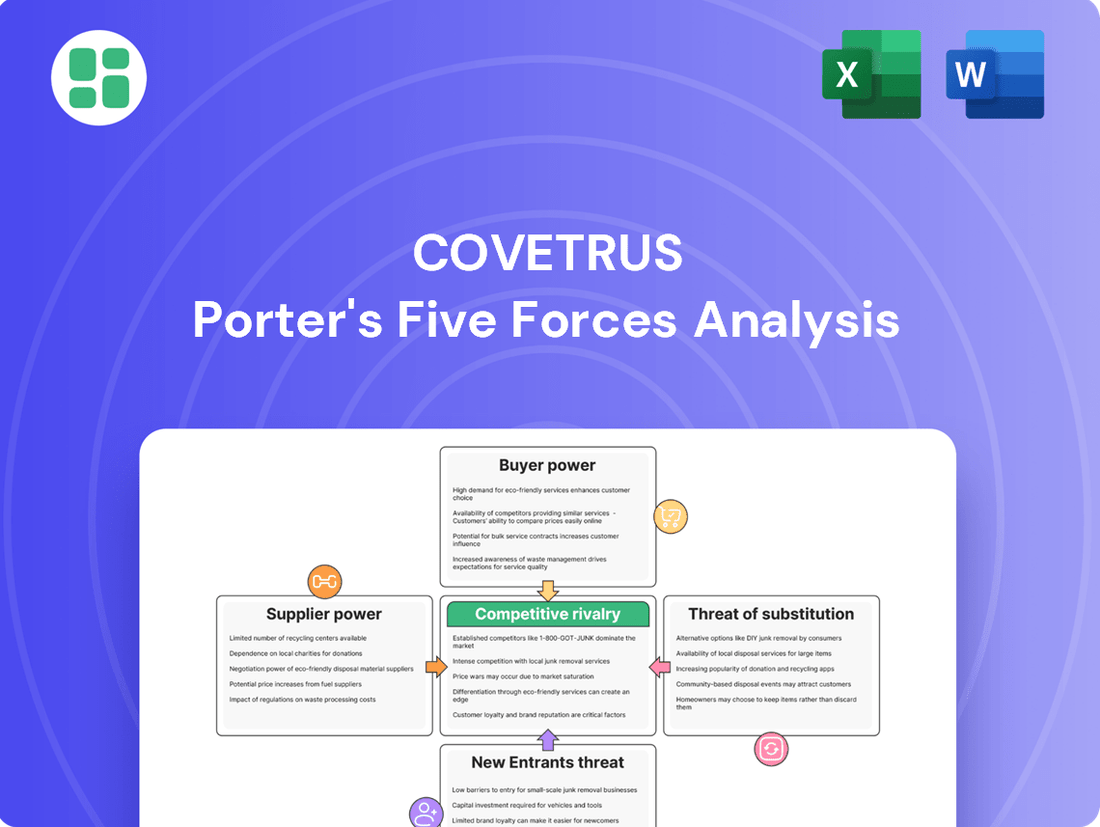

Covetrus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covetrus Bundle

Covetrus operates within a dynamic veterinary services market, facing distinct pressures from buyer power, supplier influence, and the threat of new entrants. Understanding these forces is crucial for navigating the competitive landscape and identifying strategic opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Covetrus’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Covetrus's reliance on a limited number of specialized product manufacturers, particularly in pharmaceuticals and advanced veterinary equipment, grants these suppliers substantial bargaining power. For instance, the veterinary pharmaceutical market in 2024 is characterized by a few dominant players holding patents for critical medications, leaving Covetrus with few alternatives if these suppliers dictate terms or increase prices. This concentration directly impacts Covetrus's cost of goods sold and its ability to offer competitive pricing to its own customers.

Suppliers providing proprietary software or specialized IT infrastructure can wield significant influence over Covetrus. This is especially true when switching to a different vendor involves substantial costs and complex integration processes. For instance, if a critical component of Covetrus's platform relies on a unique, patented technology, the vendor of that technology has a strong bargaining position. The expense and disruption involved in migrating data and retraining staff for a new system can make staying with the current supplier more appealing, even if alternative options exist.

