Covetrus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covetrus Bundle

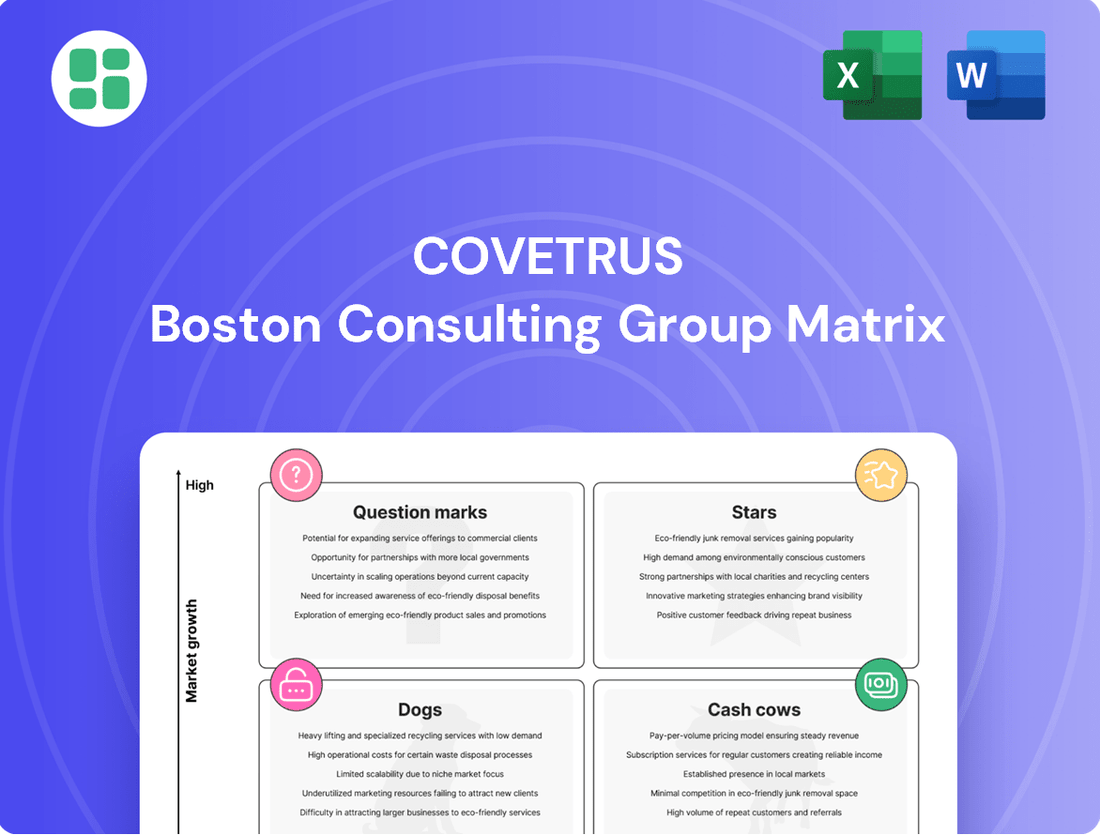

Curious about Covetrus's market position? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a strategic overview. Don't miss out on the full picture; purchase the complete BCG Matrix report to unlock detailed quadrant analysis and actionable insights for optimizing your investment and product portfolio.

Stars

Covetrus Pulse, with its advanced AI features like ambient listening and auto-generated SOAP notes, is a prime example of a question mark product within the Covetrus BCG Matrix. The animal digital health software market is projected to grow at a robust 21% CAGR from 2025 to 2034, highlighting the substantial potential for these innovative solutions. Covetrus is strategically investing in these AI capabilities to enhance practice efficiency and patient outcomes, aiming to capture a significant portion of this expanding market.

The Covetrus Platform, integrated with VetSuite, offers a comprehensive, end-to-end solution aimed at streamlining veterinary practice operations and boosting their competitive edge. This bundled approach combines technology, products, and services to tackle key industry pain points such as efficiency and cost reduction.

