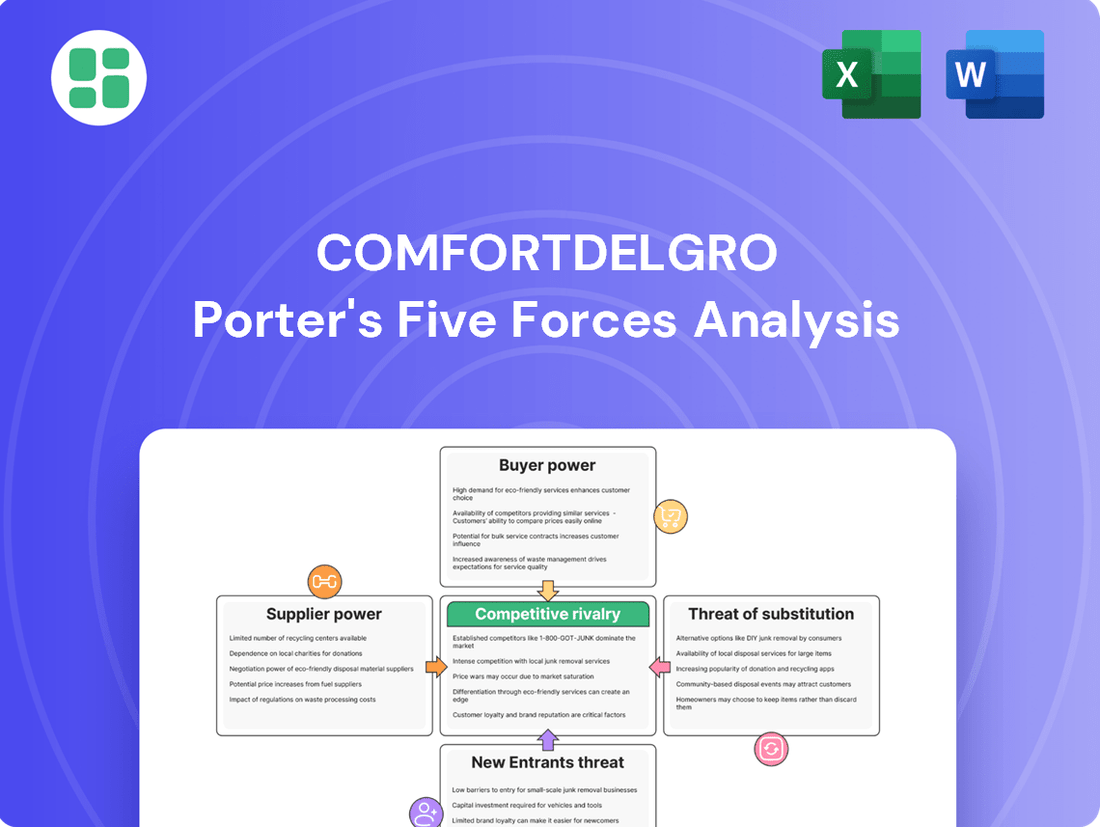

ComfortDelGro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ComfortDelGro Bundle

ComfortDelGro navigates a complex landscape shaped by intense rivalry among existing players and the constant threat of new entrants disrupting the market. Understanding the bargaining power of both suppliers and buyers is crucial for their operational efficiency and pricing strategies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ComfortDelGro’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The global driver shortage significantly boosts the bargaining power of drivers for ComfortDelGro. This scarcity means drivers can demand higher wages or incentives, directly impacting the company's operational expenses for its taxi and bus services. For instance, in 2024, many transportation companies reported increased labor costs due to these shortages.

While ComfortDelGro's public transport contracts often feature fuel indexation, the fluctuating cost of energy still gives fuel suppliers a degree of influence. Even with these mechanisms in place to lessen direct impacts, sharp price increases or interruptions in supply can empower energy providers during negotiations. ComfortDelGro actively tracks oil price shifts and uses forward contracts to manage this exposure, highlighting energy as a crucial input.

