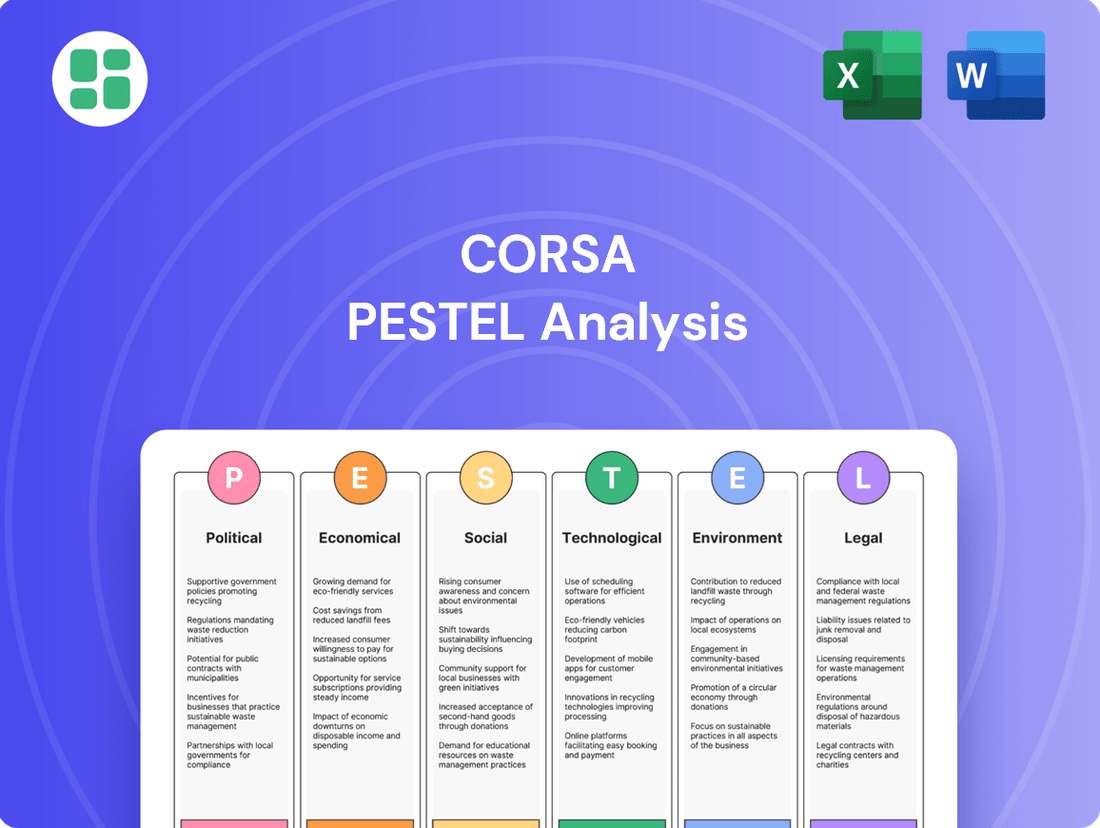

Corsa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsa Bundle

Uncover the critical external factors shaping Corsa's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, gain the strategic foresight needed to navigate the competitive automotive market. Download the full analysis to unlock actionable intelligence and empower your business decisions.

Political factors

Government policy shifts directly impact Corsa Coal's operational environment. The U.S. political landscape, particularly concerning environmental regulations and energy policy, has seen considerable fluctuation. These changes can significantly alter the cost of doing business and market demand for coal.

As of April 2025, the current administration has signaled a move towards revitalizing the coal sector. This includes potentially lifting moratoriums on coal leasing and easing certain regulatory burdens. Such policy adjustments could create a more favorable operating climate for companies like Corsa, especially in regions like Northern Appalachia where they have significant operations.

U.S. trade policies, particularly tariffs on steel imports, significantly impact Corsa Coal's international sales. For instance, the Section 232 tariffs implemented in 2018, although modified, created uncertainty and affected global steel production, a key driver for metallurgical coal demand. While Corsa Coal's metallurgical coal is sought after, retaliatory tariffs from countries like China can disrupt export markets and alter trade flows, influencing Corsa's sales balance between domestic and overseas clients.

The regulatory landscape significantly shapes Corsa Coal's operations, with agencies like the EPA and MSHA setting compliance standards and influencing operational expenses. For instance, environmental regulations directly impact mining practices and emissions controls, potentially increasing capital expenditure for compliance.

