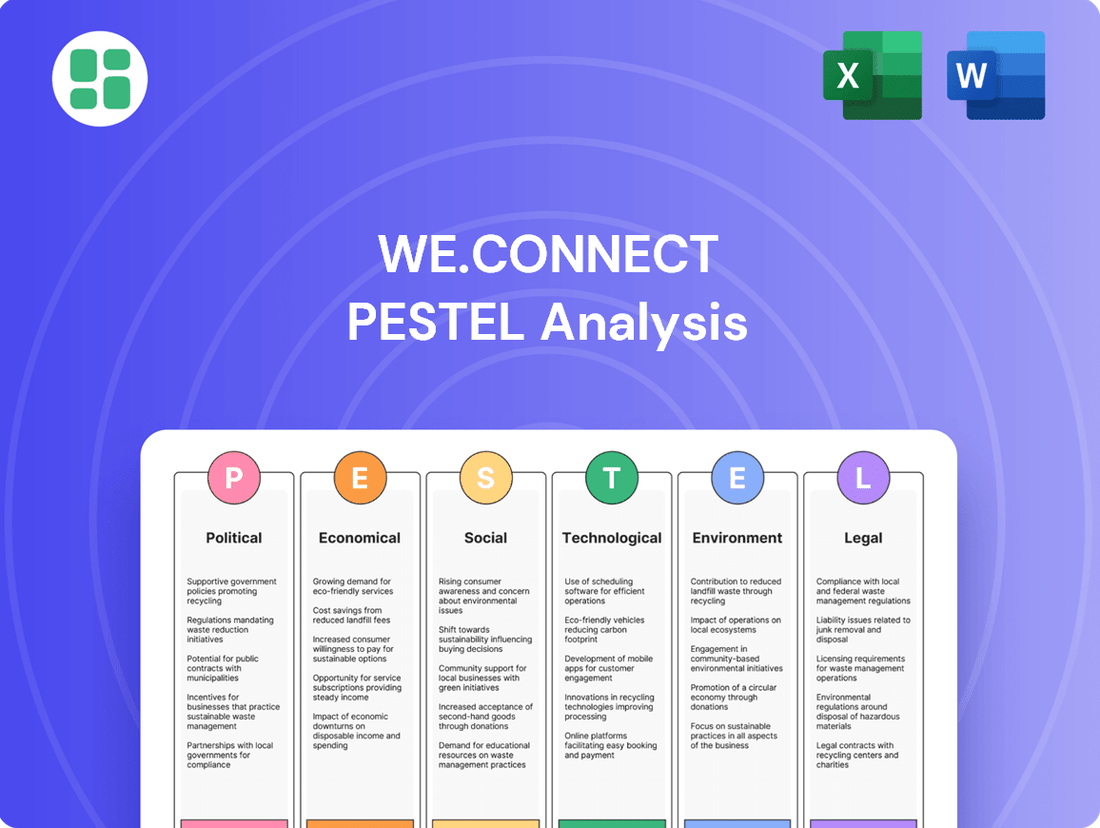

We.Connect PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

We.Connect Bundle

Navigate the complex external forces impacting We.Connect with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its landscape. Gain the strategic foresight needed to capitalize on opportunities and mitigate risks. Download the full analysis now to unlock actionable intelligence and secure your competitive advantage.

Political factors

The European Union's Cyber Resilience Act (CRA), effective from October 2024, introduces stringent cybersecurity mandates for digital products sold within the EU. This regulation places significant responsibility on manufacturers like WE.CONNECT to ensure products are secure by design and throughout their lifecycle, covering development, production, and ongoing maintenance.

Compliance with the CRA involves rigorous conformity assessments, detailed product documentation, and robust customer support, including vulnerability reporting. Failure to adhere to these new standards could result in substantial financial penalties, potentially impacting WE.CONNECT's profitability and strategic investment in product innovation.

The EU Digital Services Act (DSA), fully effective since February 2024, imposes stricter accountability on online platforms, directly impacting WE.CONNECT's digital sales channels by requiring clearer seller identification and content moderation.

This legislation mandates greater transparency in recommendation algorithms and aims to curb illegal content and products, fostering a more trustworthy online marketplace that could enhance consumer confidence in WE.CONNECT's offerings.

With over 450 million internet users in the EU, the DSA's enforcement from early 2024 is expected to create a more level playing field, potentially benefiting legitimate businesses like WE.CONNECT by reducing unfair competition from unregulated sellers.

Global trade volatility and geopolitical tensions remain significant concerns for the electronic component supply chain. For instance, the potential for increased tariffs on European metals could directly impact manufacturing costs for companies like We.Connect, while administrative shifts in US trade policy may introduce new compliance burdens and affect market access.