ComfortDelGro's commitment to electrifying its fleet, aiming for 60% cleaner energy vehicles by 2024, significantly bolsters the bargaining power of electric vehicle (EV) and charging infrastructure suppliers. This strategic shift means ComfortDelGro is increasingly dependent on a smaller pool of specialized manufacturers and technology providers for its new electric buses and commercial vans.

Supplier Power 4

Suppliers of specialized automotive engineering, vehicle testing equipment, and digital solutions wield significant bargaining power over ComfortDelGro. Their offerings are often highly technical and sometimes proprietary, making it difficult for ComfortDelGro to find readily available alternatives. This reliance on niche expertise means suppliers can command higher prices or dictate terms.

ComfortDelGro’s commitment to operational excellence necessitates the use of high-quality, often advanced, technologies and services. For instance, in 2024, the automotive sector saw continued investment in advanced diagnostics and fleet management software, areas where specialized suppliers are key. The specialized nature of these inputs limits ComfortDelGro’s ability to switch suppliers without incurring substantial costs or compromising operational efficiency.

- Specialized Technology: Suppliers of advanced automotive engineering and digital fleet management solutions possess unique expertise.

- High Switching Costs: ComfortDelGro faces significant costs and operational disruptions if it attempts to change suppliers for critical technologies.

- Limited Alternatives: The niche nature of these services restricts the availability of comparable substitutes.

- Industry Trends: Ongoing advancements in autonomous driving technology and predictive maintenance software in 2024 further solidify the power of suppliers in these specialized fields.

Supplier Power 5

Regulatory bodies, like Singapore's Land Transport Authority (LTA), act as powerful suppliers by granting essential operating licenses and defining the regulatory environment. The Transport Sector (Critical Firms) Act 2024, effective April 2025, heightens compliance burdens for critical transport entities, effectively increasing operational costs and supplier leverage.

This framework directly influences ComfortDelGro's strategic decisions by dictating operational parameters and access to the market.

- Regulatory Framework: The LTA's licensing and operational guidelines are pivotal.

- Increased Compliance: The Transport Sector (Critical Firms) Act 2024 imposes new obligations.

- Operational Costs: Stricter regulations can lead to higher compliance and operational expenses.

- Market Access: Adherence to regulatory mandates is crucial for continued market participation.

The bargaining power of suppliers for ComfortDelGro is influenced by several key factors, including driver availability, energy costs, and specialized technology providers. The global driver shortage in 2024 significantly increased driver leverage, leading to higher wage demands. Similarly, while fuel indexation helps, energy suppliers still retain influence due to potential price volatility.

ComfortDelGro's shift towards electric vehicles (EVs) in 2024 has amplified the bargaining power of EV and charging infrastructure suppliers, as the company becomes more reliant on a limited pool of specialized manufacturers. Furthermore, suppliers of advanced automotive engineering and digital fleet management solutions hold considerable sway due to the technical and often proprietary nature of their offerings, making alternatives scarce and switching costly.

| Supplier Category | Impact on ComfortDelGro | Key Factors | 2024 Data/Trend |

|---|---|---|---|

| Drivers | High Bargaining Power | Global shortage, wage demands | Increased labor costs reported across transportation sector |

| Energy Providers | Moderate Bargaining Power | Fuel price volatility, supply disruptions | Continued tracking of oil prices and use of forward contracts |

| EV & Charging Infrastructure | Increasing Bargaining Power | Fleet electrification strategy, limited specialized suppliers | Aim for 60% cleaner energy vehicles by 2024 |

| Specialized Technology & Engineering | High Bargaining Power | Proprietary solutions, high switching costs, limited alternatives | Continued investment in advanced diagnostics and fleet management software |

| Regulatory Bodies (e.g., LTA) | High Bargaining Power | Licensing, operational mandates, compliance | Transport Sector (Critical Firms) Act 2024 (effective April 2025) |

What is included in the product

This analysis of ComfortDelGro's competitive environment reveals the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes, providing strategic insights into its market position.

