Croda International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Croda International Bundle

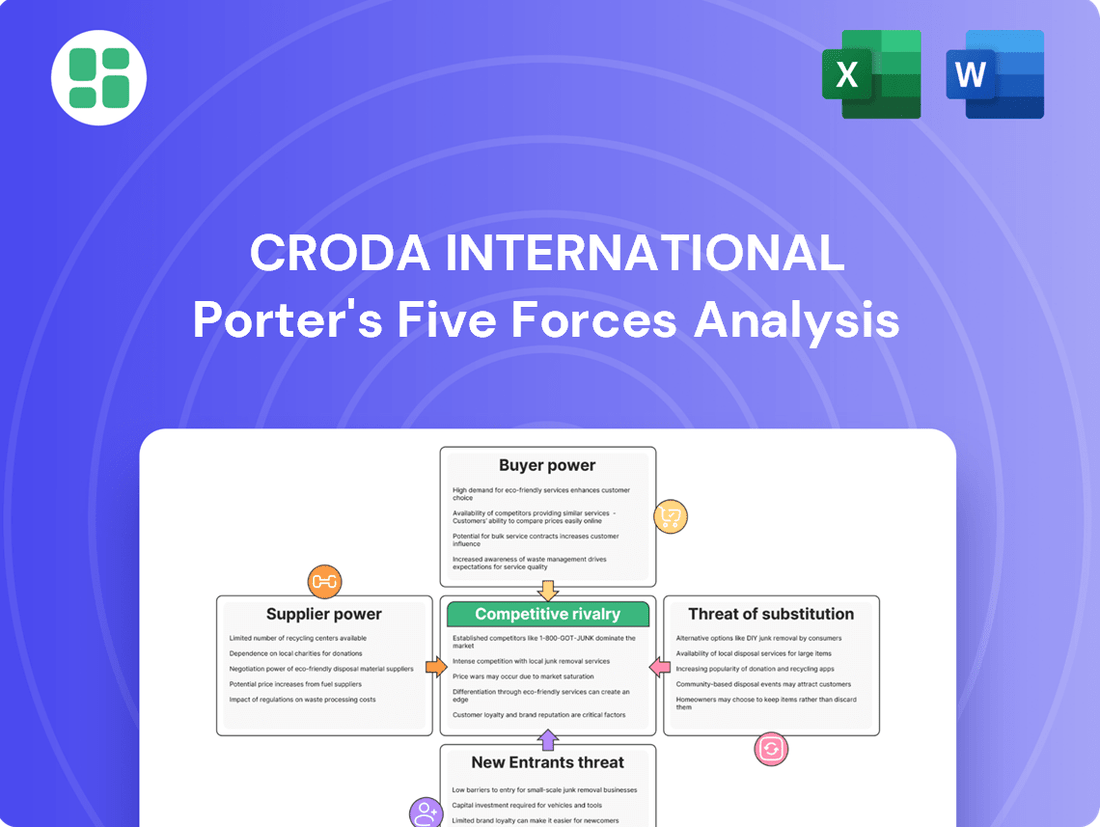

Croda International navigates a dynamic landscape shaped by powerful industry forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Croda International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Croda sources a wide array of raw materials, from natural fats and oils to chemical intermediates. The concentration and specialization of suppliers for these inputs can significantly impact their bargaining power. For instance, if a critical chemical intermediate is produced by only a few companies, those suppliers gain considerable leverage.

The specialized nature of certain high-performance ingredients Croda utilizes means that suppliers of these niche components may command higher prices and exert more influence. This is particularly true for bio-based materials, where specialized providers of sustainable inputs can build strong partnerships, potentially shifting the balance of power.

The bargaining power of suppliers for Croda International is influenced by significant switching costs for its customers. When businesses rely on Croda's specialty chemicals, they often face substantial expenses and time investments to change suppliers. This is because adopting new chemicals requires extensive testing, obtaining necessary regulatory approvals, and potentially reformulating entire product lines to ensure consistent quality and performance. These hurdles create a strong incentive for customers to maintain their existing relationships with Croda, especially for highly specialized or proprietary ingredients that are integral to their product's success.

