Croda International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Croda International Bundle

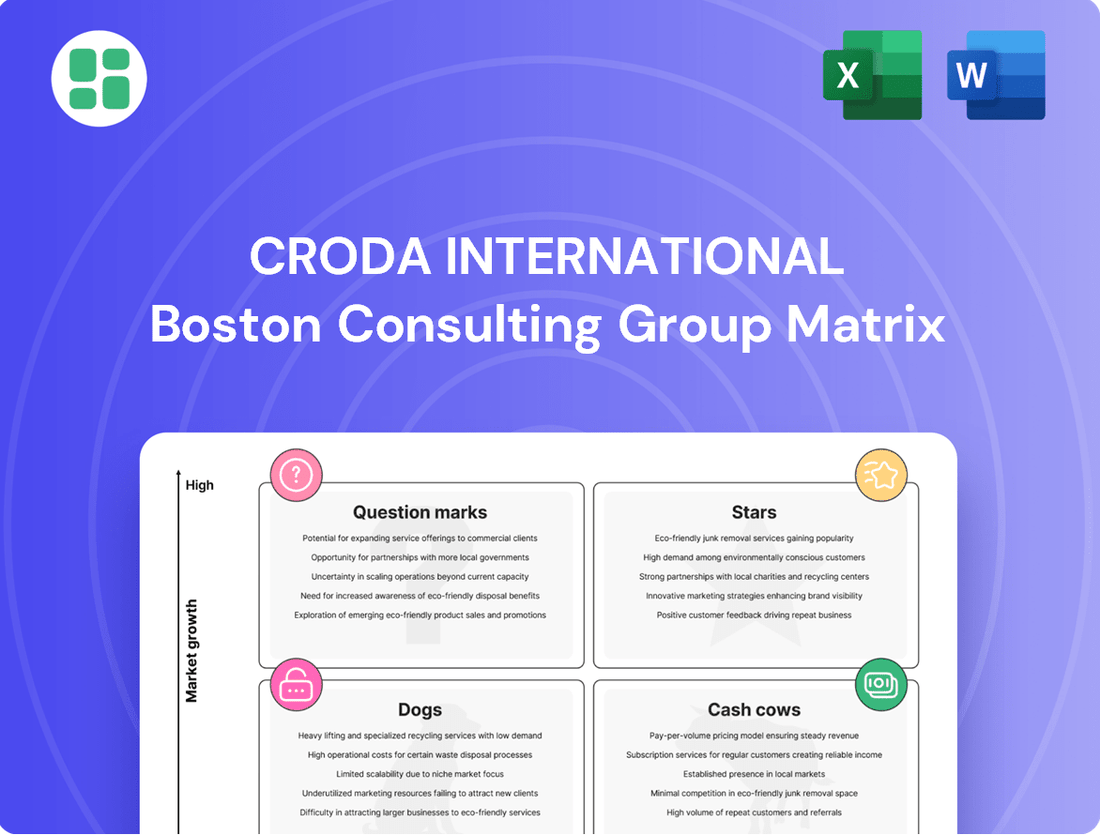

Curious about Croda International's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas, but to truly understand their market position and future potential, you need the full picture. Dive deeper into which products are their Stars, Cash Cows, Dogs, or Question Marks. Purchase the complete BCG Matrix for a comprehensive breakdown and actionable strategic insights that will empower your decision-making.

Stars

Croda's Life Sciences segment, focusing on biopharma and drug delivery systems, is a significant growth engine. This area, particularly lipids crucial for nucleic acid-based therapies, is experiencing robust expansion. Innovation pipelines are deepening, with numerous new drugs advancing through clinical trials.

The potential commercialization of new vaccines by 2025 or 2026 further fuels this segment's prospects. Croda's investment in this high-growth sector positions it to capitalize on the increasing demand for advanced drug delivery solutions.