The European Union's digital trade policy is actively shaping global rules through bilateral agreements, aiming for a leading position in digital commerce. This proactive stance can influence We.Connect's import and export expenses and the ease with which it can access international markets, underscoring the need for agile strategic sourcing and robust partnerships to secure supply chains.

Government Digital Transformation Initiatives

The French government's commitment to digital transformation is a significant tailwind for businesses like We.Connect. Substantial investments are being channeled into expanding 5G networks, aiming to blanket both urban centers and rural regions. This push not only strengthens the nation's digital backbone but also cultivates a robust demand for advanced technological solutions across various industries.

Initiatives such as France Relance underscore this commitment, earmarking considerable funds for digital infrastructure and fostering innovation. This strategic allocation directly boosts the Information and Communication Technology (ICT) market. Public sector support for crucial areas like cloud computing, artificial intelligence, and cybersecurity creates a fertile ground for companies providing professional-grade equipment.

- France Relance Investment: The €100 billion France Relance plan includes significant allocations for digital transition, aiming to accelerate the adoption of new technologies.

- 5G Rollout Progress: By early 2024, France had achieved significant 5G coverage milestones, with ongoing deployment efforts targeting broader accessibility.

- Digital Infrastructure Growth: Government-backed projects are directly stimulating demand for high-capacity networking equipment and advanced IT solutions.

Product Safety Regulations

The General Product Safety Regulation (GPSR), set to take effect in December 2024, will significantly bolster product safety across the European Union for all consumer goods, including electronics. This legislation mandates that manufacturers establish robust procedures, such as conducting internal risk assessments and maintaining up-to-date technical documentation. While its direct impact is on consumer products, the emphasis on safety and meticulous record-keeping could indirectly shape professional product standards and compliance efforts for WE.CONNECT.

The GPSR's focus on ensuring products are safe for consumers and requires manufacturers to have clear traceability and information sharing mechanisms. For WE.CONNECT, this means a heightened expectation for product integrity and transparent documentation, potentially influencing how they approach safety protocols for their own offerings. The regulation aims to create a more secure marketplace, with an estimated 20% of non-food consumer products currently failing safety checks in the EU, highlighting the need for such stringent measures.

- Enhanced Safety Standards: The GPSR introduces stricter requirements for product safety and due diligence for businesses operating within the EU.

- Documentation and Risk Assessment: Manufacturers must conduct thorough risk assessments and maintain comprehensive technical documentation for their products.

- Indirect Impact on Professional Standards: WE.CONNECT may see an indirect elevation in its own product development and compliance standards due to the broader regulatory landscape.

- Marketplace Security: The regulation aims to reduce the number of unsafe products entering the market, with a significant portion of consumer products currently failing safety tests.

Political factors significantly shape the operational landscape for WE.CONNECT, particularly concerning cybersecurity and digital market regulations within the EU. The EU's Cyber Resilience Act, effective October 2024, mandates stringent security for digital products, impacting WE.CONNECT's development and lifecycle management. Similarly, the EU Digital Services Act, fully active since February 2024, increases platform accountability, influencing WE.CONNECT's online sales channels through transparency and content moderation requirements.

Government initiatives, like France's commitment to digital transformation and its extensive 5G network expansion, create a favorable environment for technology companies. The France Relance plan, with its substantial digital transition funding, directly stimulates demand for advanced IT solutions, benefiting WE.CONNECT's market opportunities. Furthermore, the upcoming General Product Safety Regulation (GPSR) in December 2024 will elevate product safety standards across the EU, requiring enhanced diligence and documentation from manufacturers like WE.CONNECT.

| Regulation/Initiative | Effective Date | Impact on WE.CONNECT | Key Requirement | Potential Consequence |

|---|---|---|---|---|

| EU Cyber Resilience Act (CRA) | October 2024 | Product security mandates | Secure by design, lifecycle security | Financial penalties for non-compliance |

| EU Digital Services Act (DSA) | February 2024 | Online sales channel accountability | Transparency, content moderation | Enhanced consumer trust, level playing field |

| France Relance Plan | Ongoing | Digital infrastructure demand | Investment in 5G, ICT | Increased market opportunities |

| General Product Safety Regulation (GPSR) | December 2024 | Product safety standards | Risk assessment, documentation | Indirect elevation of professional standards |

What is included in the product

This We.Connect PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to empower strategic decision-making and identify potential opportunities and threats.

The We.Connect PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, eliminating the need to sift through lengthy documents.

Economic factors

The French Information and Communications Technology (ICT) market is on a strong upward trajectory. In 2024, the market was valued at USD 38.4 billion, with projections indicating a substantial expansion to USD 130.1 billion by 2033. This impressive growth is underpinned by a compound annual growth rate of 12.98% between 2025 and 2033.