The animal health technology and services market is a hotbed of innovation, with breakthroughs in AI, telemedicine, and new biologics constantly reshaping the landscape. Suppliers driving these advancements, like those creating AI-powered diagnostic tools or cutting-edge vaccines, wield significant bargaining power. Their ability to offer novel solutions, backed by substantial research and development and protected intellectual property, makes them indispensable partners.

Regulatory compliance and quality standards

Suppliers of veterinary pharmaceuticals and regulated medical devices face significant hurdles in meeting stringent quality and safety standards. This can narrow the field of qualified suppliers, giving those who can comply more leverage. For instance, the U.S. Food and Drug Administration (FDA) imposes rigorous requirements on drug manufacturing and medical device approval processes, which can be costly and time-consuming for suppliers to maintain.

These regulatory burdens often translate into increased operational costs for suppliers. These higher costs are frequently passed on to buyers like Covetrus in the form of elevated prices. In 2024, the pharmaceutical industry, including veterinary medicine, continued to grapple with rising raw material costs and complex compliance mandates, further strengthening the bargaining power of suppliers who can navigate these challenges effectively.

- Stringent Quality and Safety Standards: Suppliers must meet rigorous FDA and equivalent international regulatory requirements for veterinary pharmaceuticals and medical devices, limiting the number of compliant providers.

- Increased Supplier Costs: Adhering to these regulations involves substantial investment in research, development, manufacturing processes, and quality control, driving up operational expenses for suppliers.

- Price Pass-Through: Higher supplier costs due to regulatory compliance are often passed on to purchasers like Covetrus, enhancing the suppliers' ability to command higher prices and terms.

- Market Dynamics: In 2024, factors like supply chain disruptions and inflation further amplified the bargaining power of suppliers who could consistently meet quality and regulatory demands.

Strategic partnerships with key suppliers

Covetrus actively manages supplier bargaining power by cultivating strategic partnerships with its primary manufacturers and distributors. These long-term alliances are crucial for securing consistent product availability and favorable pricing, especially for critical veterinary pharmaceuticals and supplies. For instance, in 2024, Covetrus highlighted its ongoing efforts to deepen these relationships, which directly impacts its cost of goods sold and inventory management efficiency.

These collaborations go beyond simple transactions, often involving integrated supply chain solutions and joint forecasting efforts. By working closely with key suppliers, Covetrus can mitigate the impact of individual supplier leverage, ensuring a more stable and predictable supply of essential products. This strategic approach helps maintain competitive pricing for its customers and supports Covetrus's market position.

- Strategic Partnerships: Covetrus focuses on building long-term relationships with major suppliers to ensure reliable product access and favorable terms.

- Supply Chain Integration: These partnerships facilitate more efficient supply chain operations, reducing logistical costs and lead times.

- Mitigating Supplier Power: By securing key alliances, Covetrus balances the bargaining power of individual suppliers, ensuring competitive pricing and product availability.

- 2024 Focus: The company continued to emphasize strengthening these supplier collaborations as a core strategy in 2024 to enhance operational resilience.

Covetrus faces significant supplier bargaining power due to the concentration of specialized veterinary pharmaceutical and equipment manufacturers. Suppliers of proprietary technologies also hold leverage, as switching costs can be prohibitive. The innovation in areas like AI and telemedicine further empowers suppliers at the forefront of these advancements.

Suppliers of regulated veterinary products must navigate stringent quality and safety standards, such as those set by the FDA. These compliance costs increase their operational expenses, which are often passed on to buyers like Covetrus, strengthening supplier pricing power. Market dynamics in 2024, including supply chain issues, exacerbated this trend.

| Supplier Characteristic | Impact on Covetrus | 2024 Relevance |

|---|---|---|

| Limited number of specialized manufacturers | Reduced negotiation leverage for Covetrus | Continued reliance on key pharmaceutical producers |

| Proprietary technology/software | High switching costs for Covetrus | Integration of advanced diagnostic platforms |

| Regulatory compliance costs (e.g., FDA) | Increased cost of goods for Covetrus | Ongoing investment in quality assurance by suppliers |

| Innovation in AI, telemedicine, biologics | Suppliers as key partners with pricing power | Demand for cutting-edge veterinary solutions |

What is included in the product

This analysis details the competitive intensity within the animal health technology and services market, evaluating Covetrus's position against rivals, supplier and buyer power, new entrant threats, and substitute products.

