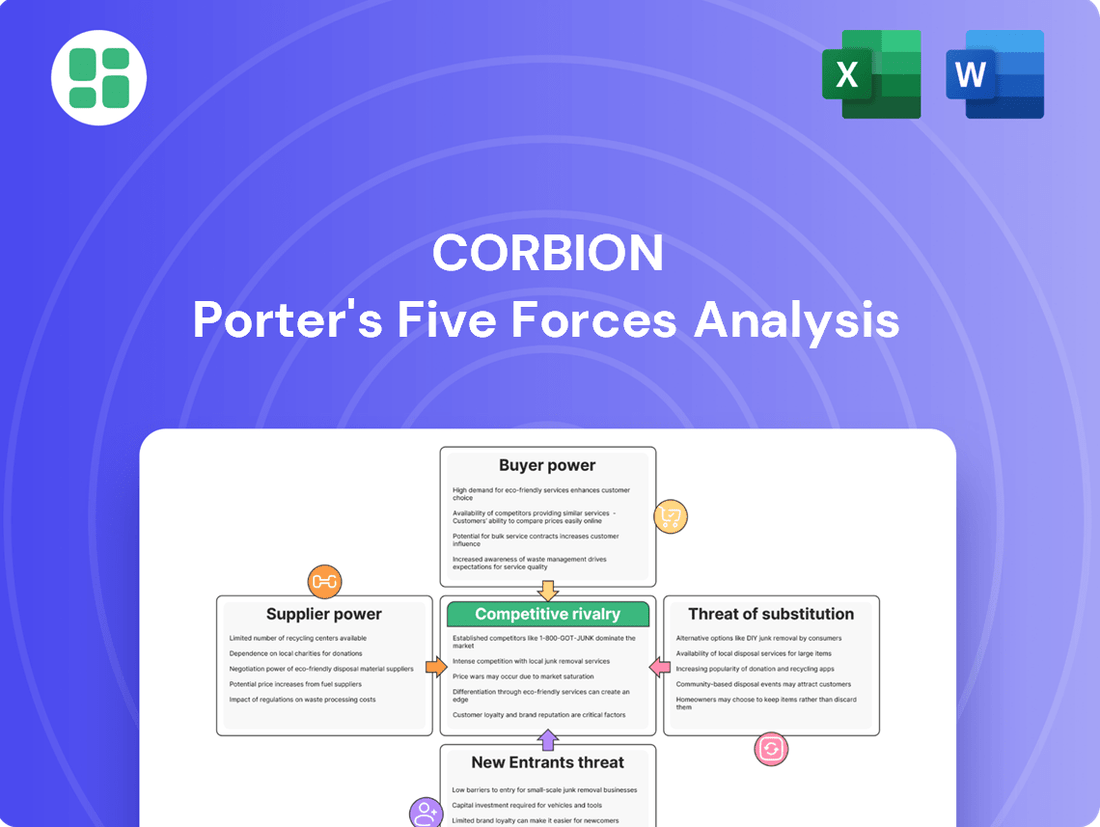

Corbion Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corbion Bundle

Corbion operates in a dynamic landscape shaped by intense rivalry and the ever-present threat of substitutes. Understanding these pressures is crucial for any strategic player in the biochemicals sector.

The full Porter's Five Forces Analysis delves into the intricate web of buyer power, supplier leverage, and the barriers new entrants face within Corbion's markets. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for Corbion's essential raw materials, like carbohydrates derived from cane sugar for fermentation, directly impacts their bargaining power. A limited number of major suppliers for these critical inputs can grant them significant leverage in dictating prices and contract terms.

Corbion's internal security-of-supply assessments, a crucial part of their risk management, specifically scrutinize procurement vulnerabilities. These evaluations include identifying and analyzing sourcing scenarios where materials are only available from a single supplier, highlighting the direct impact of supplier concentration on their operational stability and cost structure.

Corbion's focus on specialized bio-based ingredients, such as lactic acid and algae-based products, means its raw material needs are often unique. This specialization can limit the number of suppliers capable of meeting Corbion's specific quality and technical requirements, thereby enhancing the bargaining power of those select suppliers.