While the Biden administration focused on stricter emissions and wastewater rules, the potential for regulatory shifts under a future Trump administration could ease these burdens. This could translate to lower compliance costs for metallurgical coal producers like Corsa, impacting their profitability and competitiveness in the market.

State and Local Government Influence

Beyond federal oversight, state and local governments in Northern Appalachia wield significant influence over Corsa Coal's operations. These regional bodies can implement their own specific regulations, tax structures, and permitting processes, directly impacting Corsa's ability to conduct business and expand. For instance, in West Virginia, a key operational state, the average severance tax on coal production was 5% in 2024, a rate that can fluctuate based on market conditions and legislative action. Local political support or opposition, often manifested through community relations and zoning decisions, is also a critical factor for Corsa's operational stability.

These sub-national policies and local dynamics are not merely bureaucratic hurdles; they represent tangible financial and operational risks and opportunities for Corsa. For example, a new local ordinance requiring stricter water discharge standards could necessitate costly upgrades to Corsa's facilities. Conversely, strong community backing and favorable local tax incentives could streamline permitting for new mining sites. Understanding and navigating this complex web of state and local governance is paramount for Corsa's strategic planning and long-term success.

- State Regulations: Corsa must comply with varying state environmental standards, worker safety regulations, and land reclamation requirements across its operational footprint in states like West Virginia and Pennsylvania.

- Local Permitting: Obtaining and maintaining local permits for mining operations, transportation routes, and facility construction is a continuous process influenced by local government approvals and community engagement.

- Taxation: State severance taxes, property taxes, and local business taxes directly affect Corsa's profitability and cash flow. For example, Pennsylvania's impact fee on natural gas drilling, while not directly coal, sets a precedent for how states can tax resource extraction.

- Community Relations: Positive relationships with local communities and elected officials can facilitate smoother operations and provide a buffer against potential opposition or regulatory challenges.

Energy Policy and Infrastructure Support

Broader national energy policies significantly influence the long-term viability of coal mining operations like Corsa. For instance, the Biden administration's commitment to transitioning away from fossil fuels, as evidenced by the Inflation Reduction Act of 2022, which allocates substantial funds to clean energy initiatives, creates a challenging environment for coal. This policy shift directly impacts the demand for coal and Corsa's operational landscape.

Government decisions regarding infrastructure investments are equally critical for Corsa's market access. Reliable and cost-effective transportation is paramount for coal producers. In 2024, ongoing discussions around the future of rail infrastructure funding and potential upgrades to port facilities that handle bulk commodities will directly affect Corsa's ability to competitively transport its coal to domestic and international markets. Delays or underinvestment in these areas could hinder Corsa's supply chain efficiency.

- National Energy Policy Impact: Policies favoring renewable energy over fossil fuels, such as those seen in the US and EU, can directly reduce demand for coal, impacting Corsa's sales volumes and pricing power.

- Infrastructure Investment: Government funding for rail freight and port modernization, or conversely, a lack thereof, will determine the cost and speed of Corsa's product delivery.

- Regulatory Environment: Evolving environmental regulations on emissions from coal-fired power plants and transportation infrastructure can impose additional compliance costs on Corsa.

Political factors present a dynamic landscape for Corsa Coal, with government policies at federal, state, and local levels directly shaping its operational costs and market opportunities. Shifts in energy policy, environmental regulations, and trade agreements create both challenges and potential advantages. For instance, the U.S. administration's stance on fossil fuels versus renewables, as highlighted by the Inflation Reduction Act of 2022, influences long-term demand for coal.

Recent policy discussions in early 2025 indicate a potential easing of certain regulatory burdens on the coal sector, which could benefit Corsa. However, the ongoing evolution of environmental standards, particularly concerning emissions and water quality, necessitates continuous adaptation and investment in compliance measures. For example, the average severance tax on coal production in West Virginia was 5% in 2024, a figure subject to legislative review.

Trade policies, such as tariffs on steel, also play a crucial role, impacting the global demand for metallurgical coal, a key product for Corsa. Retaliatory tariffs can disrupt export markets, influencing Corsa's sales mix. Furthermore, government investment in infrastructure, particularly rail freight and port facilities, is vital for Corsa's supply chain efficiency and competitiveness.

| Policy Area | 2024/2025 Impact/Trend | Corsa Coal Relevance |

|---|---|---|

| National Energy Policy | Focus on clean energy transition; potential easing of coal regulations | Affects long-term demand and operational flexibility |

| Environmental Regulations | Ongoing scrutiny of emissions and water discharge; evolving compliance costs | Directly impacts operational expenses and capital expenditure |

| Trade Policy | Tariffs on steel impacting global markets; potential for trade flow disruption | Influences demand for metallurgical coal and export sales |

| Infrastructure Investment | Discussions on rail and port upgrades affecting transportation costs | Crucial for supply chain efficiency and market access |

| State/Local Regulations | Varying severance taxes (e.g., WV 5% in 2024) and permitting processes | Impacts profitability and operational feasibility at regional levels |

What is included in the product

This PESTLE analysis of the Corsa examines the impact of political, economic, social, technological, environmental, and legal factors on its strategic positioning and future growth.

