Corsa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsa Bundle

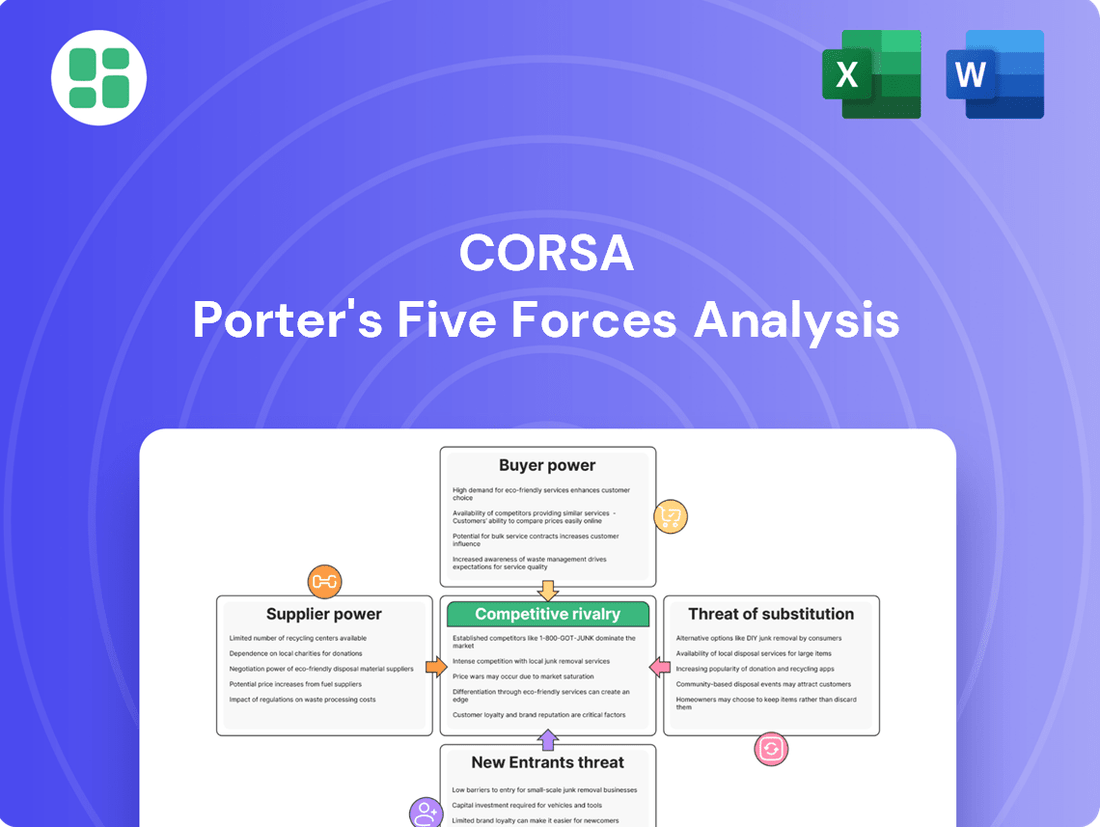

Understanding Corsa's competitive landscape is crucial, and Porter's Five Forces provides that clarity. This framework illuminates the industry's inherent attractiveness and the pressures Corsa navigates daily. Ready to uncover the full strategic picture?

The complete Porter's Five Forces Analysis for Corsa reveals the intricate web of buyer power, supplier leverage, competitive rivalry, and the ever-present threats of new entrants and substitutes. Gain the deep insights needed to anticipate market shifts and secure Corsa's competitive edge.

Don't just scratch the surface of Corsa's market dynamics. Unlock the full Porter's Five Forces Analysis for a comprehensive, data-driven understanding of the forces shaping its success and identify actionable strategies to thrive.

