PC Connection Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PC Connection Bundle

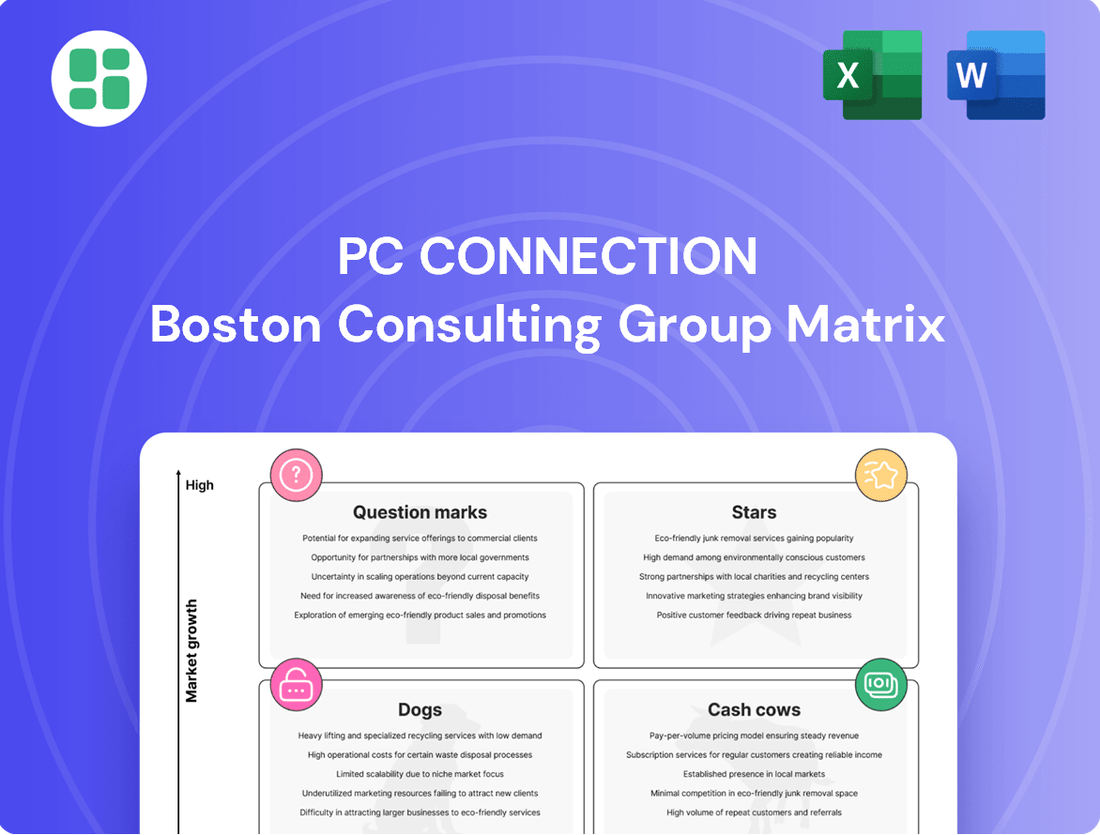

The PC Connection BCG Matrix offers a powerful framework for understanding your product portfolio's strategic position. It helps identify which products are market leaders (Stars), which generate consistent revenue (Cash Cows), which are underperforming (Dogs), and which hold future potential (Question Marks).

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Advanced Cybersecurity Services represents a strong Star for PC Connection. The company's substantial investments in integrated security solutions paid off handsomely in 2024, leading to record gross margins. This strategic push aligns perfectly with the booming cybersecurity market, fueled by escalating threats and stricter regulations.

Connection's dedication to this high-growth sector is further underscored by their achievement of a full suite of Microsoft Security Specializations in May 2025. This move positions them to capture a larger share of the market and solidify their expertise in a critical and expanding technology area.

Connection has strategically invested in AI and modern infrastructure, bolstering its integrated solutions. This move aligns with the high growth potential observed in these burgeoning sectors.

The market for generative AI and GPU technology has seen unprecedented expansion, driving record spending in the data center hardware and software segment throughout 2024. This surge underscores a dynamic and rapidly growing market environment.

Connection's dedication to datacenter modernization, encompassing servers, storage, cloud, and software, is yielding double-digit growth. These offerings are becoming key components of their Stars portfolio, capitalizing on the robust demand.

