Coca-Cola Europacific Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola Europacific Partners Bundle

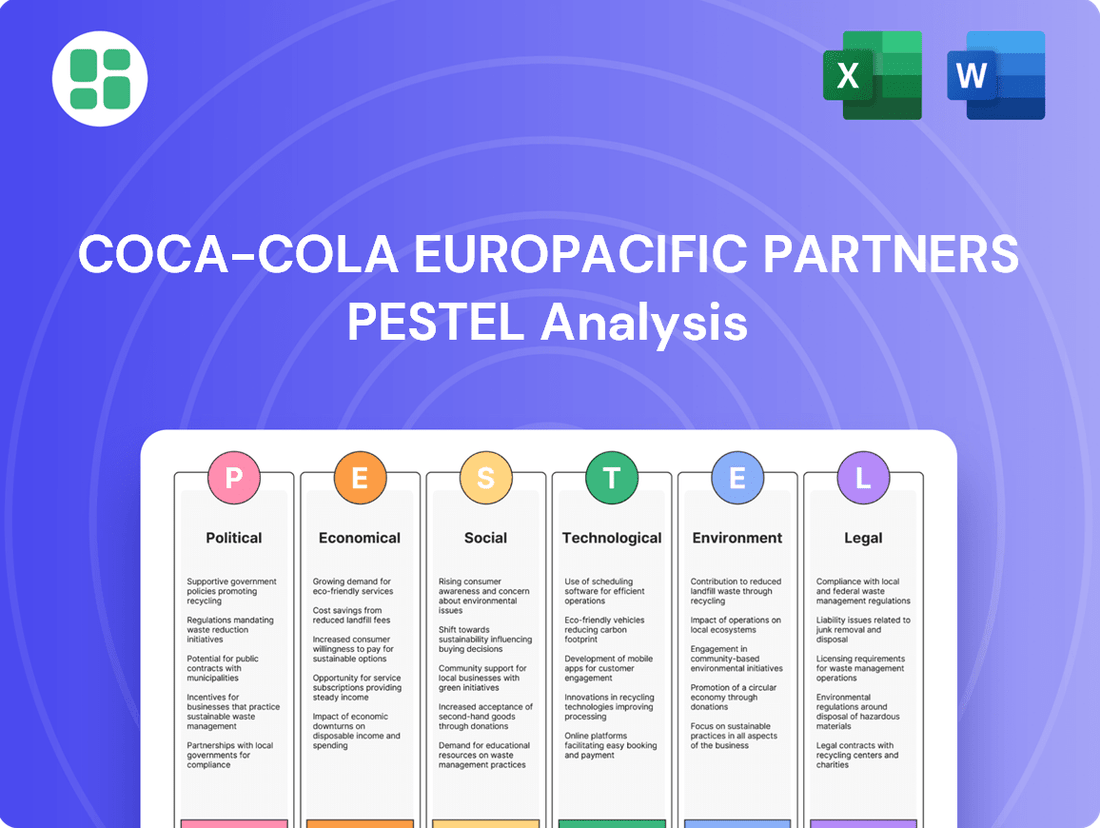

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Coca-Cola Europacific Partners's future. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate these complex dynamics. Gain a competitive edge by understanding the external forces impacting this beverage giant. Download the full PESTLE analysis now to unlock strategic insights and inform your decision-making.

Political factors

Governments in CCEP's key markets, particularly in Europe, are continuing to implement or consider sugar taxes. For instance, the UK's sugar tax, introduced in 2018, has seen manufacturers reformulate drinks to reduce sugar content. This trend is expanding, with Spain and Portugal also having introduced or strengthened similar levies, directly impacting CCEP's pricing strategies and sales volumes.

Political stability and evolving trade policies across CCEP's diverse operating regions, from Western Europe to the Asia-Pacific, significantly influence market access and operational costs. Changes in trade agreements or tariffs could affect CCEP's supply chain efficiency and the cost of importing raw materials or exporting finished goods, impacting overall profitability.

International trade policies and agreements are a critical political factor for Coca-Cola Europacific Partners (CCEP). These policies directly influence the cost of CCEP's operations, from sourcing raw materials like sugar and concentrate to acquiring manufacturing equipment and distributing finished products across its vast geographical footprint.

For instance, the European Union’s trade relationships, including those with countries outside the EU, can create either advantages or disadvantages. In 2024, the EU continued to navigate complex trade dynamics, with ongoing discussions and potential adjustments to existing agreements impacting import duties and export regulations. CCEP's extensive presence in markets like Australia, New Zealand, Indonesia, and Papua New Guinea means that bilateral trade agreements and regional pacts, such as those involving the Pacific region, are particularly important for managing supply chain costs and market access.

