Corbion SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corbion Bundle

Corbion's strengths lie in its leadership in lactic acid and its bio-based ingredients, positioning it well for the growing demand for sustainable solutions. However, potential threats like fluctuating raw material prices and intense competition require careful navigation.

Want the full story behind Corbion's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Corbion is a global leader in bio-based ingredients, particularly in lactic acid and its derivatives, where it commands a significant market share. This strong position is reinforced by its substantial presence in food preservation and algae-based ingredients, demonstrating its broad impact across the bio-ingredients sector.

With over a century of experience in fermentation and blending, Corbion has cultivated deep expertise. This allows the company to consistently deliver high-quality, nature-based ingredients that serve as effective alternatives to synthetic options, a key differentiator in today's market.

Corbion's established reputation and extensive knowledge of ingredient applications provide a formidable competitive advantage. This is evident in its ability to cater to diverse market needs, from food and beverages to pharmaceuticals and bioplastics, underscoring its global leadership.

Corbion's robust focus on sustainability is a core strategic pillar, directly addressing the growing global demand for eco-friendly solutions and aligning with the UN Sustainable Development Goals. This commitment translates into significant investment in innovative areas such as natural food preservation technologies, advanced algae-based ingredients, and biodegradable lactic acid derivatives and natural polymers.

This dedication to sustainable innovation not only positions Corbion favorably against increasing environmental regulations but also unlocks new market segments and strengthens its brand image. For instance, the company's strong performance in the 2024 CDP climate change disclosure, achieving a B rating, underscores its proactive approach to environmental stewardship and its ability to translate sustainability into tangible business advantages.

Corbion boasts a highly diversified product portfolio, catering to essential sectors like food, home and personal care, animal nutrition, pharmaceuticals, and the growing bioplastics market. This wide reach across multiple industries, organized into Functional Ingredients & Solutions and Health & Nutrition, significantly reduces dependency on any single market segment. For instance, in 2023, Corbion reported net sales of €1,078.5 million from its Food segment, demonstrating its substantial presence in this key area.

Robust Financial Performance and Strategic Realignment

Corbion demonstrated robust financial performance in 2024, highlighted by increased sales and a substantial uplift in Adjusted EBITDA and free cash flow. This financial strength provides a solid foundation for future growth and investment.

The strategic divestment of its non-core Emulsifiers business in 2024, coupled with ongoing restructuring, is a key strength. These moves are designed to simplify Corbion's structure, reduce operational complexity, and sharpen its focus.

- 2024 Adjusted EBITDA improvement

- Divestment of Emulsifiers business

- Focus on high-growth, high-margin segments

- Streamlined business structure

Advanced R&D and Application Expertise

Corbion's advanced research and development capabilities are a significant strength, underscored by its investment in state-of-the-art application laboratories. These facilities, coupled with dedicated technical support teams, allow the company to offer deep application expertise. This hands-on approach enables Corbion to collaborate effectively with customers, developing customized solutions that enhance product differentiation. For instance, in 2023, Corbion reported continued growth in its innovation pipeline, with a focus on sustainable ingredients and solutions that address key market needs.

This deep application expertise directly translates into tangible benefits for clients, particularly in crucial areas such as improving food safety, extending shelf life, and enhancing nutritional profiles. By working closely with customers, Corbion fosters strong, collaborative relationships, which are vital for driving innovation and addressing evolving consumer demands. The company's commitment to R&D is reflected in its consistent introduction of new ingredients and technologies designed to meet these challenges, contributing to its competitive edge in the market.

Corbion's strategic focus on innovation within its core segments is evident. For example, the company's advancements in lactic acid and its derivatives continue to provide solutions for a wide range of applications, from bioplastics to food preservation. This technical prowess allows them to not only meet current market demands but also to anticipate future trends, solidifying their position as a leader in bio-based ingredients and solutions.

Corbion's market leadership in lactic acid and its derivatives is a significant strength, bolstered by its deep expertise in fermentation and its commitment to sustainability. This dual focus allows the company to offer high-quality, nature-based ingredients that meet growing consumer demand for eco-friendly products. Its robust innovation pipeline and application know-how further solidify its competitive advantage across diverse markets.

