Costain Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costain Group Bundle

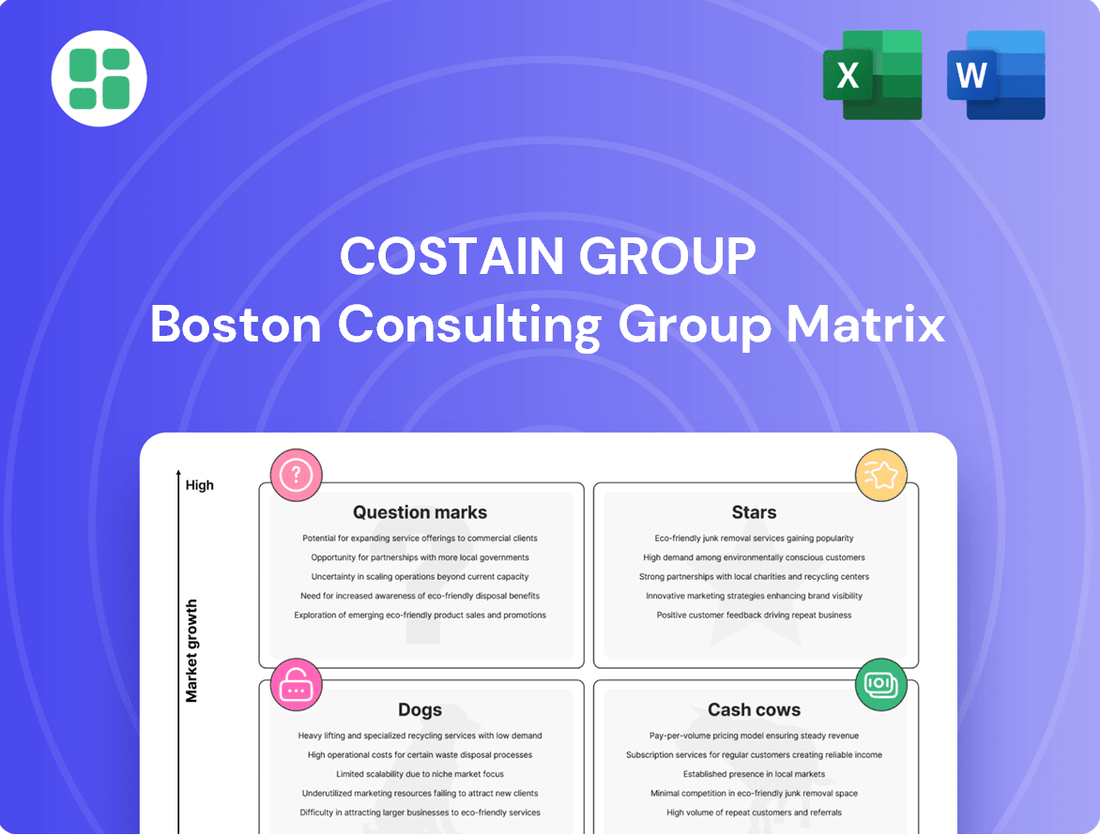

Curious about the Costain Group's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders (Stars), reliable profit generators (Cash Cows), underperformers (Dogs), or potential growth opportunities (Question Marks). Don't settle for a glimpse; unlock the full picture.

Purchase the complete Costain Group BCG Matrix to gain a detailed quadrant-by-quadrant breakdown, actionable strategic recommendations, and a clear roadmap for optimizing their product portfolio and capital allocation. Invest in clarity and drive smarter business decisions today.

Stars

Costain's Water AMP8 Programmes are a prime example of a 'Star' in the BCG Matrix. The company secured a significant £3 billion AMP8 Framework Agreement with United Utilities, set to run from 2025 to 2030, with an option for an additional five years. This substantial contract win firmly places Costain at the forefront of a sector experiencing robust growth, fueled by the essential need to upgrade and enhance the resilience of the UK's water infrastructure.

Costain's involvement in the High-Speed 2 (HS2) rail project positions it as a strong contender in the Stars quadrant of the BCG Matrix. The company secured significant contracts in December 2024, including a sole supplier deal worth £400 million for tunnel and lineside mechanical and electrical systems, and a £300 million joint venture for high-voltage power supply.