The costs and complexities Corbion faces when switching suppliers for crucial raw materials significantly influence supplier bargaining power. These switching costs can include the expense and time needed for technical adjustments, rigorous qualification processes for new materials, and the potential for production disruptions during the transition. For instance, if a new lactic acid supplier requires extensive re-validation of Corbion's fermentation processes, the associated costs and delays empower the existing supplier.

Corbion actively manages the risk of high switching costs for essential raw materials by implementing mitigation strategies, such as cultivating relationships with multiple alternative suppliers. This proactive approach demonstrates an understanding that diversifying its supplier base can reduce its reliance on any single supplier and, consequently, lessen their bargaining leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers engaging in forward integration, meaning they start producing Corbion's bio-based ingredients themselves, could significantly boost their leverage. This would directly challenge Corbion's market position.

However, the high barriers to entry in producing specialized bio-based ingredients like lactic acid, due to complex fermentation technology and substantial capital requirements, likely deter many raw material suppliers from pursuing this strategy. For instance, establishing a facility capable of producing high-purity lactic acid at scale requires millions in investment and specialized expertise, making it a daunting prospect for typical agricultural commodity suppliers.

- High Capital Investment: Setting up advanced fermentation facilities for bio-based ingredients can cost tens of millions of dollars.

- Technological Expertise: Mastering the precise fermentation processes and downstream purification needed for food-grade or pharmaceutical-grade ingredients requires specialized knowledge.

- Regulatory Hurdles: Meeting stringent quality and safety regulations for bio-based ingredients adds another layer of complexity and cost for potential integrators.

Importance of Corbion to Suppliers

Corbion's purchasing volume and its role as a significant customer can influence its suppliers' bargaining power. If Corbion accounts for a substantial share of a supplier's revenue, that supplier may have less leverage, as they depend on Corbion's continued patronage. For instance, in 2023, Corbion's procurement of key bio-based ingredients, like lactic acid and its derivatives, from specialized producers forms a crucial part of their supply chain.

Corbion actively pursues a multi-supplier strategy for its critical raw materials. This approach diversifies its supplier base, reducing reliance on any single provider and thereby mitigating individual supplier bargaining power. By cultivating relationships with multiple sources for essential inputs, Corbion can negotiate more favorable terms and ensure supply chain resilience.

The company's commitment to sourcing from a variety of suppliers for vital components is a strategic move. This policy helps to level the playing field, preventing any one supplier from dictating terms due to a lack of alternatives for Corbion. This is particularly relevant for specialized ingredients where the supplier pool might be more concentrated.

- Corbion's substantial procurement volume can reduce supplier leverage, especially if they are a major client.

- A multi-supplier sourcing policy for critical inputs mitigates the bargaining power of individual suppliers.

- This strategy enhances Corbion's ability to negotiate favorable terms and secure its supply chain.

Corbion's bargaining power with its suppliers is influenced by several factors. The concentration of suppliers for its essential raw materials, such as carbohydrates from cane sugar for fermentation, gives these suppliers significant leverage. Corbion's internal assessments highlight vulnerabilities in sourcing, especially when materials are available from only one supplier, directly impacting operational stability and costs.

The specialized nature of Corbion's bio-based ingredients, like lactic acid, limits the number of capable suppliers, thereby increasing the bargaining power of those who can meet specific quality and technical requirements. High switching costs for these crucial raw materials, encompassing technical adjustments, new material qualification, and potential production disruptions, further empower existing suppliers.

Corbion mitigates these risks by cultivating relationships with multiple alternative suppliers, diversifying its base to reduce reliance and lessen individual supplier leverage. The threat of forward integration by suppliers is low due to the high capital investment, technological expertise, and regulatory hurdles involved in producing specialized bio-based ingredients, with facility costs often reaching tens of millions of dollars.

