Csc Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

CSC Financial's market position is shaped by its robust digital infrastructure and a growing client base, but also faces challenges from evolving regulatory landscapes and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the financial sector.

Want to leverage CSC Financial's unique advantages and mitigate its potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CSC Financial Co., Ltd. holds a dominant position in China's capital markets, establishing itself as a premier full-service investment bank. This leadership is underscored by its significant contributions to the nation's financial landscape. [Prompt, 21]

In 2024, CSC Financial's investment banking division showcased exceptional strength, securing the second spot for the sheer volume of A-share equity financing projects undertaken. Furthermore, the company ranked third nationally in terms of the aggregate underwriting amount for these crucial capital-raising activities, highlighting its substantial market influence.

CSC Financial boasts a comprehensive suite of financial services, encompassing securities brokerage, investment banking, asset management, and investment advisory. This integrated approach allows them to serve a wide array of clients, from corporations and institutional investors to high-net-worth individuals, providing a one-stop shop for their financial needs.

CSC Financial is experiencing a significant upswing in its wealth and asset management sectors. The company saw a remarkable 63% year-on-year increase in new customers during 2024, alongside a five-year high in its high-net-worth client base.

By the close of 2024, CSC Financial's total assets under custody reached RMB494.9 billion. Furthermore, its subsidiary, China Fund Management Co., Ltd., demonstrated robust performance, managing RMB142.2 billion in assets, which represents a substantial 52% growth compared to the previous year.

Extensive Distribution Network

CSC Financial's extensive distribution network is a significant strength, providing a robust platform for its wealth management operations. This broad physical presence across China underpins its capacity for sustainable growth.

As of the end of 2023, CSC Financial operated 319 securities brokerage branch offices throughout China. This widespread network allows the company to reach a diverse customer base and offer its services effectively across various regions. The sheer number of these physical touchpoints is a key differentiator, enabling deeper market penetration and client engagement in the competitive financial services landscape.

- Extensive Physical Footprint: 319 securities brokerage branch offices across China as of year-end 2023.

- Foundation for Growth: This network serves as a solid base for expanding its wealth management business.

- Market Reach: Enables broad access to clients and effective service delivery nationwide.

Strong ESG Performance and Operational Support

CSC Financial's dedication to Environmental, Social, and Governance (ESG) principles is a significant strength. In 2023, the company achieved an MSCI ESG rating of A, placing it favorably within its industry. Furthermore, it ranked among the leading securities companies in China according to the S&P Global ESG Score, underscoring its commitment to sustainable practices.

Complementing its ESG focus, CSC Financial boasts a robust operational support framework. This includes specialized functions such as research consulting, information technology, comprehensive operational management, and diligent risk and compliance management.

- MSCI ESG Rating: A (2023)

- Top-ranked securities company in China for S&P Global ESG Score.

- Professional and efficient business support systems.

- Key support areas: research consulting, IT, operational management, risk, and compliance.

CSC Financial's investment banking division demonstrated significant market leadership in 2024, securing the second position for A-share equity financing project volume and third nationally for underwriting amounts. This strong performance is bolstered by a comprehensive service offering, including brokerage, asset management, and advisory, catering to a diverse client base. The company also experienced substantial growth in its wealth and asset management arms, with a 63% year-on-year increase in new customers in 2024 and a five-year high in its high-net-worth client segment.

CSC Financial's extensive distribution network, comprising 319 securities brokerage branches as of year-end 2023, provides a crucial advantage for its wealth management operations and nationwide client engagement. Furthermore, the company's commitment to ESG principles is evident in its MSCI ESG rating of A (2023) and its top ranking among Chinese securities firms for the S&P Global ESG Score. This is supported by a robust operational framework encompassing research, IT, and risk management.

