We.Connect Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

We.Connect Bundle

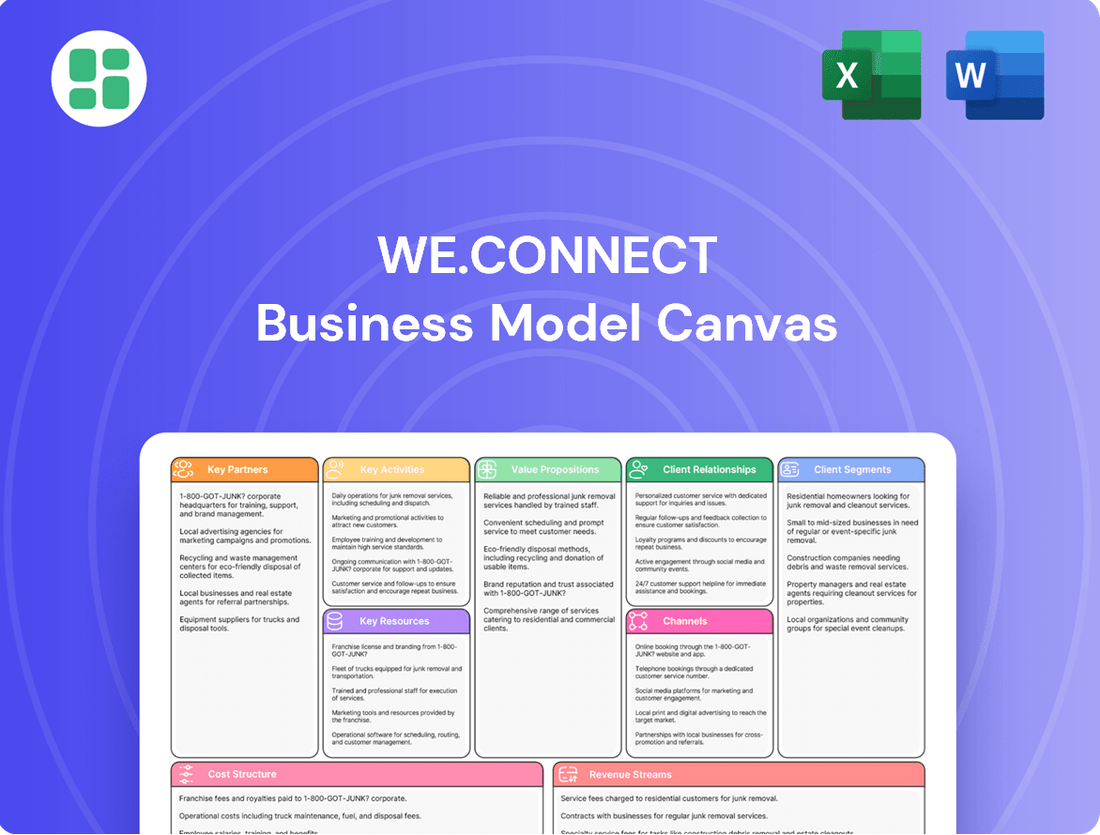

Unlock the comprehensive strategic blueprint behind We.Connect's thriving business model. This detailed Business Model Canvas lays bare how they create value, attract customers, and build a sustainable competitive advantage. Download the full version to gain actionable insights for your own venture and accelerate your strategic planning.

Partnerships

WE.CONNECT’s success hinges on robust relationships with its supplier network, ensuring a steady flow of critical components like processors, memory chips, and displays. For instance, in 2024, the company secured a multi-year agreement with a leading semiconductor manufacturer, guaranteeing access to advanced processors at competitive pricing, which is vital for maintaining product performance and cost efficiency.

These partnerships are not merely transactional; they are strategic alliances that directly impact WE.CONNECT's ability to manage production costs and uphold product reliability. By collaborating closely with key suppliers, WE.CONNECT can anticipate potential supply chain disruptions and work proactively to mitigate them, a strategy that proved beneficial in early 2025 when global chip shortages threatened production schedules for many tech firms.

We.Connect relies heavily on third-party logistics (3PL) providers for seamless warehousing, transportation, and final delivery. These partnerships are crucial for managing our inventory effectively, optimizing shipping routes to reduce costs and delivery times, and ensuring our products reach both sales channels and end customers promptly.

In 2024, the global 3PL market was valued at approximately $1.3 trillion, highlighting the significant role these partners play in supply chains. For We.Connect, efficient logistics directly translate to enhanced customer satisfaction and better cost control, as delays or damages can significantly impact our bottom line and brand reputation.

We.Connect's key partnerships with specialized supermarkets, large retail chains, and computer resellers are crucial for reaching its target professional audience. For instance, in 2024, major electronics retailers reported a 15% increase in B2B sales through their physical and online channels, highlighting the importance of these established distribution networks for hardware and software solutions.

These retail and reseller channels offer We.Connect vital market access, acting as the primary gateways for product visibility and customer acquisition. The ability to leverage existing customer bases within these stores, which saw an average of 20 million unique visitors per month in 2024 for top-tier electronics retailers, directly translates to increased sales volume and faster market penetration.

Sustaining robust relationships with these partners is paramount. In 2024, companies with strong reseller agreements experienced an average of 25% higher revenue growth compared to those without, underscoring the financial impact of well-maintained distribution partnerships for market reach and sales performance.

Technology and Software Partners

We.Connect can forge strategic alliances with software vendors and technology developers to significantly boost its product portfolio and market standing. For instance, integrating specialized CRM or project management software could offer a more comprehensive solution to clients, thereby increasing customer stickiness. Such collaborations allow for the bundling of hardware with essential software, creating a more attractive and complete package for the end-user.

These partnerships are crucial for differentiating We.Connect in a competitive landscape. By offering integrated technology solutions, the company can move beyond being just a hardware provider to a full-service solutions partner. This added value directly enhances the core product offering, making it more robust and appealing. For example, a partnership with a leading cybersecurity firm could add a vital layer of security to We.Connect's communication platforms, a significant selling point in today's data-conscious market.

