ComfortDelGro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ComfortDelGro Bundle

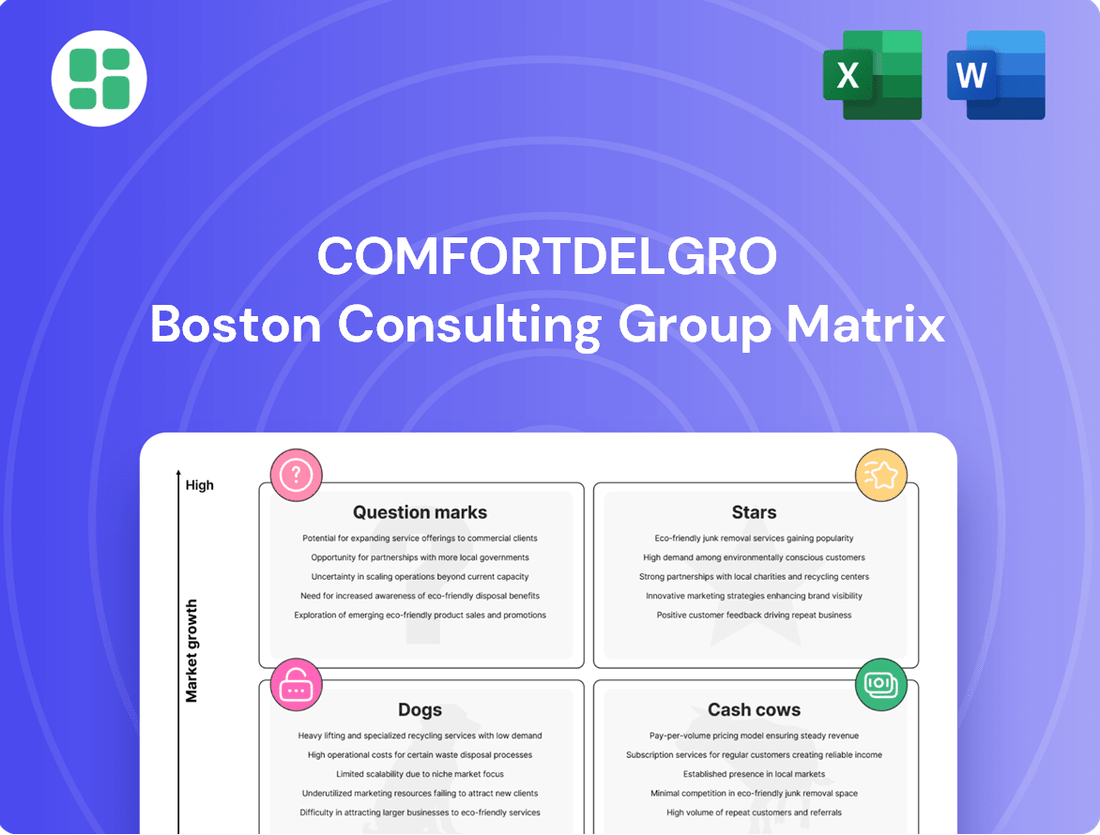

Curious about ComfortDelGro's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be categorized, hinting at potential growth areas and resource allocation.

To truly understand their market share and growth rate across different business segments, you need the full picture. Purchase the complete ComfortDelGro BCG Matrix for a detailed quadrant breakdown, actionable insights, and a clear roadmap for future investment decisions.

Stars

ComfortDelGro's UK bus operations are a significant growth engine, especially with the expansion into Greater Manchester. Starting January 2025, four new franchises will add 30% to Metroline's existing portfolio. This strategic move is bolstered by contract renewals that are enhancing profit margins.

These UK operations are key contributors to ComfortDelGro's robust earnings growth. The company is solidifying its position as a leader in a dynamic regional market, demonstrating a clear upward trajectory for this segment.

ComfortDelGro's Australian bus franchises, particularly in Victoria, are a key component of its BCG Matrix. The recent award of three bus franchises in Victoria, valued at A$1.6 billion for a decade starting July 2025, represents a significant 30% expansion of its public bus operations there.