| Metric | 2024 Data | 2023 Data | Year-on-Year Change |

|---|---|---|---|

| A-share Equity Financing Projects (Rank) | 2nd | N/A | N/A |

| A-share Equity Financing Underwriting Amount (Rank) | 3rd | N/A | N/A |

| New Wealth Management Customers | 63% increase | N/A | N/A |

| Total Assets Under Custody | RMB494.9 billion | N/A | N/A |

| China Fund Management Assets | RMB142.2 billion | N/A | N/A |

| Securities Brokerage Branch Offices | N/A | 319 | N/A |

| MSCI ESG Rating | N/A | A | N/A |

What is included in the product

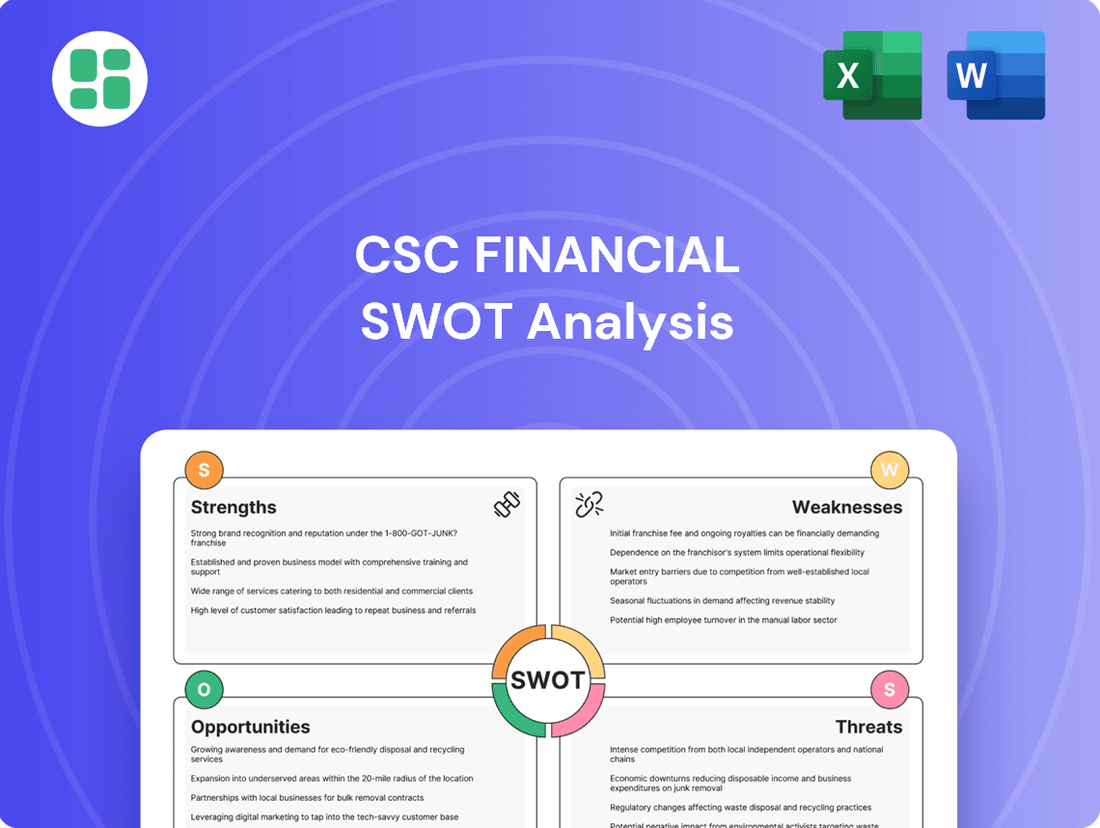

Delivers a strategic overview of Csc Financial’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Simplifies complex financial data, offering clear insights into Csc Financial's strategic landscape to alleviate decision-making paralysis.

Weaknesses

CSC Financial has faced challenges with inconsistent earnings and revenue. Over the last five years, the company's earnings have seen an average annual decrease of 9.2%, with revenue also experiencing a slight annual decline of 0.7% during the same period.

While CSC Financial reported a significant 39.5% earnings growth in the most recent year, this recent uptick contrasts with the broader five-year trend, highlighting a struggle to achieve sustained growth in both its top-line and bottom-line performance.

CSC Financial's reliance on the Chinese capital market exposes it to significant volatility. In 2024, this market saw sharp swings and substantial style shifts, directly impacting the performance of investment banks. This turbulence creates an unpredictable environment for revenue generation and strategic planning.

The broader Capital Markets industry faced headwinds in 2024, reporting a negative revenue growth rate of -5.99%. This industry-wide contraction underscores the challenging operating landscape CSC Financial navigates, making it difficult to achieve consistent growth and profitability.

Intensifying regulatory scrutiny presents a significant weakness for CSC Financial. China's financial sector is under major reform, with the April 2024 introduction of the 'New National Nine Articles' imposing stricter IPO standards and enhanced delisting oversight. These changes, aimed at bolstering market integrity, could translate into higher compliance costs and potentially restrict certain operational avenues for CSC Financial.