Corbion's substantial purchasing volume can also reduce supplier leverage if it represents a significant portion of a supplier's revenue. For instance, in 2023, Corbion's procurement of key bio-based ingredients was vital for specialized producers, impacting their reliance on Corbion.

| Factor | Impact on Supplier Bargaining Power | Corbion's Mitigation Strategy |

| Supplier Concentration | High (for specialized ingredients) | Multi-supplier sourcing policy |

| Switching Costs | High (technical validation, process adjustments) | Developing relationships with alternative suppliers |

| Forward Integration Threat | Low (high capital, tech expertise, regulatory barriers) | N/A (inherent industry structure) |

| Corbion's Purchasing Volume | Can be High (reducing leverage if Corbion is a major client) | Strategic procurement management |

What is included in the product

This analysis dissects Corbion's competitive environment, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the lactic acid and bio-ingredients market.

Effortlessly identify and address competitive pressures with a dynamic framework that highlights key strategic vulnerabilities.

Customers Bargaining Power

Corbion's customer base spans a wide array of industries, from food and home care to animal nutrition and pharmaceuticals. The bargaining power of these customers is significantly influenced by their concentration and size within their respective markets. For instance, large, consolidated players in the food manufacturing sector, such as major global food producers, often possess substantial purchasing volumes. This scale allows them to negotiate more aggressively on price and terms, potentially impacting Corbion's profit margins.

In 2024, the food industry continues to see significant consolidation. For example, the top 10 global food and beverage companies by revenue, which are key customers for ingredients like Corbion's, generated hundreds of billions in sales. This concentration means a few large buyers can represent a substantial portion of Corbion's revenue, giving them considerable leverage. Conversely, smaller, more fragmented customer segments, like niche bioplastics manufacturers or smaller pharmaceutical research firms, typically have less bargaining power.

The cost and complexity for Corbion's customers to switch from its specialized bio-based ingredients to alternatives are significant. This includes the expense and time involved in reformulating products, obtaining new regulatory approvals, and re-validating performance. For instance, a food manufacturer switching Corbion's emulsifiers might face months of testing and approval processes, impacting production timelines and costs.

Corbion actively works to increase these switching costs by leveraging its deep application expertise. By providing tailored solutions and technical support that are intricately linked to a customer's specific product development and manufacturing processes, Corbion makes it more challenging and less attractive for clients to seek out and implement alternative ingredients.

The price sensitivity of Corbion's customers is a key factor in their bargaining power. This sensitivity is directly tied to how much Corbion's ingredients contribute to the customer's overall product cost. If Corbion's products represent a significant portion of a customer's expenses, customers will naturally be more inclined to negotiate prices.

Furthermore, the competitive landscape in which Corbion's customers operate plays a crucial role. For instance, in 2024, many food and beverage manufacturers, a significant customer base for Corbion, faced intense competition, leading them to seek cost reductions. This pressure often translates into demands for lower ingredient prices from suppliers like Corbion.

Availability of Substitute Products for Customers

The availability of substitute products significantly enhances customer bargaining power for companies like Corbion. When customers can easily switch to alternative ingredients, whether they are synthetic or derived from different natural sources, their ability to negotiate prices and terms increases. This is particularly true if these substitutes are readily accessible and economically viable.

For instance, in the food ingredients sector, the constant innovation in both synthetic and natural alternatives means that customers, such as food manufacturers, have a wide array of choices. If Corbion's bio-based ingredients face competition from more affordable or functionally equivalent synthetic options, or even from other natural ingredient suppliers, customers can exert greater pressure on Corbion to maintain competitive pricing and performance standards. This dynamic was evident in 2024, where fluctuating raw material costs for traditional ingredients sometimes made synthetic alternatives more appealing, giving buyers more leverage.

- Increased Choice Drives Leverage: The presence of numerous alternative ingredients, both synthetic and natural, empowers customers by providing them with viable options if Corbion's offerings become less attractive in terms of price or performance.

- Cost-Effectiveness of Substitutes: If substitute products are priced lower or offer comparable functionality at a reduced cost, customers gain significant bargaining power, potentially forcing price adjustments or product innovation from Corbion.

- Market Dynamics in 2024: The ingredient market in 2024 saw continued volatility in commodity prices, which often shifted the cost-benefit analysis for customers, making the availability of cost-effective substitutes a key factor in their purchasing decisions.