The Fragrances and Flavours (F&F) segment within Croda International's Consumer Care division is a standout performer. In the first half of 2025, it achieved an impressive 17% growth in constant currency, significantly outpacing its respective markets. This robust expansion is attributed to the business's strong relationships with rapidly growing local and regional clients and its consistent track record of product innovation.

Croda's strategic emphasis on sustainable and biotech-derived ingredients, exemplified by innovations like KeraBio™ K31 in their Beauty Care segment, places them squarely in high-growth, high-demand market niches. These advanced ingredients, including novel ceramides, directly tap into the burgeoning consumer preference for natural and eco-friendly product formulations. This focus is a key driver for their positioning within the BCG matrix.

New and Protected Products (NPP)

New and Protected Products (NPP) are a critical component of Croda International's growth strategy, reflecting their commitment to innovation. In the first half of 2025, NPP sales accounted for a significant 33% of total sales, underscoring their importance to the company's revenue streams. This segment is expected to be a future star due to its inherent demand for ongoing innovation and its substantial contribution to overall sales.

Despite a modest overall NPP growth of 3% in H1 2025, the strategic weight of these products cannot be overstated. Their consistent sales performance and the inherent need for continuous development position them as a key driver for Croda's future market leadership and financial success.

- NPP Sales Contribution: NPP sales represented 33% of total sales in H1 2025.

- NPP Growth Rate: Overall NPP growth was 3% in H1 2025.

- Strategic Importance: NPPs are vital for Croda's innovation-driven growth strategy.

- Future Outlook: Their strategic importance and demand for innovation position them as future stars.

Asia Market Expansion (Consumer Care)

Croda's strategic investments in Asia are yielding impressive results, particularly within its Consumer Care segment. Sales in key markets like China, India, and South Korea have seen substantial increases, underscoring the region's growing demand for Croda's innovative solutions.

This rapid growth in Asia reflects strong market penetration and highlights the significant potential for further expansion. For instance, in 2024, Croda reported robust double-digit growth in its Asia-Pacific Consumer Care business, driven by new product launches and increased market share.

- Asia Consumer Care Sales Growth: Croda's Consumer Care division experienced a significant uplift in sales across China, India, and South Korea in 2024.

- Market Adoption: The strong performance indicates successful market adoption of Croda's product portfolio in these rapidly developing economies.

- Expansion Potential: The region presents a substantial opportunity for continued growth and increased market penetration for Croda's consumer care offerings.

- Investment Returns: Croda's targeted investments in Asia are clearly demonstrating a strong return, fueling future expansion strategies.

Croda's Life Sciences segment, particularly its lipids for nucleic acid therapies, is a significant growth engine, with potential new vaccine commercializations by 2025-2026 boosting prospects. The Fragrances and Flavours business achieved 17% constant currency growth in H1 2025, outperforming its markets due to strong client relationships and innovation. New and Protected Products (NPP), representing 33% of H1 2025 sales, are strategically vital for future growth, despite a modest 3% expansion in the same period.

| Business Segment | H1 2025 Growth (Constant Currency) | Key Drivers | BCG Classification |

|---|---|---|---|

| Life Sciences (Biopharma) | High Growth | Nucleic acid therapies, vaccine potential | Star |

| Fragrances & Flavours | 17% | Client relationships, product innovation | Star |

| New & Protected Products (NPP) | 3% | Innovation pipeline, 33% of total sales | Potential Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Our Croda International BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positioning to alleviate strategic uncertainty.

Cash Cows

Croda's established Beauty Care portfolio represents a significant Cash Cow within its Consumer Care division. Despite some recent price and mix challenges, this segment continues to hold a strong market position, demonstrating resilience and consistent volume delivery.

The enduring strength of this portfolio is underpinned by deeply entrenched relationships with a diverse base of local and regional customers. These established partnerships ensure a steady demand for Croda's beauty care ingredients, contributing reliably to the company's overall performance.