Driving this expansion are key trends like widespread digital transformation initiatives, increasing adoption of cloud computing services, and a growing demand for robust cybersecurity solutions. The hardware segment is particularly dominant, holding over 30% of the total market share, demonstrating its foundational role in France's digital infrastructure.

France saw inflation ease in 2024, with projections indicating a continued downward trend into 2025. This disinflation is expected to boost household purchasing power, potentially leading to increased consumer spending on goods and services.

While elevated inflation previously strained household budgets, the moderating price increases could stimulate business investment and consumer confidence. For WE.CONNECT, this economic shift might mean more predictable costs for essential components and a potential uptick in demand from its professional clientele.

Global supply chains for electronic components, while still recovering from geopolitical strains and earlier disruptions, have seen lead times improve from 2023 levels. Despite robust demand for AI hardware, some manufacturers experienced inventory build-up and slower sales in 2024, with 2025 expected to bring a more balanced market.

WE.CONNECT must remain vigilant regarding potential fluctuations in material costs, particularly for essential minerals like copper, which saw prices reach over $10,000 per tonne in early 2024. Effectively managing component availability will be crucial for sustained production and market responsiveness.

Business Investment Trends

Business investment in France is anticipated to see a contraction in 2024, largely due to the lingering effects of tighter financial conditions. For instance, the Banque de France reported a slowdown in business investment intentions for the first half of 2024, with many firms citing higher borrowing costs as a key concern.

Despite this general trend, the Information and Communication Technology (ICT) sector presents a counterpoint. Expected growth in the overall ICT market, coupled with a strong emphasis on digital transformation initiatives across industries, is likely to stimulate investment in IT infrastructure and related equipment. This digital shift is a critical factor for WE.CONNECT's growth trajectory.

WE.CONNECT's performance hinges on its ability to encourage businesses to proceed with hardware upgrades and new technology acquisitions, even amidst economic uncertainties. For example, a recent survey by Syntec Numérique indicated that while overall capital expenditure might be cautious, IT spending remains a priority for a significant portion of French companies aiming to enhance efficiency and competitiveness through digitalization.

- Projected decrease in French business investment for 2024 due to tightened financial conditions.

- ICT market growth and digital transformation initiatives are key drivers for IT infrastructure investment.

- WE.CONNECT's success depends on businesses prioritizing hardware upgrades despite economic headwinds.

- Banque de France data points to higher borrowing costs impacting business investment intentions.

Competitive Landscape and Market Dynamics

The French electronics market is facing a projected decline, with revenues anticipated to fall to around €30 billion by 2028. This presents a challenging landscape for companies like WE.CONNECT, necessitating a strong focus on innovation and differentiation to maintain or grow market share.

However, the broader Information and Communications Technology (ICT) sector, encompassing IT services and software, is experiencing robust growth. This trend highlights a significant shift in consumer and business spending priorities, a dynamic WE.CONNECT should strategically capitalize on by adapting its offerings.

- Projected French Electronics Market Revenue: Approximately €30 billion by 2028, indicating a contraction.

- ICT Market Growth: Strong expansion in IT services and software suggests opportunities in related or adjacent sectors.

- Competitive Imperative: Companies must innovate to navigate the declining electronics market and secure their position.

Economic factors impacting the French market show a mixed but generally improving outlook for WE.CONNECT. While overall business investment saw a contraction in 2024 due to tighter financial conditions, the Information and Communications Technology (ICT) sector is a bright spot, projected for significant growth. This sector's expansion, driven by digital transformation, is expected to fuel demand for IT infrastructure, a key area for WE.CONNECT.

Inflation easing in 2024 and projected to continue its downward trend into 2025 is a positive sign, potentially boosting consumer spending and business confidence. However, WE.CONNECT must remain agile in managing component costs, as seen with copper prices exceeding $10,000 per tonne in early 2024, and navigate the specific challenges of the declining French electronics market by focusing on innovation within the growing ICT space.

| Economic Factor | 2024/2025 Outlook | Impact on WE.CONNECT |

|---|---|---|

| French ICT Market Growth | Projected to reach USD 130.1 billion by 2033, with a CAGR of 12.98% (2025-2033) | Increased demand for IT infrastructure and hardware. |

| Inflation | Easing in 2024, with continued downward trend expected in 2025 | Potential for increased consumer spending and improved business confidence. |

| Business Investment | Contraction in 2024 due to tighter financial conditions | Need to encourage IT spending despite cautious overall investment. |

| Component Costs (e.g., Copper) | Fluctuations observed, with copper over $10,000/tonne in early 2024 | Requires vigilant cost management and supply chain optimization. |

Same Document Delivered

We.Connect PESTLE Analysis

The We.Connect PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis provides a detailed examination of the external factors influencing We.Connect, ensuring you receive a complete and actionable report.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering immediate insights into We.Connect's operating environment.

