Columbia Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Columbia Bank's strategic landscape. This comprehensive PESTLE analysis provides actionable intelligence to navigate challenges and capitalize on emerging opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

The U.S. banking sector faces a dynamic regulatory environment, with ongoing debates about strengthening prudential standards, especially for mid-sized banks. While a new administration might favor a more business-friendly stance on capital requirements, substantial easing of existing regulations for the largest banks is improbable.

Columbia Bank, operating as a regional entity, must adhere to federal and state banking laws. This includes adapting to potential implications from the Basel III Endgame proposals, though these are primarily anticipated to affect the biggest financial institutions.

Shifts in U.S. presidential administrations often signal changes in regulatory priorities, potentially ushering in a more deregulatory environment for financial institutions. For Columbia Bank, this could mean a more permissive stance on bank mergers and the entry of nonbank competitors, directly influencing its strategic acquisition plans and the competitive dynamics it faces. For instance, the Biden administration's approach, while emphasizing consumer protection, has also seen some easing of certain capital requirements for smaller banks compared to previous periods.

Global geopolitical instability, including ongoing conflicts like the war in Ukraine and tensions in the Middle East, creates significant uncertainty in financial markets. This uncertainty directly impacts investor confidence and can lead to increased volatility, affecting Columbia Bank's investment portfolios and overall operational risk.

Shifts in U.S. trade policies, such as the potential for new tariffs or trade disputes, can disrupt global supply chains and impact economic growth. For instance, a hypothetical 5% increase in tariffs on key imported goods could slow down economic activity, potentially reducing demand for loans and impacting Columbia Bank's profitability in 2024-2025.

Government Support and Community Reinvestment Act (CRA)

Government initiatives like the Community Reinvestment Act (CRA) significantly shape bank operations and community engagement. Columbia Bank's active participation in community development, financial literacy programs, and affordable housing projects is often directly influenced by these regulatory frameworks and associated incentives.

These efforts not only fulfill CRA obligations but also bolster the bank's standing within its operational areas. For instance, in 2023, Columbia Bank reported significant investments in low- and moderate-income communities, aligning with CRA goals and demonstrating a tangible commitment to local economic growth.

- CRA Compliance: Columbia Bank's community investments help meet regulatory requirements.

- Community Impact: Initiatives support financial literacy and affordable housing.

- 2023 Performance: The bank made substantial investments in low- and moderate-income areas.

Political Influence and Lobbying

While Columbia Banking System itself hasn't disclosed direct federal lobbying expenditures in recent election cycles, the financial sector as a whole is a significant player in influencing policy. The American Bankers Association, for instance, reported spending approximately $5.6 million on lobbying in 2023, aiming to shape legislation impacting banks of all sizes.

This industry-wide advocacy can indirectly affect Columbia Bank's operations. For example, proposed changes to capital requirements or consumer protection regulations, often debated and influenced by lobbying efforts, can alter the competitive landscape and compliance burdens for banks like Columbia.

Key areas where banking industry lobbying has an impact include:

- Capital Adequacy: Influencing rules on how much capital banks must hold against potential losses.

- Consumer Protection: Shaping regulations around lending practices, fees, and customer disclosures.

- Regulatory Burden: Advocating for streamlined or modified compliance requirements.

- Competitive Landscape: Efforts to influence policies related to market entry, mergers, and digital banking.

Political factors significantly influence Columbia Bank's operating environment, from regulatory shifts to government initiatives. Changes in administration can alter the focus on banking regulations, potentially impacting capital requirements and merger approvals, as seen with the Biden administration's approach to smaller banks.

Global geopolitical events and evolving trade policies create economic uncertainty, which can affect market volatility and loan demand, as exemplified by the potential impact of tariffs on economic growth in 2024-2025.

Government programs like the Community Reinvestment Act (CRA) directly shape Columbia Bank's community engagement and investment strategies, with the bank demonstrating commitment through substantial investments in low- and moderate-income areas during 2023.

