PC Connection Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PC Connection Bundle

PC Connection faces moderate bargaining power from its buyers, largely due to the availability of alternative IT solutions and the price sensitivity of many customers. The threat of new entrants is also a significant factor, as the IT distribution market has relatively low barriers to entry, allowing new competitors to emerge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore PC Connection’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

PC Connection's reliance on a concentrated group of major IT vendors like Microsoft, Dell, HP, and Cisco means these suppliers hold considerable sway. Their strong brand recognition and proprietary technologies give them an advantage, potentially limiting PC Connection's negotiating power on product pricing and terms.

The uniqueness of products offered by PC Connection's suppliers, especially in specialized software or advanced hardware, significantly bolsters supplier bargaining power. Many of these offerings possess distinct features or are integrated into proprietary ecosystems, making it difficult for PC Connection to find readily available substitutes. For instance, in 2024, the market for advanced AI-driven analytics software saw a concentration of a few key providers whose platforms offered unique integration capabilities, limiting PC Connection's flexibility.

While the IT component market generally has numerous suppliers, PC Connection faces limitations when it comes to certain proprietary technologies and essential industry-standard software suites. This lack of easy substitutability means switching suppliers for these critical items can be complex and costly, directly impacting PC Connection's operational efficiency and potentially increasing procurement expenses.

Switching costs for PC Connection can be moderate to high. These costs extend beyond mere financial outlays to include the effort of re-establishing relationships with new vendors, obtaining necessary certifications, and potentially reconfiguring internal systems or sales processes. For instance, a significant supplier might require substantial lead time for new product integration or specialized training for PC Connection's staff, making a switch a complex undertaking.

These switching costs directly impact PC Connection's flexibility. When it's difficult or expensive to change suppliers, PC Connection has less leverage. This inability to easily pivot to alternative sources strengthens the bargaining position of existing suppliers, allowing them to potentially dictate terms or prices more effectively. In 2024, the IT hardware market saw continued supply chain consolidation, meaning fewer alternative suppliers for certain specialized components, further increasing switching costs for businesses like PC Connection.

Threat of Forward Integration by Suppliers

Major IT manufacturers and software vendors, such as Microsoft and Dell, can directly compete with resellers like PC Connection. In 2024, many of these large tech companies continued to expand their direct sales models, aiming to capture more of the end-customer market and potentially bypass intermediaries. This direct engagement allows them to control pricing and customer relationships more effectively.

The threat of forward integration by suppliers means that PC Connection’s own suppliers could decide to sell directly to end-users or offer their own support and service packages. This could erode PC Connection's role as a value-added reseller. For instance, a major hardware manufacturer might enhance its online direct sales platform and offer installation services, directly competing with the solutions PC Connection provides.

- Direct Sales Expansion: Major IT suppliers are increasingly strengthening their direct-to-customer sales channels, offering competitive pricing and bundled services.

- Service Offering Overlap: Suppliers may launch their own managed IT services or support packages, directly encroaching on the value-added services provided by resellers.

- Margin Pressure: Increased direct competition from suppliers can put downward pressure on the profit margins for value-added resellers like PC Connection.

Importance of PC Connection to Suppliers

PC Connection's considerable annual revenue, around $2.8 billion, and its status as a Fortune 1000 entity with a worldwide sourcing network, grant it some influence as a major client for its suppliers. This scale allows Connection to negotiate terms, especially when purchasing in large volumes, which is crucial for supplier sales targets.

However, the bargaining power of suppliers is also shaped by their own market position. For suppliers who are market leaders or have highly differentiated products, PC Connection might represent just one of several significant distribution channels. In such cases, the supplier's own market dominance can counterbalance Connection's purchasing volume, limiting its ability to dictate terms.

- Revenue Scale: PC Connection's approximately $2.8 billion in annual revenue positions it as a significant buyer.

- Global Network: Its international procurement capabilities enhance its leverage with suppliers.

- Supplier Dependence: The extent to which suppliers rely on Connection for sales volume directly impacts its negotiation strength.