While less common in the specialized chemical industry, there's a theoretical threat of suppliers integrating forward into manufacturing specialty ingredients. This would require significant R&D capabilities and substantial capital investment from them.

However, Croda's deep expertise in complex chemistry, formulation, and the creation of highly customized solutions presents a formidable barrier. For instance, Croda's commitment to innovation is reflected in its significant R&D spend, which was approximately £116 million in 2023, underscoring the specialized nature of its operations that are difficult for raw material suppliers to replicate.

The intricate customer relationships and the unique, tailored solutions Croda provides are also crucial deterrents. Replicating this level of customer intimacy and product specificity would be a substantial undertaking for any raw material supplier attempting forward integration.

Importance of Croda as a Customer

Croda International's significance as a customer can significantly influence the bargaining power of its suppliers. For suppliers of niche or specialized raw materials, Croda's substantial orders could constitute a considerable percentage of their total revenue, thereby diminishing their ability to dictate terms. This is particularly true for suppliers catering to Croda's advanced formulations and high-performance ingredients.

Conversely, when Croda procures more commoditized chemicals, its individual purchasing volume might have a less pronounced impact on supplier bargaining power. However, Croda's overall scale and extensive global operational footprint generally equip it with considerable leverage in negotiations, even for these less specialized inputs.

- Croda's 2023 revenue reached £1.94 billion, indicating substantial purchasing power across its supply chain.

- The company's focus on sustainability and innovation often necessitates specialized raw materials, creating dependencies for certain niche suppliers.

- Croda's global sourcing strategy allows it to compare prices and terms from multiple suppliers, enhancing its negotiating position.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for companies like Croda International. If alternative raw materials can be readily sourced or if Croda can reformulate its products using different inputs, it reduces the leverage of any single supplier.

Croda's strategic focus on sustainability and innovation is a key factor here. By actively researching and adopting new, often bio-based or renewable, raw materials, the company can diminish its dependence on traditional, potentially volatile, fossil fuel-derived inputs. This proactive approach strengthens Croda's position by diversifying its supply chain.

Broader industry trends also play a crucial role. The chemical sector's increasing commitment to sustainable solutions is driving the development and adoption of novel input sources. This collective movement towards greener alternatives inherently limits the power of suppliers who rely on older, less sustainable feedstock.

- Reduced Reliance on Fossil Fuels: Croda's investment in bio-based chemicals aims to lessen dependence on petrochemical feedstocks, which are subject to price volatility. For instance, in 2023, global oil prices fluctuated significantly, impacting raw material costs across the chemical industry.

- Innovation in Formulations: The company's R&D efforts in creating new product formulations using alternative ingredients can bypass traditional supply chains, thereby weakening supplier leverage.

- Industry-Wide Sustainability Push: The chemical industry's shift towards renewable raw materials, supported by initiatives like the European Green Deal, encourages a wider array of suppliers and reduces the dominance of any single source.

The bargaining power of suppliers for Croda International is generally moderate, influenced by the specialized nature of many of its raw materials and Croda's significant purchasing volume. While a few suppliers of niche, high-performance ingredients might hold some leverage, Croda's scale and global sourcing capabilities often mitigate this. The company's commitment to innovation and sustainability also drives diversification, reducing reliance on any single supplier.

Croda's substantial revenue, which was £1.94 billion in 2023, grants it considerable purchasing power. This scale allows the company to negotiate favorable terms, especially for more commoditized inputs. However, for highly specialized bio-based or chemical intermediates critical to Croda's advanced formulations, supplier concentration can increase their influence.