Corbion demonstrated strong financial health in 2024, with notable improvements in sales and profitability metrics like Adjusted EBITDA. The strategic divestment of its Emulsifiers business in the same year streamlined operations and sharpened its focus on core, high-growth areas. This financial discipline and strategic agility position Corbion well for continued success.

| Metric | 2023 (EUR Million) | 2024 (EUR Million) |

|---|---|---|

| Net Sales | 1,078.5 (Food Segment) | [Data not available for full year 2024] |

| Adjusted EBITDA | [Data not available for 2023] | [Significant uplift reported] |

| Free Cash Flow | [Data not available for 2023] | [Substantial increase reported] |

What is included in the product

Delivers a strategic overview of Corbion’s internal and external business factors, highlighting its strengths in bio-based ingredients and opportunities in sustainable solutions, while also addressing weaknesses in market diversification and threats from competition and regulatory changes.

Uncovers critical market opportunities and competitive threats for informed strategic adjustments.

Weaknesses

Corbion's reliance on agricultural commodities like cane sugar and corn means its production costs are directly tied to market price swings. For instance, a significant increase in corn prices, a key ingredient for many of their bio-based products, could squeeze profit margins if not passed on to customers. This vulnerability was evident in early 2024 when global grain prices saw upward pressure due to geopolitical events, impacting input costs for many food ingredient producers.

Corbion's significant reliance on fermentation technology, while a core competency, presents a potential weakness. Should more cost-effective or efficient alternative production methods for bio-based ingredients emerge, Corbion could face competitive pressure. For example, advancements in synthetic biology or other novel bioprocessing techniques might offer superior scalability or lower production costs, impacting Corbion's market position if it doesn't adapt. Maintaining a leading edge requires substantial and ongoing investment in research and development to anticipate and integrate such technological shifts.

Corbion faces significant competition in its core markets from established giants like BASF, Bayer, Tate & Lyle, and DuPont. This intense rivalry often translates into considerable pricing pressure, forcing Corbion to constantly innovate and optimize its offerings to defend its market position and sustain profitability, especially within the highly contested food ingredients sector.

Geographical Concentration of Revenue

Corbion's reliance on the U.S. market for a substantial portion of its revenue presents a key weakness. For instance, in 2023, North America was a significant contributor to Corbion's sales, though specific percentages vary by segment. This concentration means that economic slowdowns or shifts in consumer preferences within the U.S. could disproportionately impact the company's overall financial performance.

This geographical concentration exposes Corbion to heightened risks from regional economic downturns, adverse regulatory changes, or specific market disruptions. A more diversified revenue base across different continents would typically mitigate such localized impacts, offering greater stability.

Key considerations stemming from this weakness include:

- Vulnerability to U.S. Market Fluctuations: Economic recessions or changes in consumer spending habits in the U.S. can have a magnified effect on Corbion's top line.

- Regulatory Risk Concentration: New regulations or policy changes in the U.S. impacting food ingredients or biochemicals could pose a more significant threat than if the company had a more balanced global presence.

- Competitive Landscape Intensity: Intense competition within the U.S. market, if not matched by similar competitive pressures elsewhere, could strain market share and profitability.

Integration Challenges of Acquisitions and Divestments

Corbion's recent strategic shifts, such as divesting its Emulsifiers business in 2023 for €370 million, present integration challenges. These realignments, while aimed at future growth, can lead to temporary disruptions and one-off costs impacting short-term financial performance.

The process of integrating acquired entities or smoothly separating divested units requires significant management attention and resources. This can divert focus from core operational improvements and innovation, potentially slowing down overall business momentum.

- Integration Complexity: Merging different company cultures, IT systems, and operational processes after acquisitions is inherently complex and time-consuming.

- Divestment Execution: Ensuring a clean break and value realization during divestments, like the Emulsifiers sale, demands meticulous planning to avoid lingering liabilities or operational inefficiencies.

- Resource Allocation: Significant management bandwidth and financial resources are often tied up in these restructuring activities, potentially impacting investment in organic growth initiatives.

Corbion's dependence on agricultural commodities exposes it to price volatility, impacting profit margins. For instance, fluctuations in corn prices, a key ingredient, can squeeze profitability if costs aren't fully passed on, as seen with upward price pressures in early 2024. This reliance on raw material markets creates an inherent vulnerability to supply chain disruptions and commodity market swings.

The company's significant investment in and reliance on fermentation technology could become a weakness if more cost-effective alternatives emerge. Advances in synthetic biology or other bioprocessing methods might offer superior scalability or lower production costs, potentially challenging Corbion's market position if it fails to adapt quickly. Continuous R&D investment is crucial to stay ahead of these technological shifts.