- Market Dominance of Suppliers: If suppliers are dominant players, their own market power can reduce Connection's influence.

PC Connection's significant purchasing volume, evidenced by its approximately $2.8 billion in annual revenue, grants it leverage with suppliers, particularly for high-volume orders. This scale makes Connection a key client for many IT vendors, enabling negotiations on pricing and terms. However, this power is tempered by the market dominance of certain suppliers, whose own strong positions can limit Connection's ability to dictate terms, even with substantial order sizes. For instance, in 2024, the demand for specialized AI chips remained exceptionally high, giving chip manufacturers considerable pricing power despite large orders from resellers.

| Factor | Impact on PC Connection | Supporting Data/Context (2024) |

|---|---|---|

| Purchasing Volume | Increases bargaining power | Approx. $2.8 billion annual revenue |

| Supplier Market Dominance | Decreases bargaining power | Continued consolidation in key IT hardware sectors |

| Supplier Dependence | Increases bargaining power | Varies by supplier; critical for niche product vendors |

| Switching Costs | Decreases bargaining power | Moderate to high for proprietary software and integrated systems |

What is included in the product

This analysis unpacks the competitive landscape for PC Connection, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of each force, empowering proactive strategy development.

Customers Bargaining Power

PC Connection serves a broad range of customers, from large corporations and government agencies to smaller businesses and educational institutions. This diversity means price sensitivity isn't uniform across the board. For instance, a large enterprise might focus more on integrated solutions and reliable support, making price a secondary concern.

However, smaller businesses or those simply buying commodity hardware are likely to be much more focused on getting the best price. This segment’s willingness to shop around and compare prices directly amplifies their bargaining power with PC Connection. In 2023, the IT hardware market saw intense competition, with many vendors offering aggressive pricing, which likely put further pressure on PC Connection to remain competitive, especially for price-sensitive customer segments.

Customers of PC Connection face a highly competitive market with many alternative providers, significantly boosting their bargaining power. Competitors such as CDW, Insight, and SHI International offer similar IT solutions, giving customers ample choice. Furthermore, the ability to purchase directly from manufacturers or leverage in-house IT capabilities for certain tasks provides additional leverage.

For straightforward hardware and software purchases, customers face minimal barriers when switching IT providers. This ease of transition means they can readily move to a competitor if pricing or service isn't satisfactory, thereby increasing their bargaining power.

However, the landscape shifts significantly when dealing with intricate, integrated IT solutions, managed services, or substantial project deployments. In these scenarios, switching costs escalate due to factors like specialized training, the deep integration of existing systems, and the potential for operational disruption during a transition. For instance, a company heavily reliant on a specific vendor's cloud infrastructure or managed security services might incur substantial costs and face significant operational hurdles if they were to switch. This complexity effectively curtails customer power in these more advanced service areas.

Customer Size and Concentration

PC Connection caters to a wide customer base, but significant bargaining power resides with its large enterprise, government, and educational clients. These entities often represent substantial purchasing volumes, allowing them to negotiate more aggressively on price and terms.

The sophisticated procurement processes employed by these concentrated buyers further amplify their leverage. They are adept at soliciting competitive bids and demanding customized solutions, which can pressure PC Connection's margins.

- Large clients can command significant discounts due to bulk purchasing.

- Sophisticated procurement processes empower buyers to negotiate favorable terms.

- Customized solutions are often demanded by large, concentrated customers.

Customer Information Asymmetry

Customer information asymmetry is a key factor influencing bargaining power. In the IT sector, especially with large corporate and government clients, buyers often have a deep understanding of product features, current market pricing, and what competitors are offering. This readily available information significantly levels the playing field.

This transparency directly impacts PC Connection's ability to command premium prices. When customers are well-informed, they are better equipped to push for better deals, making it harder for PC Connection to maintain high margins. For instance, in 2024, the widespread availability of online price comparison tools and detailed product reviews empowered buyers across the IT hardware and software landscape, intensifying this dynamic.

- Informed Buyers: Corporate and government entities frequently conduct extensive research, understanding technical specifications and competitive pricing.

