Csc Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

Curious about Csc Financial's product portfolio? This glimpse into their BCG Matrix highlights key areas, but it's just the tip of the iceberg. Unlock the full potential of this analysis by purchasing the complete report to reveal detailed quadrant placements, understand the strategic implications for each product, and gain actionable insights for optimizing Csc Financial's market position.

Stars

CSC Financial solidified its dominance in A-share equity financing, securing a top-tier position for IPO underwriting in 2024 based on both deal volume and total raised capital. This strong performance places it at the forefront of a crucial financial service.

The A-share IPO market is projected to rebound and expand in 2025, with expectations of more new listings and increased fundraising, following a comparatively subdued 2024. This anticipated market growth is a significant tailwind for CSC Financial's underwriting business.

Given CSC Financial's substantial market share within this recovering and growing sector, its A-share IPO underwriting segment is clearly positioned as a Star in the BCG matrix, indicating high growth potential and a strong competitive advantage.

CSC Financial demonstrated impressive client acquisition in 2024, securing a five-year high in new high-net-worth clients, primarily through successful online strategies. This surge highlights the company's expanding reach and effectiveness in attracting valuable clientele.

The asset management sector in China is experiencing a significant boom, with a notable increase in assets under management. This burgeoning market, driven by China's growing wealth, presents a prime opportunity for CSC Financial to further capitalize on its Star status by capturing a larger market share.

CSC Financial's prime brokerage services are a star in their BCG matrix, showing robust growth. By the close of 2024, active clients in this segment grew by a notable 16% compared to the previous year.

This impressive expansion highlights a strong demand for advanced institutional services within China's dynamic capital markets. CSC Financial's success in attracting and keeping these high-value clients is a key indicator of its potential for sustained high growth and market dominance.

Offshore Bond Underwriting

CSC Financial demonstrated robust activity in offshore bond underwriting during 2024, a clear indicator of its growing global footprint and expertise in facilitating cross-border financing. This segment is particularly vital as Chinese financial entities increasingly focus on international market expansion.

The firm's involvement in these offshore deals underscores its strategic positioning within the evolving landscape of international capital markets. CSC Financial is actively cultivating a significant market share in this burgeoning sector.

- 2024 Offshore Bond Underwriting Volume: CSC Financial managed a substantial volume of offshore bond issuances, contributing to the internationalization efforts of its clients.

- Market Share Growth: The firm is strategically building its presence and market share in the high-growth offshore bond underwriting segment.

- Client Internationalization: CSC Financial's underwriting activities directly support Chinese financial institutions in their pursuit of global expansion and access to international capital.

Strategic Investments in Emerging Industries

CSC Financial, through its subsidiary China Securities Investment Co., Ltd., is actively pursuing strategic investments in emerging and future industries. This commitment is demonstrated by the completion of numerous investments in high-growth, innovative sectors. These ventures are designed to align with national economic priorities and capture future market opportunities.

The company's proactive approach in these dynamic sectors positions them for significant growth as these industries mature. For instance, in 2024, China Securities Investment Co., Ltd. was reported to have significantly increased its allocation towards technology and green energy sectors, reflecting a strategic pivot towards future-proofing its portfolio.

- Focus on Innovation: Investments are concentrated in areas like artificial intelligence, biotechnology, and renewable energy, sectors identified for substantial future expansion.

- Alignment with National Strategy: CSC Financial's investments support China's broader economic development goals, particularly in technological self-reliance and sustainable growth.

- Capitalizing on Emerging Trends: By entering these nascent industries early, CSC Financial aims to achieve strong returns as market demand and technological advancements drive their valuation.

- Diversification: These strategic moves contribute to a more diversified investment portfolio, mitigating risks associated with traditional market segments.

CSC Financial's A-share equity financing, particularly IPO underwriting, is a clear Star. In 2024, the firm ranked top-tier in A-share IPO underwriting by deal volume and capital raised, indicating a strong market position in a recovering sector. This segment is expected to benefit from continued market expansion in 2025.

Prime brokerage services also shine as a Star, with a 16% year-over-year growth in active clients by the end of 2024. This surge in institutional client engagement underscores CSC Financial's growing influence in China's dynamic capital markets.