Any shifts in these trade relations, whether through new tariffs or the renegotiation of existing pacts, could introduce new barriers or open up fresh opportunities for CCEP. These changes directly affect supply chain efficiency and, consequently, the company's overall profitability by altering the cost structure of its international business operations.

Governments worldwide are increasingly focused on public health, implementing campaigns that encourage reduced consumption of sugary beverages. This trend directly impacts Coca-Cola Europacific Partners (CCEP) by potentially shifting consumer preferences towards healthier alternatives. For instance, in the UK, the government's sugar tax, introduced in 2018, has already led to a significant reformulation of many soft drinks, with CCEP actively participating by increasing its low and no-sugar offerings.

Political Stability in Operating Regions

Political stability is a critical consideration for Coca-Cola Europacific Partners (CCEP), given its extensive operations across numerous countries. Geopolitical instability and regional conflicts, as CCEP noted in its 2024 Annual Report, directly impact supply chains, profitability, and brand reputation. For instance, ongoing tensions in Eastern Europe, a key market for CCEP, can disrupt logistics and increase operational costs, as seen with the company's focus on supply chain resilience in the region.

CCEP must therefore maintain a vigilant approach to political uncertainties across its diverse operating territories. This proactive monitoring allows the company to adapt swiftly to changing political landscapes, ensuring business continuity and mitigating potential disruptions. The company's 2024 sustainability report highlights efforts to strengthen local partnerships and diversify sourcing to build resilience against such external shocks.

- Geopolitical Risks: CCEP's 2024 Annual Report explicitly mentions geopolitical instability as a significant risk factor affecting its business operations.

- Supply Chain Vulnerability: Regional conflicts can lead to disruptions in raw material sourcing and finished product distribution, impacting CCEP's ability to meet demand.

- Adaptation Strategies: The company actively monitors political developments and implements strategies, such as localized production and diversified supplier bases, to manage these risks.

- Reputational Impact: Operating in politically sensitive regions requires careful management to maintain CCEP's corporate reputation and stakeholder trust.

Lobbying and Industry Influence

Coca-Cola Europacific Partners (CCEP), as a significant player in the beverage industry, actively participates in lobbying and engages with key industry associations, such as UNESDA in Europe. These interactions are designed to shape regulations concerning ingredients, packaging, and marketing practices. The success of these lobbying endeavors in securing favorable legislative outcomes presents a critical political consideration for CCEP's operations and strategic direction.

CCEP's influence is often exerted through direct engagement with government bodies and participation in industry-wide advocacy. For instance, in 2023, the European Union continued to debate and implement policies related to the circular economy and plastic waste reduction, directly impacting CCEP's packaging strategies and costs. The company's ability to influence these discussions can lead to more manageable regulatory frameworks.

- Industry Associations: CCEP is a member of various national and international beverage associations, enabling collective lobbying efforts.

- Regulatory Focus: Key areas of influence include food safety standards, environmental regulations (e.g., Extended Producer Responsibility schemes), and advertising restrictions.

- Lobbying Expenditure: While specific figures for CCEP's lobbying in 2024/2025 are not publicly detailed, major corporations in the sector typically invest significant resources in influencing policy. For example, in 2022, the broader food and beverage industry in the EU reported substantial lobbying expenditures to shape regulatory agendas.

- Policy Outcomes: The effectiveness of CCEP's lobbying can be observed in the nuances of adopted legislation, potentially leading to phased implementation timelines or industry-friendly compliance mechanisms.

Governments' focus on public health continues to drive regulations, including sugar taxes in markets like the UK and Spain, impacting CCEP's product pricing and sales volumes. Political stability across CCEP's diverse European and Asia-Pacific markets is crucial, as geopolitical risks can disrupt supply chains and increase operational costs, as highlighted in CCEP's 2024 annual report.

CCEP actively engages in lobbying through industry associations like UNESDA to influence regulations on packaging and marketing, aiming for favorable outcomes in areas like circular economy policies debated in the EU in 2023. Trade policies and agreements are vital for CCEP, affecting raw material sourcing and finished goods distribution, with bilateral pacts in the Asia-Pacific region being particularly important for managing costs and market access in 2024.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Coca-Cola Europacific Partners across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

Provides a clear, actionable framework to navigate the complex external landscape, enabling Coca-Cola Europacific Partners to proactively address potential challenges and capitalize on emerging opportunities.