A dynamic, interactive model that allows for scenario planning across all five forces, helping ComfortDelGro anticipate and mitigate competitive threats.

Customers Bargaining Power

In ComfortDelGro's bus and rail operations, individual passengers generally possess low bargaining power. Fares are typically regulated, limiting their ability to negotiate prices. For instance, in Singapore, fare adjustments are overseen by the Public Transport Council, which considers factors like operating costs and inflation, not individual passenger demands.

However, the collective voice of commuters, often channeled through government bodies or transport authorities, holds significant influence. These entities can impact fare policies and service quality expectations. The Singapore government's ongoing investments, such as the S$25 billion allocated for public transport infrastructure development up to 2025, directly enhance commuter options and indirectly bolster their leverage by fostering competition and accessibility.

Buyer power is a significant factor for ComfortDelGro, especially in the taxi and private hire sectors. The market is flooded with ride-hailing platforms like Grab and Gojek, along with new competitors such as Geo Lah and Trans-cab Services, giving customers ample choices. This intense competition means customers can easily compare prices and availability across different apps, making them highly price-sensitive.

This price sensitivity directly impacts ComfortDelGro's performance. When customers can readily switch to a cheaper or more readily available option, it can lead to a decrease in ComfortDelGro's booking volumes. Furthermore, it puts pressure on the company's commission income, as they may need to offer more competitive pricing or incentives to retain customers.

The bargaining power of customers for ComfortDelGro is significantly influenced by the increasing availability and promotion of alternative transportation. For instance, the expansion of Singapore's MRT network, with further lines planned and integrated with bus services, offers commuters more cost-effective and convenient options, directly challenging traditional taxi and bus services. In 2023, Singapore's Land Transport Authority reported continued growth in public transport ridership, indicating a shift in consumer preference.

Government policies actively promoting a car-lite society further amplify customer bargaining power. Initiatives like enhanced cycling infrastructure and the exploration of autonomous vehicle services for first-and-last-mile connectivity reduce dependence on single-occupancy vehicles and traditional point-to-point transport providers. This broadens the competitive set from the customer's viewpoint, giving them more leverage to demand better pricing and service quality.

Buyer Power 4

Corporate and fleet customers, particularly in car rental, leasing, and automotive engineering services, wield significant bargaining power. This is driven by the substantial volume of their contracts and the potential for lucrative, long-term partnerships, enabling them to demand competitive pricing and tailored solutions. For instance, in 2023, ComfortDelGro's fleet services segment likely saw negotiations heavily influenced by the purchasing power of large business clients seeking cost efficiencies and specialized vehicle offerings, reflecting a key aspect of buyer power.

These sophisticated buyers often require customized services and are highly sensitive to price, giving them considerable leverage to negotiate more favorable terms and conditions. ComfortDelGro's strategic emphasis on business-to-business mobility solutions and light commercial vehicles directly addresses this dynamic, as these sectors typically involve clients with the capacity to influence supplier pricing and service levels. This focus allows them to secure advantageous agreements that reflect the scale of their operations.

The ability of these customers to switch providers or even bring services in-house if terms are unsatisfactory further amplifies their bargaining power. ComfortDelGro's approach in these segments must therefore balance the pursuit of volume with the necessity of offering compelling value propositions that retain these key accounts. In 2024, continued economic pressures may further embolden these customers to seek the best possible deals, making customer retention a critical strategic imperative.

Key factors influencing buyer power for ComfortDelGro's fleet and corporate clients include:

- Volume of Purchases: Larger fleets and corporate contracts represent significant revenue streams, giving buyers more leverage.

- Price Sensitivity: Businesses often prioritize cost reduction, making them highly responsive to competitive pricing.

- Customization Needs: Tailored solutions for specific business operations can create dependency, but also bargaining chips for clients.

- Switching Costs: While often high, the perceived benefit of finding a better deal can still encourage buyers to explore alternatives.