The availability of substitute inputs and Croda's ability to reformulate products are key factors in limiting supplier power. By investing in R&D, Croda actively seeks alternative raw materials, reducing dependence on traditional sources and mitigating the impact of price fluctuations, such as those seen in petrochemical feedstocks during 2023.

| Factor | Impact on Supplier Bargaining Power | Croda's Position |

|---|---|---|

| Supplier Concentration (Niche Ingredients) | Can be High | Moderate; mitigated by R&D and diversification |

| Switching Costs for Croda's Customers | Lowers Customer Bargaining Power, Indirectly Affects Supplier Power | High; customers are locked into Croda's specialized solutions |

| Croda's Purchasing Volume | Lowers Supplier Bargaining Power | Significant; £1.94 billion revenue in 2023 |

| Availability of Substitutes/Reformulation | Lowers Supplier Bargaining Power | Strong; driven by innovation and sustainability focus |

| Threat of Forward Integration by Suppliers | Low | High; Croda's R&D (£116 million in 2023) and customer intimacy are barriers |

What is included in the product

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Croda International's specialty chemicals market.

Instantly assess competitive pressures and identify strategic opportunities within the specialty chemicals market.

Gain a clear, actionable understanding of Croda's competitive landscape to inform strategic planning and risk mitigation.

Customers Bargaining Power

Croda International's customer base is diverse, spanning personal care, health, crop care, and industrial sectors. This broad reach, from global giants to smaller regional businesses, generally dilutes individual customer power. For instance, in 2023, Croda reported revenue of £1.6 billion, distributed across these varied markets, indicating no single customer segment, let alone a single customer, dominates their sales.

However, large, high-volume customers, particularly in sectors like consumer goods or pharmaceuticals, can still exert some influence due to their significant purchasing power. While specific customer concentration figures aren't publicly detailed, the sheer scale of some of these clients means their purchasing decisions can impact Croda's pricing and product development strategies.

Croda's strategy to cultivate deeper relationships with local and regional customers further aims to mitigate the bargaining power of very large, concentrated clients. By fostering a more distributed customer network, the company can reduce reliance on any single entity.

Croda's specialty ingredients are frequently mission-critical for its customers, meaning they are essential for the final product's performance and desired claims, such as anti-aging properties or sustainability credentials. Despite often representing a small percentage of a customer's total product cost, their vital role significantly reduces price sensitivity. For instance, in the personal care sector, where Croda has a strong presence, ingredient costs can be a minor component of a finished product's retail price, but their impact on efficacy is paramount.

Customers face substantial switching costs when changing specialty ingredient suppliers. These costs include the expense and time involved in reformulating products, conducting rigorous re-testing, obtaining necessary regulatory approvals, and the potential for significant disruption to their existing production processes. For instance, a change in a key ingredient for a cosmetic or pharmaceutical product can necessitate months of validation and regulatory hurdles.

Croda's direct selling model and its emphasis on collaborative innovation further solidify customer relationships, effectively raising these switching barriers. By working closely with clients on product development and offering tailored solutions, Croda embeds itself deeply into their supply chains and R&D efforts. This integration makes it considerably more challenging for customers to transition to alternative suppliers without incurring substantial costs and risking product continuity.

Customer Price Sensitivity

Customer price sensitivity for Croda International is a nuanced factor. While some customers might be more attuned to price, especially for less specialized products or when managing inventory levels, the inherent value and high performance of many Croda ingredients often reduce this pressure. For instance, in the personal care sector, where Croda has a strong presence, consumers often prioritize efficacy and specific benefits over minor price differences for premium formulations.

Croda's strategic focus on innovation and product differentiation plays a crucial role in managing customer price sensitivity. By offering unique, high-performance ingredients that provide distinct advantages in end-products, Croda is able to capture value through superior product offerings rather than engaging in price-based competition. This strategy is evident in their consistent investment in research and development, which aims to create patented technologies and specialized solutions that are difficult for competitors to replicate.

- Innovation-driven value capture: Croda's R&D spending, which has historically been a significant percentage of revenue, supports its ability to develop differentiated products that command premium pricing.

- Critical ingredient nature: Many of Croda's ingredients are essential components in high-value applications, such as pharmaceuticals and advanced materials, where performance and reliability outweigh price considerations.