This substantial growth opportunity allows ComfortDelGro to both maintain its current service agreements and introduce new routes, thereby strengthening its market presence in a vital international market and contributing positively to its overall portfolio.

ComfortDelGro's international rail segment is a significant growth area, marked by a fourfold expansion since 2021. This growth trajectory is underscored by securing the Stockholm Metro tender in Sweden, set to begin operations in late 2025, and the Jurong Region Line in Singapore, commencing in 2027.

The company is strategically positioning itself as a major global rail player through aggressive bidding for high-value contracts. This includes active pursuit of opportunities such as the Melbourne rail line, signaling a clear intent to capture substantial market share in key international markets.

Premium Point-to-Point Acquisitions

Premium Point-to-Point Acquisitions are key drivers for ComfortDelGro, significantly bolstering its taxi and private hire segment. Strategic moves like acquiring A2B Australia have positioned ComfortDelGro as the operator of Australia's largest taxi network. Similarly, the acquisition of Addison Lee in London, a prominent player in premium black cab and private hire services, reinforces this segment's strength.

These acquisitions are not just about scale; they are about enhancing profitability. By expanding market share in lucrative business-to-business segments, ComfortDelGro is effectively navigating the competitive point-to-point market. These moves are injecting strong new contributions, demonstrating a clear strategy for growth in higher-margin areas.

- A2B Australia Acquisition: Established ComfortDelGro as the largest taxi network operator in Australia.

- Addison Lee Acquisition: Strengthened presence in the premium London black cab and private hire market.

- Market Share Expansion: Increased footprint in profitable, business-to-business segments.

- Revenue Growth: Driving significant contributions to the taxi and private hire segment's financial performance.

Electric Vehicle (EV) Charging Infrastructure

ComfortDelGro's foray into Electric Vehicle (EV) charging infrastructure, through its ComfortDelGro ENGIE joint venture, signifies a strategic move into a burgeoning sector. By November 2024, the company had established 1,000 charge points in Singapore, a substantial build-out indicating aggressive market penetration. This rapid expansion is a key indicator of its commitment to capturing market share in the rapidly growing EV ecosystem.

The company has set an ambitious regional target of 8,000 charge points by 2030, underscoring a long-term vision for its EV charging business. This growth strategy includes forging strategic partnerships for network expansion and securing financing, crucial elements for scaling operations in this capital-intensive industry. These efforts position ComfortDelGro as a significant player in the transition towards sustainable mobility, aligning with global trends in electrification.

- Network Growth: 1,000 charge points in Singapore by November 2024.

- Regional Ambition: Target of 8,000 charge points across the region by 2030.

- Strategic Partnerships: Collaboration for EV charging expansion and financing.

- Market Positioning: Significant player in the sustainable mobility ecosystem.

ComfortDelGro's UK bus operations are a significant growth engine, especially with the expansion into Greater Manchester. Starting January 2025, four new franchises will add 30% to Metroline's existing portfolio. This strategic move is bolstered by contract renewals that are enhancing profit margins.

These UK operations are key contributors to ComfortDelGro's robust earnings growth. The company is solidifying its position as a leader in a dynamic regional market, demonstrating a clear upward trajectory for this segment.

ComfortDelGro's Australian bus franchises, particularly in Victoria, are a key component of its BCG Matrix. The recent award of three bus franchises in Victoria, valued at A$1.6 billion for a decade starting July 2025, represents a significant 30% expansion of its public bus operations there.

This substantial growth opportunity allows ComfortDelGro to both maintain its current service agreements and introduce new routes, thereby strengthening its market presence in a vital international market and contributing positively to its overall portfolio.

ComfortDelGro's international rail segment is a significant growth area, marked by a fourfold expansion since 2021. This growth trajectory is underscored by securing the Stockholm Metro tender in Sweden, set to begin operations in late 2025, and the Jurong Region Line in Singapore, commencing in 2027.