Buyer Power 5

The bargaining power of customers for ComfortDelGro is moderate, influenced by their sensitivity to service quality and technological advancements. While price remains a consideration, commuters are increasingly valuing digital integration, reliable service, and sustainable options. For instance, in 2023, ComfortDelGro continued to invest in its Zig app, aiming to provide a more seamless user experience, which directly addresses customer demand for digital convenience.

ComfortDelGro actively works to mitigate customer bargaining power by enhancing its service offerings and embracing innovation. The company's introduction of premium taxi services and significant investments in electric vehicle (EV) charging infrastructure, such as its expansion plans in Singapore, are strategic moves to meet evolving customer expectations. These initiatives aim to foster customer loyalty and reduce price sensitivity, thereby strengthening ComfortDelGro's market position.

- Customer Loyalty Programs: ComfortDelGro's Zig app offers rewards and promotions, encouraging repeat usage and reducing the likelihood of customers switching to competitors solely based on price.

- Service Differentiation: Investments in premium services and cleaner energy options allow ComfortDelGro to cater to specific customer segments willing to pay more for enhanced quality and sustainability.

- Digital Experience: Continuous improvement of digital platforms like the Zig app is crucial, as customers increasingly expect integrated booking, payment, and real-time tracking features.

- Market Share: As of early 2024, ComfortDelGro remains a dominant player in Singapore's public transport sector, which provides some leverage against price-sensitive customers due to its extensive network and brand recognition.

Customer bargaining power for ComfortDelGro is a mixed bag, with individual passengers having limited sway due to regulated fares, while corporate clients and the collective commuter voice wield more influence. The intense competition in ride-hailing, exemplified by the presence of Grab and Gojek, forces ComfortDelGro to remain price-competitive. For instance, in 2023, the company continued to invest in its Zig app to enhance user experience, directly responding to customer demands for digital integration and convenience.

Corporate and fleet customers, due to their significant purchasing volumes, possess substantial bargaining power. They often demand tailored solutions and are highly price-sensitive, pushing ComfortDelGro to offer competitive terms. In 2024, ongoing economic pressures are likely to further empower these clients to seek optimal deals, making customer retention a key strategic focus.

ComfortDelGro actively manages customer bargaining power by differentiating its services and investing in innovation. Initiatives like premium taxi services and the expansion of electric vehicle charging infrastructure aim to build loyalty and reduce price sensitivity. As of early 2024, ComfortDelGro's strong market share in Singapore provides some leverage against price-focused customers, supported by its extensive network and brand recognition.

| Customer Segment | Bargaining Power Factors | ComfortDelGro's Response |

|---|---|---|

| Individual Passengers | Regulated fares, limited individual negotiation | Focus on service quality, digital integration (Zig app) |

| Ride-hailing Users | High price sensitivity, numerous alternatives (Grab, Gojek) | Competitive pricing, loyalty programs, service differentiation |

| Corporate/Fleet Clients | High volume, demand for customization, price sensitivity | Tailored solutions, focus on B2B mobility, cost-efficiency |

| Collective Commuters | Influence via government bodies, impact on policy | Investment in public transport infrastructure, service improvements |

Same Document Delivered

ComfortDelGro Porter's Five Forces Analysis

This preview showcases the complete ComfortDelGro Porter's Five Forces Analysis, reflecting the identical, professionally formatted document you will receive instantly upon purchase. You're not seeing a sample; this is the actual, ready-to-use analysis, detailing the competitive landscape of the public transport giant. Rest assured, what you see is precisely what you get—a comprehensive evaluation of industry rivalry, buyer and supplier power, threat of new entrants, and the menace of substitutes.

Rivalry Among Competitors

ComfortDelGro faces a highly competitive landscape in Singapore's taxi and private-hire sector. Major players like Grab and Gojek, along with emerging local companies such as Geo Lah and Trans-cab Services, are constantly vying for market share. This intense rivalry directly impacts ComfortDelGro's ability to maintain pricing power and driver loyalty.

