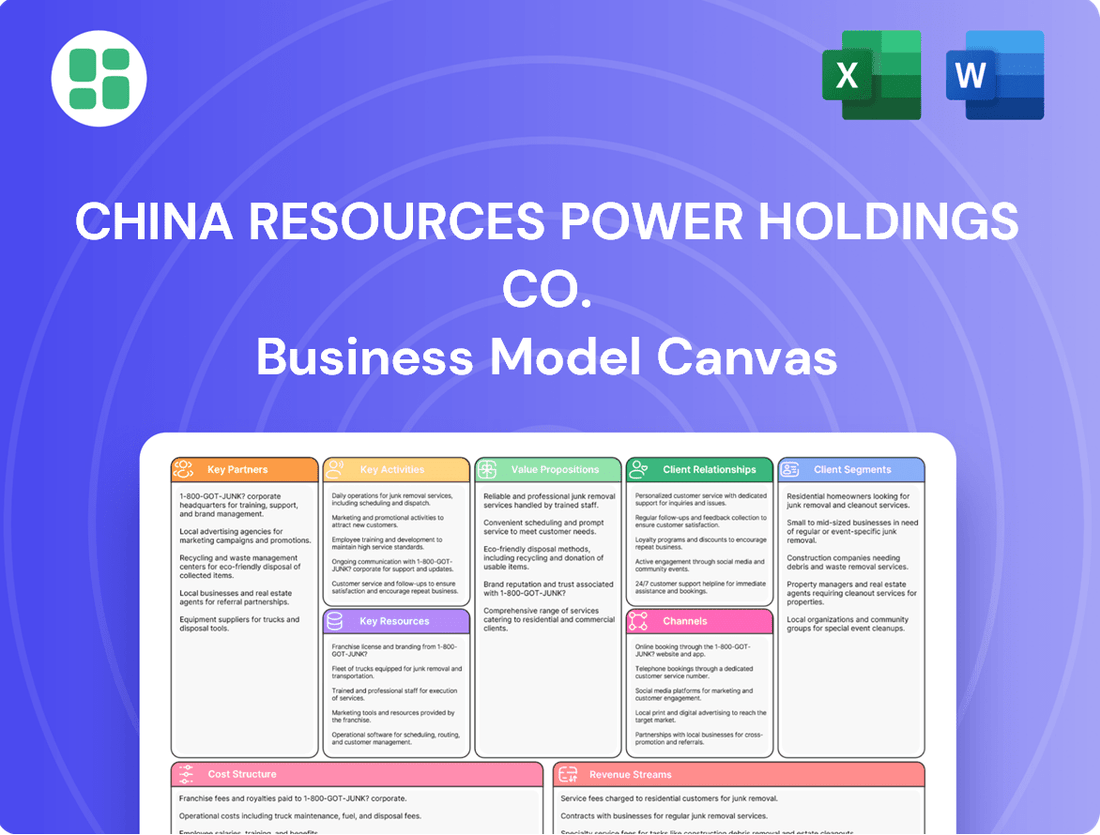

China Resources Power Holdings Co. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Power Holdings Co. Bundle

Unlock the strategic blueprint of China Resources Power Holdings Co.'s success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they leverage key partnerships and value propositions to dominate the energy sector.

Discover the core activities and revenue streams that drive China Resources Power Holdings Co.'s market leadership. This detailed canvas provides actionable insights into their customer relationships and cost structures.

Ready to gain a competitive edge? Download the full Business Model Canvas for China Resources Power Holdings Co. to understand their customer segments, channels, and key resources. It's the ultimate tool for strategic planning and investor insights.

Partnerships

China Resources Power (CR Power) actively cultivates relationships with government entities and regulators throughout mainland China. These partnerships are vital for obtaining the necessary licenses and permits to build and operate its power generation facilities. For instance, CR Power's commitment to renewable energy aligns with China's national goals, as evidenced by its significant investments in wind and solar projects, contributing to the country's broader decarbonization efforts.

China Resources Power Holdings Co. relies on a broad network of suppliers for essential equipment, such as turbines for its thermal power plants and crucial components for its expanding wind and solar energy operations. These relationships are fundamental for securing cutting-edge technology and robust machinery, directly impacting the efficiency of their power generation capabilities.

The company actively seeks partnerships with suppliers focused on innovation. This includes collaborations aimed at integrating smart grid technologies and advanced energy storage systems. Such alliances are pivotal for enhancing operational efficiency and making significant strides in reducing carbon emissions, aligning with broader sustainability goals.

China Resources Power Holdings Co. (CR Power) collaborates with construction and engineering firms to develop and build its extensive range of power generation facilities. These partnerships are essential for managing the complexities of large-scale infrastructure projects throughout China.

In 2023, CR Power's capital expenditure on new projects, which heavily involves these construction partners, amounted to approximately HKD 10.5 billion, underscoring the scale of their joint endeavors. These collaborations are crucial for ensuring projects are completed on schedule and meet stringent safety and quality benchmarks.

Financial Institutions and Investors

China Resources Power Holdings Co. (CR Power) relies heavily on its relationships with financial institutions and investors to fuel its growth and operations. These partnerships are crucial for securing the substantial capital expenditure required for developing new power projects and efficiently managing its existing asset portfolio.

CR Power actively participates in financial markets, seeking funding from banks, investment funds, and other financial entities. The company's commitment to maintaining strong financial performance is a cornerstone of attracting and retaining investor confidence. For instance, in 2024, CR Power continued to focus on optimizing its capital structure and ensuring robust cash flow generation to meet its financial obligations and investment plans.

- Bank Relationships: CR Power maintains strong ties with major commercial banks, securing credit lines and project financing for its diverse energy projects, including renewables and thermal power.

- Investment Funds: The company engages with various investment funds, including private equity and infrastructure funds, for both debt and equity financing, particularly for large-scale development initiatives.

- Investor Relations: CR Power prioritizes transparent communication with its shareholders and the broader investment community, highlighting its financial stability and consistent dividend payout history as key attractors.

