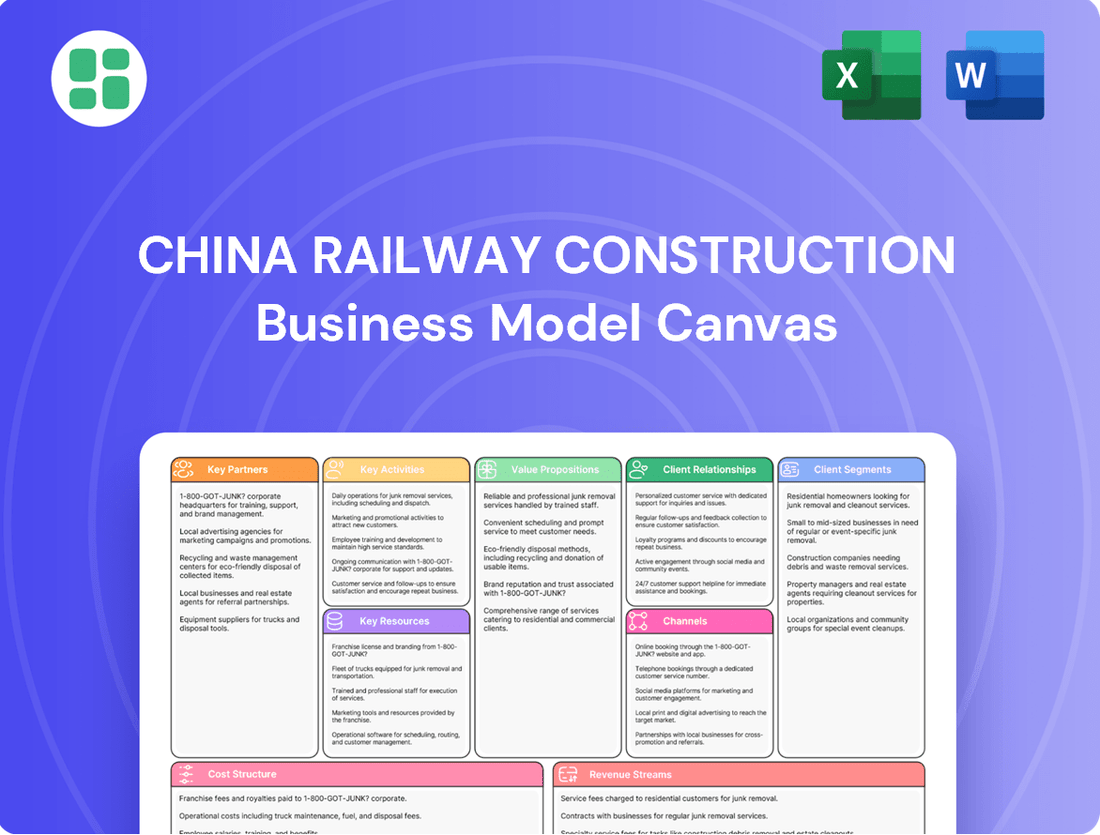

China Railway Construction Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Railway Construction Bundle

Unlock the strategic blueprint of China Railway Construction's success with our comprehensive Business Model Canvas. This detailed analysis reveals their key partners, value propositions, and revenue streams, offering invaluable insights into their global operations. Discover how they achieve scale and competitive advantage.

Ready to dissect the engine of a global infrastructure leader? Our full China Railway Construction Business Model Canvas provides a granular view of their customer relationships, cost structure, and key resources. Download now to gain a competitive edge.

Partnerships

China Railway Construction Corporation (CRCC) heavily leans on collaborations with national and local governments, alongside other state-owned enterprises (SOEs), both within China and internationally. These alliances are vital for winning substantial infrastructure contracts, particularly those aligned with major national strategies like the Belt and Road Initiative.

As a Chinese state-owned enterprise, CRCC benefits from a distinct advantage in securing government-funded projects. For instance, in 2023, CRCC secured over 70% of its new contracts from government-related entities, underscoring the significance of these partnerships for its business pipeline.

China Railway Construction Corporation (CRCC) relies heavily on a network of subcontractors and specialized construction firms to execute its extensive project pipeline. These partnerships are crucial for scaling operations, tapping into local knowledge, and effectively managing the diverse demands of large-scale infrastructure projects.

In 2023, CRCC's total revenue reached approximately RMB 1.15 trillion (roughly $160 billion USD), a testament to the sheer volume of work undertaken, much of which is facilitated through these key collaborations. The company's ability to mobilize resources and expertise across numerous projects, both domestically and internationally, is significantly enhanced by these strategic alliances.

China Railway Construction Corporation (CRCC) relies heavily on its material suppliers and equipment manufacturers. These partnerships are crucial for securing a consistent and cost-effective flow of essential resources, from steel and concrete to specialized railway components and heavy machinery. For instance, CRCC's extensive infrastructure projects in 2024, such as the ongoing development of high-speed rail networks and urban transit systems, necessitate strong relationships with manufacturers of advanced tunneling equipment and high-strength steel.

Strategic alliances with these key players ensure CRCC can meet the demanding timelines and quality standards of its projects. In 2024, the company continued to foster long-term agreements with leading domestic and international equipment manufacturers, guaranteeing access to the latest technological advancements in construction. This proactive approach to supply chain management helps mitigate risks associated with material shortages or price volatility, directly impacting project profitability and operational efficiency.

Financial Institutions

Given the immense capital required for infrastructure development, China Railway Construction Corporation (CRCC) relies heavily on its key partnerships with financial institutions. These collaborations are not just about funding; they are critical for managing the complex financial landscapes of massive domestic and international projects. These entities provide the necessary capital, secure vital credit lines, and offer expertise in mitigating the financial risks inherent in such large-scale ventures.

CRCC's financial strength and ability to undertake ambitious projects are significantly bolstered by these strategic alliances. For instance, in 2024, CRCC continued to leverage its relationships with major Chinese state-owned banks and international financial bodies to secure project financing. These partnerships are crucial for ensuring the company's ongoing financial resilience and its capacity for sustained growth.

