China Resources Power Holdings Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Power Holdings Co. Bundle

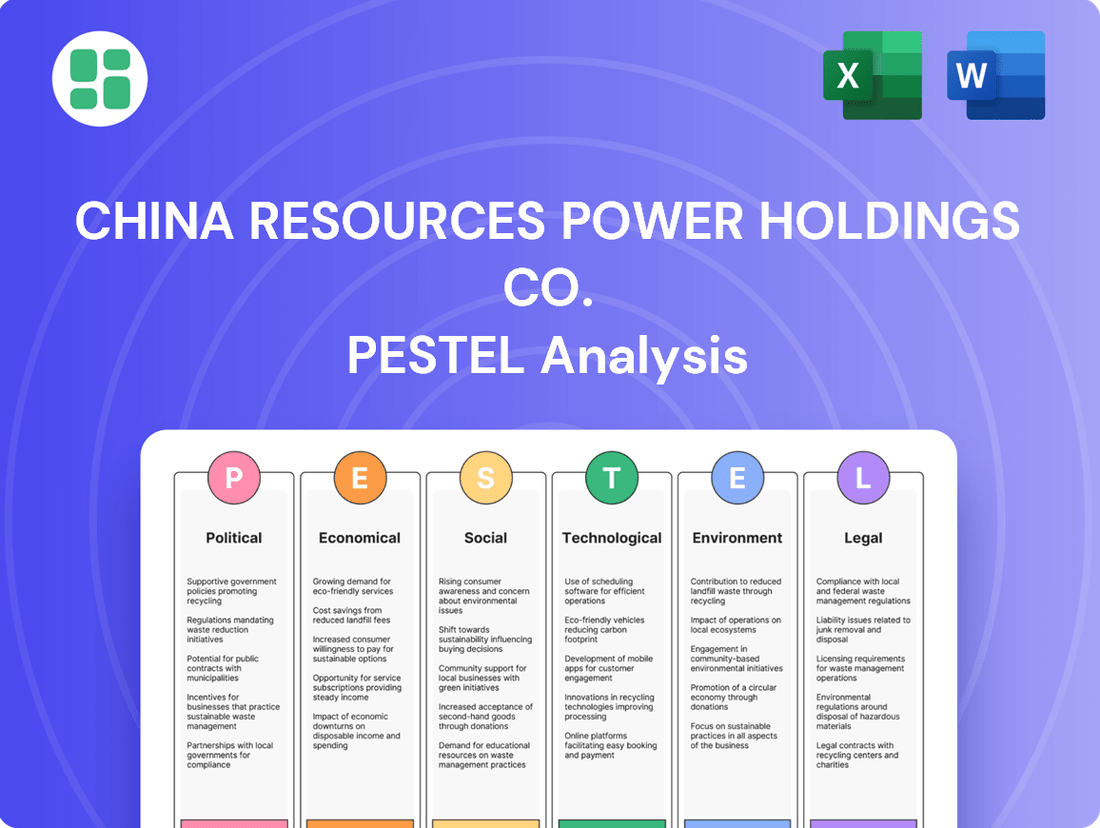

Discover the critical political, economic, social, technological, legal, and environmental factors shaping China Resources Power Holdings Co.'s trajectory. Our PESTLE analysis provides a comprehensive overview, highlighting key opportunities and challenges. Unlock actionable insights to inform your investment strategy and gain a competitive edge. Download the full report now.

Political factors

China's State Council unveiled an action plan for energy saving and carbon reduction covering 2024-2025, designed to speed up progress towards the energy efficiency goals set for the 14th Five-Year Plan (2021-2025). This initiative targets a 2.5% reduction in energy consumption and a 3.9% decrease in CO2 intensity for 2024, while also aiming for non-fossil energy sources to constitute 20% of the energy mix by 2025.

These governmental mandates significantly shape China Resources Power's investment strategies and operational priorities, driving a pronounced shift towards cleaner energy generation. The company's alignment with these policy objectives is crucial for its long-term growth and sustainability in the evolving energy landscape.

China Resources Power Holdings Co., Ltd. (CR Power) is deeply intertwined with the state's ownership structure, with China Resources Holdings holding a substantial 62.9% stake. This significant state backing offers a degree of stability and ensures strategic alignment with China's national energy development objectives, potentially facilitating access to key projects and financial resources.