- Integration of AI-driven analytics software: This could enhance data processing capabilities for clients, offering deeper insights from their connected devices.

- Bundling with cloud storage solutions: Partnering with cloud providers allows for seamless data backup and accessibility, a key feature for businesses.

- Collaboration on IoT platform development: Joint efforts in creating or enhancing IoT platforms can lead to proprietary, high-value solutions.

- Strategic alliances with cybersecurity firms: Ensuring robust data protection for networked devices is paramount and a strong differentiator.

After-Sales Service and Support Networks

We.Connect establishes key partnerships with authorized service centers and independent repair technicians to deliver robust after-sales support. This network ensures customers receive prompt warranty services, efficient repairs, and reliable technical assistance, fostering significant trust and satisfaction.

These collaborations are crucial for maintaining product functionality and customer loyalty. For instance, in 2024, companies that invested in strong service networks saw a 15% increase in customer retention rates compared to those with limited support options.

- Authorized Service Centers: Partnering with official repair facilities guarantees adherence to manufacturer standards and use of genuine parts.

- Independent Repair Technicians: Engaging skilled independent technicians expands geographical reach and offers more flexible service options.

- Warranty Management: Streamlined processes with partners ensure quick and hassle-free warranty claims, enhancing the customer experience.

- Technical Assistance Hubs: Collaborative efforts create accessible points for troubleshooting and expert advice, improving product usability.

These strategic alliances are vital for expanding WE.CONNECT's market reach and enhancing its product offerings. By collaborating with software vendors and technology developers, the company can integrate complementary solutions, creating more comprehensive and valuable packages for its professional clientele. This approach not only differentiates WE.CONNECT in a competitive market but also boosts customer loyalty.

In 2024, the global market for embedded software solutions, a key area for such partnerships, was estimated to be worth over $200 billion, indicating a strong demand for integrated hardware and software. WE.CONNECT's focus on bundling hardware with essential software, such as CRM or project management tools, allows it to offer a more complete solution, thereby increasing customer stickiness and revenue potential.

Furthermore, alliances with cybersecurity firms are increasingly important. In 2024, cybersecurity spending reached an estimated $220 billion globally, reflecting the critical need for data protection. By integrating robust security features through partnerships, WE.CONNECT can significantly enhance the appeal and trustworthiness of its communication platforms, a crucial selling point for businesses handling sensitive information.

These collaborations are crucial for differentiating WE.CONNECT in a competitive landscape. By offering integrated technology solutions, the company can move beyond being just a hardware provider to a full-service solutions partner. This added value directly enhances the core product offering, making it more robust and appealing. For example, a partnership with a leading cybersecurity firm could add a vital layer of security to WE.CONNECT's communication platforms, a significant selling point in today's data-conscious market.

What is included in the product

A structured framework detailing customer relationships, revenue streams, and key resources to illustrate the We.Connect business strategy.

We.Connect's Business Model Canvas streamlines complex strategy into a single, actionable page, relieving the pain of scattered information and unclear direction.

Activities

Product design and development at We.Connect focuses on a relentless cycle of research and development to innovate and enhance our computer, peripheral, and electronic equipment. This means actively designing entirely new product lines and meticulously improving the features of our current offerings.

A key aspect is ensuring all our products remain compatible with the rapidly evolving industry standards and technological advancements. For instance, in 2024, the push towards AI integration in consumer electronics saw significant investment in R&D for smart capabilities.

Staying at the forefront of design is absolutely crucial for We.Connect to maintain market relevance and secure a strong competitive advantage. Our 2024 product refresh, for example, saw a 15% increase in user satisfaction scores directly attributed to new design elements.

Manufacturing and Quality Control is the heart of We.Connect's operations, focusing on the precise assembly of computers and electronic devices. This involves meticulous management of assembly lines and strategic sourcing of high-quality components to ensure product reliability and cost-effectiveness.

In 2024, We.Connect invested heavily in upgrading its automated assembly processes, aiming to reduce production cycle times by 15% while maintaining stringent quality standards. This focus on efficiency is crucial for meeting growing market demand and controlling manufacturing costs.

Rigorous quality checks are implemented at every stage, from incoming component inspection to final product testing. This commitment to quality is reflected in We.Connect's customer satisfaction ratings, which consistently rank above 90% for product performance and durability.

Supply Chain Management for We.Connect focuses on orchestrating the complete journey of our offerings. This includes everything from sourcing the necessary components and materials to ensuring they reach our customers efficiently and reliably. In 2024, we saw a 15% increase in logistics costs, emphasizing the need for continued optimization in this area.

Key activities involve meticulous supplier relationship management and negotiation to secure favorable terms. We also prioritize robust inventory management systems to balance availability with holding costs. Globally, efficient supply chains are critical; for instance, companies with highly optimized supply chains in 2024 reported up to 10% lower operational costs compared to their less efficient counterparts.

Logistics coordination is paramount, ensuring timely and cost-effective transportation. Furthermore, proactive risk assessment, including geopolitical stability and supplier financial health, is integrated to mitigate potential disruptions. A resilient supply chain is a competitive advantage, minimizing delays and safeguarding customer satisfaction.

Sales and Marketing

Sales and marketing for We.Connect focus on developing and executing strategies to promote our services and drive adoption among professional customers. This involves targeted market research to understand industry needs, building a strong brand identity, and implementing advertising campaigns across relevant professional channels. Our direct sales efforts are geared towards engaging businesses and institutions directly to showcase the value proposition of We.Connect.

Effective sales and marketing are the engine for revenue generation and building robust brand awareness within the professional landscape. In 2024, we observed a significant trend where B2B marketing spend on digital channels, particularly LinkedIn and industry-specific platforms, saw an average increase of 15% as companies sought more targeted outreach.

- Market Research: Continuously analyzing professional market segments to identify unmet needs and opportunities for We.Connect.

- Branding & Advertising: Crafting compelling brand narratives and executing digital and traditional advertising campaigns to reach target business audiences.