Suppliers Bargaining Power

Supplier concentration significantly impacts Corsa Coal's bargaining power. The metallurgical coal industry, like Corsa, depends on specialized equipment and services. If only a handful of companies supply crucial mining machinery or essential logistical support, these few suppliers can wield considerable influence, dictating terms and pricing to Corsa.

Corsa's recent financial struggles, including its bankruptcy filing in January 2025, further diminish its leverage. This weakened financial standing makes it more challenging for Corsa to negotiate favorable contracts and pricing with its suppliers, potentially leading to higher operational costs.

The bargaining power of suppliers for Corsa is significantly influenced by switching costs. For Corsa, the expense and intricacy involved in changing suppliers for critical mining equipment, components, or specialized operational services can be substantial. This encompasses not only direct financial outlays but also potential operational interruptions, the necessity for staff re-training on new machinery, and the effort required to forge new supply chain partnerships, thereby strengthening the position of existing suppliers.

Corsa's reported challenges in 2024 regarding the need for capital to maintain or upgrade aging mining equipment further underscore the high switching costs. This capital expenditure implies that transitioning to new equipment or suppliers would likely involve considerable upfront investment, making it less feasible for Corsa to easily shift away from current providers, thus enhancing supplier leverage.

The uniqueness of inputs significantly influences supplier bargaining power. While coal is a commodity, the specialized machinery for mining and processing, proprietary chemicals for preparation, or expert geological consulting can be unique. If these specialized inputs are proprietary or demand niche technical skills, their suppliers gain considerable leverage. For instance, a supplier of advanced, proprietary mining equipment might command higher prices if few alternatives exist.

Threat of Forward Integration by Suppliers

Suppliers of essential mining equipment or specialized services might consider integrating forward into coal production. However, this is generally a less significant threat in the coal sector due to the immense capital requirements and stringent regulatory environment associated with mining operations. For instance, the upfront investment for a new coal mine can easily run into hundreds of millions of dollars, making it a barrier for most service providers.

While a full takeover of coal production is rare, some niche suppliers offering services that grant them significant operational influence could see their bargaining power enhanced. This could involve providing comprehensive maintenance, operational management, or even financing for mining equipment, effectively giving them a degree of control over the production process.

- Capital Intensity: The high capital expenditure required for coal mining, often exceeding hundreds of millions of dollars for new operations, discourages suppliers from backward integration.

- Regulatory Hurdles: Navigating the complex web of environmental, safety, and operational permits for coal mining presents a substantial challenge for potential integrating suppliers.

- Niche Service Providers: Smaller suppliers offering critical, integrated services that approach operational control can gain leverage, even without full backward integration.

- Limited Industry Examples: Direct forward integration by suppliers into coal production remains an uncommon strategy within the industry, reflecting the inherent difficulties and risks.

Supplier's Importance to Corsa

The bargaining power of suppliers is a key factor in Corsa's operational landscape. The importance of Corsa's business to its suppliers directly influences this power dynamic. If Corsa represents a small fraction of a supplier's total sales, that supplier holds considerable leverage, able to dictate terms more freely.

Conversely, if Corsa constitutes a substantial portion of a supplier's revenue, Corsa could wield more influence in negotiations. However, Corsa's recent financial difficulties and subsequent bankruptcy filing in 2024 significantly altered this balance. This situation likely reduced Corsa's importance as a customer for many of its suppliers.

- Supplier Dependence: Corsa's reduced financial standing means it's less critical to many suppliers' bottom lines.

- Leverage Shift: Suppliers facing Corsa's bankruptcy are more likely to prioritize their own financial stability over accommodating Corsa's needs.

- Impact on Costs: This diminished bargaining power for Corsa could lead to higher input costs from suppliers who now have less incentive to offer favorable terms.

The bargaining power of suppliers for Corsa Coal is amplified by the industry's supplier concentration and the high switching costs Corsa faces when changing providers for specialized mining equipment and services. Corsa's financial distress, including its January 2025 bankruptcy filing, has significantly weakened its negotiating position, making it harder to secure favorable terms and potentially increasing operational expenses.