However, CR Power's status as a state-owned enterprise (SOE) means it is directly influenced by government policies and any ongoing reforms within the broader SOE landscape. For instance, the ongoing push for SOE market-oriented reforms, aimed at improving efficiency and competitiveness, could lead to changes in governance or operational strategies that directly impact CR Power's business model and investment decisions.

China's unwavering focus on energy security, as codified in the Energy Law 2025, underscores a national drive for greater self-reliance and a robust defense against external vulnerabilities such as volatile global prices and geopolitical instability. This policy directly shapes China Resources Power's strategic direction, necessitating diversification of its energy portfolio to include sustained investment in domestic coal and a significant expansion of renewable energy sources, thereby guaranteeing supply continuity in an increasingly unpredictable international energy environment.

Shift in Carbon Control Mechanism

China is set to transition its primary decarbonization approach from controlling total energy consumption to managing both total carbon emissions and carbon intensity, a move slated for implementation during the 15th Five-Year Plan (2026-2030). This strategic pivot signifies a more direct focus on greenhouse gas reduction, impacting industries like power generation.

This policy evolution necessitates significant adjustments for China Resources Power. The company must refine its systems for monitoring, accounting for, and actively reducing carbon emissions. Such changes could directly influence the operational viability of its thermal power assets and accelerate the expansion of its renewable energy portfolio.

- Policy Shift: Transition from energy consumption control to carbon emissions and intensity control for the 2026-2030 period.

- Impact on Operations: Requires adaptation in emissions tracking and reduction strategies for thermal power.

- Renewable Energy Push: Encourages further development and integration of renewable energy sources.

- Data Requirement: China's national carbon emissions intensity decreased by approximately 55% between 2005 and 2022, indicating a trend towards stricter emission controls.

Market-Oriented Electricity Pricing Reforms

China's push for market-oriented electricity pricing reforms, effective June 1, 2025, for new wind and solar projects, signals a significant shift. This means on-grid prices will be determined by market forces rather than fixed tariffs, directly impacting companies like China Resources Power. The goal is to better align electricity costs with real-time supply and demand dynamics.

For China Resources Power, this transition presents both challenges and opportunities. The company, which has been steadily growing its renewable energy capacity, will need to adapt to a more competitive pricing environment. This could lead to greater price volatility for its wind and solar power generation.

- Market-Driven Pricing: New wind and solar projects starting June 1, 2025, will have their on-grid prices set by market mechanisms.

- Increased Competition: China Resources Power will face a more competitive landscape for its renewable energy sales.

- Price Volatility: Expect greater fluctuations in electricity prices as they respond to market supply and demand.

China's government is actively driving a green energy transition, with a 2024-2025 action plan targeting energy efficiency and a 20% share for non-fossil fuels by 2025. This policy shift from controlling energy consumption to managing carbon emissions and intensity, starting with the 15th Five-Year Plan (2026-2030), directly influences China Resources Power's investment in renewables and thermal power operations.

Market-oriented electricity pricing reforms, effective June 1, 2025, for new wind and solar projects, mean China Resources Power will navigate a more competitive environment with potentially greater price volatility for its renewable energy output.

| Policy Area | 2024-2025 Target | 2026-2030 Focus | Impact on CR Power |

|---|---|---|---|

| Energy Efficiency | 2.5% reduction in energy consumption | Continued focus on efficiency | Operational optimization |

| Renewable Energy Share | 20% of energy mix by 2025 | Growth expected to accelerate | Increased investment in renewables |

| Emissions Control | Focus on energy intensity | Shift to carbon emissions & intensity control | Adaptation of thermal assets, emissions tracking |

| Electricity Pricing | Existing tariffs | Market-driven pricing for new renewables (from June 1, 2025) | Increased competition, price volatility |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting China Resources Power Holdings Co., examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the company's operating landscape.

A PESTLE analysis of China Resources Power Holdings Co. provides clarity on external factors impacting the energy sector, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

Economic factors

China's economic expansion is a key driver for energy consumption. Electricity demand is anticipated to rise by approximately 6.5% in 2024, followed by a 6.2% increase in 2025.

