Costain Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costain Group Bundle

The Costain Group operates in a dynamic environment shaped by intense rivalry and the constant threat of new entrants, impacting its pricing power and market share. Understanding the bargaining power of both suppliers and buyers is crucial for Costain's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Costain Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers providing specialized construction materials, digital solutions, and advanced technologies like AI robotics and digital twin software wield considerable influence. Costain's commitment to smart infrastructure necessitates these unique offerings, allowing niche suppliers to dictate higher prices given limited alternatives. For instance, the growing market for sustainable construction materials, valued at billions globally and projected for continued growth through 2024 and beyond, gives an edge to suppliers meeting strict environmental criteria.

The UK construction and engineering industries are facing a significant and growing shortage of skilled workers. This scarcity, especially in specialized trades and advanced engineering fields, directly translates into increased bargaining power for these skilled individuals and specialized subcontractors. For companies like Costain, this means higher labor costs and more difficulty in finding the right talent.

The demand for new workers in the industry is projected to be substantial, with estimates suggesting hundreds of thousands of new entrants will be needed by 2027. This talent gap underscores how critical and influential skilled labor has become as an input for companies operating in this sector.

Ongoing inflation and global supply chain disruptions have significantly increased the costs of key construction materials. For instance, the Producer Price Index for construction materials saw a substantial year-over-year increase in 2024, particularly for items like lumber and steel.

This volatility allows suppliers to frequently revise their pricing, directly impacting Costain Group's project budgets and potentially squeezing already tight margins. The drive towards sustainable building practices also adds another layer, as eco-friendly materials often come with a higher initial price tag, further empowering suppliers.

Concentration of Key Suppliers

The concentration of key suppliers in specialized areas, such as advanced digital and engineering solutions, can significantly impact Costain Group. When a few dominant players control critical components or services, Costain's negotiation leverage diminishes, leading to increased dependence and potentially higher costs. This was evident in 2024, where the market for certain AI-driven project management software saw a consolidation, with two primary providers capturing over 60% of the enterprise-level contracts within the UK infrastructure sector.

- Supplier Concentration: In specialized segments like advanced digital solutions, few suppliers may dominate the market for critical inputs.

- Reduced Options: This concentration limits Costain's choices, increasing its reliance on these key providers.

- Pricing Influence: Dominant suppliers can dictate terms and pricing for essential, difficult-to-substitute inputs.

- 2024 Market Data: The UK infrastructure sector's AI project management software market in 2024 showed a 60% market share held by just two major providers.

Supply Chain Resilience and Regulatory Compliance

New regulations and evolving client expectations are increasingly emphasizing supply chain transparency and adherence to stringent environmental and ethical sourcing standards. This dynamic empowers suppliers who can demonstrably meet these requirements and maintain resilient supply chains, as non-compliance by main contractors like Costain Group can result in significant financial penalties and reputational damage.

The added complexity and cost associated with meeting these enhanced standards further solidify the bargaining power of suppliers who are well-positioned to comply. For instance, in the UK infrastructure sector, adherence to the Modern Slavery Act 2015 and evolving ESG (Environmental, Social, and Governance) reporting mandates are becoming critical differentiators.

- Increased Scrutiny on Sourcing: Clients demand verifiable proof of ethical and sustainable sourcing practices throughout the supply chain.

- Supplier Compliance as a Differentiator: Suppliers meeting new regulatory and client-driven transparency demands gain leverage.

- Risk of Non-Compliance for Contractors: Failure to ensure supplier compliance exposes main contractors to financial penalties and reputational harm.

- Cost Implications: Meeting these higher standards often translates to increased operational costs for suppliers, which can be passed on.

Suppliers of specialized construction materials and advanced digital solutions, such as AI robotics and digital twin software, hold significant leverage over Costain Group. This is due to the unique nature of their offerings and the limited availability of alternatives, allowing them to command higher prices. For example, the global market for sustainable construction materials, projected for strong growth through 2024, benefits suppliers who meet strict environmental criteria.