The uniqueness of certain inputs, such as proprietary mining technology or specialized geological expertise, further strengthens supplier leverage. While direct forward integration by suppliers into coal production is rare due to immense capital requirements and regulatory hurdles, niche service providers offering critical, integrated operational support can still gain considerable influence over Corsa.

Corsa's reduced financial standing means it is less critical to many suppliers, shifting the balance of power in their favor. This dynamic can lead to higher input costs for Corsa as suppliers have less incentive to offer favorable terms, especially in light of Corsa's recent financial instability.

| Factor | Impact on Corsa's Supplier Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | High | Metallurgical coal relies on specialized equipment; few suppliers can dictate terms. |

| Switching Costs | High | Significant financial outlay and operational disruption for Corsa to change suppliers for critical machinery. |

| Uniqueness of Inputs | High | Proprietary technology or niche expertise from suppliers grants them leverage. |

| Corsa's Financial Health | Low (Weakened) | Bankruptcy filing in January 2025 reduces Corsa's importance to suppliers. |

| Supplier Dependence on Corsa | Low (for most suppliers) | Corsa's reduced financial standing means it's less critical to many suppliers' revenue. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Corsa's automotive market position.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Effortlessly identify and address key competitive threats by pinpointing the strongest forces impacting your industry.

Customers Bargaining Power

Customer concentration is a key factor in assessing the bargaining power of buyers for Corsa Coal. Corsa's primary customers are steel and coke producers, both domestically and internationally. If a small number of these producers account for a large percentage of Corsa's total revenue, they gain significant leverage to negotiate lower prices or more favorable contract terms.

In the third quarter of 2024, Corsa Coal's sales were split 64% domestic and 36% international. While this indicates a degree of geographic diversification, the concentration within these domestic and international markets is crucial. A few major steel manufacturers dominating purchases could lead to substantial bargaining power, impacting Corsa's profitability.

Customer switching costs represent a significant factor in the bargaining power of buyers. For steel producers, the cost of switching metallurgical coal suppliers can be substantial. This is because the quality and consistency of coal are paramount for efficient blast furnace operations, making a change in supplier a complex and potentially disruptive process.

However, this dynamic can shift. If several suppliers can consistently provide coal of comparable quality, or if a steel manufacturer has the flexibility to adapt its procurement processes, the perceived switching costs can decrease. This flexibility directly empowers the customer.

Corsa Coal's strategy of focusing on premium quality metallurgical coal is designed to counteract this. By differentiating its product based on superior quality, Corsa aims to make it more challenging for customers to switch to competitors, thereby reducing their inclination to do so based on price alone.

Corsa's customers, primarily steel producers, exhibit high price sensitivity for metallurgical coal. This is because metallurgical coal represents a substantial portion of their input costs. For instance, in 2024, the cost of metallurgical coal can significantly influence a steel mill's overall production expenses, directly affecting their margins.

The profitability of these steel producers is closely tied to global steel demand and prevailing steel prices. When steel prices are low, their ability and willingness to absorb higher coal costs diminish, intensifying customer price sensitivity.

Looking ahead to 2025, the metallurgical coal market is projected to experience a surplus. This anticipated oversupply is expected to exert downward pressure on coal prices, further amplifying customer price sensitivity as buyers anticipate lower costs.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large steel producers, represents a significant aspect of their bargaining power. Steel manufacturers could potentially invest in metallurgical coal mining operations, thereby securing their raw material supply and gaining greater control over input costs. This strategic move, while capital-intensive, is a viable consideration for major steel conglomerates aiming to enhance supply chain resilience.

For instance, in 2024, the global steel industry continued to grapple with volatile raw material prices, making backward integration an attractive, albeit complex, long-term strategy. The significant capital expenditure required for establishing mining operations, coupled with the need for specialized expertise, acts as a barrier but not an insurmountable one for industry giants. This potential for vertical integration directly pressures metallurgical coal suppliers, as it introduces a credible threat of disintermediation.