This growth in electricity demand is fueled by several factors, including the increasing adoption of electric vehicles, the widespread use of air conditioning, and the expansion of manufacturing, especially in clean energy technologies.

This robust demand outlook offers a favorable environment for China Resources Power, particularly as the company continues to invest in and grow its clean energy generation capacity.

Despite China's commitment to renewable energy, coal continues to be a cornerstone of its power generation. Projections indicate that investments in coal infrastructure will surpass USD 54 billion by 2025, primarily to ensure grid stability and serve as a backup power source. This continued reliance means that China Resources Power, with its significant thermal power operations, remains exposed to the volatility of coal prices.

Changes in the cost of coal directly affect the profitability of China Resources Power's thermal power segment. For instance, if coal prices surge, the company's operating expenses increase, potentially squeezing profit margins. Consequently, effective coal procurement strategies and efficient operational management are crucial for navigating these cost fluctuations and maintaining financial performance.

China's commitment to clean energy is substantial, with investments exceeding USD 625 billion in 2024 alone. This includes a strong focus on upgrading grid infrastructure, energy storage, and smart grid technologies. Specifically, the nation is earmarking USD 88 billion for transmission and distribution investments in 2025, signaling a major push for modernization.

China Resources Power is well-positioned to capitalize on this national drive. The company's significant investments in renewable energy projects and its development of smart energy solutions directly align with these government priorities. This synergy allows China Resources Power to benefit from and actively contribute to China's energy transition and the ongoing modernization of its power grid.

Impact of Electricity Market Reforms on Revenue

China's move towards market-based pricing for new energy sources and the establishment of a unified national power trading market by the close of 2025 will significantly alter revenue dynamics. This shift is expected to bring about increased price fluctuations and heightened competition, directly impacting China Resources Power's earnings. The company must adapt its strategies to navigate this more volatile landscape.

To maintain revenue stability and secure competitive pricing, China Resources Power will need to refine its bidding approaches and enhance operational efficiency. This optimization will be crucial across both its thermal and renewable energy portfolios. For instance, in 2023, China Resources Power reported a substantial portion of its revenue derived from thermal power, but the increasing share of renewables necessitates a more integrated and agile approach to market participation.

- Market Volatility: The transition to market pricing for new energy will introduce greater price swings, affecting revenue predictability.

- Increased Competition: A unified national trading market will intensify competition among power generators.

- Strategic Optimization: China Resources Power must optimize bidding and operational efficiency across thermal and renewable assets.

- Revenue Stability: Adapting to these reforms is key to securing favorable prices and maintaining consistent revenue streams.

Access to Capital and Financing for Green Projects

China's commitment to a low-carbon economy, evidenced by strong government backing for clean energy, significantly enhances access to capital for green projects. This policy environment fosters innovation in green finance, creating new opportunities for companies like China Resources Power. As of early 2025, China's green bond market continues its robust expansion, with issuance projected to reach new highs, providing a substantial pool of funds for sustainable infrastructure.

China Resources Power's ambitious renewable energy expansion plans, targeting substantial growth in solar and wind capacity through 2025, are strategically aligned with these national sustainability objectives. This alignment makes the company an attractive prospect for green financing and investment. For instance, the company successfully secured significant green financing facilities in late 2024 to support its ongoing wind farm development projects, demonstrating investor confidence in its transition strategy.

- Government Incentives: China's national policies actively encourage green finance through tax breaks and subsidies for renewable energy projects.

- Green Bond Market Growth: The market for green bonds in China is experiencing rapid growth, offering diverse financing options. In 2024, green bond issuance exceeded RMB 500 billion.

- Investor Demand: There is increasing global and domestic investor appetite for ESG-compliant investments, benefiting companies with strong sustainability credentials.

- China Resources Power's Strategy: The company's substantial investments in renewable energy position it favorably to attract this growing pool of green capital.