Hybrid cloud and multi-cloud integration services represent a rapidly expanding sector. Gartner forecasts that by 2027, a substantial 90% of organizations will have adopted a hybrid cloud strategy, highlighting the immense market potential.

Connection is strategically positioned to capitalize on this trend, demonstrating robust performance with double-digit growth in datacenter modernization, a segment intrinsically linked to cloud adoption. This growth underscores their capability to deliver essential integration services in a market experiencing significant expansion.

By offering comprehensive solutions for hybrid and multi-cloud environments, Connection is well-equipped to secure a considerable share of this burgeoning market. Their expertise in integrating these complex environments is a key differentiator in helping businesses leverage the full benefits of cloud technologies.

Digital Workplace Solutions

Digital Workplace Solutions, encompassing mobility and desktops, represent a significant growth area for PC Connection. In Q1 2025, the company reported double-digit growth in this segment, underscoring robust market demand.

This expansion reflects businesses' increasing need for tools that boost efficiency and productivity, particularly as hybrid and remote work models become more prevalent. Connection's established market presence and technical acumen are key advantages in this evolving landscape.

- Double-digit growth in Q1 2025 for digital workplace solutions.

- Strong market demand driven by efficiency and productivity needs.

- Connection's expertise positions it well to leverage market expansion.

Public Sector Solutions with Federal Government Focus

Connection's Public Sector Solutions, particularly its federal government focus, is a shining star in its business portfolio. In the first quarter of 2025, this segment experienced a remarkable surge in net sales, climbing by 54.7% compared to the same period in the previous year. Sales specifically to the federal government saw an impressive increase of $40 million.

This robust growth, coupled with the sheer magnitude of IT investments made by the federal government, positions Connection to capture a significant share of the market. The federal government's IT spending is a vast landscape, offering substantial opportunities for companies like Connection that can effectively serve its needs.

- Federal Government Sales Growth: Increased by $40 million in Q1 2025.

- Public Sector Net Sales Surge: Achieved a 54.7% year-over-year increase in Q1 2025.

- Market Opportunity: Significant potential for market leadership due to large government IT budgets.

Advanced Cybersecurity Services is a clear Star for PC Connection, showing impressive performance in 2024 with record gross margins thanks to significant investments in integrated security solutions. This aligns with the booming cybersecurity market, driven by increasing threats and regulations. Connection's achievement of a full suite of Microsoft Security Specializations in May 2025 further solidifies its expertise in this critical, expanding technology area.

Connection's focus on datacenter modernization, including servers, storage, cloud, and software, is delivering robust double-digit growth, making these offerings key components of their Stars portfolio. This is further supported by the unprecedented expansion in the generative AI and GPU technology market, which fueled record spending in data center hardware and software throughout 2024.

Hybrid cloud and multi-cloud integration services represent a rapidly expanding sector, with Gartner forecasting that 90% of organizations will adopt a hybrid cloud strategy by 2027. Connection is well-positioned to capitalize on this trend, demonstrating strong performance with double-digit growth in datacenter modernization, a segment intrinsically linked to cloud adoption.

Digital Workplace Solutions, encompassing mobility and desktops, showed strong momentum for PC Connection, reporting double-digit growth in this segment during Q1 2025. This expansion is fueled by businesses' increasing need for tools that enhance efficiency and productivity, especially with the rise of hybrid and remote work models.

PC Connection's Public Sector Solutions, especially its federal government engagement, is a standout Star. The company saw a remarkable 54.7% year-over-year increase in public sector net sales in Q1 2025, with federal government sales alone climbing by $40 million. This growth, coupled with substantial federal IT investments, positions Connection to capture a significant market share.

| Business Segment | Growth Driver | 2024/2025 Performance Highlight |

|---|---|---|

| Advanced Cybersecurity Services | Escalating threats, stricter regulations | Record gross margins in 2024; Microsoft Security Specializations (May 2025) |

| Datacenter Modernization (AI/GPU) | Generative AI & GPU market expansion | Double-digit growth; Record spending in data center hardware/software (2024) |

| Hybrid/Multi-Cloud Integration | Shift to hybrid cloud strategies | Double-digit growth in datacenter modernization; 90% orgs to adopt hybrid cloud by 2027 (Gartner) |

| Digital Workplace Solutions | Hybrid/remote work, productivity needs | Double-digit growth (Q1 2025) |

| Public Sector Solutions (Federal) | High government IT investment | 54.7% YoY net sales increase (Q1 2025); $40M increase in federal sales (Q1 2025) |

What is included in the product

This BCG Matrix overview details PC Connection's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth.