- Steel conglomerates may explore backward integration into metallurgical coal mining to secure supply and manage costs.

- This strategy is particularly relevant given the price volatility of raw materials observed in the steel sector during 2024.

- Significant capital investment and specialized expertise are required, posing a barrier but not eliminating the threat for large players.

- The potential for customers to become suppliers increases their bargaining power by creating a credible threat of disintermediation.

Availability of Substitute Inputs for Customers

The availability of substitute inputs significantly impacts customer bargaining power. While metallurgical coal remains critical for traditional steel production, the growing development of green steel technologies presents a future alternative.

These emerging technologies, such as hydrogen-based direct reduction and the increased use of electric arc furnaces (EAFs) powered by scrap metal, offer customers the potential to reduce their dependence on coking coal. Although these alternatives are still in their nascent stages, their continued advancement signals a long-term shift that will likely bolster customer bargaining power.

- Technological Advancements: Green steel technologies like hydrogen DRI and EAFs offer alternatives to traditional blast furnace steelmaking.

- Reduced Reliance: These innovations could lessen customer dependence on coking coal.

- Future Bargaining Power: The ongoing development of these substitutes is expected to increase customer leverage over time.

- Market Dynamics: By 2024, the global steel industry is increasingly exploring decarbonization, with significant investments in EAF capacity and green hydrogen projects, signaling a tangible shift towards alternative inputs.

The bargaining power of Corsa Coal's customers, primarily steel producers, is a significant factor influencing its profitability. High customer concentration, where a few large buyers account for a substantial portion of sales, grants them considerable leverage. For example, if a handful of major steel manufacturers represent over 50% of Corsa's revenue, they can effectively dictate terms.

Price sensitivity is another critical element. Metallurgical coal is a major input cost for steel production, meaning steelmakers are highly attuned to its price. In 2024, this sensitivity was amplified by a projected surplus in the metallurgical coal market, which typically drives prices down and gives buyers more room to negotiate.

Customer switching costs are generally high due to the need for consistent coal quality in steelmaking, but this can be mitigated if multiple suppliers offer comparable products. Furthermore, the threat of backward integration, where steel companies invest in their own coal mining operations, represents a potent lever for customers to control costs and supply.

The ongoing development of green steel technologies, such as hydrogen-based direct reduction, also poses a long-term threat. As these alternatives become more viable, they could reduce steelmakers' reliance on metallurgical coal, thereby increasing their bargaining power.

| Factor | Impact on Corsa Coal | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High concentration increases buyer leverage. | Specific customer revenue share data not publicly detailed, but industry consolidation suggests potential concentration. |

| Price Sensitivity | High, as coal is a major input cost. | Metallurgical coal prices experienced volatility in 2024, influencing steel producer margins. |

| Switching Costs | Generally high due to quality consistency needs. | Continuously assessed based on supplier reliability and coal characteristics. |

| Threat of Backward Integration | Credible threat for large steel producers. | Steel industry continues to explore supply chain resilience, making integration a strategic consideration. |

| Availability of Substitutes | Emerging green steel tech poses long-term risk. | Investments in EAFs and green hydrogen projects increased in 2024, signaling a shift. |

Full Version Awaits

Corsa Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Corsa Porter's Five Forces Analysis provides an in-depth examination of the competitive landscape, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. You are previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

Corsa Coal faces a crowded market with several large U.S. metallurgical coal producers, including Warrior Met Coal, Alpha Metallurgical Resources, Arch Resources, and Ramaco Resources. These companies, along with Corsa, vie for market share, intensifying competitive rivalry.

While Corsa Coal concentrates its operations in Northern Appalachia, the broader metallurgical coal market is significantly impacted by international suppliers. Major exporting nations such as Australia and Mongolia contribute substantial volumes, creating a global competitive dynamic that influences pricing and demand for all players, including Corsa.