The scarcity of skilled labor in the UK construction and engineering sectors, particularly in specialized trades, directly enhances the bargaining power of these workers and subcontractors. This talent deficit means higher labor costs and greater difficulty in securing qualified personnel for companies like Costain. The industry anticipates needing hundreds of thousands of new workers by 2027, highlighting the critical influence of skilled labor.

| Factor | Impact on Costain Group | Supporting Data (2024) |

|---|---|---|

| Supplier Concentration (Digital Solutions) | Reduced negotiation leverage, increased dependence | AI project management software market in UK infrastructure saw 60% share held by two providers. |

| Skilled Labor Shortage | Increased labor costs, recruitment challenges | Hundreds of thousands of new entrants needed by 2027. |

| Supply Chain Volatility (Materials) | Higher material costs, budget pressure | Producer Price Index for construction materials saw significant year-over-year increase in 2024. |

| Regulatory Compliance (ESG/Sourcing) | Supplier advantage for compliant firms, risk for non-compliant contractors | Growing emphasis on Modern Slavery Act and ESG reporting mandates in UK infrastructure. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Costain Group's infrastructure and engineering sector.

Understand the competitive landscape for Costain Group with a visual representation of each force, allowing for rapid identification of key strategic challenges.

Customers Bargaining Power

Costain's customer base is heavily concentrated among large government entities and major blue-chip corporations. These clients operate in vital sectors such as transportation, water, energy, and defense, commissioning significant infrastructure projects.

These substantial clients, with their considerable budgets and long-term investment horizons, possess significant bargaining power. For instance, the UK's infrastructure investment is projected to reach £700-775 billion over the coming decade, offering ample opportunities for large clients to negotiate terms.

The sheer scale and strategic importance of the projects undertaken by these clients, like major rail or energy network upgrades, naturally grant them considerable leverage in negotiations with contractors like Costain.

Customers often secure services through competitive bidding and extended framework agreements. This allows them significant leverage in negotiating terms, pricing, and how risks are shared. For instance, Costain's substantial £5.4 billion forward work backlog, significantly boosted by wins in the water and rail industries, underscores the importance of these large, structured contracts.

These framework agreements, while beneficial for revenue predictability, also place considerable power in the hands of clients. They can impose demanding performance standards and rigorous cost management expectations, directly influencing Costain's operational flexibility and profitability.

Costain's significant reliance on publicly funded infrastructure projects means government policy and spending decisions wield considerable influence. For instance, the UK government's commitment to net-zero targets and ambitious housing goals directly shapes Costain's project pipeline. Changes in these national priorities or a shift in government spending reviews can alter project initiation and scope, indirectly empowering these public sector clients.

Demand for Integrated and Innovative Solutions

Customers are increasingly demanding integrated and innovative solutions, particularly in smart infrastructure. This means they want more than just traditional services; they're looking for digital advancements that boost efficiency and sustainability. For instance, in 2024, the global smart infrastructure market was projected to reach hundreds of billions of dollars, highlighting this strong customer pull towards technologically advanced offerings.

Costain's emphasis on technology-driven engineering directly addresses this trend. However, it also elevates customer expectations, pushing contractors to deliver consistent innovation and demonstrable value. This dynamic fuels competition, compelling companies to develop more sophisticated and comprehensive solutions to meet evolving client needs.

- Demand for integrated smart infrastructure solutions is growing.

- Customers expect digital and innovative approaches for efficiency and sustainability.

- Costain's technology focus aligns with but also raises customer expectations.

- Competition intensifies as firms strive to offer more advanced, comprehensive solutions.

Client Scrutiny and Financial Stability Concerns

Clients are becoming much more cautious about the financial health of construction companies. Following a series of insolvencies within the sector, particularly in 2023 and early 2024, customers are performing deeper checks on contractor stability and how well they manage risks. This increased scrutiny means clients are demanding tighter contract terms to protect themselves from potential project disruptions caused by a contractor's financial troubles.