Sociological factors

Consumer awareness regarding the environmental impact of electronics is surging, prompting a significant demand for eco-friendly products. This growing preference is compelling manufacturers, including WE.CONNECT, to prioritize sustainable sourcing and production methods.

Customers are increasingly scrutinizing companies' commitments to reducing resource waste and enhancing product recyclability. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for sustainably produced electronics, directly influencing purchasing decisions.

This shift in consumer behavior is further amplified by regulatory frameworks promoting eco-design and circular economy principles. By 2025, the EU is expected to implement stricter regulations on e-waste management, encouraging companies to design products with longevity and recyclability in mind.

The widespread adoption of work-from-home and hybrid models has dramatically increased the demand for Information and Communication Technology (ICT) solutions. This trend directly benefits WE.CONNECT, as professionals increasingly need dependable, high-performance computers and peripherals for their dual work environments. For instance, a 2024 survey indicated that 60% of knowledge workers globally now expect to work remotely at least part-time, fueling a sustained need for robust home office setups.

France is witnessing a significant surge in digital literacy, with a substantial portion of its population now comfortable using digital tools. This trend directly fuels the demand for advanced ICT solutions, benefiting companies like WE.CONNECT.

By the end of 2024, it's projected that over 85% of French businesses will have adopted cloud computing services, a testament to the widespread technology integration. This increasing reliance on digital infrastructure means a greater need for the sophisticated computer and electronic equipment that WE.CONNECT provides.

Consumer Preference for Repairability and Longevity

Consumer preferences are increasingly leaning towards products that are built to last and can be easily repaired. New European Union Ecodesign and Energy Labelling regulations, set to take effect in June 2025, will require manufacturers of items like mobile phones and tablets to prioritize longer lifespans and simpler repair processes. This regulatory push reflects a growing societal demand for sustainability and the 'right to repair,' directly impacting how companies like WE.CONNECT will need to approach product development and marketing strategies.

France, for instance, has already implemented a sustainability index for Electrical and Electronic Equipment (EEE) starting January 2025. This index specifically assesses aspects such as repairability, overall product reliability, and the availability of software and hardware updates. Such initiatives highlight a significant shift in consumer values, where durability and the ability to extend a product's life are becoming key purchasing considerations.

- EU Ecodesign and Energy Labelling: Effective June 2025, mandating longer lifespans and easier repair for mobile phones and tablets.

- French Sustainability Index: Introduced January 2025 for EEE, evaluating repairability, reliability, and update support.

- Societal Shift: Growing consumer demand for product longevity and the 'right to repair' influences market expectations.

Heightened Cybersecurity Awareness

The increasing prevalence of cyber threats, from ransomware to data breaches, has significantly amplified public and corporate awareness of cybersecurity. This heightened concern directly influences purchasing decisions, driving demand for products and services that prioritize data protection and privacy. For instance, a 2024 report indicated that over 60% of businesses consider cybersecurity a top priority when selecting new technology partners, a figure expected to rise further in 2025.

WE.CONNECT can leverage this societal shift by proactively highlighting its advanced security protocols and data encryption capabilities. Demonstrating a commitment to robust cybersecurity measures, including compliance with evolving data protection regulations like GDPR and CCPA, will resonate strongly with its target audience, particularly within the professional and enterprise segments. This focus addresses a critical need for trust and reliability in the digital landscape.

- Cybersecurity Spending: Global cybersecurity spending is projected to reach over $300 billion in 2025, reflecting the growing importance of digital security.

- Data Breach Costs: The average cost of a data breach in 2024 was estimated at $4.45 million, underscoring the financial imperative for strong security.

- Consumer Trust: Surveys in late 2024 showed that over 70% of consumers are more likely to choose brands with transparent and strong cybersecurity practices.

- Regulatory Compliance: Adherence to regulations like the NIS2 Directive in Europe, which enhances cybersecurity requirements for critical infrastructure, is becoming a competitive advantage.

Societal trends are increasingly shaping consumer expectations for technology companies. There's a growing demand for products that are not only functional but also ethically produced and environmentally conscious. For WE.CONNECT, this means a focus on sustainability and transparency in its operations.

The rise of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024-2025, has created a sustained demand for reliable ICT solutions. This shift benefits WE.CONNECT by increasing the need for high-performance computing and networking equipment for home and flexible office environments.