Covetrus has strategically invested in this integrated offering, recognizing the growing demand for complete digital transformation within the veterinary sector. This focus highlights their commitment to supporting practices in navigating the evolving landscape of animal healthcare technology.

Covetrus's advanced prescription management, including vRxPro™, and expanded home delivery services are meeting a significant market need. This directly addresses the increasing demand for convenience and direct-to-consumer options in veterinary care, a trend that accelerated notably in 2024 as more pet owners sought seamless ways to manage their pets' medications.

Practices are increasingly adopting these solutions to better compete with retail pharmacies and enhance client satisfaction. For instance, by mid-2024, a significant percentage of veterinary clinics reported integrating or expanding their home delivery capabilities to improve client retention and streamline operations, directly impacting prescription refill rates and overall practice revenue.

The emphasis on competitive pricing and user-friendly access for prescription management is a key driver for this segment's growth. This strategic focus positions Covetrus's offerings for sustained high growth and deeper market penetration, mirroring the broader shift towards digital-first service models across many consumer-facing industries throughout 2024.

Veterinary Wellness Plan Administration

Covetrus' acquisition of Veterinary Care Plans (VCP) positions it within the rapidly expanding veterinary wellness sector, a segment fueled by heightened pet humanization and a growing emphasis on preventative pet healthcare. This strategic expansion allows Covetrus to diversify its revenue streams beyond its core veterinary supply and software businesses. The company is now able to offer comprehensive wellness plan administration, a service highly sought after by veterinary practices aiming to improve client retention and recurring revenue.

The market for pet wellness plans is experiencing significant growth, with projections indicating continued expansion. For instance, the global pet care market, which includes wellness services, was valued at over $260 billion in 2023 and is expected to reach over $350 billion by 2028, demonstrating a strong compound annual growth rate. This trend underscores the increasing willingness of pet owners to invest in the long-term health and well-being of their pets, making VCP a valuable asset for Covetrus.

Covetrus' entry into wellness plan administration through VCP aligns with its broader strategy to provide integrated solutions for veterinary practices. This move enables veterinary clinics to offer predictable healthcare packages, enhancing client loyalty and providing a stable revenue base. The platform simplifies the management of these plans, reducing administrative burdens for clinics and allowing them to focus on patient care.

- Market Growth: The global pet care market, including wellness services, shows robust growth, projected to exceed $350 billion by 2028.

- Pet Humanization Trend: Increasing emotional bonds between owners and pets drive demand for premium and preventative healthcare services.

- Recurring Revenue for Clinics: Wellness plans offer veterinary practices a stable, predictable revenue stream, improving financial stability.

- Operational Efficiency: VCP streamlines administrative tasks for clinics, allowing for greater focus on veterinary services and patient outcomes.

Cloud-Based Practice Management Systems Adoption

The veterinary sector is rapidly embracing new technologies, with a notable trend towards cloud-based practice management systems. In 2025, a significant 41% of veterinary practices are projected to upgrade their software, with a clear preference for cloud solutions.

Covetrus is well-positioned in this evolving landscape, thanks to its robust development and implementation of cloud-based platforms like Ascend and Pulse. These systems are designed to simplify operations and ease the administrative workload for veterinary professionals.

- Market Growth: The shift to cloud-based systems in veterinary practice management is a key growth driver.

- Covetrus's Role: Covetrus's investment in cloud solutions like Ascend and Pulse places them as a leader in this expanding market.

- Operational Efficiency: Practices are adopting these systems to streamline workflows and reduce administrative tasks.

- Future Outlook: Continued adoption is expected as more practices recognize the benefits of cloud technology.

Covetrus's Prescription Management and Home Delivery services are performing as Stars in the BCG Matrix. These offerings are capitalizing on the growing demand for convenience in veterinary care, a trend that saw significant acceleration in 2024. By mid-2024, a substantial portion of veterinary clinics had integrated or expanded their home delivery capabilities, leading to improved client retention and increased prescription refill rates.