High Competition in the Chinese Market

The Chinese investment banking and securities market is a battlefield, teeming with formidable domestic rivals. Giants like CITIC Securities and CICC are not just participants; they are leaders. CITIC Securities, for instance, commanded the APAC region in core investment banking revenue, showcasing its significant reach. CICC, meanwhile, earned the title of China's best investment bank in 2024, particularly noted for its prowess in domestic M&A transactions.

This fierce competition presents a substantial challenge for CSC Financial. The presence of such strong domestic players can exert considerable pressure on CSC Financial's market share and, consequently, its profitability across its diverse business lines. Navigating this crowded landscape requires continuous innovation and strategic differentiation to maintain a competitive edge.

- Intense Rivalry: Strong domestic players like CITIC Securities and CICC dominate the Chinese market.

- Market Leadership: CITIC Securities led APAC in core investment banking revenue, while CICC was the best investment bank in China for 2024, particularly in domestic M&A.

- Profitability Pressure: This high level of competition can negatively impact CSC Financial's market share and overall profitability.

Macroeconomic Headwinds in China

CSC Financial, like many institutions operating within China, is susceptible to significant macroeconomic headwinds. A notable challenge is the ongoing slowdown in the Chinese real estate sector, which has a ripple effect across the broader economy. This slowdown, coupled with persistent geopolitical tensions and subdued consumer confidence, creates an environment of economic uncertainty. These factors can collectively lead to a reduced demand for financial services, potentially impacting CSC Financial's business volumes and the overall quality of its assets.

The broader economic landscape in China presents several challenges that could affect CSC Financial. For instance, the property market's struggles continue to be a concern, and heightened geopolitical risks can deter investment and economic activity. Furthermore, weak consumer sentiment, evidenced by cautious spending patterns, directly translates to lower demand for financial products and services. These macroeconomic pressures can therefore translate into decreased business volumes and potentially a deterioration in asset quality for CSC Financial.

- Real Estate Market Slump: China's property sector has faced significant headwinds, impacting related financial services.

- Geopolitical Tensions: International relations and trade disputes can create economic instability, affecting investment and financial flows.

- Consumer Confidence: Lower consumer confidence often leads to reduced spending and demand for credit and investment products.

- Impact on Financial Services: These factors can collectively dampen demand for CSC Financial's offerings and pose risks to asset quality.

CSC Financial contends with intense competition from established domestic players like CITIC Securities and CICC. CITIC Securities led the APAC region in core investment banking revenue, while CICC was recognized as China's top investment bank in 2024, particularly for domestic M&A, directly pressuring CSC Financial's market share and profitability.

The company's performance is also hampered by macroeconomic instability in China, including a struggling real estate sector and subdued consumer confidence. These factors, exacerbated by geopolitical tensions, reduce demand for financial services and can negatively impact CSC Financial's business volumes and asset quality.

CSC Financial's reliance on the volatile Chinese capital market, which experienced significant swings and style shifts in 2024, creates an unpredictable revenue environment. The broader Capital Markets industry saw negative revenue growth of -5.99% in 2024, highlighting the challenging operating landscape.

Intensified regulatory scrutiny, particularly with China's 'New National Nine Articles' in April 2024 imposing stricter IPO standards and delisting oversight, could increase compliance costs and limit operational flexibility for CSC Financial.

What You See Is What You Get

Csc Financial SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive report, ready for your strategic planning.

Opportunities

China's capital markets are a significant growth engine, with total market capitalization hitting approximately USD 13 trillion by the close of 2024. This rapid expansion solidifies its standing as a major global financial hub.

Government policies, like the 'New National Nine Articles,' are actively shaping a more robust and accessible capital market by 2035. These reforms are designed to attract and retain long-term investments, particularly from institutional players.

The Chinese government's commitment to high-level financial sector opening-up in 2025 presents a significant opportunity for CSC Financial. This includes deepening reforms to optimize resource allocation and enhance supervision, creating a more robust and predictable operating environment.

Policies aimed at channeling medium- and long-term funds into the market, a key initiative expected to gain momentum through 2025, directly benefit financial institutions like CSC Financial. This influx of capital can fuel expansion, support new product development, and broaden the client base.

By aligning with these government directives, CSC Financial can leverage the favorable policy landscape to strengthen its market position and capitalize on increased domestic and international investment flows within China's evolving financial ecosystem.

The outlook for mergers and acquisitions (M&A) in 2025 is particularly strong, with projections indicating a significant uptick in deal-making. This optimism is fueled by anticipated interest rate reductions, a potential easing of certain geopolitical tensions, and substantial uncommitted capital held by corporations. CSC Financial is well-positioned to capitalize on this trend.