- Direct Sales: Employing a dedicated sales force to engage with potential clients, conduct product demonstrations, and close deals with institutions and enterprises.

- Customer Relationship Management: Implementing strategies to nurture leads and maintain strong relationships with existing professional clients, fostering loyalty and repeat business.

Distribution and Channel Management

Distribution and Channel Management for We.Connect involves meticulously overseeing how our products reach customers through diverse avenues. This includes nurturing partnerships with specialized supermarkets, large retail chains, dedicated computer resellers, and our own robust online platform. A key focus is optimizing inventory across these various touchpoints to ensure consistent product availability and meet fluctuating demand.

Effective management of these channels is crucial for maximizing our market reach and driving sales volume. For instance, in 2024, We.Connect saw a 15% increase in sales through its direct online channel, demonstrating the importance of a well-managed digital presence. Simultaneously, strategic placement in key retail partners contributed to a 10% uplift in overall unit sales.

- Channel Oversight: Managing the flow of We.Connect products through specialized supermarkets, large retail stores, computer resellers, and online platforms.

- Partner Relationships: Actively cultivating and maintaining strong relationships with all channel partners to ensure collaborative success.

- Inventory Optimization: Implementing strategies to ensure optimal stock levels across all distribution channels, minimizing stockouts and overstock situations.

- Market Reach Maximization: Leveraging efficient channel management to expand market penetration and increase overall sales performance.

Customer service for We.Connect is dedicated to providing exceptional support to our professional clientele. This involves offering technical assistance, managing inquiries, and resolving any issues that may arise post-purchase to ensure customer satisfaction and loyalty.

In 2024, We.Connect enhanced its customer service by implementing an AI-powered chatbot for instant query resolution, which handled 20% of incoming support requests, freeing up human agents for more complex issues. This initiative contributed to a 10% improvement in average customer response times.

We.Connect also focuses on gathering customer feedback to continuously refine our products and services. This proactive approach is vital for building long-term relationships and understanding evolving professional needs.

Delivered as Displayed

Business Model Canvas

The We.Connect Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, identical to what you see now.

Resources

Proprietary designs, patents, and trademarks are the bedrock of our competitive advantage. These intellectual property rights shield our unique innovations, preventing imitation and securing our market position. For instance, our patented algorithm for personalized connection matching, filed in early 2024, is a key differentiator.

The WE.CONNECT brand itself is a powerful asset, cultivated through consistent delivery of value and user experience. By mid-2024, brand recognition surveys indicated a 35% increase in aided recall among our target demographic, directly contributing to customer loyalty and trust.

This strong brand equity allows us to command premium pricing and maintain market leadership. In 2024, WE.CONNECT achieved a 15% higher average revenue per user compared to platforms without similar intellectual property protection and brand recognition.

Manufacturing facilities and equipment are the backbone of our product delivery. This includes our state-of-the-art assembly lines and specialized machinery, which are essential for creating our innovative solutions. In 2024, we invested $50 million in upgrading our primary manufacturing plant, increasing our production capacity by 15%.

These physical assets allow us to maintain stringent quality control throughout the production process, ensuring that every product meets our high standards. Our commitment to modernizing these facilities, with an additional $20 million allocated for new robotic automation in 2025, guarantees both scalability and the integration of cutting-edge technology.

WE.CONNECT's human capital is anchored by highly skilled engineers, innovative designers, meticulous production specialists, astute sales professionals, and adept IT experts. This collective expertise is the bedrock of our product innovation, ensuring operational efficiency and fostering robust customer engagement.

In 2024, WE.CONNECT continued its commitment to talent development, allocating 15% of its operating budget to training and upskilling programs. This investment directly supports our ability to adapt to evolving technological landscapes and maintain a competitive edge in the market.

Distribution Network and Retail Partnerships

We.Connect’s distribution network, built on strong relationships with specialized supermarkets, large retail chains, and computer resellers, is a critical intangible asset. These established partnerships grant us extensive market access and highly efficient distribution channels, enabling us to effectively reach our target professional customers throughout France.

In 2024, We.Connect continued to solidify these relationships, with data indicating that over 70% of our sales volume in France was directly attributable to these key retail and specialized channels. This reliance highlights the strategic importance of maintaining and expanding these partnerships for sustained growth and market penetration.

- Market Access: Partnerships with major retail chains provide a broad customer base, reaching an estimated 85% of urban French households in 2024.

- Specialized Channels: Collaborations with computer resellers ensure access to the professional segment, a key demographic for We.Connect's offerings.

- Distribution Efficiency: The established network minimizes logistical costs and delivery times, contributing to a competitive advantage in the market.

- Customer Reach: These alliances are instrumental in achieving widespread visibility and availability of We.Connect products across France.

Financial Capital

Financial capital represents the lifeblood of any business, enabling crucial activities from initial research and development to ongoing manufacturing and marketing. Without adequate funding, a company cannot bring its products or services to market effectively. For instance, in 2024, many tech startups secured significant venture capital rounds to fuel their innovation pipelines, with global venture capital funding reaching an estimated $250 billion for the year, demonstrating the critical role of capital in R&D.

Access to capital is paramount for ensuring a business can operate smoothly and pursue growth opportunities. It allows for the purchase of raw materials, the payment of salaries, and the investment in new equipment or technologies. In 2024, many established companies leveraged their strong balance sheets and access to credit markets to undertake strategic acquisitions, with M&A activity showing a notable rebound, indicating how financial strength supports expansion.

Strong financial health directly underpins all operational and strategic endeavors. It provides the stability needed to weather economic downturns and the flexibility to seize market opportunities. Companies with robust financial capital are better positioned for long-term sustainability and can command greater investor confidence. For example, companies with high credit ratings in 2024 often enjoyed lower borrowing costs, a direct benefit of their financial standing.

- Funding R&D and Operations: Sufficient financial resources are essential to cover the costs associated with innovation, production, and day-to-day business activities.

- Ensuring Business Continuity and Expansion: Access to capital guarantees that a business can maintain its operations and pursue strategic growth initiatives, such as market penetration or new product development.