- Reduced Information Gap: The internet and industry publications provide ample data, minimizing the knowledge advantage PC Connection might otherwise hold.

- Negotiating Leverage: Armed with market intelligence, customers can effectively negotiate pricing and terms, directly impacting PC Connection's profitability.

PC Connection's customers, particularly large enterprises and government bodies, wield considerable bargaining power. Their ability to purchase in bulk allows them to negotiate significant discounts, as evidenced by the competitive IT procurement landscape in 2024 where large deals often secured substantial price reductions. Furthermore, these sophisticated buyers leverage detailed market intelligence and comparison shopping, readily available through online platforms, to ensure they secure the most favorable terms, directly impacting PC Connection's pricing strategies.

| Customer Segment | Bargaining Power Drivers | Impact on PC Connection |

|---|---|---|

| Large Enterprises/Government | High volume purchases, sophisticated procurement, information asymmetry reduction (2024 data highlights increased price transparency) | Pressure on margins, demand for customized solutions and discounts |

| Small to Medium Businesses (SMBs) | Price sensitivity, ease of switching providers for commodity IT | Need for competitive pricing, potential for customer churn if not met |

| Educational Institutions | Budget constraints, volume purchasing potential | Negotiations for educational discounts, focus on value and support |

Preview Before You Purchase

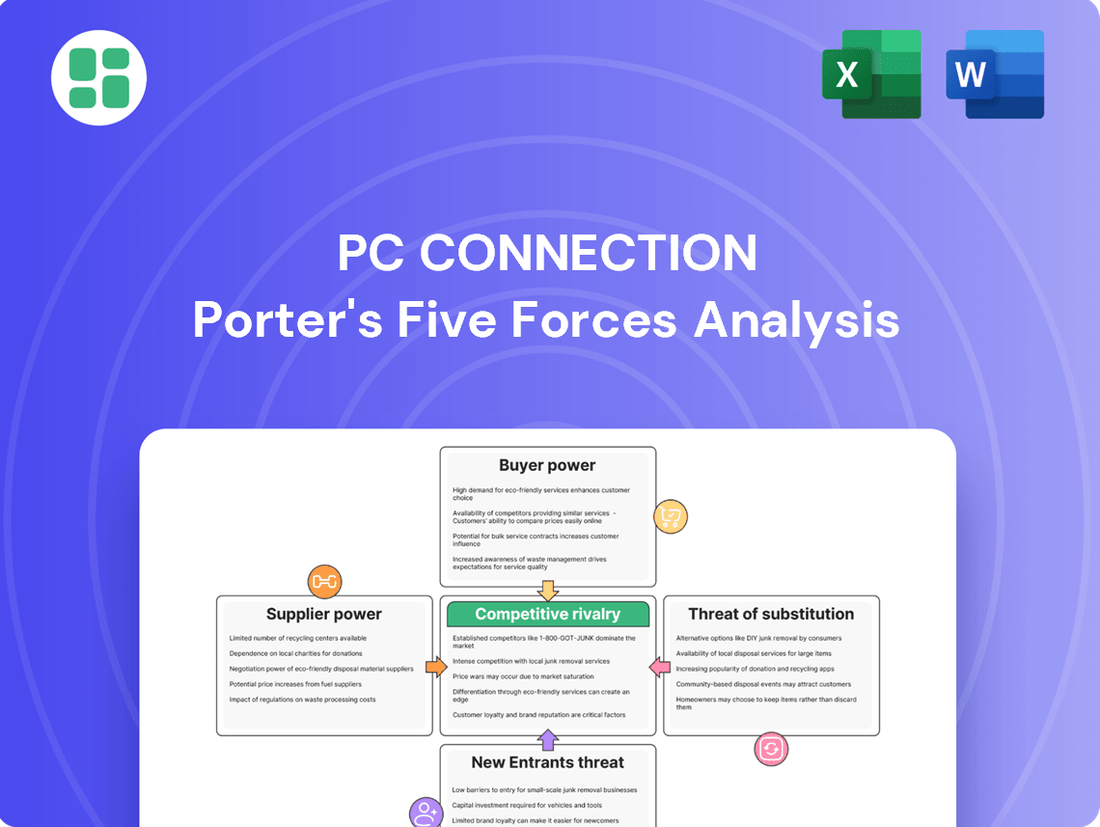

PC Connection Porter's Five Forces Analysis

This preview showcases the complete PC Connection Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the IT solutions sector. The document you see here is precisely what you will receive, fully formatted and ready for immediate use upon purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