- Market segmentation: The company strategically targets markets and applications where its specialized ingredients offer clear performance advantages, thereby reducing direct price comparisons with commodity chemicals.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly concerning the threat of backward integration, is a key consideration for Croda International. For large, sophisticated customers, there's a theoretical possibility they could produce their own specialty ingredients. However, the reality is that the substantial capital outlay, specialized research and development know-how, and intricate manufacturing involved in Croda's high-performance chemistry make this a generally low threat.

Customers usually find it more advantageous to concentrate on their primary strengths, which lie in manufacturing and marketing their finished products. This strategic focus allows them to leverage their existing expertise rather than investing heavily in complex chemical production, which is Croda's core business.

For instance, in the personal care sector, a major customer might be a large cosmetics brand. While they possess significant market power, the specialized nature of ingredients like Croda's patented emulsifiers or conditioning agents requires dedicated R&D and manufacturing facilities that are outside their typical operational scope. The cost and complexity of replicating such specialized chemistry often outweigh the potential benefits of backward integration.

In 2023, Croda reported strong performance in its Personal Care segment, underscoring the continued reliance of major brands on its innovative ingredient solutions. This demonstrates that, despite theoretical possibilities, the practical barriers to backward integration remain a significant deterrent for most of Croda's customer base.

Croda International generally faces moderate customer bargaining power, largely due to the specialized and often mission-critical nature of its ingredients. While large customers can exert some influence, high switching costs and Croda's innovation-driven strategy significantly mitigate this power. The threat of backward integration is also low, as customers typically focus on their core competencies rather than investing in complex chemical production.

Croda's customer base is diverse, with no single customer dominating sales, as evidenced by its £1.6 billion revenue in 2023 spread across multiple sectors. However, large-volume buyers in sectors like consumer goods can still wield influence. For example, a major personal care brand relying on Croda's patented emulsifiers faces high reformulation costs if they switch suppliers.

The critical role of Croda's ingredients in end-product performance reduces customer price sensitivity. For instance, in the personal care market, where Croda has a strong presence, the cost of an ingredient is often a small fraction of the final product's retail price, but its impact on efficacy is paramount.

Switching costs for Croda's customers are substantial, encompassing reformulation, re-testing, and regulatory approvals, often taking months to complete. This deep integration, coupled with collaborative innovation, makes it difficult and costly for customers to change suppliers.

Preview the Actual Deliverable

Croda International Porter's Five Forces Analysis

This preview showcases the complete Croda International Porter's Five Forces Analysis, offering a detailed examination of competitive intensity and industry attractiveness. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no surprises and immediate usability for your strategic planning needs.

Rivalry Among Competitors

Competitive rivalry in the global specialty chemicals market is quite strong. The market isn't dominated by just a few big companies; instead, there are many players, both large international ones and smaller regional ones. This means companies like Croda have to constantly fight for their piece of the market.

Croda International faces significant competition from established global players such as Ashland, BASF, Evonik, DSM-Firmenich, Johnson Matthey, Elementis, and Victrex. This diverse group of competitors, each with their own strengths and market focus, intensifies the pressure on Croda to innovate and maintain its competitive edge.

The fragmented nature of the specialty chemicals industry, with its numerous participants, directly translates into a highly competitive environment. Companies are continually vying for market share through product development, pricing strategies, and customer relationships, making it crucial for Croda to stay agile and responsive.

In the specialty chemicals sector, competition is fierce and largely driven by a company's ability to differentiate its products and consistently innovate. Croda International excels here by focusing on research and development to carve out unique market and technology niches. This commitment to 'smart science' is central to their strategy.

Croda’s emphasis on innovation allows them to develop high-performance ingredients that stand out. For instance, in 2023, their investment in R&D reached £143.2 million, a testament to their dedication to staying ahead. This investment fuels their ability to create solutions that meet evolving customer needs, particularly in areas like sustainability and advanced materials.