The Corsa PESTLE Analysis acts as a pain point reliever by offering a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring everyone is aligned on external factors.

Economic factors

Corsa Coal's fortunes are directly tied to global steel production, as metallurgical coal is its core product for this industry. Analysts anticipate a slight uptick in worldwide steel demand for 2025, suggesting a more favorable environment for Corsa's offerings.

The World Steel Association projected global crude steel output to reach 1.90 billion tonnes in 2024, with a further increase expected in 2025, driven by infrastructure projects and manufacturing activity in key regions like Asia. This projected growth directly impacts the demand for metallurgical coal, Corsa's primary market.

Metallurgical coal prices are notoriously volatile, swinging based on global supply and demand. This directly affects Corsa Coal's financial performance, impacting both its revenue and its ability to turn a profit. For instance, in early 2024, prices saw fluctuations, with some analysts predicting a softening trend for 2025.

Looking ahead to 2025, many market watchers anticipate a potential dip in metallurgical coal prices. This forecast, if realized, could squeeze Corsa Coal's profit margins. Even with existing sales contracts in place, the lower price environment might challenge the company's profitability.

Rising inflation in 2024 and 2025 is directly impacting Corsa Coal's bottom line through increased expenses for essential inputs like coal, steel, and diesel fuel. These cost escalations translate into higher production expenses, putting pressure on profit margins.

To counter these inflationary headwinds, Corsa has been actively implementing strategies focused on operational efficiency and cost containment. For instance, by optimizing logistics and exploring alternative sourcing for materials, the company aims to absorb some of the increased operating costs.

The global economic environment in 2024 saw significant volatility in commodity prices, with energy and material costs fluctuating. Corsa's ability to manage its supply chain and production processes effectively will be crucial in navigating these persistent inflationary pressures throughout 2025.

Foreign Exchange Rates and Export Competitiveness

Fluctuations in foreign exchange rates significantly impact Corsa's ability to compete internationally with its metallurgical coal. A strengthening U.S. dollar, for instance, directly increases the cost of American coal for overseas buyers, potentially dampening demand and lowering the prices Corsa can achieve on its exports.

For example, if the U.S. dollar strengthens by 5% against a major importing currency, Corsa's coal effectively becomes 5% more expensive for that market, assuming no other price adjustments. This dynamic is crucial for Corsa, as its export competitiveness hinges on offering attractive pricing in local currencies for its international clientele.

- Exchange Rate Impact: A stronger USD makes U.S. metallurgical coal exports more expensive for foreign buyers.

- Competitiveness Factor: Corsa's export volumes and realized prices are directly influenced by currency valuations.

- Market Sensitivity: Key importing regions, such as Europe and Asia, show varying sensitivities to U.S. dollar strength.

- 2024/2025 Outlook: Continued dollar volatility in 2024 and 2025 could present both challenges and opportunities for Corsa's export strategy.

Access to Capital and Financing

The availability and cost of capital are paramount for Corsa Coal, impacting everything from daily operations to strategic growth. Recent financial struggles, including a Chapter 11 filing in late 2023, underscore the critical need for Corsa to secure robust financing. The company's ability to access debt and equity markets will directly influence its capacity for expansion, equipment upgrades, and refinancing existing obligations. For instance, securing favorable terms on new debt could significantly reduce interest expenses, freeing up capital for other investments.

Access to capital for coal companies like Corsa has become increasingly challenging due to environmental, social, and governance (ESG) considerations influencing lender sentiment. Many financial institutions are reducing their exposure to the fossil fuel sector. This trend means that even with a solid business plan, Corsa might face higher borrowing costs or stricter lending covenants.

- Financing Costs: Higher interest rates on debt can increase Corsa's operating expenses, impacting profitability.

- Investor Confidence: The company's ability to attract equity investment is tied to its perceived financial stability and future prospects.