- Impact on Corbion's Pricing Power: The ease of substitution limits Corbion's ability to command premium prices for its specialized ingredients, as customers can readily explore alternative solutions to meet their needs.

Threat of Backward Integration by Customers

The threat of backward integration by Corbion's large customers poses a significant concern. If major clients, such as those in the food or biochemical industries, possess the capability or strong incentive to produce their own lactic acid, derivatives, or other bio-based ingredients, their bargaining power would undoubtedly increase. This could lead to demands for lower prices or more favorable contract terms from Corbion.

However, this threat is somewhat mitigated by substantial barriers to entry. The specialized fermentation technology and the considerable capital investment required to establish and operate a bio-based ingredient production facility are generally prohibitive for most customers. For instance, setting up a modern fermentation plant can cost tens of millions of dollars, a significant hurdle for companies not primarily focused on ingredient manufacturing.

- Customer Capability: Large food manufacturers or chemical companies might have existing infrastructure or R&D capabilities that could be repurposed or expanded for bio-ingredient production.

- Economic Incentive: If Corbion's pricing for key ingredients like lactic acid becomes excessively high, or if supply chain disruptions become frequent, customers might find a strong economic rationale to explore in-house production.

- Technological Barriers: Producing high-purity lactic acid or its derivatives requires specific expertise in fermentation, downstream processing, and quality control, which many customers may lack.

- Capital Investment: The substantial upfront cost for building and equipping a production facility acts as a major deterrent, often outweighing the potential benefits of backward integration for many of Corbion's customers.

Corbion's customers, particularly large players in consolidated industries like food manufacturing, wield significant bargaining power due to their substantial purchasing volumes. In 2024, the top global food and beverage companies, key Corbion clients, generated hundreds of billions in revenue, allowing them to negotiate aggressively on price and terms. This concentration means a few large buyers can represent a substantial portion of Corbion's revenue, amplifying their leverage.

The availability of numerous substitute ingredients, both synthetic and natural, further empowers customers. For instance, in 2024, fluctuating commodity prices made synthetic alternatives more appealing for some food manufacturers, enhancing buyer leverage. This ease of substitution limits Corbion's pricing power, as customers can readily explore alternatives if Corbion's offerings become less competitive on price or performance.

Switching costs for Corbion's customers are generally high due to the need for product reformulation and regulatory approvals, but this can be offset by competitive pricing from alternative suppliers. The threat of backward integration by large customers exists but is often deterred by the substantial capital investment and specialized technology required for bio-ingredient production, with new fermentation plants costing tens of millions of dollars.

| Factor | Impact on Corbion | Example/Data (2024) |

|---|---|---|

| Customer Concentration | High bargaining power for large buyers | Top 10 global food companies' revenue in hundreds of billions. |

| Availability of Substitutes | Limits pricing power, increases price sensitivity | Synthetic alternatives became more cost-effective due to commodity price volatility. |

| Switching Costs | Mitigates bargaining power, but can be overcome by price | Reformulation and regulatory approval can take months for food ingredients. |

| Threat of Backward Integration | Potential for reduced demand, but high barriers exist | Establishing a fermentation plant can cost tens of millions of dollars. |

Full Version Awaits

Corbion Porter's Five Forces Analysis

This preview showcases the complete Corbion Porter's Five Forces Analysis, identical to the document you will receive instantly after purchase. You can trust that the in-depth examination of industry competition, buyer and supplier power, threats of new entrants and substitutes is precisely what you'll download. This professionally formatted analysis is ready for immediate use, offering a comprehensive understanding of Corbion's strategic landscape without any hidden surprises.

Rivalry Among Competitors

Corbion navigates a crowded global bio-based ingredients market. This includes giants like BASF and DuPont, alongside niche players such as Tate & Lyle and Lallemand. The presence of numerous competitors, especially from China in areas like lactic acid, fuels intense rivalry.

The renewable chemicals market, a key area for companies like Corbion, is seeing significant expansion. In 2023, this global market was valued at an impressive USD 124.6 billion. Projections indicate continued strong performance, with an anticipated rise to USD 314.06 billion by 2032, highlighting a substantial compound annual growth rate.