PC Connection operates in a highly competitive IT solutions and services market. The landscape is populated by a vast array of competitors, from major national resellers such as CDW, Insight Enterprises, and SHI, to niche IT consulting outfits and even direct sales arms of technology manufacturers.

This extensive and varied competitive environment fuels intense rivalry as businesses constantly battle to capture and expand their market share. For instance, in 2023, the IT services market size was estimated to be around $1.3 trillion globally, indicating the sheer scale of competition PC Connection faces.

The global IT services market is anticipated to expand at a compound annual growth rate (CAGR) of 7.2% between 2025 and 2032. This robust growth signals a burgeoning market, which, while often tempering rivalry, does not eliminate it in the IT sector.

The dynamic nature of the IT market, fueled by rapid digital transformation and the increasing adoption of artificial intelligence, continues to foster intense competition. Companies are aggressively vying to secure their share of emerging opportunities within this expanding landscape.

Product and service differentiation in the IT reseller and solution provider space is a constant challenge. Many companies offer similar hardware, software, and basic support. PC Connection strives to stand out by offering a more complete package, which includes not just products but also help with designing solutions, putting them into practice, and ongoing managed services. This integrated approach aims to provide greater value beyond just transactional sales.

Despite PC Connection's efforts to differentiate through its broad portfolio and value-added services like solution design and managed IT, the inherent nature of the industry means competitors can often replicate offerings relatively easily. This ease of replication fuels intense rivalry, compelling companies like PC Connection to continuously innovate and refine their service delivery to maintain a competitive edge. For instance, in 2024, the IT services market saw significant growth, with many smaller players emerging to offer specialized cloud migration or cybersecurity services, directly challenging established providers.

Exit Barriers

Exit barriers for PC Connection, operating in the IT solutions and services sector, are generally considered moderate. These can include specialized IT assets that are difficult to repurpose, deeply ingrained customer relationships built over years of service, and the significant costs associated with ceasing operations, such as severance packages and contract terminations.

These moderate exit barriers can have a notable impact on competitive intensity. Firms that are struggling or are less profitable might find it economically challenging to leave the market, leading them to persist. This can result in a larger pool of active competitors, potentially intensifying price wars and reducing overall profitability for all players in the industry.

For instance, in the broader IT services market, companies often invest heavily in proprietary software platforms and specialized training for their workforce. The inability to easily divest these assets or redeploy personnel can act as a significant disincentive to exit. In 2023, the global IT services market was valued at over $1.3 trillion, demonstrating the scale of investment that can become trapped by exit barriers.

- Specialized Assets: Difficulty in selling or repurposing IT infrastructure and proprietary software.

- Customer Relationships: Long-term contracts and established trust make it hard for clients to switch.

- Operational Wind-Down Costs: Expenses related to employee severance, lease terminations, and data migration.

- Market Persistence: Moderate barriers can keep less profitable firms in the market, increasing competition.

Strategic Stakes and Aggressiveness of Competitors

The IT solutions market is intensely competitive, with players like CDW and Insight frequently engaging in aggressive strategies. These competitors are known for significant investments in emerging technologies, such as artificial intelligence, and actively expand their service portfolios. Their pursuit of mergers and acquisitions further intensifies the rivalry, creating a dynamic environment where market share and customer loyalty are constantly contested.

This high level of strategic engagement means that companies like PC Connection must constantly innovate and adapt to stay ahead. For instance, in 2023, CDW reported net sales of $23.5 billion, demonstrating its substantial market presence and capacity for aggressive investment. Such figures highlight the scale of resources competitors deploy, necessitating robust strategies for PC Connection to maintain its competitive edge and secure its position in the market.