Economic factors

Rising inflation rates across Coca-Cola Europacific Partners' (CCEP) key markets, especially in Europe, are significantly impacting the cost of essential raw materials like sugar, aluminum, and PET plastic. These inflationary pressures also extend to energy and transportation expenses, directly affecting CCEP's operational expenditures. For instance, in 2024, many European economies experienced inflation rates exceeding 5%, a trend anticipated to persist into 2025, though potentially moderating.

Consequently, CCEP must implement robust cost management strategies, including dynamic pricing adjustments and targeted efficiency programs, to safeguard its profit margins. The company's commitment to effectively managing its cost of sales, a critical focus area for 2025, underscores the importance of navigating these inflationary headwinds. This proactive approach is vital for maintaining competitiveness and shareholder value in a challenging economic climate.

Consumer purchasing power significantly influences CCEP's performance. Economic downturns or high inflation can shrink disposable income, potentially decreasing demand for beverages like Coca-Cola or prompting a switch to cheaper, private-label alternatives. For instance, in Q1 2024, CCEP reported a 6.1% increase in revenue, partly driven by price increases, indicating a delicate balance in maintaining demand amidst cost pressures.

CCEP's extensive product portfolio and diverse packaging options allow for flexible pricing and promotional strategies. This adaptability is key to catering to a wide range of consumers, from those seeking premium options to budget-conscious shoppers. In 2023, CCEP's focus on value-added offerings and strategic promotions helped it navigate varying consumer spending habits across its European markets.

Coca-Cola Europacific Partners (CCEP) operates in numerous countries, meaning it deals with various currencies like the Euro, Australian Dollar, and Indonesian Rupiah. This exposure to different exchange rates creates a risk, as currency values can change unpredictably. For instance, a strengthening Euro against the Australian Dollar could make CCEP's Australian earnings worth less when reported in Euros.

These fluctuations directly affect CCEP's financial performance. When local currency earnings are translated back to the company's reporting currency, significant exchange rate movements can alter reported revenues and profits. For example, if the Indonesian Rupiah weakens substantially against the Euro, CCEP's sales in Indonesia would translate to fewer Euros, impacting its overall profitability figures for 2024.

Economic Growth and Market Expansion

Positive economic growth across Coca-Cola Europacific Partners' (CCEP) operating regions is a significant tailwind, particularly in emerging markets. This expansion fuels consumer spending on beverages, driving both volume and revenue growth for the company. CCEP is strategically positioned to capitalize on these trends.

CCEP's focus on faster-growing markets, such as the Asia Pacific and Southeast Asia, is a key element of its expansion strategy. Countries like the Philippines and Indonesia are experiencing robust economic development, translating into increased demand for CCEP's diverse product portfolio.

CCEP's investments and expansion initiatives in these high-potential regions are designed to capture this growth. For example, continued investment in distribution networks and marketing efforts in markets like Indonesia, which saw a GDP growth of approximately 5.0% in 2023, directly supports increased market penetration and sales.

- Asia Pacific Growth: CCEP's operating regions in Asia Pacific, including the Philippines and Indonesia, are experiencing strong economic expansion, creating fertile ground for increased beverage consumption.

- Strategic Investments: The company is actively investing in these markets to enhance its distribution capabilities and brand presence, aiming to maximize its share of the growing demand.

- Volume and Revenue Potential: This economic uplift directly translates into opportunities for CCEP to grow its sales volumes and overall revenue as consumer purchasing power rises.

Interest Rates and Access to Capital

Changes in interest rates directly impact Coca-Cola Europacific Partners' (CCEP) operational costs and strategic flexibility. Higher interest rates translate to increased borrowing expenses for CCEP, potentially hindering its capacity to finance crucial capital expenditures like upgrading bottling facilities or expanding its distribution network.

Conversely, a supportive interest rate environment can significantly bolster CCEP's growth initiatives. For instance, the company's announced €1 billion share buyback plan for 2025 is more feasible and value-accretive when capital can be accessed at lower borrowing costs. This allows CCEP to return capital to shareholders while still pursuing strategic investments.

- Borrowing Costs: Rising interest rates increase the cost of debt for CCEP, impacting profitability and investment capacity.

- Investment Financing: Access to capital at favorable rates is crucial for CCEP's planned investments in production, technology, and potential acquisitions.

- Shareholder Returns: Lower interest rates make capital allocation strategies, such as the €1 billion share buyback in 2025, more financially attractive and sustainable.

Global economic slowdowns and recessions pose a significant threat to Coca-Cola Europacific Partners (CCEP) by reducing consumer disposable income and overall demand for beverages. For example, if major markets like Germany or Australia experience a contraction in GDP in 2024 or 2025, CCEP's sales volumes could decline. This necessitates a focus on value offerings and cost efficiency to maintain market share and profitability during such periods.