Consumer awareness around data privacy and cybersecurity has reached new heights. A 2024 report indicated that 70% of consumers consider robust security practices a key factor when choosing technology brands, directly impacting purchasing decisions and brand loyalty.

Societal emphasis on the 'right to repair' and product longevity is growing, with new EU regulations in 2025 mandating longer lifespans and easier repairability for electronics. This trend encourages companies like WE.CONNECT to design products with durability and serviceability in mind.

| Societal Factor | Trend Description | Impact on WE.CONNECT | Relevant Data (2024-2025) |

|---|---|---|---|

| Environmental Consciousness | Growing consumer demand for eco-friendly products and sustainable manufacturing. | Need to prioritize sustainable sourcing and production; potential for premium pricing on green products. | 60% of consumers willing to pay more for sustainable electronics (2024 survey). |

| Workforce Mobility | Increased adoption of remote and hybrid work models. | Sustained demand for reliable ICT solutions for home and flexible office setups. | 60% of knowledge workers expect to work remotely part-time (2024 survey). |

| Data Privacy & Security | Heightened awareness and concern regarding cyber threats and data protection. | Emphasis on highlighting advanced security protocols and data encryption capabilities. | 70% of consumers prioritize brands with strong cybersecurity (late 2024 surveys). |

| Product Longevity & Repairability | Societal push for durable products and the 'right to repair'. | Product development must focus on longevity and ease of repair to meet regulatory and consumer demands. | EU Ecodesign regulations effective June 2025 mandate longer lifespans for electronics. |

Technological factors

The electronics manufacturing sector is in constant flux, fueled by breakthroughs in areas like advanced semiconductor technologies and novel materials. Innovations in advanced packaging and System-on-Chip (SoC) designs are paving the way for the next generation of electronic gadgets, with the global semiconductor market projected to reach $600 billion in 2024.

WE.CONNECT must therefore maintain a swift pace of innovation to ensure its products remain competitive and relevant. The market is characterized by increasingly compressed product lifecycles, meaning companies need to adapt quickly to stay ahead.

The electronics manufacturing sector is seeing a significant shift driven by AI and automation. Companies are adopting smart factory concepts, where AI-powered robots and advanced analytics optimize production. This integration promises to boost efficiency, minimize errors, and ultimately lower manufacturing costs. For instance, by 2025, the global industrial automation market is projected to reach $310 billion, reflecting the widespread adoption of these technologies.

WE.CONNECT can capitalize on these technological advancements by integrating AI and automation into its own manufacturing operations. This would lead to improved production quality and reduced operational expenses. Furthermore, WE.CONNECT can develop and offer AI-enabled products to its professional clientele, tapping into a growing market demand for intelligent solutions.

The widespread rollout of 5G in France, with coverage reaching over 60% of the population by early 2024, is a critical technological factor. This advancement fuels demand for high-speed, low-latency connectivity, essential for the growth of IoT and AI-driven services.

WE.CONNECT must leverage these 5G capabilities to enhance its offerings, particularly for professional users who increasingly rely on seamless, high-performance communication solutions. The demand for advanced, connected technologies is directly correlated with the expansion of this robust network infrastructure.

Cloud Computing and Data Center Trends

Businesses are increasingly adopting cloud computing for enhanced agility, scalability, and cost savings. In France, the cloud computing sector is experiencing significant growth, with projections indicating a substantial increase in market value throughout 2024 and into 2025. This shift fuels a robust demand for the foundational hardware that underpins these cloud environments, such as servers, storage solutions, and networking gear.

WE.CONNECT is well-positioned to capitalize on this trend by supplying the essential hardware infrastructure and integrated solutions required for building and maintaining cloud platforms. The expansion of data centers, both public and private, is a direct consequence of this cloud migration.

- Cloud market growth: The global cloud computing market is expected to reach over $1 trillion by 2025, with significant contributions from Europe.

- Hardware demand: Increased cloud adoption directly translates to higher demand for servers, storage, and networking equipment, creating opportunities for hardware providers.

- Data center expansion: Investments in data center infrastructure are rising globally, driven by the need to support growing cloud services and data processing.

Growth of IoT and Edge Computing

The expansion of the Internet of Things (IoT) is a significant technological driver. Projections indicate the number of connected IoT devices globally will surpass 25 billion by 2025, fueling demand for advanced sensor technology and energy-efficient product development. This trend necessitates that WE.CONNECT's product design prioritizes compatibility and optimal performance within these increasingly interconnected ecosystems.

Edge computing, a parallel development, involves processing data nearer to its origin rather than in a centralized cloud. This shift impacts how data is managed and analyzed. WE.CONNECT must integrate this into its strategic considerations, ensuring its offerings can effectively leverage edge computing capabilities for faster data processing and reduced latency.