The metallurgical coal market's growth rate significantly shapes how fiercely companies compete. When the market is expanding rapidly, it's easier for everyone to gain ground. However, a slower growth trajectory, or even the prospect of too much supply, forces companies to battle harder for the same slice of the pie.

Looking ahead, the forecast for metallurgical coal between 2024 and 2029 suggests a compound annual growth rate of about 4.8%. This sounds healthy, but a key factor to watch is the projected shift towards a surplus in 2025. This surplus is a critical indicator that competitive pressures are likely to increase as companies vie for available demand.

Corsa Coal (now part of Arch Resources) highlights its premium quality metallurgical coal, but the actual differentiation in this market can be subtle. When metallurgical coal is viewed as a commodity, price often dictates purchasing decisions, intensifying rivalry among producers and squeezing profit margins.

Corsa's historical financial performance, including periods of significant losses, suggests that relying solely on perceived quality has been a challenge in maintaining a strong competitive position. For instance, in 2023, metallurgical coal prices experienced volatility, with benchmark indices like the Australian Premium Low Vol PCI fluctuating significantly, underscoring the price-sensitive nature of the market.

Exit Barriers

High exit barriers can trap companies in a declining industry, even when profitability wanes. This is often due to substantial investments in specialized fixed assets, like mines and processing plants, which are hard to divest or repurpose. Additionally, long-term contracts and significant environmental cleanup responsibilities can make exiting prohibitively expensive.

Corsa's situation in early 2025 exemplifies these challenges. Following its Chapter 11 bankruptcy filing in January 2025, the company faced considerable hurdles in its March 2025 asset sales. This process highlighted how difficult it can be for companies with such specialized and capital-intensive operations to cease operations or exit the market gracefully.

- Specialized Assets: Corsa's operations likely involve significant fixed assets such as mines and processing facilities, which have limited alternative uses, increasing the cost and difficulty of exiting.

- Contractual Obligations: Long-term supply agreements, labor contracts, or other commitments can create financial penalties for early termination, acting as a barrier to exit.

- Environmental Liabilities: The coal industry, in particular, often carries substantial environmental remediation costs, such as mine reclamation, which must be addressed even after operations cease, adding to exit expenses.

- Bankruptcy Process: Corsa's Chapter 11 filing and subsequent asset sales in March 2025 demonstrate that even in bankruptcy, the process of disentangling operations and liabilities is complex and time-consuming, indicating high practical exit barriers.

Cost Structure and Overcapacity

The mining industry, including Corsa, often contends with high fixed costs related to exploration, equipment, and infrastructure. This inherent cost structure, when combined with potential market overcapacity, can pressure companies to engage in aggressive pricing. Even if margins are thin, selling at a lower price can help cover these substantial fixed expenses.

Corsa's financial performance in 2024 underscored these challenges. The company reported a decline in revenue and incurred net losses. This suggests that Corsa found it difficult to align its cost structure with prevailing market prices, intensifying competitive pressures and impacting its profitability.

- High Fixed Costs: Mining operations require significant upfront investment in plant, machinery, and infrastructure.

- Overcapacity Risk: When supply outstrips demand, companies may lower prices to maintain sales volume.

- 2024 Performance: Corsa experienced revenue decline and net losses, indicating cost structure and market price pressures.

Competitive rivalry in the metallurgical coal sector, where Corsa Coal operates, is intense due to the presence of numerous large domestic producers like Warrior Met Coal and Alpha Metallurgical Resources. This crowded landscape forces companies to constantly vie for market share, often leading to price competition. The market's growth rate is a critical factor; a slower growth environment, projected for metallurgical coal between 2024 and 2029 with a CAGR of approximately 4.8%, signals increased competition, especially with a predicted surplus in 2025.