The company is strategically positioning itself as a major global rail player through aggressive bidding for high-value contracts. This includes active pursuit of opportunities such as the Melbourne rail line, signaling a clear intent to capture substantial market share in key international markets.

Premium Point-to-Point Acquisitions are key drivers for ComfortDelGro, significantly bolstering its taxi and private hire segment. Strategic moves like acquiring A2B Australia have positioned ComfortDelGro as the operator of Australia's largest taxi network. Similarly, the acquisition of Addison Lee in London, a prominent player in premium black cab and private hire services, reinforces this segment's strength.

These acquisitions are not just about scale; they are about enhancing profitability. By expanding market share in lucrative business-to-business segments, ComfortDelGro is effectively navigating the competitive point-to-point market. These moves are injecting strong new contributions, demonstrating a clear strategy for growth in higher-margin areas.

- A2B Australia Acquisition: Established ComfortDelGro as the largest taxi network operator in Australia.

- Addison Lee Acquisition: Strengthened presence in the premium London black cab and private hire market.

- Market Share Expansion: Increased footprint in profitable, business-to-business segments.

- Revenue Growth: Driving significant contributions to the taxi and private hire segment's financial performance.

ComfortDelGro's foray into Electric Vehicle (EV) charging infrastructure, through its ComfortDelGro ENGIE joint venture, signifies a strategic move into a burgeoning sector. By November 2024, the company had established 1,000 charge points in Singapore, a substantial build-out indicating aggressive market penetration. This rapid expansion is a key indicator of its commitment to capturing market share in the rapidly growing EV ecosystem.

The company has set an ambitious regional target of 8,000 charge points by 2030, underscoring a long-term vision for its EV charging business. This growth strategy includes forging strategic partnerships for network expansion and securing financing, crucial elements for scaling operations in this capital-intensive industry. These efforts position ComfortDelGro as a significant player in the transition towards sustainable mobility, aligning with global trends in electrification.

- Network Growth: 1,000 charge points in Singapore by November 2024.

- Regional Ambition: Target of 8,000 charge points across the region by 2030.

- Strategic Partnerships: Collaboration for EV charging expansion and financing.

- Market Positioning: Significant player in the sustainable mobility ecosystem.

ComfortDelGro's Stars segment, primarily its premium point-to-point acquisitions and international rail ventures, exhibits high market growth and high relative market share. The strategic acquisitions of A2B Australia and Addison Lee have solidified its dominance in the Australian taxi market and the premium London private hire sector, respectively. Similarly, the aggressive expansion in international rail, including securing the Stockholm Metro tender, positions it for substantial future revenue streams in a growing global market.

This segment's performance is characterized by strong revenue contributions and significant potential for further expansion, driven by market leadership and strategic investments. The company's focus on high-margin business-to-business segments within its taxi operations, coupled with its global rail ambitions, highlights its commitment to capitalizing on high-growth opportunities.

The significant increase in its international rail portfolio, with a fourfold expansion since 2021, and the substantial Australian bus franchise awards valued at A$1.6 billion, underscore the high growth nature of these operations.

These Star businesses are crucial for ComfortDelGro's overall portfolio, providing the highest returns and acting as engines for future growth and market leadership.

| Segment | Market Growth | Relative Market Share | Key Initiatives | Financial Impact |

| UK Bus Operations | High | High | Greater Manchester expansion, contract renewals | Enhanced profit margins, robust earnings growth |

| Australian Bus Operations | High | High | Victoria franchise awards (A$1.6bn) | 30% expansion, strengthened market presence |

| International Rail | High | High | Stockholm Metro, Jurong Region Line, Melbourne rail pursuit | Fourfold expansion since 2021, major global player positioning |

| Premium Point-to-Point | High | High | A2B Australia, Addison Lee acquisitions | Largest taxi network in Australia, strong B2B contributions |

| EV Charging Infrastructure | High | Low to Medium | ComfortDelGro ENGIE JV, 1,000 charge points (Nov 2024) | Aggressive market penetration, regional target of 8,000 by 2030 |

What is included in the product

The ComfortDelGro BCG Matrix analyzes its diverse mobility services, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investing in growth, milking profits, nurturing potential, or divesting underperforming units.