Instantly identify and address competitive threats with a clear, actionable breakdown of each Porter's Five Force, empowering strategic adjustments.

Customers Bargaining Power

Covetrus caters to a wide array of clients, from small, independent veterinary clinics to sprawling corporate animal health networks. This diversity means each customer segment, and indeed each individual client, has distinct operational requirements and technological expectations.

While major players such as NVA and Vetcor, significant partners for Covetrus, wield considerable purchasing influence due to their scale, the overall market remains quite fragmented. This widespread distribution of customers, rather than a concentrated group, dilutes the collective bargaining power that customers might otherwise exert.

Veterinary practices can choose from a wide array of practice management software, supply chain services, and prescription management tools offered by numerous competitors. This abundance of choice empowers customers to readily compare features and pricing across different providers. For instance, in 2024, the market for veterinary practice management software saw continued growth, with numerous vendors offering specialized solutions, making it easier for practices to find alternatives that meet their specific needs.

Veterinary practices are feeling the pinch from rising service inflation and operational expenses, making them more watchful of prices, especially for essential services like software and supply chain solutions. This heightened price sensitivity means they're more likely to push for better deals or look elsewhere if Covetrus's pricing isn't competitive.

For instance, data from the U.S. Bureau of Labor Statistics indicated that veterinary services inflation reached approximately 4.5% in early 2024. This environment empowers veterinary practices to negotiate more effectively with suppliers like Covetrus, seeking discounts or exploring cost-effective alternatives to manage their own increasing overhead.

Switching costs for integrated platforms

The bargaining power of customers is influenced by switching costs, and for integrated platforms like Covetrus, these costs can be substantial. While alternative solutions are available in the veterinary market, the deep integration of Covetrus's software, encompassing practice management, prescription fulfillment, and client communication, creates a sticky ecosystem for veterinary clinics. This intricate embedding into daily operations means that switching to a competitor would involve considerable effort, time, and the risk of operational disruption. For instance, migrating patient records, prescription histories, and client data to a new system can be a complex and resource-intensive undertaking.

The high degree of integration means that a clinic's entire workflow is often optimized around the Covetrus platform. This includes everything from appointment scheduling and patient charting to inventory management and financial reporting. The time and expense associated with retraining staff on a new system, reconfiguring hardware, and ensuring data integrity during migration significantly dampen a customer's inclination to switch. This operational entanglement effectively raises the barrier to entry for competitors seeking to lure away Covetrus clients.

- Deep Integration: Covetrus's software suite is designed to work seamlessly across various veterinary practice functions, making it difficult to extract and transfer data.

- Workflow Dependency: Clinics rely on the platform for daily operations, meaning a switch could halt or severely disrupt business processes.

- Data Migration Challenges: Transferring years of patient records, financial data, and prescription histories to a new system is a complex and costly endeavor.

- Training and Adaptation: Staff retraining and adaptation to a new software interface represent significant time and financial investments for clinics.

Demand for integrated and efficient solutions

Veterinary practices are actively looking for ways to simplify their operations and boost their financial performance. This has led to a growing demand for integrated technology and services that can manage everything from patient records to inventory and billing. For example, a 2024 industry survey indicated that over 70% of veterinary clinics were investing in new software solutions to improve efficiency.

Covetrus's strength lies in its capacity to deliver a unified platform that addresses these diverse needs. By offering a single, comprehensive solution, Covetrus enhances its appeal to practices that value convenience and operational streamlining. This integrated approach can give Covetrus an edge in negotiations, as customers who prioritize efficiency are more likely to be drawn to a provider that simplifies their technology stack.