The focus on competitive pricing and user-friendly access for prescription management is a key driver for this segment's high growth and market penetration. This strategic positioning aligns with the broader industry shift towards digital-first service models observed throughout 2024, solidifying these services as key revenue generators for Covetrus.

| Product/Service | BCG Category | Key Growth Drivers | Market Share | Growth Rate |

| Prescription Management & Home Delivery | Star | Convenience, Direct-to-Consumer Trend, Competitive Pricing | High | High |

| Veterinary Care Plans (VCP) | Question Mark | Pet Humanization, Preventative Care Demand | Low to Medium | High |

| Covetrus Pulse | Question Mark | AI Features, Practice Efficiency | Low to Medium | High |

| Covetrus Platform | Cash Cow | Integrated Solutions, Streamlined Operations | High | Medium |

What is included in the product

The Covetrus BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

The Covetrus BCG Matrix offers a clear, one-page overview of each business unit's position, simplifying strategic decision-making.

Cash Cows

Covetrus’s established veterinary product supply chain acts as a strong Cash Cow. This segment reliably generates substantial revenue by supplying essential pharmaceuticals, equipment, and consumables to over 100,000 veterinary practices worldwide. The recurring demand for these products ensures a consistent and high-volume cash flow, a hallmark of a Cash Cow.

Covetrus's core practice management software, including established systems like RxWorks and VisionVPM, represents a significant cash cow. These solutions maintain a strong installed base within veterinary clinics, consistently generating recurring revenue from licensing, maintenance, and support. This reliable income stream underpins the company's financial stability, even as newer technologies emerge.

Covetrus's pharmaceutical compounding services, exemplified by its Phoenix facility, represent a stable Cash Cow. This segment consistently generates reliable revenue by meeting the ongoing demand for customized veterinary medications, which are crucial for tailored patient care.

The company's investment in advanced compounding capabilities underscores its commitment to this established market. In 2024, the veterinary compounding market was valued at approximately $7.5 billion globally, with a projected compound annual growth rate of 6.5% through 2030, highlighting the sustained demand for these specialized services.

Wholesale Distribution of Veterinary Medicines

Covetrus's wholesale distribution of veterinary medicines acts as a significant Cash Cow. This segment leverages its position as a major distributor, supplying a wide array of veterinary pharmaceuticals from top manufacturers to clinics and hospitals.

The business model is characterized by a mature, yet indispensable, role within the animal health sector. Its strength lies in an efficient supply chain that ensures consistent product availability, meeting the ongoing demand for animal health treatments.

This consistent demand translates into substantial and reliable revenue streams. For instance, the global animal health market was valued at approximately $50 billion in 2023 and is projected to grow steadily, with veterinary pharmaceuticals being a core component.

- Market Position: Covetrus is a key intermediary, connecting pharmaceutical producers with veterinary service providers.

- Revenue Generation: The segment benefits from high sales volume and recurring purchases of essential animal medications.

- Industry Importance: It underpins the operational capacity of veterinary practices by ensuring access to critical pharmaceutical supplies.

- Financial Contribution: This business line consistently contributes significant, stable profits to Covetrus's overall financial performance.

Basic Financial and Operational Support Services

Covetrus's basic financial and operational support services, encompassing financial management, inventory control, and business administration tools, are designed to enhance veterinary practice efficiency. These essential offerings form a stable revenue stream, serving a wide array of clients who depend on Covetrus for their daily operational needs.

These services function as cash cows within the Covetrus portfolio, characterized by their low growth but high market share. They provide the foundational financial stability that allows Covetrus to invest in more dynamic areas of its business. For instance, in 2023, recurring revenue from these support services contributed significantly to Covetrus's overall financial performance, demonstrating their consistent value proposition.

- Stable Recurring Revenue: These services generate predictable income from a large, established customer base.

- Operational Efficiency Focus: They directly address core needs of veterinary practices, ensuring high client retention.

- Foundation for Growth: The profits generated support investment in higher-growth segments of Covetrus's business.

- Market Maturity: While not high-growth, these services maintain a strong market position due to their essential nature.