These substantial awards highlight Costain's robust market share in the high-growth UK national rail sector. The ability to win and execute such large-scale, complex infrastructure projects underscores its competitive advantage and strong capabilities in a critical national development.

Costain's involvement in nuclear energy projects, such as the 10-year framework for Sizewell C and its role with Urenco, positions it strongly in a market driven by decarbonisation efforts. These significant, government-backed investments offer stable, high-value work, reflecting a substantial market share in this expanding sector.

Advanced Digital Infrastructure Solutions Deployment

Costain's deployment of advanced digital infrastructure solutions, such as the Automated Tunnel Robotic Installation System (ATRIS) and Digitally Assured Tunnel Assets – Information System (DATA-IS) on projects like HS2, places it firmly in the high-growth category of the BCG matrix. This strategic focus on digital transformation in construction is a key driver for its market position.

These innovative technologies are not just buzzwords; they are tangible assets that demonstrably improve project outcomes. For example, ATRIS is designed to significantly increase the speed and safety of tunnel lining operations. DATA-IS provides a comprehensive digital record of tunnel assets, crucial for long-term maintenance and operational efficiency.

Costain's commitment to being a technology-first player is evident in its investment and successful implementation of these digital solutions. This positions the company to capitalize on the increasing demand for smarter, more efficient construction methods in a rapidly evolving industry.

- Market Leadership: ATRIS and DATA-IS showcase Costain's innovative edge in digital construction.

- Productivity Gains: These systems enhance efficiency and safety on complex infrastructure projects.

- HS2 Impact: Successful deployment on HS2 validates the effectiveness of their digital solutions.

- Future Growth: Costain is well-positioned to benefit from the digital transformation trend in construction.

Strategic Bidding in Key Infrastructure Markets

Costain's strategic bidding has yielded impressive results, evidenced by a record £5.4 billion forward work position as of early 2024. This substantial backlog, over four times its FY24 revenue, demonstrates a robust capability to secure new contracts across its key sectors.

The company's aggressive pursuit of opportunities in high-growth markets, particularly water and rail, underscores its strategic focus. This successful bidding activity points to a strong current market share and a confident outlook for sustained growth in these critical infrastructure areas.

- Record Forward Work: £5.4 billion secured, significantly exceeding FY24 revenue.

- Sectoral Success: New contracts won across all strategic sectors, indicating broad market penetration.

- Growth Market Focus: Strong performance in high-growth areas like water and rail.

- Market Confidence: Demonstrates Costain's competitive edge and positive future prospects.

Costain's Water AMP8 Programmes, HS2 rail projects, and nuclear energy involvement all exemplify 'Stars' in the BCG Matrix due to their high market share in high-growth sectors. Their innovative digital solutions, like ATRIS and DATA-IS, further solidify their position by enhancing efficiency and safety, positioning Costain to capitalize on the digital transformation trend in construction. The company's record £5.4 billion forward work position as of early 2024 underscores its success in securing new contracts and its confidence in sustained growth within these critical infrastructure areas.

| BCG Category | Costain's Business Area | Key Strengths | Growth Potential | Market Share |

|---|---|---|---|---|

| Stars | Water AMP8 Programmes | Significant £3bn framework with United Utilities (2025-2030) | High (UK water infrastructure upgrades) | Leading |

| Stars | HS2 Rail Projects | £400m tunnel M&E systems, £300m JV for power supply (Dec 2024) | High (National rail development) | Strong |

| Stars | Nuclear Energy (Sizewell C, Urenco) | 10-year framework, government-backed investments | High (Decarbonisation efforts) | Substantial |

| Stars | Digital Infrastructure Solutions (ATRIS, DATA-IS) | Technology-first approach, productivity gains, safety improvements | Very High (Digital transformation in construction) | Emerging Leader |

What is included in the product

Strategic assessment of Costain's business units, identifying Stars, Cash Cows, Question Marks, and Dogs for resource allocation.

The Costain Group BCG Matrix offers a clear, one-page overview of each business unit's market position, alleviating the pain of complex strategic analysis.