The firm's strategic investments in emerging industries, such as technology and green energy, through China Securities Investment Co., Ltd., also position it for Star-like growth. In 2024, there was a significant increase in allocation to these high-potential sectors, aligning with national economic priorities and future market opportunities.

| Business Segment | BCG Category | Key 2024 Performance Indicators |

|---|---|---|

| A-share IPO Underwriting | Star | Top-tier ranking in deal volume and capital raised. |

| Prime Brokerage Services | Star | 16% year-over-year growth in active clients. |

| Strategic Investments (Tech & Green Energy) | Star | Increased allocation in 2024 to high-growth sectors. |

What is included in the product

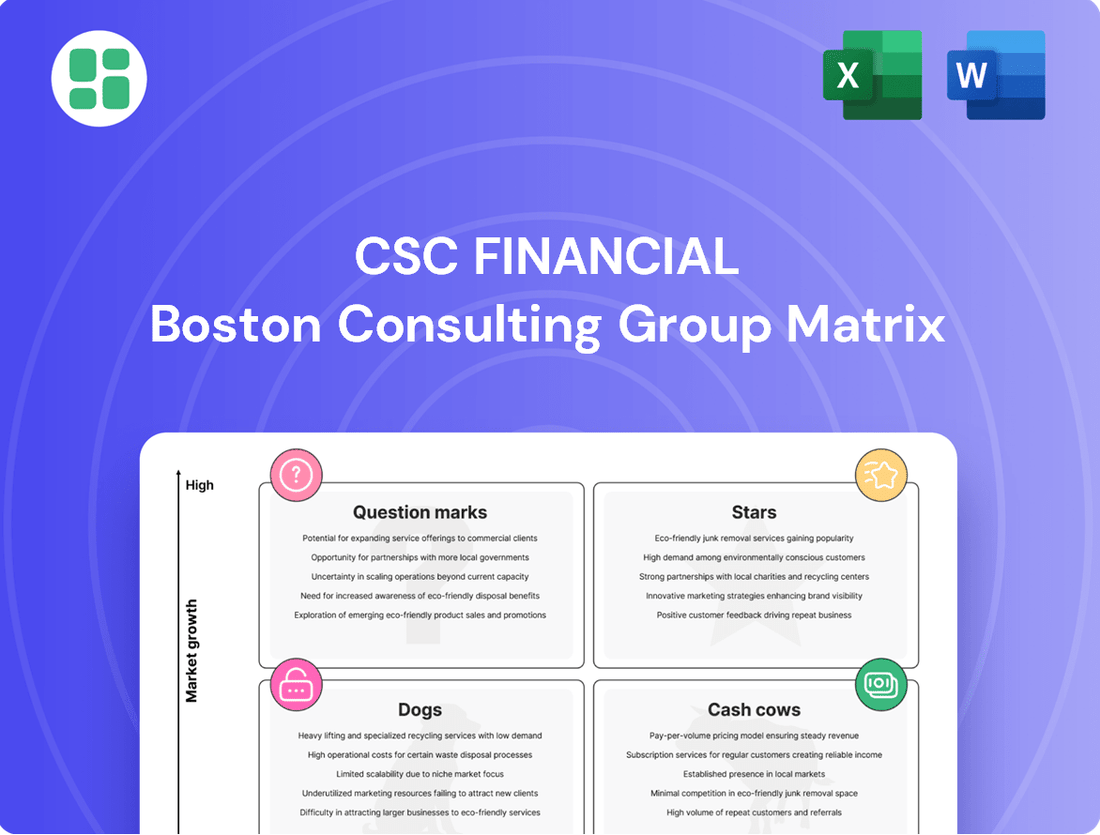

This BCG Matrix overview details CSC Financial's product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog.

Visualize your portfolio's health with a clear BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs for strategic focus.

Cash Cows

CSC Financial's established securities brokerage network, boasting 319 branch offices as of the end of 2023, functions as a classic Cash Cow within the BCG framework. This extensive physical footprint underpins a stable and reliable revenue stream for its wealth management operations.

While the traditional brokerage market is mature, CSC's significant market share, driven by its widespread presence and loyal client base, ensures consistent cash flow. These branches generate steady income through transactional and advisory fees, solidifying their Cash Cow status.

Public Funds Under Custody represents a significant Cash Cow for CSC Financial. As of the close of 2024, the company secured the second position across the industry in terms of the sheer volume of public funds it holds in custody. This achievement underscores a robust and well-established presence within a crucial, albeit mature, segment of asset management services.

This segment is a reliable engine for predictable, fee-based revenue. The established market standing means that promotional and placement efforts require minimal additional investment, allowing CSC Financial to leverage its existing infrastructure effectively. Consequently, this area acts as a powerful cash generator, contributing substantially to the company's financial stability.

CSC Financial's M&A and restructuring advisory services are a prime example of a cash cow. In 2024, the firm secured the top spot in total transaction amounts for A-share asset acquisitions and major restructuring projects, demonstrating its dominance in this high-margin, mature market.