The company's financial health is also influenced by global trade policies and tariffs, which can affect the cost of imported raw materials or finished goods. Additionally, geopolitical instability can disrupt supply chains and impact consumer confidence, indirectly affecting CCEP's performance. CCEP's ability to adapt its supply chain and pricing strategies in response to these macroeconomic shifts is crucial for its resilience.

Same Document Delivered

Coca-Cola Europacific Partners PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Coca-Cola Europacific Partners details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a robust framework for understanding the external forces shaping their business strategy and operational landscape.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a heightened awareness of sugar content, obesity, and artificial ingredients in beverages. This sociological shift directly impacts CCEP's product strategy, as evidenced by the growing demand for low-sugar, zero-sugar, and functional drinks.

In 2024, the global functional beverage market, which includes drinks with added health benefits, was projected to reach over $170 billion, indicating a strong consumer appetite for these products. CCEP's response includes significant investment in reformulating existing brands and expanding its portfolio of healthier alternatives, such as water and reduced-sugar options, to align with these evolving consumer preferences.

Consumer tastes are shifting beyond just health consciousness, with a growing appetite for variety, novel flavors, and tailored experiences. Coca-Cola Europacific Partners (CCEP) is actively addressing this by focusing on new product development, introducing updated versions of beloved brands, and expanding into emerging segments such as hydration, coffee, and alcoholic ready-to-drink (ARTD) beverages.

Demographic shifts are significantly shaping CCEP's market landscape. For instance, Europe's aging population in 2024 might lead to a greater demand for lower-sugar or functional beverages, while the burgeoning youth demographic in the Asia Pacific region, which saw a significant increase in the under-25 population in recent years, presents opportunities for growth in traditional and innovative drink categories.

Urbanization trends are also a key sociological factor. As more people migrate to cities, particularly in the Asia Pacific, CCEP needs to optimize its distribution networks to reach these concentrated consumer bases effectively. This shift necessitates agile route-to-market strategies to ensure product availability in diverse urban consumption occasions, from convenience stores to food service establishments.

Sustainability and Ethical Consumption

Consumers are increasingly prioritizing brands that demonstrate a commitment to sustainability and ethical practices. This trend directly impacts purchasing decisions, with a growing preference for companies that offer recyclable packaging, minimize their carbon footprint, and ensure ethical sourcing throughout their supply chains. Coca-Cola Europacific Partners (CCEP) is actively responding to this by investing in initiatives aimed at reducing environmental impact and promoting responsible consumption.

CCEP's sustainability efforts are crucial for maintaining a positive brand image and driving consumer loyalty. For instance, in 2023, CCEP reported that 96% of its packaging was recyclable, a significant step towards its goal of 100% by 2025. Furthermore, the company is working to reduce its greenhouse gas emissions, aiming for a 30% reduction across its value chain by 2030 compared to a 2019 baseline.

- Packaging Innovation: CCEP is investing in lightweighting and increasing the recycled content in its plastic bottles, with a target of 50% recycled PET by 2025.

- Water Stewardship: The company aims to replenish 100% of the water used in its manufacturing processes by 2030, reflecting a commitment to responsible water management.

- Carbon Reduction: CCEP is transitioning to renewable energy sources for its operations and exploring lower-carbon logistics solutions to meet its emission reduction targets.

Digital Influence and Social Media

The ever-growing reach of digital and social media, including platforms like TikTok, profoundly influences how consumers perceive brands, what trends they follow, and how they make purchasing decisions. Coca-Cola Europacific Partners (CCEP) actively utilizes these channels for its marketing efforts, connecting with customers through creative campaigns and swiftly adapting to emerging market trends.

CCEP's digital strategy is crucial for maintaining brand relevance and driving sales. For instance, in 2024, CCEP continued to invest in digital advertising, aiming to capture the attention of younger demographics who are heavily influenced by social media trends. Their engagement strategies often involve influencer collaborations and user-generated content campaigns, designed to foster authentic connections.

- Digital Engagement: CCEP's social media presence saw significant growth in 2024, with key platforms reporting millions of engagements on campaign-specific content.

- Trend Responsiveness: The company demonstrated agility in incorporating viral social media trends into its marketing, leading to measurable increases in brand visibility.

- Consumer Insights: Real-time data from social listening tools allows CCEP to quickly gauge consumer sentiment and adjust product offerings or marketing messages.

Sociological factors significantly influence Coca-Cola Europacific Partners (CCEP) by shaping consumer preferences towards health, sustainability, and authentic brand experiences. The increasing demand for low-sugar and functional beverages, alongside a growing concern for environmental impact, directly guides CCEP's product development and corporate responsibility initiatives.