The competitive pressure is further amplified by GrabCab's expansion into street-hail taxi services in July 2025. This strategic move by Grab directly challenges ComfortDelGro's traditional booking volumes and puts downward pressure on commission rates across the industry. Drivers' tendency to operate on multiple platforms also intensifies this competition, as they can easily switch between services based on demand and incentives.

In the public transport arena, particularly for bus and rail services, competition is largely shaped by government tenders for operating contracts. ComfortDelGro, through its subsidiary SBS Transit, actively participates in these bidding processes, facing off against both local and international transport companies vying for lucrative route packages and rail franchises.

The company's ability to secure and renew contracts globally, as demonstrated by recent successes in the UK, Australia, and Sweden, underscores its competitive standing. For instance, in 2023, SBS Transit secured a new bus contract in Singapore valued at approximately S$1.2 billion, showcasing its continued relevance in its home market.

ComfortDelGro faces intense competition, driving its strategy to defend core businesses through superior service and aggressive overseas expansion. Acquisitions like A2B Australia and Addison Lee in the UK are key moves to build scale and diversify revenue streams, signaling a highly competitive landscape where growth often comes through consolidation.

Competitive Rivalry 4

Competitive rivalry within the transportation sector, particularly for drivers, is intense. Operators frequently offer incentives and improved working conditions to secure and retain this essential workforce. This competition for drivers can significantly increase operational expenses and affect service reliability, especially in the taxi and private hire markets.

The ongoing global driver shortage further intensifies this rivalry. For instance, in 2024, reports indicated a persistent shortage of qualified drivers across many regions, impacting delivery services and public transportation alike.

- Driver Acquisition Costs: Increased competition for drivers leads to higher recruitment and retention costs, including sign-on bonuses and improved pay structures.

- Service Availability: A shortage of drivers can directly translate to reduced service availability and longer wait times for customers.

- Operational Efficiency: High driver turnover due to competitive pressures can negatively impact operational efficiency and driver training expenses.

Competitive Rivalry 5

The competitive rivalry within the taxi and ride-hailing sector is particularly fierce. Traditional taxi operators like ComfortDelGro are increasingly facing off against app-based platforms, blurring the traditional lines of the industry and intensifying competition. For instance, in 2023, Singapore saw continued growth in ride-hailing services, with Grab remaining a dominant player, forcing established taxi companies to adapt.

ComfortDelGro's strategic moves, such as integrating its services through its Zig app and developing premium offerings, are direct responses to this evolving competitive landscape. These initiatives aim to retain and attract customers by offering a more seamless and diverse transportation experience.

- Intensified Competition: The rise of app-based ride-hailing platforms has significantly increased competitive pressure on traditional taxi services.

- Industry Convergence: Traditional taxi services and ride-hailing platforms are merging, creating a more complex and competitive market environment.

- ComfortDelGro's Strategy: The company is focusing on digital integration with its Zig app and expanding premium services to stay competitive.

- Adaptability is Key: Success in this market hinges on the ability to innovate and quickly respond to changing customer preferences and market dynamics.

ComfortDelGro faces intense rivalry, especially in Singapore's taxi and private-hire market, with players like Grab and Gojek constantly competing for market share, impacting pricing and driver loyalty.

The competition is further heightened by GrabCab's expansion into street-hail services in July 2025, directly challenging traditional booking volumes and pushing down commission rates, while drivers' multi-platform engagement intensifies this dynamic.

In public transport, government tenders for bus and rail contracts are key battlegrounds, with SBS Transit, a ComfortDelGro subsidiary, competing against local and international firms for lucrative routes, as evidenced by its S$1.2 billion Singapore bus contract win in 2023.