The global specialty chemicals market is poised for significant expansion, with projected compound annual growth rates (CAGR) between 3.2% and 6.7% from 2024 through 2034. This upward trend, fueled by increasing demand for advanced and eco-friendly products across various sectors, naturally intensifies rivalry as companies compete for a larger share of this growing market.

Exit Barriers

High capital intensity in the specialty chemicals sector, a key area for Croda International, presents substantial exit barriers. Companies invest heavily in specialized manufacturing facilities and research and development, making it difficult and costly to divest or repurpose these assets. For instance, many specialty chemical plants are designed for specific production processes, limiting their utility elsewhere.

Furthermore, long-term customer contracts are common in this industry, locking companies into ongoing commitments. Breaking these agreements can incur penalties, further increasing the cost of exiting. This contractual entrenchment means that even struggling firms might continue operations to fulfill obligations, rather than face immediate financial repercussions.

These significant exit barriers can foster prolonged periods of intense competition. Unprofitable companies may choose to persist in the market, absorbing losses rather than bearing the high costs associated with shutting down or selling off specialized operations. This dynamic contributes directly to sustained rivalry within the specialty chemicals landscape.

In 2024, the global specialty chemicals market continued to see investment in advanced manufacturing, underscoring the capital-intensive nature of the industry. Companies like Croda often focus on niche markets requiring unique formulations and production capabilities, which inherently raises the cost and complexity of exiting these segments.

- High Capital Intensity: Significant investments in specialized plant and equipment create substantial financial commitment.

- Specialized Assets: Manufacturing facilities are often tailored to specific chemical processes, reducing resale value or alternative use.

- Long-Term Contracts: Customer agreements can impose penalties for early termination, making exit financially punitive.

- Sustained Rivalry: These barriers encourage less profitable firms to remain operational, intensifying competition.

Strategic Focus and Sustainability

Competitive rivalry at Croda International is increasingly shaped by sustainability. The market is rapidly prioritizing eco-friendly and bio-based alternatives, making a company's environmental, social, and governance (ESG) performance a key differentiator. Croda's proactive stance, evidenced by its ambitious targets for emission reductions and a growing portfolio of bio-based products, places it favorably in this evolving landscape. For instance, by 2023, Croda reported that 68% of its innovation projects had sustainability benefits, a testament to its strategic alignment with market demands.

Companies that don't pivot their offerings to meet these sustainability expectations face a tangible risk of losing ground. The demand for greener chemicals is not a niche trend but a fundamental shift. In 2024, the global bio-based chemicals market is projected to reach significant figures, indicating the scale of this transition. Croda's investment in sustainable innovation, including its 'Smart Science to Improve Lives' strategy, directly addresses this competitive pressure.

The intensity of competition is therefore amplified by the need to demonstrate genuine commitment to sustainability. Croda's progress, such as increasing its use of renewable electricity and developing biodegradable ingredients, directly impacts its competitive standing. Those lagging in these areas may find their value propositions becoming less attractive to customers and investors alike.

- Sustainability as a Competitive Driver: Competition is increasingly won or lost based on a company's commitment to eco-friendly and bio-based solutions.

- Croda's Strategic Alignment: Croda's strong focus on sustainability, with clear targets for emission reduction and a growing bio-based product pipeline, enhances its competitive position.

- Market Shift and Risk: Failure to adapt value propositions to align with sustainability trends poses a significant risk of market share erosion for competitors.

- Data Point: In 2023, Croda highlighted that 68% of its innovation projects delivered sustainability benefits, showcasing its strategic integration of ESG principles.

Competitive rivalry in the specialty chemicals sector is intense, driven by numerous global and regional players. Croda International competes with established companies like BASF, Evonik, and DSM-Firmenich, necessitating continuous innovation and differentiation. The market's fragmented nature means companies must actively vie for market share through superior product development, strategic pricing, and strong customer relationships.

Croda's strategic focus on innovation, backed by substantial R&D investment, is crucial for maintaining its competitive edge. In 2023, the company invested £143.2 million in research and development, aiming to create unique, high-performance ingredients that cater to evolving market demands, particularly in sustainability and advanced materials.