- Aggressive Investment in AI: Competitors are channeling substantial capital into AI development and integration, aiming to offer advanced solutions.

- Service Portfolio Expansion: Rivals are broadening their service offerings, moving beyond product sales to provide comprehensive IT solutions and support.

- Mergers and Acquisitions: The IT solutions sector has seen significant M&A activity, consolidating market power and increasing competitive pressure.

- Market Leadership Pursuit: The strategic stakes are high, driving competitors to aggressively pursue market leadership and customer retention through various means.

Competitive rivalry within the IT solutions sector is fierce, driven by a crowded marketplace and aggressive strategies from major players. Companies like CDW and Insight Enterprises are notable for their substantial investments in emerging technologies, particularly AI, and their continuous expansion of service portfolios. This intense competition is further amplified by ongoing mergers and acquisitions, which consolidate market power and heighten the pressure on all participants.

PC Connection faces a landscape where differentiation is challenging due to the similarity of many core IT offerings. Competitors are actively pursuing market leadership through significant investments, as evidenced by CDW's reported net sales of $23.5 billion in 2023. This high level of strategic engagement necessitates constant innovation and adaptation from PC Connection to maintain its competitive standing.

| Competitor | 2023 Net Sales (USD Billions) | Key Competitive Strategy |

|---|---|---|

| CDW | 23.5 | Aggressive investment in AI, service expansion, M&A |

| Insight Enterprises | 10.1 | Focus on digital transformation solutions, cloud services |

| SHI International Corp. | 14.0 | Broad product portfolio, global reach, cybersecurity focus |

SSubstitutes Threaten

The rise of cloud computing, including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), presents a substantial substitution threat to PC Connection's traditional business model. Companies can now directly access computing resources and software from major providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, bypassing the need for resellers.

This shift allows businesses to scale their IT infrastructure and software needs on demand, offering greater flexibility and potentially lower upfront costs compared to purchasing hardware and perpetual software licenses through intermediaries. For instance, the global cloud computing market was projected to reach over $1.3 trillion by the end of 2024, highlighting the massive scale of this migration away from traditional IT procurement channels.

Large enterprises and government bodies increasingly invest in building robust in-house IT departments. This trend directly reduces their need for external IT solution providers for everything from system design to ongoing managed services, directly impacting demand for third-party IT offerings.

For instance, in 2024, many large corporations reported significant increases in their IT budgets, with a portion allocated to expanding internal teams and capabilities rather than outsourcing. This internal substitution directly challenges PC Connection's market share by offering a self-sufficient alternative.

The rise of high-quality open-source software presents a significant threat of substitutes for PC Connection's proprietary software offerings. This trend allows businesses and individuals to access functional alternatives for many common IT needs, bypassing traditional licensing and procurement routes. For instance, the global open-source software market was valued at approximately $23.2 billion in 2023 and is projected to grow substantially, indicating a growing preference for these cost-effective solutions.

Direct Procurement from Manufacturers

Customers increasingly have the option to purchase IT hardware and software directly from manufacturers, bypassing traditional resellers like PC Connection. This is particularly true for standardized products or when making large volume purchases, effectively serving as a substitute for the distribution and support services offered by PC Connection.

This direct procurement trend can exert downward pressure on PC Connection's pricing and margins. For instance, in 2024, many major IT manufacturers continued to strengthen their direct-to-customer sales channels, offering competitive pricing that challenges reseller models. This allows businesses with sufficient volume and technical expertise to potentially achieve cost savings by cutting out the intermediary.

- Direct Sales Growth: Major IT manufacturers have reported significant growth in their direct sales channels, indicating a shift in customer purchasing behavior.

- Volume Discounts: Manufacturers often provide substantial volume discounts when purchasing directly, a key incentive for larger organizations.

- Standardized Products: The availability of widely standardized IT components and software makes direct procurement a more viable and less risky option for many buyers.