Industry-wide lobbying, such as the American Bankers Association's reported $5.6 million expenditure in 2023, indirectly influences policy decisions on capital adequacy, consumer protection, and the overall competitive landscape for banks.

| Policy Area | Potential Impact on Columbia Bank | Example Data/Trend |

|---|---|---|

| Regulatory Stance (e.g., Capital Requirements) | Could affect lending capacity and compliance costs. | Basel III Endgame proposals primarily target large banks, offering some stability for regional players. |

| Community Reinvestment Act (CRA) | Drives community development investments and partnerships. | Columbia Bank's 2023 investments in LMI communities supported local economic growth. |

| Trade Policy & Tariffs | May influence economic growth and demand for loans. | A hypothetical 5% tariff increase could slow economic activity, impacting profitability. |

| Industry Lobbying Efforts | Shapes the broader regulatory and competitive environment. | ABA lobbying in 2023 focused on capital adequacy and consumer protection. |

What is included in the product

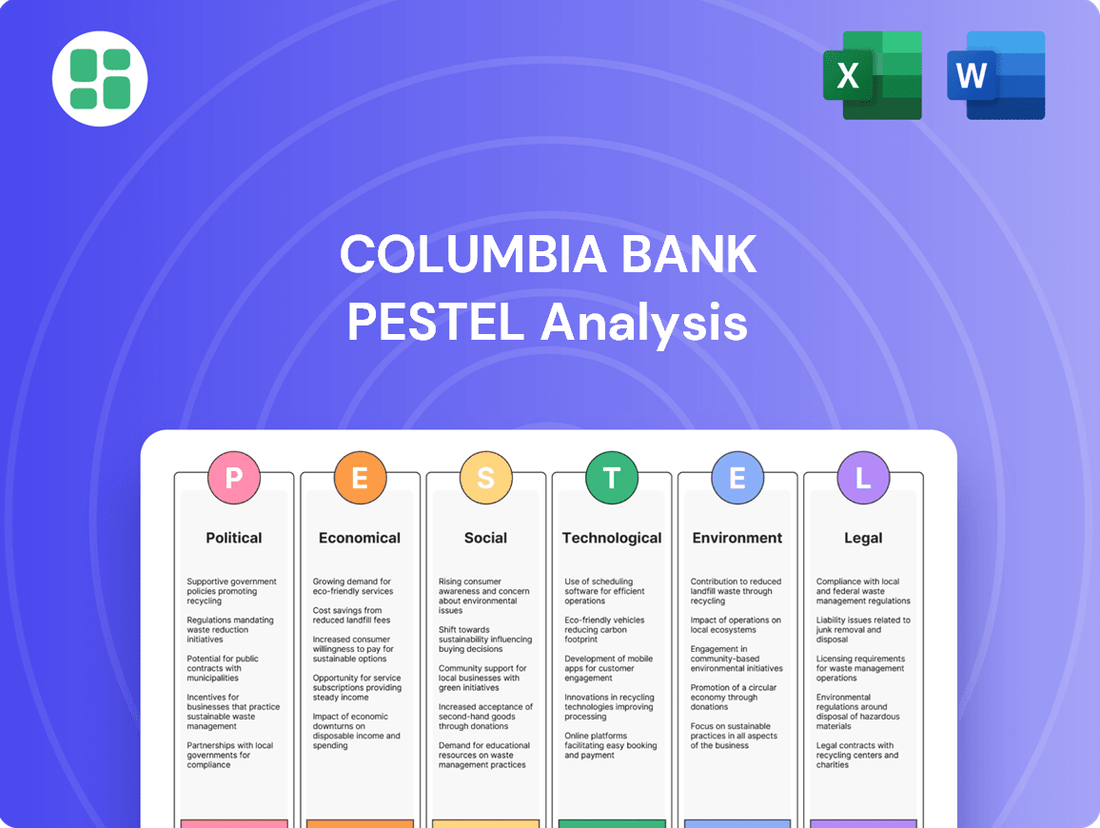

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Columbia Bank across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the bank's operating landscape.

The Columbia Bank PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby alleviating the pain point of information overload.

Economic factors

The prevailing interest rate environment is a critical determinant of Columbia Bank's profitability, directly influencing its Net Interest Margin (NIM). As of Q1 2025, Columbia Bank reported a NIM of 3.60%, a slight decrease from the previous quarter, primarily attributed to reduced yields on its earning assets.