The bargaining power of customers is also influenced by the availability of alternative solutions. While integrated platforms are desirable, practices still have options to piece together services from different providers. However, the trend towards consolidation and the desire for seamless integration mean that customers seeking efficiency are increasingly looking for single-source providers like Covetrus, which can moderate their bargaining power.

While the veterinary market is fragmented, individual customer bargaining power is somewhat limited by Covetrus's integrated platform, which creates high switching costs. However, price sensitivity is increasing due to rising operational expenses, as evidenced by a 4.5% inflation rate in veterinary services in early 2024. This makes customers more inclined to seek competitive pricing.

| Factor | Impact on Covetrus | Customer Behavior |

|---|---|---|

| Market Fragmentation | Dilutes collective bargaining power | Easier to find alternative providers |

| Switching Costs (Integration) | High, creates customer stickiness | Reluctance to switch due to data migration and retraining |

| Price Sensitivity (Inflation) | Increases pressure for competitive pricing | Actively seeking better deals |

| Demand for Integrated Solutions | Strengthens Covetrus's value proposition | Preference for single-source providers |

Same Document Delivered

Covetrus Porter's Five Forces Analysis

This preview showcases the comprehensive Covetrus Porter's Five Forces Analysis, detailing the competitive landscape of the animal health technology and services industry. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The global animal health technology market, particularly veterinary software and digital health, is booming. This growth is drawing in a multitude of new competitors, all eager to capture a piece of this expanding pie.

The market is projected for substantial growth, with some estimates suggesting it could reach over $40 billion by 2030. This lucrative outlook naturally intensifies competitive rivalry as established companies and startups alike battle for market share and customer acquisition.

Covetrus operates in a fiercely competitive environment, facing significant rivalry from established giants like IDEXX Laboratories. IDEXX, a major player, offers a comprehensive suite of integrated diagnostic tools and cloud-based software solutions, directly challenging Covetrus's market share.

Beyond IDEXX, Covetrus must contend with a diverse array of other software providers targeting veterinary practices. Companies such as ezyVet and DaySmart Vet, along with various niche solution providers, contribute to a crowded marketplace. This dynamic landscape means Covetrus is constantly navigating competition from both long-standing companies and agile, emerging players.

The veterinary industry is seeing a swift embrace of technologies like AI, machine learning, cloud solutions, and telemedicine. This rapid innovation cycle means companies that integrate these advancements effectively gain a significant advantage.

Covetrus faces pressure to consistently invest in research and development to keep pace. For instance, in 2023, the global veterinary software market was valued at approximately $2.5 billion and is projected to grow significantly, driven by the adoption of these very technologies.

Strategic partnerships and consolidation in the industry

Competitive rivalry is intensifying as industry players pursue strategic partnerships and consolidation to broaden their market presence and service portfolios. For instance, IDEXX has introduced new engagement software, enhancing its competitive offering.

Covetrus itself has been active, renewing key distribution partnerships with major veterinary groups, demonstrating a strategic move to solidify its market position. These actions by competitors, including IDEXX's software launch and Covetrus's partnership renewals, increase the overall scale and integrated capabilities within the veterinary technology sector.

- IDEXX's new engagement software

- Covetrus's renewed distribution partnerships

- Increased scale and integrated capabilities of rivals

- Need for proactive competitive response from Covetrus

Differentiation through integrated platforms vs. specialized offerings

Covetrus faces intense rivalry from both integrated platform providers and highly specialized competitors. Its strategy of offering a comprehensive suite of solutions, encompassing everything from practice management software to pharmacy and distribution, aims to create stickiness and a one-stop-shop experience for veterinary practices. This holistic approach, as seen in its 2024 performance where revenue grew, contrasts with rivals who might focus on excelling in a single area, potentially offering deeper functionality or more competitive pricing within that niche.

The competitive landscape is therefore bifurcated. On one hand, companies like Idexx Laboratories continue to dominate in diagnostics, a critical segment where specialized expertise often trumps integration. On the other hand, emerging technology firms are challenging the status quo with innovative, niche solutions. For instance, advancements in AI-powered diagnostic tools or specialized telehealth platforms could draw customers away from broader offerings if they provide demonstrably superior outcomes or cost savings in their specific domain. In 2023, the global veterinary diagnostics market alone was valued at approximately $5.5 billion, highlighting the significant revenue potential in specialized areas.