Covetrus's established veterinary product supply chain is a prime example of a Cash Cow, reliably generating substantial revenue by supplying essential pharmaceuticals, equipment, and consumables to over 100,000 veterinary practices globally. The consistent demand for these products ensures a high-volume, stable cash flow, a defining characteristic of a Cash Cow.

The company's core practice management software, including systems like RxWorks and VisionVPM, also functions as a cash cow. These solutions maintain a strong installed base, consistently generating recurring revenue from licensing and support, providing financial stability.

Covetrus's pharmaceutical compounding services, such as those offered through its Phoenix facility, represent another stable Cash Cow. These services consistently meet the ongoing demand for customized veterinary medications, crucial for tailored patient care.

The wholesale distribution of veterinary medicines is a significant Cash Cow, leveraging Covetrus's position as a major distributor to supply a wide array of veterinary pharmaceuticals. This segment benefits from high sales volume and recurring purchases, underpinning the operational capacity of veterinary practices by ensuring access to critical supplies.

Covetrus's basic financial and operational support services, including financial management and inventory control tools, are designed to enhance veterinary practice efficiency. These essential offerings form a stable revenue stream, serving a wide client base and providing foundational financial stability.

| Covetrus Cash Cow Segments | Key Characteristics | 2023/2024 Data Points |

|---|---|---|

| Veterinary Product Supply Chain | High volume, recurring purchases of essential items | Serves over 100,000 veterinary practices globally. |

| Practice Management Software (RxWorks, VisionVPM) | Strong installed base, recurring revenue from licensing/support | Consistent revenue generation from maintenance and support contracts. |

| Pharmaceutical Compounding Services | Meeting ongoing demand for customized medications | Global veterinary compounding market valued at ~$7.5 billion in 2024, with a projected 6.5% CAGR through 2030. |

| Wholesale Distribution of Veterinary Medicines | Essential intermediary role, high sales volume | Global animal health market valued at ~$50 billion in 2023, with pharmaceuticals as a core component. |

| Financial & Operational Support Services | Stable recurring revenue, high client retention | Contributed significantly to overall financial performance in 2023 due to consistent value proposition. |

Preview = Final Product

Covetrus BCG Matrix

The Covetrus BCG Matrix preview you're seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a complete, analysis-ready report designed for strategic decision-making.

Dogs

Outdated on-premise practice management software solutions represent a potential Question Mark or Dog in Covetrus's BCG Matrix. These legacy systems, while still supported, are not part of the company's strategic cloud-first initiatives and receive minimal development investment. Their market share is likely shrinking as veterinary practices increasingly adopt modern, cloud-based alternatives.

Covetrus, while a major distributor, deals with many highly commoditized basic veterinary supplies. Think of things like generic bandages, cleaning solutions, or basic diagnostic consumables. In this segment, differentiation is minimal, and competition is fierce, primarily driven by price.

These products, while necessary, often have slim profit margins for Covetrus. For instance, in 2023, the overall gross profit margin for the animal health distribution sector hovered around 15-20%, with commoditized items likely falling at the lower end of this range.

The strategic value of these basic supplies is limited due to their lack of proprietary branding and predictable, slow growth prospects. Covetrus’s focus in these areas is more on volume and efficient logistics rather than innovation or premium pricing.

Covetrus may have some regional distribution hubs or older physical assets that are not performing as well as others. These legacy assets might be less efficient, leading to higher operational costs compared to the revenue they bring in. This situation often points to a smaller market share in the specific areas where these hubs operate.

For instance, if a particular distribution center in a less populated or economically slower region is struggling, its operational expenses might outweigh its contribution. In 2024, companies like Covetrus are intensely focused on network optimization, so such underperforming assets could be candidates for review or divestment if they don't align with future growth strategies.

Niche or Standalone Ancillary Software Tools

Niche or standalone ancillary software tools within Covetrus's portfolio represent a category that may be facing declining relevance. These are often older systems, perhaps acquired through past mergers, that haven't been fully integrated into the broader Covetrus Platform or VetSuite. Their limited market share in an evolving, highly integrated veterinary technology sector suggests a potential for redundancy.