Looking ahead to 2025, moderating inflation and anticipated interest rate cuts by central banks could potentially stimulate loan demand. However, the bank faces ongoing pressure from elevated deposit costs, and a potential decline in longer-term interest rates could further challenge NIM expansion.

Loan demand is anticipated to strengthen in 2025, particularly in the mortgage sector, as interest rates are projected to decline, although credit card and auto loan segments may experience subdued expansion.

Columbia Bank observed a modest contraction in its loan portfolio during Q1 2025, attributed to loan repayments and a slower pace of new loan originations, but forecasts low to mid-single-digit growth for the remainder of the year.

The bank’s commitment to a cautious credit strategy is evident, with non-performing assets standing at a low 0.35% of total assets as of June 30, 2025, offering a degree of protection against potential credit quality erosion.

Competition for customer deposits remains a significant challenge, forcing banks to offer higher rates. This trend keeps funding costs elevated, even when broader interest rates are falling.

Columbia Bank saw robust customer deposit growth in the first quarter of 2025, adding $440 million. This increase was partly fueled by effective marketing initiatives targeting small businesses.

Effectively managing the types of deposits held and controlling the associated costs are vital for Columbia Bank's profitability. Navigating a fluctuating interest rate landscape requires careful attention to these funding dynamics.

Economic Growth and Business Confidence

While U.S. economic growth is projected to slow down in 2025, with anticipated moderation in consumer spending and subdued business investment, a notable surge in U.S. corporate optimism occurred in late 2024. Companies expressed expectations for growth, lower borrowing costs, and increased capital expenditures.

This heightened business confidence, especially the anticipation of cheaper funding, could directly translate into a stronger demand for commercial loans, a key product for Columbia Bank. The bank's focus on small and medium-sized businesses means its financial performance is particularly tied to the sentiment and investment appetite of this segment.

- Economic Growth Forecast: U.S. GDP growth is expected to decelerate in 2025, impacting overall market activity.

- Business Investment Trends: Projections indicate weak business investment in the near term, potentially affecting loan demand.

- Corporate Optimism: U.S. companies reported a significant increase in optimism in late 2024, anticipating growth and improved financing conditions.

- Loan Demand Impact: Cheaper funding costs and growth expectations could drive higher demand for commercial loans from SMEs.

Acquisition and Market Expansion

Columbia Banking System's acquisition of Pacific Premier Bancorp, Inc., slated for completion in the latter half of 2025, represents a significant move to fast-track its Southern California market expansion by roughly ten years. This strategic merger is projected to solidify its standing in the region, spur loan portfolio growth, and ultimately boost shareholder returns through operational efficiencies and greater economies of scale.

The combined entity is expected to benefit from a more robust market presence and enhanced competitive capabilities. Key financial projections from the deal indicate potential for substantial cost savings, estimated to be around 10% of Pacific Premier's non-interest expense base, contributing to improved profitability and a stronger balance sheet.

- Accelerated Market Entry: The acquisition is designed to compress a decade of organic growth into a much shorter timeframe, providing immediate access to a larger customer base and market share in Southern California.

- Enhanced Loan Growth Potential: By integrating Pacific Premier's loan portfolio, Columbia anticipates a significant uplift in its lending activities, potentially increasing its loan book by over $7 billion.

- Synergistic Cost Savings: The merger is projected to yield approximately $50 million in annual cost savings, primarily through operational consolidation and technology integration, which will bolster profitability.

- Increased Scale and Efficiency: The combined institution will operate with a larger asset base, estimated at over $36 billion, enabling greater operational efficiency and a stronger competitive position against larger financial institutions.

Economic factors significantly shape Columbia Bank's operational landscape, with interest rate movements directly impacting its Net Interest Margin. While inflation is expected to moderate in 2025, leading to potential interest rate cuts, the bank faces persistent pressure from elevated deposit costs.

Despite a projected slowdown in overall U.S. economic growth for 2025, a notable surge in corporate optimism late in 2024, particularly regarding lower borrowing costs, could stimulate demand for commercial loans, a key area for Columbia Bank.