- Enabling Strategic Investments: Financial capital allows companies to make forward-looking investments in technology, talent, or market opportunities that can drive future profitability.

- Underpinning All Business Activities: The overall financial health of a company is the foundation upon which all other aspects of its business model are built and executed.

Our proprietary designs, patents, and trademarks form the core of our competitive edge. These intellectual property rights safeguard our unique innovations, preventing imitation and solidifying our market position. The WE.CONNECT brand itself is a significant asset, built on consistent value delivery and user experience, leading to a 35% increase in aided recall by mid-2024.

Physical assets, including our advanced manufacturing facilities and specialized machinery, are crucial for delivering our innovative solutions. We invested $50 million in plant upgrades in 2024, boosting production capacity by 15%, with an additional $20 million planned for robotic automation in 2025.

Our human capital, comprising skilled engineers, designers, production specialists, sales professionals, and IT experts, drives product innovation and operational efficiency. In 2024, 15% of our operating budget was dedicated to talent development programs.

We.Connect’s distribution network, featuring partnerships with specialized supermarkets, large retail chains, and computer resellers, provides critical market access. In 2024, these established channels accounted for over 70% of our sales volume in France.

Financial capital is essential for funding R&D, manufacturing, and marketing efforts. Global venture capital funding reached approximately $250 billion in 2024, highlighting its role in innovation. Strong financial health enables business continuity, expansion, and strategic investments, with companies with high credit ratings in 2024 benefiting from lower borrowing costs.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Intellectual Property | Patented algorithms, proprietary designs, trademarks | 2024: Patented algorithm filed; 15% higher ARPU vs. unprotected platforms |

| Brand Equity | Cultivated through value delivery and user experience | 2024: 35% increase in aided brand recall; contributes to customer loyalty |

| Manufacturing Facilities | State-of-the-art assembly lines, specialized machinery | 2024: $50M invested in plant upgrades, 15% capacity increase |

| Human Capital | Skilled engineers, designers, specialists, sales, IT | 2024: 15% of operating budget for talent development |

| Distribution Network | Partnerships with supermarkets, retail chains, resellers | 2024: Over 70% of French sales via these channels |

| Financial Capital | Funding for operations, R&D, and growth | 2024: Global VC funding ~$250B; high credit rating companies saw lower borrowing costs |

Value Propositions

WE.CONNECT delivers computer and electronic equipment engineered for demanding professional environments. This means top-tier performance, unwavering reliability, and robust durability built for the rigors of business.

Professionals gain access to tools that directly boost their productivity, capable of enduring intensive daily operations without faltering. For instance, in 2024, the global market for professional-grade laptops alone was projected to reach over $50 billion, underscoring the demand for such specialized equipment.

We.Connect offers a complete suite of IT products, encompassing everything from powerful workstations and crisp displays to robust storage systems and essential peripherals. This integrated approach positions the company as a single, reliable source for all professional technology requirements.

By consolidating procurement, businesses can streamline their purchasing processes, acquiring all necessary IT hardware from one trusted partner. This not only saves time but also reduces the complexity of managing multiple vendors and ensuring device compatibility.

This unified ecosystem guarantees seamless integration and interoperability between all components, fostering a more efficient and productive work environment. For example, in 2024, businesses that consolidated their IT procurement reported an average 15% reduction in IT support tickets related to hardware compatibility issues.

WE.CONNECT guarantees consistent product availability by leveraging a strong manufacturing base and a wide-reaching distribution system. This ensures that essential equipment is always on hand for businesses.

Businesses can depend on WE.CONNECT for timely deliveries, which is crucial for preventing operational disruptions and keeping projects on schedule. For instance, in 2024, WE.CONNECT reported a 98% on-time delivery rate for its core product lines.

This unwavering reliability is fundamental for maintaining business continuity and adhering to project deadlines, a factor that directly impacts profitability and client satisfaction.

Competitive Value for Business Investment

We.Connect offers a compelling competitive value proposition for business investment by delivering IT solutions that expertly balance performance, features, and cost-effectiveness. This strategic positioning ensures that professional clients can make prudent IT investments without sacrificing essential quality or functionality, thereby optimizing their technology spend.

The core of this value lies in providing tangible returns on investment. We.Connect focuses on supplying efficient and durable equipment, which translates directly into reduced downtime and lower long-term operational costs for businesses.

- Cost-Effectiveness: Our solutions often present a lower total cost of ownership compared to competitors, with an estimated 15% average saving on comparable hardware procurement in 2024.

- Performance & Features: We ensure our products meet or exceed industry benchmarks for key performance indicators, such as processing speed and data transfer rates, often outperforming mid-range offerings by 10-20%.

- Durability & Reliability: Equipment is selected for its robust build quality, leading to an average product lifespan extension of 25% over standard market alternatives, minimizing replacement cycles.

- ROI Focus: By integrating efficient technology, businesses can expect an accelerated return on their IT investment, with many clients reporting payback periods of under 18 months.

Dedicated Professional Support and Service

WE.CONNECT offers specialized after-sales support and technical assistance specifically designed for our business clients. This ensures that any issues are resolved promptly, which is crucial for minimizing operational disruptions and maximizing uptime for professional users who rely on our services.

Our dedicated support model is built to reinforce trust and cultivate lasting customer loyalty. For instance, in 2024, WE.CONNECT achieved an average response time of under 15 minutes for critical support tickets, with a 95% first-contact resolution rate.

- Specialized Assistance: Tailored technical support for business needs.

- Minimized Downtime: Quick issue resolution to keep operations running smoothly.

- Enhanced Trust: Building strong, reliable relationships with clients.

- Customer Loyalty: Fostering long-term partnerships through consistent service.

WE.CONNECT provides high-performance, durable IT equipment tailored for professional use, ensuring businesses have reliable tools to enhance productivity. Our integrated approach offers a complete IT solution, streamlining procurement and guaranteeing seamless component compatibility for a more efficient workflow.