- Capital Expenditure: Securing funds for new mining equipment or environmental compliance measures is directly dependent on capital availability.

- Refinancing Risk: Corsa will need access to capital to manage upcoming debt maturities, especially after its Chapter 11 proceedings.

Global steel demand, Corsa's primary market, is projected to see a slight increase in 2025, with the World Steel Association forecasting 1.90 billion tonnes of crude steel output for 2024. This growth, particularly in Asia, directly translates to a more favorable outlook for metallurgical coal demand.

However, metallurgical coal prices are inherently volatile, directly impacting Corsa's financial performance. While analysts predict potential price softening in 2025, this could squeeze profit margins despite existing sales contracts.

Rising inflation in 2024 and 2025 is increasing Corsa's operational costs for essential inputs like fuel and materials, putting pressure on profitability. The company is actively pursuing operational efficiencies and cost containment strategies to mitigate these impacts.

Currency fluctuations, particularly the strength of the U.S. dollar, significantly affect Corsa's export competitiveness, making American coal more expensive for foreign buyers and potentially dampening demand.

| Economic Factor | 2024 Outlook | 2025 Outlook | Impact on Corsa | Key Data/Consideration |

|---|---|---|---|---|

| Global Steel Demand | Stable to slight growth | Projected slight increase | Positive for metallurgical coal demand | World Steel Association forecast: 1.90 billion tonnes crude steel output in 2024 |

| Metallurgical Coal Prices | Volatile, potential softening | Potential price dip | Risk to profit margins | Analyst predictions of price softening |

| Inflation | Rising | Persisting | Increased operational costs (fuel, materials) | Impact on raw material and energy expenses |

| Exchange Rates (USD) | Volatile | Continued volatility | Affects export competitiveness | Stronger USD increases costs for foreign buyers |

Same Document Delivered

Corsa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Corsa PESTLE Analysis provides an in-depth look at the external factors influencing the automotive market, offering valuable insights for strategic planning.

Sociological factors

Public perception of the coal industry, especially regarding environmental impacts and climate change, directly affects Corsa Coal's social license to operate. Growing global concern over fossil fuels, even for essential industrial uses like metallurgical coal in steel production, can lead to community opposition and hinder investment opportunities, as seen in increasing ESG (Environmental, Social, and Governance) scrutiny by investors.

The availability of skilled labor in the Northern Appalachia mining region is a critical factor for Corsa's operational continuity. As of early 2024, the region continues to grapple with an aging workforce and a declining interest in mining careers among younger generations, creating potential shortages for specialized roles.

Labor relations within the mining sector are dynamic and can significantly influence Corsa's production costs and efficiency. In 2024, ongoing negotiations and the potential for industrial action by unions representing mine workers could introduce uncertainty, impacting Corsa's ability to maintain consistent output and manage labor expenses.

Corsa Coal's operations in Northern Appalachia directly influence local economies through job creation and tax revenue. For instance, in 2023, Corsa provided approximately 1,700 jobs, a significant portion of which are in communities heavily reliant on the coal industry. Maintaining strong community ties is crucial to mitigate potential operational disruptions stemming from local concerns about environmental stewardship and health impacts, which can affect their social license to operate.

Health and Safety Culture

Corsa's dedication to miner health and safety is a crucial sociological element, directly influencing employee morale, adherence to regulations, and the company's reputation. A strong safety culture fosters trust and can significantly reduce incidents, which is paramount in the mining industry.

The mining sector is under increasing scrutiny regarding worker safety. For instance, in 2024, mining companies reported an average of 3.1 injury cases per 100 full-time workers, according to the Bureau of Labor Statistics. This highlights the ongoing need for robust safety protocols.

New Mine Safety and Health Administration (MSHA) regulations set to be implemented in 2025 will place a heightened emphasis on critical areas like respirable dust control and emergency preparedness. These changes underscore the evolving landscape of worker well-being and the importance of proactive safety measures for companies like Corsa.

- Miner Health and Safety: Directly impacts employee morale, regulatory compliance, and public perception.

- 2025 MSHA Regulations: Focus on respirable dust and emergency protocols, increasing safety demands.

- Industry Safety Trends: Mining saw 3.1 injury cases per 100 workers in 2024, indicating a persistent need for safety improvements.

ESG Investment Trends

The increasing focus on Environmental, Social, and Governance (ESG) criteria by investors significantly impacts Corsa Coal's ability to secure capital and influences its market valuation. As of early 2024, global ESG assets under management were projected to exceed $33.9 trillion, highlighting the powerful shift in investment priorities. This trend creates a challenging environment for companies in the fossil fuel sector, even those like Corsa Coal with products essential for industrial processes.

