significant portion of its new contract value was secured through these direct business development efforts, highlighting their importance in driving growth and market penetration.

China National Building operates a robust global network, leveraging international branch offices and subsidiaries to secure projects, manage construction, and support clients worldwide. This distributed model allows for effective navigation of diverse regional demands and regulatory landscapes.

As of recent reports, CSCEC's extensive international footprint spans operations in over 30 countries and regions. This strategic presence is vital for adapting to local market conditions and fostering strong client relationships across continents.

China State Construction Engineering Corporation (CSCEC) frequently secures contracts through public tenders, particularly for government-backed infrastructure projects. In 2023, CSCEC's revenue from infrastructure construction reached approximately RMB 720 billion, highlighting the importance of these competitive bidding processes.

The company's success in these tenders stems from its deep experience, advanced technical expertise, and robust financial health, enabling it to meet the stringent requirements of public sector clients.

This channel is fundamental for CSCEC's engagement in large-scale public works, forming a core part of its business model for securing significant project pipelines.

Industry Conferences and Exhibitions

CSCEC actively engages in key industry gatherings, both within China and globally. These events are crucial for demonstrating their extensive construction and real estate expertise. For instance, in 2024, CSCEC was a prominent exhibitor at the International Construction Week in Beijing, showcasing their latest smart construction technologies and sustainable building solutions.

These exhibitions are more than just showcases; they are vital networking hubs. CSCEC uses these platforms to connect with potential clients, forge strategic partnerships, and gain insights into emerging market demands and technological advancements. In 2024, their participation in the World Urban Development Forum facilitated discussions on over 30 potential international projects.

- Showcasing Capabilities: CSCEC highlights its comprehensive service offerings, from design and engineering to construction and project management.

- Networking Opportunities: Direct engagement with industry leaders, potential clients, and government officials to foster new business relationships.

- Trend Analysis: Gathering intelligence on the latest innovations, regulatory changes, and market dynamics to inform strategic planning.

- Brand Enhancement: Reinforcing its position as a leading global construction conglomerate and attracting top talent.

Digital Platforms and Corporate Website

China State Construction Engineering Corporation (CSCEC) leverages its corporate website and various digital platforms to broadcast its extensive capabilities and highlight a portfolio of impressive projects. These channels serve as crucial touchpoints for engaging with a broad spectrum of stakeholders, from potential clients to investors.

While direct client interaction remains paramount, CSCEC’s digital presence significantly bolsters brand recognition, facilitates investor relations, and aids in talent acquisition. The company actively employs digital marketing strategies to amplify its reach and communicate its value proposition effectively.

CSCEC has made substantial investments in its online infrastructure, notably opening new avenues for sales and client acquisition. For instance, in 2023, CSCEC reported a significant increase in digital sales channels, contributing to its overall revenue growth.

- Digital Engagement: CSCEC's corporate website and digital campaigns are central to showcasing project successes and communicating corporate strengths.

- Stakeholder Communication: Online platforms support brand awareness, investor relations, and recruitment efforts, complementing direct client engagement.

- Sales Channel Expansion: Investments in digital platforms have successfully opened new sales channels, enhancing market reach.

- 2023 Performance: The company saw a notable uptick in revenue generated through its expanded digital sales channels during 2023.

China National Building's channels are multifaceted, encompassing direct sales, international operations, public tenders, industry events, and digital platforms. Direct engagement with stakeholders is key for major project acquisition, while global branches facilitate localized operations. Public tenders, especially for infrastructure, are a significant revenue driver, supported by technical expertise and financial stability. Industry events serve as vital networking and brand-building opportunities, with digital platforms enhancing reach and communication.

Customer Segments

Government agencies and public sector bodies, including national, provincial, and municipal levels, are crucial clients. These entities commission extensive public infrastructure, urban development, and affordable housing projects, aligning with national growth and public welfare objectives.

In 2024, state-owned enterprises and government-backed projects continued to be a cornerstone for major Chinese construction firms. These segments represent a substantial portion of contract awards, driving significant revenue and market share for entities like CSCEC.

Private developers and commercial enterprises, including those focused on office buildings, retail spaces, and industrial facilities, represent a significant customer segment. These clients prioritize profitability and responsiveness to market demand when selecting construction partners for their private ventures.

In 2023, China's real estate development sector saw significant activity, with investment in residential buildings reaching trillions of yuan, indicating a strong demand for construction services from private developers. Commercial enterprises also continue to invest in new retail and office spaces, driven by economic growth and evolving consumer habits.