Quickly identify which business units need strategic attention, relieving the pain of uncertainty.

Cash Cows

Traditional hardware sales, encompassing notebooks and desktops, represent a significant Cash Cow for PC Connection. These sales saw a robust 14% year-over-year increase in Q4 2024, contributing a substantial 46% to the company's net sales. This demonstrates a large and stable revenue foundation.

Despite the maturity of the broader hardware market, PC Connection leverages its deep-rooted customer relationships and optimized supply chain. This strategic advantage enables the company to secure a considerable market share in this fundamental product category, ensuring a consistent generation of cash flow.

Standard software licensing and renewals represent a core component of PC Connection's business. While precise growth figures for this segment weren't explicitly broken out, it's a foundational offering that underpins their broader technology solutions. In 2024, software sales were a contributor to the company's gross margins, indicating its ongoing financial relevance.

Given PC Connection's established market presence and extensive customer relationships, it's reasonable to assume they maintain a significant and stable market share in this mature segment. This steady demand for essential software, coupled with renewal revenue streams, positions it as a reliable contributor to the company's overall financial performance.

Basic IT support and helpdesk services, while not a high-growth area, are crucial for PC Connection's strategy. These services act as a stable, recurring revenue stream, providing essential support that maintains strong client relationships. In 2024, the IT services market, including helpdesk, saw continued demand, with many businesses prioritizing reliable support to ensure operational continuity.

On-Premise Server and Storage Sales

On-premise server and storage sales represent a significant cash cow for PC Connection. In the fourth quarter of 2024, these sales saw a healthy 9% increase year-over-year, demonstrating continued demand. This segment contributed 8% to Connection's overall net sales, highlighting its stable and consistent revenue generation.

Even with the ongoing migration to cloud solutions, many large enterprises continue to rely on substantial on-premise infrastructure. PC Connection leverages its deep expertise in sourcing and implementing these critical systems. This capability allows them to secure a considerable portion of this mature market, ensuring a steady stream of income for the company.

- Market Position: Cash cow within PC Connection's portfolio.

- Performance: 9% year-over-year sales increase in Q4 2024.

- Revenue Contribution: Accounted for 8% of Connection's net sales.

- Strategic Advantage: Expertise in procurement and deployment for enterprise on-premise needs.

Volume-Based Networking Equipment Sales

PC Connection's extensive networking equipment offerings, including routers and switches, represent a significant Cash Cow within its BCG Matrix. This segment benefits from the persistent demand for dependable network infrastructure across numerous organizations.

Connection's strength lies in its capacity to fulfill these needs at scale, capitalizing on its robust supply chain management. This positions volume-based networking equipment sales as a high-market-share product in a mature, stable market, ensuring consistent revenue generation.

- Market Share: High

- Market Growth: Low

- Revenue Generation: Consistent and stable

- Strategic Focus: Maintain efficiency and profitability

PC Connection's traditional hardware sales, especially notebooks and desktops, are clear Cash Cows. These products saw a 14% year-over-year sales increase in Q4 2024, making up 46% of the company's net sales, showcasing a stable revenue base.

The company's established customer relationships and efficient supply chain allow it to maintain a significant market share in these mature hardware categories, consistently generating cash flow.

On-premise server and storage solutions also function as Cash Cows, with Q4 2024 sales rising 9% year-over-year and contributing 8% to net sales. This demonstrates their ongoing importance and stable revenue generation.

Networking equipment, like routers and switches, also represents a Cash Cow due to consistent demand for reliable infrastructure, allowing PC Connection to leverage its supply chain for high-volume sales in a mature market.

| Product Category | BCG Status | Q4 2024 YoY Growth | % of Net Sales (Approx.) | Strategic Importance |

|---|---|---|---|---|

| Notebooks & Desktops | Cash Cow | 14% | 46% | Stable revenue, high market share |

| On-Premise Servers & Storage | Cash Cow | 9% | 8% | Consistent demand, expertise leverage |

| Networking Equipment | Cash Cow | Stable (Low Growth) | Significant | High volume, supply chain efficiency |

| Software Licensing & Renewals | Cash Cow | Stable (Not Explicitly Broken Out) | Contributes to Gross Margins | Foundational offering, recurring revenue |

Full Transparency, Always

PC Connection BCG Matrix

The PC Connection BCG Matrix preview you are currently viewing is the exact, unedited document you will receive immediately after completing your purchase. This ensures transparency and allows you to assess the quality and content before committing, providing a fully formatted and analysis-ready strategic tool for your business planning.