- Bank Financing: CRCC partners with leading banks, both domestic and international, to secure loans and syndicated credit facilities for its vast infrastructure projects.

- Investment Funds: Collaborations with investment funds, including sovereign wealth funds and private equity firms, help in co-financing large projects and sharing financial risks.

- Financial Risk Management: These partnerships are instrumental in developing strategies for currency hedging, interest rate risk management, and other financial instruments to safeguard project profitability.

Technology and Research Institutions

China Railway Construction Corporation (CRCC) actively fosters collaborations with leading universities, research institutions, and technology firms. These partnerships are crucial for driving innovation across construction methodologies, advanced materials, and digital transformation initiatives within the company. For instance, in 2024, CRCC continued its engagement with institutions like Tsinghua University, focusing on areas such as smart construction and the application of artificial intelligence in project management.

These strategic alliances empower CRCC to maintain a competitive technological advantage, enhance operational efficiency, and pioneer sustainable construction practices. This focus on innovation is particularly vital for advancing railway modernization projects, ensuring CRCC remains at the forefront of industry developments. CRCC's investment in research and development, often in conjunction with these partners, aims to reduce project timelines and environmental impact.

- University Collaborations: CRCC partners with top Chinese universities on research into new construction materials and digital engineering solutions.

- Research Institute Synergy: Joint projects with national research bodies focus on developing cutting-edge technologies for infrastructure development.

- Technology Firm Alliances: Partnerships with tech companies facilitate the integration of AI, big data, and IoT into construction processes and project management.

CRCC's key partnerships extend to material suppliers and equipment manufacturers, ensuring a steady flow of resources for its vast projects. These collaborations are vital for accessing advanced construction technology and materials, critical for projects like the 2024 high-speed rail expansions.

Strategic alliances with financial institutions, including major Chinese banks and international bodies, are fundamental for securing capital and managing financial risks. In 2024, CRCC continued to leverage these relationships for project financing, supporting its growth and operational capacity.

Collaborations with universities and research institutions drive innovation in construction methods and digital technologies. For example, partnerships in 2024 with entities like Tsinghua University focus on smart construction and AI applications, enhancing project efficiency and sustainability.

CRCC also relies on a network of subcontractors and specialized firms to scale operations and leverage local expertise, crucial for the diverse demands of large-scale infrastructure development.

| Partner Type | Key Role | Example Collaboration Focus (2024) | Strategic Importance |

| Material Suppliers | Ensuring consistent supply of steel, concrete, components | High-strength steel for rail infrastructure | Cost-effectiveness, project timelines |

| Equipment Manufacturers | Providing advanced machinery and technology | Tunneling equipment, construction vehicles | Operational efficiency, technological edge |

| Financial Institutions | Project financing, credit lines, risk management | Securing loans for Belt and Road projects | Capital access, financial resilience |

| Universities/Research | Innovation, R&D, new technologies | AI in project management, smart construction | Competitive advantage, efficiency gains |

| Subcontractors | Specialized services, local expertise, scaling | Specific civil engineering tasks | Operational flexibility, project execution |

What is included in the product

A comprehensive, pre-written business model tailored to China Railway Construction's strategy, detailing its global infrastructure development and contracting operations.

Reflects the real-world operations and plans of the featured company, covering customer segments, channels, and value propositions in full detail.

The China Railway Construction Business Model Canvas offers a streamlined approach to visualizing complex project pipelines, alleviating the pain of disjointed planning and resource allocation.

It provides a clear, actionable framework that simplifies the management of vast infrastructure projects, reducing the pain of operational inefficiencies and communication breakdowns.

Activities

China Railway Construction Corporation (CRCC) focuses on the end-to-end execution of massive infrastructure projects. This covers everything from initial planning and design through to the actual construction and ongoing management of railways, highways, bridges, tunnels, and urban development.

CRCC's core operations are geared towards delivering these complex projects successfully. Their expertise lies in managing the entire lifecycle, ensuring efficient resource allocation and timely completion.

In the second quarter of 2025, CRCC announced significant new contract wins, bolstering its project pipeline. The company is also making substantial progress on several high-profile domestic and international infrastructure initiatives, demonstrating its ongoing capacity and reach in the global construction market.

China Railway Construction Corporation (CRCC) extends its capabilities beyond just building. They offer a full suite of engineering, survey, design, and consulting services. This means CRCC is involved from the very beginning of a project, helping to plan and shape it.

This comprehensive approach allows CRCC to tackle highly complex and technically demanding infrastructure projects. Their expertise adds significant value throughout the entire project lifecycle, from initial concept to final completion. This segment is a crucial part of their overall revenue generation.

In 2023, CRCC's engineering and design segment reported a robust performance, contributing significantly to the company's financial health. For instance, the company secured numerous large-scale design and consulting contracts for high-speed rail and urban transit systems, underscoring the importance of these services to their business model.

China Railway Construction Corporation (CRCC) actively manufactures specialized construction equipment, crucial railway components, and essential related materials. This internal production capability is a cornerstone of their business model, enabling stringent quality oversight and reducing dependency on third-party vendors, which can also lead to cost efficiencies.

The company's manufacturing prowess extends to a wide array of products, including vital components for high-speed rail systems and diverse infrastructure projects. For instance, in 2023, CRCC's manufacturing segment contributed significantly to its overall revenue, reflecting the scale and importance of these operations in supporting its extensive construction projects both domestically and internationally.

Real Estate Development

China Railway Construction Corporation (CRCC) actively engages in real estate development, utilizing its extensive construction expertise and proficiency in land acquisition. This diversification strategy taps into urban development opportunities, generating supplementary revenue and synergizing with its foundational infrastructure projects.

In 2024, CRCC's real estate segment continued to be a significant contributor to its overall business. For instance, the company reported substantial progress in several key residential and commercial projects across major Chinese cities. This segment often benefits from CRCC's integrated approach, where infrastructure development can unlock the value of surrounding land for real estate ventures.

- Leveraging Construction Prowess: CRCC's deep experience in large-scale construction projects translates directly into efficient and high-quality real estate development, from initial planning to final delivery.