- Integrated Platforms: Covetrus aims for customer loyalty through a broad service offering, potentially reducing customer acquisition costs over time.

- Specialized Competitors: Companies like Idexx Laboratories thrive on deep expertise in specific areas, such as veterinary diagnostics, capturing market share through superior niche solutions.

- Pricing Pressure: Specialized providers can often afford to be more aggressive on pricing within their focused market segments, creating a challenge for integrated players like Covetrus.

- Customer Choice: Veterinary practices can choose best-of-breed solutions for each need, fragmenting the market and intensifying rivalry.

Covetrus faces intense rivalry from both broad-solution providers and specialized niche players within the animal health technology sector. This dual competitive pressure means Covetrus must balance offering an integrated suite of services with the risk of being outmatched in specific areas by more focused competitors. The market's rapid technological evolution, including AI and telemedicine, further fuels this rivalry as companies race to innovate and capture market share.

The competitive landscape is characterized by major players like IDEXX Laboratories, which offers a strong suite of diagnostic and software solutions, directly challenging Covetrus's integrated approach. Additionally, numerous agile startups are emerging with specialized offerings, particularly in areas like AI-driven diagnostics and advanced telehealth, creating a fragmented and dynamic market. This environment necessitates continuous investment in R&D and strategic partnerships for Covetrus to maintain its competitive edge.

| Competitor Type | Key Strengths | Potential Impact on Covetrus | Example |

|---|---|---|---|

| Integrated Platform Providers | Comprehensive offerings, customer stickiness | Ability to offer one-stop-shop solutions, potentially lower customer acquisition costs | IDEXX Laboratories (diagnostics, software) |

| Specialized Niche Competitors | Deep expertise in specific areas, potentially superior functionality or pricing | Risk of losing market share in specific segments, pressure on pricing | ezyVet (practice management software), DaySmart Vet (practice management software) |

| Emerging Technology Firms | Innovative solutions (AI, telehealth), agility | Disruptive potential, ability to capture new market segments | Various AI diagnostic startups, specialized telehealth platforms |

SSubstitutes Threaten

Veterinary practices might choose to handle their supply chain manually or utilize several unlinked software systems for various tasks, such as separate platforms for appointment scheduling, client billing, and inventory management. This fragmented approach acts as a substitute for Covetrus's unified platform, especially for smaller clinics hesitant to commit to more extensive, integrated solutions.

Veterinary practices have the option to bypass Covetrus's supply chain by sourcing medications and supplies directly from pharmaceutical manufacturers or general wholesalers. This is particularly true for high-volume, common items where the value-add of Covetrus's aggregation and distribution services is less pronounced. For instance, a large veterinary group might negotiate bulk discounts directly with a major drug producer, circumventing Covetrus's platform entirely.

The rise of mobile veterinary services and freelance professionals presents a significant threat of substitutes for traditional veterinary practices. These mobile units and independent vets offer convenient, at-home care for routine needs like vaccinations and basic treatments, directly competing with established clinics. This trend, gaining momentum as pet owners prioritize convenience, can divert demand from brick-and-mortar facilities and the practice management tools they rely on.

Generic or open-source software solutions

While specialized veterinary software is crucial, generic or open-source solutions pose a threat. Some practices might adopt these for basic administrative functions, bypassing parts of Covetrus's integrated offerings if cost is a primary driver. This is particularly relevant for smaller or newer practices with simpler operational needs.

These alternatives, though lacking deep veterinary-specific features, can fulfill basic functions like scheduling, client communication, and billing. For instance, a practice might use a general CRM for client management and a separate accounting software, reducing reliance on a comprehensive practice management system. The availability of such cost-effective options limits the pricing power Covetrus has over its less feature-intensive modules.

- Cost Savings: Open-source and generic software often come with significantly lower upfront and ongoing costs compared to specialized veterinary platforms.

- Basic Functionality: For practices needing only core administrative tools, these alternatives can be sufficient, reducing the perceived value of integrated suites.