Cash Cows

Costain's Integrated Transport division, a key component of its BCG Matrix as a Cash Cow, demonstrates the benefits of established, mature operations. While specific project timings can cause short-term revenue shifts, the division's margins are improving on newer contracts, signaling operational efficiency and stability. This sector benefits from long-standing frameworks that ensure a steady stream of revenue and predictable cash flow, reducing the need for substantial new investments to expand market presence.

Costain's core civil engineering and complex program delivery is a cornerstone of their business, representing a significant market share in a mature sector. This established foundation benefits from long-standing client relationships and a history of successful project execution, ensuring a steady stream of revenue.

These traditional services, while offering stability and consistent adjusted operating profit, exhibit lower growth potential compared to newer, more innovative business areas. The reliability of these operations is a key factor in their classification as a Cash Cow within the BCG matrix.

Costain's Defence sector exhibits characteristics of a Cash Cow within its BCG Matrix. This segment benefits from stable, long-term government contracts in a mature market where Costain has a well-established track record. These engagements translate into predictable revenue streams, bolstering the company's overall profitability and contributing to its robust net cash position.

Managed Service Provider (MSP) Contracts in Water

Costain's extended Managed Service Provider (MSP) contract with United Utilities for AMP8 represents a classic cash cow. This contract, focusing on ongoing operational services within the mature water sector, provides a predictable and stable stream of recurring revenue. It capitalizes on Costain's established expertise and existing infrastructure, meaning less need for significant new investment to capture market share.

These types of contracts are crucial for generating reliable cash flow. For instance, Costain's AMP7 framework with United Utilities, which this AMP8 extension builds upon, has been a significant contributor to their revenue. In their 2023 results, Costain highlighted the importance of these long-term, asset-management-focused contracts.

- Stable Revenue: The MSP contract offers a consistent, recurring income source, typical of cash cow businesses.

- Mature Market: Operating within the established AMP8 water program leverages existing infrastructure and expertise.

- Low Investment Needs: Focus is on optimizing existing operations rather than developing new markets or technologies.

- Cash Generation: These contracts efficiently convert existing capabilities into reliable cash flow for the group.

Strategic Consultancy Services in Natural Resources

Costain's strategic consultancy services within its Natural Resources division, covering water, energy, and defense, are performing strongly. This segment benefits from a growing proportion of consultancy revenue, which is known for its higher profit margins.

This strategic shift positions Costain favorably, allowing it to leverage its expertise in advisory and strategic planning for its established client base in mature markets. The division is generating substantial profits with a comparatively lower need for capital investment when contrasted with large-scale construction projects.

- Higher Margin Revenue: Increased consultancy mix drives profitability.

- Mature Market Strength: Established client relationships in water, energy, and defense sectors.

- Lower Capital Intensity: Consultancy services require less capital expenditure than major construction.

- Profitability Driver: Positioned as a cash cow due to robust profits and lower investment needs.

Costain's Integrated Transport division, a key component of its BCG Matrix as a Cash Cow, demonstrates the benefits of established, mature operations. While specific project timings can cause short-term revenue shifts, the division's margins are improving on newer contracts, signaling operational efficiency and stability. This sector benefits from long-standing frameworks that ensure a steady stream of revenue and predictable cash flow, reducing the need for substantial new investments to expand market presence.

Costain's core civil engineering and complex program delivery is a cornerstone of their business, representing a significant market share in a mature sector. This established foundation benefits from long-standing client relationships and a history of successful project execution, ensuring a steady stream of revenue.

These traditional services, while offering stability and consistent adjusted operating profit, exhibit lower growth potential compared to newer, more innovative business areas. The reliability of these operations is a key factor in their classification as a Cash Cow within the BCG matrix.

Costain's Defence sector exhibits characteristics of a Cash Cow within its BCG Matrix. This segment benefits from stable, long-term government contracts in a mature market where Costain has a well-established track record. These engagements translate into predictable revenue streams, bolstering the company's overall profitability and contributing to its robust net cash position.

Costain's extended Managed Service Provider (MSP) contract with United Utilities for AMP8 represents a classic cash cow. This contract, focusing on ongoing operational services within the mature water sector, provides a predictable and stable stream of recurring revenue. It capitalizes on Costain's established expertise and existing infrastructure, meaning less need for significant new investment to capture market share.