- IoT Device Growth: Over 25 billion connected IoT devices expected globally by 2025.

- Edge Computing Adoption: Increasing trend for localized data processing.

- Product Design Implications: Need for sensor technology, power efficiency, and compatibility.

- WE.CONNECT Strategy: Adapt offerings to support connected environments and edge processing.

Technological advancements are rapidly reshaping the electronics landscape, with AI and automation driving efficiency in manufacturing. The global industrial automation market is set to reach $310 billion by 2025, highlighting the widespread adoption of these smart factory concepts.

WE.CONNECT can leverage these trends by integrating AI into its operations for improved quality and cost reduction, while also developing AI-enabled products for its clients. The expansion of 5G networks, covering over 60% of France's population by early 2024, is creating a strong demand for high-speed connectivity, crucial for IoT and AI services.

The company should capitalize on this by enhancing its offerings with 5G capabilities, catering to professionals who require seamless communication. Furthermore, the burgeoning cloud computing market, projected to exceed $1 trillion globally by 2025, fuels a significant demand for the underlying hardware WE.CONNECT provides.

The increasing adoption of edge computing, processing data closer to its source, also necessitates that WE.CONNECT's product design considers compatibility and optimal performance within these evolving, interconnected ecosystems, especially with over 25 billion IoT devices expected globally by 2025.

| Technological Factor | 2024/2025 Projection/Data | Impact on WE.CONNECT |

|---|---|---|

| AI & Automation in Manufacturing | Industrial Automation Market: $310 billion by 2025 | Enhance production efficiency, reduce costs, develop AI-enabled products. |

| 5G Network Expansion | France: >60% population coverage by early 2024 | Improve connectivity-dependent product offerings for professionals. |

| Cloud Computing Growth | Global Cloud Market: >$1 trillion by 2025 | Increase demand for WE.CONNECT's hardware infrastructure solutions. |

| IoT & Edge Computing | IoT Devices: >25 billion globally by 2025 | Prioritize sensor tech, power efficiency, and edge processing compatibility in product design. |

Legal factors

The EU Cyber Resilience Act (CRA), effective from December 2027, mandates robust cybersecurity for digital products sold within the EU. This regulation, officially Regulation (EU) 2024/2847, requires WE.CONNECT to embed security from the initial design phase and maintain it throughout the product's life, including proactive vulnerability management. The CRA's impact is substantial, with estimates suggesting that compliance could necessitate up to a 15% increase in R&D spending for affected companies in the initial years.

France's updated WEEE and Battery regulations, effective January 2025, introduce eco-modulation criteria focused on battery accessibility. These rules penalize products that don't allow for easy battery removal by end-users or authorized professionals, aiming to reduce electronic waste and its environmental footprint.

To comply, WE.CONNECT must ensure its products facilitate straightforward battery replacement, potentially impacting design choices and requiring detailed documentation to avoid fines. For instance, the European Commission's proposed Ecodesign for Sustainable Products Regulation (ESPR) already highlights battery design and repairability as key areas, with France’s implementation reinforcing this trend.

The EU Ecodesign for Sustainable Products Regulation (ESPR), effective July 2024, sets new sustainability benchmarks for products sold within the EU. This legislation mandates that products should be designed for greater durability, reliability, reusability, and ease of repair, impacting a wide array of goods including electronics.

WE.CONNECT must proactively adapt its product development and manufacturing to meet these stringent environmental criteria, ensuring compliance with the ESPR's focus on detailed product information and lifecycle sustainability.

France EEE Sustainability Index

France's commitment to sustainability in electronics is evolving with Decree No. 2024-316, enacted in April 2024. This decree establishes a new sustainability index for Electrical and Electronic Equipment (EEE), set to phase out the current repairability index. The new index offers a more comprehensive assessment, factoring in aspects like energy efficiency, the recyclability of materials, and the availability of software and hardware updates. This initiative aims to drive greater environmental responsibility within the electronics sector.

Producers such as WE.CONNECT are now tasked with a crucial responsibility: calculating and clearly displaying this sustainability index for every EEE model offered for sale in France. This move is designed to foster transparency, empowering consumers with detailed information about the environmental and social footprint of their purchases. For WE.CONNECT, this means a strategic imperative to integrate sustainability metrics deeply into product development and lifecycle management. By 2025, it's anticipated that this index will significantly influence consumer purchasing decisions, potentially impacting market share for companies that excel in sustainability performance.

The implementation of this index highlights a broader European trend towards enhanced product environmental accountability. Key performance indicators for the index include:

- Energy Efficiency Ratings: Quantifying the energy consumption of EEE during operation and standby modes.