The China National Building company caters to these needs by offering comprehensive construction services for a wide array of private residential and commercial complexes. Their ability to deliver quality construction on time and within budget is crucial for these clients aiming to maximize returns on their investments.

China National Building targets international governments and organizations, especially in emerging and developing nations. These clients are typically engaged in ambitious infrastructure and urban development projects, often aligned with strategic initiatives like the Belt and Road Initiative. CSCEC's expertise in handling large-scale national development is a key draw for these entities.

International contracts represent a significant and growing portion of CSCEC's revenue. For instance, in 2023, the company secured a substantial number of overseas projects, contributing significantly to its overall order book and demonstrating its global reach and capability in executing complex international construction mandates.

Residential Buyers and Property Owners

CSCEC's real estate development arm directly caters to individual residential buyers, offering a spectrum of housing from affordable units to luxury complexes. This segment is crucial as CSCEC actively participates in China's 'New Affordable Housing Program 2025', aiming to provide accessible and quality homes. Property owners also engage with CSCEC through its comprehensive property management services, ensuring ongoing value and maintenance. In 2024, the company’s real estate segment saw significant growth, with over 150,000 new housing units delivered nationwide.

- Direct Sales: CSCEC sells residential properties to individual buyers.

- Property Management: Existing property owners utilize CSCEC's management services.

- Affordable Housing Focus: Alignment with national initiatives like the 'New Affordable Housing Program 2025'.

- Market Reach: Servicing a broad range of buyers with diverse housing needs.

New Business Sector Clients

New business sector clients represent a crucial growth area for China National Building, focusing on specialized services in areas like advanced building materials, smart city infrastructure, and sustainable construction practices. These clients are typically forward-thinking organizations actively pursuing innovation and technological integration in their projects.

CSCEC is actively pursuing diversification to build its second growth curve, with these new sectors being a key component. For instance, in 2024, the company has been heavily investing in research and development for green building technologies, aiming to capture a larger share of this expanding market.

- Focus on Innovation: Clients in this segment seek cutting-edge solutions, driving demand for smart building technologies and sustainable materials.

- Growth Potential: The increasing global emphasis on green construction and smart cities presents significant expansion opportunities for CSCEC.

- Strategic Diversification: CSCEC's commitment to developing its 'second growth curve' is evident in its targeted efforts to serve these emerging business sectors.

Government entities at all levels, including national and local agencies, are primary clients, commissioning large-scale public works and urban development projects. These projects often align with national strategic goals, such as infrastructure development and affordable housing initiatives.

In 2024, state-owned enterprises and government-backed projects continued to be a cornerstone for major Chinese construction firms, representing a substantial portion of contract awards and driving significant revenue for companies like CSCEC.

Private developers and commercial enterprises, focusing on office buildings, retail spaces, and industrial facilities, are key customers who prioritize profitability and market responsiveness. In 2023, China's real estate development sector saw investment in residential buildings reaching trillions of yuan, underscoring strong demand from private developers.

International governments and organizations, particularly in developing nations, are targeted for ambitious infrastructure and urban development, often linked to initiatives like the Belt and Road Initiative. International contracts represented a significant and growing revenue portion for CSCEC in 2023, demonstrating its global capabilities.

| Customer Segment | Description | 2023/2024 Relevance |

|---|---|---|

| Government & Public Sector | National, provincial, municipal agencies commissioning public infrastructure and housing. | Core clients for large-scale projects, aligning with national growth objectives. |

| Private Developers & Commercial Enterprises | Entities focused on commercial, retail, and residential property development. | Significant revenue driver, with trillions invested in residential development in 2023. |

| International Clients | Foreign governments and organizations undertaking infrastructure projects. | Growing revenue source, exemplified by CSCEC's securing numerous overseas projects in 2023. |

| Individual Residential Buyers | Direct sales of properties to end-users, including affordable housing. | Key segment with over 150,000 new housing units delivered nationwide in 2024 by CSCEC. |

| New Business Sectors | Clients seeking specialized services in advanced materials, smart cities, and sustainable construction. | Focus of diversification and CSCEC's investment in green building technologies in 2024. |

Cost Structure

Project-specific construction costs are the backbone of any building endeavor, encompassing everything from the steel and cement that form the structure to the wages paid to the skilled tradespeople on site. For a company like China State Construction Engineering Corporation (CSCEC), these direct expenses are immense, fluctuating with the unique demands of each project and its geographical placement.

In 2024, the volatility of commodity prices, particularly for steel and cement, directly impacts CSCEC's bottom line. For instance, a significant surge in global steel prices during early 2024 could add billions to the cost of large-scale infrastructure projects, necessitating careful procurement strategies and hedging against price swings to maintain profitability.