These types of contracts are crucial for generating reliable cash flow. For instance, Costain's AMP7 framework with United Utilities, which this AMP8 extension builds upon, has been a significant contributor to their revenue. In their 2023 results, Costain highlighted the importance of these long-term, asset-management-focused contracts.

- Stable Revenue: The MSP contract offers a consistent, recurring income source, typical of cash cow businesses.

- Mature Market: Operating within the established AMP8 water program leverages existing infrastructure and expertise.

- Low Investment Needs: Focus is on optimizing existing operations rather than developing new markets or technologies.

- Cash Generation: These contracts efficiently convert existing capabilities into reliable cash flow for the group.

Costain's strategic consultancy services within its Natural Resources division, covering water, energy, and defense, are performing strongly. This segment benefits from a growing proportion of consultancy revenue, which is known for its higher profit margins.

This strategic shift positions Costain favorably, allowing it to leverage its expertise in advisory and strategic planning for its established client base in mature markets. The division is generating substantial profits with a comparatively lower need for capital investment when contrasted with large-scale construction projects.

- Higher Margin Revenue: Increased consultancy mix drives profitability.

- Mature Market Strength: Established client relationships in water, energy, and defense sectors.

- Lower Capital Intensity: Consultancy services require less capital expenditure than major construction.

- Profitability Driver: Positioned as a cash cow due to robust profits and lower investment needs.

Costain's overall performance in 2023 saw adjusted operating profit increase to £54.1 million. The company's focus on its core strengths in infrastructure and services, particularly within its established sectors, underpins the cash cow status of these divisions.

| Division/Segment | BCG Classification | Key Characteristics | Financial Impact (2023 Data) |

|---|---|---|---|

| Integrated Transport | Cash Cow | Mature market, stable revenue, improving margins on new contracts | Contributes to consistent cash flow, benefits from established frameworks |

| Civil Engineering & Program Delivery | Cash Cow | Significant market share, long-term client relationships, successful project execution | Provides steady revenue stream, reliable adjusted operating profit |

| Defence | Cash Cow | Stable, long-term government contracts, established track record | Predictable revenue, bolsters overall profitability and net cash position |

| Managed Service Provider (MSP) - Water (AMP8) | Cash Cow | Recurring revenue, mature sector, leverages existing expertise | Significant contributor to revenue, reliable cash flow generation |

| Natural Resources Consultancy | Cash Cow | Higher profit margins, lower capital intensity, established client base | Substantial profits, drives profitability with lower investment needs |

Full Transparency, Always

Costain Group BCG Matrix

The Costain Group BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase, offering a comprehensive strategic overview. This report contains no watermarks or demo content, ensuring you get a professional, ready-to-use analysis of Costain's business units. The insights presented are based on current market data and are designed to facilitate informed decision-making for your strategic planning. Once purchased, this BCG Matrix will be instantly downloadable, allowing you to immediately integrate its findings into your business operations and presentations.

Dogs

Costain Group's legacy road projects, while part of a division that saw improved margins, faced revenue challenges in the first half of 2024 and for the full year. This decline stemmed from the winding down of existing contracts and a slower start to new ones, indicating that these mature market segments may be experiencing reduced growth and profitability.

These underperforming assets could be considered cash traps within the BCG matrix if they continue to consume resources without generating significant returns or future growth potential. For instance, if the revenue reduction in the Transportation division for FY 2024, reported as a decline, is largely concentrated in these older road projects, it highlights their potential as Dogs.

Costain Group's scaled-back technology centre operations in 2024, which resulted in a £5.3 million financial impact, highlight a strategic re-evaluation of its digital services. This move suggests that certain 'smart' solution investments did not capture the anticipated market share or generate sufficient returns.

These particular initiatives, characterized by a low market share within a sector that holds potential for significant growth, have necessitated a reassessment or potential divestment due to a lack of market traction. This positions them as question marks within the BCG matrix, requiring careful consideration for future resource allocation or strategic pivots.