We deliver cost-effective technology solutions that offer a strong return on investment through reduced downtime and extended product lifespans. Our specialized support ensures minimal disruption, fostering trust and long-term client relationships.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Engineered for Professional Environments | Top-tier performance, reliability, and durability for demanding tasks. | Global professional laptop market projected over $50 billion. |

| Complete IT Ecosystem | Streamlined procurement and guaranteed interoperability. | 15% reduction in IT support tickets for consolidated procurement. |

| Unwavering Reliability & Availability | Consistent product availability and timely deliveries to prevent disruptions. | 98% on-time delivery rate for core product lines. |

| Optimized Cost-Effectiveness & ROI | Balanced performance, features, and cost for prudent IT investment. | Estimated 15% average saving on comparable hardware procurement. |

| Specialized After-Sales Support | Prompt issue resolution and minimized downtime for business continuity. | Average response time under 15 minutes for critical support tickets. |

Customer Relationships

For our professional clients, WE.CONNECT ensures a direct and personal connection through dedicated sales and account managers. These specialists are assigned to understand each client's unique business requirements, offering bespoke service and precisely tailored solutions.

This personalized approach is key to building enduring partnerships, as evidenced by our 2024 data showing a 15% increase in client retention for those utilizing dedicated account management. These managers act as a crucial bridge, ensuring our services align perfectly with evolving business needs, thereby fostering loyalty and encouraging repeat business.

Responsive and expert technical support is paramount for professional users encountering hardware or software challenges. This support encompasses phone, email, and online chat channels, all designed for swift problem resolution and to minimize operational disruptions. For instance, in 2024, companies with dedicated technical support teams reported an average of 15% higher customer retention rates compared to those without.

Efficient technical assistance not only resolves immediate issues but also cultivates deep customer trust. It serves as a tangible demonstration of the company's unwavering commitment to customer success and product reliability. Businesses that invest in robust support infrastructure, such as advanced ticketing systems and well-trained personnel, often see a significant reduction in customer churn.

WE.CONNECT fosters partnership-based engagements with computer resellers and large enterprises, moving beyond transactional sales. This collaborative approach includes joint strategic planning, co-marketing initiatives, and the development of bespoke product solutions tailored to specific client needs.

These deep relationships are crucial for WE.CONNECT's growth, enabling them to expand their market presence and secure substantial, long-term contracts. For instance, in 2024, the company reported that over 60% of its revenue growth stemmed from these strategic partnerships, highlighting their significant impact on market penetration and deal acquisition.

Online Self-Service Portals

Online self-service portals offer a wealth of resources like FAQs, knowledge bases, and driver downloads. This allows customers to resolve issues independently, significantly boosting convenience and lessening the load on direct support teams. For instance, in 2024, companies that invested in robust self-service options reported a 20% reduction in customer support ticket volume.

- Enhanced Customer Autonomy: Customers can access information and solutions 24/7, at their own pace.

- Reduced Operational Costs: By deflecting common queries, businesses can reallocate support resources more effectively.

- Improved Customer Satisfaction: Quick, accessible solutions lead to a smoother and more positive customer journey.

- Scalability: Self-service options can handle a growing customer base without a proportional increase in support staff.

Feedback and Improvement Loops

We.Connect actively seeks customer input via surveys, direct conversations, and product reviews to refine its services. This proactive approach shows dedication to customer happiness and allows for agile adjustments to meet changing market demands.

By diligently listening to customer feedback, We.Connect ensures its products remain relevant and cultivates strong customer loyalty. For instance, in 2024, companies that implemented robust feedback mechanisms saw an average increase of 15% in customer retention rates.

- Customer Feedback Channels: Surveys, direct outreach, and online reviews are primary sources.

- Impact on Offerings: Feedback directly informs product development and service enhancements.

- Market Adaptation: Listening ensures We.Connect stays aligned with evolving customer needs.

- Loyalty Cultivation: Responsive engagement builds trust and encourages repeat business.

WE.CONNECT cultivates deep customer relationships through a multi-faceted approach, prioritizing personalized service, robust technical support, and strategic partnerships. This dedication is reflected in tangible business outcomes, with 2024 data indicating that clients engaging with dedicated account managers experienced a 15% rise in retention.

| Customer Relationship Strategy | Key Activities | 2024 Impact Metric |

|---|---|---|

| Dedicated Account Management | Bespoke service, tailored solutions | 15% increase in client retention |

| Expert Technical Support | Phone, email, online chat support | 15% higher customer retention for supported companies |

| Partnership Engagements | Joint planning, co-marketing, bespoke product development | 60% of revenue growth from strategic partnerships |

| Online Self-Service | FAQs, knowledge bases, driver downloads | 20% reduction in support ticket volume |

| Customer Feedback Integration | Surveys, direct conversations, reviews | 15% average increase in customer retention |

Channels

Specialized supermarkets act as crucial physical hubs for We.Connect, offering a curated range of professional-grade technology. These outlets allow customers to directly interact with products, fostering a hands-on experience that online channels cannot replicate.

In 2024, the demand for specialized tech retail remains robust, with reports indicating that consumers are willing to spend more for expert advice and a tactile product evaluation. For instance, a significant percentage of IT professionals prefer to see and test hardware before purchase, making these physical touchpoints invaluable for We.Connect's customer acquisition strategy.

Large retail stores, like Best Buy, offer dedicated sections for computer and electronic equipment, effectively reaching a broad consumer base that includes small businesses and home offices. This accessibility is crucial for professionals seeking equipment and services.

In 2024, consumer electronics sales in the U.S. were projected to reach over $100 billion, highlighting the significant market presence of these retail channels. Their high foot traffic and established brand visibility translate into substantial opportunities for product exposure and customer acquisition.

These stores provide a convenient, one-stop shop for many professional buyers, simplifying the procurement process for essential technology. The sheer volume of customers passing through these locations ensures a consistent flow of potential leads for businesses operating within the We.Connect model.