The heightened awareness of financial risks translates directly into greater bargaining power for customers. They are less willing to tolerate delays or disruptions stemming from a contractor's financial instability. For example, a client might insist on performance bonds or escrow accounts to safeguard their investment.

- Increased Due Diligence: Clients are conducting more thorough financial health checks on potential contractors.

- Stricter Contractual Terms: Agreements now often include clauses designed to protect clients from contractor insolvency.

- Risk Mitigation Demands: Customers are pushing for mechanisms like performance bonds to ensure project continuity.

- Project Continuity Focus: Clients prioritize contractors who demonstrate robust financial management to avoid delays.

Costain's customers, primarily large government bodies and major corporations, wield considerable bargaining power due to the scale of their projects and the competitive bidding processes they employ. These clients, involved in critical sectors like transportation and energy, often secure services through framework agreements, which allow them to negotiate pricing, terms, and risk-sharing extensively.

| Customer Type | Project Scale | Bargaining Lever |

|---|---|---|

| Government Entities & Blue-Chip Corporations | Large-scale infrastructure projects (e.g., rail, water, energy) | Competitive bidding, framework agreements, significant investment volumes |

| UK Infrastructure Investment (Projected) | £700-775 billion over next decade | Client ability to negotiate terms across numerous large projects |

| Costain's Forward Work Backlog | £5.4 billion (as of recent reports) | Highlights reliance on large, structured contracts with powerful clients |