Corbion faces intense competition from major players like BASF and DuPont, leading to pricing pressure in its core markets. This rivalry necessitates constant innovation and operational efficiency to maintain market share and profitability, particularly in the competitive food ingredients sector.

A substantial portion of Corbion's revenue is tied to the U.S. market, making it vulnerable to regional economic downturns, regulatory changes, or shifts in consumer preferences. This geographical concentration amplifies the impact of any adverse events in the U.S. on the company's overall financial performance.

What You See Is What You Get

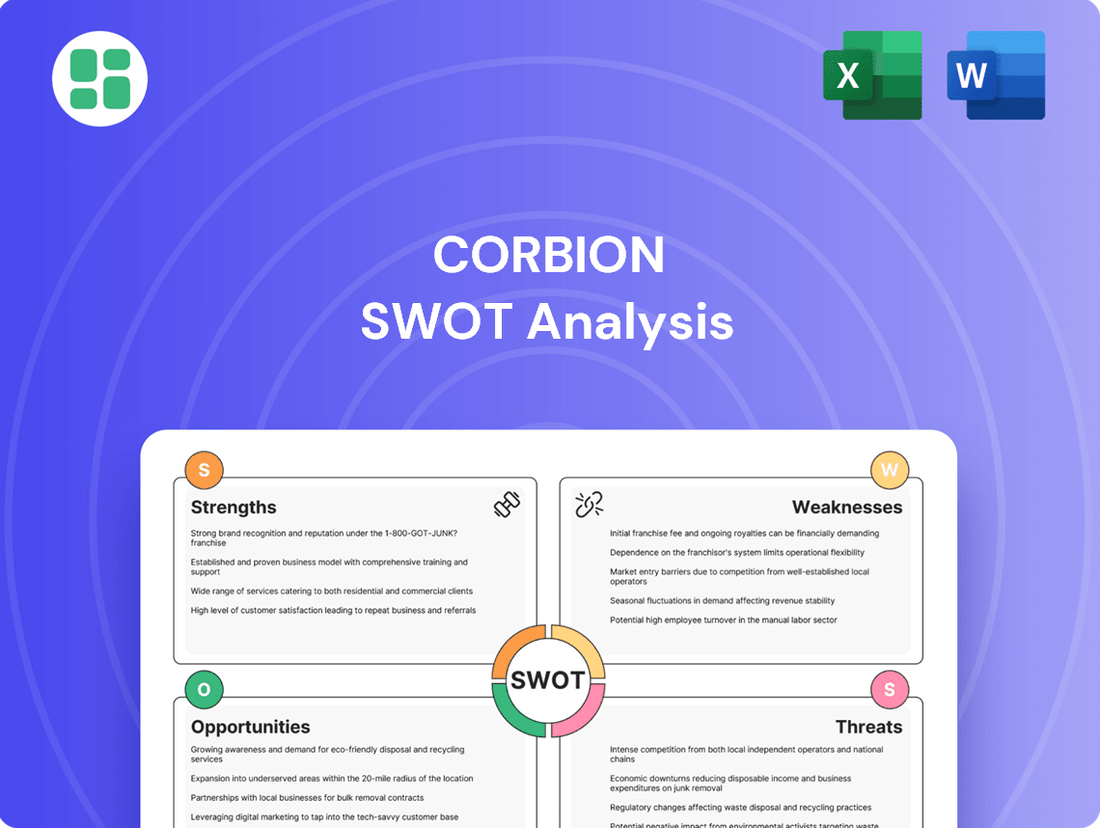

Corbion SWOT Analysis

This is the actual Corbion SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering detailed insights into Corbion's strategic positioning and competitive landscape.

Opportunities

The increasing consumer preference for natural and sustainably sourced ingredients is a major tailwind for Corbion. This trend is evident across food, personal care, and even industrial applications, with a clear move away from synthetic alternatives. For instance, the global market for natural food colors alone was valued at approximately $1.8 billion in 2023 and is projected to grow significantly, showcasing the scale of this opportunity.

Corbion's Health & Nutrition segment, encompassing algae-based omega-3s, pharmaceuticals, and biomedical polymers, represents a significant opportunity due to its high-growth and high-margin characteristics.