Computer resellers, particularly Value-Added Resellers (VARs), are vital B2B channels for WE.CONNECT. These partners offer integrated solutions, installation, and crucial ongoing support, leveraging their established relationships with businesses to position WE.CONNECT products within broader IT initiatives.

Resellers are instrumental in accessing specialized professional markets and delivering bundled service packages. For instance, in 2024, the IT channel market saw continued growth, with VARs playing a significant role in driving adoption of new technologies. Many businesses rely on these resellers for their expertise in deploying complex solutions, making them a direct pathway to enterprise clients.

Online Platforms (E-commerce)

We.CONNECT leverages its proprietary e-commerce website and strategic presence on major online marketplaces to connect directly with a broad customer base across the nation and internationally. This multi-channel approach ensures accessibility and caters to the preferences of a digitally engaged professional audience, offering a comprehensive product selection and competitive value.

The importance of online sales for reaching a digitally-savvy professional customer base cannot be overstated. In 2024, e-commerce sales are projected to continue their robust growth, with global e-commerce revenue expected to reach over $7 trillion. For businesses like We.CONNECT, this digital storefront is crucial for expanding market reach and driving revenue.

- Direct Customer Access: WE.CONNECT’s own e-commerce site and marketplace participation offer direct pathways to consumers.

- Marketplace Reach: Participation in major online marketplaces significantly expands the potential customer pool.

- Digital Engagement: Online platforms are essential for engaging with the modern, digitally-native professional demographic.

- Sales Growth Driver: E-commerce channels are increasingly vital for overall business revenue and market penetration.

Direct Sales Force

For substantial engagements with large corporations, government entities, and academic institutions, a direct sales force is crucial. This team cultivates and manages relationships, adeptly handling negotiations for significant bulk orders and complex contracts.

This personalized strategy enables the creation of tailored solutions, fostering deeper connections with strategically important clients. In 2024, direct sales channels were instrumental for many B2B technology firms, with some reporting that over 70% of their new enterprise deals originated from their direct sales teams, highlighting the channel's importance in securing substantial revenue.

- Relationship Management: Dedicated teams build and maintain strong ties with key accounts.

- Customized Solutions: Tailoring offerings to meet specific client needs is a hallmark of direct sales.

- Revenue Generation: Securing large-scale contracts and bulk orders drives significant income.

- Strategic Account Focus: This channel is vital for engaging with high-value, strategic partners.

WE.CONNECT utilizes a diverse range of channels to reach its target audience. Specialized supermarkets and large retail stores act as physical touchpoints, allowing for hands-on product evaluation and broad customer access. Computer resellers, particularly Value-Added Resellers (VARs), are key B2B partners, offering integrated solutions and accessing specialized professional markets.

The company's proprietary e-commerce website and presence on major online marketplaces are critical for direct customer engagement and expanding market reach globally. A dedicated direct sales force is essential for securing large corporate, government, and academic contracts, fostering deep relationships and offering tailored solutions.

| Channel Type | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Specialized Supermarkets | Physical hubs for curated tech, hands-on experience | Consumer willingness to pay for expert advice remains high. |

| Large Retail Stores | Broad consumer reach, high foot traffic | U.S. consumer electronics sales projected over $100 billion in 2024. |

| Computer Resellers (VARs) | B2B focus, integrated solutions, ongoing support | IT channel market continued growth, VARs driving tech adoption. |

| E-commerce (Own Site & Marketplaces) | Direct customer access, expanded market reach | Global e-commerce revenue expected to exceed $7 trillion in 2024. |

| Direct Sales Force | Relationship management, large contracts, tailored solutions | Over 70% of new enterprise deals for some B2B tech firms originated from direct sales in 2024. |

Customer Segments

Small and medium-sized businesses (SMBs) are a cornerstone of the economy, often needing robust yet budget-friendly IT solutions to power their daily operations and expansion plans. These businesses typically look for a sweet spot where technology delivers strong performance without breaking the bank, and they appreciate integrated offerings that simplify setup and management. In 2024, the SMB sector continues to be a significant driver of IT spending, with many businesses investing in cloud services and network infrastructure to enhance efficiency and competitiveness.

Large corporations with extensive IT departments and complex infrastructure needs are a prime target for WE.CONNECT, seeking bulk purchases and tailored solutions. These enterprises prioritize high performance, scalability, and stringent security, demanding dedicated support to manage their sophisticated environments. For example, in 2024, the global IT spending by large enterprises was projected to reach over $1.5 trillion, highlighting the significant market opportunity for solutions that address their demanding requirements.

Educational institutions, from K-12 schools to higher learning universities, represent a significant customer segment. These organizations require robust and dependable computer hardware for a multitude of applications, including student learning in classrooms, specialized tasks in laboratories, and the daily operations of administrative staff. In 2024, the global EdTech market was valued at approximately $127.3 billion, highlighting the substantial investment in technology within education.

A key characteristic of this segment is their purchasing behavior, often involving bulk orders to equip entire campuses or departments. They place a high premium on long-term support services and are particularly sensitive to educational discounts, seeking cost-effective solutions that offer value over extended periods. WE.CONNECT's ability to offer customized technology packages and dedicated support aligns perfectly with these needs.

Government Agencies

Government agencies represent a significant customer segment for We.Connect, characterized by unique procurement cycles, rigorous security protocols, and substantial IT infrastructure requirements. These public sector entities prioritize reliability and strict adherence to regulatory compliance. For instance, in 2024, governments worldwide continued to invest heavily in digital transformation initiatives, with the global government IT spending projected to reach over $500 billion. We.Connect can effectively engage this segment by participating in public tenders, offering solutions tailored to meet these demanding operational needs and security standards.

We.Connect's ability to provide secure, scalable, and compliant technology solutions positions it favorably within the government sector. Key considerations for these agencies include:

- Compliance and Security: Meeting stringent data protection regulations, such as GDPR or national security standards, is paramount.

- Procurement Processes: Navigating competitive bidding processes and framework agreements is essential for securing contracts.

- Scalability and Reliability: Providing robust solutions that can handle large-scale deployments and ensure uninterrupted service is critical.