The perception of metallurgical coal as a commodity also heightens rivalry, as differentiation is minimal, making price a primary purchasing driver. Corsa's historical financial struggles, marked by losses in 2023 and a revenue decline in 2024, illustrate the difficulty in maintaining profitability when facing such price pressures. High exit barriers, including specialized assets and environmental liabilities, further trap companies in this competitive environment, as seen with Corsa's challenging asset sales following its January 2025 bankruptcy filing.

SSubstitutes Threaten

The threat of substitutes for metallurgical coal in steelmaking isn't about finding another rock to burn. Instead, it's about entirely different ways to make steel. Think of electric arc furnaces (EAFs) that primarily use recycled steel scrap. These are gaining traction.

Another significant substitute is the direct reduced iron (DRI) process, especially those powered by hydrogen. This method can drastically cut down the reliance on traditional coking coal. In fact, EAF capacity is anticipated to see substantial growth by 2030, meaning less demand for coal in those operations.

Currently, traditional blast furnace steelmaking, relying on metallurgical coal, stands as the most cost-effective and scalable method for producing virgin steel. This cost advantage is a significant barrier for emerging substitutes.

While 'green steel' technologies, such as those utilizing hydrogen or electric arc furnaces powered by renewable energy, offer substantial environmental benefits, their current economic viability is a major hurdle. For instance, estimates suggest that green steel production could be 20-50% more expensive than traditional methods in the near term, impacting their adoption rate.

The performance of these substitutes, particularly in terms of production volume and consistency, is still being refined for widespread commercial application. Until the cost gap narrows and scalability is proven, traditional methods will likely retain their dominant position in the market.

Steel producers are increasingly considering alternatives to traditional methods, influenced by stricter environmental rules and a growing consumer preference for eco-friendly goods. For instance, a significant portion of the steel industry is exploring hydrogen-based direct reduced iron (DRI) as a greener alternative, with projections indicating a substantial rise in its use by 2030.

Despite this shift, the substantial capital outlay and the need for complete operational restructuring mean that a swift transition to these new processes is difficult. Many countries, including major players like India, continue to depend heavily on coal-reliant steelmaking technologies, highlighting the existing infrastructure's inertia.

Technological Advancements in Steelmaking

Ongoing research and development in steelmaking technologies, particularly in hydrogen-based ironmaking and carbon capture, represent a significant long-term threat to metallurgical coal demand. These innovations aim to drastically reduce or eliminate the carbon footprint associated with steel production, directly impacting the primary application of metallurgical coal. While widespread commercial adoption is still some decades away, these technological shifts signal a clear directional threat to the industry's traditional reliance on coal.

These advancements are not merely theoretical; significant investments are being made. For instance, pilot projects exploring hydrogen direct reduction of iron are gaining traction, with companies worldwide investing billions. The European Union's Green Deal, for example, is actively promoting decarbonization pathways for heavy industries, including steel, which will inevitably reduce the demand for traditional inputs like metallurgical coal.

- Hydrogen-based ironmaking: Aims to replace coal with hydrogen, a cleaner fuel source, in the reduction of iron ore.

- Carbon Capture, Utilization, and Storage (CCUS): Technologies that capture CO2 emissions from steel production, preventing their release into the atmosphere.

- Investment Trends: Global investment in green steel technologies is projected to reach hundreds of billions of dollars by 2030, as outlined by various industry reports.

- Policy Drivers: Stringent environmental regulations and carbon pricing mechanisms are accelerating the adoption of these cleaner steelmaking processes.

Regulatory and Environmental Pressures

The intensifying global focus on environmental sustainability, particularly the push to reduce carbon emissions, is a significant threat to metallurgical coal. Governments worldwide are implementing stricter regulations, forcing industries to seek out lower-carbon alternatives. For instance, by mid-2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) is expected to impose costs on carbon-intensive imports, making traditional steel production methods more expensive and encouraging the adoption of greener processes. This regulatory landscape directly pressures steelmakers to reduce their reliance on metallurgical coal, even if current substitutes present cost or technical challenges. The long-term trajectory clearly indicates a diminishing demand for coal as industries prioritize decarbonization efforts.