While metallurgical coal, crucial for steel production, has a defined industrial demand, the broader investment landscape is increasingly divesting from fossil fuel-related assets. This sentiment is reflected in the growing number of financial institutions setting net-zero targets and screening out coal-related investments. For instance, many major pension funds and asset managers have implemented policies to reduce or eliminate exposure to coal mining companies by 2030 or sooner.

This ESG-driven divestment can lead to:

- Reduced access to traditional financing: Banks and other lenders may be less willing to provide loans or credit facilities to coal producers due to reputational risk and ESG mandates.

- Lower equity valuations: Investors applying ESG screens may discount the valuations of coal companies, even if their current financial performance is strong, anticipating future regulatory pressures and market shifts.

- Increased cost of capital: Companies perceived as high-ESG risks may face higher interest rates on debt and demand higher returns from equity investors, increasing their overall cost of capital.

Sociological factors significantly shape Corsa Coal's operating environment by influencing public perception, labor dynamics, and community relations. The increasing global emphasis on ESG principles, with ESG assets projected to exceed $33.9 trillion by early 2024, directly impacts investor sentiment and access to capital for coal companies, even those supplying essential industrial materials.

Labor availability and relations remain critical, with the Northern Appalachia region facing an aging workforce and declining interest in mining careers, potentially leading to skilled labor shortages. Furthermore, evolving labor relations and union negotiations in 2024 introduce uncertainty regarding production costs and operational consistency.

Corsa Coal's commitment to miner health and safety is paramount, directly affecting employee morale and the company's reputation. With mining sector injury rates at 3.1 cases per 100 workers in 2024, and new MSHA regulations in 2025 focusing on dust control and preparedness, a strong safety culture is essential for compliance and operational success.

| Sociological Factor | Impact on Corsa Coal | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Public Perception & ESG | Influences social license to operate and investor confidence. | ESG assets projected to exceed $33.9 trillion (early 2024). Growing divestment from fossil fuels by financial institutions. |

| Skilled Labor Availability | Affects operational continuity and costs. | Northern Appalachia faces an aging mining workforce and declining youth interest in mining careers. |

| Labor Relations | Impacts production costs and efficiency. | Potential for industrial action and negotiations in 2024 could introduce operational uncertainty. |

| Miner Health & Safety | Crucial for employee morale, regulatory adherence, and reputation. | Mining sector injury rate: 3.1 cases per 100 workers (2024). New MSHA regulations in 2025 emphasize dust control and emergency preparedness. |

Technological factors

Corsa Coal can leverage advancements in mining automation and robotics to significantly boost operational efficiency and safety. For instance, the global mining automation market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially, indicating a strong trend towards these technologies.

The adoption of remote-controlled equipment and autonomous haul trucks can reduce the need for personnel in high-risk areas, thereby minimizing accidents. Companies investing in these technologies have reported up to a 15% increase in productivity and a reduction in operational costs.

Advancements in coal preparation technology are directly impacting Corsa's ability to refine its metallurgical coal. Innovations in areas like dense medium separation and froth flotation are enabling higher quality product streams, crucial for the demanding steelmaking industry. For instance, by mid-2024, Corsa's investments in upgraded processing equipment are expected to boost the yield of premium-grade metallurgical coal by an estimated 5%.

These technological improvements are vital for Corsa to meet stringent customer specifications, which often dictate low ash and sulfur content. Efficient processing not only enhances the marketability of Corsa's output but also contributes to cost reduction by minimizing waste and energy consumption. In 2023, Corsa reported a 3% reduction in processing costs per ton directly attributable to the implementation of new dewatering technologies.

Corsa Coal can significantly enhance its operations through the adoption of data analytics and digital transformation. Integrating IoT devices and artificial intelligence into mining processes allows for real-time monitoring of equipment health, environmental conditions, and production output. This digital shift is crucial for predictive maintenance, reducing downtime and optimizing operational decisions, ultimately boosting efficiency.

For instance, the global mining analytics market was valued at approximately USD 2.5 billion in 2023 and is projected to grow substantially by 2030, indicating a strong industry trend toward data-driven insights. Corsa can leverage this by implementing AI-powered systems to analyze sensor data from heavy machinery, anticipating potential failures before they occur. This proactive approach not only minimizes costly repairs but also ensures consistent production levels, a key factor in maintaining competitiveness in the 2024-2025 period.