In 2024, the Beauty Care segment, as a key component of Consumer Care, continues to be a vital contributor. While specific financial breakdowns for individual product lines within Beauty Care are not publicly detailed, Croda's overall Consumer Care segment reported robust performance, with underlying sales growth driven by its specialty ingredients.

Croda's core crop protection ingredients, despite market fluctuations and inventory adjustments, represent a stable revenue stream. This segment benefits from established products that maintain consistent demand, acting as a reliable foundation for the company.

The company has observed a positive trend in this business, with performance improvements anticipated in the latter half of 2024 and extending into the first half of 2025. This recovery underscores the resilience and enduring value of Croda's established crop protection offerings.

Croda's Industrial Specialties segment acts as a cash cow, leveraging optimized utilization of shared manufacturing sites. This division focuses on maximizing sales of existing chemistries into high-value industrial applications, contributing significantly to overall operational efficiency.

In the first half of 2025, Industrial Specialties demonstrated robust sales growth. While projections indicate a broadly flat performance for the remainder of the year, the segment is expected to maintain its stability, continuing its role as a reliable revenue generator for Croda.

Home Care Ingredients

Croda International's Home Care ingredients, a key component of its Consumer Care division, are performing exceptionally well. This segment is experiencing robust growth, fueled by a rising consumer preference for ingredients that are not only sustainable but also deliver high performance.

The Home Care business consistently generates significant cash flow, a testament to its strong market position and the efficient utilization of Croda's established infrastructure. This reliable cash generation allows for reinvestment in other business areas or distribution to shareholders.

- Strong Growth Driver: The Home Care segment within Consumer Care has seen substantial growth, outpacing many other sectors.

- Sustainability & Performance Focus: Demand is high for ingredients that meet both eco-friendly criteria and offer superior functionality.

- Cash Flow Generation: This business unit acts as a significant cash cow, supporting the company's overall financial health.

- Market Leverage: Croda's existing market presence and infrastructure enable this segment to maximize its profitability and cash generation potential.

Mature Pharma Applications (non-COVID lipids)

Croda's mature pharmaceutical applications, excluding the fluctuating COVID-19 lipid business, represent a strong Cash Cow. These established product lines, built on years of formulation expertise, provide a consistent and reliable revenue stream for the company.

The stability of these non-COVID pharmaceutical ingredients is crucial for Croda's financial health. They require minimal additional investment to maintain their market position, allowing the company to generate significant cash flow from these mature segments.

- Stable Revenue Base: These mature applications consistently contribute to Croda's top line, offering predictability in earnings.

- Low Investment Needs: As established products, they do not necessitate substantial capital expenditure for growth or maintenance.

- Profitability: Their long-standing market presence and optimized production processes typically lead to healthy profit margins.

Croda's Beauty Care portfolio, a significant Cash Cow, continues to demonstrate resilience despite some market challenges. This segment benefits from strong customer relationships and consistent volume delivery.

The Home Care ingredients business is a standout performer, experiencing robust growth driven by consumer demand for sustainable and high-performance products. This unit reliably generates substantial cash flow, supporting the company's overall financial stability.

Established pharmaceutical applications, excluding the COVID-19 lipid business, represent another key Cash Cow. These mature product lines require minimal investment, ensuring consistent revenue streams and healthy profit margins.

Croda's core crop protection ingredients, while subject to market adjustments, provide a stable revenue base. The company anticipates performance improvements in this segment, reinforcing its role as a reliable contributor.