Demographic shifts, such as an aging European population and a youthful demographic in Asia Pacific, present distinct market opportunities and challenges that CCEP must address through tailored product offerings and marketing strategies. Urbanization also necessitates optimized distribution to cater to concentrated consumer bases.

Digital and social media platforms are paramount in shaping consumer perceptions and purchasing decisions, compelling CCEP to maintain a strong online presence and adapt swiftly to emerging trends. This digital engagement is vital for brand relevance and connecting with diverse consumer segments.

| Sociological Factor | Impact on CCEP | Example/Data (2024/2025) |

|---|---|---|

| Health & Wellness Consciousness | Drives demand for low-sugar, functional drinks. | Global functional beverage market projected over $170 billion in 2024. |

| Sustainability & Ethical Practices | Influences brand loyalty and purchasing decisions. | CCEP's 2023 report showed 96% recyclable packaging; target 100% by 2025. |

| Changing Tastes & Variety Seeking | Prompts new product development and portfolio expansion. | CCEP expanding into hydration, coffee, and alcoholic ready-to-drink (ARTD) segments. |

| Digital & Social Media Influence | Shapes brand perception and marketing strategies. | CCEP investing in digital advertising and influencer collaborations in 2024. |

Technological factors

Coca-Cola Europacific Partners (CCEP) leverages advanced automation and robotics across its production and supply chain to boost efficiency and cut costs. This includes significant investment in new production lines, with a focus on optimizing operational processes and minimizing downtime through predictive maintenance systems. For instance, CCEP's 2023 capital expenditure of €1.1 billion was partly allocated to enhancing manufacturing capabilities and supply chain infrastructure, reflecting a commitment to technological advancement.

Coca-Cola Europacific Partners (CCEP) is increasingly leveraging data analytics and artificial intelligence (AI) to sharpen its operational edge. AI and machine learning are being deployed across CCEP's value chain, from predicting consumer demand and managing stock levels to ensuring product quality and tailoring marketing campaigns. For instance, AI-driven insights from extensive sales and supply chain data are crucial for optimizing procurement processes, leading to demonstrable cost efficiencies.

The burgeoning growth of e-commerce presents both opportunities and challenges for Coca-Cola Europacific Partners (CCEP). To effectively cater to evolving consumer shopping habits, CCEP must maintain and enhance its digital sales platforms, ensuring a seamless online experience. This includes investing in user-friendly websites and mobile applications that facilitate easy browsing and purchasing.

Furthermore, the efficiency of last-mile delivery is paramount in the digital age. CCEP needs to optimize its logistics network to ensure timely and cost-effective delivery of its products to consumers who increasingly opt for online purchases. This might involve partnerships with third-party logistics providers or further development of its own delivery infrastructure.

CCEP's commitment to digital expansion is evident in its ongoing investments. For instance, by the end of 2023, CCEP reported a significant increase in digital sales, with online channels contributing a growing percentage to its overall revenue. This trend is projected to continue, with e-commerce expected to capture an even larger share of the beverage market in 2024 and beyond, necessitating sustained investment in digital capabilities to maintain competitiveness and expand market reach.

New Packaging Technologies

Innovation in packaging technology is a significant technological factor for Coca-Cola Europacific Partners (CCEP). The company is actively exploring advancements like nano stretch film, which can reduce material usage and waste. For instance, CCEP has committed to using 100% recycled or renewable materials in its packaging by 2025, a target that heavily relies on technological progress in this area.

Advancements in recycled PET (rPET) are crucial for CCEP to meet its ambitious sustainability goals and cater to growing consumer demand for environmentally friendly products. CCEP's investment in new recycling technologies and partnerships aims to increase the availability and quality of rPET. By 2023, CCEP reported that 98.6% of its plastic packaging was recyclable, reusable, or compostable, highlighting ongoing technological improvements.

Developing more recyclable and reusable packaging solutions is a key focus. This involves research into novel materials and packaging designs that minimize environmental impact throughout their lifecycle. CCEP's efforts include piloting reusable packaging systems in various markets, supported by technological infrastructure for collection and refilling.

- Nano stretch film: Reduces material waste in secondary packaging.

- Recycled PET (rPET): Increased use of rPET in bottles, with targets for higher percentages.

- Reusable packaging: Investment in technologies for refillable and returnable bottle systems.

- Sustainable materials research: Ongoing innovation in plant-based and biodegradable packaging alternatives.