China's economic trajectory significantly influences energy demand, with electricity consumption projected to grow around 6.2% in 2025, driven by EVs and industrial expansion. Despite this growth, coal remains vital for grid stability, with over USD 54 billion invested in coal infrastructure by 2025, impacting China Resources Power's thermal segment profitability through coal price volatility. The nation's substantial clean energy investments, exceeding USD 625 billion in 2024, including USD 88 billion for grid upgrades in 2025, create opportunities for China Resources Power's renewable projects and smart energy solutions.

| Factor | 2024 Data/Projection | 2025 Data/Projection | Impact on China Resources Power |

| Electricity Demand Growth | ~6.5% | ~6.2% | Increased revenue potential for power generation |

| Coal Infrastructure Investment | N/A (Ongoing) | > USD 54 billion | Exposure to coal price volatility affecting thermal power margins |

| Clean Energy Investment | > USD 625 billion | N/A (Ongoing) | Opportunities for renewable energy projects and smart grid integration |

| Transmission & Distribution Investment | N/A (Ongoing) | USD 88 billion | Enhanced grid stability and capacity for renewable integration |

Preview the Actual Deliverable

China Resources Power Holdings Co. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Resources Power Holdings Co. delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. You'll gain valuable insights into market dynamics and potential challenges.

Sociological factors

As China aims for carbon neutrality, public sentiment is increasingly favoring renewable energy. Surveys in 2024 indicate a growing majority of Chinese citizens support a faster transition away from fossil fuels, with particular concern over air quality in urban centers. This societal shift directly influences policy and corporate strategy.

China Resources Power's proactive investment in renewables, aiming for 47.2% of its capacity to be from wind and solar by the end of 2024, reflects this evolving public demand for cleaner energy. The company's financial reports for the first half of 2024 show a significant increase in revenue from its renewable energy segment, outperforming its thermal power generation business.

The global shift towards renewable energy sources is profoundly reshaping employment within the power sector. This transition from fossil fuels to green technologies necessitates a significant upskilling and reskilling of the existing workforce. For China Resources Power, this presents a dual challenge and opportunity: adapting its operations and personnel for renewable energy maintenance and development while also fostering new job creation in this burgeoning green economy.

By 2024, China's renewable energy sector already employed over 4.5 million people, highlighting the growing demand for skilled labor. China Resources Power's strategic investments in solar and wind power, for instance, are creating new roles in project management, installation, and ongoing operational support, aiming to ensure a stable and skilled workforce capable of powering the nation's future energy needs.

China Resources Power actively supports China's rural revitalization strategy, demonstrating a commitment to community development through initiatives like 'renewable energy+' and 'infrastructure assistance'. In 2023 alone, the company invested over RMB49.9 million in public welfare projects, underscoring its dedication to social upliftment.

These Corporate Social Responsibility (CSR) efforts are crucial for China Resources Power, as they bolster its social license to operate, foster positive community relations, and ensure smoother progress for its large-scale energy infrastructure projects by building local trust and support.

Health and Quality of Life Improvements from Decarbonization

China's national drive for energy conservation and carbon reduction, underscored by stringent coal consumption limits, directly targets enhanced air quality and public health. For China Resources Power, this translates into improved social license to operate as its efforts to lower its carbon footprint and boost clean energy output contribute to a better quality of life for residents. In 2023, China's PM2.5 concentration averaged 30 micrograms per cubic meter, a 9.1% decrease from 2022, highlighting the tangible health benefits of such policies.

The company's commitment to decarbonization aligns with societal expectations for environmental stewardship, potentially leading to increased brand loyalty and reduced regulatory scrutiny. This focus on public well-being is crucial for long-term business sustainability in a nation increasingly prioritizing environmental and health outcomes.

- Improved Air Quality: Strict controls on coal consumption are a key driver for reducing harmful pollutants, leading to healthier living environments.

- Enhanced Public Health: Lower emissions directly correlate with reduced respiratory and cardiovascular diseases, a significant societal benefit.

- Boosted Corporate Reputation: By contributing to cleaner air and better health, China Resources Power can strengthen its image and public trust.

- Increased Social Acceptance: Demonstrating a commitment to public well-being fosters greater acceptance of the company's operations and future projects.

Energy Consumption Habits and Electrification

China's electricity consumption is surging, fueled by a societal shift towards electrification across various sectors. This includes a significant increase in electric vehicle (EV) adoption and the widespread use of air conditioning in homes, both contributing to higher demand. For instance, China's electricity consumption grew by 6.7% year-on-year in 2023, reaching 9.48 trillion kilowatt-hours, indicating a robust upward trend.