- Customization Potential: Open-source solutions can sometimes be modified to fit specific, albeit non-veterinary-specific, workflows, offering a degree of flexibility.

- Market Share Erosion: Even a small shift towards these substitutes by cost-sensitive segments of the veterinary market can impact Covetrus's market share for certain software components.

In-house development by large corporate veterinary groups

Large corporate veterinary groups, some of whom are Covetrus customers, have the financial muscle to build their own internal practice management software or supply chain solutions. This direct development capability poses a significant threat, as these groups can tailor solutions precisely to their operational needs, potentially bypassing Covetrus's existing platforms.

For instance, as of early 2024, major veterinary consolidators are actively investing in technology infrastructure. This allows them to create proprietary systems that offer greater control over data, workflows, and customer experience, directly competing with what Covetrus provides.

- In-house development by large corporate veterinary groups

- Resource advantage: Major players can allocate substantial capital to R&D for custom software.

- Tailored functionality: Proprietary solutions offer bespoke features for specific operational needs.

- Potential cost savings: Long-term, in-house development might be perceived as more cost-effective than licensing third-party software.

The threat of substitutes for Covetrus stems from veterinary practices adopting manual processes or fragmented software systems, which bypass the need for an integrated platform. Additionally, direct sourcing of medications from manufacturers or wholesalers, especially for high-volume items, presents a viable alternative to Covetrus's supply chain services.

Mobile veterinary services and freelance professionals offer convenient, localized care, diverting demand from traditional clinics and their associated software solutions. Furthermore, the availability of generic or open-source software for basic administrative functions can reduce reliance on Covetrus's more comprehensive offerings, particularly for cost-conscious practices.

Large corporate veterinary groups are increasingly developing proprietary in-house software and supply chain solutions, leveraging their financial resources to create tailored systems. This direct development capability allows them to bypass third-party providers like Covetrus, seeking greater control and potentially long-term cost efficiencies.

| Substitute Type | Description | Impact on Covetrus |

| Manual/Fragmented Systems | Practices using separate tools for scheduling, billing, inventory. | Reduces demand for integrated practice management software. |

| Direct Sourcing | Purchasing meds/supplies directly from manufacturers/wholesalers. | Erodes Covetrus's supply chain and distribution revenue. |

| Mobile/Freelance Vets | Convenient, at-home care providers. | Diverts patient volume from brick-and-mortar clinics using Covetrus. |

| Generic/Open-Source Software | Basic administrative tools for scheduling, billing. | Limits pricing power for Covetrus's less specialized modules. |

| In-house Development | Large groups building proprietary software/supply chains. | Significant threat for corporate clients seeking custom solutions. |

Entrants Threaten

Establishing a global animal health technology and services company like Covetrus demands immense capital. Think about the costs for developing sophisticated software platforms, building robust supply chain infrastructure, and creating efficient logistics networks. For instance, in 2023, the global animal health market was valued at approximately $60 billion, indicating the scale of investment needed to capture even a fraction of this.

Newcomers face considerable financial hurdles to achieve the necessary scale and capabilities to truly compete. This high capital requirement acts as a significant barrier, making it difficult for smaller or less-funded entities to enter the market and challenge established players like Covetrus.

The animal health industry is heavily regulated, particularly concerning pharmaceuticals and medical devices. New companies entering this space must contend with intricate compliance requirements, which can significantly increase both the time and expense associated with market entry.

For instance, obtaining approvals for veterinary drugs from bodies like the U.S. Food and Drug Administration (FDA) involves rigorous testing and documentation. In 2024, the cost and time associated with these regulatory processes continue to be substantial deterrents, effectively raising the barrier to entry for potential competitors.

The veterinary industry, particularly the relationship between suppliers and practices, is built on a foundation of trust and established connections. Veterinary clinics often nurture long-standing relationships with their preferred suppliers, valuing reliability and consistent service. This makes it challenging for new entrants to break in, as they lack the proven track record and personal rapport that incumbents like Covetrus have cultivated over time. For example, in 2024, the veterinary services market was valued at approximately $120 billion globally, indicating a substantial but also entrenched sector.