Preview the Actual Deliverable

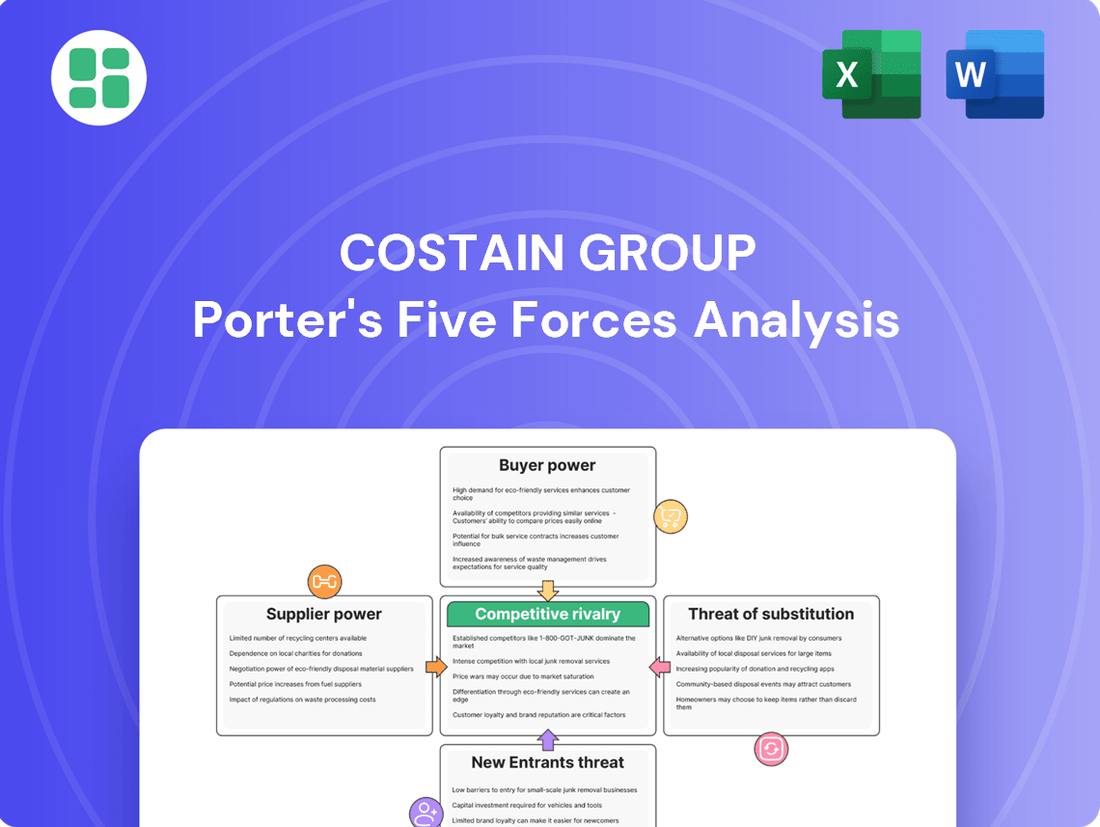

Costain Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Costain Group's Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The UK construction and engineering sector is indeed a crowded space. Costain contends with major players such as Kier Group, Galliford Try, BAM Nuttall, Balfour Beatty, Renew Holdings, Keller Group, and Amey UK Ltd. These companies frequently vie for the same significant infrastructure contracts, both public and private.

This intense competition naturally drives aggressive bidding processes, which in turn puts considerable pressure on profit margins for all involved. Many of these rivals offer a comparable range of engineering and construction services, further intensifying the direct competition for project wins.

Costain Group operates in an environment with substantial fixed costs, including significant investments in specialized plant, machinery, and a skilled workforce. These high overheads necessitate a continuous flow of projects to ensure profitability and cover operational expenses. For instance, in 2023, Costain reported capital expenditure of £75 million, highlighting ongoing investment in its asset base.

The sector's project-based structure inherently drives intense competition as companies actively bid for new contracts to maintain operational capacity and workforce utilization. This constant pursuit of work often leads to aggressive pricing, especially when demand fluctuates. In 2023, Costain secured significant contracts, including a £300 million Highways England framework, demonstrating the critical nature of winning new business.

The UK construction market is showing signs of expansion, especially in infrastructure projects. However, certain areas, like road transportation, have experienced a slowdown in activity as major projects conclude or face delays. This dynamic creates a mixed environment for companies like Costain.

Costain is strategically focusing on sectors with strong growth potential, such as water, rail, defense, and nuclear energy. These areas are expected to see continued investment, offering a solid foundation for the company's future. For instance, the UK government's commitment to upgrading water infrastructure, with significant investment planned through to 2030, highlights the opportunities in this sector.

While Costain's focus on these growth areas is advantageous, it also intensifies competition. As these segments become more attractive due to their growth prospects and government backing, more players are entering or increasing their presence, leading to a more aggressive competitive landscape. This means Costain will need to leverage its expertise and existing relationships to maintain its market position.

Differentiation through Technology and Innovation

Costain Group seeks to stand out by offering 'smart infrastructure solutions,' incorporating advanced digital tools such as AI-powered robotics and digital twins. This strategic emphasis on technology and innovation helps to lessen direct competition based on price, particularly for intricate and large-scale projects.

While this approach offers a competitive advantage, it's important to note that other players in the industry are also channeling resources into developing comparable technological capabilities. This means Costain must consistently innovate to sustain its distinctiveness and market position.

- Costain's 2023 revenue was £1.1 billion, with a focus on its strategy to deliver integrated, technology-led solutions.

- The company has highlighted its investments in digital capabilities as a key differentiator in securing complex projects.

- Competitors like Balfour Beatty and Kier are also investing in digital transformation and innovation, intensifying the need for continuous R&D.

Economic Headwinds and Insolvencies

The UK construction sector is grappling with significant economic headwinds in 2024. Persistent inflation, elevated interest rates, and ongoing planning permission delays are creating a challenging financial landscape for many companies. This has unfortunately resulted in a notable increase in insolvencies within the industry.

This difficult economic climate intensifies competitive rivalry. With fewer, more stable projects available, remaining construction firms are competing fiercely for these opportunities. Clients, in turn, are exercising greater caution in their project commitments.

The pressure to secure work in this environment can lead to a detrimental 'race to the bottom' on pricing for certain contracts. This dynamic puts further strain on profit margins for companies like Costain Group.