China Resources Power must adapt its generation strategies to meet this escalating demand for electricity. This involves not only increasing overall capacity but also strategically adjusting its energy mix to support the growing electrification trend in manufacturing, such as the booming EV and battery production industries, and in residential areas.

The company's ability to ensure a reliable and sustainable power supply is crucial for supporting China's broader societal transition towards electrification. This transition is reshaping consumption patterns and requires power providers to be agile and forward-thinking in their operational planning and investment decisions.

- Rising Electrification: China's commitment to EVs and smart home technologies is driving unprecedented electricity demand.

- Manufacturing Power Needs: The expansion of electrified manufacturing processes, particularly in the automotive and electronics sectors, significantly boosts industrial power consumption.

- Residential Demand Growth: Increased ownership of electric appliances and air conditioning units is a key driver of higher residential electricity use.

- Capacity Alignment: China Resources Power faces the challenge of matching its generation capacity and fuel mix to these dynamic and growing consumption trends.

Societal expectations for environmental responsibility are paramount, with a strong public mandate for cleaner air and reduced carbon emissions driving policy. This sentiment is directly influencing China Resources Power's strategic direction, pushing for greater investment in renewable energy sources. The company's commitment to these cleaner alternatives is not only meeting regulatory demands but also aligning with public health concerns and a desire for improved living conditions.

Technological factors

China's commitment to renewable energy is accelerating, with a remarkable surge in solar and wind power installations. By June 2024, new energy sources collectively surpassed coal in installed capacity, a significant milestone. This shift is driven by technological advancements that make these sources increasingly efficient and cost-effective.

China Resources Power is strategically capitalizing on these advancements. The company is actively investing in and deploying cutting-edge renewable energy technologies. This includes expanding its portfolio of wind farms, developing large-scale photovoltaic power plants, and optimizing its existing hydropower assets. These investments are crucial for increasing its non-fossil fuel generation share and aligning with national decarbonization targets.

China is heavily investing in grid modernization, aiming for over 40 million kilowatts of new energy storage capacity by the end of 2025. This push includes developing smart grid infrastructure to improve reliability and efficiency.

China Resources Power's 'Green Energy Development Plan' directly benefits from these technological advancements. By investing in smart grid tech and energy storage, the company can better manage the integration of renewable sources like solar and wind, boosting its operational flexibility.

China's Energy Law 2025 actively supports the adoption of clean and efficient coal utilization, a move that benefits companies like China Resources Power. This legislation encourages the reduction of pollutants and carbon emissions through the implementation of advanced technologies.

China Resources Power, possessing substantial thermal power assets, is well-positioned to capitalize on these technological advancements. By integrating clean coal technologies, the company can enhance the environmental performance and operational efficiency of its existing coal-fired power plants.

This strategic adoption of cleaner coal practices ensures that China Resources Power's thermal assets can continue to serve as reliable and flexible backup capacity within the evolving energy landscape. For instance, advancements in ultra-low emission technologies have allowed some Chinese coal plants to achieve emission levels comparable to gas-fired plants, with SO2 and NOx emissions falling below 10 mg/Nm³ and PM below 5 mg/Nm³ in many cases.

Digitalization and AI in Power Plant Management

China Resources Power is actively leveraging digitalization and Artificial Intelligence (AI) to transform its power plant management. The company has introduced the 'China Resources Smart Energy Cloud Platform,' a significant technological advancement. This platform integrates comprehensive energy management and optimization features.

Key capabilities of the Smart Energy Cloud Platform include real-time monitoring of distributed solar power systems and sophisticated management of energy storage solutions. This digital integration significantly boosts operational efficiency across its assets. Furthermore, it enhances the company's carbon asset management, a critical aspect of modern energy operations.

The company's commitment to technological innovation is evident in how this platform supports smart manufacturing processes. This strategic move positions China Resources Power as a frontrunner in adopting cutting-edge technologies within the energy sector. For instance, in 2023, the company reported a substantial increase in the utilization of digital tools for predictive maintenance, leading to a 5% reduction in unplanned downtime across its key facilities.