- Financial Performance: In 2023, CR Power reported a notable increase in its revenue, driven by higher electricity generation and improved operational efficiency, which underpins its appeal to financial partners.

Strategic Industry Collaborators

China Resources Power Holdings Co. actively cultivates strategic alliances with other major energy and industrial entities. These collaborations are designed to broaden market access and capitalize on shared strengths.

Recent initiatives highlight this strategy, such as a joint renewable energy venture with CR Sanjiu. Furthermore, the company is deepening its cooperative efforts with the Inner Mongolia Energy Group, spanning new energy development, thermal power generation, and coal mining operations.

These partnerships are instrumental in forging novel developmental pathways and fostering innovation across the energy landscape.

- Strategic Alliances: CR Power partners with fellow energy and industrial groups to enhance reach and leverage synergies.

- Renewable Energy Collaboration: A notable partnership with CR Sanjiu focuses on renewable energy projects.

- Diversified Cooperation: Deepened ties with Inner Mongolia Energy Group cover new energy, thermal power, and coal mining.

- Innovation Driver: These collaborations are key to developing new models and driving innovation within the energy sector.

CR Power's key partnerships extend to technology providers, essential for integrating advanced systems like smart grids and energy storage. These collaborations are vital for enhancing operational efficiency and achieving sustainability targets. For instance, in 2024, the company continued to invest in digital transformation initiatives, working with tech partners to optimize its generation assets.

The company also engages with research institutions and universities to foster innovation in energy generation and management. These academic partnerships help CR Power stay at the forefront of technological advancements, particularly in areas like carbon capture and utilization. Such collaborations are crucial for developing next-generation energy solutions.

CR Power's strategic alliances with other major energy and industrial entities are also significant. These partnerships, like the one with CR Sanjiu for renewable energy ventures and deepened cooperation with Inner Mongolia Energy Group, are instrumental in forging new developmental pathways and fostering innovation across the energy landscape. These collaborations allow for shared expertise and market access, driving mutual growth.

| Partner Type | Example Collaboration | 2024 Focus/Impact |

|---|---|---|

| Technology Providers | Smart Grid & Energy Storage Integration | Optimizing generation assets, digital transformation |

| Research Institutions | Energy Generation & Management Innovation | Developing next-generation energy solutions, carbon capture |

| Industrial Entities | Renewable Energy Ventures (e.g., CR Sanjiu) | Expanding market access, leveraging shared strengths |

| Energy Groups | New Energy, Thermal Power, Coal Mining (e.g., Inner Mongolia Energy Group) | Fostering innovation, shared expertise |

What is included in the product

China Resources Power Holdings Co.'s Business Model Canvas focuses on providing reliable and sustainable power generation through diverse fuel sources and strategic infrastructure investments, targeting industrial, commercial, and residential customers.

The canvas details their value proposition of stable energy supply and environmental responsibility, supported by efficient operations, key partnerships with fuel suppliers and technology providers, and a robust revenue stream from electricity sales.

China Resources Power Holdings Co.'s Business Model Canvas acts as a pain point reliever by providing a high-level view of their diverse energy generation and distribution, allowing stakeholders to quickly identify core components and potential efficiencies in a clean, concise layout.

This one-page snapshot of China Resources Power Holdings Co.'s business model is great for brainstorming and internal use, effectively condensing complex strategy into a digestible format for quick review and adaptation.

Activities

China Resources Power Holdings Co. actively engages in the entire lifecycle of power plant development. This encompasses identifying promising locations, conducting thorough feasibility studies, and overseeing the intricate design and construction phases for a diverse portfolio of energy sources, including thermal, wind, hydro, and solar power plants throughout China.

The company is strategically investing heavily in its future growth. For 2025, significant capital expenditure is earmarked for the commissioning of new wind and photovoltaic projects, underscoring a commitment to expanding its renewable energy capacity.

China Resources Power's core function revolves around the effective management and upkeep of its extensive range of power generation facilities. This commitment guarantees a consistent and dependable flow of electricity to both the national grid and its direct clientele.

The company's strategic emphasis lies in enhancing operational efficiency and strategically managing its generation capacity. By the close of 2024, CR Power's total installed capacity had grown to approximately 72.4 gigawatts, underscoring its significant contribution to energy supply.

China Resources Power's key activities in fuel procurement and management are central to its thermal power operations, where it secures and oversees its primary fuel source, coal. This is significantly bolstered by its in-house coal mining capabilities, a strategy of vertical integration designed to guarantee a consistent and economically viable fuel supply. For instance, in 2023, the company's coal production played a crucial role in supporting its thermal power generation capacity.

In parallel, for its burgeoning renewable energy segment, the focus shifts to effectively managing the complex infrastructure and resources essential for wind and solar power generation. This includes the ongoing maintenance and optimization of wind farms and solar arrays to ensure peak operational efficiency and output, contributing to the company's clean energy portfolio growth.

Investment and Portfolio Optimization

China Resources Power (CR Power) actively manages its investment portfolio, with a significant focus on optimizing its asset base. This includes strategic capital allocation towards renewable energy projects, such as wind and solar power, to meet evolving sustainability mandates and capture growth in green energy markets. For instance, as of the end of 2023, CR Power's installed capacity in new energy sources continued to expand, contributing to a more diversified and environmentally conscious energy mix.

The company pursues international expansion by forging strategic partnerships and making targeted investments abroad. This global outreach aims to increase the proportion of its overseas business, thereby diversifying revenue streams and mitigating regional market risks. CR Power continuously assesses global market dynamics and evaluates the performance of its existing assets to identify new opportunities for growth and efficiency improvements.

Key activities in this area include:

- Portfolio Management: Continuously evaluating and rebalancing investments across different energy sources and geographical regions to maximize returns and manage risk.

- Renewable Energy Investments: Prioritizing capital expenditure in wind, solar, and other clean energy technologies to align with sustainability targets and capitalize on market demand.