The global driver shortage in 2024 further exacerbates competition for drivers, increasing operational costs and potentially affecting service availability, a challenge ComfortDelGro addresses through overseas expansion and acquisitions like Addison Lee in the UK.

| Aspect | Description | Impact on ComfortDelGro |

|---|---|---|

| Ride-hailing Platforms | Dominance of app-based services like Grab and Gojek. | Pressure on pricing, need for digital integration (Zig app), and focus on premium offerings. |

| Driver Competition | Intense rivalry for drivers, leading to higher acquisition and retention costs. | Increased operational expenses, potential impact on service reliability. |

| Public Transport Tenders | Competition for government contracts for bus and rail services. | Requires competitive bidding and operational efficiency to secure and renew contracts. |

SSubstitutes Threaten

Public transportation, particularly the extensive bus network and the rapidly growing MRT system in Singapore, presents a strong substitute for ComfortDelGro's taxi and private hire offerings. Government efforts to enhance public transport's convenience and accessibility, alongside a push for car-lite urban living, directly steer commuters towards these alternatives. The ambitious target for 80% of households to be within a 10-minute walk of an MRT station by 2030 further intensifies this competitive pressure.

Active mobility, like walking and cycling, is increasingly becoming a viable substitute for short trips, especially with government backing. For instance, Singapore's National Cycling Plan aims to significantly expand its cycling path network by 2025, with over 1,000 kilometers of pathways planned, making these options more attractive and accessible.

This growth in active mobility directly challenges short-distance services offered by taxi and ride-hailing companies, including those operated by ComfortDelGro. As more people opt for these eco-friendly and often quicker alternatives for shorter journeys, the demand for traditional motorized transport for these segments is likely to decline.

The emergence of autonomous vehicles, like robotaxis and self-driving shuttles, poses a significant future threat of substitution for ComfortDelGro's traditional taxi and bus services. Singapore's ambitious plan to widely deploy driverless vehicles within the next five years, focusing on enhancing first-and-last-mile connectivity, could fundamentally alter the transportation landscape. ComfortDelGro's own exploration into robotaxi operations acknowledges this evolving competitive dynamic.

4

The threat of substitutes for ComfortDelGro's transportation services, particularly its car rental and leasing segments, is a significant consideration. Personal car ownership, despite Singapore's car-lite policy, remains a substitute, offering ultimate convenience for some users. However, the high costs associated with car ownership, including COE premiums and maintenance, make it less accessible for many.

Peer-to-peer car-sharing platforms, such as Drive lah, present a more immediate and growing substitute. These services offer flexibility and cost-effectiveness, allowing users to access vehicles for short periods without the long-term financial commitment of ownership. This is particularly appealing for individuals and businesses seeking occasional transport solutions.

In 2023, the car-sharing market in Singapore continued to expand, with platforms reporting increased user engagement. For instance, some reports indicated a year-on-year growth of over 20% in active users for leading car-sharing services. This trend highlights the increasing acceptance and adoption of these alternatives.

The availability of these substitutes directly impacts ComfortDelGro's pricing power and market share in its rental and leasing divisions. As more consumers opt for flexible, on-demand transportation solutions, the demand for traditional car rentals and leases may face pressure.

- Personal Car Ownership: Remains a substitute, though constrained by Singapore's car-lite policies and high ownership costs.

- Peer-to-Peer Car-Sharing: Services like Drive lah offer a flexible and cost-effective alternative, gaining traction among users seeking occasional transport.

- Market Growth: The car-sharing sector saw significant user engagement growth in 2023, indicating a rising trend in substitute adoption.

- Impact on ComfortDelGro: Substitutes pose a competitive threat, potentially affecting pricing power and market share in rental and leasing.

5

The threat of substitutes for ComfortDelGro is moderate, primarily stemming from alternative personal mobility devices (PMDs) and micro-mobility solutions. While regulations are in place, these options offer viable substitutes for short-distance urban travel, impacting demand for traditional point-to-point transport. For instance, the growth in e-scooter and bike-sharing services in major cities like Singapore, where ComfortDelGro operates extensively, presents a direct alternative for some journeys.

This diversification of mobility choices empowers consumers, offering them greater flexibility beyond conventional taxi and bus services. As of early 2024, the adoption of these micro-mobility solutions continues to rise, particularly for last-mile connectivity, potentially chipping away at ComfortDelGro's market share in specific segments.