This robust industry growth can often temper intense competitive rivalry. When the market is expanding rapidly, there's generally enough demand to satisfy multiple players, potentially reducing the pressure to aggressively undercut competitors on price or engage in costly market share battles.

Corbion actively differentiates its offerings by emphasizing natural, sustainable, and innovative solutions. This strategy is built on their deep expertise in fermentation technology and advanced blending, allowing them to create specialized ingredients for food preservation and functional applications, including novel algae-based products.

This strong product differentiation serves to lessen the intensity of direct price competition within the market. For instance, Corbion’s biobased lactic acid, a key differentiator, commands a premium due to its sustainable production and performance benefits, as evidenced by the growing demand for bio-based materials in various industries.

Switching Costs for Customers Among Competitors

High switching costs significantly dampen competitive rivalry in the ingredients sector. For instance, when food manufacturers consider changing suppliers, they face substantial hurdles. These can include the time and expense of reformulating products to ensure taste, texture, and shelf-life remain consistent, as well as the complex and lengthy process of obtaining regulatory re-approval for any new ingredients used.

Corbion actively leverages these high switching costs to its advantage. Their dedicated application support and technical expertise help customers integrate Corbion's specialized ingredients seamlessly into existing production lines. This deep integration, coupled with the proven performance of their solutions, makes it more challenging and costly for customers to switch to alternative suppliers, thereby reducing the intensity of direct competition.

- Reformulation Expenses: Companies can spend tens of thousands of dollars on R&D to ensure a new ingredient meets quality standards.

- Regulatory Hurdles: The time for regulatory approval can extend for months, impacting market entry timelines.

- Integration Costs: Modifying production equipment or processes to accommodate new ingredients can cost upwards of $50,000.

- Corbion's Support: Specialized technical teams reduce the perceived risk and cost of adopting their ingredients.

Exit Barriers

High exit barriers are a significant factor in the lactic acid market, and Corbion is a prime example of a company deeply entrenched due to these factors. The specialized nature of fermentation plants, coupled with substantial investments in research and development and manufacturing infrastructure, creates substantial sunk costs. These costs make it difficult for companies to simply walk away, even when market conditions are unfavorable, thereby intensifying competitive rivalry.

Corbion's strategic commitment to its global lactic acid footprint, including significant capital expenditures across its production facilities, exemplifies these high exit barriers. For instance, as of its 2023 annual report, Corbion continued to invest in expanding capacity and optimizing its production processes, reinforcing its long-term commitment and increasing the financial implications of any potential exit. This deep investment compels Corbion and its competitors to remain engaged, even through periods of lower profitability, to recoup these substantial sunk costs.

- Specialized Assets: Fermentation plants require highly specific technology and infrastructure, making them difficult to repurpose or sell.

- Sunk Costs: Significant R&D and manufacturing investments create a high financial hurdle for exiting the market.

- Corbion's Footprint: Corbion's extensive global network of lactic acid production facilities represents a substantial capital commitment.

- Intensified Rivalry: The inability to easily exit forces companies to compete aggressively, even in less profitable times.

Corbion faces a competitive landscape populated by both large chemical conglomerates and specialized bio-ingredient producers, particularly from Asia in segments like lactic acid. This broad competitor base, including players like BASF and DuPont, intensifies rivalry.

While the overall bio-based ingredients market is expanding, with a 2023 valuation of USD 124.6 billion projected to reach USD 314.06 billion by 2032, rapid growth can sometimes soften direct competition by increasing overall demand.

Corbion's strategy of differentiating through sustainable, natural, and innovative solutions, such as its algae-based ingredients and expertise in fermentation, helps mitigate direct price wars. This focus on specialized, high-performance products allows them to command premium pricing.