The bank's loan portfolio saw a slight contraction in Q1 2025, but low non-performing assets at 0.35% as of June 30, 2025, indicate a resilient credit quality, offering a buffer against economic downturns.

Columbia Bank's acquisition of Pacific Premier Bancorp in late 2025 is poised to accelerate its Southern California expansion, projected to increase its loan book by over $7 billion and yield approximately $50 million in annual cost savings.

| Economic Factor | Columbia Bank Impact | 2025 Projection/Data |

|---|---|---|

| Interest Rates | Net Interest Margin (NIM) | NIM at 3.60% (Q1 2025), potential rate cuts may impact NIM |

| Inflation | Consumer Spending, Loan Demand | Moderating inflation expected in 2025 |

| Economic Growth | Overall Market Activity, Loan Demand | U.S. GDP growth projected to decelerate |

| Corporate Optimism | Commercial Loan Demand | Surge in late 2024, anticipating growth and lower borrowing costs |

| Acquisition Impact | Market Share, Loan Growth, Cost Savings | Loan book increase >$7B, ~$50M annual cost savings |

Preview the Actual Deliverable

Columbia Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Columbia Bank provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering critical insights into Columbia Bank's strategic landscape. It covers all essential components of a PESTLE framework, ensuring you have a complete understanding.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying, providing a robust PESTLE analysis for Columbia Bank. This document is designed for immediate application in your strategic planning.

Sociological factors

The banking sector is navigating significant shifts as customer demographics evolve, particularly with the rise of Gen Z and Gen Alpha. These younger generations overwhelmingly favor digital and mobile-first banking solutions, demanding seamless online account opening, intuitive mobile apps, and robust digital payment options. For instance, a 2024 report indicated that over 80% of Gen Z consumers prefer to manage their finances entirely through digital channels.

Columbia Bank is actively responding to these changing preferences by enhancing its digital banking platform and ensuring strong customer service across all touchpoints. Recognizing the importance of inclusivity, the bank also emphasizes its multilingual capabilities to serve a diverse community base effectively. This dual focus on digital innovation and personalized service aims to attract and retain a broad spectrum of accountholders.

Columbia Bank actively demonstrates its commitment to community well-being through robust corporate responsibility programs. In 2024 alone, the Columbia Bank Foundation provided nearly $2.0 million in grants to various local charities, directly impacting community development and support services.

Beyond financial contributions, the bank fosters a culture of service among its employees. Associates dedicated almost 30,000 volunteer hours in 2024 to support local causes, amplifying the bank's positive societal footprint.

Key initiatives also focus on long-term community empowerment, with significant emphasis placed on financial literacy education and the development of affordable housing programs, aiming to build stronger, more resilient communities.

Columbia Bank is actively working to improve financial inclusion by offering products and services tailored for low- and moderate-income individuals and communities. This focus aims to broaden access to essential financial tools and resources for underserved populations.

In 2024 alone, the bank hosted 105 financial literacy events, many of which qualified under the Community Reinvestment Act (CRA). These initiatives underscore Columbia Bank's commitment to equipping individuals with the knowledge needed to manage their finances effectively.

Workforce and Employee Engagement

Columbia Bank prioritizes a strong workforce, with employee engagement a key focus. In 2024, over 300 of its approximately 800 employees actively participated in Employee Resource Groups (ERGs), demonstrating a commitment to community and belonging within the organization.

The bank's 'Do Right Together' philosophy underpins its efforts to cultivate a positive work environment. This approach emphasizes employee wellness, a supportive culture, and continuous development, all crucial for attracting and retaining top talent in the competitive financial sector.

- Workforce Size: Nearly 800 employees as of 2024.

- ERG Participation: Over 300 employees involved in ERGs in 2024.

- Core Philosophy: 'Do Right Together' focusing on wellness, culture, and development.

Customer Trust and Relationship Banking

Customer trust in community and regional banks has been on a downward trend since 2023. For instance, a 2024 survey by the American Bankers Association indicated that only 45% of consumers felt a high level of trust in regional banks, down from 58% in 2022. This makes it imperative for institutions like Columbia Bank to actively cultivate and demonstrate financial stability and reliability.