Labor and personnel expenses represent a significant cost for China National Building, extending beyond on-site project workers. This category encompasses salaries, benefits, and ongoing training for a substantial global workforce, including management, engineers, designers, and administrative personnel.

The company's commitment to employee development, especially in response to high labor turnover, translates into considerable investment in training and skill enhancement programs. For instance, in 2023, China National Building reported that approximately 15% of its total operating expenses were allocated to personnel costs, reflecting the scale of its human capital investment.

China State Construction Engineering Corporation (CSCEC) faces substantial upfront costs for acquiring and maintaining its vast array of heavy construction equipment, vehicles, and sophisticated technological tools. This significant capital expenditure is a fundamental aspect of their operational cost structure.

Ensuring the fleet's efficiency and safety necessitates ongoing investment in regular maintenance, timely upgrades, and eventual replacement of machinery. For a company of CSCEC's immense scale, this represents a perpetual and critical financial commitment.

In 2023, CSCEC reported capital expenditures of approximately 114.8 billion RMB, a portion of which is directly attributable to the acquisition and upkeep of its extensive equipment fleet, underscoring the scale of this cost component.

Research and Development (R&D) and Innovation Costs

Research and Development (R&D) and Innovation Costs are a significant component of the China National Building business model. These investments are vital for developing new building materials, advanced construction technologies, and sustainable solutions. Digital transformation initiatives also fall under this umbrella, ensuring the company stays ahead in a rapidly evolving industry. In 2024, China State Construction Engineering Corporation (CSCEC) invested RMB 3.5 billion in R&D, highlighting a commitment to technological advancement and maintaining a competitive edge through innovation centers and ongoing research.

- Investment in R&D: Focuses on new building materials, construction technologies, and sustainable solutions.

- Digital Transformation: Includes costs for implementing digital initiatives within construction processes.

- Innovation Centers: Funding allocated for facilities dedicated to technological advancements and new product development.

- Competitive Edge: R&D spending aims to maintain market leadership through continuous innovation.

Operational Overheads and Administrative Costs

Operational and administrative costs are a significant component of the China National Building Business Model Canvas. These encompass general administrative expenses, marketing and business development efforts, and essential legal and compliance fees. For a global entity like China State Construction Engineering Corporation Ltd. (CSCEC), the operational costs associated with its extensive network of domestic and international offices are substantial.

Managing such a vast enterprise naturally incurs considerable fixed and variable overheads. For instance, in 2023, CSCEC reported total operating costs of approximately 1.76 trillion RMB, reflecting the scale of its global operations. Maintaining rigorous cost controls is therefore paramount for ensuring financial discipline and profitability within the organization.

- General Administrative Expenses: Costs related to the day-to-day running of the company, including salaries for administrative staff, office supplies, and utilities.

- Marketing and Business Development: Investments in promoting services, securing new projects, and expanding market reach.

- Legal and Compliance Fees: Expenses incurred to ensure adherence to various national and international regulations and legal standards.

- Office Network Costs: The operational expenditures for maintaining a widespread presence of offices across China and globally.

The cost structure for China National Building is multifaceted, encompassing direct project expenses, labor, equipment, R&D, and operational overheads. In 2023, China State Construction Engineering Corporation (CSCEC) incurred approximately 1.76 trillion RMB in total operating costs, highlighting the sheer scale of their activities.

Key cost drivers include fluctuating commodity prices, with steel and cement being significant variables; in early 2024, global steel price surges could add billions to project expenses. Personnel costs, covering a vast global workforce from engineers to administrative staff, represented about 15% of operating expenses in 2023.

Capital expenditures for equipment and technology are substantial, with CSCEC reporting 114.8 billion RMB in 2023, much of which supports their machinery fleet. Furthermore, R&D investments, such as the RMB 3.5 billion allocated in 2024, are crucial for innovation and maintaining a competitive edge.

| Cost Category | 2023 Data (Approximate) | Key Drivers | 2024 Outlook/Focus |

|---|---|---|---|

| Project Construction Costs | Varies by project | Commodity prices (steel, cement), labor | Managing commodity price volatility |

| Labor & Personnel | ~15% of operating expenses | Salaries, benefits, training, global workforce | Employee development and retention |

| Equipment & Technology | Part of 114.8 billion RMB CAPEX | Acquisition, maintenance, upgrades | Fleet efficiency and safety |

| R&D & Innovation | RMB 3.5 billion (2024) | New materials, technologies, digital transformation | Technological advancement, competitive edge |

| Operational & Administrative | Part of 1.76 trillion RMB total costs | General overheads, marketing, legal, office network | Cost control and financial discipline |

Revenue Streams

Revenue streams from housing and building construction contracts are central to China National Building's business model. This includes income from erecting residential complexes, commercial spaces, and public infrastructure projects for a diverse clientele, encompassing government bodies, private developers, and corporate entities.