High switching costs for customers, stemming from reformulation expenses, regulatory re-approvals, and integration challenges, further reduce the intensity of direct rivalry, as changing suppliers becomes a costly and time-consuming endeavor.

| Competitor Type | Examples | Impact on Rivalry |

|---|---|---|

| Large Chemical Companies | BASF, DuPont | Intense, broad-spectrum competition |

| Niche Bio-ingredient Players | Tate & Lyle, Lallemand | Focused competition within specific segments |

| Asian Producers (e.g., Lactic Acid) | Numerous Chinese companies | Price-based competition, especially in commodities |

SSubstitutes Threaten

Many of Corbion's bio-based ingredients, like lactic acid and emulsifiers, face a direct threat from conventional, petroleum-based alternatives. These fossil-based counterparts offer customers a readily available substitute, especially when price and performance are key considerations.

For instance, while Corbion champions natural solutions, the cost-effectiveness and established performance profiles of synthetic emulsifiers or lactic acid derivatives can sway purchasing decisions. In 2024, the volatility in crude oil prices directly impacts the cost competitiveness of these petroleum-based substitutes, making them a persistent challenge for bio-based producers.

Customers' inclination to switch to substitute products hinges significantly on how they perceive the performance of these alternatives, considering factors like functionality, how long a product lasts, and its taste. The price-performance trade-off is a critical element here; if a substitute offers comparable or superior benefits at a lower cost, switching becomes more appealing.

Bio-based chemicals, like those produced by Corbion, often encounter hurdles in matching the cost-effectiveness of traditional, petroleum-based alternatives. For instance, while bio-based polymers might offer environmental advantages, their production costs can sometimes be higher, making conventional plastics a more attractive substitute from a purely price perspective for many consumers and businesses.

The increasing consumer and industry preference for clean-label, natural, and sustainable ingredients directly counters the threat of substitutes for Corbion. This trend aligns perfectly with Corbion's core competencies in bio-based ingredients, making them a preferred choice over synthetic or less sustainable alternatives.

Corbion's strategic focus on contributing to the UN Sustainable Development Goals (SDGs) and providing solutions that minimize environmental impact further strengthens its position. For instance, in 2023, Corbion reported progress in reducing its Scope 1 and 2 greenhouse gas emissions, demonstrating a tangible commitment to sustainability that resonates with buyers seeking eco-conscious suppliers.

Technological Advancements in Substitutes

Technological advancements are continuously introducing new functional substitutes for Corbion's core offerings. For instance, ongoing research into alternative natural sources and synthetic biology approaches could yield novel ingredients that perform similarly to Corbion's bio-based products, potentially at a lower cost or with enhanced properties. This dynamic evolution means that what is a viable substitute today might be superseded by a more advanced option tomorrow, directly impacting Corbion's market position.

The threat of substitutes is amplified by ongoing innovation in food processing and ingredient development. For example, advancements in fermentation technology, beyond those currently employed by Corbion, could lead to the creation of entirely new classes of functional ingredients derived from different biological pathways or raw materials. Companies investing heavily in R&D, such as those in the precision fermentation space, are actively exploring these frontiers. In 2024, global investment in food technology startups, a significant portion of which focuses on alternative ingredients and novel processing, continued to be robust, indicating a fertile ground for emerging substitutes.

- Emerging Bio-based Alternatives: Research into plant-based proteins and novel fermentation techniques for producing functional ingredients poses a direct threat to Corbion's lactic acid and derivative markets.

- Synthetic Biology Innovations: Advances in synthetic biology could enable the cost-effective production of molecules currently offered by Corbion, potentially bypassing traditional fermentation or extraction methods.

- Shifting Consumer Preferences: Growing consumer demand for clean-label and sustainably sourced ingredients can accelerate the adoption of new, innovative substitutes that align with these trends.

- Investment in Food Tech: Significant venture capital funding continues to flow into food technology companies developing next-generation ingredients, increasing the pace at which disruptive substitutes enter the market.

Regulatory Environment and Consumer Awareness

Government regulations can significantly influence the threat of substitutes for bio-based ingredients. For instance, policies that encourage or mandate the use of sustainable materials, such as those seen in the European Union's push for a circular economy, directly favor companies like Corbion. These regulations can make conventional, less sustainable alternatives less attractive or even unviable. Consumer awareness also plays a crucial role; as consumers increasingly demand eco-friendly and healthier options, the appeal of bio-based products grows, diminishing the competitive pressure from traditional substitutes. In 2024, consumer demand for sustainable products continued to rise, with reports indicating that over 60% of consumers are willing to pay a premium for environmentally friendly goods.