Columbia Bank's strategic approach hinges on fostering enduring customer relationships through personalized financial services. Their emphasis on a strong branch network, coupled with consistently high customer service ratings, aims to rebuild and solidify this trust.

Key elements of Columbia Bank's trust-building strategy include:

- Personalized Service: Tailoring financial solutions to individual customer needs.

- Branch Accessibility: Maintaining a physical presence to enhance customer interaction and support.

- Customer Service Excellence: Consistently achieving high satisfaction scores, with recent reports showing an average of 92% customer satisfaction for their branch interactions in early 2025.

- Financial Transparency: Clearly communicating financial health and security measures to reassure customers.

Societal expectations are shifting, with a growing demand for banks to demonstrate strong corporate social responsibility and community engagement. Younger demographics, in particular, prioritize institutions that align with their values, seeking out banks that actively contribute to social causes. Columbia Bank's commitment is evident in its 2024 foundation grants totaling nearly $2.0 million and over 30,000 employee volunteer hours dedicated to local initiatives, reflecting a deep integration into community well-being.

Technological factors

Community banks like Columbia Bank are significantly boosting their digital capabilities. This investment aims to make operations smoother and customer interactions better. For instance, many banks are prioritizing investments in automation and cloud solutions to drive efficiency.

The strategic shift is now about getting the most from current technology and staff. This includes leveraging artificial intelligence (AI) to automate tasks and improve decision-making processes. The goal is to optimize existing resources for greater output.

By focusing on these technological advancements, banks are enhancing their competitive edge. This digital transformation not only streamlines internal processes but also elevates the overall customer experience, a crucial factor in today's market.

Cybersecurity is paramount in today's digital banking landscape, especially with a reported 40% surge in cyberattacks targeting financial institutions during 2024. Columbia Bank must prioritize robust defenses to counter these threats effectively.

To safeguard customer data and maintain trust, Columbia Bank is investing heavily in advanced fraud detection systems and implementing multi-factor authentication across its platforms. Compliance with evolving data protection regulations, such as updated GDPR provisions effective in early 2025, is also a key focus to prevent costly breaches and maintain operational integrity.

The financial sector is rapidly integrating AI and machine learning, with nearly 40% of community banks actively incorporating these technologies into their strategic plans. This adoption is largely driven by the pursuit of greater efficiency, enhanced data analytics capabilities, and the ability to deliver hyper-personalized banking experiences to customers.

Columbia Bank is actively bolstering its technology initiatives, with a clear focus on leveraging AI. This strategic investment aims to streamline operations, enabling more informed decision-making processes and the development of highly customized customer offerings. The bank's commitment to AI reflects a broader industry trend toward digital transformation and customer-centric innovation.

Enhanced Digital Services and Customer Experience

Columbia Bank is leveraging cloud banking platforms to significantly upgrade its digital services, aiming to provide customers with greater access through new online channels. This strategic move is designed to speed up decision-making processes and minimize customer wait times, directly addressing the expectations of a modern, digitally inclined customer base.

The bank is actively investing in key technologies like instant payment systems, automated loan processing, and streamlined digital account opening procedures. These enhancements are crucial for meeting the demands of a market that increasingly values convenience and immediate digital interactions. For instance, by mid-2024, many financial institutions reported a significant uptick in digital transaction volumes, with some seeing over 70% of customer interactions occurring through online or mobile platforms.

- Cloud Adoption: Columbia Bank's shift to cloud platforms is enabling greater scalability and agility in delivering new digital features.

- Instant Payments: Investment in instant payment capabilities aims to reduce transaction settlement times, a key demand from tech-savvy consumers.

- Digital Onboarding: Streamlining digital account openings and loan processing directly addresses the need for faster, more convenient banking experiences.

- Customer Experience: These technological upgrades are central to enhancing overall customer satisfaction by offering seamless and efficient digital interactions.

Data Analytics and Personalization

Data analytics is fundamentally reshaping the banking sector, offering deep insights into customer behavior. This allows institutions like Columbia Bank to tailor their products and services, delivering them through increasingly sophisticated digital channels. By understanding individual customer needs, banks can create more relevant and engaging experiences. For instance, a report by Statista in early 2024 indicated that over 70% of consumers expect personalized offers from their financial institutions.