- Smart Energy Cloud Platform: Integrates energy management and optimization.

- Key Functions: Monitors distributed solar, manages energy storage.

- Efficiency Gains: Enhances operational efficiency and carbon asset management.

- Industry Leadership: Supports smart manufacturing, showcasing technological innovation.

Ultra-High Voltage (UHV) Transmission Technology

China's pioneering role in Ultra-High Voltage (UHV) transmission technology, with large-scale commercial operations, is a significant technological factor for China Resources Power. This capability is vital for efficiently moving substantial power volumes over vast distances, a key enabler for integrating renewable energy sources located far from population centers.

The UHV infrastructure directly benefits China Resources Power by facilitating the seamless connection of its geographically spread-out power generation facilities, especially its growing renewable energy portfolio, to the national grid. This minimizes energy loss during transmission, enhancing the overall efficiency and economic viability of these assets.

- UHV Dominance: China is the sole nation with extensive commercial UHV operations, a critical technological advantage.

- Renewable Integration: UHV is essential for transmitting renewable energy from remote hubs to demand centers, supporting China Resources Power's green energy strategy.

- Transmission Efficiency: The technology allows for minimal power loss over long distances, improving the performance of China Resources Power's dispersed assets.

Technological advancements are reshaping China's energy sector, with a strong push towards renewables and grid modernization. China Resources Power is actively integrating these innovations, from advanced solar and wind technologies to smart grid solutions and energy storage. The company is also leveraging digitalization and AI through its Smart Energy Cloud Platform to optimize operations and manage carbon assets effectively.

China's commitment to UHV transmission technology is crucial for integrating its vast renewable energy resources. This allows for efficient power transfer over long distances, directly benefiting China Resources Power's geographically dispersed renewable projects and enhancing overall grid efficiency.

| Technology Area | Key Development | Impact on China Resources Power | Data Point (2024/2025 Focus) |

|---|---|---|---|

| Renewable Energy | Increased efficiency & cost-effectiveness of solar/wind | Expansion of solar and wind portfolios | New energy sources surpassed coal in installed capacity by June 2024 |

| Grid Modernization | Smart grid infrastructure & energy storage | Improved integration of renewables, enhanced operational flexibility | Target of over 40 million kW of new energy storage capacity by end of 2025 |

| Digitalization & AI | Smart Energy Cloud Platform | Real-time monitoring, optimized energy management, improved carbon asset management | 5% reduction in unplanned downtime in 2023 due to predictive maintenance adoption |

| Transmission | Ultra-High Voltage (UHV) | Efficient integration of remote renewable assets, reduced transmission losses | China leads globally in commercial UHV operations |

Legal factors

China's comprehensive Energy Law 2025, effective January 1, 2025, places a significant emphasis on renewable energy, establishing ambitious long-term targets and mechanisms for tracking annual progress in non-fossil fuel usage. This legislation mandates state support for wind and solar power expansion, aligning perfectly with China Resources Power's strategic objective to grow its renewable energy assets and adhere to national energy directives.

The law's provisions are expected to stimulate substantial investment in renewable infrastructure, potentially increasing the share of non-fossil fuels in China's primary energy consumption beyond the projected 25% by 2030. For China Resources Power, this translates to a favorable regulatory environment, encouraging further development and integration of wind and solar projects into its operational mix.

China's commitment to climate goals is driving significant regulatory changes, notably the expansion of its Emissions Trading System (ETS). This system now mandates companies, including those in the power sector, to acquire carbon credits for their CO2 emissions, directly impacting operational costs and strategic planning.

The national ETS, launched in July 2021, initially focused on the power sector, which is a major contributor to China's carbon footprint. By the end of 2023, it covered approximately 5 billion tonnes of CO2 annually, making it the world's largest carbon market by covered emissions.

China Resources Power, with its substantial thermal power generation capacity, is directly affected by these environmental protection laws and the ETS. The company must implement robust carbon reduction strategies and actively participate in the carbon market to manage compliance costs and align with national climate objectives.