- Recyclability Score: Assessing the ease with which EEE components can be recycled and the percentage of recycled materials used.

- Software and Hardware Update Longevity: Evaluating the commitment of manufacturers to provide updates that extend the usable life of the product.

- Presence of Hazardous Substances: Monitoring and reporting on the use of restricted or hazardous materials in product manufacturing.

Digital Services Act (DSA) and Consumer Protection

The Digital Services Act (DSA), fully enforced since February 2024, imposes significant obligations on platforms like those WE.CONNECT utilizes for distribution. It demands greater platform accountability, including risk assessments for illegal products and enhanced transparency. This regulatory shift means WE.CONNECT must ensure its online marketplace partners adhere to these stricter standards.

Furthermore, the upcoming European Accessibility Act (EAA), effective June 2025, will mandate that product information and e-commerce services are accessible to all users. This directly impacts WE.CONNECT's online sales channels, requiring adjustments to ensure compliance with these new digital consumer protection mandates.

- DSA Compliance: Platforms used by WE.CONNECT must now actively mitigate risks associated with illegal content and products, impacting supplier vetting and marketplace operations.

- EAA Implementation: WE.CONNECT must prepare its online product listings and e-commerce interfaces to meet accessibility standards by June 2025, broadening its customer reach.

- Consumer Trust: Adherence to these digital consumer protection laws can bolster trust and brand reputation, potentially attracting a wider customer base concerned with ethical online practices.

Legal factors are increasingly shaping the electronics landscape, with new regulations focusing on cybersecurity, sustainability, and digital accessibility. The EU Cyber Resilience Act, effective late 2027, requires WE.CONNECT to build security into products from the ground up, potentially increasing R&D by 15%. France's updated WEEE and Battery regulations, effective early 2025, penalize products with difficult-to-remove batteries, pushing for easier recycling.

The EU Ecodesign for Sustainable Products Regulation (ESPR), active mid-2024, mandates greater product durability and repairability, influencing design choices. France's new sustainability index for electronics, implemented April 2024, replaces the repairability index with a broader assessment including energy efficiency and recyclability, with WE.CONNECT needing to display this index by 2025. The Digital Services Act (DSA), fully enforced early 2024, requires platforms WE.CONNECT uses to manage illegal content, while the upcoming European Accessibility Act (EAA) by mid-2025 will necessitate accessible online product information and services.

| Regulation | Effective Date | Key Impact on WE.CONNECT | Potential Cost/Benefit |

|---|---|---|---|

| EU Cyber Resilience Act | December 2027 | Mandatory cybersecurity by design and throughout product lifecycle. | Up to 15% R&D increase in initial years. |

| French WEEE & Battery Regs | January 2025 | Facilitate easy battery removal to reduce e-waste. | Design adjustments, potential documentation costs. |

| EU Ecodesign for Sustainable Products (ESPR) | July 2024 | Focus on durability, reusability, and repairability. | Adapt product development and manufacturing processes. |

| French Sustainability Index for EEE | April 2024 (index established) | Calculate and display a comprehensive sustainability index. | Integrate sustainability metrics into product lifecycle; potential market share impact by 2025. |

| Digital Services Act (DSA) | February 2024 | Ensure online marketplace partners manage illegal content. | Vetting suppliers, monitoring marketplace operations. |

| European Accessibility Act (EAA) | June 2025 | Make product information and e-commerce accessible. | Adapt online listings and interfaces; broaden customer reach. |

Environmental factors

France's updated Waste Electrical and Electronic Equipment (WEEE) and Battery regulations, taking effect January 2025, will place a significant emphasis on the design of electronic devices, specifically concerning battery removability and replaceability. This shift aims to simplify the recycling process and encourage longer product lifespans.

Compliance with the WEEE Register in France is mandatory for companies like WE.CONNECT, requiring diligent management and transparent reporting of electronic waste streams. This includes tracking the collection, treatment, and recycling rates of WEEE, ensuring adherence to environmental standards.

WE.CONNECT must navigate these extended producer responsibility (EPR) frameworks by registering and submitting regular reports on their WEEE management activities. For instance, in 2023, France collected approximately 900,000 tonnes of WEEE, with battery-related components being a key focus for improved recovery rates.

The electronics manufacturing sector is facing significant pressure to embrace sustainable production. This includes a push for eco-friendly materials, energy-saving manufacturing, and minimizing waste. For instance, the global market for sustainable electronics is projected to reach $20.4 billion by 2027, growing at a CAGR of 15.2%.