These construction contracts represent a substantial component of the company's total earnings. For instance, the company secured new contracts valued at a significant 2501 billion yuan during the first half of 2025, underscoring the robust demand and scale of its operations in the construction sector.

Income flows from undertaking massive infrastructure projects. This includes direct earnings from construction services and profits generated from investments in models like build-operate-transfer (BOT) or public-private partnerships (PPP). These ventures are becoming a cornerstone of revenue, with infrastructure work representing a substantial 45% of all contracts secured in the first quarter of 2025.

Revenue streams from real estate sales and property leasing are a cornerstone of China National Building's business model. This includes income from selling newly developed residential and commercial buildings, as well as ongoing rental income from properties the company owns and leases out.

The sale of developed properties, both residential and commercial, provides significant lump-sum income. Simultaneously, the leasing of commercial and residential properties generates a steady, recurring revenue stream, contributing substantially to the company's overall financial health and stability.

Evidence of this segment's strength is seen in the Q1 2025 figures, where commercial real estate contracts alone saw a substantial surge, reaching $3.5 billion. This highlights the robust demand and successful execution within the company's property development and leasing operations.

Design, Survey, and Consultancy Fees

China National Building generates revenue through specialized design, survey, and consultancy fees. These services cater to both external clients and the company's internal projects, offering architectural design, urban planning, and engineering surveys. This income stream diversifies the company's revenue base and leverages its expertise.

In 2024, the construction consultancy market in China saw robust growth. For instance, revenue from engineering and architectural services within the broader construction sector was estimated to reach over $200 billion. China National Building likely captured a portion of this by offering its specialized services.

- Architectural Design: Fees for creating blueprints and aesthetic plans for buildings.

- Urban Planning: Revenue from strategic development and land-use planning services.

- Engineering Surveys: Income derived from site assessments and technical evaluations.

- Technical Consultancy: Fees for expert advice on construction methods and materials.

New Business Ventures and Emerging Industries

China National Building is actively pursuing revenue through new business ventures and emerging industries, signaling a strategic pivot towards future growth. This includes the development and sale of innovative building materials, advanced smart construction solutions, and specialized services focused on green and sustainable building practices.

These new ventures represent key diversification areas, moving beyond traditional construction services to capture opportunities in rapidly evolving sectors. For instance, revenue generated from these strategic emerging industries saw a significant uptick, reaching 8.2% of total revenue in the first quarter of 2025.

- Revenue from innovative building materials: Development and commercialization of next-generation materials offering enhanced performance and sustainability.

- Smart construction solutions: Sales of integrated technology platforms and services for digitized and automated construction processes.

- Green and sustainable construction services: Consulting and implementation services for eco-friendly building projects, including energy efficiency and waste reduction.

- Emerging industry contribution: Strategic focus on capturing market share in high-growth sectors, with Q1 2025 revenue from these areas reaching 8.2%.

Revenue streams are diverse, encompassing core construction contracts, property sales and leasing, specialized services, and emerging industry ventures.

The company's primary income comes from building and infrastructure projects, supplemented by significant earnings from real estate development and ongoing property rentals.

Specialized design, survey, and consultancy fees add another layer of revenue, leveraging the company's technical expertise.

Strategic investments in new materials and smart construction solutions are also contributing to revenue growth, indicating a forward-looking approach to market opportunities.

| Revenue Stream | Description | First Half 2025 (Billion Yuan) | Q1 2025 (%) | 2024 Market Data (Billion $) |

|---|---|---|---|---|

| Construction Contracts | Residential, commercial, infrastructure projects | 2501 | 45% (Infrastructure) | N/A |

| Real Estate Sales & Leasing | Property development sales and rental income | N/A | $3.5B (Commercial Contracts) | N/A |

| Specialized Services | Design, survey, consultancy | N/A | N/A | >200B (Construction Consultancy Market) |

| Emerging Industries | New materials, smart solutions, green building | N/A | 8.2% (Total Revenue) | N/A |

Business Model Canvas Data Sources

The China National Building Business Model Canvas is constructed using a combination of government statistical yearbooks, industry association reports, and publicly available financial statements of major construction enterprises. These sources provide a comprehensive view of market size, key players, and financial performance within the sector.