Industrial Specialties leverages optimized manufacturing to maximize sales of existing chemistries. This segment offers stability, contributing reliably to Croda's revenue generation.

| Segment | BCG Category | Key Characteristics | 2024/2025 Outlook |

|---|---|---|---|

| Beauty Care | Cash Cow | Strong market position, loyal customer base, consistent volume | Resilient, steady contributor |

| Home Care | Cash Cow | High growth, sustainability focus, strong cash generation | Robust growth expected |

| Pharmaceutical Applications (non-COVID) | Cash Cow | Mature products, low investment needs, stable revenue | Consistent, predictable earnings |

| Crop Protection | Cash Cow | Established products, stable demand, market resilience | Anticipated performance improvement |

| Industrial Specialties | Cash Cow | Optimized manufacturing, high-value applications, operational efficiency | Stable, reliable revenue generator |

Full Transparency, Always

Croda International BCG Matrix

The preview of the Croda International BCG Matrix you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional and ready-to-use strategic tool. You can confidently use this preview to assess the quality and relevance of the analysis for your business needs. Once purchased, this comprehensive BCG Matrix report will be immediately available for your strategic planning and decision-making processes.

Dogs

Legacy Industrial Applications, characterized by low growth, represent segments within Croda International that may not align with the company's strategic emphasis on high-performance and sustainable solutions. These areas typically exhibit modest market expansion and present limited opportunities for substantial market share increases.

For instance, certain established industrial chemical applications, if they lack differentiation or are not integrated into Croda's forward-looking sustainability initiatives, could be categorized here. In 2023, Croda's overall revenue was £1.57 billion, with its Performance Technologies and Industrial Specialties sectors showing varying growth profiles, highlighting the importance of strategic alignment.

Certain consumer health products within Croda International's Life Sciences segment are experiencing a downturn, marked by reduced demand and ongoing inventory adjustments by customers. This situation is particularly concerning for products with a low market share operating within stagnant market segments.

These underperforming products, if they fit the profile of low market share in a slow-growing or declining market, would likely be classified as Dogs in the BCG Matrix. For instance, if a specific niche within consumer health saw a market growth rate of only 1-2% in 2024, and Croda's product in that niche held less than a 10% share, it would strongly indicate a Dog status.

Commodity-like chemical products within Croda International's portfolio, if any, would be characterized by low differentiation and face fierce price competition. These products typically reside in slow-growing markets and would likely exhibit low market share, resulting in minimal returns for the company.

Croda's overarching strategy is to steer clear of such commoditized segments. However, it's possible that some legacy products or those operating in highly mature end-markets might still fall into this category, despite the company's focus on specialty chemicals. For instance, in 2023, Croda's Performance Technologies sector, which includes some more mature product lines, saw revenue growth of around 2% compared to the prior year, indicating a more stable but less dynamic market.

Divested/Non-Core Businesses

Divested or non-core businesses in Croda International's portfolio would typically be categorized as Dogs in a BCG Matrix analysis. This signifies assets that generate low revenue and low market share, often requiring significant investment to maintain or improve their position, or are simply no longer strategic to the company's core operations. Croda's active acquisition strategy, as seen with the acquisition of Solvay's High Performance Polymers business in 2023 for €1.4 billion, suggests a focus on strengthening core areas. Any divestitures would therefore signal a deliberate move to streamline the business and enhance overall profitability by shedding underperforming or non-strategic units.

For instance, if Croda were to divest a legacy chemical division that has seen declining demand and faces intense competition, this segment would likely be classified as a Dog. Such a move allows Croda to reallocate capital and management attention towards its more promising growth areas, like specialty ingredients for consumer care and life sciences, which are key components of its Smart Materials and Life Sciences segments. In 2023, Croda reported a 13% decrease in Consumer Care sales to £558.7 million, partly due to destocking, indicating potential areas that might be reviewed for strategic fit.

- Divestiture Rationale: Exiting low-growth, low-margin businesses to improve overall portfolio focus and profitability.

- Strategic Alignment: Divestments signal a commitment to concentrating resources on core, high-potential growth areas.

- Financial Impact: Shedding non-core assets can free up capital and management bandwidth for more lucrative investments.

- Example Scenario: A legacy chemical division with declining demand and high competitive pressure would be a prime candidate for divestiture and classification as a Dog.