This escalating regulatory environment acts as a potent substitute threat. As environmental compliance costs rise and public demand for sustainable products grows, customers are increasingly willing to explore and invest in alternatives to coal-based steel production. For example, advancements in green hydrogen-based direct reduced iron (DRI) technology, while still developing, offer a viable long-term substitute that bypasses the need for metallurgical coal altogether. The persistent nature of these environmental pressures ensures that the threat of substitutes for metallurgical coal will continue to grow.

The financial implications of this shift are substantial. By the end of 2023, investments in green steel technologies, including those that reduce or eliminate coal usage, had reached billions globally, signaling a clear market pivot. This trend suggests that the cost-effectiveness of coal-based steelmaking is likely to erode further as regulations tighten and alternative technologies mature.

- Environmental Regulations: Increasing global regulations on carbon emissions are a primary driver for seeking alternatives to metallurgical coal.

- Customer Pressure: Customers are increasingly motivated by sustainability goals to explore and adopt lower-carbon steel production methods.

- Technological Advancements: Innovations in green steelmaking, such as hydrogen-based DRI, present viable long-term substitutes for coal.

- Economic Factors: Rising compliance costs and growing investment in alternative technologies make coal-based steelmaking less economically competitive over time.

The threat of substitutes for metallurgical coal in steelmaking primarily stems from alternative production methods and evolving industry priorities. While traditional blast furnace steelmaking remains dominant due to cost, technologies like electric arc furnaces (EAFs) utilizing scrap steel are gaining ground. Furthermore, direct reduced iron (DRI) processes, especially those powered by hydrogen, offer a significant pathway to reduce coal dependence.

The push for decarbonization is a major catalyst, with green steel technologies like hydrogen DRI and renewable-powered EAFs presenting long-term substitutes. Despite current cost and scalability challenges, these innovations are attracting substantial investment. For instance, global investment in green steel technologies is projected to reach hundreds of billions by 2030, indicating a clear market shift away from coal reliance.

Stringent environmental regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM) by mid-2024, are increasing the cost of carbon-intensive steel production, further incentivizing the adoption of cleaner alternatives. This regulatory pressure, coupled with growing customer demand for sustainable products, amplifies the threat of substitutes, making coal-based steelmaking less economically viable over time.

| Substitute Technology | Current Status/Outlook | Impact on Metallurgical Coal Demand |

|---|---|---|

| Electric Arc Furnaces (EAFs) using scrap | Growing capacity, significant adoption | Reduces demand for virgin steel production, hence coal |

| Direct Reduced Iron (DRI) with Hydrogen | Under development, pilot projects active | Potential to largely eliminate coal use in virgin steelmaking |

| Green Steel Initiatives (general) | Increasing investment, policy support | Long-term threat to coal as sustainability becomes paramount |

Entrants Threaten

Entering the metallurgical coal mining sector, crucial for steel production, demands immense upfront capital. For instance, securing mining rights, conducting thorough geological surveys, developing mine infrastructure, and building processing facilities can easily run into hundreds of millions, if not billions, of dollars. Corsa Coal's own extensive operations, encompassing multiple mines and a dedicated preparation plant, underscore these significant financial hurdles, effectively deterring many potential new players from entering the market.

The coal mining sector faces significant barriers to entry due to stringent regulatory requirements. Obtaining the necessary permits, which encompass environmental impact assessments, safety protocols, and land reclamation plans, can be an arduous and lengthy process. For instance, in 2024, the average time to secure a new mine permit in many jurisdictions exceeded two years, often involving multiple governmental agencies.

These extensive permitting processes, coupled with the need to comply with evolving environmental standards such as those related to water quality and emissions, add substantial upfront costs for potential new entrants. These compliance costs can easily run into millions of dollars, making it difficult for smaller or less capitalized firms to compete. The regulatory landscape is dynamic, with new legislation or stricter enforcement often introduced, further increasing the risk and investment required.