Columbia Bank is actively employing data analytics to refine its strategic decisions, focusing on anticipating and meeting customer demands. This data-driven approach aims to foster stronger customer relationships through personalized solutions, which in turn boosts engagement, encourages product adoption, and cultivates lasting loyalty. The bank’s investment in these capabilities is a direct response to market trends showing a significant preference for customized banking experiences.

- Customer Behavior Insights: Data analytics helps Columbia Bank understand transaction patterns, product preferences, and digital interaction habits.

- Personalized Offerings: Leveraging these insights, the bank can craft targeted product recommendations and financial advice.

- Digital Experience Enhancement: Data informs the design of user-friendly online and mobile banking platforms that cater to individual user journeys.

- Increased Customer Loyalty: Personalized service driven by data analytics is a key strategy for retaining and growing customer relationships in a competitive market.

Columbia Bank is enhancing its digital infrastructure, with a significant focus on cloud adoption and AI integration. By mid-2024, over 70% of customer interactions for many financial institutions were happening digitally, highlighting the critical need for robust online and mobile platforms. This strategic push aims to improve operational efficiency and deliver more personalized customer experiences, a key differentiator in the current market.

| Technology Focus | Impact | 2024/2025 Trend |

|---|---|---|

| AI & Machine Learning | Automating tasks, enhanced data analytics, personalized services | Nearly 40% of community banks incorporating AI into strategic plans. |

| Cloud Banking Platforms | Scalability, agility, improved digital service delivery | Enabling faster decision-making and reduced customer wait times. |

| Instant Payments | Reduced transaction settlement times | Meeting consumer demand for immediate digital interactions. |

| Cybersecurity | Protecting data, maintaining trust | 40% surge in cyberattacks targeting financial institutions in 2024. |

Legal factors

Columbia Bank navigates a complex dual banking system, facing oversight from both federal and state authorities. This means adhering to a broad spectrum of rules governing everything from how much capital they must hold to how they manage risks. For instance, following the regional bank stresses in early 2023, regulatory bodies like the Federal Reserve and state banking departments increased their focus on capital adequacy and liquidity requirements for institutions like Columbia Bank.

Key regulatory areas such as capital adequacy, liquidity management, and stress testing are under constant review. The proposed Basel III Endgame rules, for example, are expected to introduce more stringent capital requirements for banks, potentially increasing compliance burdens and impacting profitability. These evolving regulations directly influence Columbia Bank's operational strategies and financial health.

Policymakers are increasingly scrutinizing financial institutions for consumer protection, with a particular focus on areas like 'junk fees' and overdraft practices. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively investigating and proposing rules to curb excessive fees, aiming to increase transparency in deposit accounts and lending. Columbia Bank must adapt its offerings to align with these evolving standards, ensuring compliance to prevent penalties and preserve customer confidence.

Columbia Bank, like all financial institutions, operates under intense scrutiny for anti-money laundering (AML) and financial crime compliance. In 2024, regulators worldwide, including FinCEN in the United States, continue to emphasize robust AML programs. Failure to comply can result in significant penalties; for instance, in 2023, several major banks faced multi-million dollar fines for AML deficiencies.

Adhering to these stringent regulations necessitates continuous investment in technology and personnel to detect and report suspicious transactions effectively. Columbia Bank must maintain sophisticated internal controls and adapt its compliance infrastructure to evolving typologies of financial crime, ensuring it meets the expectations set by global regulatory bodies and avoids costly enforcement actions.

Data Privacy and Security Laws

Columbia Bank faces growing scrutiny under data privacy and security laws, a trend amplified by its digital transformation initiatives. Compliance with regulations like GDPR and CCPA, which govern the handling of sensitive customer data, is paramount. In 2024, the financial sector saw a significant rise in cyber threats, with data breaches costing an average of $5.58 million globally, according to IBM's 2024 Cost of a Data Breach Report. This underscores the critical need for robust cybersecurity measures and ethical data handling practices to prevent breaches and maintain customer trust.

The bank must actively implement and maintain strong cybersecurity protocols to protect customer information. This includes investing in advanced threat detection, regular security audits, and employee training on data protection best practices. Failure to comply can result in substantial fines and reputational damage, impacting customer loyalty and market standing.