The specialty chemicals market is experiencing robust growth, with projected CAGRs of 3.2% to 6.7% between 2024 and 2034. This expansion, fueled by demand for eco-friendly products, heightens competition as companies strive to capture a larger share of this expanding market.

Sustainability is a major differentiator in the specialty chemicals market, pushing companies to develop eco-friendly and bio-based alternatives. Croda's commitment to sustainability, including emission reduction targets and a growing portfolio of bio-based products, positions it well. In 2023, 68% of Croda's innovation projects had sustainability benefits, reflecting its strategic alignment with market trends.

| Key Competitors | R&D Investment (2023) | Sustainability Focus |

| BASF | Not specified | High |

| Evonik | Not specified | High |

| DSM-Firmenich | Not specified | High |

| Croda International | £143.2 million | 68% of innovation projects had sustainability benefits in 2023 |

SSubstitutes Threaten

The threat of substitutes for Croda International is primarily driven by customers' ability to find alternative ingredients or reformulate their products to achieve comparable performance without relying on Croda's specialized chemistry. For instance, in the personal care sector, while Croda's emollients and surfactants offer unique sensory profiles, advancements in plant-based or bio-derived alternatives could emerge, potentially reducing reliance on Croda's patented formulations.

While Croda's ingredients are often highly differentiated, offering distinct performance benefits, the constant evolution in material science and chemical engineering presents a continuous threat. For example, breakthroughs in biodegradable polymers or novel encapsulation technologies from competitors could offer viable substitutes for Croda's specialty ingredients, impacting market share.

Customers closely examine substitutes by weighing their performance capabilities against their price points. If alternative ingredients, perhaps less specialized or more budget-friendly, can achieve satisfactory results, customers may indeed consider switching their suppliers.

However, for Croda's specialized, high-performance ingredients, the significant performance advantages often justify the higher cost. This means that cheaper, but less effective, substitutes become less appealing to customers who prioritize superior outcomes.

For instance, in the personal care sector, while a basic surfactant might be cheaper, Croda's advanced emulsifiers offer superior texture and stability, which customers are willing to pay a premium for, especially in premium product formulations.

The threat of substitutes for Croda International is significantly mitigated by high customer switching costs. These costs encompass the extensive processes of re-formulating products, conducting rigorous re-testing, and navigating complex regulatory re-approval procedures. For instance, in the personal care sector, a shift away from a Croda ingredient could necessitate months of development and validation, impacting time-to-market and incurring substantial R&D expenses.

Regulatory and Sustainability-Driven Substitutes

Increasing regulatory pressure and a growing consumer push for sustainability are significant drivers for substitution. This trend could see alternatives, even those not directly chemically equivalent, gain traction if they offer a more environmentally friendly profile. For instance, in 2024, the global market for bio-based chemicals was projected to reach $100 billion, highlighting the substantial shift towards greener alternatives.

Croda is proactively addressing this threat by heavily investing in and promoting its sustainable and bio-based product lines. Their strategy aims to position Croda as the go-to supplier for these emerging needs, thereby mitigating the risk of being bypassed by alternative solutions. In 2023, Croda reported that 58% of its sales were from sustainability-driven solutions, demonstrating tangible progress in this area.

- Regulatory Shifts: Evolving environmental regulations, such as those concerning single-use plastics or carbon emissions, can favor substitute materials.

- Consumer Demand: A rising preference for eco-friendly products directly encourages the adoption of bio-based or biodegradable alternatives across various industries.

- Croda's Response: The company's focus on sustainable innovation, including its extensive portfolio of renewable ingredients, aims to preemptively meet these market demands.

- Market Opportunity: By leading in sustainable solutions, Croda can capture market share from competitors less equipped to adapt to these changing preferences.

Innovation Cycle in Downstream Industries

Innovation within Croda's downstream customer industries, such as personal care and pharmaceuticals, presents a threat of substitutes. For instance, advancements in formulation science might lead to products requiring fewer of Croda's specialty chemicals or favoring entirely different ingredient types. This dynamic was evident in 2024 as the personal care market saw increased demand for water-based formulations, potentially reducing reliance on certain oil-based emollients where Croda has a strong presence.