Continued strategic investments in these areas are poised to capitalize on increasing consumer demand for healthier and functional ingredients across both human and animal nutrition markets, promising substantial future revenue streams.

For instance, the global omega-3 market, a key component of this segment, was projected to reach over $40 billion by 2024, highlighting the immense potential for expansion.

Corbion's stake in TotalEnergies Corbion positions it advantageously within the burgeoning bioplastics sector, specifically in polylactic acid (PLA). The global PLA market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, driven by a strong push for sustainable alternatives.

This growth is fueled by escalating consumer and regulatory demand for eco-friendly packaging and materials, directly impacting traditional petroleum-based plastics. For instance, by 2028, the bioplastics market is expected to reach over $20 billion globally, a substantial portion of which will be PLA, highlighting a clear opportunity for Corbion.

Leveraging Restructuring for Enhanced Efficiency and Margins

Corbion's recent restructuring, designed to streamline operations and reduce costs, is a key opportunity for boosting financial performance. This initiative is projected to unlock substantial free cash flow and lead to better profit margins.

Successfully implementing these efficiency gains will provide the company with the financial flexibility to invest more in promising growth sectors, ultimately enhancing its overall profitability.

- Streamlined Business Units: Simplification of the organizational structure to improve focus and agility.

- Cost Savings Focus: Implementation of measures aimed at reducing operational expenses across the board.

- Free Cash Flow Generation: The restructuring is anticipated to significantly increase the company's free cash flow.

- Margin Improvement: Expected positive impact on profit margins due to increased efficiency and cost control.

Strategic Partnerships and Market Penetration

Corbion's strategy of forming strategic alliances is a key driver for expanding its market presence and product offerings. By teaming up with other companies, Corbion can unlock new geographical territories or enhance its portfolio with complementary technologies, fostering co-development of cutting-edge solutions.

A prime example of this opportunity is Corbion's determined push to increase its penetration with major aquafeed producers for its omega-3 oils. This targeted approach directly aims at capturing a larger share of a growing market, leveraging partnerships to solidify its position.

- Market Expansion: Alliances can provide access to new customer segments and regions, accelerating market penetration.

- Product Innovation: Collaborations facilitate the co-development of novel ingredients and solutions, enhancing Corbion's competitive edge.

- Omega-3 Oils Growth: Increased focus on aquafeed producers for omega-3s demonstrates a clear strategy for market share expansion in this segment.

- Synergistic Benefits: Partnerships can lead to shared resources, reduced R&D costs, and faster go-to-market strategies.

Corbion is well-positioned to capitalize on the growing demand for natural and sustainable ingredients, particularly in the food and health sectors. The company's expansion into algae-based omega-3s and bioplastics, such as PLA, presents significant growth avenues. Strategic alliances and operational efficiencies are further enhancing its market reach and profitability.

| Opportunity Area | Key Driver | Market Data Point (2024/2025 Estimates) |

|---|---|---|

| Natural & Sustainable Ingredients | Consumer preference shift | Global natural food colors market projected to exceed $2 billion by 2024. |

| Health & Nutrition (Omega-3s) | Demand for functional ingredients | Global omega-3 market estimated to surpass $40 billion by 2024. |

| Bioplastics (PLA) | Sustainability regulations & demand | Global PLA market expected to grow at over 10% CAGR, reaching over $20 billion by 2028. |

| Operational Efficiency | Restructuring for cost savings | Projected increase in free cash flow and improved profit margins. |

Threats

The bio-based and food ingredients industries face increasingly rigorous regulations concerning product safety, accurate labeling, environmental impact, and sustainability assertions. For instance, the Corporate Sustainability Reporting Directive (CSRD) in Europe, which came into full effect for many companies in 2024, mandates extensive new disclosures, significantly increasing compliance burdens and associated costs.

Meeting these evolving regulatory requirements, such as those related to food traceability and bio-ingredient sourcing, demands substantial investment in new technologies, data management systems, and specialized personnel. These escalating compliance costs can directly impact profitability and require careful allocation of financial resources, potentially diverting funds from research and development or market expansion initiatives.

Rapid advancements in biotechnology present a significant threat, as new ingredients or production methods could emerge that directly challenge Corbion's current offerings. For instance, breakthroughs in synthetic biology might yield bio-based alternatives that are cheaper or offer enhanced functionalities, potentially displacing Corbion's established bio-ingredients.