- Regulatory Landscape: Navigating evolving data privacy laws is crucial for financial institutions.

- Cybersecurity Investment: Increased spending on advanced security measures is non-negotiable.

- Customer Trust: Robust data protection directly correlates with customer confidence and retention.

- Compliance Costs: Proactive compliance can mitigate potentially crippling fines and legal expenses.

Merger and Acquisition (M&A) Regulations

Columbia Bank's strategic acquisition of Pacific Premier Bancorp in 2024, valued at approximately $2.1 billion, underscores the critical role of merger and acquisition (M&A) regulations in the banking industry. These regulations ensure financial stability and fair competition, requiring thorough review and approval from bodies like the Federal Reserve and the Office of the Comptroller of the Currency.

The regulatory landscape for bank mergers is dynamic. While a new administration might signal a more permissive environment for consolidation, potentially easing some approval hurdles, stringent oversight and robust approval processes are expected to persist. This careful balance aims to prevent systemic risks while allowing for efficient market adjustments.

- Regulatory Approval: Columbia Bank's acquisition of Pacific Premier Bancorp required extensive review by U.S. banking regulators.

- Potential for Permissiveness: A shift in administration could lead to a more favorable environment for future bank M&A activity.

- Ongoing Oversight: Despite potential shifts, strict oversight and rigorous approval processes remain fundamental to banking M&A.

- Market Consolidation: Regulatory frameworks directly influence the pace and feasibility of consolidation within the banking sector.

Columbia Bank must navigate a constantly evolving legal framework, from consumer protection laws to stringent data privacy regulations. The Consumer Financial Protection Bureau's (CFPB) ongoing focus on areas like overdraft fees and 'junk fees' directly impacts how banks structure their customer agreements and fee schedules. Furthermore, increased regulatory scrutiny following the 2023 regional banking stresses means heightened attention on capital adequacy and liquidity, as exemplified by the proposed Basel III Endgame rules which will likely increase capital requirements for banks like Columbia.

Anti-money laundering (AML) and cybersecurity compliance remain critical legal imperatives. In 2024, regulators continue to emphasize robust AML programs, with significant fines levied against institutions for deficiencies, underscoring the need for advanced detection and reporting systems. Similarly, data breaches, which cost an average of $5.58 million globally in 2024 according to IBM, necessitate substantial investment in cybersecurity to comply with data protection laws and maintain customer trust.

Merger and acquisition (M&A) regulations, such as those governing Columbia Bank's $2.1 billion acquisition of Pacific Premier Bancorp in 2024, are vital for ensuring financial stability and fair competition. While a new administration might signal a more permissive environment for consolidation, rigorous oversight and approval processes from bodies like the Federal Reserve are expected to persist, shaping the future of market consolidation.

Environmental factors

Columbia Bank is actively integrating environmental considerations into its operations, with its Nominating/Governance Committee taking the lead in overseeing ESG strategies throughout 2024. This focus is designed to measure and reduce the bank's environmental footprint.

The bank's dedication to sustainability is evident in its policies, which aim to foster positive environmental and social outcomes. For instance, Columbia Bank has set targets to reduce its Scope 1 and 2 greenhouse gas emissions by 25% by 2030 compared to a 2022 baseline.

Columbia Bank's Environmental Liability and Risk Policy addresses potential risks stemming from lending activities impacted by adverse environmental factors. This proactive approach is crucial as the financial sector increasingly scrutinizes climate-related risks, with a growing emphasis on integrating environmental considerations into investment and lending decisions. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, widely adopted by financial institutions, mandates reporting on climate-related risks and opportunities, reflecting a global shift towards greater transparency and accountability.

Columbia Bank's focus on small and medium-sized businesses naturally limits its direct exposure to the fossil fuel sector. However, the broader financial industry is seeing a significant shift towards 'green' lending and the establishment of emission reduction targets by financial institutions. For instance, as of late 2024, major global banks have committed billions to sustainable finance initiatives, reflecting this growing trend.