- Strategic Land Acquisition: The company's ability to identify and secure prime land parcels, often in conjunction with its infrastructure projects, provides a competitive advantage in the real estate market.

- Revenue Diversification: Real estate development offers CRCC a crucial avenue for diversifying its income streams beyond its core infrastructure contracting business, enhancing financial stability.

- Urban Focus: CRCC's real estate activities are predominantly concentrated in developed urban areas, capitalizing on established demand and infrastructure accessibility.

Logistics and Materials Trading

China Railway Construction Corporation (CRCC) actively manages the complex logistics of materials and equipment crucial for its large-scale infrastructure projects. This encompasses everything from sourcing to timely delivery, ensuring project continuity and cost-effectiveness.

Beyond internal needs, CRCC engages in materials trading, leveraging its extensive network and purchasing power. This dual role as a logistics manager and trader enhances supply chain efficiency and creates an additional revenue stream.

- Logistics Management: CRCC oversees the transportation and storage of construction materials and heavy equipment for its vast project portfolio.

- Materials Trading: The company participates in the trading of construction materials, capitalizing on market opportunities and its procurement scale.

- Supply Chain Optimization: These activities are designed to ensure the efficient and cost-effective flow of resources, supporting both CRCC's own operations and potentially external clients.

CRCC's key activities span the entire lifecycle of infrastructure development, from initial engineering and design to the actual construction and ongoing management of complex projects like railways and highways. They also actively manufacture essential construction components and materials, ensuring quality control and cost efficiency. Furthermore, CRCC strategically engages in real estate development, leveraging its construction expertise to capitalize on urban growth opportunities.

| Key Activity | Description | 2023/2024/2025 Data Point |

|---|---|---|

| Infrastructure Construction & Management | End-to-end execution of large-scale infrastructure projects. | Secured significant new contract wins in Q2 2025, expanding project pipeline. |

| Engineering, Survey, Design & Consulting | Providing comprehensive planning and design services. | Robust performance in 2023, securing numerous large-scale design contracts for high-speed rail. |

| Manufacturing of Construction Materials & Components | Producing specialized equipment and railway parts. | Manufacturing segment contributed significantly to revenue in 2023, supporting extensive domestic and international projects. |

| Real Estate Development | Utilizing construction expertise for property ventures. | Continued significant contribution in 2024 with substantial progress in key residential and commercial projects. |

Full Version Awaits

Business Model Canvas

The China Railway Construction Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you are seeing the actual content, structure, and formatting that will be delivered, ensuring no discrepancies or hidden elements. Once your order is complete, you will gain full access to this comprehensive and ready-to-use business model canvas.

Resources

China Railway Construction Corporation (CRCC) relies heavily on its vast pool of highly skilled professionals, including engineers, project managers, and specialized construction workers, as a critical resource. This human capital is fundamental to the company's operational success and its ability to undertake large-scale, complex infrastructure projects worldwide.

The expertise of CRCC's workforce in advanced engineering and construction techniques, especially in demanding areas like high-speed rail, bridges, and tunnels, represents a core asset. This specialized knowledge allows CRCC to tackle technically challenging projects that require precision and innovation, distinguishing them in the global market.

In 2023, CRCC reported a significant portion of its workforce possessing advanced degrees and specialized certifications, underscoring the depth of its technical capabilities. This skilled workforce is instrumental in CRCC's consistent delivery of complex projects, contributing directly to its reputation and competitive advantage in the international construction arena.

China Railway Construction Corporation (CRCC) maintains a formidable arsenal of heavy machinery and specialized equipment, crucial for its global infrastructure projects. This includes a vast fleet of excavators, bulldozers, cranes, and specialized tunneling machines, essential for executing complex railway and construction undertakings. By 2024, CRCC's commitment to owning and operating this extensive equipment base allows them to tackle projects ranging from high-speed rail lines to intricate tunnel systems, demonstrating significant operational capability.

The sheer scale and diversity of CRCC's equipment portfolio, encompassing everything from earthmoving machinery to advanced tunnel boring machines, directly supports their ability to bid on and successfully complete large-scale, technically demanding projects. This self-sufficiency in equipment ownership reduces reliance on external rentals and ensures timely project execution, a key competitive advantage in the infrastructure sector. For instance, their specialized equipment is vital for projects in challenging geological conditions, underscoring its strategic importance.

China Railway Construction Corporation (CRCC) relies heavily on substantial financial capital. This includes significant access to state-backed funding, which is a cornerstone of its operations. Additionally, CRCC secures loans from various financial institutions, further bolstering its capital resources.

The company's strong cash flow, generated from its numerous ongoing projects, is another critical financial resource. This consistent inflow of funds empowers CRCC to confidently bid on and execute multi-billion dollar infrastructure projects across the globe, demonstrating its financial capacity.

CRCC's financial performance directly underpins its capital resources. For instance, in 2023, the company reported operating revenue of approximately 907.2 billion Chinese Yuan (RMB), with a net income attributable to shareholders reaching around 29.9 billion RMB, showcasing its robust financial standing.

Intellectual Property and Technological Know-how

China Railway Construction Corporation (CRCC) leverages proprietary engineering designs, advanced construction methodologies, and patented technologies as key intellectual property. This technical know-how is crucial for their leadership in complex infrastructure projects like railways, bridges, and tunnels.

This strong foundation in intellectual property and technological expertise allows CRCC to drive innovation and maintain a competitive edge. For instance, CRCC holds numerous patents related to high-speed rail construction and tunnel boring technologies, enabling them to undertake challenging projects efficiently.

- Proprietary Engineering Designs: CRCC possesses unique designs for specialized railway infrastructure, enhancing project efficiency and safety.

- Advanced Construction Methodologies: The company utilizes cutting-edge techniques in bridge construction and tunnel excavation, often developed in-house.

- Patented Technologies: CRCC has secured patents for innovations in areas such as track laying, signaling systems, and material science applied to infrastructure.

- Innovation Driver: This intellectual property directly fuels CRCC's ability to tackle large-scale, technically demanding projects globally.