Digital Transformation and Cybersecurity

Coca-Cola Europacific Partners (CCEP) is actively engaged in a comprehensive digital transformation, a strategic move that includes substantial investment in cloud computing and generative artificial intelligence. Working with partners like Microsoft, CCEP is integrating these advanced technologies to streamline operations and enhance customer engagement. This digital evolution is critical for maintaining a competitive edge in the rapidly changing beverage market.

The company's digital transformation journey necessitates robust cybersecurity measures. As CCEP expands its digital footprint and data processing capabilities, protecting sensitive information and ensuring the integrity of its operations becomes paramount. The increasing sophistication of cyber threats demands continuous vigilance and investment in advanced security protocols to safeguard against potential disruptions and data breaches.

- Digital Investment: CCEP's commitment to digital transformation includes significant investments in cloud and generative AI technologies, aiming to modernize its infrastructure and unlock new efficiencies.

- Cybersecurity Imperative: The digital shift amplifies the need for strong cybersecurity to protect vast amounts of data and maintain operational continuity amidst escalating cyber risks.

- Strategic Partnerships: Collaborations with technology leaders like Microsoft are central to CCEP's digital strategy, facilitating the adoption of cutting-edge solutions.

Coca-Cola Europacific Partners (CCEP) is heavily investing in automation and AI to optimize its manufacturing and supply chain operations. This includes adopting advanced robotics and predictive maintenance systems to boost efficiency and reduce costs. For instance, CCEP's 2023 capital expenditure of €1.1 billion supported enhancements in manufacturing capabilities and supply chain infrastructure, underscoring a strong commitment to technological advancement.

The company is also leveraging data analytics and AI to improve demand forecasting, inventory management, and product quality. These technologies are crucial for optimizing procurement and tailoring marketing efforts, leading to tangible cost savings. CCEP's digital transformation includes significant investments in cloud computing and generative AI, with strategic partnerships, such as with Microsoft, driving the adoption of cutting-edge solutions.

Innovation in packaging technology is a key focus, with CCEP aiming to use 100% recycled or renewable materials by 2025, a goal reliant on advancements in areas like recycled PET (rPET) and new materials. By 2023, 98.6% of its plastic packaging was recyclable, reusable, or compostable, showcasing progress in sustainable material technology.

Legal factors

Coca-Cola Europacific Partners (CCEP) operates under a stringent framework of food safety and quality regulations across its diverse markets. These regulations are not merely guidelines but legally binding requirements that dictate everything from ingredient sourcing to final product packaging. For instance, in the European Union, the General Food Law (Regulation (EC) No 178/2002) establishes overarching principles for food safety, including traceability and hazard analysis. Adherence is non-negotiable.

Failure to comply can result in severe consequences. In 2023, food safety recalls in the UK alone led to significant financial losses for various food and beverage companies, with some facing millions in lost revenue and reputational damage. CCEP's commitment to rigorous quality control, including extensive testing and supplier audits, is therefore crucial to mitigate these risks and ensure consumer confidence, especially considering the sheer volume of beverages, like the 2.3 billion unit cases of beverages CCEP sold in 2023.

New and evolving packaging regulations, such as the EU Packaging and Packaging Waste Regulation (PPWR) set to take full effect in January 2025, are significantly impacting Coca-Cola Europacific Partners (CCEP). These laws introduce strict mandates for recycled content, recyclability, and reusability across all packaging types.

CCEP must adapt its packaging designs and material sourcing strategies to comply with these stringent requirements, which aim to reduce packaging waste and promote a circular economy. For instance, the PPWR targets a 25% recycled content in PET beverage bottles by 2025, a figure CCEP is actively working towards across its portfolio.

Coca-Cola Europacific Partners (CCEP) must navigate a complex web of advertising and marketing laws, particularly those concerning health claims, sugar content, and the targeting of children. These regulations directly shape how CCEP promotes its diverse beverage portfolio across its vast European and Pacific territories. For instance, in 2023, the UK's Advertising Standards Authority (ASA) continued to enforce strict rules against misleading health claims in food and drink advertising, impacting CCEP's ability to highlight specific product benefits without robust substantiation.

Compliance is not just about avoiding penalties; it's crucial for maintaining brand trust and reputation. CCEP actively participates in voluntary industry initiatives, such as the Portman Group's codes of practice in the UK, which set standards for responsible alcohol marketing. Failure to adhere to these, or to evolving consumer protection laws across its operating regions, could lead to significant fines and damage CCEP's carefully cultivated brand image. The company's 2023 annual report highlighted ongoing efforts to ensure all marketing materials align with local and international advertising standards.