A clear BCG Matrix visualizing ComfortDelGro's portfolio, identifying underperforming units and guiding strategic resource allocation.

Cash Cows

ComfortDelGro's subsidiary, SBS Transit, holds a significant position in Singapore's public bus services, evidenced by its win of the Seletar bus package. This mature market offers reliable and consistent revenue, a hallmark of a cash cow.

The public bus sector in Singapore is characterized by its essential nature, ensuring steady demand regardless of economic fluctuations. SBS Transit's continued success in securing and retaining major bus contracts, like the Seletar package, underscores its stable cash-generating capabilities for ComfortDelGro.

Singapore Rail Services, operated by SBS Transit, including vital MRT lines like the North-East and Downtown lines, represent a strong Cash Cow for ComfortDelGro. This is due to their high market share within Singapore's mature and indispensable public transportation landscape.

With domestic rail ridership consistently high and fare adjustments in December 2024 anticipated to boost revenue, these services are poised for stable earnings. This makes them a dependable source of cash generation for the group.

Singapore Taxi Operations, a cornerstone of ComfortDelGro's portfolio, continues to be a robust Cash Cow. Despite the rise of ride-hailing, ComfortDelGro commands a significant 65% share of street-hail trips in Singapore with its fleet of over 8,400 taxis.

Recent strategic moves, such as adjusting taxi booking commission rates, have bolstered the profitability of this mature segment. These adjustments ensure that the taxi operations consistently generate strong, reliable cash flow, reinforcing its Cash Cow status.

Automotive Engineering and Inspection Services

ComfortDelGro's automotive engineering and inspection services function as a classic Cash Cow within its business portfolio. These operations, which include vehicle maintenance, repair, and rigorous testing, cater to both the company's extensive fleet and a broad base of external customers. This segment thrives in a mature market where demand for such essential services remains consistently high, providing a reliable stream of revenue.

The company's vehicle inspection and testing facilities are crucial for ensuring the safety and operational efficiency of its diverse transportation assets. This segment benefits from established infrastructure and expertise, allowing it to generate steady profits. For instance, in 2024, ComfortDelGro's automotive engineering division continued to be a significant contributor to overall profitability, leveraging its strong reputation and operational efficiencies.

- Stable Revenue Generation: The automotive engineering and inspection services consistently contribute to ComfortDelGro's bottom line due to ongoing demand.

- Mature Market Dominance: Operating in a well-established market, these services benefit from predictable demand and a strong existing client base.

- Operational Efficiency: ComfortDelGro's extensive fleet necessitates and supports efficient automotive engineering operations, creating a synergistic advantage.

- Profitability Driver: This segment represents a reliable source of earnings, characterized by low capital requirements and high operational stability.

Car Rental and Leasing Services

ComfortDelGro's car rental and leasing segment operates as a Cash Cow within its business portfolio. This division serves a consistent demand from both individual consumers and corporate entities, reflecting a stable, mature market. The business benefits from ComfortDelGro's established fleet management capabilities, generating predictable cash flows despite modest growth expectations.

The company's extensive fleet and operational experience allow for efficient management, translating into reliable earnings. In 2024, ComfortDelGro reported its car rental and leasing segment as a significant contributor to overall revenue, demonstrating its dependable cash-generating nature. This segment is characterized by steady, albeit low, growth prospects, making it a cornerstone for funding other business ventures.

- Mature Market: Caters to consistent demand from individuals and corporations.

- Fleet Expertise: Leverages existing fleet management knowledge for efficiency.

- Stable Revenue: Provides reliable cash generation with low growth potential.

- Cash Cow Status: Funds other segments of ComfortDelGro's operations.

ComfortDelGro's public bus services, particularly SBS Transit's operations in Singapore, are prime examples of Cash Cows. These services benefit from a mature market with consistent demand, ensuring steady revenue streams. The company's continued success in securing major bus contracts, such as the Seletar bus package, highlights its stable cash-generating ability.