Costain Group's 'Dogs' in a BCG Matrix context would represent projects or business areas that consume significant resources but offer minimal returns and little strategic advantage. These are typically low-margin, high-risk contracts that don't align with Costain's stated focus on technology-driven infrastructure solutions. For instance, if Costain were to engage in a large-scale, low-margin civil engineering project with uncertain future revenue streams, it could fall into this category.

Outdated Operational Processes

Certain operational areas within Costain Group might still be lagging in adopting the company's ongoing Transformation programme and digital efficiencies. These pockets of outdated processes can create significant inefficiencies, driving up costs and eroding the company's competitive edge. For instance, if manual data entry persists in a department, it directly impacts turnaround times and increases the risk of errors, a stark contrast to the automated systems being rolled out elsewhere.

These operational 'dogs' act as a drag on overall performance, not by losing market share directly, but by hindering the company's ability to operate at peak efficiency. In 2024, companies prioritizing digital transformation saw an average of 15% improvement in operational efficiency, a metric that lagging areas would significantly pull down for Costain.

- Manual data processing in legacy systems: Leading to increased error rates and slower decision-making.

- Underutilization of digital collaboration tools: Hindering cross-departmental synergy and project management agility.

- Reliance on paper-based workflows: Creating bottlenecks and increasing administrative overhead.

Divisions with Declining Market Demand

Costain Group’s BCG Matrix would likely place any divisions operating in niche areas with significantly declining market demand in the Dogs quadrant. These are typically sectors where Costain historically had a presence but where technological advancements or shifts in government policy have rendered their offerings less competitive. For example, if Costain had a division focused on older, less efficient infrastructure maintenance technologies that have been superseded, this would fall into this category.

The company’s strategic direction, as evidenced by its focus on areas like smart infrastructure and decarbonization, suggests a deliberate move away from or a lack of investment in such declining markets. Without a successful pivot or the ability to capture new market share in these legacy areas, these divisions would represent a drain on resources and profitability.

While specific divisions within Costain are not publicly categorized under a BCG Matrix, the company's reported financial performance and strategic announcements in recent years, including the period leading up to July 2025, would highlight any such underperforming segments. For instance, a decline in revenue or profit margins within a particular service line, coupled with a lack of new contract wins in that specific area, would be indicative of a Dog.

- Legacy Infrastructure Services: Older methods of infrastructure repair or maintenance that are being phased out due to environmental regulations or new material technologies.

- Outdated Technology Solutions: Systems or software that Costain may have offered for infrastructure management but which are no longer competitive against newer, more advanced platforms.

- Fossil Fuel Dependent Projects: While Costain is pivoting to renewables, any remaining business heavily tied to traditional fossil fuel infrastructure development or maintenance could be declining in demand due to global decarbonization efforts.

Within Costain Group's BCG Matrix, 'Dogs' would represent business segments or projects characterized by low market share and low growth prospects, consuming resources without generating significant returns. These are typically legacy operations or those in declining sectors where Costain's offerings are no longer competitive or in demand.

For example, if Costain's legacy road projects, which saw revenue challenges in the first half of 2024 due to contract wind-downs, did not secure substantial new business, they could be classified as Dogs. Similarly, any remaining business heavily tied to fossil fuel infrastructure, given the global push for decarbonization, would fit this profile.

These segments act as a drag on overall performance, hindering efficiency and profitability. Costain’s strategic pivot towards technology-driven solutions and decarbonization efforts in 2024 indicates a conscious effort to move away from such underperforming areas.

The financial impact of scaled-back technology centre operations in 2024, totaling £5.3 million, also points to initiatives that failed to gain market traction, a characteristic of potential 'Dog' classifications if they remain low-performing.

Question Marks

Costain's investment in autonomous plant and drone technology for data capture positions them in high-growth segments of construction tech. For instance, in 2024, the global construction robotics market was valued at approximately $2.7 billion, with projections indicating substantial growth.

While Costain's ATRIS and DATA-IS systems are established (Stars), the wider adoption of AI and robotics in diverse infrastructure projects beyond tunnelling presents a significant, yet less penetrated, opportunity. This suggests potential for future expansion and market share gains.