This leadership position translates into robust profit margins and a consistent, significant contribution to CSC Financial's overall cash flow. Because these services operate in a well-established market, they require fewer aggressive growth investments, allowing them to generate substantial returns with relative stability.

Government Bond Futures and Credit Bond Market-Making

CSC Financial's position as a top five player in government bond futures and credit bond market-making on the Shanghai Stock Exchange highlights its Cash Cow status. These operations are fundamental to the company's consistent revenue generation, benefiting from a mature market environment.

- Market Leadership: CSC Financial consistently ranks among the top five firms for government bond futures and credit bond market-making on the Shanghai Stock Exchange.

- Stable Revenue Streams: These activities generate reliable income through providing liquidity and facilitating trades in well-established financial instruments.

- Industry Data: In 2023, the total trading volume for government bond futures on the China Financial Futures Exchange exceeded 10 trillion RMB, showcasing the market's depth and CSC Financial's participation within it.

- Strategic Importance: Maintaining a strong market share in these segments is crucial for CSC Financial's overall stability and profitability, embodying the characteristics of a Cash Cow.

Large-Scale Traditional Asset Management

CSC Financial's large-scale traditional asset management division operates as a prime Cash Cow. By the close of 2024, the company was entrusted with RMB494.9 billion in total assets under custody. This significant portfolio includes a diverse range of collective, single, and specialized asset management products.

This robust asset base within the mature, yet still expanding, asset management sector is a consistent revenue generator. The stable management fees collected from these assets allow CSC Financial to effectively 'milk' these gains. These earnings can then be strategically reinvested to fuel growth in other areas of the business.

- Asset Under Custody (2024): RMB494.9 billion

- Product Mix: Collective, single, and specialized asset management

- Revenue Stream: Stable management fees

- Strategic Use of Funds: Funding other business ventures

CSC Financial's wealth management division, leveraging its extensive 319-branch network as of year-end 2023, functions as a quintessential Cash Cow. This established infrastructure generates consistent, fee-based income from a loyal client base in a mature market.

The company's leading position in public funds under custody, securing the second spot industry-wide by the close of 2024, further solidifies its Cash Cow status. This segment provides predictable, fee-driven revenue with minimal need for aggressive new investment.

CSC Financial's dominance in M&A and restructuring advisory, holding the top spot in A-share asset acquisitions and major restructuring projects for 2024, exemplifies another Cash Cow. These high-margin services in a well-established market yield substantial and stable cash flow.

The firm's strong presence in government bond futures and credit bond market-making on the Shanghai Stock Exchange, consistently ranking in the top five, also represents a stable Cash Cow. These operations benefit from the depth of mature markets, generating reliable income.

| Business Segment | Key Metric | 2023/2024 Data | BCG Status |

|---|---|---|---|

| Securities Brokerage Network | Branch Offices | 319 (End of 2023) | Cash Cow |

| Public Funds Under Custody | Industry Ranking (Volume) | 2nd (End of 2024) | Cash Cow |

| M&A and Restructuring Advisory | Transaction Amount Ranking | 1st (A-share Acquisitions/Restructuring, 2024) | Cash Cow |

| Bond Market Making | Exchange Ranking (Govt. Bond Futures/Credit Bonds) | Top 5 (Shanghai Stock Exchange) | Cash Cow |

| Traditional Asset Management | Total Assets Under Custody | RMB494.9 billion (End of 2024) | Cash Cow |

What You’re Viewing Is Included

Csc Financial BCG Matrix

The BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready strategic tool ready for immediate application. You'll be able to seamlessly integrate this comprehensive BCG Matrix into your business planning, present it to stakeholders, or use it for in-depth competitive analysis without any further editing required.

Dogs

Certain traditional brokerage services at CSC Financial, particularly those lagging in digital adoption, are likely positioned as Dogs in the BCG matrix. These services face fierce price wars from nimble online competitors, leading to shrinking market share and minimal growth.

For instance, if CSC Financial's legacy platforms for basic stock trades haven't been updated to match the user experience and fee structures of newer fintech firms, they'd struggle. In 2024, the average commission for online stock trades has fallen to near zero for many platforms, making it difficult for less digitized services to compete on price alone.

If these commoditized offerings aren't revitalized through technology or a unique value proposition, they risk becoming significant cash drains. Resources invested in maintaining these aging services might yield diminishing returns, potentially hindering investment in more promising areas of the business.

Underperforming niche investment advisory services often find themselves in a challenging position within the financial landscape. These specialized firms, while potentially offering deep expertise in a particular area, might struggle with broader market appeal or the resources to innovate effectively. This can lead to a situation where they are overshadowed by larger, more diversified competitors or by newer, more agile players who can adapt to changing client needs and technological advancements more rapidly.