The rail services, operated by SBS Transit, including the North-East and Downtown lines, also represent significant Cash Cows. With high ridership and the anticipation of fare adjustments in December 2024, these essential services are poised to deliver reliable earnings, reinforcing their status as dependable cash generators for the group.

ComfortDelGro's taxi operations in Singapore are a robust Cash Cow, commanding a substantial 65% share of street-hail trips with over 8,400 taxis. Strategic adjustments, like revised booking commission rates in 2024, have further bolstered profitability in this mature segment, ensuring consistent and strong cash flow.

The automotive engineering and inspection services are classic Cash Cows, serving both ComfortDelGro's fleet and external clients. This segment thrives in a mature market with consistent demand for essential vehicle maintenance and testing, providing a reliable revenue stream. In 2024, this division continued its strong contribution to profitability.

Car rental and leasing also operates as a Cash Cow, catering to consistent demand from individuals and corporations. Leveraging its fleet management expertise, this segment generates predictable cash flows. In 2024, car rental and leasing was a significant revenue contributor, underscoring its dependable cash-generating nature.

| Business Segment | BCG Category | Key Characteristics | 2024 Relevance |

| Public Bus Services (SBS Transit) | Cash Cow | Mature market, stable demand, consistent revenue | Secured Seletar bus package, stable cash generation |

| Rail Services (SBS Transit) | Cash Cow | High market share, indispensable service, predictable earnings | Anticipated fare adjustments in Dec 2024 to boost revenue |

| Taxi Operations | Cash Cow | Dominant market share (65%), strong cash flow | Revised booking commission rates boosted profitability |

| Automotive Engineering & Inspection | Cash Cow | Mature market, consistent demand, operational efficiency | Significant contributor to overall profitability in 2024 |

| Car Rental & Leasing | Cash Cow | Stable demand, fleet expertise, predictable cash flow | Significant revenue contributor in 2024, funds other segments |

Preview = Final Product

ComfortDelGro BCG Matrix

The ComfortDelGro BCG Matrix preview you are viewing is the complete and final document you will receive immediately after purchase. This means you'll get the fully formatted, professionally analyzed report without any watermarks or sample data, ready for your strategic decision-making.

Dogs

The traditional street-hail taxi fleet, a cornerstone of ComfortDelGro's operations, is navigating a challenging landscape. Intense competition from ride-hailing platforms has significantly impacted this segment, contributing to a shrinking fleet size.

In 2023, ComfortDelGro reported a continued decline in its taxi fleet in Singapore, with the number of taxis operating falling below 9,000. This trend reflects the broader industry shift towards app-based bookings and the increasing preference for private-hire vehicles among consumers.

While this segment remains substantial, it operates in a low-growth, highly disrupted market. Careful management is essential to mitigate potential declines in market share and ensure profitability amidst evolving consumer demands and regulatory changes.

ComfortDelGro's older diesel bus fleet falls into the Dogs category of the BCG matrix. With a commitment to transitioning 50% of its fleet to cleaner energy by 2030, these older diesel buses face declining long-term viability.

These vehicles likely carry higher operational and maintenance expenses than their modern counterparts, representing an investment in an obsolescent asset base with limited growth potential. For instance, in 2023, ComfortDelGro reported that a significant portion of its fleet still relied on traditional diesel engines, contributing to higher fuel and repair costs.

ComfortDelGro's mature market bus operations, particularly in Singapore, face challenges from expired or non-renewed contracts. For instance, the Jurong West bus package, which expired in August 2024, signifies a segment where the company might be losing market share or operating under less favorable terms. This situation aligns with the characteristics of a 'Dog' in the BCG matrix, indicating low growth and low market share.

Underperforming Niche Overseas Transport Operations

Underperforming niche overseas transport operations within ComfortDelGro's portfolio can be categorized as Dogs. These are typically smaller, non-core international ventures that consistently show low profitability and struggle to capture substantial market share in their specific regions. For instance, if a particular overseas bus service in a less developed market is experiencing declining ridership and high operational costs, it would fit this description.