- Increased Insolvencies: Reports indicate a rise in construction firm insolvencies throughout 2024, impacting the overall market stability.

- Inflationary Pressures: Rising material and labor costs continue to squeeze project budgets and company finances.

- Client Caution: Economic uncertainty makes clients more hesitant, leading to fewer new project starts and increased competition for existing ones.

- Price Sensitivity: The drive to win contracts in a tight market often results in aggressive bidding, potentially compromising profitability.

Competitive rivalry within the UK construction sector is fierce, with Costain Group facing numerous established players like Kier Group and Balfour Beatty. These companies frequently compete for the same large-scale infrastructure projects, driving aggressive bidding and pressuring profit margins.

The industry's high fixed costs and project-based nature necessitate a constant pursuit of new contracts. In 2023, Costain's capital expenditure of £75 million underscores the ongoing investment required to maintain competitiveness.

Despite a growing market, economic headwinds in 2024, including inflation and increased insolvencies, are intensifying this rivalry. This environment can lead to price-sensitive bidding, impacting profitability.

| Competitor | 2023 Revenue (approx.) | Key Focus Areas |

|---|---|---|

| Kier Group | £4.4 billion | Infrastructure, Construction, Homes |

| Balfour Beatty | £9.4 billion | Infrastructure, Construction, Investments |

| Galliford Try | £1.3 billion | Construction, Investments |

SSubstitutes Threaten

Large clients, especially government bodies and major asset owners, might choose to bolster their internal engineering and construction departments. This is a significant threat as it directly reduces the need for external firms like Costain, particularly for routine maintenance or less complex project phases. For instance, the UK government's commitment to infrastructure projects, while creating opportunities, also presents a backdrop where in-house scaling is a consideration for significant asset owners.

Clients are increasingly exploring alternative project delivery models that could reduce reliance on traditional large-scale engineering and construction firms like Costain. For instance, the global modular construction market was valued at approximately USD 103.4 billion in 2023 and is projected to grow significantly, indicating a strong trend towards off-site manufacturing and prefabrication.

This shift means clients might opt for specialized firms offering modular solutions or even manage component procurement directly, bypassing traditional contracting. Such a move could diminish the demand for Costain's integrated services, impacting its market share and revenue streams if it cannot adapt its offerings.

Clients may increasingly opt for digital optimization of existing assets over new physical infrastructure. This presents a threat as purely digital solutions, like predictive maintenance software or digital twin applications, might be seen as substitutes for traditional construction projects. For instance, the global digital twin market was valued at approximately $3.8 billion in 2021 and is projected to reach $40.7 billion by 2030, indicating substantial growth in this area.

While Costain Group has a digital solutions arm, the threat is amplified by pure-play technology companies that specialize solely in these digital optimization tools. These firms may offer more agile and cost-effective solutions that directly address the need for efficiency and asset management without the need for large-scale physical construction, potentially diverting investment away from Costain's core infrastructure services.

Maintenance and Upgrade over New Builds

Economic shifts or policy changes might favor infrastructure maintenance and upgrades over new construction. This trend could steer demand towards smaller, specialized firms or internal maintenance departments, potentially diminishing the market for Costain's end-to-end lifecycle services if they don't adapt.

For instance, in 2024, many governments are focusing on extending the life of existing assets to manage budgets more effectively. This could mean less investment in brand-new, large-scale projects and more in refurbishment and upkeep.

- Shift in Spending: A move towards maintenance could reduce the pipeline for new build projects, impacting revenue streams for companies like Costain that specialize in large-scale construction.

- Increased Competition: Smaller, specialized maintenance contractors might offer more agile and cost-effective solutions for specific upgrade tasks, intensifying competition.

- Adaptation Strategy: Costain's ability to pivot and enhance its maintenance and upgrade service offerings will be crucial to mitigating this threat.