- Growing adoption of e-scooters and bike-sharing in urban centers.

- Increased consumer choice in short-distance personal mobility.

- Potential for incremental reduction in demand for traditional transport services.

- Regulatory landscape for PMDs influencing their competitive impact.

The threat of substitutes for ComfortDelGro is significant, driven by advancements in public transportation, active mobility, and emerging technologies. Singapore's commitment to expanding its MRT network, aiming for 80% of households within a 10-minute walk of a station by 2030, directly competes with taxi and private hire services. Furthermore, the growth of cycling infrastructure, with over 1,000 km of planned pathways by 2025, makes walking and cycling more attractive for short trips, directly impacting ComfortDelGro's shorter journey segments.

The rise of peer-to-peer car-sharing platforms like Drive lah offers a flexible and cost-effective alternative to ComfortDelGro's car rental and leasing. These services saw over 20% user growth in 2023, indicating a strong shift towards on-demand mobility solutions, which can pressure ComfortDelGro's pricing power and market share.

Emerging technologies like autonomous vehicles, or robotaxis, also pose a substantial future threat. Singapore's plans for widespread driverless vehicle deployment within five years could fundamentally reshape the transportation landscape, directly challenging ComfortDelGro's traditional taxi and bus operations.

| Substitute Category | Key Examples | Impact on ComfortDelGro | Relevant Data/Trends (as of mid-2025) |

|---|---|---|---|

| Public Transportation | MRT, Buses | Strong substitute for taxi/private hire; increasing convenience and accessibility | 80% of households within 10-min walk of MRT by 2030 (Singapore target) |

| Active Mobility | Walking, Cycling | Viable for short trips, government-supported | Over 1,000 km of cycling paths planned by 2025 (Singapore) |

| Emerging Tech | Autonomous Vehicles (Robotaxis) | Potential future disruption to taxi and bus services | Widespread deployment planned within 5 years (Singapore) |

| Car Sharing | Drive lah | Flexible, cost-effective alternative for occasional transport needs | Over 20% year-on-year user growth in 2023 for leading platforms |

Entrants Threaten

The threat of new entrants in Singapore's land transport sector, especially for public bus and rail, is quite low. This is mainly because you need a massive amount of money to even get started, covering things like building infrastructure and buying a whole fleet of vehicles. For instance, the Land Transport Authority's (LTA) Bus Contracting Model requires operators to manage significant fleet sizes and operational costs.

Furthermore, the government's rigorous tendering process for public transport contracts acts as a major hurdle. Only companies with deep pockets and proven operational experience stand a chance, making it incredibly tough for newcomers to gain a foothold. ComfortDelGro's consistent success in securing and renewing these contracts, including their recent wins for new bus service packages, highlights just how difficult it is for new players to penetrate this established market.

The threat of new entrants for ComfortDelGro is significantly mitigated by substantial regulatory hurdles. For instance, the Transport Sector (Critical Firms) Act 2024 in Singapore, enacted in 2024, imposes stringent oversight and approval requirements for critical transport entities. This legislation aims to ensure the stability and reliability of essential transport services, creating a complex compliance landscape that new firms must navigate to obtain necessary licenses, thereby posing a considerable barrier to entry.

Despite significant capital requirements and regulatory hurdles in the public transport sector, the taxi and private hire market has experienced notable new entrants. In 2025, companies such as Geo Lah and Trans-cab Services emerged, alongside Grab's expansion into street-hailing services with GrabCab, directly challenging established players like ComfortDelGro.

These newer entrants are effectively utilizing technology platforms to streamline operations and attract both drivers and passengers through competitive incentives. This strategy not only diversifies service offerings but also directly intensifies the competitive landscape for incumbent operators.

While the initial market share of these new players may be modest, their entry fundamentally increases the overall contestability of the market. This means that even smaller competitors can disrupt existing market dynamics, forcing established firms to adapt and innovate to retain their customer base and profitability.