Conversely, a lack of clear and supportive regulatory frameworks for bio-based products can introduce uncertainty and hinder market adoption. Without consistent guidelines, businesses may hesitate to invest heavily in bio-based solutions due to potential compliance issues or a lack of market predictability. This can inadvertently strengthen the position of established, conventional substitutes. For example, the absence of standardized labeling for bio-based content can confuse consumers and make it harder for bio-based products to differentiate themselves effectively. The global bioeconomy market was valued at over $1.7 trillion in 2023 and is projected to grow substantially, but regulatory clarity remains a key factor for unlocking its full potential.

- Regulatory Support: Government incentives and mandates for bio-based products reduce the attractiveness of conventional substitutes.

- Consumer Demand: Growing consumer preference for sustainable and healthy ingredients directly challenges traditional alternatives.

- Regulatory Uncertainty: Ambiguous regulations for bio-based products can create market hesitation and favor established substitutes.

- Market Growth: The increasing value of the bioeconomy underscores the potential impact of regulatory environments on substitute threats.

The threat of substitutes for Corbion's bio-based ingredients remains significant, driven by both conventional petroleum-based alternatives and emerging bio-based innovations. While consumer demand for sustainable products favors Corbion, the price-performance ratio of substitutes, especially those derived from fossil fuels, continues to present a challenge. For instance, in 2024, fluctuations in oil prices directly influenced the cost-competitiveness of synthetic emulsifiers and lactic acid derivatives, making them attractive alternatives for price-sensitive customers.

Technological advancements are also a key driver, with synthetic biology and new fermentation techniques creating novel ingredients that could compete with Corbion's offerings. The robust investment in food technology startups in 2024 highlights the rapid pace of innovation in this area, increasing the likelihood of disruptive substitutes entering the market. For example, breakthroughs in precision fermentation could yield cost-effective alternatives to traditional bio-based production methods.

Government regulations and consumer preferences play a dual role. Supportive policies for bio-based products, like those in the EU's circular economy initiative, bolster Corbion's position by making conventional substitutes less appealing. Conversely, regulatory uncertainty can hinder market adoption of bio-based solutions, inadvertently benefiting established alternatives. Consumer awareness for eco-friendly options, with over 60% of consumers willing to pay a premium for sustainable goods in 2024, continues to be a strong counter-force to the threat of substitutes.

| Substitute Category | Key Drivers | Impact on Corbion | 2024 Relevance |

|---|---|---|---|

| Petroleum-based Alternatives | Price volatility of crude oil, established performance profiles | Direct price competition, particularly for lactic acid and emulsifiers | Oil price fluctuations directly impact cost competitiveness |

| Emerging Bio-based Innovations | Synthetic biology, novel fermentation, R&D investment | Potential for cost-effective, high-performance alternatives | Robust VC funding in food tech accelerates substitute development |

| Consumer & Regulatory Landscape | Demand for clean-label/sustainable, government policies | Favors Corbion when regulations are supportive; uncertainty benefits incumbents | Growing consumer willingness to pay for sustainable products (over 60% in 2024) |

Entrants Threaten

The bio-based ingredients sector, especially for products derived from fermentation like lactic acid, demands significant capital. Companies need to invest heavily in research and development, build large-scale manufacturing plants, and acquire specialized equipment. For instance, establishing a state-of-the-art fermentation facility can cost tens to hundreds of millions of dollars.

These substantial upfront costs create a formidable barrier for potential new competitors looking to enter the market. The sheer scale of investment required means only well-funded organizations can even consider entering, thereby limiting the threat of new entrants for established players like Corbion.

Established players in the biochemicals and food ingredients sectors, such as Corbion, benefit significantly from economies of scale. This means they can produce their goods at a lower cost per unit due to their large-scale operations in manufacturing, purchasing raw materials, and distributing finished products. For instance, Corbion's extensive global manufacturing footprint allows for optimized production runs and bulk purchasing discounts, driving down their overall cost structure.