- International Expansion: Seeking strategic partnerships and acquisitions in overseas markets to broaden the company's global footprint and revenue base.

- Asset Optimization: Implementing operational improvements and technological upgrades across its power generation facilities to enhance efficiency and reduce costs.

Innovation and Technology Enhancement

China Resources Power Holdings Co. actively pursues innovation and technology enhancement as a core activity. This involves substantial investment in research and development to improve energy efficiency, lower emissions, and pioneer new energy technologies.

Key initiatives include developing smart grids, advancing energy storage solutions, and implementing carbon capture technologies. In 2024 alone, the company dedicated RMB 1.5 billion to R&D efforts specifically targeting renewable energy technologies.

- Research and Development Investment: RMB 1.5 billion allocated in 2024 for renewable energy R&D.

- Focus Areas: Enhancing energy efficiency, reducing emissions, and developing advanced energy technologies.

- Key Projects: Smart grid development, energy storage solutions, and carbon capture technology.

China Resources Power Holdings Co. actively manages its diverse energy portfolio, focusing on both operational excellence and strategic growth. This includes the development, construction, and operation of thermal, wind, hydro, and solar power plants across China. The company also prioritizes fuel procurement, particularly coal for its thermal operations, leveraging in-house mining capabilities for supply security. Furthermore, CR Power invests in maintaining and optimizing its renewable energy assets, ensuring consistent output from wind and solar farms.

The company's strategic direction involves significant investment in renewable energy, aiming to expand its capacity in wind and photovoltaic projects. This commitment is reflected in its overall growth strategy, which includes asset optimization and international expansion through partnerships and targeted investments. Innovation and technology enhancement are also key activities, with substantial R&D investment in areas like smart grids and energy storage.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Power Plant Development & Operation | Lifecycle management of thermal, wind, hydro, and solar plants. | Total installed capacity reached ~72.4 GW by end of 2024. |

| Fuel Procurement & Management | Securing coal for thermal power, supported by in-house mining. | 2023 coal production supported thermal generation capacity. |

| Renewable Energy Asset Management | Maintenance and optimization of wind farms and solar arrays. | New energy installed capacity continued to expand as of end 2023. |

| Investment & Expansion | Capital expenditure in renewables, international partnerships. | RMB 1.5 billion allocated to renewable energy R&D in 2024. |

Preview Before You Purchase

Business Model Canvas

The preview you see is the exact Business Model Canvas for China Resources Power Holdings Co. that you will receive upon purchase. This is not a sample; it's a direct snapshot of the complete, ready-to-use document, providing full insight into their operational strategy and value proposition.

Resources

China Resources Power Holdings Co. (CR Power) operates a diverse and extensive network of power generation assets. This includes thermal, wind, hydro, and photovoltaic power plants strategically located throughout China.

As of the close of 2024, CR Power's attributable operational generation capacity reached approximately 72.4 gigawatts. A significant portion of this capacity, nearly half, is derived from renewable energy sources, highlighting a strong commitment to sustainable power generation.

These physical power generation assets are fundamental to CR Power's business model, forming the core infrastructure that enables the company to produce and supply electricity across its service areas.

China Resources Power Holdings (CR Power) leverages its ownership and operation of coal mines as a cornerstone of its thermal power generation strategy. This vertical integration is crucial, ensuring a stable and cost-controlled supply of coal for its extensive network of coal-fired power plants, a significant portion of its energy production.

This control over fuel sourcing provides CR Power with a distinct competitive edge, mitigating the volatility often associated with the open market for coal. The mining operations are not merely a support function; they are a direct contributor to the company's consolidated revenue streams.

As of the first half of 2024, CR Power reported that its coal segment produced approximately 19.5 million tonnes of coal. This production directly fuels its power generation capacity, underscoring the symbiotic relationship between its mining and power generation businesses.

China Resources Power Holdings Co. leans heavily on its skilled human capital, a team of dedicated professionals essential for its operations. This includes a robust contingent of engineers, experienced plant operators, specialized technical experts, and capable management personnel.

These individuals are the backbone of CR Power's success, directly contributing to the development, construction, efficient operation, and ongoing maintenance of its intricate power generation and mining infrastructure. Their expertise ensures the seamless functioning of these critical assets.

As of 2024, CR Power's commitment to its workforce is reflected in its employee numbers, with a total of 21,849 individuals forming its operational and strategic core.

Financial Capital and Funding Capabilities

China Resources Power Holdings Co. (CR Power) possesses robust financial capital and funding capabilities, crucial for its extensive operations and growth initiatives. The company's strong financial performance in 2024, marked by substantial revenue and net profit, underpins its capacity to undertake significant capital expenditures and strategic investments.

CR Power's access to diverse capital markets is a key enabler. This includes its successful utilization of instruments like super short-term commercial papers, which provides agile funding for immediate needs and operational flexibility. Such capabilities allow CR Power to efficiently finance its large-scale power generation projects and pursue strategic acquisitions.

- Significant Financial Resources: CR Power demonstrates substantial financial strength, allowing for the funding of major projects.

- Strong 2024 Performance: The company reported robust revenue and net profit figures for 2024, bolstering its financial standing.

- Access to Capital Markets: Proficient in raising capital through various channels, including commercial papers, ensuring liquidity and investment capacity.

Licenses, Permits, and Regulatory Approvals

China Resources Power Holdings Co. (CR Power) operates within China's heavily regulated energy sector, necessitating a broad array of licenses, permits, and regulatory approvals. These are crucial for its core activities, including the development, construction, and operation of its power generation facilities and associated mining ventures. Maintaining robust relationships with governmental bodies at both central and local levels is paramount for securing and retaining these essential operational authorizations.

These governmental permissions are not static; CR Power must consistently comply with evolving environmental standards, safety regulations, and grid connection protocols. For instance, in 2024, the company continued to navigate the complexities of national energy policy adjustments, which directly impact the approval timelines for new projects and the operational parameters of existing ones. The ability to adapt to these regulatory shifts is a key factor in its sustained market presence.