This environmental push creates a strategic opening for Columbia Bank. By proactively developing specialized green finance products and services, the bank can cultivate a unique competitive edge in the market. This could involve offering loans for renewable energy projects or sustainable business practices, aligning with the increasing demand for environmentally conscious financial solutions.

Operational Environmental Footprint

Columbia Bank is actively working to shrink its environmental impact through sustainable business practices. A key focus is measuring and reducing greenhouse gas emissions stemming directly from its operations, demonstrating a commitment to corporate responsibility and environmental stewardship.

In 2023, Columbia Bank reported a 15% reduction in energy consumption across its branches compared to 2020 levels, largely due to energy-efficient upgrades and smart building technology. The bank also aims to increase its use of renewable energy sources, targeting 50% of its energy needs to be met by renewables by 2027.

- Energy Efficiency: Implementing LED lighting and motion sensors in all facilities.

- Waste Reduction: Aiming for a 25% reduction in paper usage by promoting digital banking solutions.

- Emissions Monitoring: Tracking Scope 1 and Scope 2 emissions with a goal of a 30% reduction by 2030.

- Sustainable Procurement: Prioritizing suppliers with strong environmental track records.

Stakeholder Pressure and Reputation

Increasing societal awareness of climate change is placing significant pressure on financial institutions like Columbia Bank. Stakeholders, including customers and investors, are increasingly scrutinizing banks' environmental impact and demanding more sustainable practices. This can directly affect a bank's reputation and customer loyalty, especially as organizations actively encourage a shift towards greener financial options.

Groups like Bank.Green are actively mobilizing consumers to pressure banks to divest from fossil fuels and support environmentally conscious institutions. They highlight the importance of a bank's climate score, influencing customer decisions. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental policies when making purchasing decisions, a trend that extends to banking relationships.

Columbia Bank's approach to environmental, social, and governance (ESG) factors, particularly its climate stance, is therefore crucial for maintaining a positive public image. Failure to address these concerns could lead to reputational damage and a loss of business to competitors with stronger sustainability credentials. By 2025, it's projected that ESG-focused investments will represent a significant portion of the global asset management market, underscoring the financial imperative of environmental responsibility.

- Growing Demand for Sustainable Finance: By Q1 2025, the global sustainable finance market is expected to exceed $50 trillion, with a growing segment of this directed towards banks demonstrating robust environmental commitments.

- Reputational Risk: A bank's perceived inaction on climate change could lead to negative media coverage and consumer boycotts, potentially impacting market share.

- Investor Scrutiny: Institutional investors are increasingly integrating climate risk into their due diligence, with a notable increase in shareholder resolutions demanding climate action from banks in 2024 and 2025.

- Customer Loyalty: Studies from late 2024 show that banks with clear and actionable climate policies experience higher customer retention rates, particularly among younger demographics.

Columbia Bank's environmental strategy is evolving, with a 25% reduction target for Scope 1 and 2 greenhouse gas emissions by 2030 from a 2022 baseline. The bank is also working to increase its use of renewable energy, aiming for 50% by 2027, and reported a 15% energy consumption reduction in 2023 compared to 2020.

Growing societal and investor pressure for climate action is a significant environmental factor. By Q1 2025, the global sustainable finance market is projected to surpass $50 trillion, with a substantial portion favoring institutions with strong environmental commitments. This trend highlights the reputational and financial benefits of robust sustainability practices.

Columbia Bank's focus on small and medium-sized businesses naturally limits direct exposure to high-emission sectors like fossil fuels. However, the broader financial industry is experiencing a surge in green lending, with major global banks committing billions to sustainable initiatives as of late 2024.

| Environmental Initiative | Target/Status | Year | Impact Metric |

|---|---|---|---|

| Greenhouse Gas Emission Reduction (Scope 1 & 2) | 25% reduction | 2030 | vs. 2022 baseline |

| Renewable Energy Usage | 50% | 2027 | of total energy needs |

| Energy Consumption Reduction | 15% reduction | 2023 | vs. 2020 levels |

| Paper Usage Reduction | 25% reduction | Ongoing | via digital banking |

PESTLE Analysis Data Sources

Our Columbia Bank PESTLE analysis is meticulously constructed using a combination of official government publications, reputable financial news outlets, and industry-specific reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.