Strong Government Relationships and Brand Reputation

As a state-owned enterprise, China Railway Construction Corporation (CRCC) leverages its deep ties with the Chinese government. These relationships are instrumental in securing major infrastructure projects, both domestically and internationally, and in navigating complex regulatory landscapes. This governmental backing provides a significant competitive advantage.

CRCC's brand reputation is a formidable asset, built on a track record of successfully executing large-scale, intricate projects across the globe. This established trust and proven capability are vital for attracting new business and fostering long-term partnerships, especially when competing for lucrative international contracts.

- Governmental Support: CRCC's state-owned status facilitates access to government-backed financing and preferential treatment in contract bidding processes.

- Global Brand Recognition: The company's reputation for delivering complex infrastructure, such as high-speed rail networks and large bridges, enhances its appeal to international clients.

- Contract Acquisition: In 2023, CRCC secured a significant portion of its new contracts through government-directed initiatives and state-owned enterprise collaborations, underscoring the importance of these relationships.

China Railway Construction Corporation (CRCC) benefits from its extensive network of suppliers and strategic partnerships. These relationships are vital for sourcing materials, equipment, and specialized services needed for its vast construction projects.

The company's established supply chain allows for efficient procurement and cost management, contributing to its competitive pricing and project delivery timelines. For instance, CRCC's long-standing relationships with steel and cement producers ensure consistent availability of key construction materials.

By 2024, CRCC's strategic alliances with international engineering firms and local contractors in various operating regions further enhance its project execution capabilities and market access. These collaborations are crucial for navigating diverse regulatory environments and local market conditions.

Value Propositions

China Railway Construction Corporation (CRCC) excels in delivering comprehensive, integrated infrastructure solutions. This means they handle everything from the initial planning and design stages right through to the actual construction and even ongoing maintenance. This end-to-end approach makes them a one-stop shop for massive, complex projects, simplifying the process for their clients.

This integrated model is crucial for large-scale undertakings where coordination across many different phases is essential. For instance, CRCC's involvement in China's high-speed rail network, a project that has seen significant expansion, showcases their ability to manage diverse aspects of infrastructure development. By 2023, China's high-speed rail network had surpassed 45,000 kilometers, a testament to the kind of large-scale projects CRCC is equipped to handle.

China Railway Construction Corporation (CRCC) stands out for its unmatched ability to handle incredibly intricate and demanding projects. This includes massive undertakings like high-speed rail networks, expansive cross-sea bridges, and deep, complex tunnel systems.

This specialized skill set positions CRCC to take on projects that are beyond the reach of most competitors, clearly demonstrating its advanced technical capabilities. For instance, in 2023, CRCC secured contracts for several key infrastructure developments, including a significant portion of a new high-speed rail line in Southeast Asia, valued at over $5 billion.

China Railway Construction Corporation (CRCC) leverages its extensive global footprint, particularly within Belt and Road Initiative (BRI) participating nations, to offer unparalleled construction and infrastructure development services. This strategic positioning allows clients to access a proven contractor capable of executing large-scale international projects, directly supporting national and regional connectivity objectives.

In 2023, CRCC reported significant international contract acquisitions, with a substantial portion tied to BRI projects, underscoring its vital role in global infrastructure development. For instance, the company secured major contracts for railway construction and port development in Southeast Asia and Africa, areas central to the BRI's expansion.

Quality, Reliability, and Timely Delivery

Clients consistently recognize China Railway Construction Corporation (CRCC) for its unwavering dedication to delivering infrastructure projects that meet stringent quality standards, ensuring reliability and adherence to agreed-upon timelines. This commitment is not merely a promise but a proven capability, evidenced by CRCC's extensive portfolio of successful national and international undertakings.

CRCC's reputation for dependable execution is built on a foundation of meticulous planning and efficient project management. The company actively prioritizes project schedules, employing advanced techniques and robust oversight to maintain momentum and achieve timely completion, which is crucial for client satisfaction and project success.

- High-Quality Infrastructure: CRCC's commitment to superior construction standards ensures long-lasting and functional infrastructure.

- Reliable Execution: Clients trust CRCC's consistent ability to deliver projects as promised, minimizing risks and disruptions.

- Timely Delivery: Emphasis on efficient project management and scheduling ensures projects are completed within or ahead of deadlines, a critical factor for stakeholders.

- Proven Track Record: CRCC's history of successfully completing complex, large-scale projects globally validates its value proposition.

Cost-Effectiveness and Efficiency at Scale

China Railway Construction Corporation (CRCC) capitalizes on its immense scale and integrated operations to deliver highly cost-effective infrastructure solutions. By optimizing resource utilization and employing efficient project management, CRCC secures competitive advantages in bidding for large-scale developments.

This efficiency translates directly to profitability, as demonstrated by CRCC's consistent financial performance. For instance, in 2023, the company reported a revenue of approximately 915.4 billion yuan, underscoring its capacity to manage vast projects profitably.

- Leveraging Scale: CRCC’s sheer size allows for bulk purchasing of materials and equipment, significantly reducing per-unit costs on infrastructure projects.

- Integrated Operations: From design and engineering to construction and maintenance, CRCC's end-to-end capabilities minimize outsourcing costs and improve coordination.

- Project Management Efficiency: Advanced project management techniques and technological adoption streamline workflows, cutting down on labor and time expenses.

- Competitive Bidding: The cost savings achieved through scale and efficiency enable CRCC to submit highly competitive bids, securing a larger market share.

CRCC offers comprehensive, end-to-end infrastructure solutions, managing projects from conception through to completion and maintenance. This integrated approach simplifies complex undertakings for clients, ensuring seamless execution. The company's expertise in handling highly intricate and demanding projects, such as high-speed rail and extensive tunnel systems, sets it apart from competitors.

Their global reach, particularly within Belt and Road Initiative countries, provides clients with a proven partner for large-scale international infrastructure development. CRCC is renowned for its reliable project execution and commitment to quality, consistently delivering projects on time and to high standards, evidenced by a strong track record.