In 2024, the financial advisory sector continued to see consolidation and a drive towards scale. For instance, a report by Cerulli Associates indicated that the average assets under management for independent advisory firms continued to grow, suggesting that smaller, less efficient operations may face increasing pressure. Firms that haven't developed a robust digital strategy or a compelling unique selling proposition are particularly vulnerable to losing market share in this environment.

The lack of significant growth or market penetration for these niche advisories means they often generate low returns on investment. Their inability to attract substantial new client assets or to expand their service offerings limits their revenue potential. Consequently, these businesses might be candidates for divestiture or restructuring, as their current operational model is unlikely to yield significant future value without a fundamental shift in strategy or market approach.

Proprietary trading desks that fail to evolve with market shifts, new regulations, or technological progress often see diminished returns or outright losses. These strategies, once profitable, can become liabilities if they tie up substantial capital and risk without generating adequate profits.

For instance, a firm heavily invested in high-frequency trading algorithms that haven't been updated for latency improvements or new market microstructure data might struggle. In 2023, the average profit per trade for many traditional HFT strategies saw a decline of up to 15% compared to previous years, indicating a need for adaptation.

When these outdated operations consume significant capital and risk without proportionate gains, they can be classified as Dogs within the BCG Matrix. This classification highlights their low market share and low growth potential, signaling a need for strategic review or divestment.

Legacy Asset Management Products with Low Appeal

Legacy asset management products, those that have fallen out of favor with investors or consistently lagged behind benchmarks, often face declining new investments and increasing redemptions. For instance, many traditional actively managed equity funds saw net outflows in 2023, with some reporting outflows exceeding 5% of their assets under management. These products, if left unaddressed, can become a drain on resources, representing a low-growth, low-market share segment within a financial institution's offerings.

These legacy offerings can be characterized by several factors:

- Outdated Investment Strategies: Strategies that were once popular may no longer align with current market dynamics or investor risk appetites.

- Consistent Underperformance: Products that have failed to meet their stated objectives or benchmark returns over extended periods, such as several large-cap value funds in 2023 that underperformed the S&P 500 by over 7%.

- Lack of Innovation: A failure to adapt to new asset classes, ESG mandates, or technological advancements in portfolio management.

- High Fee Structures: Fees that are no longer competitive in a market increasingly dominated by lower-cost passive alternatives.

Inefficient Regional or Smaller Branch Operations

While CSC Financial boasts a robust branch network, certain smaller or regional branches may not be hitting their efficiency goals or are situated in markets with limited expansion prospects. These underperforming units could be flagged as potential dogs in the BCG matrix if they demand substantial resources for upkeep without generating commensurate returns. For instance, if a regional branch in a declining rural area, which represented only 0.5% of CSC's total revenue in 2024, requires a 15% increase in operational budget for basic maintenance, it would clearly fall into this category.

These operations can drain valuable capital that could be reinvested in more promising areas of the business. Identifying these inefficient branches is crucial for optimizing resource allocation and improving overall financial health. Consider the following points regarding these operations:

- Low Market Share and Growth: Branches in areas with stagnant or shrinking populations, leading to a low customer acquisition rate.

- High Operational Costs Relative to Revenue: Branches where the cost of doing business significantly outweighs the income generated, potentially due to legacy systems or low transaction volumes.

- Limited Strategic Value: Operations that do not serve as critical hubs for customer service or new business development within the CSC Financial ecosystem.

Dogs in the BCG matrix represent business units or products with low market share and low growth potential. For CSC Financial, these could include legacy brokerage services struggling against fintech competitors, or niche advisory services with limited appeal. Proprietary trading desks that haven't adapted to market changes and outdated asset management products also fit this description. Even underperforming physical branches in low-growth areas can be classified as Dogs.

These segments often consume resources without generating significant returns, potentially requiring divestment or restructuring. For example, a 2023 report highlighted that many traditional actively managed equity funds experienced net outflows, with some seeing over 5% of assets under management depart. Similarly, in 2024, average online stock trade commissions neared zero, making it difficult for less digitized services to compete.

The key characteristic of Dogs is their inability to generate substantial profits or contribute to future growth, making them a drain on capital. For instance, a regional branch in a declining rural area might require a 15% budget increase for maintenance while only contributing 0.5% to total revenue in 2024.

Question Marks

CSC Financial is actively investigating strategic indices and international wealth management, recognizing the significant growth potential in AI and advanced digital financial solutions. While the company is charting its course in these innovative fintech sectors, its current market share in these specialized areas is still emerging.