The market could see the rise of more cost-effective or functionally superior substitutes for Corbion's products. If Corbion is slow to innovate or adapt, its market share could be significantly impacted. Consider the food industry, where consumer demand for plant-based alternatives is growing; if new, highly appealing plant-based ingredients gain traction, they could directly compete with Corbion's lactic acid derivatives used in food preservation and flavor enhancement.

Global economic volatility, including inflation and interest rate shifts, poses a significant threat to Corbion. For instance, persistent inflation in 2024 has driven up input costs for many industries, and Corbion, reliant on agricultural commodities, is not immune. Geopolitical instability can further exacerbate these issues, leading to unpredictable market conditions and impacting Corbion's international operations and sales.

Disruptions in global supply chains, a recurring theme in recent years, directly affect Corbion's ability to source raw materials and distribute finished products efficiently. The ongoing tensions and trade policies in key regions can lead to increased logistics costs and potential shortages. This can translate into higher production expenses and, consequently, affect Corbion's profit margins and its capacity to meet customer demand reliably.

Brand Reputation and Product Safety Risks

Corbion's position as a key supplier to the food and health industries means that any lapse in product quality or safety could have severe repercussions. Such incidents, including potential recalls, pose a significant threat to its brand reputation. For instance, in 2023, the food ingredient sector experienced an increase in product recalls, with regulatory bodies like the FDA issuing numerous safety alerts, highlighting the constant vigilance required.

A damaged brand reputation can directly translate into lost customer trust and market share. This was evident in past incidents involving other food ingredient suppliers, where sales saw a noticeable decline following public safety concerns. Corbion's extensive global supply chain, while a strength, also presents a complex challenge in ensuring consistent product safety across all operations.

- Brand Reputation: Negative publicity from a product recall can erode consumer confidence built over years.

- Legal Liabilities: Recalls and safety issues can lead to substantial legal costs and settlements.

- Sales Impact: Consumers and B2B customers may switch to competitors perceived as safer, directly affecting revenue.

- Market Trust: Rebuilding trust after a safety scandal is a long and expensive process.

Cybersecurity Risks and Data Breaches

Corbion, as a global entity with a vast operational footprint and significant data assets, faces considerable cybersecurity risks. The potential for data breaches is a persistent threat, capable of exposing sensitive corporate and customer information. Such breaches can lead to severe operational disruptions, substantial financial penalties, and lasting damage to the company's reputation, impacting trust and market standing.

In 2023, the global average cost of a data breach reached an all-time high of $4.45 million, according to IBM's Cost of a Data Breach Report. For a company like Corbion, with its extensive supply chains and diverse customer base, the financial and operational ramifications of a successful cyberattack could be immense. This includes not only direct costs like incident response and recovery but also indirect costs such as lost business and increased insurance premiums.

- Cybersecurity Vulnerabilities: Corbion's global operations and extensive data collection make it a target for sophisticated cyber threats.

- Data Breach Impact: A breach could compromise sensitive customer and proprietary company data, leading to significant financial losses and reputational harm.

- Operational Disruption: Cyberattacks can halt production, disrupt logistics, and impair critical business functions, affecting revenue and customer service.

- Financial and Reputational Costs: Beyond direct recovery expenses, incidents can result in regulatory fines, legal liabilities, and a loss of customer trust, impacting long-term profitability.

Corbion faces intensified regulatory scrutiny, with new directives like Europe's CSRD (effective 2024) demanding extensive disclosures and increasing compliance costs. This can divert resources from innovation and market expansion, impacting profitability.

Emerging biotechnologies and cost-effective substitutes pose a threat, potentially displacing Corbion's established bio-ingredients if the company is slow to adapt. For example, advancements in synthetic biology could offer cheaper alternatives to Corbion's lactic acid derivatives used in food.

Global economic volatility, including inflation and geopolitical instability, directly impacts Corbion by increasing input costs for agricultural commodities. Supply chain disruptions further exacerbate these issues, leading to higher logistics expenses and potential shortages, affecting profit margins.

Product quality or safety lapses, including recalls, represent a significant threat to Corbion's brand reputation, as seen with increased recalls in the food ingredient sector in 2023. Rebuilding trust after such incidents is a lengthy and costly process, impacting sales and market share.

SWOT Analysis Data Sources

This Corbion SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and reliable assessment.