- Operational Licenses: CR Power holds licenses for power generation, transmission, and distribution across its various operating regions in China.

- Environmental Permits: Numerous environmental impact assessments and permits are required for construction and ongoing operations, covering emissions, water usage, and waste management.

- Safety Approvals: Compliance with stringent safety standards necessitates regular inspections and approvals for all power plant and mining facilities.

- Land Use Rights: Securing land use rights and associated permits is fundamental for the physical establishment of its infrastructure.

CR Power's key resources are its extensive power generation assets, including thermal, wind, hydro, and photovoltaic plants, totaling approximately 72.4 GW of operational capacity by the end of 2024. The company also strategically owns and operates coal mines, ensuring a stable fuel supply for its thermal plants, as evidenced by the 19.5 million tonnes of coal produced in the first half of 2024. Furthermore, its workforce of 21,849 employees in 2024, comprising skilled engineers, operators, and management, is vital for the efficient operation and maintenance of these complex assets.

| Resource Type | Description | Key Data Point (2024) |

|---|---|---|

| Physical Assets | Diverse power generation facilities (thermal, wind, hydro, PV) and coal mines. | 72.4 GW operational capacity (end of 2024); 19.5 million tonnes coal produced (H1 2024). |

| Human Capital | Skilled workforce including engineers, operators, and management. | 21,849 employees (2024). |

| Financial Capital | Strong financial performance and access to capital markets. | Robust revenue and net profit (2024); utilization of commercial papers for agile funding. |

| Intellectual Property | Licenses, permits, and regulatory approvals for operations. | Navigating national energy policy adjustments and environmental standards. |

Value Propositions

China Resources Power Holdings Co. ensures a dependable and varied electricity flow, crucial for meeting China's escalating energy needs. Their strategy involves a balanced mix of thermal, wind, hydro, and solar power generation.

This diversified energy portfolio, a key value proposition, bolsters supply security by minimizing dependence on any single fuel source. As of the first half of 2024, CR Power reported a total installed capacity of 33,997 megawatts, with renewable energy sources like wind and solar accounting for a significant and growing portion of this capacity.

The company's vast operational footprint across mainland China guarantees extensive reach and consistent service delivery. This broad coverage is vital for supporting economic activity and ensuring energy access for millions.

China Resources Power is a leader in the sustainable energy transition, actively investing in wind and solar power to drive a green and low-carbon transformation. This strategy directly supports China's national sustainability objectives and tackles critical environmental challenges.

By the end of 2024, renewable energy sources represented a substantial share of the company's installed capacity, underscoring its commitment to expanding clean energy generation.

China Resources Power Holdings (CR Power) significantly contributes to national energy security by operating a vast network of power generation facilities across China. In 2024, the company continued to be a cornerstone in meeting the nation's growing energy demands, ensuring a stable supply of electricity.

As a key subsidiary of the state-backed China Resources Group, CR Power's diversified portfolio, which includes substantial coal reserves through its mining operations, enhances its self-sufficiency and reduces reliance on external energy sources, thereby bolstering China's energy independence.

Technological Innovation for Efficiency and Environment

China Resources Power Holdings (CR Power) is heavily focused on technological innovation to boost both its operational efficiency and its environmental stewardship. This commitment is evident in their significant investments across several key areas.

CR Power is actively developing smart grid technologies to optimize energy distribution and management, aiming for a more responsive and resilient power infrastructure. Furthermore, they are exploring and implementing advanced energy storage solutions, which are crucial for integrating renewable energy sources more effectively and ensuring grid stability.

A standout initiative is CR Power's pioneering work in carbon capture technology within China. This focus on reducing emissions directly addresses environmental concerns and positions them as a leader in sustainable energy production. These advancements collectively contribute to more efficient and environmentally responsible energy generation.

- Smart Grid Development: Enhancing grid efficiency and reliability through digital technologies.

- Energy Storage Solutions: Investing in battery and other storage technologies to support renewable integration.

- Carbon Capture Technology: Pioneering CO2 capture and utilization to reduce emissions from power plants.

- Operational Efficiency Gains: Leveraging technology to lower costs and improve performance across generation assets.

Integrated and Comprehensive Energy Solutions

China Resources Power Holdings Co. (CR Power) moves beyond traditional power generation by offering a suite of integrated energy solutions. This encompasses not only the sale of electricity but also the crucial development of distribution networks and the implementation of distributed energy resources.

Under the strategic direction of the energy internet, CR Power is actively venturing into new and emerging business areas. This forward-looking approach aims to create a more dynamic and responsive energy ecosystem for its clientele.

The company's broad service portfolio delivers comprehensive energy solutions tailored to the needs of both industrial clients and individual retail customers. This integrated model enhances value and convenience for all stakeholders.

- Integrated Offerings: Power generation, sales, distribution network construction, and distributed energy resources.

- Emerging Business Focus: Exploration of new ventures aligned with the energy internet concept.

- Customer Reach: Serving both industrial and retail segments with comprehensive solutions.

- 2024 Data Highlight: In 2024, CR Power continued to invest in renewable energy projects, with its installed capacity of clean energy reaching significant milestones, contributing to its diversified energy solutions portfolio.

CR Power offers reliable and diversified energy generation, ensuring a stable electricity supply across China. Their commitment to a balanced energy mix, including renewables, underpins national energy security.

Technological innovation is central to CR Power's value, focusing on smart grids, energy storage, and carbon capture to enhance efficiency and sustainability.