These ventures often consume capital without generating significant returns or demonstrating promising growth potential. While specific financial figures for every minor international operation aren't always publicly broken down, the overall strategy suggests that such underperforming assets are candidates for divestment or restructuring.

- Low Profitability: Operations consistently failing to meet internal profitability benchmarks.

- Limited Market Share: Inability to gain a significant foothold or compete effectively in their niche markets.

- High Operational Costs: Expenses that outweigh revenue generation, leading to consistent losses.

- Lack of Growth Prospects: Limited potential for future expansion or increased market penetration.

Outdated Advertising Platforms

Outdated advertising platforms, such as static advertising spaces on older vehicles, are increasingly becoming less effective and profitable for Moove Media. This is particularly true when compared to their newer digital billboards and programmatic advertising solutions. These traditional platforms can be categorized as Dogs within the ComfortDelGro BCG Matrix.

They represent a segment with low market share and low market growth potential. As the advertising landscape rapidly shifts towards digital, these older formats are likely to see diminishing returns. For instance, while digital out-of-home advertising revenue is projected to grow significantly, traditional static OOH is facing stagnation.

- Low Market Share: Traditional static advertising on older vehicles likely holds a smaller portion of Moove Media's overall advertising revenue compared to digital offerings.

- Low Market Growth: The overall market for static advertising on older vehicles is not expanding, unlike the rapidly growing digital advertising sector.

- Diminishing Returns: As consumer attention and advertising budgets move online and to digital OOH, the profitability of these older platforms is likely to decline.

- Strategic Consideration: ComfortDelGro may need to consider divesting or significantly reducing investment in these outdated platforms to focus resources on more promising digital ventures.

ComfortDelGro's older diesel bus fleet represents a 'Dog' in the BCG matrix, facing declining viability as the company aims to transition 50% of its fleet to cleaner energy by 2030. These vehicles incur higher operational and maintenance costs, representing an investment in an aging asset with limited future growth.

Mature bus operations, particularly in Singapore, are also showing 'Dog' characteristics, evidenced by contract expirations like the Jurong West bus package in August 2024, indicating potential market share erosion. Similarly, underperforming niche overseas transport ventures, characterized by low profitability and minimal market share, are considered 'Dogs' and may be candidates for divestment.

Outdated advertising platforms within Moove Media, such as static advertising on older vehicles, are also 'Dogs' due to low market share and growth, especially when contrasted with the expanding digital advertising sector. These platforms are experiencing diminishing returns as advertising budgets shift towards digital solutions.

Question Marks

ComfortDelGro's robotaxi pilot program, a two-year initiative with Pony.ai in Guangzhou, China, commencing in March 2025, represents a high-growth, high-risk endeavor. This venture is focused on pioneering autonomous transport solutions.

Although its current market share within the broader transportation sector is modest, this program holds the potential to transform mobility. Success could pave the way for expansion into additional international markets.

The pilot program requires substantial cash investment for research, development, and deployment, reflecting its ambitious nature and the significant upfront costs associated with advanced autonomous technology.

ComfortDelGro's new digital mobility platforms, like its Zig ride-hailing service, represent a strategic pivot into high-growth, albeit intensely competitive, digital markets. These ventures are designed to capture a share of the evolving transportation landscape, which is increasingly dominated by app-based solutions.

These platforms are currently in a phase of significant investment, requiring substantial capital for technology development, marketing campaigns, and user acquisition. For instance, the ride-hailing market globally saw significant funding pour in during 2024, with companies investing heavily in driver incentives and customer promotions to build loyalty and market presence.

The challenge for ComfortDelGro lies in differentiating its offerings and achieving critical mass in markets where established players already command considerable user bases. Success hinges on effectively competing with global giants and local innovators by offering superior user experience, competitive pricing, and unique value propositions.

ComfortDelGro's early-stage international market entries function as Question Marks in the BCG Matrix. These ventures are characterized by a minimal initial footprint in new geographical markets, requiring substantial investment to establish and grow market share. For instance, the company's expansion into emerging transportation markets in Southeast Asia in the early 2020s, such as its initial investments in ride-hailing services in Vietnam, exemplifies this. These markets typically exhibit high growth potential but also high uncertainty and low current market penetration for ComfortDelGro.