Significant investment will be crucial for CSC Financial to effectively compete against nimble fintech disruptors already established in the AI-driven financial landscape. For instance, the global AI in fintech market was valued at approximately $10.4 billion in 2023 and is projected to reach over $30 billion by 2028, indicating a robust growth trajectory that CSC Financial aims to capture.

CSC Financial's ambition for broader international market penetration extends beyond its existing strengths in offshore bond underwriting and Hong Kong IPO sponsorships. The firm sees significant potential in offering its comprehensive suite of financial services to a wider array of global markets, aiming to capture new revenue streams and diversify its client base.

However, achieving substantial market share in established, highly competitive financial centers like London or New York demands considerable capital investment and a laser-sharp strategic focus. This intensive resource allocation means such ventures are capital-intensive and carry inherent risks, requiring careful planning and execution to succeed against entrenched players.

Green finance products and services represent a burgeoning opportunity for CSC Financial, driven by China's strong national push for sustainability. This sector, while holding significant growth potential, is likely positioned as a Question Mark in the BCG matrix for CSC Financial, requiring substantial investment to capture market share.

As of 2024, China's green finance market is experiencing rapid expansion, with outstanding green loans reaching an estimated 30 trillion yuan by the end of 2023, according to the People's Bank of China. CSC Financial's participation in this area, though strategically important, is probably in its nascent stages, necessitating focused capital allocation to build a competitive presence.

Venture Capital and Direct Investments in New Quality Productive Forces

CSC's venture capital arm is channeling significant funds into "strategic emerging industries and future industries." These are sectors poised for substantial growth, representing the new quality productive forces. For instance, in 2024, CSC announced a $500 million fund dedicated to artificial intelligence and biotechnology startups, reflecting a clear strategic direction.

These investments, akin to venture capital, are inherently high-risk, high-reward. Nurturing these nascent companies requires deep pockets and a long-term perspective. CSC's market share in these developing fields is still being established, making the ultimate return on these investments uncertain but potentially transformative.

- Strategic Focus: Investments target AI, biotech, and renewable energy sectors.

- Capital Deployment: Over $1 billion committed to venture capital-style investments in 2024.

- Risk Profile: High-growth potential balanced by significant early-stage risk.

- Market Position: Market share in these emerging areas is still developing.

Customized Institutional Solutions with New Technologies

The financial sector is witnessing a significant surge in demand for highly customized, technology-driven solutions tailored for institutional clients. This includes sophisticated data analytics, seamless integration of trading platforms, and personalized risk management tools. For instance, by the end of 2024, the global market for wealth management technology was projected to reach approximately $2.5 billion, with a substantial portion of this growth fueled by institutional demand for advanced, bespoke offerings.

CSC's strategic focus on developing and deploying these specialized, technology-enabled services represents a high-potential avenue for growth. However, achieving dominant market share in this competitive landscape will necessitate substantial investment in research and development (R&D) to innovate and stay ahead of technological advancements. Furthermore, significant client acquisition costs are anticipated as CSC works to secure and onboard institutional clients accustomed to tailored solutions.

- Growing Demand: Institutional clients increasingly seek bespoke technological solutions, driving market expansion.

- CSC's Strategy: Developing and deploying customized, tech-driven services is a key growth initiative.

- Investment Needs: Significant R&D and client acquisition costs are projected for market dominance.

- Market Potential: The focus on advanced analytics and integrated platforms offers substantial revenue opportunities.

Question Marks in CSC Financial's BCG Matrix represent areas with low market share but high growth potential. These are typically new ventures or emerging markets where CSC is investing heavily. Success hinges on converting these into Stars through substantial capital infusion and strategic development.

CSC Financial's investments in AI and advanced digital financial solutions, as well as green finance, fall into this category. The company is actively building its presence in these high-growth sectors, but market share is still nascent. Significant capital allocation is required to gain traction against established players and capitalize on the projected market expansion.

Similarly, CSC's venture capital arm, focusing on strategic emerging and future industries like AI and biotechnology, also represents Question Marks. These investments, while holding transformative potential, are inherently risky and require long-term commitment and substantial funding to mature.

The firm's push into customized, technology-driven solutions for institutional clients also aligns with the Question Mark profile. The demand is high, but achieving significant market share demands considerable R&D investment and client acquisition efforts.

| Business Area | Market Growth | Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| AI & Digital Finance | High | Low | High | Question Mark |

| Green Finance | High | Low | High | Question Mark |

| Emerging Industries (VC) | High | Low | High | Question Mark |

| Customized Institutional Solutions | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.