Safety Technology Advancements

New safety technologies are revolutionizing mining operations. Enhanced respirable dust monitoring systems, for instance, provide real-time data, crucial for preventing silicosis and other respiratory ailments. In 2024, the mining industry saw a significant investment in these advanced monitoring tools, with companies reporting up to a 15% reduction in dust exposure incidents through their implementation.

Proximity detection systems are also a critical advancement, helping to prevent collisions between heavy machinery and personnel. These systems, often utilizing radar or Lidar technology, are becoming standard, contributing to a safer working environment. By mid-2025, it's projected that over 70% of new mining equipment will come equipped with these advanced proximity alerts.

Real-time tracking for miners offers another layer of safety, allowing for immediate location and status updates in case of emergencies. This technology is vital for Corsa to meet and exceed evolving Mine Safety and Health Administration (MSHA) regulations. The adoption of such tracking solutions is directly linked to improved emergency response times, potentially saving lives.

- Respirable Dust Monitoring: Aimed at reducing dust exposure by up to 15% in 2024.

- Proximity Detection: Expected to be integrated into over 70% of new mining equipment by mid-2025.

- Real-Time Tracking: Enhances miner safety and emergency response capabilities.

Carbon Capture and Utilization Technologies

Advancements in Carbon Capture and Utilization (CCU) technologies, while currently more focused on thermal coal and industrial emissions, present a potential future influence on metallurgical coal. As CCUS solutions mature and become more economically viable, environmental regulations and expectations could broaden to encompass other coal-related sectors, including mining and processing. For instance, by 2024, global investment in CCUS projects was projected to reach over $20 billion, signaling significant progress in the field.

The increasing focus on decarbonization across industries means that even sectors not directly targeted by early CCUS applications might face evolving environmental standards. This could lead to increased research and development into capture and utilization methods applicable to metallurgical coal operations, potentially impacting operational costs and long-term viability. By 2025, several large-scale CCUS projects are expected to be operational, further driving down costs and increasing accessibility.

- Global CCUS investment projected to exceed $20 billion by 2024.

- Technological advancements may lead to broader environmental scrutiny for metallurgical coal.

- Potential for CCUS to influence future operational standards in the coal industry.

Technological advancements are reshaping mining, with automation and robotics boosting efficiency and safety. For instance, the global mining automation market reached approximately $3.5 billion in 2023, with significant growth projected. Innovations in coal preparation are also key, with Corsa aiming to increase premium-grade metallurgical coal yield by 5% through upgraded equipment by mid-2024.

Digital transformation, including AI and IoT, is enhancing operations through real-time monitoring and predictive maintenance. The mining analytics market, valued at about USD 2.5 billion in 2023, is expected to grow substantially, enabling Corsa to optimize decisions and minimize downtime. New safety technologies, like advanced dust monitoring and proximity detection systems, are also crucial for a safer working environment.

| Technological Area | Key Advancement | Projected Impact/Data Point |

| Automation & Robotics | Autonomous haul trucks, remote operation | Up to 15% productivity increase reported by early adopters |

| Coal Preparation | Dense medium separation, froth flotation | Corsa targeting 5% yield increase by mid-2024 |

| Digital Transformation | AI-powered analytics, IoT monitoring | Mining analytics market ~USD 2.5 billion in 2023 |

| Safety Technology | Respirable dust monitoring, proximity detection | 15% reduction in dust exposure incidents; 70% of new equipment to have proximity alerts by mid-2025 |

Legal factors

Corsa Coal operates under stringent Mine Safety and Health Administration (MSHA) regulations, which are subject to ongoing revisions. These regulations are critical for ensuring worker well-being and operational integrity within the mining sector.

New MSHA rules slated for implementation in 2025 will significantly affect Corsa. These updates emphasize improved respirable dust standards, more robust emergency response plans, and the mandatory adoption of new technologies, all of which will necessitate substantial investment and adjustments to Corsa's operational framework and associated expenditures.

The Environmental Protection Agency (EPA) imposes stringent regulations that directly impact Corsa's operations, especially concerning water pollution from wastewater discharge and the management of coal ash. These rules necessitate significant investment in compliance technologies and processes.

Anticipated EPA rule revisions in 2024 and potential further changes in 2025 are a key consideration for Corsa. For instance, the EPA's proposed effluent limitation guidelines for power plants, which could affect wastewater discharge standards, are under review. Corsa must remain agile in adapting its environmental strategies to meet evolving compliance demands, which could involve upgrading treatment facilities or altering operational procedures.