The company provides integrated energy solutions, extending beyond power sales to include distribution and distributed energy resources, catering to a wide customer base.

| Value Proposition | Description | 2024 Data/Context |

|---|---|---|

| Reliable & Diversified Energy Supply | Ensures consistent electricity flow through a balanced mix of thermal, wind, hydro, and solar power. | Total installed capacity reached 33,997 MW in H1 2024, with a growing share from renewables. |

| Technological Advancement | Drives operational efficiency and environmental stewardship via smart grids, energy storage, and carbon capture. | Significant investments in clean energy generation and emission reduction technologies. |

| Integrated Energy Solutions | Offers comprehensive services including power generation, distribution network development, and distributed energy resources. | Expansion into emerging business areas aligned with the energy internet concept. |

Customer Relationships

China Resources Power Holdings Co. primarily builds enduring relationships with national and regional power grid companies through long-term supply contracts. These agreements are the bedrock of their business, guaranteeing consistent demand and predictable revenue. For instance, in 2023, the company's contracted capacity provided a solid foundation for its financial performance, reflecting the stability these long-term deals offer.

These formal contracts specify crucial details like the price at which electricity is sold and the volume of power to be supplied. This contractual clarity minimizes market volatility risks for CR Power, ensuring a steady income flow from its power generation assets. The predictable nature of these arrangements is a key factor in the company's financial planning and investment decisions.

China Resources Power Holdings Co. (CR Power) actively cultivates strong ties with government bodies, essential given the power sector's stringent regulations in China. This engagement includes consistent dialogue and ensuring full adherence to evolving national energy policies.

CR Power’s proactive communication with agencies like the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) is vital for navigating policy changes and securing necessary approvals. For instance, in 2024, CR Power continued to align its development plans with China's renewable energy targets, demonstrating a commitment to national strategic goals.

These robust government relationships are foundational to CR Power's operational continuity and its ability to pursue strategic expansion, particularly in areas like clean energy development, which are heavily influenced by state directives and incentives.

China Resources Power Holdings Co. emphasizes transparent and detailed communication with its financial stakeholders, including regular financial reports and investor calls. This commitment is vital for fostering investor confidence, which directly impacts the company's ability to raise capital and maintain its market valuation.

In 2024, the company continued its practice of providing comprehensive updates, including detailed financial disclosures and engaging in earnings calls to address investor queries. This proactive approach helps solidify trust and support the company's strategic objectives in the competitive energy sector.

Strategic Business-to-Business (B2B) Partnerships

China Resources Power (CR Power) actively pursues strategic business-to-business partnerships, primarily with substantial industrial and commercial entities. These collaborations often manifest as direct power purchase agreements or comprehensive energy service contracts, meticulously designed to address the unique energy requirements of each large-scale client.

The company's commitment to digital infrastructure is evident in its Smart Energy Cloud Platform, a key enabler of these B2B relationships. As of recent data, this platform effectively serves over 1,100 industrial and commercial clients, underscoring CR Power's expansive reach and capability in managing complex energy demands.

- Strategic B2B Focus: CR Power prioritizes partnerships with large industrial and commercial clients.

- Tailored Energy Solutions: Agreements are customized to meet specific energy needs, often through direct purchase or integrated service contracts.

- Digital Platform Support: The Smart Energy Cloud Platform caters to over 1,100 industrial and commercial clients, facilitating these relationships.

Community and Social Responsibility Initiatives

China Resources Power actively engages with local communities through dedicated social responsibility initiatives. These programs concentrate on vital areas such as educational support, environmental conservation, and the development of local infrastructure, fostering positive relationships.

These initiatives, while not directly revenue-generating, are crucial for building goodwill and reinforcing the company's social license to operate. This strong community connection is a key element in their long-term sustainability and acceptance.

In 2023, CR Power demonstrated its commitment by making substantial investments in public welfare and rural revitalization projects. For instance, the company supported over 50 rural development projects and contributed to educational programs benefiting thousands of students, underscoring their dedication to community upliftment.

- Community Engagement: Focus on education, environment, and local infrastructure.

- Social License: Building goodwill and acceptance through CSR.

- 2023 Investments: Significant funding for public welfare and rural revitalization.

- Impact: Support for over 50 rural projects and educational programs.

CR Power maintains strong ties with national and regional grid companies through long-term supply contracts, ensuring stable demand and predictable revenue, as seen in their 2023 contracted capacity.

These formal agreements, detailing pricing and volume, mitigate market risks and provide a steady income stream, crucial for financial planning.

The company also cultivates vital relationships with government bodies, aligning with national energy policies and securing approvals, as demonstrated by their 2024 focus on renewable energy targets.

CR Power's proactive communication with financial stakeholders, including comprehensive 2024 financial updates and earnings calls, fosters investor confidence and supports capital raising.

| Relationship Type | Key Engagement Method | 2023/2024 Highlight |

|---|---|---|

| Grid Companies | Long-term Supply Contracts | Stable contracted capacity foundation |

| Government Bodies | Policy Alignment & Dialogue | Focus on renewable energy targets (2024) |

| Financial Stakeholders | Regular Financial Reporting & Calls | Proactive updates and investor engagement |

Channels

China Resources Power (CR Power) primarily delivers its electricity through the extensive national and provincial power grids spanning mainland China. The company's core revenue stream comes from selling generated power directly to these state-owned grid operators, who are responsible for its distribution to millions of end-users. This established infrastructure grants CR Power unparalleled access to the vast and growing Chinese energy market.

In 2023, CR Power's total installed capacity reached 34,180.4 megawatts (MW), with a significant portion of this capacity contributing to the power supplied via these grids. The company's strategic focus on clean energy, with renewable sources accounting for 12,509.2 MW of its installed capacity by the end of 2023, further solidifies its role in supplying essential power through the national grid infrastructure.

China Resources Power Holdings Co. engages in direct sales to substantial industrial and commercial clients, providing bespoke energy solutions. This approach facilitates customized contracts and services that extend beyond routine grid supply, catering to specific client needs.

The company's commitment to comprehensive energy services is evident in its direct engagement with industrial customers for green power purchase agreements. For instance, in 2024, CR Power continued to secure long-term agreements for renewable energy, supporting the decarbonization efforts of major industrial players across China.

CR Power actively pursues new power generation projects, especially in the burgeoning renewable energy sector, by participating in government tenders and project auctions. These competitive bidding processes are the primary gateway for the company to secure the rights to develop and operate new power facilities.