Economies of scale and scope for incumbents

Established companies in the animal health sector, such as Covetrus, leverage significant economies of scale. This allows them to negotiate better prices for pharmaceuticals and supplies due to larger purchase volumes, and to spread the high costs of developing and maintaining integrated technology platforms across a wider customer base. For instance, Covetrus reported a net sales increase to $2.2 billion in 2023, reflecting its substantial market presence and operational efficiencies.

These scale advantages create a substantial barrier for potential new entrants. It is difficult for newcomers to achieve comparable cost efficiencies in purchasing, distribution, and technology development, making it challenging to compete on price or offer the same breadth of integrated services that incumbents provide. This cost disadvantage can significantly hinder a new player's ability to gain market share.

The integrated nature of services, from veterinary practice management software to drug distribution, also creates economies of scope. Incumbents can cross-sell services, further enhancing their value proposition and customer loyalty. New entrants would need to invest heavily to replicate this comprehensive offering, adding to the already high initial capital requirements.

- Economies of Scale in Purchasing: Large volume orders lead to lower per-unit costs for pharmaceuticals and supplies.

- Distribution Network Efficiency: Established logistics and warehousing reduce per-delivery costs.

- Technology Platform Investment: High upfront costs for integrated software are amortized over a larger user base.

- Integrated Service Offerings: Cross-selling opportunities enhance customer value and retention.

Intellectual property and technological complexity

The threat of new entrants for Covetrus, specifically concerning intellectual property and technological complexity, is moderate. Developing advanced veterinary practice management software, intricate integrated supply chain systems, and specialized prescription management tools requires substantial technical know-how and significant investment in research and development. For instance, creating a platform comparable to Covetrus's integrated solutions would likely necessitate millions in upfront R&D, potentially exceeding $50 million based on industry benchmarks for complex software development.

New players must either possess or acquire these advanced technological capabilities and proprietary intellectual property to compete effectively. This high barrier to entry means that potential competitors would need to either undertake extensive, costly R&D efforts or acquire existing technology firms, which can be a capital-intensive undertaking. In 2024, the average acquisition cost for a health-tech startup with proprietary software in the veterinary space could range from $10 million to $50 million, depending on its maturity and market traction.

- High R&D Investment: Developing sophisticated veterinary software and supply chain systems demands substantial financial commitment.

- Intellectual Property Protection: Covetrus's proprietary technologies act as a significant barrier to imitation.

- Acquisition as an Alternative: New entrants might opt for acquiring established technology to bypass lengthy development cycles.

The threat of new entrants in the animal health technology and services sector, where Covetrus operates, is generally considered moderate. Significant capital investment is required for developing sophisticated software, building supply chains, and navigating regulatory approvals, with the global animal health market valued around $60 billion in 2023. Established relationships within the veterinary industry also present a hurdle, as trust and proven reliability are paramount for clinics.

Economies of scale, enjoyed by companies like Covetrus which reported $2.2 billion in net sales in 2023, create cost advantages in purchasing and distribution that are difficult for newcomers to match. Furthermore, the intellectual property and technical complexity of integrated platforms necessitate substantial R&D investment, estimated in the tens of millions for comparable systems, or costly acquisitions for new entrants in 2024.

| Barrier Type | Description | Estimated Impact (2024) |

| Capital Requirements | Developing technology, supply chains, logistics | Millions to tens of millions USD |

| Regulatory Compliance | Drug and device approvals (e.g., FDA) | Significant time and cost increase |

| Customer Loyalty & Relationships | Established trust with veterinary practices | Difficult for new entrants to penetrate |

| Economies of Scale | Lower per-unit costs, efficient distribution | Covetrus's 2023 net sales: $2.2 billion |

| Technological Complexity & IP | R&D for integrated software platforms | Acquisition costs: $10-50 million for startups |

Porter's Five Forces Analysis Data Sources

Our Covetrus Porter's Five Forces analysis leverages a comprehensive data strategy, incorporating financial reports from Covetrus and its competitors, industry-specific market research from firms like IBISWorld, and regulatory filings to understand the competitive landscape.