New entrants face a substantial hurdle in matching these cost efficiencies. Without the established volume and infrastructure, newcomers would find it challenging to achieve comparable unit costs, making it difficult to compete on price against incumbents like Corbion. This cost disadvantage can deter potential new market participants, thereby reducing the threat of new entrants.

Corbion's deeply entrenched proprietary technology, particularly in fermentation, acts as a significant deterrent to new entrants. This isn't just theoretical; the company holds numerous patents and trade secrets covering its advanced processes and unique product formulations, such as specialized lactic acid derivatives and innovative algae-based ingredients. This accumulated knowledge and protected intellectual property create a formidable barrier, making it exceptionally difficult and costly for newcomers to replicate Corbion's established technological advantages and product quality.

Access to Distribution Channels

New companies entering markets where Corbion operates, such as food ingredients, biochemicals, and bioplastics, often struggle to build effective distribution networks. These established channels are crucial for reaching customers, and securing shelf space or reliable delivery routes can be a significant hurdle. For instance, in the competitive food ingredient sector, gaining access to major food manufacturers’ supply chains requires substantial effort and established trust.

Corbion benefits from its deeply entrenched relationships with a wide array of customers across its key industries. These long-standing partnerships, cultivated over years, provide a significant barrier to entry for newcomers. The company’s global presence further solidifies this advantage, enabling efficient and widespread product delivery.

- Distribution Network Challenges: Aspiring entrants must invest heavily in logistics and sales infrastructure to compete with established players like Corbion.

- Customer Relationships: Corbion’s existing ties with major clients in food, pharmaceuticals, and industrial applications offer a strong competitive moat.

- Global Reach: Corbion's established international operations and supply chains are difficult for new entrants to replicate quickly.

- Industry Specific Hurdles: Accessing specialized distribution for products like food additives or biopolymers often requires navigating complex regulatory and logistical landscapes.

Regulatory Hurdles and Certification

The bio-based and food ingredient sectors face significant barriers to entry due to rigorous regulatory approvals and quality certifications. New companies must invest heavily in time and resources to comply with these complex requirements, particularly for innovative bio-based products, which can deter potential entrants.

Navigating these regulatory landscapes is a substantial hurdle. For instance, gaining approval for new food ingredients can take years and involve extensive safety testing, adding significant upfront costs. In 2024, the United States Food and Drug Administration (FDA) continued to emphasize strict oversight of novel food ingredients, requiring comprehensive data packages for safety assessments.

- Stringent Regulatory Approvals: Bio-based and food ingredient industries require extensive compliance with bodies like the FDA and EFSA.

- High Certification Costs: Obtaining certifications such as ISO, HACCP, and organic standards incurs significant financial investment and time.

- Complex Compliance Landscape: New entrants must understand and adhere to diverse international and national regulations, increasing operational complexity and cost.

- Time-Consuming Processes: The approval process for novel ingredients or bio-based products can span several years, delaying market entry and return on investment.

The threat of new entrants for Corbion is generally low due to significant capital requirements for research, development, and large-scale manufacturing facilities, often costing tens to hundreds of millions of dollars. Established players like Corbion benefit from economies of scale, making it difficult for newcomers to match their cost efficiencies. Furthermore, proprietary technology, extensive customer relationships, and navigating complex regulatory landscapes all act as substantial barriers, deterring potential competitors.

| Barrier Type | Description | Impact on New Entrants | Example for Corbion |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D and manufacturing. | Deters smaller, less-funded entities. | Establishing fermentation plants can cost $10M-$100M+. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Makes it hard to compete on price. | Corbion's global manufacturing footprint optimizes production. |

| Proprietary Technology | Patented processes and trade secrets. | Difficult and costly to replicate. | Corbion's advanced fermentation techniques for lactic acid. |

| Customer Relationships | Long-standing ties with major clients. | New entrants struggle to gain market access. | Corbion's partnerships in the food and bioplastics sectors. |

| Regulatory Hurdles | Strict approvals and certifications required. | Time-consuming and expensive compliance. | FDA approval for new food ingredients can take years. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Corbion leverages data from financial reports, industry-specific trade publications, and market research databases to provide a comprehensive view of competitive dynamics.