This environment creates a prime opportunity for CSC Financial's investment banking division. The firm can leverage its expertise to offer critical advisory, underwriting, and sponsorship services for a wave of upcoming mergers, acquisitions, and corporate restructuring initiatives. For instance, in 2024, M&A deal volume saw a notable increase in the technology and healthcare sectors, signaling a broader market readiness for strategic transactions.

Expanding Wealth Management and Digital Transformation

The asset and wealth management sector in Hong Kong experienced significant expansion in 2024, with private banking assets under management (AUM) climbing 15% compared to the previous year. This regional dynamism, combined with China's accelerated progress in artificial intelligence and a strategic emphasis on technological independence, presents a compelling avenue for CSC Financial. The company can leverage these trends to bolster its digital wealth management offerings and incorporate cutting-edge financial technologies.

CSC Financial has a clear opportunity to capitalize on these market shifts by:

- Enhancing Digital Platforms: Investing in and upgrading digital wealth management tools to cater to a growing, tech-savvy client base.

- AI Integration: Incorporating AI-driven insights and personalized advisory services into its wealth management solutions.

- Leveraging China's Tech Growth: Partnering or developing capabilities that align with China's advancements in AI and fintech, particularly in areas of self-reliance.

- Expanding Service Offerings: Developing new digital products and services that meet the evolving needs of high-net-worth individuals in the region.

Green Finance and Sustainable Investment Initiatives

CSC Financial is well-positioned to leverage the increasing global demand for green finance and sustainable investment opportunities. The company's established full-chain green financial service system provides a strong foundation to tap into this rapidly expanding market, which saw global sustainable investment reach an estimated $35.3 trillion in 2024, according to the Global Sustainable Investment Alliance.

The company's exploration of integrated carbon finance services directly supports national strategies aimed at high-quality economic growth and achieving environmental targets. This strategic alignment is crucial as China continues to prioritize carbon neutrality goals, with significant investments expected in renewable energy and emissions reduction projects throughout 2025.

- Capitalizing on Green Finance Growth: CSC Financial can benefit from the expanding market for environmentally responsible investments.

- Integrated Carbon Finance: The company's development of carbon finance services aligns with China's national environmental and economic strategies.

- Full-Chain Green Services: CSC Financial's existing infrastructure supports a comprehensive offering in the green finance sector.

- Supporting National Goals: The company's initiatives contribute to China's commitment to sustainable development and carbon neutrality.

CSC Financial can capitalize on the robust growth in China's capital markets, which saw total market capitalization reach approximately USD 13 trillion by the end of 2024. The government's commitment to financial sector opening-up in 2025, along with policies supporting medium- to long-term fund inflows, creates a fertile ground for expansion and new product development.

The anticipated surge in M&A activity in 2025, driven by potential interest rate adjustments and corporate capital availability, presents a significant opportunity for CSC Financial's investment banking services. The firm can leverage its expertise to advise on a projected increase in strategic transactions, particularly in sectors like technology and healthcare which showed strong M&A volume in 2024.

CSC Financial is positioned to benefit from the expanding asset and wealth management sector in Hong Kong, which saw a 15% rise in private banking AUM in 2024. By integrating AI and enhancing digital platforms, the company can cater to a tech-savvy clientele and capitalize on China's advancements in artificial intelligence.

The growing global demand for green finance, with sustainable investments estimated at $35.3 trillion in 2024, offers a prime opportunity for CSC Financial. Its established green financial service system and focus on carbon finance align with national strategies for high-quality economic growth and carbon neutrality goals expected to drive significant investment in 2025.

| Opportunity Area | 2024/2025 Data Point | CSC Financial Relevance |

|---|---|---|

| China Capital Markets Growth | USD 13 trillion market cap (end of 2024) | Leverage expansion, product development |

| M&A Activity | Projected uptick in 2025 deal-making | Investment banking advisory, underwriting |

| Hong Kong Wealth Management | 15% AUM growth in private banking (2024) | Enhance digital wealth, AI integration |

| Green Finance Demand | USD 35.3 trillion sustainable investments (2024) | Capitalize on green finance growth, carbon services |

Threats

CSC Financial faces a growing challenge from China's ever-evolving and increasingly stringent regulatory landscape for fintech and financial services. This includes demanding licensing procedures, substantial capital reserves for lending operations, and strict rules on where data must be stored.

The Chinese government's intensified focus on oversight, evidenced by increased disciplinary actions against private fund managers in 2024, suggests a proactive approach to enhancing industry quality. For CSC Financial, this translates to a heightened compliance burden and potentially higher operational expenses as they adapt to these stricter enforcement measures.