Dogs

Niche legacy system upgrades fall into the Dogs quadrant of the BCG Matrix. This segment is characterized by low growth and low market share, reflecting the IT industry's rapid evolution towards newer technologies like AI and cloud computing. PC Connection would likely experience diminishing returns and a significant drain on resources by focusing on these specialized, declining opportunities.

Ad-hoc, non-contracted break-fix services, while offering immediate IT solutions, are generally characterized by lower profit margins and less consistent income streams when contrasted with managed service agreements. This type of work often falls into a commoditized market segment.

For larger IT providers like PC Connection, this fragmented service area can represent a low market share, classifying it as a 'dog' in the BCG matrix. Such services often struggle to achieve significant profitability, sometimes barely covering their operational costs, especially when factoring in the unpredictable nature of demand and the specialized skills required for rapid response.

The sale of highly commoditized or technologically outdated peripherals, like older monitor models or basic webcams, falls into a low-growth market with very little room for differentiation. These types of stand-alone, low-value items likely contribute very little to PC Connection's overall profitability and market share, especially as the company emphasizes integrated solutions.

Highly Commoditized Basic IT Supplies

Highly commoditized basic IT supplies, such as generic printer ink, standard network cables, and basic keyboards, represent a segment where PC Connection likely faces significant price pressure and limited differentiation. These products are readily available from numerous vendors, leading to thin profit margins and intense competition.

In 2024, the global market for IT peripherals and supplies, which includes these basic items, was estimated to be worth over $100 billion. However, the portion specifically dedicated to highly commoditized, low-margin items would contribute a smaller, yet significant, piece of this total. Companies like PC Connection often carry these items to offer a one-stop-shop experience for their customers, even if the strategic value or profitability of each individual sale is low.

- Low Profit Margins: Expect net profit margins in the low single digits for these types of products.

- High Competition: Numerous online retailers and brick-and-mortar stores compete on price for basic IT supplies.

- Volume-Driven: Success in this category relies heavily on achieving high sales volumes to offset low per-unit profitability.

- Customer Retention Tool: While not highly profitable, offering these items can help retain customers who are already purchasing higher-margin products.

Resale of Discontinued IT Products

Reselling discontinued IT products, while a way to move old stock, generally falls into the 'dog' category of the BCG Matrix. This is because the market for these items is typically shrinking, and demand is limited. For instance, in 2024, the market for refurbished older-generation laptops, while present, saw a significant decline in growth compared to newer models, with some segments experiencing a contraction.

Engaging in this type of resale often results in a low market share. The effort required to find buyers and manage the logistics for these products can be substantial, yet the returns are usually minimal. This ties up valuable resources that could be better allocated to more promising areas of the business.

Consider these points regarding the resale of discontinued IT products:

- Low Market Growth: The overall market for older IT hardware is not expanding; in fact, it's often contracting as technology advances rapidly.

- Limited Demand: Consumer and business demand is primarily focused on current or recent technology, leaving a small niche for discontinued items.

- Resource Drain: The cost of marketing, sales, and support for these products can outweigh the revenue generated, negatively impacting profitability.

- Opportunity Cost: Resources spent on dogs could be invested in 'stars' or 'question marks' with higher potential for future growth and returns.

Dogs represent business areas with low market share and low growth potential, often consuming resources without significant returns. For PC Connection, this could include highly commoditized IT supplies like basic cables or older monitor models. Such segments are characterized by intense price competition and minimal differentiation, making it difficult to achieve substantial profitability. These offerings may serve as customer retention tools but are unlikely to drive significant growth.

| BCG Matrix Category | Characteristics | Examples for PC Connection | Strategic Implications |

|---|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Commoditized IT supplies, discontinued hardware resale, ad-hoc break-fix services | Divest, harvest, or minimize investment; focus on efficiency |

Question Marks

The Internet of Things (IoT) market is a significant growth area, with projections indicating continued expansion. For PC Connection, their IoT solutions and implementation services likely fall into the question mark category of the BCG matrix. This means they are in a high-growth market but may currently hold a relatively small market share.

While PC Connection provides broad IT solutions, their expertise in the intricate deployment and integration of complex IoT systems might not yet be as established as more specialized competitors. The global IoT market was valued at approximately $1.1 trillion in 2023 and is expected to grow substantially, presenting a clear opportunity for players like PC Connection to increase their market share.