Croda actively combats this threat through a strategy of collaborative innovation with its clients. By working closely with customers on their product development pipelines, Croda ensures its specialty ingredients are not just current solutions but are also integral to emerging product trends. This proactive approach helps maintain the relevance of Croda's portfolio, as demonstrated by their investment in sustainable and bio-based ingredients, aligning with the growing consumer preference for eco-friendly products seen throughout 2024.

- Customer Collaboration: Croda's direct engagement with clients on R&D projects mitigates the risk of being sidelined by substitute innovations.

- Market Trend Alignment: By anticipating and adapting to shifts like the demand for sustainable ingredients, Croda positions its offerings as preferred solutions.

- Diversified Portfolio: A broad range of specialty chemicals across various end-markets reduces the impact of substitution in any single sector.

The threat of substitutes for Croda is moderate, influenced by the availability of alternative ingredients and customer willingness to reformulate. While Croda's specialty chemicals offer distinct performance advantages, often justifying higher costs, the growing demand for sustainability and potential regulatory shifts could favor bio-based or biodegradable alternatives. For example, the global bio-based chemicals market was projected to reach $100 billion in 2024, indicating a strong market pull for greener options.

Croda actively counters this threat by investing heavily in sustainable and bio-based product lines, aiming to be a leader in these emerging needs. In 2023, 58% of Croda's sales were already from sustainability-driven solutions, demonstrating a strategic pivot to mitigate substitution risks.

| Factor | Impact on Croda | Mitigation Strategy |

|---|---|---|

| Alternative Ingredients | Moderate threat, especially if performance parity is achieved at lower cost. | Focus on high-performance differentiation and premium pricing. |

| Sustainability Trends | Growing threat, favoring bio-based and biodegradable alternatives. | Proactive investment and promotion of sustainable product lines. |

| Customer Switching Costs | High, due to reformulation, testing, and regulatory hurdles. | Maintain strong customer relationships and collaborative R&D. |

Entrants Threaten

Entering the specialty chemicals sector, especially for advanced ingredients like those Croda International produces, demands significant capital. Think millions, if not billions, for state-of-the-art manufacturing plants, cutting-edge research and development facilities, and highly specialized machinery.

For instance, establishing a new, competitive production capacity in this field can easily run into hundreds of millions of dollars. This substantial financial barrier makes it incredibly difficult for newcomers to even begin, let alone compete effectively with established players like Croda.

Croda International's robust intellectual property, built on a legacy of innovation and a commitment to 'smart science', presents a significant hurdle for potential new entrants. This proprietary technology, encompassing patents and trade secrets for specialized chemical formulations and manufacturing processes, makes it exceedingly challenging for newcomers to replicate Croda's distinctive products without substantial R&D expenditure and the risk of legal disputes.

The specialty chemicals sector faces significant regulatory hurdles, acting as a strong deterrent for new entrants. For instance, in 2024, companies seeking to operate in the European Union must comply with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, which involve extensive data submission and can cost millions of euros per substance.

Navigating these complex and costly compliance processes, including obtaining numerous certifications and adhering to strict environmental standards across different regions, presents a substantial barrier. The United States' TSCA (Toxic Substances Control Act) also imposes rigorous requirements, with new chemical substances undergoing a review process that can delay market entry and increase initial investment significantly.

Established Customer Relationships and Distribution Channels

Croda benefits from deep, long-standing relationships with its diverse customer base, built through direct sales, technical support, and collaborative innovation. For instance, in 2023, Croda reported strong customer retention rates across its key sectors, underscoring the stickiness of these partnerships.

Establishing such trust and market access, especially in mission-critical applications like specialty chemicals for pharmaceuticals and personal care, is time-consuming and challenging for new entrants. The significant investment required for regulatory approvals and product qualification further erects barriers.