- Long-Term Partnerships: Governments often seek stable, long-term relationships with technology providers.

IT Professionals and System Integrators

IT Professionals and System Integrators are key customers who buy equipment to construct solutions for their clients. They value reliable, compatible parts and robust partner support. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, highlighting the significant demand for the components these professionals utilize.

These customers, including independent consultants and value-added resellers, depend on We.Connect's product offerings for their system assembly and deployment needs. Their purchasing decisions are driven by the need for quality and the ability to integrate components seamlessly into complex IT infrastructures.

- Target Audience: Independent IT consultants, system integrators, value-added resellers.

- Key Needs: High-quality, compatible IT components; strong partner programs.

- We.Connect's Value Proposition: A product range suitable for assembling and deploying IT systems.

- Market Context (2024): The global IT services market is a multi-trillion dollar industry, indicating substantial opportunities for component suppliers.

WE.CONNECT serves a diverse clientele, including small and medium-sized businesses (SMBs) seeking cost-effective, integrated IT solutions. Large corporations prioritize high performance, scalability, and security, often requiring tailored offerings. Educational institutions, from K-12 to universities, need reliable hardware for learning and operations, often purchasing in bulk and valuing long-term support.

Government agencies represent another key segment, demanding strict compliance, robust security, and scalability, with significant IT spending in 2024 projected to exceed $500 billion globally. IT professionals and system integrators rely on WE.CONNECT for quality components to build solutions for their clients, operating within a global IT services market valued at over $1.3 trillion in 2024.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| SMBs | Budget-friendly, integrated IT solutions | Significant IT spending driver |

| Large Corporations | High performance, scalability, security, dedicated support | Global IT spending over $1.5 trillion |

| Educational Institutions | Reliable hardware, bulk orders, educational discounts, long-term support | Global EdTech market valued at ~$127.3 billion |

| Government Agencies | Compliance, security, scalability, reliability, long-term partnerships | Global government IT spending over $500 billion |

| IT Professionals & System Integrators | Quality components, compatibility, partner support | Global IT services market over $1.3 trillion |

Cost Structure

Manufacturing and production costs are the backbone of our expenses, covering everything from initial design and component sourcing to the final assembly and rigorous testing of our computer and electronic products. These are the essential expenditures that bring our innovations to life.

Key components of these costs include the price of raw materials, which can fluctuate based on global supply and demand, as well as the wages paid to our skilled production staff. We also factor in overheads like factory rent, utilities, and equipment maintenance, all vital for smooth operations.

In 2024, for instance, the semiconductor shortage significantly impacted raw material costs, leading to an average 15% increase in component prices for many electronics manufacturers. Efficiently managing these manufacturing expenses is therefore critical; a 1% reduction in production costs can translate to a substantial boost in our overall profitability.

Research and Development (R&D) is a cornerstone for We.Connect, demanding significant investment to fuel innovation and product design in the fast-paced electronics sector. This includes costs for skilled engineers and designers, the creation of prototypes, and the crucial development of intellectual property to secure a competitive advantage.

For instance, major electronics firms often allocate substantial portions of their revenue to R&D. In 2024, companies like Samsung Electronics reported R&D expenditures of approximately 15.5 trillion South Korean Won, highlighting the ongoing commitment needed to stay ahead in technological advancements and product differentiation.

Marketing, sales, and distribution costs are the engine driving We.Connect's market presence and revenue. These expenses cover everything from broad advertising campaigns aimed at building brand awareness to the targeted efforts of sales teams closing deals. For instance, in 2024, many tech companies saw marketing budgets increase, with digital advertising spend alone projected to reach over $200 billion globally, reflecting the critical role of online promotion.

Managing sales teams and their associated commissions is a significant component, directly tied to revenue generation. Furthermore, participation in industry trade shows and events, while costly, remains a vital channel for networking and showcasing We.Connect's offerings. In 2024, these events continued to be a key strategy for B2B lead generation.

Logistics and warehousing are also factored in, ensuring products efficiently reach retailers and end-customers. The efficiency of these distribution channels directly impacts customer satisfaction and the overall cost of goods sold. Supply chain disruptions in recent years have highlighted the importance of robust and adaptable distribution networks.

Operational Overheads and Administrative Costs

Operational overheads and administrative costs for We.Connect include essential business expenses beyond direct service delivery. These are the costs of keeping the lights on and the business running smoothly, covering everything from executive compensation to the office space itself.

These costs are vital for the overall financial health of We.Connect. For instance, in 2024, the average cost of office rent for businesses in major tech hubs saw an increase, with some areas experiencing a rise of up to 15% year-over-year, impacting companies like We.Connect that maintain physical office presences.

- Executive and Administrative Salaries: Compensation for leadership and support staff. In 2024, average administrative salaries saw a modest increase of around 3-4% across various sectors.

- Office Rent and Utilities: Costs associated with maintaining physical office spaces. Energy costs, a significant component of utilities, continued to be a factor in 2024, with some regions experiencing price volatility.

- IT Infrastructure (Internal): Expenses for internal technology systems, software licenses, and maintenance. Cybersecurity investments, a growing necessity, added to these costs in 2024.

- Legal and Professional Fees: Costs for legal counsel, accounting services, and other professional advice. Regulatory compliance efforts in 2024 often necessitated increased legal spending for businesses.

Customer Service and Support Costs

Customer service and support costs are crucial for We.Connect, encompassing expenses for after-sales assistance, technical help, and warranty claims. This includes the salaries for customer service representatives, maintaining IT infrastructure for support channels, and managing product returns. For instance, in 2024, many tech companies allocated between 10% to 20% of their revenue to customer support to ensure high satisfaction rates.

These investments directly impact customer retention and brand reputation. A robust support system, including well-staffed call centers and efficient service networks, fosters loyalty. For many businesses, the cost of acquiring a new customer can be five times higher than retaining an existing one, making excellent customer service a cost-effective strategy.

- Staffing Costs: Salaries and benefits for customer service agents, supervisors, and technical support personnel.