Project Deferral or Cancellation

Economic uncertainty, shifts in government policy, or sudden budget limitations can prompt clients to postpone or scrap planned infrastructure projects. This situation directly substitutes for the services offered by construction and engineering firms, as the need for new developments vanishes or is delayed. For instance, in 2024, global infrastructure spending forecasts faced downward revisions due to persistent inflation and higher interest rates, impacting project pipelines.

This threat is particularly potent in sectors highly susceptible to political and economic fluctuations. For Costain Group, this means that if a major government infrastructure initiative, like a new high-speed rail line, is canceled due to fiscal concerns, it directly removes a significant potential revenue stream. The UK's infrastructure sector, a key market for Costain, experienced a 3.1% contraction in output in Q1 2024, underscoring the sensitivity to these macroeconomic factors.

- Project Deferral/Cancellation as Substitute: Clients delaying or canceling projects effectively removes demand for construction and engineering services, acting as a direct substitute for engaging such firms.

- Economic Uncertainty Impact: Factors like inflation and interest rate hikes, prevalent in 2024, directly influence client decisions to postpone or cancel infrastructure investments.

- Government Policy and Budget Constraints: Changes in government spending priorities or unexpected budget shortfalls are significant drivers for project deferrals, impacting firms like Costain.

- Sector Sensitivity: The infrastructure sector, a core area for Costain, is inherently vulnerable to these economic and political shifts, amplifying the threat of substitutes.

Clients are increasingly looking at digital solutions and asset optimization over new construction, a trend amplified by the growth in markets like digital twins, projected to reach $40.7 billion by 2030. Pure-play tech firms offering these services can be a direct substitute for Costain's integrated infrastructure offerings.

Furthermore, a shift towards maintaining and upgrading existing infrastructure, driven by economic prudence in 2024, favors specialized maintenance firms or in-house capabilities over large-scale new builds. This could reduce the demand for Costain's end-to-end lifecycle services if they don't adapt their focus.

Economic volatility and policy shifts can lead to project deferrals or cancellations, directly substituting the need for construction services. For instance, the UK infrastructure sector's output contraction in Q1 2024 highlights this vulnerability, impacting Costain's revenue potential.

Clients may also opt for modular construction, a market valued at over $103.4 billion in 2023, or even manage procurement directly. This bypasses traditional large-scale contracting, diminishing the demand for Costain's comprehensive services.

| Substitute Type | Market Trend/Data Point | Implication for Costain |

|---|---|---|

| Digital Optimization | Global Digital Twin Market: ~$3.8B (2021) to $40.7B (2030) | Potential diversion of investment from physical infrastructure to digital solutions. |

| Maintenance & Upgrades | Focus on asset longevity due to 2024 economic conditions. | Reduced demand for new large-scale projects, increased competition from specialized maintenance firms. |

| Modular Construction | Global Market Value: ~$103.4B (2023) | Clients may bypass traditional contracting, opting for specialized or in-house modular solutions. |

| Project Deferral/Cancellation | UK Infrastructure Output: -3.1% (Q1 2024) | Directly removes potential revenue streams due to economic uncertainty and policy changes. |

Entrants Threaten

The infrastructure and complex engineering sector, where Costain Group operates, presents a formidable threat of new entrants due to exceptionally high capital requirements. Establishing a presence necessitates massive investments in specialized heavy machinery, cutting-edge digital engineering tools, and the recruitment and retention of a highly skilled, certified workforce. For instance, a single large-scale infrastructure project can easily run into hundreds of millions, if not billions, of pounds, demanding significant upfront capital for bidding, execution, and risk management.

The UK infrastructure sector is a minefield of regulations, demanding rigorous adherence to safety standards, environmental protocols, and a constantly shifting legislative framework, such as the Building Safety Act. Newcomers must invest heavily in compliance systems and specialized knowledge to even begin operating.

Costain's strategic pivot towards smart infrastructure solutions, heavily reliant on specialized expertise and advanced technologies such as AI-driven robotics and digital twins, presents a significant barrier to entry. New competitors must grapple with the substantial investment and time required to cultivate these sophisticated capabilities and secure the necessary skilled workforce, a challenge exacerbated by ongoing shortages in specialized engineering talent.