Labor Laws and Employment Regulations

Coca-Cola Europacific Partners (CCEP), employing around 41,000 individuals across its operating regions, navigates a complex web of labor laws. These regulations govern everything from minimum wage and working hours to workplace safety and the right to unionize. Staying compliant is crucial for CCEP to maintain good employee relations and avoid costly legal battles.

CCEP's adherence to labor laws directly impacts its operational costs and workforce stability. For instance, minimum wage adjustments in key markets like Germany or the UK can influence overall labor expenditure. Recent data from 2023 indicated that labor costs represent a significant portion of operating expenses for beverage manufacturers.

- Wage Compliance: CCEP must ensure all employees are paid at least the statutory minimum wage in each country of operation, which can vary significantly.

- Working Conditions: Regulations dictate standards for working hours, rest breaks, and health and safety protocols within CCEP's manufacturing and distribution facilities.

- Employee Rights: Laws protect employees' rights to fair treatment, non-discrimination, and the ability to engage in collective bargaining with unions.

- Collective Bargaining: In many European markets, CCEP engages with works councils and trade unions to negotiate terms of employment, impacting salary structures and benefits.

Competition and Anti-Trust Laws

Coca-Cola Europacific Partners (CCEP) navigates a highly competitive beverage market, necessitating strict adherence to competition and anti-trust laws across its operating regions, including Europe and Australia. These regulations are crucial for preventing monopolistic behavior, fostering fair market practices, and avoiding potential investigations and penalties from regulatory bodies. For instance, the European Commission actively monitors mergers and acquisitions within the food and beverage sector to ensure they do not unduly restrict competition. CCEP's market share and pricing strategies are continuously scrutinized to comply with these mandates.

CCEP's commitment to fair competition is vital for its long-term sustainability and reputation. Regulatory bodies like the UK's Competition and Markets Authority (CMA) have the power to impose significant fines for anti-competitive practices. In 2024, the CMA continued its focus on market dominance in various sectors, underscoring the importance of CCEP's compliance framework. Failure to comply could result in substantial financial penalties and operational disruptions.

- Regulatory Scrutiny: CCEP faces ongoing oversight from competition authorities in key markets like the EU and UK, ensuring its business practices do not stifle competition.

- Merger & Acquisition Compliance: Any significant acquisitions or partnerships undertaken by CCEP are subject to rigorous review by anti-trust regulators to assess their impact on market competition.

- Pricing and Distribution Practices: CCEP must ensure its pricing strategies and distribution agreements are compliant with anti-trust laws, preventing predatory pricing or exclusionary practices.

- Potential Penalties: Non-compliance can lead to substantial fines, mandated changes to business operations, and reputational damage, as demonstrated by past enforcement actions against other major beverage companies.

Coca-Cola Europacific Partners (CCEP) must navigate evolving environmental regulations, particularly concerning sustainability and waste management. The EU's Circular Economy Action Plan, with its focus on reducing waste and promoting recycling, directly influences CCEP's operations. For instance, the 2023 push for increased recycled content in plastic bottles, aiming for 30% by 2030, necessitates significant investment in material sourcing and processing capabilities.

CCEP's commitment to reducing its environmental footprint is also driven by legislation related to carbon emissions and water usage. The company's 2023 sustainability report highlighted progress in reducing greenhouse gas emissions by 10.7% compared to its 2019 baseline, a testament to adapting to climate-related legal pressures. Failure to meet these targets can result in penalties and reputational damage, impacting its ability to attract environmentally conscious investors and consumers.

The company also faces legal frameworks governing product labeling and ingredient disclosure, ensuring consumers are accurately informed about product contents and nutritional values. These regulations, like the EU's FIC (Food Information to Consumers) Regulation, mandate clear and comprehensive labeling, impacting CCEP's product packaging and marketing strategies. Ensuring compliance across its diverse product portfolio, which includes over 200 brands, is a continuous operational challenge.

CCEP's legal obligations extend to intellectual property rights, safeguarding its iconic brands and proprietary formulas. The company actively protects its trademarks and patents against infringement to maintain its competitive advantage. In 2023, CCEP continued to monitor and enforce its intellectual property rights across all markets, a crucial aspect of its brand value and market position.

Environmental factors

Coca-Cola Europacific Partners (CCEP) is actively addressing climate change, setting ambitious science-based targets to reduce its greenhouse gas (GHG) emissions. The company aims for a 30% cut in emissions by 2030 and aspires to reach Net Zero by 2040.

Achieving these goals necessitates substantial investment in renewable energy sources, enhanced energy efficiency measures, and the adoption of low-carbon technologies throughout CCEP's extensive operations and supply chain.