Products with Declining Price/Mix

Within Croda International's BCG Matrix, products experiencing a decline in price/mix often represent businesses that have become cash cows, but are now facing increased competition or market saturation. These segments might include certain specialty chemicals or ingredients where Croda has strategically lowered prices to defend market share, particularly in product lines that cater to more price-sensitive segments of the Beauty Care or Agriculture markets. This approach can be seen as a tactic to prevent further erosion of volume in the face of intense competitive pressure.

For instance, in 2024, some of Croda's legacy product lines in personal care ingredients, which historically commanded premium pricing due to their innovative formulations, may have seen price adjustments. This is often a response to the emergence of more cost-effective alternatives or a shift in consumer demand towards value-oriented products. The company's ability to manage this transition effectively, by optimizing production costs and focusing on maintaining high quality even with reduced margins, is crucial for these 'dog' or 'cash cow' segments.

- Price Reduction Strategy: Croda may selectively reduce prices in mature product categories to maintain market share against competitors.

- Competitive Pressure: Increased competition, especially at the lower price points of product portfolios, can necessitate price adjustments.

- Portfolio Management: Products in Beauty Care and Agriculture segments are examples where such price/mix declines have been observed, indicating a need for careful portfolio management.

- Market Dynamics: These declining segments often represent mature markets where innovation has slowed, leading to commoditization and price sensitivity.

Products classified as Dogs in Croda International's portfolio represent business units with low market share in slow-growing or declining industries. These segments typically offer minimal returns and require careful strategic consideration, often leading to divestment or a strategic decision to phase them out. For example, if a legacy industrial chemical product line experienced a market growth rate of less than 2% in 2024 and Croda's share within that niche was below 10%, it would strongly suggest a Dog classification.

Croda's strategic focus on high-performance and sustainable solutions means that such Dog categories are actively managed, often through divestiture. In 2023, Croda's revenue was £1.57 billion, and the company's ongoing acquisition strategy, such as the purchase of Solvay's High Performance Polymers business, underscores a commitment to strengthening core, high-growth areas by shedding underperforming units.

These underperforming segments, whether in legacy industrial applications or certain consumer health niches facing reduced demand, are prime candidates for divestment. Croda's 2023 performance, with a notable 13% decrease in Consumer Care sales, highlights areas that might be reviewed for strategic fit and potential divestiture, freeing up capital for more promising ventures.

The rationale behind classifying and potentially divesting these Dog segments is to improve overall portfolio focus and profitability. By shedding non-core assets, Croda can reallocate resources and management attention towards its more dynamic growth areas, such as specialty ingredients for consumer care and life sciences, thereby enhancing overall organizational performance.

Question Marks

Croda International's acquisition of Solus Biotech in 2023 was a strategic move to bolster its personal care ingredients, specifically with Solus Biotech's advanced ceramide technology. This acquisition represents a significant, albeit recent, investment into a high-growth potential area.

While ceramide sales have seen a substantial increase, this growth stems from a relatively low initial base. This positions Solus Biotech's ceramide business within Croda's BCG Matrix as a potential Question Mark, requiring continued investment to capture a larger market share and transition into a Star performer.

Croda's lipid delivery systems are positioned to capitalize on the burgeoning RNA therapeutics market, which saw significant investment and development throughout 2024. The global RNA therapeutics market is projected to reach tens of billions of dollars in the coming years, driven by advancements in mRNA vaccines and gene editing technologies.

While the potential is immense, the ultimate market share and profitability for Croda's specific delivery systems are still in their nascent stages of development. This places them in a question mark category within the BCG matrix, indicating high growth potential but also significant uncertainty regarding future returns.

New biotech-derived innovations, like Croda's KeraBio™ K31, a biomimetic bond builder, showcase significant technological advancement. These cutting-edge ingredients are in their early stages, demanding considerable investment and market development to capture substantial market share.