China's electricity market reform, driven by the NDRC and NEA, is actively integrating new energy sources through competitive pricing mechanisms. China Resources Power needs to adjust its trading and operational strategies to comply with these evolving regulations, which include differentiated policies for new versus existing projects to foster a stable transition and long-term growth.

Safety and Operational Compliance Standards

China Resources Power Holdings Co. operates within a highly regulated environment where safety and operational compliance are paramount. The company must navigate a complex web of national and provincial regulations governing every stage of its power generation activities, from initial development and construction to ongoing operations. This includes adhering to strict safety protocols to prevent accidents and ensure the reliable supply of electricity from its diverse portfolio, which encompasses both traditional thermal power plants and increasingly, renewable energy facilities.

These stringent standards are designed to mitigate risks inherent in the power generation sector, safeguarding both personnel and the environment. For instance, China Resources Power's commitment to safety is reflected in its operational procedures, which are continuously updated to align with evolving regulatory requirements. In 2023, the company continued its focus on enhancing safety management systems across its operational sites, aiming to minimize incidents and maintain high standards of operational integrity. The company's investment in safety training and advanced monitoring technologies underscores its dedication to compliance.

Key areas of regulatory focus for China Resources Power include:

- Environmental Protection: Adherence to emission standards for thermal power plants and environmental impact assessments for new projects.

- Workplace Safety: Implementation of robust safety management systems to prevent accidents at all facilities, including adherence to national safety production laws.

- Grid Connection and Operation: Compliance with national grid codes and operational standards to ensure stable and reliable power supply.

- Renewable Energy Standards: Meeting specific safety and operational requirements for wind, solar, and other renewable energy installations.

Land Use and Permitting Regulations for Power Projects

China Resources Power must meticulously adhere to China's evolving land use and permitting regulations, particularly for its expanding portfolio of renewable energy projects. The acquisition of land for large-scale wind and solar farms involves navigating intricate legal frameworks, including national and provincial land use plans.

Securing necessary permits is a critical step, encompassing environmental impact assessments (EIAs) and obtaining approvals from various local government bodies. For instance, in 2024, the National Development and Reform Commission (NDRC) continued to emphasize streamlined permitting processes for clean energy projects to meet ambitious decarbonization targets.

- Land Acquisition Complexity: Obtaining rights for vast tracts of land for renewable projects is a multi-stage legal process.

- Environmental Compliance: Strict EIAs are mandatory, scrutinizing potential impacts on ecosystems and biodiversity.

- Local Government Approvals: Securing permits requires coordination and approval from provincial, municipal, and county-level authorities.

- Regulatory Updates: China Resources Power must stay abreast of policy shifts, such as those aimed at accelerating renewable energy development in 2025, which may alter permitting timelines and requirements.

China's evolving legal landscape significantly impacts China Resources Power, particularly through environmental regulations and the expanding Emissions Trading System (ETS). The Energy Law 2025, effective January 1, 2025, mandates support for renewables, aligning with the company's strategic shift. The national ETS, covering approximately 5 billion tonnes of CO2 annually by end-2023, necessitates robust carbon reduction strategies for China Resources Power's thermal assets.

The company must also navigate complex land use and permitting regulations for its growing renewable energy portfolio. Streamlined permitting processes for clean energy projects were emphasized by the NDRC in 2024. China Resources Power's operational integrity relies on strict adherence to safety and grid connection standards, with continuous updates to safety management systems a priority, as seen in their 2023 focus.

Environmental factors

China has set ambitious environmental goals, aiming to peak its carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060. The power sector is a significant contributor to these emissions, making its transformation crucial for meeting these targets.

China Resources Power's strategy directly addresses these national imperatives. The company is committed to reducing its carbon intensity and substantially increasing its renewable energy portfolio. This alignment guides its investment decisions and operational focus towards decarbonization, ensuring its business model supports China's environmental objectives.

China's National Energy Administration (NEA) has set ambitious goals, aiming for renewable power to surpass 50% of total installed capacity by 2025. Concurrently, the nation targets non-fossil fuel sources to contribute roughly 20% of its overall energy consumption.

China Resources Power is making significant strides to meet these mandates, actively growing its renewable energy portfolio. By the close of 2024, renewable capacity represented a substantial 47.2% of its total operational capacity, showcasing a strong alignment with national environmental objectives.