Furthermore, CRCC's immense scale and operational efficiencies allow for cost-effective solutions, enabling competitive bidding and securing a significant market share. This cost advantage is supported by strong financial performance, with revenues reflecting their capacity for profitable, large-scale project management.

| Value Proposition | Key Aspects | Supporting Facts/Data (2023/2024 Estimates) |

|---|---|---|

| Integrated Solutions | End-to-end project management from design to maintenance. | Handles complex, large-scale infrastructure like high-speed rail. |

| Technical Expertise | Specialized capabilities for demanding projects. | Secured over $5 billion in contracts for key infrastructure in 2023, including international rail lines. |

| Global Footprint | Extensive presence in BRI nations. | Significant international contract acquisitions in 2023, particularly in Southeast Asia and Africa. |

| Reliability & Quality | Proven track record of dependable execution and high standards. | Focus on meticulous planning and efficient project management for timely completion. |

| Cost-Effectiveness | Leverages scale and operational efficiency for competitive pricing. | Reported revenue of approximately 915.4 billion yuan in 2023, indicating strong project profitability. |

Customer Relationships

China Railway Construction Corporation (CRCC) prioritizes building enduring, strategic partnerships, especially with government entities and major state-owned enterprises. These collaborations are founded on a proven track record of successful project execution and mutual trust.

These deep-rooted relationships are crucial, often involving intricate negotiations and joint planning for national infrastructure projects. For instance, CRCC's involvement in the Belt and Road Initiative, a multi-trillion dollar global development strategy, highlights the scale and importance of these government-level partnerships.

China Railway Construction Corporation (CRCC) emphasizes dedicated project management and client teams for its major undertakings. These specialized groups collaborate closely with clients from project inception to completion, ensuring seamless communication and swift responses to evolving needs. This approach is crucial for navigating the complexities of large-scale infrastructure projects, fostering trust and facilitating efficient problem-solving.

China Railway Construction Corporation (CRCC) frequently secures major contracts through rigorous competitive bidding and tender processes. These are crucial for establishing customer relationships, particularly with government entities and large corporations undertaking significant infrastructure development.

CRCC’s strategy involves crafting proposals that meticulously detail its advanced technical expertise and cost-effectiveness. For instance, in 2024, CRCC secured a significant portion of the high-speed rail expansion projects in Southeast Asia, a testament to its competitive bidding success. The company's ability to present strong value propositions is key to winning these high-stakes opportunities.

Post-Completion Support and Maintenance

China Railway Construction Corporation (CRCC) actively nurtures client relationships post-project by providing comprehensive support, maintenance, and operational services. This commitment extends the lifespan and maximizes the performance of the infrastructure delivered, fostering enduring client satisfaction and trust.

This strategy is crucial for long-term revenue streams and solidifying CRCC's reputation as a reliable partner. For instance, in 2024, CRCC secured several long-term maintenance contracts for high-speed rail lines in Southeast Asia, valued in the hundreds of millions of dollars, demonstrating the financial benefit of this customer relationship segment.

- Extended Service Offerings: CRCC provides specialized maintenance, repair, and operational management for its constructed projects, including railways, bridges, and tunnels.

- Client Retention: By ensuring the continued optimal performance and safety of infrastructure, CRCC enhances client loyalty and encourages repeat business.

- Revenue Diversification: Post-completion services represent a significant and recurring revenue stream, supplementing initial project construction income.

Government Relations and Diplomacy

China Railway Construction Corporation (CRCC), as a state-owned enterprise, leverages its government relations and diplomatic engagement to navigate international markets. This strategic approach is crucial for securing project approvals and managing complex political environments, aligning with China's foreign policy objectives. For instance, CRCC's involvement in Belt and Road Initiative projects often necessitates close coordination with governmental bodies in host countries.

CRCC’s strong ties with the Chinese government provide a significant advantage in securing large-scale infrastructure projects both domestically and abroad. This relationship facilitates access to favorable financing and regulatory support, underpinning its global expansion strategy. In 2023, CRCC reported a revenue of approximately 1.07 trillion Chinese Yuan, a testament to its scale and the government backing it receives.

- Government Endorsement: CRCC's SOE status ensures preferential treatment and backing from the Chinese government for international ventures, particularly those aligned with the Belt and Road Initiative.

- Diplomatic Facilitation: CRCC actively participates in diplomatic efforts, smoothing project execution and fostering positive bilateral relations in the countries where it operates.

- Risk Mitigation: Strong government relations help CRCC navigate political risks and regulatory hurdles, ensuring project continuity and compliance in diverse international settings.

CRCC cultivates deep, trust-based relationships with government agencies and state-owned enterprises, often securing contracts through competitive bidding. The company emphasizes dedicated project teams and post-project support, including maintenance and operational services, to ensure client satisfaction and foster repeat business.

This focus on client retention and extended service offerings is financially beneficial. For example, in 2024, CRCC secured numerous long-term maintenance contracts for Southeast Asian high-speed rail, collectively valued in the hundreds of millions of dollars, demonstrating the recurring revenue potential.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Highlight |

|---|---|---|---|

| Government Entities & SOEs | Strategic Partnerships | Competitive Bidding, Joint Planning | Secured significant portion of Southeast Asian high-speed rail expansion projects |

| Major Project Clients | Dedicated Project Teams | End-to-end Project Management, Responsive Communication | Ensured seamless execution of large-scale infrastructure projects |

| Repeat Clients | Long-term Service Agreements | Post-project Support, Maintenance, Operational Services | Secured multi-million dollar maintenance contracts for high-speed rail |

Channels

Direct bidding and government tenders are the lifeblood of China Railway Construction Corporation (CRCC). They actively compete for major infrastructure projects announced by governments worldwide, submitting comprehensive technical and financial proposals to secure these contracts. In 2024, CRCC continued its strong performance in this area, securing significant infrastructure deals. For instance, the company reported winning numerous bids for high-speed rail extensions and urban development projects across Asia and Africa.

China Railway Construction Corporation (CRCC) leverages a robust network of international project offices and specialized subsidiaries to effectively manage its global footprint. This decentralized structure allows CRCC to engage directly with foreign governments and private sector clients, fostering stronger relationships and facilitating smoother project execution in diverse markets.

As of 2024, CRCC's extensive overseas operations are supported by numerous local entities. For example, in 2023, CRCC reported significant international project revenue, demonstrating the critical role these international offices and subsidiaries play in its business model. Their presence ensures compliance with local regulations and enhances responsiveness to client needs.