The legal landscape for land use and mining permits in Northern Appalachia directly impacts Corsa Coal's operational capacity and growth potential. Navigating these regulations is paramount for securing the necessary approvals to extract and transport coal.

The process of obtaining and renewing mining permits can be lengthy and intricate, presenting potential legal hurdles and operational delays for Corsa. For instance, in 2023, the average time for a new surface mining permit in West Virginia was reported to be around 270 days, highlighting the significant lead times involved.

International Trade Laws and Agreements

Corsa's global reach means its export sales are directly impacted by international trade laws and agreements. Tariffs and quotas, for instance, can significantly alter the cost of goods sold for Corsa's vehicles in foreign markets.

Recent shifts in trade policy, such as the imposition of retaliatory tariffs, can quickly erode the economic attractiveness of Corsa's international market strategies. For example, a 25% tariff on imported vehicles, as seen in past trade disputes, would substantially increase the price of Corsa vehicles for consumers in affected countries.

- Trade Agreements: Corsa benefits from agreements like the USMCA, which facilitates smoother trade with Canada and Mexico, reducing certain tariffs and regulatory hurdles.

- Tariff Impact: In 2023, the automotive sector experienced ongoing discussions regarding potential tariffs on vehicles imported into the US, which could increase Corsa's production costs if components or finished vehicles are sourced from or exported to countries subject to these tariffs.

- Global Trade Volatility: Geopolitical tensions can lead to sudden changes in trade regulations, directly affecting Corsa's supply chain and market access, as witnessed with past trade disputes impacting global automotive manufacturing.

Bankruptcy and Corporate Restructuring Laws

Bankruptcy and corporate restructuring laws significantly impact Corsa Coal's operational and financial landscape. The company's Chapter 11 filing in January 2025 illustrates how these legal frameworks are crucial for managing debt, continuing operations, and facilitating asset sales. Such filings allow companies breathing room to reorganize their finances and business strategies under court supervision.

These laws provide a structured process for companies facing insolvency. For Corsa Coal, this means navigating the legal requirements for debt repayment, creditor negotiations, and potential asset divestitures, all while aiming to emerge as a viable entity. The outcome of such restructuring efforts often depends on the specific provisions of bankruptcy law and the company's ability to present a feasible reorganization plan.

- January 2025: Corsa Coal filed for Chapter 11 bankruptcy protection.

- Chapter 11: This allows for reorganization, not liquidation, providing a path to continued operations.

- Asset Sales: Restructuring laws permit the sale of assets to satisfy creditors and fund operations.

Corsa Coal's operations are heavily influenced by evolving environmental regulations, particularly those from the EPA concerning wastewater discharge and coal ash management. Anticipated EPA rule revisions in 2024 and 2025, such as potential changes to effluent limitation guidelines, necessitate ongoing adaptation and investment in compliance technologies. The company also faces significant legal scrutiny regarding land use and mining permits in Northern Appalachia, with permit acquisition processes averaging around 270 days in West Virginia as of 2023, impacting operational timelines and growth strategies.

The company's financial stability is directly shaped by bankruptcy and corporate restructuring laws, as evidenced by its January 2025 Chapter 11 filing. This legal framework allows for operational continuation and asset management during reorganization, with the success of such efforts hinging on adherence to legal provisions and the viability of the proposed reorganization plan.

| Legal Factor | Impact on Corsa | Key Data/Event |

| Mine Safety and Health Administration (MSHA) Regulations | Mandates improved safety standards, requiring investment in new technologies and procedures. | New MSHA rules for 2025 focus on respirable dust, emergency response, and technology adoption. |

| Environmental Protection Agency (EPA) Regulations | Governs wastewater discharge and coal ash management, necessitating compliance investments. | Potential EPA effluent limitation guideline revisions in 2024-2025 impact wastewater standards. |

| Land Use and Mining Permits | Affects operational capacity and growth potential; lengthy approval processes create delays. | Average 270-day permit acquisition time in West Virginia (2023) highlights lead times. |

| Bankruptcy and Corporate Restructuring Laws | Provides a framework for managing debt and continuing operations during financial distress. | Corsa Coal filed for Chapter 11 bankruptcy in January 2025, allowing for reorganization. |

Environmental factors

Global and national climate change policies are increasingly pressuring industries reliant on carbon-intensive processes. For example, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, will impose a levy on imported goods based on their embedded carbon emissions, potentially impacting steel producers and their reliance on metallurgical coal.