Shifting IT Consumption Models

The IT industry is seeing a significant move away from customers buying hardware outright, which was PC Connection's core business, towards paying for IT services on a subscription basis. This shift to an operational expenditure (OpEx) model, often referred to as 'as-a-service,' means businesses can access technology without large upfront capital outlays. For example, cloud computing services like Microsoft Azure and Amazon Web Services have seen substantial growth, with the global cloud computing market projected to reach over $1.3 trillion by 2025, demonstrating the scale of this substitution.

This fundamental change in IT consumption directly substitutes PC Connection's traditional product resale model. Instead of purchasing PCs or servers, companies are increasingly opting for cloud-based solutions and managed IT services. This trend is driven by the flexibility, scalability, and often lower total cost of ownership that 'as-a-service' models provide. For instance, many small to medium-sized businesses (SMBs) are finding it more cost-effective to use Microsoft 365 subscriptions for their productivity needs rather than buying individual software licenses and managing on-premises servers.

Consequently, PC Connection faces a growing threat from these alternative IT consumption models. Companies are re-evaluating their IT spending, prioritizing ongoing service agreements over one-time hardware purchases. This necessitates that PC Connection adapt its strategy to include a stronger service component to remain competitive.

- Shift to OpEx: Businesses prefer subscription-based IT services over capital expenditure on hardware.

- 'As-a-Service' Dominance: Cloud computing and managed services are increasingly favored alternatives.

- Market Growth: The global cloud computing market is expected to exceed $1.3 trillion by 2025, highlighting the scale of the shift.

- Competitive Pressure: PC Connection's traditional product resale model is directly challenged by these evolving consumption patterns.

The increasing availability of direct-to-customer sales channels from major IT manufacturers represents a significant substitute for PC Connection's reseller model. Companies with sufficient purchasing power can bypass intermediaries like PC Connection, often securing better pricing and direct support. This trend is amplified by the standardization of many IT products, making direct procurement less complex.

For example, in 2024, many leading hardware and software vendors continued to invest heavily in their direct sales infrastructure, reporting substantial growth in this segment. This allows them to capture a larger share of the market by offering competitive pricing and streamlined purchasing experiences, directly impacting the volume and margins available to resellers.

The growing adoption of cloud-based services and subscription models also acts as a potent substitute. Instead of purchasing hardware and software licenses, businesses are increasingly opting for 'as-a-service' solutions. This shift, driven by flexibility and scalability, reduces the need for traditional IT procurement channels.

The global cloud computing market is a prime example, projected to exceed $1.3 trillion by 2025. This massive market expansion signifies a fundamental change in how businesses acquire and manage IT resources, substituting the need for physical products and the services of resellers like PC Connection.

| Substitution Threat | Description | Impact on PC Connection | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Direct Manufacturer Sales | Customers buying directly from hardware/software vendors. | Reduced sales volume and margin compression. | Major vendors report significant growth in direct channels. |

| Cloud Computing ('As-a-Service') | Subscription-based IT services replacing hardware/software purchases. | Decreased demand for traditional product resale. | Global cloud market projected to exceed $1.3 trillion by 2025. |

| Open-Source Software | Free, functional software alternatives to proprietary solutions. | Lower demand for licensed software sales. | Open-source market valued around $23.2 billion in 2023, with strong growth. |

Entrants Threaten

Entering the full-service IT solutions and services market, like the one PC Connection operates in, demands significant upfront capital. This includes substantial investments in inventory, sophisticated infrastructure such as warehouses and data centers, and building a large team of skilled IT professionals. For instance, a new competitor might need to spend tens of millions of dollars just to establish a basic operational footprint.

These high capital requirements act as a substantial barrier, effectively deterring many potential new entrants from challenging established companies like PC Connection. The sheer financial commitment needed to even begin competing means only well-funded entities can realistically consider entering this space, thereby protecting existing market players.

PC Connection, a seasoned player since 1982, has cultivated a robust brand reputation and deep customer trust across its business, government, and education clientele. New entrants would struggle to replicate this established credibility and the loyalty it commands, which is a significant barrier.