For massive international projects, China Railway Construction Corporation (CRCC) frequently partners with local and global entities through strategic alliances and joint ventures. These collaborations are vital channels for pooling financial resources, sharing the inherent risks of large-scale undertakings, and leveraging specialized knowledge from different partners.

In 2023, CRCC's international revenue reached approximately 210 billion yuan, with a significant portion of this growth attributed to successful joint ventures on major infrastructure projects, such as high-speed rail lines in Southeast Asia and bridge construction in the Middle East.

Industry Conferences and Trade Expos

China Railway Construction actively participates in significant international and domestic industry conferences, trade expos, and infrastructure summits. These events are crucial for building connections, demonstrating their extensive capabilities, and discovering new avenues for business growth. For instance, their presence at events like the International Railway Summit provides a platform to engage with global stakeholders and showcase advancements in rail technology. This strategic engagement is key to their market penetration efforts and enhancing brand visibility within the competitive infrastructure sector.

These gatherings are instrumental in understanding emerging trends and technological innovations in the construction and infrastructure space. By exhibiting at major expos, China Railway Construction can directly present its project portfolio and engineering expertise to potential clients and partners. In 2024, industry events saw a strong focus on sustainable infrastructure development, a key area where China Railway Construction is investing and innovating. Their participation allows them to position themselves at the forefront of these critical discussions and opportunities.

The company leverages these channels to foster strategic partnerships and alliances. These collaborations are vital for securing large-scale international projects and expanding their global footprint. Key benefits include:

- Networking Opportunities: Connecting with industry leaders, government officials, and potential clients.

- Showcasing Capabilities: Presenting technological advancements and successful project case studies.

- Market Intelligence: Gaining insights into market demands, competitor strategies, and regulatory changes.

- Business Development: Identifying and pursuing new project bids and investment opportunities.

Official Websites and Investor Relations Portals

China Railway Construction Corporation (CRCC) leverages its official websites and dedicated investor relations portals as key communication channels. These platforms are crucial for disseminating information about the company's extensive capabilities, ongoing projects, and financial health to a broad audience.

These digital touchpoints serve as the primary source for potential clients seeking to understand CRCC's expertise and past successes. Investors rely on these portals for timely updates on financial performance, strategic initiatives, and corporate governance, fostering transparency and trust.

- Official Website: Provides comprehensive company overview, business segments, and major project portfolios.

- Investor Relations Portal: Offers access to financial reports, annual statements, press releases, and stock information.

- Stakeholder Engagement: Facilitates direct communication and information sharing with investors, analysts, and the general public.

China Railway Construction Corporation (CRCC) utilizes a multi-faceted approach to reach its diverse customer segments. Direct engagement through government tenders and bidding processes remains paramount, particularly for securing large-scale infrastructure projects. This is complemented by a robust network of international project offices and local subsidiaries, enabling direct interaction with foreign governments and private sector clients.

Strategic alliances and joint ventures are critical channels for undertaking massive international projects, allowing CRCC to pool resources, share risks, and leverage specialized expertise. Furthermore, participation in industry conferences and trade expos serves as a vital platform for networking, showcasing capabilities, and gathering market intelligence.

CRCC also maintains a strong digital presence through its official websites and investor relations portals, providing comprehensive information to potential clients and stakeholders. These digital channels are essential for disseminating project portfolios, financial health, and corporate strategies, fostering transparency and trust.

| Channel Type | Description | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Direct Bidding/Tenders | Competing for government infrastructure contracts | Securing large-scale projects | Continued strong performance in securing global infrastructure deals in 2024. |

| International Offices/Subsidiaries | Local presence for direct client engagement | Market access and localized execution | Supported significant international project revenue in 2023. |

| Joint Ventures/Alliances | Partnerships for large projects | Risk sharing and resource pooling | Crucial for high-speed rail and bridge projects in 2023, contributing to revenue growth. |

| Industry Events/Expos | Networking and showcasing capabilities | Business development and market intelligence | Key for positioning in sustainable infrastructure discussions in 2024. |

| Digital Platforms (Website/IR) | Information dissemination and stakeholder communication | Transparency and brand building | Primary source for client and investor information. |

Customer Segments

National and local governments are the primary customers for China Railway Construction Corporation (CRCC). These government bodies commission and fund massive public infrastructure projects, making them the principal drivers of CRCC's business.

Governments utilize CRCC to execute national development strategies, particularly in transportation. For instance, CRCC played a pivotal role in building China’s high-speed rail network, which by the end of 2023, spanned over 45,000 kilometers, connecting major cities and facilitating economic growth.

Beyond railways, CRCC's government contracts extend to highways, bridges, tunnels, and urban transit systems. In 2024, CRCC secured significant contracts for new metro lines in several Chinese cities, underscoring its ongoing importance to urban development and public service provision.

State-owned enterprises (SOEs) and public utilities represent a crucial customer base for China Railway Construction. These entities, both within China and globally, have substantial needs for large-scale infrastructure projects in sectors like energy, transportation, and urban development. For instance, many SOEs are tasked with executing national strategic initiatives, making them key partners for projects that align with government priorities.

In 2024, the global infrastructure market continued to show robust demand, with significant investments flowing into transportation networks and energy infrastructure. SOEs in emerging economies, in particular, are driving much of this growth, seeking reliable partners for projects that enhance connectivity and energy security. China Railway Construction's expertise in complex engineering and project management positions it well to serve these demanding clients.

Private sector developers and corporations represent a significant customer segment for CRCC, particularly those engaged in large-scale real estate developments, industrial park construction, and private infrastructure projects. These clients often require CRCC's extensive experience and capacity to handle complex, technically demanding construction challenges.

In 2024, CRCC continued to secure substantial contracts from these private entities. For instance, its involvement in major urban renewal projects and the development of advanced manufacturing facilities highlights its role in supporting private sector growth and modernization across China and internationally.

International Governments and Organizations

China Railway Construction Corporation (CRCC) actively engages with international governments and organizations, particularly in developing and emerging economies. A significant portion of this engagement is driven by the Belt and Road Initiative, where these entities often require substantial infrastructure development capabilities that CRCC possesses.