Decarbonization efforts extend to steel production, a significant consumer of metallurgical coal. While Corsa's metallurgical coal isn't for direct power generation, the growing demand for green steel, utilizing methods like hydrogen-based direct reduction, could gradually reduce the overall market for traditional steelmaking inputs. By 2030, several major economies aim to have at least 30% of their steel production utilize low-carbon technologies.

Corsa Coal's operations are heavily reliant on effective water management, facing increasing scrutiny over discharge quality and volume. The company must navigate evolving environmental standards, particularly those set by the EPA.

New EPA regulations impacting wastewater from coal facilities, even those primarily aimed at power generation, signal a broader trend of stricter oversight for the entire coal industry. This heightened focus means Corsa Coal will likely face increased compliance costs and potential operational adjustments to meet these water quality mandates.

Environmental regulations increasingly require companies like Corsa to undertake extensive land reclamation once mining activities conclude, aiming to restore the land to its original condition or a beneficial post-mining use. This process can involve significant financial commitments and operational adjustments.

Biodiversity concerns are paramount, with regulators and stakeholders scrutinizing the potential for habitat disruption and species loss during mining operations. For instance, in 2024, the European Union's Biodiversity Strategy for 2030 emphasizes restoring degraded ecosystems, potentially increasing compliance burdens for mining firms operating within member states.

Air Quality Regulations and Emissions

Corsa's operations, particularly the processing and handling of metallurgical coal, are subject to stringent air quality regulations aimed at controlling dust and particulate matter emissions. Compliance with these rules is crucial for minimizing environmental impact and avoiding penalties.

The company must actively manage its processes to meet emission standards set by regulatory bodies. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce National Ambient Air Quality Standards (NAAQS) which set limits for pollutants like particulate matter (PM2.5 and PM10).

- Regulatory Compliance: Corsa must adhere to EPA and state-level air quality standards, which include limits on particulate matter emissions from coal handling and processing.

- Emission Control Technologies: Investment in and maintenance of dust suppression systems, enclosed conveyors, and other emission control technologies are essential for meeting these standards.

- Environmental Monitoring: Regular monitoring of air quality around Corsa's facilities is required to demonstrate compliance and identify areas for improvement.

- Potential Fines: Non-compliance can result in significant fines, operational disruptions, and damage to the company's reputation.

Coal Ash Disposal and Management

Corsa Coal faces increasing scrutiny regarding the safe management and disposal of coal ash, also known as Coal Combustion Residuals (CCRs). Evolving environmental regulations at both federal and state levels dictate how these materials must be handled to prevent groundwater contamination. For instance, the U.S. Environmental Protection Agency's (EPA) CCR rule, which was updated in 2020 and saw further amendments proposed in late 2023, sets stringent requirements for disposal facilities.

Meeting these standards is critical for Corsa Coal's operations. Non-compliance can lead to significant fines and operational disruptions. In 2024, the focus remains on ensuring disposal practices, including landfill design and monitoring, adhere to these updated federal and state mandates. The financial implications of failing to meet these standards are substantial, as demonstrated by past settlements and penalties levied against other companies in the industry for environmental violations.

Key considerations for Corsa Coal include:

- Compliance with EPA's CCR Rule: Ensuring all disposal sites meet the latest federal standards for liners, leachate collection, and groundwater monitoring.

- State-Specific Regulations: Adhering to any additional or more stringent CCR management requirements imposed by the states where Corsa Coal operates.

- Groundwater Protection: Implementing robust monitoring programs to detect and prevent any potential contamination of local water sources from CCR disposal.

- Long-Term Liability: Managing the long-term risks and potential liabilities associated with historical and ongoing coal ash disposal.

Environmental factors significantly shape Corsa Coal's operational landscape, driven by global and regional climate policies and increasing demands for sustainable practices. The push towards decarbonization, exemplified by the EU's Carbon Border Adjustment Mechanism (CBAM) and the growing interest in green steel production, directly impacts the long-term market for metallurgical coal. Consequently, Corsa must adapt to stricter regulations concerning water management, air quality, and land reclamation, which necessitate substantial investments in compliance and advanced emission control technologies. The company also faces evolving mandates for the safe disposal of coal combustion residuals, with updated EPA regulations in 2024 emphasizing groundwater protection and long-term liability management.

PESTLE Analysis Data Sources

Our Corsa PESTLE analysis is built on a robust foundation of data from official government agencies, reputable automotive industry associations, and leading economic forecasting firms. We ensure each insight, from regulatory changes to market trends, is supported by credible and current information.