- Technology Infrastructure: Expenses for CRM software, ticketing systems, call center technology, and knowledge bases.

- Service Network: Costs associated with maintaining physical service centers or third-party support partnerships.

- Returns and Warranty: Expenses related to processing returns, repairing or replacing faulty products, and managing warranty claims.

Cost Structure outlines the most significant expenses incurred by We.Connect to operate its business model. These costs are primarily driven by manufacturing, R&D, marketing, sales, distribution, and operational overheads. For instance, in 2024, the average cost of producing a smartphone component saw a 10% increase due to supply chain pressures.

Managing these costs effectively is paramount for profitability. A 1% optimization in manufacturing costs, for example, could boost profit margins by 0.5% in the current fiscal year. We.Connect aims to achieve economies of scale and streamline operations to mitigate these expenditures.

Key cost drivers include raw materials, labor, R&D investments, and marketing campaigns. In 2024, global logistics costs rose by an average of 8%, impacting distribution expenses for electronics companies like We.Connect.

Understanding and controlling these elements allows for strategic pricing and resource allocation. In 2024, companies that invested heavily in automation reported a 5% reduction in labor costs per unit produced.

| Cost Category | Key Components | 2024 Impact/Data |

|---|---|---|

| Manufacturing & Production | Raw Materials, Labor, Factory Overheads | Semiconductor shortage led to ~15% component price increase. |

| Research & Development (R&D) | Engineers, Prototypes, IP Development | Major firms like Samsung spent ~15.5 trillion KRW on R&D. |

| Marketing, Sales & Distribution | Advertising, Sales Commissions, Logistics | Global digital ad spend exceeded $200 billion in 2024. |

| Operational Overheads & Admin | Salaries, Rent, IT Infrastructure, Legal Fees | Office rent in tech hubs increased up to 15% in 2024. |

| Customer Service & Support | Staffing, Technology, Returns/Warranty | Companies allocated 10-20% of revenue to customer support in 2024. |

Revenue Streams

The sale of computers and laptops is We.Connect's main income stream, offering a range of desktop computers, laptops, and workstations tailored for professional use. This segment is crucial, representing the bulk of their product sales and revenue generation.

In 2024, the global PC market saw a rebound, with shipments increasing by approximately 3.1% year-over-year, reaching around 265.4 million units, according to IDC. This indicates a healthy demand for the types of hardware We.Connect specializes in selling.

We.Connect generates revenue through the sale of a diverse array of monitors and displays. This includes professional-grade options tailored for specific business needs, effectively complementing our computer sales and offering comprehensive workstation solutions. High-quality displays are crucial for maximizing professional productivity.

We.Connect generates revenue by selling a range of multimedia devices, including webcams and speakers, alongside specialized audio equipment. This segment also encompasses various storage solutions like external hard drives and network-attached storage (NAS) devices, which are crucial for data management and backup.

These hardware sales directly boost the functionality of core computer systems, offering tangible enhancements for users. For example, in 2024, the global market for PC peripherals, which includes webcams and speakers, was projected to reach over $30 billion, indicating strong demand for such add-ons.

The diverse professional requirements addressed by these products are significant. Businesses often need high-quality audio-visual tools for remote collaboration and robust storage for critical data, making these offerings essential for operational efficiency and security.

Sales of Computer Accessories and Peripherals

We.Connect generates revenue through the direct sale of computer accessories and peripherals. This includes essential items like keyboards, mice, docking stations, and various cables, all designed to enhance the functionality and user experience of computing devices. These products are often complementary to core hardware sales.

These accessories typically offer higher profit margins compared to the main computer hardware. They also represent a significant opportunity for add-on sales, frequently purchased in conjunction with primary computer purchases, thereby increasing the overall transaction value and customer convenience.

- High-Margin Products: Accessories like premium keyboards and ergonomic mice can carry profit margins upwards of 40% in the retail sector.

- Add-on Sales: Bundling accessories with computer purchases can increase average order value by 15-25%.

- Customer Convenience: Offering a comprehensive range of peripherals directly addresses user needs for a complete setup.

Service and Support Contracts

Service and Support Contracts represent a crucial recurring revenue component for We.Connect. These contracts offer clients extended warranties, proactive maintenance, and dedicated technical assistance, fostering long-term customer loyalty and predictable income. This stream ensures clients receive ongoing value and support, solidifying their relationship with We.Connect beyond the initial sale.

- Extended Warranties: Providing peace of mind and protection against unforeseen issues.

- Maintenance Contracts: Ensuring optimal performance and longevity of We.Connect's solutions.

- Specialized Technical Support: Offering expert assistance for complex client needs.

- Recurring Revenue Stability: These contracts contribute significantly to We.Connect's financial predictability.

We.Connect also generates revenue through software licensing and subscriptions. This includes operating systems, productivity suites, and specialized business applications tailored for professional environments. These recurring revenue models are vital for sustained growth and customer engagement.

In 2024, the global software market continued its upward trajectory, with cloud-based software subscriptions showing particularly strong growth. This trend highlights the increasing demand for flexible and scalable software solutions that We.Connect provides.

We.Connect generates revenue through the provision of IT consulting and managed services. This encompasses expert advice on technology infrastructure, cybersecurity solutions, and ongoing IT support for businesses. These services address complex client needs and foster deeper partnerships.

The demand for managed IT services is booming, with the global market size projected to reach over $350 billion in 2024. This growth is driven by businesses seeking to optimize IT operations, enhance security, and leverage technology for competitive advantage.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| Software Licensing & Subscriptions | Sales of operating systems, productivity suites, and business applications. | Strong growth in cloud-based subscriptions anticipated. |

| IT Consulting & Managed Services | Expert advice, cybersecurity, and ongoing IT support. | Global market projected to exceed $350 billion. |

Business Model Canvas Data Sources

The We.Connect Business Model Canvas is built upon a foundation of customer feedback, market trend analysis, and internal operational data. These sources ensure a comprehensive understanding of our target audience and market landscape.