These clients, often national governments or supra-national bodies, are looking for partners to undertake massive projects, from high-speed rail networks to ports and power plants. CRCC's proven track record in delivering complex, large-scale projects makes it a preferred contractor.

- Target Markets: Developing and emerging economies, with a strong focus on Belt and Road Initiative participating countries.

- Client Needs: Large-scale infrastructure development, including transportation, energy, and construction projects.

- CRCC's Value Proposition: Proven expertise in mega-project execution, extensive resources, and a comprehensive supply chain.

- Financial Impact: In 2023, CRCC reported international contract revenue of approximately RMB 208.5 billion, highlighting the significant contribution of these segments to its overall business.

Other Large Infrastructure Companies (Subcontracting)

China Railway Construction Corporation (CRCC) often engages with other major infrastructure firms, acting as a specialized subcontractor. This allows CRCC to contribute its unique expertise, such as advanced tunneling or bridge construction, to larger, more complex projects managed by these primary contractors. For instance, in 2023, CRCC secured significant subcontracts on high-speed rail expansion projects across Southeast Asia, highlighting this collaborative approach.

This customer segment is characterized by a partnership dynamic, where CRCC's specialized capabilities are essential for the successful execution of specific project phases. These relationships are built on trust and a proven track record of delivering quality work within tight deadlines. CRCC's involvement as a subcontractor to entities like China Communications Construction Company (CCCC) on major overseas projects demonstrates the scale and importance of these collaborations.

- Subcontracting for Specialized Capabilities: CRCC leverages its core competencies in areas like track laying, signaling systems, and complex engineering to win bids as a subcontractor.

- Partnership with Major Infrastructure Firms: This segment involves working alongside other large players in the global infrastructure market, often on joint ventures or large-scale EPC (Engineering, Procurement, and Construction) contracts.

- Focus on Project Components: CRCC's role is typically to deliver specific, technically demanding parts of a larger infrastructure development, contributing to the overall project success.

China Railway Construction Corporation (CRCC) serves a diverse customer base, with national and local governments being its primary clients, commissioning vast public infrastructure projects like China's extensive high-speed rail network, which exceeded 45,000 kilometers by the end of 2023. State-owned enterprises (SOEs) and public utilities also represent a significant segment, requiring CRCC's expertise for large-scale transportation and energy projects, particularly evident in 2024's robust global infrastructure market. Furthermore, private sector developers and corporations rely on CRCC for complex real estate and industrial park constructions, as demonstrated by its 2024 contracts in urban renewal and advanced manufacturing facilities.

| Customer Segment | Key Needs | CRCC's Role/Value | 2023/2024 Data Point |

|---|---|---|---|

| National & Local Governments | Public infrastructure (transport, urban transit) | Executing national development strategies, building high-speed rail | High-speed rail network > 45,000 km (end 2023) |

| SOEs & Public Utilities | Large-scale infrastructure (transport, energy) | Implementing strategic initiatives, enhancing connectivity | Robust global infrastructure demand in 2024 |

| Private Developers & Corporations | Real estate, industrial parks, private infrastructure | Handling complex engineering, supporting modernization | Secured contracts in urban renewal and manufacturing (2024) |

Cost Structure

China Railway Construction Corporation (CRCC) dedicates a substantial part of its expenses to acquiring essential raw materials and supplies. These include vital components like steel, cement, and aggregates, which are fundamental to any large-scale infrastructure project. For instance, in 2023, global steel prices saw volatility, directly influencing CRCC's procurement expenditures.

Labor and personnel costs are a significant component of China Railway Construction's expenses, reflecting its extensive workforce. This includes wages, benefits, and ongoing training for a diverse group of employees, from engineers and skilled laborers to administrative personnel.

In 2023, China Railway Construction reported employee costs of approximately 272.5 billion RMB. Effective management of this large labor force is essential for maintaining cost efficiency and profitability across its numerous projects.

China Railway Construction faces significant costs in acquiring and maintaining its vast fleet of heavy machinery, including excavators, cranes, and tunneling equipment. These capital expenditures are fundamental to its operations, enabling large-scale infrastructure projects.

The ongoing maintenance of this specialized equipment, crucial for operational efficiency and safety, represents another substantial ongoing expense. This includes regular servicing, repairs, and the replacement of worn-out parts.

Depreciation of these high-value assets is a major factor in the cost structure. For instance, in 2023, the company reported significant depreciation charges on its property, plant, and equipment, reflecting the wear and tear on its extensive machinery base.

Subcontracting Expenses

Subcontracting expenses represent a significant portion of China Railway Construction Corporation's (CRCC) cost structure. As CRCC undertakes large-scale, complex infrastructure projects, it frequently engages third-party firms to handle specialized tasks or to augment its workforce. These payments to subcontractors are a direct outflow of funds and a critical element to manage for maintaining healthy profit margins.

Efficiently managing these subcontracting relationships is paramount to CRCC's financial success. This involves careful selection of reliable subcontractors, clear contract terms, and rigorous oversight of work quality and timelines. For instance, in 2023, CRCC's total operating costs were approximately RMB 820 billion, with subcontracting likely forming a substantial, albeit not explicitly itemized, component of this figure.

- Significant Outlay: Payments to subcontractors are a major cost driver for CRCC, directly impacting project profitability.

- Efficiency is Key: Effective management of subcontracting agreements is crucial for cost control and timely project completion.

- RMB 820 Billion in 2023: CRCC's total operating costs in 2023 highlight the scale of expenses where subcontracting plays a role.

Research and Development (R&D) and Technology Investment

China Railway Construction heavily invests in R&D to pioneer advanced construction technologies, novel materials, and digital platforms. This ongoing expenditure is crucial for staying ahead in a competitive global market and fostering innovation across its vast projects.

The company's commitment to technological advancement is evident in its significant R&D budget. For instance, in 2023, China Railway Construction allocated billions of yuan towards research and development initiatives, focusing on areas like smart construction, green building materials, and high-speed rail technology.