CSC Financial faces significant threats from China's ongoing economic slowdown. A struggling real estate sector and concerning local government debt levels could lead to a decline in the quality of credit assets held by financial institutions, directly impacting CSC Financial's loan portfolios.

Furthermore, weak consumer confidence in China dampens spending and investment, posing a risk to CSC Financial's profitability. The government's active measures to manage systemic risks in these troubled sectors might also create volatility and uncertainty for the firm's investment activities.

Escalating geopolitical tensions and expanding trade wars, particularly the ongoing tariff disputes between the United States and China, pose a significant threat to CSC Financial. These conflicts disrupt global supply chains, potentially increasing operational costs and impacting the availability of key resources. For instance, the imposition of new tariffs on Chinese goods by the US in 2024 could directly affect the cost of components or finished products CSC Financial relies on, thereby squeezing profit margins.

The ripple effects of these trade wars extend to investment flows and international economic cooperation, which are vital for a financial institution like CSC Financial. Reduced cross-border capital market activity and a general slowdown in international trade can limit opportunities for mergers, acquisitions, and new market entries. This environment makes forecasting and strategic planning more challenging, as external economic policies can rapidly alter the landscape of global finance.

Market Volatility and Investor Sentiment

The Chinese equity market, despite policy backing, is prone to significant fluctuations driven by shifts in investor sentiment. This volatility makes it challenging for CSC Financial to ensure steady returns for its clients.

A notable example of this market behavior occurred in early 2024, when the CSI 300 index experienced a sharp decline, impacting overall investor confidence. The Shanghai Composite Index also saw considerable swings throughout 2023, reflecting ongoing economic uncertainties.

- Market Susceptibility: The Chinese equity market's inherent volatility poses a direct threat to CSC Financial's ability to generate consistent returns.

- Investor Confidence Erosion: Economic uncertainties and policy ambiguity can quickly dampen investor sentiment, leading to a potential pullback from the market.

- Impact on Demand: A decline in investor confidence can translate into reduced trading volumes and a lower demand for CSC Financial's investment products and services.

Intensified Competition from Foreign Players

China's strategic push for higher-level financial sector opening, including expanded foreign participation in bond underwriting and the Stock Connect program, presents a significant competitive threat. This liberalization allows global financial institutions, with their established expertise and resources, to more readily enter and compete within the Chinese market.

CSC Financial faces intensified competition, particularly in lucrative segments like asset management and investment banking, as international players leverage this opening to grow their footprint. For instance, by the end of 2024, foreign institutions were increasingly active in China's onshore bond market, with their holdings reaching record levels, indicating a growing competitive landscape.

- Increased foreign participation in China's bond market: Foreign holdings in China's interbank bond market surpassed RMB 3.5 trillion by early 2025.

- Expansion of Stock Connect: The inclusion of more eligible securities and potentially new market segments under Stock Connect by 2024-2025 will broaden avenues for foreign investment and competition.

- Asset Management Competition: Global asset managers are actively seeking to increase their market share, with many reporting significant growth in their China-based AUM in 2024.

CSC Financial contends with a dynamic and tightening regulatory environment in China, necessitating adherence to stringent licensing, capital requirements, and data localization rules. Increased government oversight, as seen with heightened disciplinary actions against private fund managers in 2024, translates to greater compliance burdens and potentially higher operational costs.

The firm is also vulnerable to China's economic slowdown, with a struggling real estate sector and local government debt posing risks to its credit asset quality. Weak consumer confidence further impacts profitability by dampening spending and investment, while government efforts to manage systemic risks can introduce market volatility.

Geopolitical tensions and trade wars, particularly US-China tariff disputes, disrupt supply chains and increase operational costs. For example, new US tariffs in 2024 could affect component costs for CSC Financial. These conflicts also reduce cross-border capital market activity, limiting growth opportunities and complicating strategic planning.

The Chinese equity market's inherent volatility, exemplified by sharp declines in indices like the CSI 300 in early 2024, poses a threat to consistent return generation and investor confidence. This can lead to reduced trading volumes and lower demand for CSC Financial's services.

China's financial sector liberalization, allowing greater foreign participation in areas like bond underwriting and Stock Connect, intensifies competition. Global institutions are increasingly active, with foreign holdings in China's interbank bond market surpassing RMB 3.5 trillion by early 2025, indicating a growing competitive landscape for CSC Financial.

SWOT Analysis Data Sources

This CSC Financial SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and insightful assessment.