Advanced AI and Predictive Analytics Initiatives

ComfortDelGro's investment in advanced AI and predictive analytics represents a significant strategic push to optimize operations and elevate customer interactions. This initiative, while holding substantial future potential, currently functions as a foundational capability rather than a distinct, profit-generating business segment. Consequently, its direct market share in terms of profitability is nascent, necessitating ongoing capital allocation to unlock its full value.

- Investment Focus: ComfortDelGro is channeling resources into AI for predictive maintenance of its fleet, aiming to reduce downtime and repair costs.

- Customer Experience Enhancement: AI is being deployed to personalize customer journeys, predict demand patterns for ride-hailing services, and optimize route planning, potentially boosting customer satisfaction and loyalty.

- Market Share in AI Capabilities: While specific market share figures for AI capabilities are not directly reported, the company's commitment signifies an effort to build a competitive advantage in a technologically evolving industry.

- Financial Implications: These initiatives are classified under operational investments and R&D, reflecting a long-term strategy rather than immediate revenue generation, with continued investment expected to yield efficiency gains and potential new service offerings.

Specialized Patient Transport Services

Within ComfortDelGro's broader 'Other Private Transport' segment, specialized patient transport services fit the profile of a Question Mark. These services cater to a niche market, potentially experiencing rapid growth, but ComfortDelGro likely holds a small market share currently. Significant investment would be needed to expand operations and capture a larger portion of this emerging sector.

The demand for non-emergency medical transportation is on the rise, driven by an aging population and increasing healthcare needs. For instance, in 2024, the global non-emergency medical transportation market was valued at approximately $50 billion and is projected to grow at a compound annual growth rate of over 6% through 2030. This presents a substantial growth opportunity for ComfortDelGro.

- Niche Market Growth: Specialized patient transport operates in a growing, specialized segment of the transportation industry.

- Low Current Market Share: ComfortDelGro's involvement in this specific service is likely nascent, resulting in a low current market share.

- High Investment Requirement: Scaling these services necessitates considerable investment in specialized vehicles, trained personnel, and technology.

- Potential for High Returns: If successful in gaining market share, these services could yield significant future returns due to market growth.

ComfortDelGro's ventures into emerging markets and new technologies, like its robotaxi pilot and digital mobility platforms, represent classic Question Marks. These initiatives are characterized by high growth potential but currently low market share, demanding significant investment to establish a strong foothold.

The company's investment in AI and specialized patient transport also fall into this category. While these areas show promise for future returns, they require substantial capital and strategic development to gain traction and compete effectively in their respective evolving sectors.

The success of these Question Marks hinges on ComfortDelGro's ability to navigate market uncertainties, differentiate its offerings, and secure sufficient funding for expansion and innovation, aiming to eventually transition them into Stars or Cash Cows.

The company's strategic investments in areas like autonomous driving technology and digital ride-hailing platforms are positioned as potential high-growth opportunities. However, their current market share in these nascent sectors is minimal, necessitating substantial capital infusion for research, development, and market penetration. For example, global investment in autonomous vehicle technology saw significant acceleration in 2024, with billions poured into R&D and pilot programs worldwide.

| Venture | Market Growth Potential | Current Market Share | Investment Need | Strategic Outlook |

|---|---|---|---|---|

| Robotaxi Pilot (Guangzhou) | Very High | Negligible | High | Develop into Star/Dog |

| Digital Mobility Platforms (e.g., Zig) | High | Low | High | Develop into Star |

| AI & Predictive Analytics | High | Not Directly Measurable (Enabling Tech) | Moderate to High | Enhance Existing Businesses/New Services |

| Specialized Patient Transport | High | Low | Moderate | Develop into Star/Cash Cow |

BCG Matrix Data Sources

Our ComfortDelGro BCG Matrix is built upon comprehensive data, including financial statements, operational performance metrics, and market share analysis, to accurately position each business segment.