Water scarcity poses a significant environmental risk for Coca-Cola Europacific Partners (CCEP) as it is a fundamental ingredient in their beverage production. CCEP is actively addressing this by enhancing water efficiency across its operations, aiming to reduce water usage per liter of product. In 2023, CCEP reported returning 168% of the water used in its finished products back to nature and communities through watershed replenishment projects, demonstrating a commitment to water stewardship.

Growing global awareness of plastic pollution significantly influences Coca-Cola Europacific Partners (CCEP) strategy, pushing for a circular economy model. This commitment is reflected in ambitious targets, such as having all primary packaging be 100% recyclable by 2025.

CCEP aims for a substantial increase in recycled content, targeting 50% recycled plastic in PET bottles across Europe and the Asia-Pacific region by 2025. Furthermore, the company is working towards a significant milestone: collecting and recycling a bottle or can for every single one it sells by 2030.

Waste Management and Recycling Infrastructure

The robustness of waste management and recycling systems across Coca-Cola Europacific Partners' (CCEP) operational regions is a key environmental factor. CCEP's success in achieving its goals for using recycled materials and fostering a circular economy hinges on the efficiency of these infrastructures. For instance, in 2023, CCEP reported that 26% of its packaging was made from recycled PET, a figure it aims to increase significantly.

CCEP actively engages in supporting national container deposit schemes (CDS) and collaborates with various industry partners. These initiatives are crucial for enhancing beverage container collection rates. In Australia, where CCEP operates, the effectiveness of state-based CDS programs varies, but they are generally credited with diverting a substantial amount of plastic from landfill. For example, New South Wales' CDS has seen over 10 billion containers returned since its inception.

- Recycled Content Goals: CCEP aims for 100% recycled PET in all its plastic bottles by 2025, a target directly influenced by local recycling infrastructure.

- Industry Collaboration: Partnerships with organizations like the Ellen MacArthur Foundation and local waste management bodies are vital for improving collection and recycling processes.

- Container Deposit Schemes: CCEP's support for CDS, such as those in Australia and Germany, directly boosts the availability of high-quality recycled materials for its packaging.

- Infrastructure Investment: The company invests in and advocates for improved waste management infrastructure to ensure greater material recovery and recyclability.

Sustainable Sourcing and Biodiversity

Coca-Cola Europacific Partners (CCEP) is actively building a sustainable and resilient supply chain, focusing on reducing greenhouse gas (GHG) emissions. This involves close collaboration with suppliers to encourage responsible sourcing of key ingredients.

CCEP's commitment extends to addressing biodiversity and ecosystem impacts across its entire value chain. This proactive approach aims to mitigate environmental risks and enhance long-term sustainability.

- Supplier Engagement: CCEP works with over 10,000 direct suppliers, encouraging them to set science-based targets for GHG emission reductions.

- Responsible Sourcing: The company aims for 100% of its key agricultural ingredients to be sustainably sourced by 2025, with significant progress already made.

- Biodiversity Focus: Initiatives include water stewardship programs and efforts to protect natural habitats in sourcing regions.

Environmental factors significantly shape Coca-Cola Europacific Partners' (CCEP) operations, particularly concerning climate change and resource management. CCEP has set ambitious targets, aiming for a 30% reduction in GHG emissions by 2030 and Net Zero by 2040, requiring substantial investment in renewable energy and efficiency.

Water scarcity is a critical concern for CCEP, given its reliance on water for production. The company actively works on water efficiency, having returned 168% of water used in finished products back to nature in 2023 through replenishment projects.

CCEP is also heavily focused on tackling plastic pollution, with a goal of 100% recyclable primary packaging by 2025 and 50% recycled plastic in PET bottles across its regions by the same year. By 2030, CCEP aims to collect and recycle a bottle or can for every one sold.

| Environmental Factor | CCEP Target/Action | 2023 Data/Progress |

|---|---|---|

| GHG Emissions Reduction | 30% reduction by 2030; Net Zero by 2040 | Ongoing investment in renewables and efficiency |

| Water Stewardship | Enhance water efficiency; return water to nature | 168% of water used in finished products returned in 2023 |

| Packaging Recyclability | 100% recyclable primary packaging by 2025 | 26% recycled PET in packaging |

| Recycled Content in PET | 50% recycled plastic by 2025 | Ongoing progress towards target |

| Collection & Recycling | Collect/recycle a bottle/can for every one sold by 2030 | Support for CDS and industry partnerships |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Coca-Cola Europacific Partners is informed by a robust blend of official government publications, leading economic indicators from institutions like the IMF and World Bank, and comprehensive industry reports. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.