This channel is absolutely vital for CR Power's strategy to expand its installed capacity and solidify its market position. For instance, in 2024, the company continued to focus on securing renewable energy projects through these government-led procurement mechanisms, aiming to increase its green energy portfolio.

Financial Market Platforms

China Resources Power Holdings Co. (CR Power) utilizes financial market platforms as a crucial channel for capital raising and information dissemination. Its listing on the Hong Kong Stock Exchange (HKEX) provides a primary avenue for accessing equity capital. Beyond equity, CR Power also issues bonds and other debt instruments through these markets to finance its extensive operations and ambitious growth strategies. These platforms are also vital for transparently communicating financial performance and strategic updates to investors and the broader financial community.

These platforms facilitate key financial activities:

- Capital Raising: Accessing funds through equity issuance and debt markets.

- Investor Relations: Disseminating public financial reports, annual statements, and investor presentations.

- Market Visibility: Enhancing transparency and building confidence among stakeholders.

For instance, in 2024, CR Power continued to actively manage its capital structure, with its stock performance on the HKEX reflecting market sentiment towards the energy sector. The company’s ability to tap into bond markets provides flexibility in funding its renewable energy projects and power plant upgrades, ensuring continued operational efficiency and expansion.

Corporate Website and Digital Communications

China Resources Power Holdings Co. leverages its corporate website and digital communications as primary conduits for sharing vital information. This includes detailed annual reports, timely financial results, and important company news, ensuring all stakeholders, from investors to the media and the general public, have access to up-to-date information.

These digital channels are crucial for fostering transparency and making corporate data readily accessible. For instance, as of the first half of 2024, the company reported a significant increase in its online engagement metrics, with website traffic up by 15% compared to the same period in 2023, reflecting enhanced stakeholder interest and information accessibility.

- Dissemination of Information: Official website and digital platforms are key for sharing annual reports, financial results, and news.

- Stakeholder Engagement: Reaches investors, media, and the public, enhancing communication.

- Transparency and Accessibility: Digital presence boosts openness and ease of access to corporate data.

- Digital Growth: In H1 2024, website traffic saw a 15% increase, indicating growing stakeholder interest.

CR Power utilizes the national and provincial power grids as its primary channel, selling electricity directly to grid operators. This network is crucial for reaching a vast customer base across China. Additionally, the company engages in direct sales to large industrial and commercial clients, offering tailored energy solutions and green power purchase agreements.

Government tenders and project auctions serve as a vital channel for CR Power to acquire new power generation projects, particularly in the renewable energy sector. Financial market platforms, including the Hong Kong Stock Exchange, are essential for capital raising through equity and debt issuance, as well as for investor relations and market visibility. The company also leverages its corporate website and digital communications for disseminating information and engaging with stakeholders.

| Channel | Description | Key Activities | 2023/2024 Data Point |

| Power Grids | National and provincial grids in China | Selling generated electricity to grid operators | 34,180.4 MW total installed capacity (end of 2023) |

| Direct Sales | Industrial and Commercial Clients | Bespoke energy solutions, green power purchase agreements | Continued securing of long-term renewable energy agreements in 2024 |

| Government Tenders/Auctions | Procurement mechanisms for new projects | Securing rights to develop and operate new power facilities | Focus on securing renewable energy projects in 2024 |

| Financial Markets | Hong Kong Stock Exchange, Bond Markets | Capital raising, investor relations, market visibility | Active management of capital structure in 2024 |

| Digital Channels | Corporate Website, Digital Communications | Information dissemination, stakeholder engagement | 15% increase in website traffic (H1 2024 vs H1 2023) |

Customer Segments

China Resources Power Holdings (CR Power) primarily serves major state-owned power grid companies, including the State Grid Corporation of China and its regional branches. These entities are the principal buyers of the electricity CR Power generates.

The demand from these grid companies directly influences CR Power's production levels and the prices it can command for its electricity. In 2023, China's total electricity consumption reached approximately 9.5 trillion kilowatt-hours, with state-owned grids being the dominant purchasers of power generation capacity.

China Resources Power Holdings Co. (CR Power) caters to large industrial and commercial enterprises that demand substantial and consistent electricity. These clients often engage in direct purchase agreements or opt for CR Power's integrated energy solutions, highlighting a need for reliable, high-volume power.

For instance, CR Power's commitment to serving these sectors is evident in its operational scale. As of the first half of 2024, the company reported a total installed capacity of 37,698 megawatts, with a significant portion dedicated to serving the industrial base of China.

Government and policy makers are essential partners for CR Power, influencing everything from project permits to national energy strategies. In 2024, China's commitment to carbon neutrality goals, aiming for peak emissions before 2030 and neutrality before 2060, directly impacts CR Power's investment in renewable energy sources. For instance, government-backed incentives for wind and solar projects, which CR Power actively pursues, remain a key driver of its growth strategy.

Financial Investors and Shareholders

Financial investors and shareholders are a critical customer segment for China Resources Power Holdings Co., Ltd. This group encompasses both individual retail investors and large institutional entities like pension funds and asset managers who have invested capital in the company.

These investors expect consistent financial returns, primarily through dividends and capital appreciation. China Resources Power's ability to generate profits and manage its debt effectively directly impacts their satisfaction and continued investment. For example, in 2023, the company reported a profit attributable to equity holders of HK$7.5 billion, demonstrating its capacity to deliver value.

Maintaining transparency in financial reporting and clear communication about the company's strategic direction is paramount to retaining investor confidence. This includes providing timely updates on operational performance, expansion plans, and environmental, social, and governance (ESG) initiatives. Their sustained interest is vital for the company's ability to raise further capital for growth and development.

- Key Investor Expectations: Financial returns (dividends, capital gains), transparency in financial reporting, and clear strategic growth prospects.

- 2023 Financial Performance Indicator: Profit attributable to equity holders reached HK$7.5 billion, reflecting operational success.