Despite China's significant push towards renewable energy, coal-fired power plants remain a crucial part of its energy mix, requiring robust pollution control. China Resources Power Holdings must continue to invest in advanced emission reduction technologies for its thermal fleet to comply with increasingly stringent environmental regulations.

The company is focused on 'clean and efficient' coal utilization, aiming to significantly reduce sulfur dioxide (SOx), nitrogen oxides (NOx), and particulate matter emissions. For example, in 2023, China Resources Power reported that its thermal power plants achieved ultra-low emissions standards, with SOx emissions at 12 mg/m³, NOx at 20 mg/m³, and particulate matter at 5 mg/m³, well below national standards.

Water Scarcity and Resource Management

China Resources Power's operations, especially thermal power generation, are significantly water-intensive. This reliance poses a challenge as water scarcity is a growing concern in many parts of China. For instance, by the end of 2023, several northern provinces, critical for economic activity, faced moderate to severe water stress, impacting industrial water availability.

To address this, the company is compelled to adopt advanced water management strategies and invest in technologies that minimize water usage. This includes exploring dry-cooling systems for power plants, which can reduce water consumption by up to 90% compared to traditional wet-cooling methods. Such initiatives are crucial for ensuring the sustainability of their power generation capacity amidst increasing environmental regulations and the realities of water resource limitations.

- Water Intensity: Thermal power plants can consume millions of gallons of water daily for cooling.

- Regional Scarcity: Northern and northwestern China regions often experience higher water stress, impacting industrial operations.

- Technological Solutions: Investments in dry-cooling and water recycling technologies are becoming essential for new and existing facilities.

- Regulatory Pressure: Evolving environmental policies in China increasingly mandate efficient water use in heavy industries.

Biodiversity Conservation and Ecological Governance

China's commitment to high-quality development is intrinsically linked with ecological protection, paving the way for green and low-carbon growth alongside biodiversity conservation. This national focus directly influences China Resources Power's operational strategy, demanding careful consideration of site selection and plant operations to mitigate ecological footprints, especially for large-scale projects situated in ecologically sensitive regions.

The company's approach to biodiversity conservation and ecological governance is becoming a critical component of its social license to operate. This involves not only adhering to stringent environmental regulations but also actively contributing to broader ecological restoration and protection initiatives. For instance, in 2023, China Resources Power reported investments in environmental protection measures exceeding RMB 5 billion, a significant portion of which is allocated to biodiversity impact assessments and mitigation strategies for new and existing power generation facilities.

- Responsible Site Selection: Prioritizing locations that minimize disruption to sensitive ecosystems and biodiversity hotspots.

- Ecological Impact Mitigation: Implementing advanced technologies and practices to reduce pollution and habitat fragmentation during construction and operation.

- Contribution to Ecological Governance: Participating in national and regional programs aimed at enhancing ecological protection and biodiversity conservation efforts.

- Investment in Green Technologies: Allocating capital towards renewable energy sources and cleaner fossil fuel technologies to align with low-carbon development goals.

China's environmental regulations are increasingly stringent, pushing companies like China Resources Power to invest heavily in emission controls and cleaner technologies. The national drive for carbon neutrality by 2060 significantly impacts the power sector, requiring substantial shifts in operational strategies and capital allocation towards renewables.

By the end of 2024, China Resources Power's renewable energy capacity reached 47.2% of its total operational capacity, demonstrating a strong commitment to decarbonization and alignment with national targets. For its thermal fleet, the company achieved ultra-low emissions in 2023, with SOx at 12 mg/m³, NOx at 20 mg/m³, and particulate matter at 5 mg/m³, underscoring its focus on cleaner coal utilization.

Water scarcity is a growing concern, compelling China Resources Power to adopt advanced water management. Investments in dry-cooling systems, which can reduce water consumption by up to 90%, are crucial for sustainability. The company's 2023 environmental protection investments exceeded RMB 5 billion, with a portion dedicated to biodiversity impact assessments and mitigation.

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Resources Power Holdings Co. is built on a robust foundation of data from official Chinese government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific research firms. These sources provide critical insights into political stability, economic growth, technological advancements, and environmental regulations impacting the energy sector in China.