Quantum computing readiness consulting for PC Connection likely falls into the Question Mark category of the BCG matrix. This emerging technology is experiencing rapid growth, with the global quantum computing market projected to reach $1.7 billion in 2024 and potentially $12.9 billion by 2030, according to some industry forecasts. PC Connection, as an IT solutions provider, might be dipping its toes into this nascent market by offering preliminary advisory services.

However, their current market share in this specialized consulting area is likely negligible, reflecting the early stage of development and adoption. This positions quantum computing readiness consulting as a high-potential, high-risk venture for PC Connection, requiring significant investment and strategic focus to transform it into a future market leader.

The global mixed reality market, which includes augmented and virtual reality, is on a strong growth trajectory, with projections indicating a substantial 43% compound annual growth rate extending through 2032. This rapid expansion suggests a significant opportunity for companies to develop and offer innovative enterprise solutions.

PC Connection might be exploring or already providing AR/VR solutions tailored for business needs, such as immersive training modules or advanced design visualization tools. However, given the nascent stage and high innovation within this sector, their current market share is likely modest as they establish their presence in this evolving landscape.

Specialized Vertical-Specific AI Solutions

AI is a major growth driver for consulting and implementation services, with enterprises integrating AI into their core operations expected to account for 67% of projected AI spending in 2025. This presents a significant opportunity, but also highlights areas where PC Connection may have limited current market share.

PC Connection's current market share in highly specialized, vertical-specific AI solutions, such as AI for medical imaging analysis or AI-powered financial fraud detection, is likely to be low. Gaining meaningful traction in these niche areas will require substantial investment in developing or acquiring specialized expertise and technologies.

- AI Adoption: Enterprises embedding AI into core operations will drive 67% of projected AI spending in 2025.

- Market Specialization: PC Connection's current position in niche, vertical-specific AI solutions is likely limited.

- Investment Needs: Significant investment is required to build or acquire capabilities for specialized AI offerings.

- Competitive Landscape: Success in vertical AI demands deep domain expertise and tailored solutions.

Blockchain-as-a-Service Integration

Blockchain-as-a-Service (BaaS) integration for PC Connection, if pursued, would likely place them in the question mark category of the BCG Matrix. This is due to blockchain's status as a high-growth, emerging technology with significant potential across various sectors like supply chain management, financial services, and enhanced data security.

In this rapidly evolving and somewhat speculative market, PC Connection would likely hold a low market share, reflecting the nascent stage of their involvement or the overall fragmentation of the BaaS provider landscape. For example, the global BaaS market was projected to reach approximately $10.2 billion in 2024, with significant growth expected in the coming years, indicating a high potential but also a competitive and developing environment.

- High Growth Potential: Blockchain technology offers transformative capabilities in areas such as supply chain transparency, secure financial transactions, and robust data integrity, driving market expansion.

- Low Market Share: As an emerging service, PC Connection's current penetration and established presence in the BaaS integration space would likely be minimal.

- Speculative Domain: The blockchain market, while promising, still faces regulatory uncertainties and technological adoption challenges, making it a high-risk, high-reward area.

- Investment Required: To capitalize on BaaS growth, significant investment in specialized talent, platform development, and strategic partnerships would be necessary for PC Connection.

Question Marks represent business areas with low market share in high-growth markets. For PC Connection, this means investing in these areas could lead to future market leadership if successful. The challenge lies in identifying which Question Marks have the potential to become Stars.

These ventures require careful consideration of investment and strategic focus to move them out of the Question Mark category. Without strategic development, they risk becoming Dogs, draining resources without significant returns.

The key is to analyze the market dynamics and PC Connection's capabilities to make informed decisions about resource allocation for these high-potential, high-risk opportunities.

| Business Area | Market Growth | PC Connection Market Share | BCG Category |

| IoT Solutions | High | Low | Question Mark |

| Quantum Computing Consulting | High | Negligible | Question Mark |

| Mixed Reality Solutions | High | Modest | Question Mark |

| Specialized AI Solutions | High | Low | Question Mark |

| Blockchain-as-a-Service (BaaS) | High | Minimal | Question Mark |

BCG Matrix Data Sources

Our PC Connection BCG Matrix is built on verified market intelligence, combining sales data, product performance metrics, and industry growth forecasts for accurate strategic insights.