The veterinary software market is increasingly prioritizing seamless integration and comprehensive solutions. Standalone tools, by their nature, can create data silos and workflow inefficiencies for veterinary practices. As of early 2024, the trend towards unified practice management systems is strong, with many practices seeking to consolidate their technology stack for better operational efficiency and client engagement.

- Low Market Share: These tools likely hold a small percentage of the overall veterinary software market compared to integrated platforms.

- Integration Challenges: Their standalone nature makes them difficult to connect with other essential practice systems, reducing their utility.

- Redundancy Risk: As Covetrus focuses on its core integrated offerings, these niche tools may become obsolete or unsupported.

- Strategic Divestment Potential: Companies often consider divesting or phasing out non-core, low-performing assets to streamline operations and focus resources.

Services with Low Client Adoption in Mature Segments

In the mature segments of the veterinary market, certain services within Covetrus's portfolio have struggled with client adoption. These offerings, potentially stemming from older business models or facing intense competition, are now considered question marks in the BCG Matrix. Their low uptake means they require ongoing investment but yield minimal returns, hindering overall growth.

For instance, services that were once innovative but have since been surpassed by more advanced or integrated solutions may fall into this category. The veterinary industry is dynamic, and what was once a key offering can quickly become obsolete if not continuously updated or repositioned. In 2024, the focus for many veterinary practices has shifted towards digital health records and telehealth, leaving some legacy services in the dust.

- Legacy diagnostic services: Older, less integrated diagnostic platforms that have been superseded by faster, more accurate, or cloud-based alternatives.

- Basic inventory management software: Standalone inventory solutions that lack integration with practice management systems or advanced analytics, which are now standard.

- Outdated pharmaceutical distribution models: Distribution channels that do not offer the convenience or cost-effectiveness of modern, direct-to-clinic supply chains.

Certain commoditized veterinary supplies, like basic consumables, represent potential Dogs for Covetrus. These products face intense price competition, leading to slim profit margins, potentially around 15-20% gross profit in 2023 for the sector. Their limited differentiation and slow growth prospects mean Covetrus focuses on volume rather than innovation.

Underperforming regional distribution hubs or older physical assets can also be classified as Dogs. These legacy assets may have higher operational costs than revenue generated, especially in less economically active areas. Companies like Covetrus are focusing on network optimization in 2024, making these less efficient sites candidates for review or divestment.

Niche, standalone ancillary software tools that haven't integrated into Covetrus's core platform could also be Dogs. The veterinary software market in early 2024 heavily favors integrated solutions, making these tools less relevant and potentially redundant due to integration challenges.

Covetrus's portfolio may include legacy diagnostic services or basic inventory management software that have been surpassed by more advanced or cloud-based alternatives. These offerings struggle with client adoption and yield minimal returns, requiring ongoing investment without significant growth prospects.

Question Marks

Early-stage AI-driven advanced diagnostics represent a significant growth opportunity within the veterinary sector, even as AI's integration into core practice management systems (PMS) solidifies Covetrus's Star position. These specialized AI tools, such as those for radiology interpretation or predictive analytics, are still in their nascent stages of market adoption.

While the overall market for these advanced diagnostics is projected for substantial expansion, Covetrus's current market share in these specific, emerging sub-segments might be relatively limited. For instance, the global veterinary diagnostics market was valued at approximately $4.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, with AI-powered solutions anticipated to be a key driver of this growth.

Covetrus's expansion into untapped global markets aligns with the Stars or Question Marks in the BCG Matrix, depending on the specific market's growth trajectory and Covetrus's current position. These markets, characterized by rapidly developing veterinary care sectors, represent significant growth potential where Covetrus's market share is currently minimal.

For instance, in Southeast Asia, the pet care market is projected to grow at a compound annual growth rate of over 10% in the coming years, yet Covetrus's penetration remains relatively low. Such ventures demand substantial upfront investment for infrastructure, marketing, and regulatory compliance, indicating a high-risk, high-reward scenario.