Strategic Investments in New Manufacturing Capacity

Croda's substantial investment in scaling up its pharmaceutical manufacturing capacity positions these ventures as Stars within the BCG matrix. This strategic move signals a strong belief in the future demand and profitability of its pharmaceutical ingredients business. For instance, Croda has been actively expanding its capabilities in high-purity excipients and active pharmaceutical ingredients (APIs), areas that typically command premium pricing and offer robust growth potential.

Until this newly built capacity is fully operational and generating the anticipated revenue streams, these high-investment, high-potential areas function as Stars. The significant capital expenditure on new facilities, such as those announced for advanced intermediates, requires substantial ongoing investment to maintain and optimize. This aligns with the characteristics of a Star, which demands significant investment to sustain its growth and market share.

- Pharmaceutical Capacity Expansion: Croda's commitment to increasing its manufacturing footprint in the pharmaceutical sector, a key growth driver.

- High Investment, High Potential: These scaled-up operations require considerable capital outlay but are expected to yield significant future returns.

- Star Classification: Until full utilization and expected returns are realized, these segments are categorized as Stars due to their strong market growth prospects and competitive positioning.

- Market Dynamics: The pharmaceutical industry's consistent demand for specialized ingredients and Croda's focus on innovation support the Star classification.

Personalization Technologies in Consumer Care/Pharma

The increasing demand for personalized solutions in consumer care and pharmaceuticals is a significant growth driver. In pharmaceuticals, this translates to targeted therapies and precision medicine, while consumer care sees a rise in bespoke cosmetic and skincare formulations. Croda's strategic positioning in these nascent, high-potential markets is crucial for future expansion.

Croda's investment in developing ingredients for personalized medicine and tailored consumer products places it in a strong position within the BCG matrix, likely as a question mark. This segment requires substantial R&D and marketing investment to achieve market penetration and establish leadership. For example, the global personalized medicine market was valued at approximately USD 577.5 billion in 2023 and is projected to grow significantly.

- Targeted Therapies: Development of excipients and delivery systems for precision pharmaceuticals.

- Customized Formulations: Supplying specialized ingredients for bespoke skincare and cosmetic products.

- R&D Investment: Significant capital allocation required to innovate and gain market share in these specialized areas.

- Market Penetration: Focus on building brand recognition and distribution channels for personalized solutions.

Croda's ventures into emerging, high-growth sectors like personalized medicine and advanced biotech ingredients, while promising, currently represent Question Marks on the BCG matrix. These areas demand substantial ongoing investment and market development to solidify their positions and achieve widespread adoption.

The company's strategic acquisitions and R&D efforts in these nascent fields, such as Solus Biotech's ceramide technology and innovations in RNA therapeutics delivery, highlight their potential but also their current uncertainty. For example, the personalized medicine market was valued at approximately USD 577.5 billion in 2023, indicating a substantial growth runway for related Croda offerings.

As these segments mature, they require continued capital allocation to scale production, enhance market penetration, and overcome competitive challenges. Success in these areas will determine their transition from Question Marks to potential Stars or Cash Cows in the future.

Croda's investment in biomimetic bond builders like KeraBio™ K31 also falls into this category, requiring significant market education and adoption efforts to realize their full potential.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Market Context/Data |

|---|---|---|---|

| Solus Biotech Ceramides | Question Mark | High growth potential, low current market share, requires significant investment. | Acquired in 2023; sales increasing from a low base, focusing on market penetration. |

| RNA Therapeutics Delivery Systems | Question Mark | Nascent market, high R&D investment, uncertain future returns. | Global RNA therapeutics market projected for significant growth; Croda investing in lipid systems. |

| Personalized Medicine Ingredients | Question Mark | High investment in R&D and marketing, focused on niche, high-growth markets. | Global personalized medicine market valued at ~USD 577.5 billion in 2023; demand for tailored solutions. |

| Biomimetic Bond Builders (e.g., KeraBio™ K31) | Question Mark | Early stage innovation, requires market development and significant investment. | Represents technological advancement in hair care, needs market adoption. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from Croda's annual reports, investor presentations, and market research firms to analyze product performance and market share.