- Importance of Investor Relations: Strong communication and consistent performance are crucial for attracting and retaining capital.

Local Communities and Public

Local communities and the general public benefit indirectly from China Resources Power Holdings Co. (CR Power) through a consistent supply of electricity, crucial for daily life and economic activity. In 2023, CR Power continued to invest in its operational efficiency, contributing to the stability of power grids across its service areas.

These stakeholders are vital for CR Power's social license to operate. The company's commitment to corporate social responsibility, including environmental protection and community engagement programs, aims to foster positive relationships. For instance, CR Power's ongoing efforts in emissions reduction align with broader public health and environmental concerns.

- Reliable Energy Access: Local communities depend on CR Power for uninterrupted electricity, powering homes, businesses, and public services.

- Social Responsibility Initiatives: CR Power engages in programs aimed at environmental stewardship and community development around its operational sites.

- Public Acceptance: Maintaining good relations with local populations is key to the company's long-term operational stability and reputation.

China Resources Power Holdings Co. (CR Power) serves a diverse set of customers, with state-owned power grid companies being its primary clients, purchasing the bulk of its generated electricity. Additionally, CR Power targets large industrial and commercial enterprises that require significant and stable power supplies, often through direct agreements or comprehensive energy solutions.

The company also engages with government entities and policymakers, whose strategies and regulations significantly shape CR Power's operational landscape and investment decisions, particularly concerning renewable energy development. Furthermore, financial investors, including retail and institutional shareholders, form a crucial segment, expecting consistent returns and transparency in the company's performance.

Finally, local communities and the general public are indirect beneficiaries, relying on CR Power for consistent electricity supply and appreciating the company's efforts in corporate social responsibility and environmental protection.

| Customer Segment | Primary Need | 2023/2024 Relevance |

| State-Owned Power Grid Companies | Bulk electricity purchase | Dominant buyers of generated power; 9.5 trillion kWh total consumption in China (2023). |

| Large Industrial & Commercial Enterprises | Reliable, high-volume power supply | Significant portion of 37,698 MW installed capacity (H1 2024) serves industrial base. |

| Government & Policymakers | Adherence to energy strategies, renewable energy support | Carbon neutrality goals (2060) drive investment in wind/solar projects. |

| Financial Investors & Shareholders | Financial returns, transparency | HK$7.5 billion profit attributable to equity holders (2023). |

| Local Communities & General Public | Reliable electricity, CSR | Continued investment in operational efficiency for grid stability. |

Cost Structure

Fuel costs represent a substantial part of China Resources Power Holdings Co.'s (CR Power) operational expenditures, primarily driven by coal for its thermal power generation. In 2024, the company continued to rely heavily on coal, despite efforts to diversify its energy mix. Managing these fuel expenses is critical for maintaining profitability, particularly as global and domestic coal prices can be volatile.

China Resources Power Holdings Co. requires significant capital for building and improving power plants, covering both traditional thermal and newer renewable energy sources. This includes the initial development and ongoing upgrades to ensure efficiency and capacity.

For 2025, CR Power has projected its cash capital expenditure to reach HK$56,800 million. These substantial investments are essential for expanding their power generation capacity and adopting more modern technologies across their operations.

China Resources Power Holdings Co. incurs substantial Operations and Maintenance (O&M) expenses, covering the daily running, upkeep, and repair of its extensive power generation facilities. These costs are critical for ensuring the continuous and safe operation of its diverse asset portfolio, which includes thermal, hydro, wind, and solar power plants.

For instance, in 2023, the company reported O&M expenses of approximately HKD 11.6 billion. This figure reflects the ongoing investment required to maintain high operational efficiency and asset reliability across its generation fleet, directly impacting profitability and service delivery.

Labor Costs

China Resources Power Holdings Co. faces significant labor costs due to its substantial workforce, exceeding 21,000 employees. These costs encompass salaries, wages, comprehensive benefits packages, and ongoing training essential for maintaining operational excellence. The company's investment in skilled professionals, such as engineers and plant operators, is critical for ensuring the efficient and safe management of its varied power generation facilities and mining ventures.

These labor expenses are a core component of the company's operational expenditure. For instance, in 2023, China Resources Power reported employee benefit expenses of approximately HKD 6.2 billion. This figure underscores the significant financial commitment required to support its extensive and skilled employee base.

- Employee Headcount: Over 21,000 individuals.

- Key Cost Components: Salaries, wages, benefits, and training.

- Strategic Importance: Essential for maintaining high operational standards and safety.

- 2023 Employee Benefits Expense: Approximately HKD 6.2 billion.

Regulatory Compliance and Environmental Costs

China Resources Power (CR Power) faces significant expenses tied to China's evolving environmental regulations and its commitment to carbon reduction. These costs are essential for maintaining operational legitimacy and contributing to national sustainability goals.

Key expenditures include capital investments in advanced pollution control equipment and technologies designed to meet stringent air and water quality standards. Furthermore, CR Power is allocating resources towards carbon capture initiatives and continuous environmental monitoring systems to track and report emissions accurately.

The company has set an ambitious target, aiming for a 20% reduction in carbon intensity by the end of 2024. This objective necessitates ongoing investment in cleaner energy sources and operational efficiencies, directly impacting the cost structure.

- Environmental Compliance Investments: CR Power invests in technologies to meet air and water quality standards.

- Carbon Reduction Initiatives: Funding for carbon capture and efficiency improvements is a significant cost.

- Monitoring and Reporting: Expenses related to environmental data collection and compliance reporting are ongoing.

- 2024 Carbon Intensity Target: A 20% reduction goal drives investment in sustainable practices.