The burgeoning market for wearable pet technology, projected to reach over $6 billion globally by 2028, offers Covetrus a unique opportunity. This technology provides invaluable real-time health monitoring data, such as activity levels and vital signs, which can significantly enhance patient care.

Covetrus's integration of this data into its practice management systems is likely in its nascent stages, placing it in the 'Question Mark' quadrant of the BCG Matrix. While the market shows substantial growth potential, Covetrus's current market share in this specific niche is relatively small.

New, Specialized Telemedicine Offerings

Covetrus's new, specialized telemedicine offerings represent a strategic move into niche areas of veterinary telehealth. These services go beyond simple virtual check-ups, focusing on specific conditions or types of care, aiming to attract a broader customer base within the expanding telehealth market. While these specialized platforms are still developing and building their presence, they hold significant potential for future growth.

The veterinary telehealth market is experiencing robust expansion. For instance, the global veterinary telehealth market size was valued at approximately USD 1.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 16.5% from 2024 to 2030. This growth indicates a strong demand for innovative solutions like Covetrus's specialized offerings.

- Targeted Services: Development of platforms for chronic disease management, dermatology consultations, or post-operative care monitoring.

- Market Penetration: Focus on acquiring new user segments and increasing market share in specialized telehealth niches.

- Revenue Potential: These offerings are designed to tap into the increasing willingness of pet owners to pay for convenient, high-quality virtual veterinary care.

- Competitive Landscape: Positioned to compete with both general telehealth providers and emerging specialized veterinary services.

Subscription-Based Preventative Care Solutions (New Offerings)

Covetrus's expansion into subscription-based preventative care solutions, building on its Veterinary Cooperation Program (VCP) acquisition, is positioned as a significant growth driver. This initiative aims to offer new or enhanced preventative care plans to its entire customer base, tapping into a burgeoning service model. The company recognizes this as a high-growth opportunity requiring substantial investment to secure widespread adoption and establish market leadership.

The strategic importance of these new offerings is underscored by the potential to capture a larger share of the recurring revenue market in veterinary services. Covetrus is likely channeling significant capital into marketing, technology infrastructure, and customer education to support this rollout. For instance, the global veterinary services market was valued at approximately $100 billion in 2023 and is projected to grow, with preventative care subscriptions playing an increasingly vital role.

- High Growth Potential: Subscription models in veterinary care are gaining traction, offering predictable revenue streams and enhanced customer loyalty.

- Investment Required: To achieve dominant market share, Covetrus must commit substantial resources to drive adoption and refine service delivery.

- Market Evolution: This move aligns with a broader industry shift towards value-based care and proactive health management for pets.

- Customer Engagement: Expanded preventative care plans can deepen relationships with veterinary practices and pet owners alike.

Covetrus's early-stage AI diagnostics and wearable pet technology initiatives are prime examples of Question Marks. These ventures operate in high-growth, emerging markets where Covetrus's current market share is minimal, necessitating significant investment to build presence and capture future demand.

The specialized telemedicine offerings also fall into this category. While the veterinary telehealth market is expanding rapidly, with a projected CAGR of around 16.5% from 2024 to 2030, Covetrus's niche services are still establishing their foothold.

These Question Marks represent opportunities for substantial future growth if Covetrus can successfully navigate the investment requirements and competitive landscape to build market share.

The subscription-based preventative care solutions, while promising, also require substantial upfront investment to drive adoption and establish leadership, placing them in the Question Mark quadrant due to the high investment needed for market penetration.

| Initiative | Market Growth | Covetrus Market Share | Investment Needs | BCG Quadrant |

|---|---|---|---|---|

| AI Diagnostics | High (AI in vet diagnostics driving growth) | Low/Nascent | High | Question Mark |

| Wearable Pet Tech | High (Projected >$6B by 2028) | Low | High | Question Mark |

| Specialized Telehealth | Very High (CAGR ~16.5% from 2024-2030) | Low | High | Question Mark |

| Preventative Care Subscriptions | High (Growing recurring revenue model) | Low/Developing | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.