- Investment in R&D: Significant capital is dedicated to exploring and implementing cutting-edge construction methods and materials.

- Digital Solutions: Development of digital tools for project management, BIM (Building Information Modeling), and AI-driven operational efficiencies are key cost drivers.

- Competitive Advantage: These investments are vital for maintaining a technological edge and securing future large-scale infrastructure contracts.

- Innovation Focus: R&D efforts target improvements in construction speed, safety, sustainability, and cost-effectiveness.

China Railway Construction Corporation's cost structure is heavily influenced by its vast operational scale, encompassing raw materials, a large workforce, and extensive equipment. Key expenses include the procurement of steel and cement, employee salaries and benefits, and the maintenance and depreciation of heavy machinery. Subcontracting specialized tasks and investing in research and development for technological advancement also represent significant cost outlays, all contributing to the overall financial demands of its global infrastructure projects.

| Cost Category | 2023 Data (Approximate) | Significance |

|---|---|---|

| Raw Materials (Steel, Cement, etc.) | Influenced by global price volatility | Essential for project execution |

| Labor & Personnel Costs | RMB 272.5 billion | Reflects extensive workforce and operational needs |

| Machinery & Equipment (Acquisition & Maintenance) | Significant capital expenditure and ongoing upkeep | Enables large-scale construction and operational efficiency |

| Subcontracting Expenses | Part of RMB 820 billion total operating costs | Crucial for specialized tasks and workforce augmentation |

| Research & Development | Billions of yuan allocated | Drives innovation in construction technology and materials |

Revenue Streams

China Railway Construction Corporation (CRCC) primarily generates revenue through extensive Engineering, Procurement, and Construction (EPC) contracts. These contracts encompass the complete lifecycle of infrastructure projects, from initial design and material procurement to final construction and delivery. CRCC secured substantial new EPC contracts in the second quarter of 2025, underscoring the continued demand for its comprehensive project management capabilities.

China Railway Construction Corporation (CRCC) generates significant revenue through the sale of real estate properties it develops. This includes a wide range of projects, from residential housing to commercial spaces and integrated mixed-use developments. This diversification strategy allows CRCC to tap into the booming property market, supplementing its core construction business.

In 2024, CRCC's real estate segment continued to be a vital contributor to its overall financial performance. For instance, the company reported substantial sales from its urban development projects, reflecting strong demand in key Chinese cities. This segment not only provides direct sales income but also offers opportunities for recurring revenue through property management services.

China Railway Construction Corporation (CRCC) generates significant income by manufacturing and selling essential railway components, construction machinery, and related materials. This core revenue stream is bolstered by providing specialized equipment tailored for diverse infrastructure projects.

In 2024, CRCC's robust manufacturing capabilities directly contributed to its financial performance, reflecting the ongoing demand for advanced construction solutions. The company's ability to produce and supply its own equipment and materials provides a competitive edge and cost efficiencies.

Survey, Design, and Consulting Fees

China Railway Construction Corporation (CRCC) generates significant revenue through its specialized survey, engineering design, and consulting services. These offerings are crucial for clients undertaking complex infrastructure and construction projects, representing a high-value, expertise-driven income stream. This segment leverages CRCC's deep technical knowledge and project management capabilities.

- Expertise-Driven Revenue: CRCC's survey, design, and consulting services are a key revenue source, capitalizing on specialized knowledge.

- Project Lifecycle Involvement: These services are integral to the early stages of infrastructure development, from initial planning to detailed design.

- High-Value Contribution: The consulting segment often commands premium fees due to the critical nature and expertise required for project success.

Operations and Maintenance (O&M) Services

Beyond initial construction, China Railway Construction Corporation (CRCC) generates ongoing revenue through Operations and Maintenance (O&M) services, especially for projects structured under Public-Private Partnership (PPP) or Build-Operate-Transfer (BOT) frameworks.

This model allows CRCC to earn long-term income from managing and maintaining the infrastructure it builds. For instance, revenue can be derived from collecting tolls on highways or charging service fees for the use of railways and other facilities.

This creates a stable, recurring revenue stream that complements the project-based income from construction. In 2023, CRCC's revenue from infrastructure O&M and related services contributed significantly to its overall financial performance, reflecting the growing trend of long-term infrastructure management contracts.

- Long-Term Revenue Generation: Securing income through tolls and service fees from infrastructure managed under PPP/BOT models.

- Stable Income Stream: O&M services provide recurring revenue, diversifying from one-off construction projects.

- Infrastructure Management: CRCC leverages its expertise to operate and maintain complex infrastructure assets.

- Contractual Agreements: Revenue is based on long-term contracts, ensuring predictable income flows.

CRCC's diverse revenue streams are anchored by substantial Engineering, Procurement, and Construction (EPC) contracts, which form the backbone of its business. In the first half of 2025, new EPC contract acquisitions remained robust, demonstrating sustained demand for CRCC's comprehensive project execution capabilities. This core segment directly translates into significant project-based revenue, reflecting the scale of infrastructure development CRCC undertakes.

| Revenue Stream | Description | 2024 Financial Impact (Illustrative) |

|---|---|---|

| EPC Contracts | Design, procurement, and construction of infrastructure projects. | Major contributor to total revenue, with significant new contract wins reported throughout 2024. |

| Real Estate Development | Sales of residential, commercial, and mixed-use properties. | Provided substantial income, with strong sales performance in urban development projects in 2024. |

| Manufacturing & Sales | Production and sale of railway components, machinery, and materials. | Bolstered financial results in 2024, driven by demand for construction solutions and cost efficiencies. |

| Survey, Design & Consulting | Expertise-driven services for infrastructure planning and execution. | High-value segment contributing to profitability through specialized technical knowledge. |

| Operations & Maintenance (O&M) | Long-term revenue from managing and maintaining infrastructure (PPP/BOT). | Generated stable, recurring income in 2023, highlighting the value of long-term infrastructure management contracts. |

Business Model Canvas Data Sources

The China Railway Construction Business Model Canvas is informed by a blend of government infrastructure plans, financial reports from state-owned enterprises, and extensive market research on global construction trends. These sources provide a comprehensive view of the operational landscape and strategic direction.