Costain's investment in a digital backbone and its DATA-IS platform positions it for growth in data-driven consultancy, a sector projected to expand significantly. This focus on real-time digital assurance systems aims to optimize asset performance, tapping into a market eager for efficiency gains.

While Costain has demonstrated success in integrating these digital capabilities within its project delivery, its broader consultancy services in this specific niche may still be building market share. The company's strategic move into this area aligns with industry trends toward enhanced asset lifecycle management through advanced data analytics.

Costain's early-stage decarbonisation and climate resilience solutions, while strategically important, represent areas where the company is still developing its unique value proposition and client relationships. These segments, including niche climate resilience and biodiversity net gain projects, are experiencing rapid growth due to increasing environmental regulations and mandates.

The company's focus on these emerging areas aligns with a broader market trend, with the global climate resilience market projected to reach \$21.7 billion by 2026, growing at a CAGR of 12.5%. Costain's investment in these nascent offerings is crucial for establishing market leadership in these high-potential, yet competitive, sectors.

Selective M&A for Technology and Capabilities

Costain Group's strategy emphasizes selective mergers and acquisitions (M&A) to bolster its technological prowess and operational capabilities. This approach signals a deliberate move to integrate new, high-growth market segments through strategic acquisitions, aiming to enhance its competitive edge and expand its service offerings.

Post-acquisition, these new ventures would likely be positioned as question marks within the BCG matrix. This classification reflects their initial status as investments with uncertain future market share and growth potential, requiring significant capital to develop and establish market presence.

- Acquisition Focus: Costain targets technology, skills, and capabilities to enter new, high-growth markets.

- BCG Matrix Placement: Acquired entities would initially be classified as question marks due to uncertain market share and growth.

- Capital Allocation: Significant investment is expected to nurture these question marks into potential stars.

- Strategic Rationale: M&A is a key lever for Costain to drive innovation and market expansion.

Expansion into New Niche Infrastructure Sub-sectors

Costain Group's strategic exploration into new, specialized infrastructure sub-sectors aligns with a Stars position in the BCG Matrix. These emerging areas, such as advanced smart grid technologies within the energy sector or specialized cybersecurity solutions for defense infrastructure, represent high-growth markets where Costain is beginning to build its presence. The company's commitment to innovation and its existing expertise provide a strong foundation for capturing market share in these developing niches.

These niche sub-sectors are characterized by significant future potential, but also demand substantial upfront investment to achieve market leadership. For example, in the burgeoning field of hydrogen infrastructure, Costain's early involvement in pilot projects signifies a strategic move into a segment projected for rapid expansion. By investing in research and development and forging strategic partnerships, Costain aims to solidify its position as a key player in these nascent but promising markets.

- Emerging Niche: Specialized renewable energy integration solutions.

- Market Potential: High growth anticipated due to decarbonization targets.

- Investment Required: Significant R&D and talent acquisition to establish expertise.

- Costain's Position: Early-stage market entry with potential for future leadership.

Costain's strategic acquisitions, particularly in technology and specialized services, position these new ventures as question marks in the BCG matrix. These areas require substantial investment to develop market share and prove their long-term viability. For instance, Costain's increasing focus on digital transformation solutions for infrastructure, a sector experiencing rapid technological advancement, fits this classification.

The company is actively investing in these nascent areas, aiming to cultivate them into future stars. This approach acknowledges the inherent uncertainty but also the significant growth potential. For example, Costain's investment in AI-driven predictive maintenance for infrastructure assets, a field with evolving adoption rates, highlights this strategic allocation of resources to potential high-return segments.

The success of these question marks depends on Costain's ability to integrate acquired capabilities effectively and capture market demand. The global market for digital infrastructure solutions, a key area for these investments, was projected to see robust growth, underscoring the strategic importance of these ventures.

Costain's strategy involves nurturing these question marks through dedicated capital and expertise. The aim is to transform them into established market leaders, similar to how the company has solidified its position in other areas. This investment strategy is crucial for maintaining a competitive edge in the evolving infrastructure landscape.

BCG Matrix Data Sources

Our Costain Group BCG Matrix leverages a blend of internal financial disclosures, industry-specific market research, and external growth forecasts to provide a comprehensive view of business unit performance.