Established IT solution providers like PC Connection cultivate deep, long-standing relationships and hold critical certifications with major hardware and software vendors. For instance, as of early 2024, PC Connection's partnerships with giants like Microsoft and Lenovo provide them with preferential pricing and access to an extensive product catalog. Newcomers would find it incredibly difficult to replicate these ingrained alliances and secure comparable access to essential product lines, creating a significant barrier.

Economies of Scale and Scope

PC Connection leverages significant economies of scale in purchasing, a key deterrent for new entrants. Its substantial order volumes in 2024 allowed for negotiation of more favorable terms with suppliers compared to smaller, emerging competitors. This purchasing power directly translates into competitive pricing, a critical factor in the IT solutions market.

Furthermore, PC Connection's broad scope of offerings, encompassing everything from basic hardware procurement to sophisticated managed IT services and cloud solutions, creates a formidable barrier. Replicating this comprehensive service portfolio would demand a substantial initial investment and operational complexity that new, focused entrants would struggle to overcome quickly.

- Economies of Scale: PC Connection's large purchasing volume in 2024 provides a significant cost advantage over smaller competitors.

- Economies of Scope: The company's wide range of integrated IT services, from hardware to cloud solutions, presents a complex and costly challenge for new entrants to match.

- Capital Investment: New entrants would require considerable capital to establish similar purchasing power and a broad service infrastructure.

Intellectual Property and Technical Expertise

The threat of new entrants in the IT solution provider space is significantly tempered by the substantial intellectual property and technical expertise required. While manufacturers hold patents on IT products, companies like PC Connection build their own valuable assets. These include proprietary service methodologies, unique software tools such as Connection's MarkITplace®, and a deep well of accumulated technical know-how. This specialized knowledge acts as a formidable barrier, making it difficult for newcomers to replicate the established provider's capabilities and service quality.

New entrants face a steep learning curve and significant investment to develop comparable expertise. For instance, building a platform like MarkITplace® would require substantial upfront development costs and ongoing maintenance. Furthermore, the IT services sector often relies on certifications and proven track records, which are difficult for new firms to establish quickly. This intellectual capital, developed over years of operation and customer engagement, creates a durable competitive advantage.

- Proprietary Tools: Connection's MarkITplace® exemplifies the type of unique software solutions that differentiate IT providers.

- Specialized Services: The development of unique service delivery models and methodologies requires significant R&D and operational experience.

- Accumulated Expertise: Years of experience in diagnosing, implementing, and supporting complex IT solutions build invaluable technical knowledge.

- Talent Acquisition: Attracting and retaining highly skilled IT professionals with specific expertise is a major hurdle for new entrants.

The threat of new entrants for PC Connection is considerably low due to the substantial capital investment required to establish a comparable operational scale and vendor relationships. New competitors would need to invest heavily in inventory, infrastructure, and skilled personnel, a barrier that well-established players like PC Connection have already overcome through years of operation and strategic growth.

Furthermore, the IT solutions market demands significant intellectual property and specialized expertise, including proprietary tools and deep vendor partnerships, which are difficult and costly for newcomers to replicate. PC Connection’s established brand reputation and customer loyalty, built over decades, also present a formidable challenge for any emerging competitor seeking to gain market traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront costs for inventory, infrastructure, and talent. | Significant deterrent; requires substantial funding. |

| Brand Reputation & Customer Loyalty | Decades of trust and established relationships. | Difficult to replicate, leading to slower customer acquisition. |

| Vendor Relationships & Certifications | Preferential pricing and access through partnerships. | New entrants struggle to secure comparable product access. |

| Economies of Scale | Cost advantages from large purchasing volumes. | New entrants face higher per-unit costs. |

| Intellectual Property & Expertise | Proprietary tools, methodologies, and accumulated knowledge. | Requires significant R&D and time to develop comparable capabilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for PC Connection is built upon a foundation of comprehensive data, including company investor relations websites, financial reports, and industry-specific market research from sources like Gartner and IDC. This blend of primary and secondary data allows for a thorough examination of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.