Established Client Relationships and Frameworks

The threat of new entrants in the infrastructure sector, particularly for companies like Costain Group, is significantly mitigated by the deeply entrenched relationships major clients, such as government bodies and large utility firms, have with existing contractors. These relationships are often formalized through long-term framework agreements, creating substantial barriers to entry for newcomers. For instance, in the UK's construction and infrastructure market, securing a place on a major utility's framework can take years of demonstrated performance and relationship building.

New companies struggle to penetrate these established networks because clients prioritize reliability, a proven track record, and existing trust, especially for critical national infrastructure projects. Without a history of successful delivery and strong, pre-existing client connections, new entrants find it exceedingly difficult to win the large, stable contracts that define this industry. This makes it challenging for them to gain the necessary scale and experience to compete effectively.

- Entrenched Client Networks: Major clients in infrastructure, like National Highways or major water companies, often operate on multi-year framework agreements with a select group of established suppliers.

- High Switching Costs: For clients, changing contractors on large, complex projects involves significant due diligence, potential disruption, and the risk associated with unproven entities, making them hesitant to switch.

- Proven Track Record Requirement: New entrants lack the demonstrable history of successful project delivery and safety compliance that clients demand for critical infrastructure, hindering their ability to secure initial contracts.

- Capital Intensity and Scale: The sheer scale and capital investment required for major infrastructure projects mean that only well-resourced and experienced firms can realistically bid, further limiting the pool of potential new entrants.

Reputation and Track Record Requirements

The threat of new entrants into the complex infrastructure sector, like that faced by Costain Group, is significantly mitigated by the sheer weight of reputation and track record requirements. Successfully delivering major national infrastructure projects isn't just about having the technical know-how; it's about demonstrating a history of reliability, robust risk management, and consistent project execution. Newcomers simply don't possess this crucial credibility.

Clients commissioning high-value, high-risk projects, such as major transportation or energy networks, place an immense premium on proven capability. They need assurance that a contractor can navigate intricate logistical challenges, manage substantial budgets, and deliver on time, every time. This deep-seated need for trust makes it incredibly difficult for unproven entities to break into the market, especially when dealing with government agencies or large utility companies that prioritize financial stability and a history of success.

- Proven Track Record: Companies like Costain have decades of experience delivering critical national infrastructure, building a reputation for reliability.

- Client Trust: Major clients prioritize demonstrable success and financial stability, making it hard for new entrants to gain confidence.

- Risk Management: The ability to effectively manage the inherent risks in large-scale projects is a key barrier to entry.

- High Capital Investment: The upfront capital required to even bid on and execute such projects is substantial, further deterring new players.

The threat of new entrants for Costain Group is low, primarily due to the immense capital required to enter the infrastructure sector. For example, major infrastructure projects in the UK, such as HS2 or offshore wind farm developments, involve billions of pounds in investment for machinery, technology, and skilled labor. New companies also face significant hurdles with stringent regulations and the need for a proven track record, which can take years to build. In 2024, the UK government continued to invest heavily in infrastructure, with the National Infrastructure Strategy outlining significant spending, further solidifying the position of established players like Costain.

| Factor | Impact on New Entrants | Costain Group's Position |

| Capital Requirements | Extremely High | Established financial strength and access to capital |

| Regulatory Environment | Complex and Stringent | Extensive experience in compliance and navigating regulations |

| Client Relationships | Deeply Entrenched | Long-standing framework agreements with key clients |

| Technical Expertise & Track Record | Demanding | Decades of successful project delivery and specialized skills |

Porter's Five Forces Analysis Data Sources

Our Costain Group Porter's Five Forces analysis is built upon a foundation of robust data, including Costain's official annual reports, industry-specific market research from firms like IBISWorld, and relevant government regulatory filings. This blend ensures a comprehensive understanding of the competitive landscape.