The existing distribution networks are also well-entrenched, providing Croda with efficient market penetration and logistical advantages that new competitors would struggle to replicate quickly. This established infrastructure is a significant deterrent.

- Established Customer Relationships: Croda's long-standing partnerships, evidenced by consistent revenue growth from repeat business in 2023, make it difficult for new players to gain traction.

- Technical Support and Innovation: The company's commitment to collaborative innovation and technical support creates high switching costs for customers, deterring new entrants.

- Distribution Network Advantage: Croda's established and efficient distribution channels provide a significant competitive edge that new entrants would find challenging and costly to build.

- Mission-Critical Applications: The nature of Croda's products in sensitive industries requires extensive qualification and trust, acting as a substantial barrier to entry for newcomers.

Economies of Scale and Experience Curve

Existing players like Croda International leverage significant economies of scale in their operations. This includes cost advantages in raw material procurement, large-scale manufacturing processes, and substantial investment in research and development, making it difficult for new entrants to match their cost structures. For instance, in 2023, Croda reported revenue of £1.59 billion, demonstrating the scale of its established business.

The experience curve is another formidable barrier. Decades of accumulated knowledge in specialized chemistry, refining production processes, and understanding intricate market demands give incumbents like Croda a distinct edge. This deep-seated expertise translates into operational efficiencies and product innovation that are challenging for newcomers to replicate quickly.

- Economies of Scale: Croda's large production volumes and global supply chain allow for lower per-unit costs compared to smaller, emerging competitors.

- Experience Curve Benefits: Years of refining chemical formulations and manufacturing techniques lead to higher product quality and more efficient production for established players.

- R&D Investment: Significant and consistent investment in research and development by incumbents like Croda creates a pipeline of innovative products that new entrants may struggle to fund or match.

The threat of new entrants in the specialty chemicals sector, where Croda International operates, is generally low due to substantial barriers. High capital requirements for advanced manufacturing and R&D, estimated in the hundreds of millions of dollars, deter many potential competitors. Furthermore, Croda's strong intellectual property portfolio and established, trusted customer relationships, built over years of providing technical support and innovation, create significant hurdles for newcomers aiming to gain market share.

Regulatory compliance, such as REACH in Europe and TSCA in the US, adds considerable cost and time to market entry, with compliance for a single substance potentially costing millions of euros. Croda's established distribution networks and the mission-critical nature of its products in sensitive industries like pharmaceuticals and personal care necessitate extensive qualification and trust, making it difficult for new players to penetrate the market. Economies of scale and the experience curve also provide incumbents with cost and efficiency advantages that new entrants struggle to match, as evidenced by Croda's 2023 revenue of £1.59 billion.

| Barrier Type | Description | Impact on New Entrants | Example for Croda |

|---|---|---|---|

| Capital Requirements | High investment needed for advanced manufacturing and R&D facilities. | Significant financial hurdle, requiring hundreds of millions of dollars. | Establishing new, competitive production capacity. |

| Intellectual Property | Proprietary technology, patents, and trade secrets. | Makes replication difficult and costly, risking legal disputes. | Croda's specialized chemical formulations and manufacturing processes. |

| Regulatory Compliance | Adherence to stringent chemical regulations (e.g., REACH, TSCA). | Adds millions in costs and delays market entry. | Navigating complex data submission and certification processes. |

| Customer Relationships & Trust | Long-standing partnerships and deep market understanding. | High switching costs and difficulty gaining initial customer trust. | Croda's strong customer retention in key sectors (2023 data). |

| Economies of Scale & Experience | Cost advantages from large-scale production and accumulated knowledge. | New entrants struggle to match cost structures and operational efficiencies. | Croda's £1.59 billion revenue in 2023 reflects its operational scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Croda International is built upon a foundation of robust data, including Croda's annual reports and investor presentations, as well as industry-specific market research from firms like IBISWorld and Statista.

We also incorporate insights from financial databases such as S&P Capital IQ and Bloomberg, alongside regulatory filings and relevant trade publications to ensure a comprehensive understanding of the competitive landscape.