WE.CONNECT should actively investigate and integrate sustainable materials, such as bio-based plastics and metals that can be easily recycled. Investing in energy-efficient machinery for production lines is also crucial. A 2024 report indicated that companies prioritizing energy efficiency in manufacturing saw a 10-15% reduction in operational costs.

The telecommunications industry is increasingly embracing circular economy principles, moving away from the traditional linear model towards a focus on recycling, remanufacturing, and reusing components. This shift is driven by a growing awareness of resource scarcity and environmental impact.

Regulations like the EU's Ecodesign for Sustainable Products Regulation (ESPR) are pivotal, mandating that products be designed for durability, reusability, and repairability. For instance, the ESPR aims to reduce raw material consumption by promoting longer product lifespans and easier repairability for electronics, a sector WE.CONNECT operates within.

WE.CONNECT can proactively integrate these circular economy principles into its product design and overall lifecycle management. This strategic integration not only minimizes environmental impact but also ensures compliance with evolving regulatory landscapes, potentially leading to cost savings through reduced material usage and waste.

Carbon Footprint and Battery Regulations

The EU Battery Regulation, effective from August 2023, mandates specific carbon footprint declarations and performance classes for all batteries sold in the EU starting mid-2025. This regulation aims to build a sustainable and circular battery market by scrutinizing the entire battery lifecycle. For WE.CONNECT, this means adapting manufacturing processes and sourcing to meet these new sustainability benchmarks.

Compliance with the EU Battery Regulation presents both challenges and opportunities for WE.CONNECT. The regulation's focus on lifecycle assessment, including raw material extraction and recycling, will require enhanced supply chain transparency. For instance, companies will need to track the carbon intensity of materials like lithium and cobalt, which are critical components of modern batteries.

- EU Battery Regulation: Effective August 2023, with mid-2025 deadline for carbon footprint declarations and performance classes.

- Lifecycle Focus: Addresses sustainability across the entire battery lifecycle, from production to end-of-life.

- WE.CONNECT Impact: Requires adaptation in manufacturing and sourcing to meet stringent sustainability standards.

- Supply Chain Transparency: Necessitates tracking the carbon intensity of key battery materials.

Product Longevity and Repairability Initiatives

New European Union regulations, set to take effect in June 2025, will require smartphones and tablets to be designed for extended durability and easier repairs. These rules mandate that spare parts and repair information will be accessible for at least seven years, directly impacting product lifecycles.

France's own sustainability index for electronic equipment further encourages product longevity by assessing repairability and the availability of software and hardware updates. This regulatory landscape highlights a growing demand for more sustainable electronic goods.

- EU Eco-design rules for smartphones and tablets begin June 2025.

- Products must be repairable for at least 7 years.

- France's sustainability index scores EEE on repairability and updates.

- WE.CONNECT can build brand loyalty by meeting these environmental expectations.

Environmental factors are increasingly shaping the electronics industry, pushing companies like WE.CONNECT towards greater sustainability. New EU regulations starting mid-2025 will mandate carbon footprint declarations for batteries, impacting sourcing and manufacturing. France's upcoming WEEE and Battery regulations in January 2025 will also prioritize battery removability and replaceability, influencing product design.

The push for circular economy principles, driven by regulations like the EU's Ecodesign for Sustainable Products Regulation, emphasizes product durability, reusability, and repairability. This is further reinforced by upcoming EU rules in June 2025 requiring smartphones and tablets to be repairable for at least seven years, with spare parts and information available for that duration.

WE.CONNECT must adapt to these evolving environmental standards by integrating sustainable materials and energy-efficient production methods. For example, the global market for sustainable electronics is projected to reach $20.4 billion by 2027, highlighting a significant growth opportunity for environmentally conscious companies.

France's sustainability index for electronic equipment also plays a role, scoring products on repairability and update availability, encouraging longer product lifecycles and building brand loyalty for those that meet these expectations.

| Regulation/Factor | Effective Date | Key Requirement | WE.CONNECT Implication | Market Data/Context |

| France WEEE & Battery | January 2025 | Battery removability/replaceability | Product design adaptation | France collected ~900,000 tonnes WEEE in 2023 |

| EU Battery Regulation | Mid-2025 (for declarations) | Battery carbon footprint declarations | Supply chain transparency, manufacturing adjustments | Focus on lifecycle assessment of materials like lithium, cobalt |

| EU Eco-design (Smartphones/Tablets) | June 2025 | Durability, 7-year repairability/parts availability | Extended product lifecycles, repair service integration | France's sustainability index scores repairability |

| Sustainable Electronics Market | Projected 2027 | Growth in eco-friendly products | Opportunity for market share gain | Projected to reach $20.4 billion, CAGR 15.2% |

PESTLE Analysis Data Sources

Our We.Connect PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable financial institutions, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable and current information.