New entrants into Corsa’s market face a significant hurdle in securing access to crucial distribution channels. They would need to forge relationships with domestic and international steel producers and establish reliable transportation infrastructure, including rail lines and port access. For instance, in 2024, the cost of building new rail infrastructure can run into millions per mile, a substantial barrier.

Corsa, on the other hand, enjoys a distinct advantage due to its established sales channels and existing access to vital transportation networks, such as the Norfolk Southern rail line. This pre-existing infrastructure is something that new competitors would find exceedingly difficult and costly to replicate, effectively limiting their ability to compete on logistics and reach.

Experience and Expertise

The threat of new entrants in metallurgical coal mining is significantly mitigated by the substantial experience and expertise required. Metallurgical coal extraction demands specialized geological understanding and proficiency in complex mining techniques, such as deep mining. Furthermore, efficient processing capabilities are crucial for producing saleable product.

Experienced management teams and a highly skilled workforce are indispensable for navigating the operational complexities and ensuring profitability. Corsa's own recent operational hurdles, including production disruptions in 2023, underscore the steep learning curve and inherent difficulties even for established players in this sector.

- Specialized Knowledge: Deep geological understanding is a prerequisite.

- Operational Prowess: Mastery of advanced mining and processing techniques is essential.

- Human Capital: Experienced management and skilled labor are critical success factors.

- Barriers to Entry: Corsa's challenges highlight the difficulty for new, less experienced firms.

Economies of Scale

Existing large-scale metallurgical coal producers often benefit from significant economies of scale in mining, processing, and logistics. This allows them to achieve lower per-unit costs, making it challenging for newcomers to match their pricing. For instance, in 2024, major players in the metallurgical coal market continued to leverage their established infrastructure to maintain competitive cost structures.

New entrants would likely face a substantial cost disadvantage until they can achieve comparable operational scale. This hurdle makes it difficult to compete effectively on price, especially in a commodity market known for its volatility. The capital investment required to reach a scale that negates this disadvantage can be prohibitive for many potential new entrants.

- Economies of Scale: Existing large producers in the metallurgical coal sector benefit from lower per-unit costs due to their scale in operations.

- Cost Disadvantage for New Entrants: Newcomers face a significant cost disadvantage until they can achieve similar production volumes.

- Market Volatility: The volatile nature of commodity pricing exacerbates the challenge for new entrants to compete on price.

The threat of new entrants in the metallurgical coal sector is considerably low due to the massive capital expenditure required, estimated to be in the hundreds of millions to billions of dollars for mine development and infrastructure. Stringent regulatory hurdles, including lengthy permitting processes that can take over two years in 2024, and substantial compliance costs for environmental standards further deter new players. Additionally, the need for specialized knowledge, experienced personnel, and established distribution channels, alongside the significant economies of scale enjoyed by existing producers, creates formidable barriers that limit new competition.

| Barrier Type | Description | Estimated Cost/Timeframe |

|---|---|---|

| Capital Requirements | Mine development, infrastructure, processing facilities | Hundreds of millions to billions of dollars |

| Regulatory Hurdles | Permitting, environmental compliance, safety standards | Average 2+ years for permits (2024); millions in compliance costs |

| Expertise & Experience | Geological understanding, mining techniques, skilled labor | Indispensable; steep learning curve |

| Distribution & Logistics | Access to rail, ports, established sales channels | Millions per mile for new rail infrastructure (2024) |

| Economies of Scale | Lower per-unit costs for established producers | Significant cost advantage over new entrants |

Porter's Five Forces Analysis Data Sources

Our Corsa Porter's Five Forces analysis is built upon a foundation of robust data, drawing from official Opel/Vauxhall annual reports, automotive industry market research from firms like IHS Markit, and publicly available sales and production figures.