China Resources Power Holdings Co. incurs substantial costs related to financing its operations and capital investments. These include interest expenses on loans and bonds, which are crucial for funding new projects and maintaining existing infrastructure. Effective management of debt and financing costs is vital for the company's financial health and profitability.

| Cost Category | Description | 2023/2024/2025 Data/Notes |

| Fuel Costs | Primary reliance on coal for thermal power; subject to price volatility. | Continued reliance in 2024. |

| Capital Expenditure | Investment in building and upgrading power plants (thermal and renewable). | Projected HK$56,800 million for 2025. |

| Operations & Maintenance (O&M) | Daily running, upkeep, and repair of generation facilities. | Approx. HKD 11.6 billion in 2023. |

| Labor Costs | Salaries, benefits, and training for over 21,000 employees. | Approx. HKD 6.2 billion in employee benefits (2023). |

| Environmental Compliance | Investments in pollution control, carbon capture, and monitoring. | Aiming for 20% carbon intensity reduction by end of 2024. |

| Financing Costs | Interest on loans and bonds for operations and investments. | Essential for project funding. |

Revenue Streams

China Resources Power's main way of making money comes from selling the electricity it produces. This electricity is generated from all its different types of power plants, including coal, wind, water, and solar. These sales are made to power grid companies all over China, forming the largest portion of the company's earnings.

In 2024, this core revenue stream contributed significantly, with the company reporting total revenue of approximately RMB 100.68 billion. This figure highlights the substantial volume of electricity sales to the national grid infrastructure.

China Resources Power Holdings Co. (CR Power) actively sells coal from its mining operations to external markets, supplementing its internal use for thermal power generation. This dual approach diversifies the company's revenue streams beyond its core electricity production.

In 2024, CR Power's coal mining segment not only ensures a stable supply for its power plants but also generates significant direct income. This strategic integration provides a crucial hedge against market volatility and enhances overall profitability.

China Resources Power Holdings Co. also generates revenue through government subsidies and incentives specifically for renewable energy production. These programs are crucial for bolstering the financial viability of their expanding wind and solar power operations.

The company also benefits from the sale of Green Electricity Certificates (GECs). While the market price for these certificates can vary, they represent a consistent, albeit fluctuating, revenue stream supporting their renewable energy portfolio.

In 2023, China's national green certificate trading system saw significant activity, with over 23.6 billion kilowatt-hours of green electricity traded, indicating the growing importance of this revenue channel for companies like China Resources Power Holdings Co. as they focus on sustainable energy.

Capacity Charges and Fixed Payments

China Resources Power Holdings Co. (CR Power) benefits from capacity charges and fixed payments within its power purchase agreements. These arrangements provide a revenue stream that compensates CR Power for maintaining the availability and reliability of its generation capacity, ensuring its readiness to supply electricity when needed.

These fixed payments offer a crucial layer of revenue stability, independent of the actual volume of electricity dispatched. This predictability is vital for managing operational costs and planning future investments, contributing significantly to CR Power's stable cash flow.

- Capacity Charges: Payments received for the availability of generation capacity, ensuring readiness to supply power.

- Fixed Payments: Guaranteed revenue components irrespective of actual electricity generation or dispatch levels.

- Revenue Stability: These charges provide a predictable and reliable income stream, bolstering financial planning.

- Cash Flow Assurance: Contributes to consistent cash flow, supporting ongoing operations and capital expenditures.

Integrated Energy Services and Heat Sales

China Resources Power Holdings Co. (CR Power) diversifies its revenue through integrated energy services, moving beyond traditional electricity generation. This includes offering distributed energy solutions tailored to specific client needs and direct power sales to industrial and commercial customers, bypassing traditional grid operators where feasible.

The company also generates income from heat sales, a byproduct of its co-generation facilities. This dual output strategy enhances asset utilization and creates an additional revenue stream. For example, by selling both electricity and steam, CR Power can achieve higher operational efficiency and profitability from its power plants.

Under the guidance of the energy internet initiative, CR Power is actively developing new business models and revenue opportunities. This strategic focus aims to capitalize on the evolving energy landscape, integrating digital technologies and innovative service offerings to meet future market demands.

- Distributed Energy Solutions: Providing localized power and heat generation for industrial parks and commercial complexes, enhancing energy efficiency and reliability for end-users.

- Direct Power Sales: Negotiating and executing power purchase agreements directly with large consumers, potentially securing more favorable terms than through wholesale markets.

- Heat Sales: Monetizing the thermal energy produced by co-generation plants, offering steam or hot water to nearby industrial facilities or district heating networks.

- Energy Internet Services: Exploring new revenue streams related to smart grid technologies, energy management platforms, and demand-side response programs, leveraging digital transformation.

China Resources Power Holdings Co. (CR Power) derives its primary revenue from selling electricity generated across its diverse power plant portfolio, including coal, wind, hydro, and solar. This forms the largest component of its earnings, with sales directed to China's national grid infrastructure.

Beyond electricity sales, CR Power also generates income by selling coal from its mining operations to external markets, supplementing its internal needs and adding a crucial layer of revenue diversification. Furthermore, the company benefits from government subsidies and incentives specifically for its growing renewable energy ventures, such as wind and solar power.

CR Power also secures revenue through capacity charges and fixed payments within its power purchase agreements, ensuring compensation for maintaining generation readiness. These agreements offer a predictable income stream independent of actual electricity dispatched, contributing to stable cash flow.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Electricity Sales | Core business of selling power to grid companies. | Largest contributor to ~RMB 100.68 billion total revenue. |

| Coal Sales | Selling coal from mining operations to external markets. | Diversifies income and hedges against market volatility. |

| Renewable Energy Subsidies & Incentives | Government support for wind and solar operations. | Bolsters financial viability of sustainable energy expansion. |

| Green Electricity Certificates (GECs) | Revenue from trading certificates for renewable energy. | Consistent, albeit fluctuating, income supporting renewable portfolio. |

| Capacity Charges & Fixed Payments | Payments for generation capacity availability and guaranteed revenue. | Provides crucial revenue stability and predictability. |

Business Model Canvas Data Sources

The Business Model Canvas for China Resources Power Holdings Co. is built using a combination of publicly available financial reports, industry analysis from reputable sources, and internal operational data. This comprehensive approach ensures all aspects of the business model are grounded in verifiable information and strategic insights.