Threat of New Entrants 4

The threat of new entrants in the point-to-point transportation sector, particularly for companies like ComfortDelGro, is significantly mitigated by the challenge of securing a reliable and sufficient driver pool. This is a substantial barrier for any new player aiming to enter the market.

The ongoing global driver shortage, a trend that has persisted and even intensified in recent years, makes attracting and retaining drivers a costly endeavor. New entrants must invest heavily in incentives, training, and operational support to lure drivers away from established companies or other industries, making it a significant financial hurdle for startups.

- Driver Acquisition Costs: New entrants face substantial upfront costs for driver recruitment and retention programs.

- Operational Scale: Building a driver network of sufficient scale to compete with incumbents like ComfortDelGro requires significant time and capital.

- Brand Loyalty: Established brands benefit from existing customer loyalty, making it harder for new entrants to gain market share.

Threat of New Entrants 5

The threat of new entrants in the public transportation sector, particularly for a company like ComfortDelGro, is generally moderate due to significant barriers. Established players benefit from substantial brand recognition and existing customer loyalty, making it challenging for newcomers to gain traction. For instance, ComfortDelGro, a major player in Singapore and Australia, has cultivated a strong reputation over decades, which new entrants would struggle to replicate without considerable investment in marketing and service quality.

Economies of scale are a critical deterrent. ComfortDelGro's vast fleet, extensive operational network, and centralized management allow for cost efficiencies that smaller, emerging companies cannot easily match. In 2024, the ongoing investments in fleet modernization and technology integration further enhance these scale advantages. New entrants would need to make significant capital outlays to achieve a comparable operational footprint and cost structure, which is a substantial hurdle.

Furthermore, regulatory environments in many operating regions can act as a barrier. Licensing requirements, safety standards, and fare regulations often favor established operators with proven track records. ComfortDelGro's compliance with these stringent regulations, honed over years of operation, presents a compliance challenge for nascent competitors. The company's diversified services, from bus and taxi operations to vehicle leasing and inspection, also create a robust business model that is difficult for a singular new entrant to challenge across the board.

- Brand Recognition and Loyalty: ComfortDelGro's long-standing presence fosters strong customer trust and repeat business, a difficult asset for new entrants to build.

- Economies of Scale: Large-scale operations, including fleet size and maintenance, lead to lower per-unit costs for incumbents, creating a price disadvantage for new players.

- Capital Requirements: Significant investment is needed for fleet acquisition, technology, and regulatory compliance, posing a high financial barrier to entry.

- Regulatory Hurdles: Navigating complex licensing, safety, and operational permits often favors experienced operators like ComfortDelGro.

The threat of new entrants for ComfortDelGro in Singapore's public transport sector remains low due to substantial capital requirements and stringent regulatory frameworks. The Land Transport Authority's (LTA) contracting model necessitates significant fleet investment and operational scale, which new firms find difficult to match. For instance, in 2024, the Transport Sector (Critical Firms) Act further amplified these barriers by introducing rigorous oversight and approval processes for essential transport entities, demanding extensive compliance from any prospective entrant.

However, the point-to-point transportation market, including taxis and private hire, presents a different scenario. By 2025, new players like Geo Lah and Trans-cab Services, alongside Grab's expansion, have entered the fray, leveraging technology and competitive incentives to attract drivers and passengers. This has increased market contestability, forcing incumbents to adapt.

| Factor | Impact on New Entrants | ComfortDelGro Advantage |

|---|---|---|

| Capital Requirements | Very High (Fleet, Infrastructure) | Established financial capacity and economies of scale |

| Regulatory Hurdles | High (Licensing, Safety, Compliance) | Proven track record and established compliance processes |

| Driver Pool Acquisition | Challenging (Shortages, Incentives) | Existing large driver network and retention programs |

| Brand Recognition & Loyalty | Low (Needs significant marketing) | Decades of operation fostering trust and repeat business |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ComfortDelGro leverages data from company annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial filings from regulatory bodies.